Navigating the financial landscape of your business can feel like charting uncharted waters. This guide provides a roadmap, equipping you with the knowledge and tools to effectively plan, manage, and grow your financial health. From setting SMART goals to mitigating risks, we’ll cover the essential elements of successful business financial planning, empowering you to make informed decisions and achieve sustainable success.

We explore key areas including budgeting, forecasting, financial statement analysis, securing funding, managing cash flow, and navigating tax compliance. We’ll delve into practical strategies and provide clear examples to illustrate core concepts, ensuring the information is both accessible and actionable. This guide aims to be your comprehensive resource, helping you build a strong financial foundation for your business.

Defining Business Financial Goals

Setting clear and achievable financial goals is crucial for the success of any small business. Without a defined roadmap, businesses risk drifting aimlessly, missing opportunities, and ultimately, failing to reach their full potential. This section Artikels the process of establishing SMART financial goals and provides examples for various business types.

The SMART framework provides a structured approach to goal setting, ensuring that objectives are specific, measurable, achievable, relevant, and time-bound. This approach minimizes ambiguity and maximizes the likelihood of success.

Setting SMART Financial Goals

Defining SMART financial goals involves a systematic process. First, identify your overarching business objectives. What are you trying to accomplish in the short-term and long-term? Then, translate these broad objectives into specific, measurable financial targets. For instance, instead of aiming for “increased profitability,” set a goal like “increase net profit margin by 15% within the next fiscal year.” Ensure your goals are achievable given your current resources and market conditions. Relevance is key; goals must align with your overall business strategy. Finally, set a deadline to maintain accountability and track progress.

Examples of Short-Term and Long-Term Financial Objectives

Short-term goals typically focus on immediate operational efficiency and profitability, while long-term goals address sustainable growth and financial stability.

Here are some examples:

| Business Type | Short-Term Goal (1 year) | Long-Term Goal (3-5 years) |

|---|---|---|

| Retail | Increase average transaction value by 10% through improved customer service and targeted promotions. | Expand to a second location, achieving a 25% increase in overall revenue. |

| Service | Improve client retention rate by 15% through enhanced customer relationship management. | Establish a strong brand reputation, leading to a 50% increase in client acquisition. |

| Manufacturing | Reduce production costs by 8% through process optimization and material sourcing strategies. | Expand production capacity by 30% to meet increased demand and secure new contracts. |

Aligning Financial Goals with Overall Business Strategy

Financial goals should not exist in isolation. They must be intrinsically linked to your overall business strategy. For example, a business aiming for rapid expansion might prioritize securing external funding and increasing sales volume. Conversely, a business focused on maintaining market share might concentrate on improving operational efficiency and enhancing customer loyalty. The financial goals should directly support the chosen strategic path. Failure to align financial goals with the overall strategy leads to misallocation of resources and ultimately, hinders the achievement of the business’s ultimate objectives. A clear understanding of the business’s strategic direction is therefore fundamental to the process of setting effective financial goals.

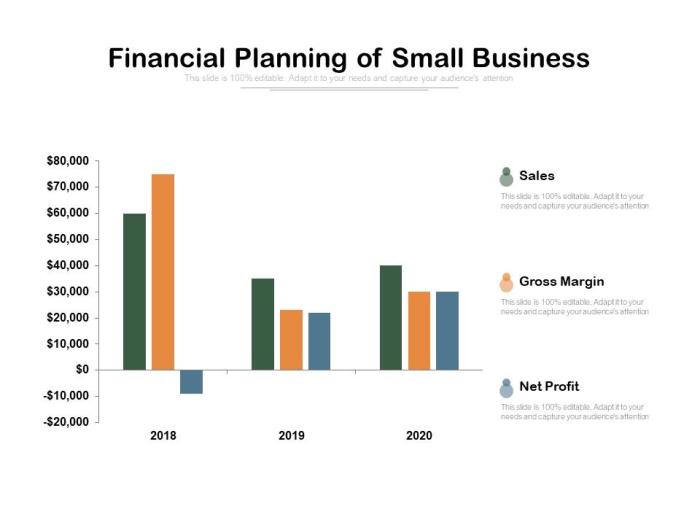

Budgeting and Forecasting

Effective budgeting and forecasting are crucial for the financial health of any business, especially during its formative years. A well-structured budget provides a roadmap for managing resources, while accurate forecasting allows for proactive adjustments and informed decision-making. This section will guide you through the process of creating and utilizing budgets and forecasts for your business.

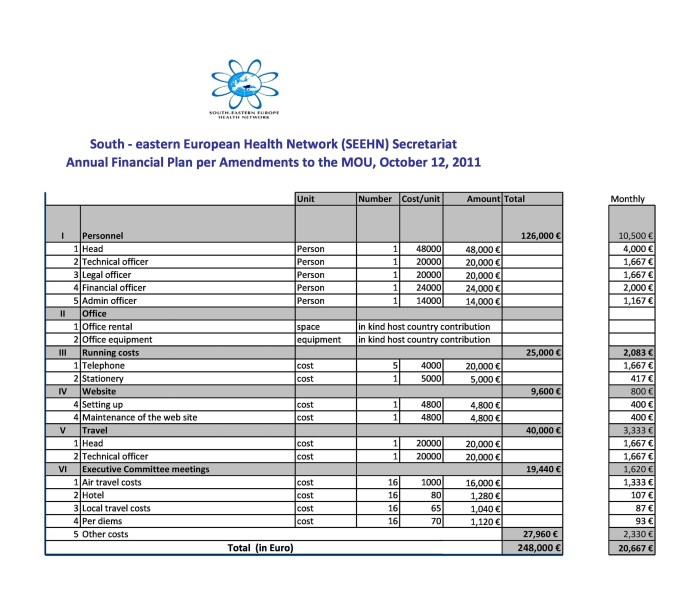

Sample Budget Template

A comprehensive budget should encompass all anticipated income and expenses. This template provides a basic framework; you may need to adjust categories based on your specific business needs.

| Income | Projected Amount | Expense | Projected Amount |

|---|---|---|---|

| Sales Revenue | $50,000 | Rent | $10,000 |

| Service Revenue (if applicable) | $20,000 | Utilities | $2,000 |

| Other Income (e.g., investments) | $5,000 | Salaries | $25,000 |

| Marketing & Advertising | $5,000 | ||

| Supplies & Materials | $3,000 | ||

| Total Projected Income | $75,000 | Total Projected Expenses | $45,000 |

| Projected Profit | $30,000 |

Revenue and Expense Forecasting Methods

Forecasting involves predicting future revenue and expenses. This can be done using various methods. One common approach is to analyze historical data, identifying trends and patterns to extrapolate into the future. For example, if sales grew by 10% annually for the past three years, a conservative forecast might project a similar growth rate for the coming year. Additionally, incorporating market research and industry trends provides a more nuanced prediction. For instance, if a competitor launches a new product, your forecast should account for potential market share changes.

Budgeting Approaches

Different budgeting approaches exist, each with its strengths and weaknesses.

Zero-based budgeting starts from scratch each year, requiring justification for every expense. This approach promotes efficiency by scrutinizing all spending, but it can be time-consuming. Incremental budgeting, conversely, uses the previous year’s budget as a base and adjusts it based on anticipated changes. This method is faster and simpler but may not be as effective in identifying areas for cost reduction.

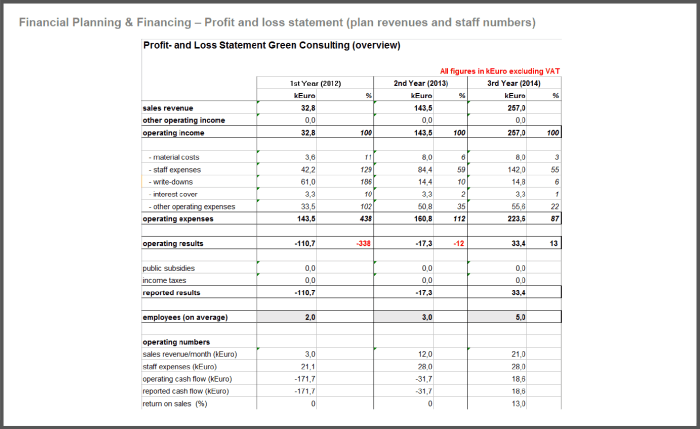

Cash Flow Budget vs. Profit & Loss Budget

| Feature | Cash Flow Budget | Profit & Loss Budget |

|---|---|---|

| Focus | Liquidity; inflow and outflow of cash | Profitability; revenue and expenses |

| Timing | Tracks cash movements over time | Summarizes revenue and expenses over a period |

| Metrics | Cash balance, cash inflows, cash outflows | Revenue, cost of goods sold, gross profit, net income |

| Purpose | To ensure sufficient cash to meet obligations | To assess the financial performance of the business |

Financial Statement Analysis

Understanding your business’s financial health is crucial for informed decision-making. Analyzing key financial statements provides a clear picture of your company’s performance, profitability, and overall financial stability. This analysis allows you to identify strengths, weaknesses, and areas needing improvement, ultimately guiding strategic planning and resource allocation.

Key Financial Statement Analysis

Financial statement analysis involves examining three core statements: the income statement, the balance sheet, and the cash flow statement. Each statement offers a unique perspective on your business’s financial performance, and analyzing them together provides a comprehensive understanding. The income statement shows profitability over a period, the balance sheet shows a snapshot of assets, liabilities, and equity at a specific point in time, and the cash flow statement tracks the movement of cash both in and out of the business.

Calculating and Interpreting Key Financial Ratios

Financial ratios are calculated using data from the financial statements to provide meaningful insights into various aspects of your business’s financial health. Different types of ratios offer different perspectives. Profitability ratios, such as gross profit margin and net profit margin, measure how effectively a company generates profit from its operations. Liquidity ratios, such as the current ratio and quick ratio, assess the ability of a company to meet its short-term obligations. Solvency ratios, such as the debt-to-equity ratio and times interest earned ratio, gauge a company’s ability to meet its long-term debt obligations.

For example, a high debt-to-equity ratio might indicate a high level of financial risk, while a low current ratio could suggest difficulties in meeting immediate payments. Conversely, a high gross profit margin suggests efficient cost management, and a strong net profit margin signals healthy profitability. Analyzing these ratios over time allows you to track trends and identify potential problems before they escalate.

Identifying Areas for Improvement Through Financial Statement Analysis

Financial statement analysis can reveal areas where a business can improve its efficiency and profitability. For instance, a declining net profit margin might indicate the need to reduce costs or increase sales prices. A low inventory turnover ratio could suggest excess inventory and potential losses due to obsolescence. Similarly, a high accounts receivable turnover ratio could point to inefficient credit collection practices. By identifying these weaknesses, businesses can implement targeted strategies to address the underlying issues. For example, a business with high operating expenses might explore ways to streamline operations or negotiate better terms with suppliers.

Interpreting a Balance Sheet: A Step-by-Step Guide

Understanding the balance sheet is fundamental to financial statement analysis. It provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity. Here’s a step-by-step guide:

- Review Assets: Begin by examining the company’s assets, categorized as current (easily converted to cash) and non-current (long-term assets). Analyze the composition of assets and look for any unusual trends or imbalances.

- Analyze Liabilities: Next, analyze the company’s liabilities, also categorized as current (short-term debts) and non-current (long-term debts). A high level of short-term debt relative to assets might indicate liquidity issues.

- Examine Equity: Examine the company’s equity, representing the owners’ stake in the business. A decrease in equity could signal losses or distributions to owners.

- Assess the Accounting Equation: Verify the fundamental accounting equation: Assets = Liabilities + Equity. This ensures the balance sheet is balanced and accurate.

- Compare to Previous Periods: Compare the current balance sheet to previous periods to identify trends in asset growth, debt levels, and equity changes.

Funding and Financing Options

Securing the necessary capital is a critical step in the lifecycle of any business. Understanding the various funding and financing options available, and their respective implications, is crucial for making informed decisions that align with your business goals and risk tolerance. This section will explore different funding sources, helping you choose the best fit for your specific needs.

Advantages and Disadvantages of Funding Sources

Businesses can access funds through several avenues, each with its own set of advantages and disadvantages. Careful consideration of these factors is vital for selecting the most suitable option.

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Bank Loans | Relatively low cost of capital (compared to equity financing), predictable repayment schedule, can be used for various purposes. | Requires strong credit history and collateral, rigorous application process, can be time-consuming. |

| Equity Financing (Venture Capital, Angel Investors) | Provides significant capital infusion, may offer valuable expertise and networks, no debt repayment obligation. | Dilution of ownership, potential loss of control, investors may demand high returns. |

| Crowdfunding | Access to a wide pool of investors, can generate significant publicity, relatively low barriers to entry. | High dependence on marketing and social media, may not raise sufficient funds, requires transparency and strong communication. |

| Government Grants | No repayment required, can support specific business initiatives or social impact projects. | Highly competitive application process, specific eligibility criteria, often requires detailed reporting. |

Factors to Consider When Choosing a Funding Option

The optimal funding source depends heavily on several key factors. These factors should be carefully weighed to ensure alignment with the business’s overall strategy and financial health.

- Business Stage: Early-stage startups may rely on bootstrapping, angel investors, or crowdfunding, while established businesses may pursue bank loans or equity financing.

- Funding Amount Needed: The size of the funding requirement influences the available options. Smaller amounts might be suitable for microloans or crowdfunding, while larger sums might necessitate bank loans or private equity.

- Risk Tolerance: Equity financing dilutes ownership but avoids debt, while loans carry the risk of default and potential loss of assets.

- Repayment Capacity: Businesses must assess their ability to repay loans or meet the expectations of equity investors.

- Time Horizon: Some funding sources offer quicker access to capital than others. The urgency of the funding need should influence the choice.

Preparing a Loan Application Package

A comprehensive loan application package is essential for securing bank financing. A well-prepared package demonstrates your business’s financial health and repayment capacity.

Key elements include a detailed business plan outlining your business model, market analysis, and financial projections; a complete set of financial statements (income statement, balance sheet, cash flow statement); personal financial statements for the business owners; and collateral information (if required). Supporting documentation such as tax returns, licenses, and permits may also be necessary. The level of detail required will vary depending on the lender and the loan amount. For example, a small business loan application may require less extensive documentation than a large commercial loan.

Comparison of Funding Options

The following table summarizes key characteristics of various funding options. Note that interest rates, repayment terms, and eligibility criteria can vary significantly depending on the lender and the specific circumstances of the business.

| Funding Option | Typical Interest Rate | Repayment Terms | Eligibility Criteria |

|---|---|---|---|

| Bank Loan | Varies greatly depending on creditworthiness and loan type (e.g., 5-15%) | Monthly installments over a set period (e.g., 1-10 years) | Good credit history, collateral, viable business plan |

| Venture Capital | Equity stake, no interest | No fixed repayment schedule, return on investment upon exit | High growth potential, strong management team, large market opportunity |

| Crowdfunding | No interest, equity or rewards-based | No fixed repayment schedule (rewards-based), equity dilution (equity-based) | Compelling business idea, strong marketing strategy, established online presence |

| Government Grants | N/A | N/A | Meets specific program criteria, aligns with government priorities |

Managing Cash Flow

Effective cash flow management is crucial for business survival and growth. A consistent positive cash flow ensures you can meet your financial obligations, invest in opportunities, and weather economic downturns. Poor cash flow, conversely, can lead to missed payments, strained supplier relationships, and ultimately, business failure. This section will explore key strategies for optimizing your cash flow.

Optimizing Accounts Receivable and Payable

Efficient management of accounts receivable and payable is paramount to healthy cash flow. Accounts receivable represent money owed to your business by customers, while accounts payable represent money your business owes to suppliers and creditors. Optimizing both is key to maximizing your available cash. Strategies include implementing robust invoicing processes with clear payment terms, offering early payment discounts to incentivize prompt payments, and actively pursuing overdue payments through timely follow-up and, if necessary, collection agencies. For accounts payable, negotiating favorable payment terms with suppliers, such as extended payment periods, can free up cash in the short term. Careful monitoring of payment deadlines and utilizing automated payment systems can also contribute to efficient payable management. Consider implementing a system for prioritizing payments to ensure critical vendors are paid on time.

Improving Cash Flow Forecasting Accuracy

Accurate cash flow forecasting is essential for proactive financial management. Improving forecast accuracy involves utilizing historical data, incorporating sales projections, and considering seasonal variations in revenue and expenses. Regularly reviewing and updating the forecast, incorporating actual results, and adjusting projections based on changing market conditions are crucial steps. The use of sophisticated forecasting software can also enhance accuracy by analyzing complex data sets and identifying trends. For example, a restaurant might analyze past sales data to predict higher revenue during holiday seasons and adjust staffing and inventory accordingly. A retail business might use sales data from previous years to forecast demand for seasonal items and ensure sufficient stock is available.

Maintaining Sufficient Working Capital

Working capital, the difference between current assets and current liabilities, represents the funds available for day-to-day operations. Maintaining sufficient working capital is essential to cover immediate expenses, meet short-term obligations, and take advantage of unexpected opportunities. Insufficient working capital can severely restrict a business’s ability to operate effectively. Strategies for maintaining sufficient working capital include optimizing inventory levels to avoid excessive storage costs and stockouts, negotiating favorable credit terms with suppliers, and securing lines of credit or other financing options as a safety net. Regularly monitoring working capital ratios, such as the current ratio and quick ratio, can provide valuable insights into the financial health of the business. For instance, a business might need to secure a line of credit to cover unexpected expenses like equipment repairs or seasonal inventory increases.

Negative Impacts of Poor Cash Flow Management

Poor cash flow management can have severe consequences for a business. Missed payments to vendors can damage relationships and lead to disruptions in the supply chain. Inability to meet payroll obligations can result in employee dissatisfaction and high turnover. A lack of cash can also prevent a business from taking advantage of growth opportunities, such as expanding into new markets or investing in new technologies. In extreme cases, poor cash flow can lead to bankruptcy. For example, a small construction company that fails to accurately forecast its cash needs might struggle to pay its subcontractors on time, leading to project delays and reputational damage. Similarly, a retail store that overstocks inventory might tie up its working capital, leaving it unable to meet its operating expenses.

Financial Risk Management

Effective financial risk management is crucial for the long-term health and success of any business, regardless of size. Understanding and mitigating potential financial risks allows businesses to operate more efficiently, make informed decisions, and ultimately, enhance profitability. Ignoring these risks can lead to significant financial losses or even business failure.

Common Financial Risks Faced by Businesses

Businesses face a variety of financial risks, broadly categorized into credit risk, market risk, and liquidity risk. Credit risk encompasses the potential for losses due to borrowers’ failure to repay debts. This risk is particularly relevant for businesses extending credit to customers or relying on debt financing. Market risk refers to the potential for losses due to fluctuations in market conditions, such as interest rate changes, currency exchange rate shifts, or commodity price volatility. Liquidity risk is the risk that a business will not have enough readily available cash to meet its short-term obligations. This can lead to disruptions in operations and even bankruptcy. Other risks include operational risks (failures in internal processes), legal risks (lawsuits or regulatory changes), and reputational risks (damage to brand image).

Strategies for Mitigating Financial Risks

Several strategies can effectively mitigate financial risks. Insurance policies can transfer some risks to insurance companies, providing financial protection against unforeseen events such as property damage, liability claims, or business interruption. Hedging, a risk management technique, involves taking a position in a financial instrument to offset potential losses from an existing position. For example, a business expecting to receive a large payment in a foreign currency might use a forward contract to lock in an exchange rate, mitigating the risk of currency fluctuations. Diversification, spreading investments across different assets, can also reduce risk by not concentrating exposure to any single area. Maintaining a healthy cash reserve is a crucial liquidity risk mitigation strategy.

The Role of Financial Planning in Risk Mitigation

Financial planning plays a vital role in risk mitigation by providing a framework for identifying, assessing, and responding to potential risks. A comprehensive financial plan includes a detailed analysis of a business’s financial position, its sources of funding, and its potential exposures to various risks. This analysis enables the business to develop proactive strategies to mitigate those risks, such as setting aside reserves for contingencies or establishing credit limits for customers. Regular monitoring and review of the financial plan allows for adjustments to be made as the business environment changes and new risks emerge. Scenario planning, which involves creating different possible future scenarios and assessing their impact on the business, is a powerful tool used within financial planning for risk mitigation.

Hypothetical Risk Management Plan for a Small Business

Let’s consider a small bakery, “Sweet Success,” as an example.

| Potential Risk | Mitigation Strategy |

|---|---|

| Credit risk from customers not paying their invoices | Implement a strict credit policy, including credit checks and payment deadlines; consider offering discounts for prompt payment. |

| Market risk from fluctuating ingredient prices | Negotiate long-term contracts with suppliers to secure stable pricing; explore hedging strategies using futures contracts for key ingredients like flour and sugar. |

| Liquidity risk from unexpected expenses or slow sales | Maintain a healthy cash reserve; establish a line of credit with a bank; monitor cash flow closely and adjust spending as needed. |

| Operational risk from equipment malfunction | Implement a regular maintenance schedule; purchase equipment insurance; have backup equipment or arrangements in place. |

| Reputational risk from negative online reviews | Actively monitor online reviews and respond promptly to any negative feedback; maintain high standards of customer service. |

Tax Planning and Compliance

Effective tax planning is crucial for the long-term financial health of any business. Minimizing your tax liability through proactive strategies allows you to reinvest more profits back into your company, fueling growth and increasing profitability. Ignoring tax planning can lead to significant financial penalties and hinder your business’s potential.

Importance of Tax Planning for Businesses

Proactive tax planning helps businesses legally minimize their tax burden. This involves understanding applicable tax laws and regulations, strategically structuring transactions, and taking advantage of available deductions and credits. A well-structured tax plan can significantly improve cash flow, allowing for greater investment in operations, expansion, or employee compensation. Furthermore, it can enhance the overall financial stability and resilience of the business, providing a stronger foundation for future success. Failing to plan effectively can result in unexpected tax bills, impacting profitability and potentially jeopardizing the business’s financial stability.

Common Tax Deductions and Credits Available to Businesses

Several tax deductions and credits can significantly reduce a business’s tax liability. These vary depending on the business structure (sole proprietorship, partnership, LLC, corporation), industry, and specific circumstances. Understanding and utilizing these benefits is vital for effective tax planning.

Examples include deductions for:

- Business expenses: This encompasses a wide range of costs directly related to business operations, such as rent, utilities, salaries, supplies, and professional services (legal, accounting).

- Depreciation: This allows businesses to deduct the cost of assets (equipment, vehicles, etc.) over their useful life, reducing taxable income gradually.

- Home office deduction: If a portion of your home is used exclusively and regularly for business, you may be able to deduct expenses related to that space.

Examples of tax credits include:

- Research and development (R&D) tax credit: This incentivizes businesses to invest in innovation by offering a credit for qualifying R&D expenses.

- Small business tax credits: Various credits exist to support small businesses, often depending on location, industry, or specific initiatives.

It is important to consult with a tax professional to determine which deductions and credits your business is eligible for.

Process of Filing Business Tax Returns

The process of filing business tax returns involves several key steps. Accuracy and timeliness are paramount to avoid penalties. The specific forms and deadlines vary based on the business structure and the tax year.

Key steps generally include:

- Gathering financial records: This includes income statements, balance sheets, expense receipts, and other relevant documentation.

- Choosing the correct tax forms: Different forms are required depending on the business structure and type of income.

- Preparing the tax return: This can be done using tax software, hiring a tax professional, or manually filling out the forms.

- Filing the return: Returns are typically filed electronically through the relevant tax authority’s website.

- Paying any taxes owed: Taxes are usually due by a specific date, and penalties apply for late payments.

Best Practices for Ensuring Tax Compliance

Maintaining tax compliance involves proactive measures to minimize risks and avoid penalties. This requires meticulous record-keeping, accurate reporting, and staying informed about tax law changes.

Key best practices include:

- Maintain accurate and organized financial records: Keep detailed records of all income and expenses, supporting documentation, and tax forms.

- Understand applicable tax laws and regulations: Stay updated on changes in tax laws and regulations that may affect your business.

- Seek professional tax advice: Consult with a tax professional to ensure compliance and optimize your tax strategy.

- File tax returns on time: Late filing can result in significant penalties.

- Regularly review your tax strategy: Your business circumstances may change over time, requiring adjustments to your tax plan.

Using Financial Software and Tools

Leveraging financial software and tools is crucial for streamlining business financial planning, providing valuable insights, and ultimately improving decision-making. These tools automate complex calculations, generate reports, and offer forecasting capabilities, freeing up valuable time and resources that can be better allocated to strategic initiatives. The right software can significantly enhance accuracy and efficiency in managing your business finances.

Efficient financial management is significantly enhanced through the use of various software and tools. These range from simple spreadsheet programs to sophisticated enterprise resource planning (ERP) systems, each offering a unique set of features tailored to specific business needs and sizes. Selecting the appropriate tool depends on factors such as budget, business size, and the complexity of financial operations.

Types of Financial Software and Tools

Numerous financial software and tools cater to different business needs. Spreadsheet software like Microsoft Excel and Google Sheets offer basic functionalities for budgeting, forecasting, and financial statement analysis. More advanced options include accounting software such as QuickBooks, Xero, and Sage, which provide comprehensive features for managing accounts payable and receivable, generating financial reports, and managing payroll. Dedicated business intelligence (BI) tools, like Tableau and Power BI, offer data visualization and analysis capabilities, allowing for deeper insights into financial performance. Finally, Enterprise Resource Planning (ERP) systems, such as SAP and Oracle, integrate various business functions, including finance, into a single platform.

Selecting Appropriate Financial Software

Choosing the right financial software requires careful consideration of several factors. The size and complexity of your business directly impact the features you need. A small business might find a simple accounting software sufficient, while a larger enterprise may require a comprehensive ERP system. Your budget is another critical factor; the pricing models for financial software vary significantly, from subscription-based services to one-time purchases. The software’s ease of use and integration with existing systems are also crucial considerations. Finally, consider the level of technical support offered by the vendor. A responsive and knowledgeable support team can be invaluable when troubleshooting issues or learning new features.

Comparison of Popular Business Financial Software

| Software | Key Features | Pricing Model | Best Suited For |

|---|---|---|---|

| QuickBooks Online | Invoicing, expense tracking, financial reporting, bank reconciliation | Subscription-based, various plans | Small to medium-sized businesses |

| Xero | Invoicing, expense tracking, payroll, inventory management, project management | Subscription-based, various plans | Small to medium-sized businesses |

| Sage 50cloud Accounting | Comprehensive accounting features, inventory management, reporting, payroll | Subscription-based, various plans | Small to medium-sized businesses |

| Zoho Books | Invoicing, expense tracking, inventory management, time tracking, project management | Subscription-based, various plans | Small to medium-sized businesses |

Ultimate Conclusion

Effective business financial planning isn’t just about numbers; it’s about strategic foresight and proactive management. By understanding your financial goals, implementing robust budgeting practices, analyzing your performance, and managing risks effectively, you can pave the way for sustainable growth and long-term prosperity. This guide provides the framework; your dedication and implementation will determine your success. Remember to regularly review and adapt your financial plan as your business evolves.

FAQ Resource

What is the difference between a profit and loss statement and a cash flow statement?

A profit and loss statement (P&L) shows your revenue and expenses over a period, resulting in net profit or loss. A cash flow statement tracks the actual movement of cash into and out of your business during that same period.

How often should I review my financial plan?

Ideally, your financial plan should be reviewed at least quarterly, and more frequently if needed (e.g., during significant business changes). This allows for timely adjustments based on performance and market conditions.

What are some common mistakes in financial planning?

Common mistakes include unrealistic forecasting, inadequate cash flow management, neglecting financial statement analysis, and insufficient risk assessment. Seeking professional advice can help mitigate these errors.

Where can I find free financial software for small businesses?

Many free or freemium options exist, but their features are often limited. Research options carefully, considering your specific needs and the scale of your business. Some accounting software providers offer free plans for basic functionalities.

What if I don’t understand some of the financial terms?

Numerous online resources, including business websites and financial literacy platforms, can help you clarify financial terminology. Consider seeking guidance from a financial advisor or accountant if needed.