Navigating the dynamic world of foreign exchange (forex) trading requires a robust understanding of various strategies. This guide delves into the core principles, encompassing technical and fundamental analysis, risk management, and popular trading approaches like scalping, day trading, and swing trading. We’ll explore how to leverage indicators, interpret economic data, and manage risk effectively to enhance your trading performance.

From understanding basic concepts to mastering advanced techniques like automated trading and backtesting, we aim to equip you with the knowledge needed to confidently approach the forex market. We’ll examine different trader profiles and their preferred methods, highlighting the importance of aligning your strategy with your risk tolerance and trading goals. The journey to successful forex trading begins with a clear understanding of the strategies available and the discipline to implement them effectively.

Introduction to Forex Trading Strategies

Forex trading, or foreign exchange trading, involves the buying and selling of currencies to profit from fluctuations in their exchange rates. It’s a decentralized, global market operating 24 hours a day, five days a week, offering significant opportunities for profit but also considerable risk. Understanding the market’s dynamics and employing effective strategies are crucial for success.

Forex trading strategies are the systematic approaches traders use to analyze the market and make informed decisions about buying or selling currencies. These strategies vary greatly in complexity, time horizon, and risk tolerance, reflecting the diverse needs and preferences of individual traders.

A Brief History of Popular Forex Trading Strategies

The evolution of forex trading strategies mirrors the development of financial markets and technological advancements. Early strategies were largely based on fundamental analysis, focusing on economic indicators and geopolitical events to predict currency movements. The rise of technical analysis, utilizing charts and price patterns, marked a significant shift. The late 20th and early 21st centuries saw the emergence of algorithmic trading, employing sophisticated computer programs to execute trades based on pre-defined rules and market data. More recently, the integration of artificial intelligence and machine learning into trading strategies is gaining traction, further automating and refining the decision-making process.

Examples of Trader Profiles and Their Preferred Strategies

Different trader profiles favor different strategies based on their risk appetite, trading style, and time commitment. For instance, a day trader, focusing on short-term price movements, might utilize scalping strategies, aiming for small profits on numerous trades throughout the day. These strategies often rely heavily on technical analysis and require quick decision-making. In contrast, a swing trader, holding positions for several days or weeks, might employ trend-following strategies, identifying and capitalizing on sustained price movements. These strategies might incorporate both technical and fundamental analysis. A long-term investor, holding positions for months or years, might focus on fundamental analysis, considering macroeconomic factors and long-term economic trends. Their strategies prioritize capital preservation and long-term growth, often involving less frequent trading activity. Finally, algorithmic traders utilize automated systems to execute trades based on complex algorithms, potentially involving high-frequency trading (HFT) where numerous trades are executed within milliseconds. The strategies employed by algorithmic traders are often highly sophisticated and require significant technical expertise.

Technical Analysis Strategies

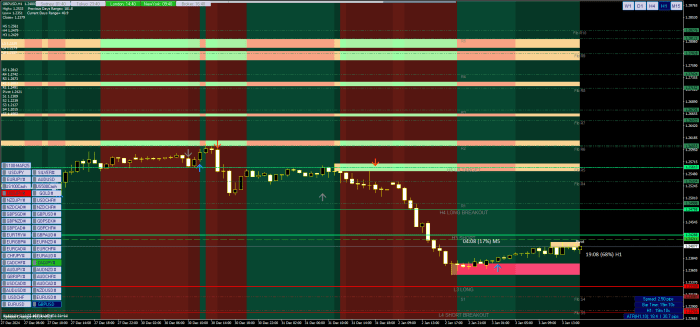

Technical analysis is a crucial aspect of Forex trading, focusing on interpreting past market data to predict future price movements. Traders utilize various technical indicators to identify potential entry and exit points, manage risk, and ultimately enhance their trading performance. This section will explore common technical indicators and illustrate how they can be combined to create effective trading strategies.

Common Technical Indicators

Technical indicators provide traders with quantifiable data points derived from price and volume information. Understanding their strengths and weaknesses is key to effective application. The following table compares five commonly used indicators:

| Indicator | Description | Strengths | Weaknesses |

|---|---|---|---|

| Moving Averages (MA) | Calculates the average price over a specific period (e.g., 50-day MA, 200-day MA). Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are common variations. | Identifies trends, provides support and resistance levels, smooths out price volatility. | Lagging indicator (reacts to price changes rather than predicting them), susceptible to whipsaws in ranging markets. |

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Typically ranges from 0 to 100. | Identifies potential reversals, useful in ranging markets. | Can generate false signals, especially in strong trending markets. The interpretation of overbought/oversold levels can be subjective. |

| Moving Average Convergence Divergence (MACD) | Shows the relationship between two moving averages, indicating momentum and potential trend changes. Consists of a MACD line, a signal line, and a histogram. | Identifies momentum changes, confirms trend direction, can signal potential buy/sell opportunities. | Can generate false signals, prone to whipsaws in ranging markets. Interpretation can be complex. |

| Stochastic Oscillator | Compares a closing price to its price range over a given period. Ranges from 0 to 100. | Identifies overbought and oversold conditions, can predict trend reversals. | Prone to false signals, particularly in sideways markets. Parameter adjustments can significantly affect results. |

| Bollinger Bands | Plots standard deviations around a moving average, indicating volatility and potential price reversals. | Visualizes volatility, identifies potential support and resistance levels, signals potential breakouts. | Can be difficult to interpret in ranging markets, doesn’t predict the direction of price movement. |

A Sample Trading Strategy

This strategy combines the 20-period EMA, the RSI (14-period), and the MACD (12,26,9).

Entry Point: A long position is entered when the 20-period EMA crosses above the 50-period EMA, the RSI is below 30 (oversold condition), and the MACD line crosses above its signal line. A short position is entered when the 20-period EMA crosses below the 50-period EMA, the RSI is above 70 (overbought condition), and the MACD line crosses below its signal line.

Exit Point: Long positions are exited when the RSI reaches 70 or the MACD line crosses below its signal line. Short positions are exited when the RSI reaches 30 or the MACD line crosses above its signal line.

Stop-Loss: A stop-loss order is placed below the recent swing low for long positions and above the recent swing high for short positions. The distance of the stop-loss order from the entry point should be determined based on risk tolerance. For example, a stop-loss could be set at 1% of the account value.

Take-Profit: Take-profit levels are determined based on risk-reward ratios. A common approach is to set a take-profit level at twice the distance of the stop-loss. For example, if the stop-loss is 1% of the account value, the take-profit would be 2%.

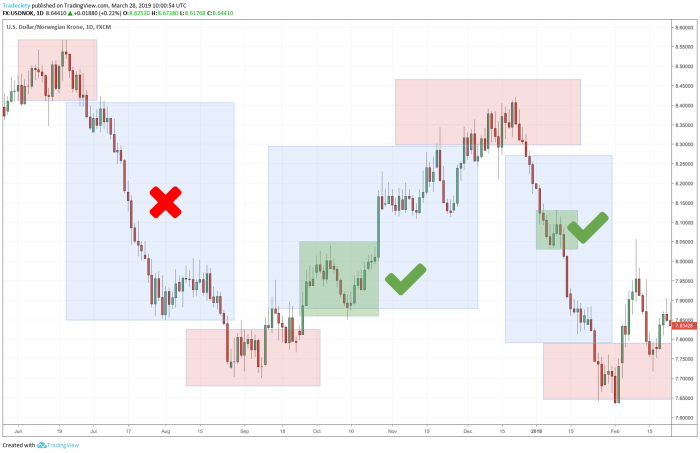

Trend-Following vs. Counter-Trend Trading

Trend-following strategies aim to capitalize on established trends by entering trades in the direction of the prevailing momentum. These strategies often utilize indicators like moving averages to identify and follow trends. Counter-trend strategies, conversely, attempt to profit from price reversals by identifying overbought or oversold conditions and entering trades against the current trend. Indicators like RSI and Stochastic Oscillator are frequently employed in counter-trend trading. Trend-following strategies generally involve lower frequency trading, while counter-trend strategies may involve more frequent trades. Both approaches have their own risks and rewards; trend-following strategies can be exposed to significant losses during trend reversals, while counter-trend strategies may suffer from frequent losses if the trend persists. Successful Forex trading often involves a blend of both approaches, adapting strategies to market conditions.

Fundamental Analysis Strategies

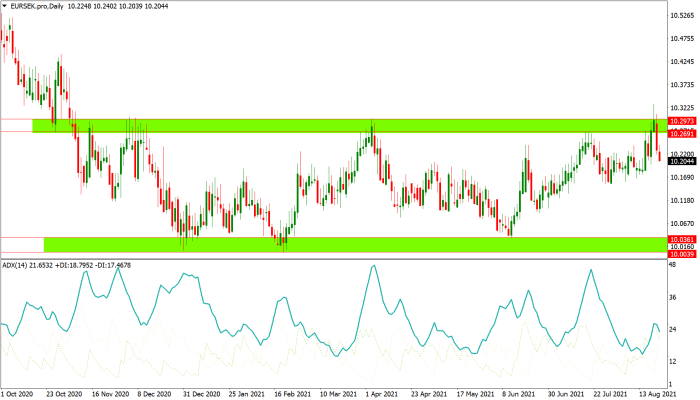

Fundamental analysis in forex trading involves assessing the economic factors that influence currency values. Unlike technical analysis, which focuses on price charts and patterns, fundamental analysis delves into the underlying economic health and political climate of countries whose currencies are being traded. By understanding these factors, traders can attempt to predict future currency movements and capitalize on market shifts.

Understanding the interplay between economic data and currency valuations is crucial for successful forex trading using fundamental analysis. Economic indicators provide valuable insights into a country’s economic strength and stability, which directly impact the demand for its currency. Similarly, news events, both anticipated and unexpected, can significantly shift market sentiment and trigger immediate currency price changes. Therefore, staying informed and interpreting these elements effectively is paramount.

Key Economic Indicators and Their Impact on Currency Pairs

Economic indicators offer a snapshot of a nation’s economic performance. Different indicators highlight various aspects of the economy, allowing for a comprehensive assessment. A strong economy generally leads to increased demand for its currency, while weak economic data can cause its value to depreciate. The impact of these indicators is often relative; a positive report for one country might be overshadowed by even stronger data from another, impacting the currency pair accordingly.

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country’s borders. A higher-than-expected GDP growth rate typically strengthens the currency, indicating a healthy and expanding economy. Conversely, a lower-than-expected GDP growth rate or contraction can weaken the currency.

- Inflation Rate (CPI and PPI): The Consumer Price Index (CPI) and Producer Price Index (PPI) measure the rate of price increases in consumer goods and producer goods respectively. High inflation erodes purchasing power and generally weakens a currency. Central banks often respond to high inflation by raising interest rates, which can have a complex impact on the currency.

- Interest Rates: A country’s central bank sets interest rates to manage inflation and economic growth. Higher interest rates attract foreign investment, increasing demand for the currency and strengthening its value. Lower interest rates can have the opposite effect.

- Unemployment Rate: The unemployment rate indicates the percentage of the workforce that is unemployed. A low unemployment rate suggests a strong economy, potentially leading to currency appreciation. High unemployment often indicates economic weakness and may weaken the currency.

- Trade Balance: The trade balance is the difference between a country’s exports and imports. A trade surplus (exports exceeding imports) generally strengthens the currency, while a trade deficit (imports exceeding exports) can weaken it.

Examples of Fundamental Analysis in Predicting Currency Movements

Consider the scenario where the US Federal Reserve unexpectedly raises interest rates. This action, based on fundamental economic data suggesting inflation is higher than desired, would likely strengthen the US dollar (USD) against other currencies. Investors seeking higher returns would flock to USD-denominated assets, increasing demand and pushing up its value. Conversely, if unexpectedly weak employment data is released in the Eurozone, the Euro (EUR) might depreciate against the USD as investors lose confidence in the Eurozone’s economic outlook. This illustrates how fundamental analysis, by interpreting economic indicators and news events, allows traders to anticipate currency movements.

Risk Management in Forex Trading

Successful forex trading hinges not just on profitable strategies but, critically, on effective risk management. Without a robust risk management plan, even the most astute trader can quickly lose their capital. This section explores key techniques to protect your investment and ensure long-term sustainability in the forex market.

Position Sizing

Position sizing determines the amount of capital allocated to each trade. It’s a crucial aspect of risk management, aiming to limit potential losses to a manageable percentage of your overall trading account. Incorrect position sizing can lead to significant losses, even with accurate market predictions. A common approach involves calculating the position size based on a predetermined risk percentage per trade. For example, a trader might risk only 1% to 2% of their account balance on any single trade.

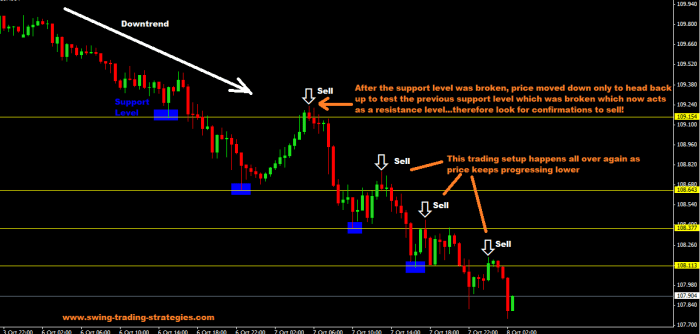

Stop-Loss Orders

Stop-loss orders are essential tools for limiting potential losses. These orders automatically close a trade when the price reaches a pre-defined level, preventing further losses beyond a predetermined point. They are placed below the entry price for long positions and above the entry price for short positions. The placement of stop-loss orders should be based on technical analysis, considering factors such as support and resistance levels, and should be adjusted as market conditions change. Ignoring stop-loss orders can lead to substantial and potentially devastating losses.

Diversification

Diversification involves spreading investments across multiple currency pairs, reducing the impact of losses from a single trade or currency pair. By diversifying, traders reduce their overall portfolio risk. Instead of focusing all capital on one or two pairs, traders can allocate capital across a range of currencies, potentially offsetting losses in one area with gains in another. However, overly diversifying can dilute potential profits, so a balance is crucial.

Risk Management Strategies Comparison

| Strategy | Advantages | Disadvantages | Example |

|---|---|---|---|

| Position Sizing (1% Risk per Trade) | Limits potential losses to a predetermined percentage of account balance, promotes consistent trading. | May limit potential profits if trade is highly successful; requires careful calculation. | With a $10,000 account and a 1% risk tolerance, the maximum loss per trade is $100. |

| Stop-Loss Orders | Automatically limits losses, prevents emotional trading, protects against unexpected market movements. | May trigger prematurely due to market volatility, can result in missed opportunities if the market reverses quickly. | Setting a stop-loss 50 pips below the entry price for a long position. |

| Diversification (across 3 currency pairs) | Reduces overall portfolio risk, mitigates losses from single currency pair underperformance. | May dilute potential profits, requires more market research and monitoring. | Investing 33% of capital in EUR/USD, 33% in GBP/USD, and 33% in USD/JPY. |

| Combined Approach (Position Sizing + Stop-Loss + Diversification) | Offers the most comprehensive risk management, balances loss limitation with profit potential. | Requires more complex planning and monitoring, necessitates a higher level of trading expertise. | Using a 1% risk per trade position sizing, stop-losses on all trades, and diversifying across 5 currency pairs. |

Calculating Position Size

Calculating appropriate position size involves considering your account balance, risk tolerance, and the stop-loss distance. A common formula is:

Position Size = (Account Balance * Risk Percentage) / (Stop Loss in Pips * Pip Value)

For instance, a trader with a $5,000 account, a 2% risk tolerance, a stop-loss of 50 pips, and a pip value of $10 would calculate their position size as follows:

Position Size = ($5,000 * 0.02) / (50 * $10) = 2 units

This means the trader should buy or sell only 2 units of the currency pair to limit potential losses to $100 (2% of their account balance). Remember that pip value varies depending on the currency pair and the broker.

Popular Forex Trading Strategies

Forex trading offers a diverse range of strategies, each with its own set of advantages and disadvantages. The optimal approach depends heavily on individual trading goals, risk tolerance, and available time commitment. Understanding the nuances of different strategies is crucial for successful forex trading.

Comparison of Scalping, Day Trading, Swing Trading, and Position Trading

The following table compares and contrasts four popular forex trading strategies: scalping, day trading, swing trading, and position trading. These strategies differ significantly in their time horizons, risk profiles, and required skills.

| Strategy | Time Horizon | Risk Profile | Characteristics of Successful Traders |

|---|---|---|---|

| Scalping | Seconds to minutes | High (frequent trades, small profits/losses) | Highly disciplined, quick decision-makers, adept at technical analysis, comfortable with high-frequency trading platforms. They often utilize very tight stop-losses. |

| Day Trading | Minutes to hours (within a single trading day) | Medium to High (multiple trades per day) | Strong technical analysis skills, excellent risk management, ability to manage multiple trades simultaneously, high attention to detail and market awareness. They tend to focus on intraday price action. |

| Swing Trading | Days to weeks | Medium (fewer trades, larger potential profits/losses) | Good understanding of both technical and fundamental analysis, patience, ability to identify and capitalize on short-term price trends, capable of managing open positions overnight. They often use longer-term indicators. |

| Position Trading | Weeks to months or even years | Low to Medium (few trades, potentially very large profits/losses) | Strong fundamental analysis skills, long-term perspective, high risk tolerance (due to longer holding periods), excellent risk management strategies to withstand market fluctuations. They may ride out significant price swings. |

Characteristics of Successful Forex Traders Employing Different Strategies

Success in forex trading, regardless of the chosen strategy, requires a combination of skills and traits. However, the specific characteristics emphasized vary depending on the trading style. For instance, a successful scalper needs lightning-fast reflexes and the ability to identify fleeting opportunities, while a position trader needs patience and a deep understanding of long-term market trends. Consistent profitability across all strategies hinges on meticulous risk management and disciplined execution.

Psychological Aspects of Trading and Their Influence on Strategy Selection and Execution

The psychological aspect of trading is often underestimated. Fear, greed, and emotional decision-making can significantly impact trading performance, regardless of the strategy employed. Successful traders cultivate emotional control and discipline, adhering to their pre-defined trading plans. For example, a trader prone to fear might struggle with position trading, which involves holding positions for extended periods and potentially enduring significant drawdowns. Conversely, a trader driven by greed might over-trade and neglect risk management, leading to losses regardless of their chosen strategy. Self-awareness and the ability to manage emotions are crucial for selecting and effectively executing a suitable trading strategy. Strategies should be chosen based on an individual’s psychological profile and risk tolerance to maximize the chance of success and minimize emotional interference.

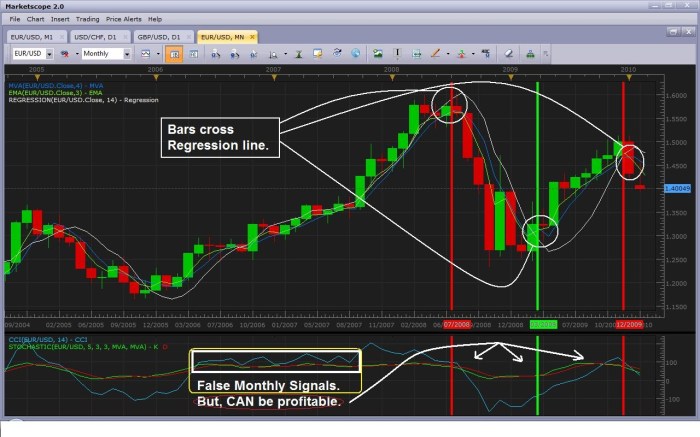

Automated Trading Strategies

Automated trading strategies leverage technology to execute trades based on pre-defined rules and algorithms, eliminating emotional decision-making and allowing for faster execution than manual trading. This approach utilizes software programs, primarily Expert Advisors (EAs) in the forex market, to analyze market data and execute trades according to a specified strategy. Algorithmic trading, a broader term encompassing automated trading, employs sophisticated algorithms to identify and exploit trading opportunities across various financial markets.

Expert Advisors (EAs) and Algorithmic Trading in Forex

Expert Advisors are custom-programmed software applications that run within the forex trading platform, automatically analyzing market data and executing trades according to a predetermined set of rules. These rules, often based on technical indicators or fundamental analysis, dictate when to enter and exit trades, managing position sizing and risk parameters. Algorithmic trading, encompassing EAs, uses complex algorithms to identify and execute trades, often at speeds and volumes impossible for human traders. This allows for the execution of high-frequency trading strategies and the analysis of vast datasets to identify subtle patterns.

Advantages and Disadvantages of Automated Trading Systems

Automated trading systems offer several advantages, including the ability to execute trades 24/5, eliminating emotional biases, and allowing for the backtesting of strategies. They also enable the implementation of complex trading strategies that would be impractical for manual execution. However, automated systems are not without their drawbacks. They can be susceptible to unexpected market events, requiring robust error handling and risk management. Over-optimization of a strategy to past data can lead to poor performance in live trading. Furthermore, the initial setup and maintenance of automated systems can require significant technical expertise.

A Simple Automated Trading Strategy Based on the Relative Strength Index (RSI)

This strategy uses the Relative Strength Index (RSI), a momentum oscillator, to identify overbought and oversold conditions. The RSI ranges from 0 to 100. Readings above 70 are generally considered overbought, suggesting a potential price reversal, while readings below 30 are considered oversold, suggesting a potential price bounce.

The algorithm for this simple automated strategy is as follows:

1. Data Input: The EA receives real-time price data and calculates the RSI.

2. Overbought Condition: If the RSI rises above 70, the EA initiates a short position (selling). The position size is determined by a pre-defined risk management rule, such as a percentage of the account balance.

3. Oversold Condition: If the RSI falls below 30, the EA initiates a long position (buying). Again, position sizing is determined by the risk management rule.

4. Stop-Loss and Take-Profit: Stop-loss orders are placed to limit potential losses, while take-profit orders are placed to secure profits. These levels are determined based on the trader’s risk tolerance and profit targets.

5. Position Management: The EA continuously monitors the market and adjusts positions based on changes in the RSI and pre-defined exit rules. For instance, it might close a short position if the RSI falls below a certain threshold or close a long position if the RSI rises above a certain threshold. Trailing stop-loss orders could also be implemented to protect profits as the price moves favorably.

Example: Let’s assume a trader sets a risk of 2% per trade and a take-profit target of twice the stop-loss. If the account balance is $1000, the maximum risk per trade would be $20. If the stop-loss is set at 10 pips, the position size would be calculated accordingly. If the RSI crosses above 70, a short position would be opened, with a stop-loss 10 pips above the entry price and a take-profit 20 pips below the entry price.

Backtesting and Optimization of Strategies

Backtesting and optimization are crucial steps in developing a robust and profitable Forex trading strategy. They allow traders to evaluate the historical performance of their strategy and refine it to improve future results. However, it’s vital to understand the limitations of backtesting and the importance of subsequent testing using live market data.

Backtesting involves simulating the performance of a trading strategy using historical market data. This process allows traders to assess the strategy’s profitability, risk exposure, and overall effectiveness before risking real capital. Effective backtesting requires careful consideration of data quality, transaction costs, and slippage.

Backtesting Process Using Historical Data

The backtesting process typically begins with selecting a suitable historical data set. This data should encompass a sufficiently long period to capture a wide range of market conditions, including both bullish and bearish trends, as well as periods of high and low volatility. The chosen timeframe will depend on the trading strategy’s holding period; a day trading strategy requires high-frequency data, while a swing trading strategy might use daily or weekly data. The strategy’s rules are then applied to the historical data, generating a simulated trading record that shows the strategy’s performance over time. This record includes metrics such as net profit/loss, maximum drawdown, win rate, and average trade duration. The results are then analyzed to identify strengths and weaknesses of the strategy. For example, if a strategy performs poorly during periods of high volatility, it might require adjustments to better manage risk during such times. Software tools or programming languages like Python with libraries such as Pandas and TA-Lib are commonly used to automate this process.

Importance of Forward Testing and Out-of-Sample Testing

Backtesting, while valuable, is not a foolproof method for predicting future performance. This is because historical data may not accurately reflect future market conditions. To mitigate this limitation, forward testing and out-of-sample testing are essential. Forward testing involves applying the backtested strategy to a period of data that was not used during the backtesting phase. This helps assess how well the strategy generalizes to unseen data. Out-of-sample testing is a more rigorous approach that involves using a completely separate dataset for testing. For instance, a strategy might be backtested on data from 2015-2020 and then forward tested on data from 2021-2022. Significant discrepancies between backtested and forward-tested results indicate potential overfitting or issues with the strategy’s robustness. A strategy that performs well in both backtests and forward tests is more likely to perform well in live trading.

Methods for Optimizing Trading Strategies

Optimization involves adjusting parameters within a trading strategy to improve its performance. This is often done iteratively, with each adjustment being evaluated through backtesting and forward testing. Over-optimization is a common pitfall, where a strategy is tweaked excessively to fit the historical data, resulting in poor performance on new data. To avoid over-optimization, traders often employ techniques like walk-forward analysis, which involves dividing the historical data into multiple periods and optimizing the strategy on each period separately. This helps assess the consistency of the strategy’s performance across different market conditions. Another method is to use a separate out-of-sample dataset for evaluating the performance of the optimized strategy. This helps to identify if the strategy’s improvement is genuine or simply due to overfitting. Parameter optimization can involve adjusting various aspects of the strategy, such as stop-loss levels, take-profit targets, position sizing, or the indicators used to generate trading signals. The goal is to find a balance between maximizing profitability and minimizing risk.

Summary

Mastering forex trading involves a blend of technical skill, fundamental knowledge, and disciplined risk management. This guide has provided a framework for understanding various strategies, from technical indicators to fundamental analysis and automated trading systems. Remember, consistent learning, practice, and adaptation are crucial for long-term success in this dynamic market. By carefully considering your risk tolerance, choosing a suitable trading style, and rigorously backtesting your strategies, you can pave the way towards achieving your forex trading objectives.

Detailed FAQs

What is the minimum account size needed for Forex trading?

Minimum account sizes vary by broker, but many allow accounts with as little as $100-$500. However, starting with a larger amount allows for better position sizing and risk management.

How much time commitment is required for Forex trading?

This depends heavily on your chosen strategy. Scalping requires constant monitoring, while swing trading may only need a few checks per day. Consider your lifestyle and available time when selecting a strategy.

Are there any legal considerations for Forex trading?

Yes, regulations vary by country. Ensure you comply with all local laws and regulations regarding forex trading and choose a regulated broker.

What are the common mistakes beginners make in Forex trading?

Overtrading, ignoring risk management, emotional decision-making, and lack of proper education are common pitfalls for beginners.