Sustainable investment funds are rapidly gaining prominence as investors increasingly seek both financial returns and positive societal impact. This guide delves into the multifaceted world of sustainable investing, exploring various fund types, ESG integration strategies, risk management techniques, and the regulatory landscape shaping this dynamic sector. We’ll examine the performance of sustainable funds compared to traditional counterparts, analyze successful case studies, and discuss the crucial role of impact measurement and reporting.

From understanding core principles and different investment approaches like ESG and impact investing to navigating the complexities of ESG data verification and regulatory compliance, this comprehensive overview equips readers with the knowledge needed to confidently navigate the evolving field of sustainable finance. We will also explore future trends and opportunities within the sector, highlighting the transformative potential of technology and innovative investment strategies.

Defining Sustainable Investment Funds

Sustainable investment funds represent a growing segment of the financial market, prioritizing both financial returns and positive environmental and social impact. These funds integrate environmental, social, and governance (ESG) factors into their investment decisions, aiming to generate long-term value while contributing to a more sustainable future. They differ significantly from traditional investment funds which primarily focus on maximizing financial returns without explicit consideration for sustainability.

Core Principles of Sustainable Investment Funds

Sustainable investment funds operate on several key principles. Firstly, they explicitly incorporate ESG factors into their investment analysis and selection process. This means evaluating companies not only on their financial performance but also on their environmental impact (e.g., carbon emissions, resource consumption), social responsibility (e.g., labor practices, human rights), and corporate governance (e.g., board diversity, executive compensation). Secondly, these funds aim for long-term value creation, recognizing that sustainability considerations often contribute to greater resilience and long-term profitability. Finally, transparency and accountability are crucial; sustainable funds typically provide detailed information on their investment strategies, ESG integration process, and impact measurement.

Types of Sustainable Investment Funds

Several distinct approaches characterize sustainable investment funds. ESG integration is the most common, where ESG factors are incorporated alongside traditional financial analysis. Impact investing goes further, explicitly aiming to generate measurable social and environmental impact alongside financial returns. Green bonds are debt securities specifically issued to finance environmentally friendly projects, such as renewable energy infrastructure or sustainable transportation. Each approach offers a unique balance between financial goals and sustainability objectives.

Investment Strategies Employed by Sustainable Funds

Sustainable investment funds employ a range of strategies to achieve their objectives. Some focus on excluding companies involved in controversial activities, such as fossil fuels or weapons manufacturing (negative screening). Others actively seek out companies demonstrating strong ESG performance (positive screening). Some funds employ engagement strategies, actively communicating with companies to promote improved sustainability practices. Thematic investing focuses on specific sectors or industries contributing to sustainability, such as renewable energy or sustainable agriculture. Finally, some funds utilize a combination of these strategies for a comprehensive approach. For example, a fund might exclude companies with poor environmental records while simultaneously investing in companies leading the transition to a low-carbon economy.

Comparison of Sustainable Investment Fund Types

| Fund Type | Investment Focus | Risk Level | Potential Returns |

|---|---|---|---|

| ESG Integration | Companies with strong overall ESG performance | Generally similar to traditional funds | Potentially similar to or slightly below traditional funds, but with long-term resilience |

| Impact Investing | Companies generating measurable social and environmental impact | Can be higher than traditional funds, depending on the specific investments | Potential for both financial and social returns, but potentially more volatile |

| Green Bonds | Environmentally friendly projects | Generally lower risk than other sustainable investment types, often comparable to traditional fixed-income investments | Moderate, relatively stable returns, but often lower than equities |

ESG Factors and their Integration

Sustainable investment funds increasingly incorporate Environmental, Social, and Governance (ESG) factors into their investment decisions. This shift reflects a growing awareness of the interconnectedness between a company’s sustainability performance and its long-term financial viability. Investors recognize that companies with strong ESG profiles are better positioned to manage risks, seize opportunities, and deliver superior returns over the long term.

ESG criteria are assessed and integrated into the investment process through various methods. Fund managers may utilize ESG ratings provided by specialized agencies, conduct their own in-depth research, or engage directly with companies to understand their ESG practices. This assessment often involves analyzing a company’s environmental impact (e.g., carbon emissions, waste management), social responsibility (e.g., labor practices, community engagement), and governance structure (e.g., board diversity, executive compensation). The integration of ESG factors can range from negative screening (excluding companies with poor ESG performance) to positive screening (selecting companies with strong ESG profiles) to active ownership (engaging with companies to improve their ESG performance).

ESG Data Measurement and Verification Challenges

Measuring and verifying ESG data presents significant challenges. The lack of standardized metrics and reporting frameworks makes it difficult to compare companies across different sectors and geographies. Data inconsistencies, inaccuracies, and the potential for “greenwashing” (misrepresenting ESG performance) further complicate the process. Furthermore, the subjective nature of some ESG factors makes objective measurement challenging. For example, assessing a company’s commitment to social responsibility may require qualitative analysis, which is inherently less precise than quantitative data on carbon emissions. This lack of consistent, reliable data hinders the ability of investors to accurately assess ESG risks and opportunities.

Hypothetical ESG Scoring System for Renewable Energy Companies

A hypothetical ESG scoring system for renewable energy companies could utilize a weighted average approach. Each ESG factor (environmental, social, and governance) would be assigned a specific weight reflecting its relative importance to the industry. For example, environmental factors might receive the highest weight (e.g., 50%), followed by social factors (e.g., 30%) and governance factors (e.g., 20%). Within each category, specific metrics would be identified and scored.

| Factor | Metric | Weight | Score (0-100) |

|---|---|---|---|

| Environmental | Greenhouse gas emissions reduction | 25% | 90 |

| Environmental | Renewable energy source diversification | 25% | 80 |

| Social | Employee safety and well-being | 15% | 95 |

| Social | Community engagement and development | 15% | 75 |

| Governance | Board diversity and independence | 10% | 85 |

| Governance | Transparency and accountability | 10% | 90 |

The scores for each metric would be weighted and aggregated to produce an overall ESG score. For instance, a company with scores as shown in the table above would receive an overall ESG score of 85. This hypothetical system demonstrates how a weighted approach can integrate diverse ESG metrics into a single, comparable score. The specific metrics and weights used would need to be adjusted based on the evolving needs of the renewable energy sector and the preferences of investors. Such a system, however, highlights the complexity of developing robust and reliable ESG scoring methodologies.

Performance and Risk Management

Sustainable investment funds have gained significant traction, but understanding their performance characteristics and associated risks is crucial for potential investors. This section delves into a comparison of sustainable and traditional fund performance, explores inherent risks, and Artikels strategies for effective risk mitigation.

Sustainable investing, while aiming for long-term positive impact, is not immune to market fluctuations. A nuanced understanding of both the potential benefits and drawbacks is essential for making informed investment decisions.

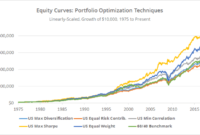

Historical Performance Comparison

Direct comparisons between sustainable and traditional funds’ historical performance are complex due to variations in fund mandates, investment strategies, and benchmark indices. While some studies suggest that sustainable funds have performed comparably to or even slightly better than their traditional counterparts over certain periods, this isn’t consistently true across all asset classes or timeframes. The performance of any investment, regardless of its sustainability focus, is heavily influenced by broader market conditions, economic cycles, and sector-specific trends. A comprehensive analysis requires considering specific fund characteristics and relevant benchmarks rather than making sweeping generalizations.

Potential Risks Associated with Sustainable Investing

Sustainable investing presents unique risks alongside the potential for positive returns. These risks include:

* Greenwashing: Companies might exaggerate their sustainability credentials to attract investors, leading to misallocation of capital. Diligent due diligence and transparent reporting are vital to avoid such instances.

* Limited Investment Universe: Focusing solely on sustainable companies can restrict the investment pool, potentially missing out on high-performing assets in non-sustainable sectors. Careful portfolio diversification can help mitigate this.

* Higher Fees: Some sustainable funds charge higher management fees than traditional funds, impacting overall returns. Comparing fee structures is crucial before investing.

* Regulatory Uncertainty: The evolving regulatory landscape surrounding ESG factors can create uncertainty and affect investment decisions. Staying updated on relevant regulations is essential.

* Data Reliability and Transparency: Inconsistencies and limitations in ESG data can make accurate assessments challenging. Relying on reputable data providers and engaging in thorough research is crucial.

Risk Mitigation Strategies

Several strategies can effectively mitigate the risks associated with sustainable investing:

* Diversification: Spreading investments across various asset classes, sectors, and geographies reduces exposure to specific risks.

* Due Diligence: Thorough research into companies’ sustainability practices, including verifying claims and assessing potential greenwashing, is crucial.

* Active Management: Employing active fund managers with expertise in sustainable investing can enhance risk management and performance.

* ESG Integration: Integrating ESG factors into the investment process provides a structured approach to assessing and managing risks and opportunities.

* Regular Monitoring and Rebalancing: Continuously monitoring portfolio performance and rebalancing assets as needed helps maintain a desired risk profile.

Key Factors Influencing Sustainable Fund Performance

Several key factors influence the performance of sustainable investment funds:

- Market Conditions: Broad market trends significantly impact fund performance, regardless of their investment strategy.

- ESG Integration Approach: The method of integrating ESG factors (e.g., exclusionary screening, best-in-class selection, thematic investing) influences both risk and return.

- Fund Manager Expertise: The skill and experience of the fund manager play a critical role in navigating market dynamics and identifying sustainable investment opportunities.

- Investment Strategy and Portfolio Construction: The chosen investment strategy (e.g., growth, value, income) and portfolio construction techniques significantly affect performance.

- Regulatory Changes and Policy Developments: Changes in environmental regulations and government policies can influence the performance of sustainable investments.

- Data Quality and Availability: The accuracy and reliability of ESG data used for investment decisions directly impact performance.

Regulatory Landscape and Transparency

The regulatory environment surrounding sustainable investment funds is rapidly evolving, driven by growing investor demand for transparency and accountability in ESG (Environmental, Social, and Governance) investing. A patchwork of regulations exists across different jurisdictions, reflecting varying levels of commitment to sustainable finance and the complexities of defining and measuring sustainability. This dynamic landscape presents both challenges and opportunities for fund managers and investors alike.

The importance of a robust regulatory framework cannot be overstated. Clear rules and guidelines are essential for ensuring that funds genuinely align with their stated sustainable investment objectives, preventing greenwashing, and fostering investor confidence. Without effective oversight, the integrity of the sustainable finance market is at risk.

Key Regulatory Bodies and their Roles

Several international and national regulatory bodies play crucial roles in overseeing sustainable finance. These organizations establish standards, conduct oversight, and promote transparency within the sector. Their activities significantly influence the development and implementation of sustainable investment strategies.

Transparency and Disclosure in Sustainable Investing

Transparency is paramount in sustainable investing. Investors need access to clear, consistent, and reliable information to assess the environmental and social impact of their investments. This requires standardized reporting frameworks and robust disclosure requirements. Without adequate transparency, it becomes difficult to verify the sustainability claims made by fund managers, potentially leading to misallocation of capital and undermining investor trust. Furthermore, transparent reporting allows for effective monitoring and evaluation of the actual impact of sustainable investment strategies.

Key Regulations Related to Sustainable Finance

| Jurisdiction | Regulation/Initiative | Key Focus |

|---|---|---|

| European Union | Sustainable Finance Disclosure Regulation (SFDR) | Disclosure of ESG risks and sustainable investment strategies by financial market participants. |

| United Kingdom | Sustainable Disclosure Requirements (SDR) | Similar to SFDR, focusing on transparency and disclosure for sustainable investments. |

| United States | SEC Climate-Related Disclosures | Mandates climate-related disclosures for publicly traded companies, indirectly impacting sustainable investment funds. |

| Switzerland | Various initiatives under the umbrella of the Swiss Sustainable Finance (SSF) | Focuses on promoting sustainable finance practices and fostering dialogue between stakeholders. |

| Singapore | Green Finance Action Plan | Aims to develop a vibrant green finance ecosystem through tax incentives and various initiatives. |

Future Trends and Opportunities

The sustainable investment landscape is rapidly evolving, driven by increasing environmental concerns, stricter regulations, and the growing recognition of the financial benefits of incorporating ESG factors. This section explores key emerging trends, growth opportunities, and the transformative role of technology in shaping the future of sustainable finance. We will also examine innovative investment strategies that are leading the charge towards a more sustainable and responsible investment ecosystem.

The integration of Environmental, Social, and Governance (ESG) factors is no longer a niche strategy; it’s becoming the mainstream approach to investment management. This shift is propelled by investor demand, regulatory pressures, and the increasing availability of ESG data and analytics. The potential for growth in this sector is immense, driven by both the increasing awareness of ESG risks and opportunities and the growing pool of capital seeking sustainable investment solutions.

Emerging Trends in Sustainable Investing

Several key trends are reshaping the sustainable investment landscape. The focus is shifting from solely minimizing negative impacts (avoiding “brown” investments) to actively seeking out and promoting positive environmental and social outcomes (“green” investments). This includes a growing interest in impact investing, which aims to generate measurable social and environmental impact alongside financial returns. Another significant trend is the increasing demand for transparency and accountability, with investors demanding more robust ESG data and reporting from companies. Finally, the integration of ESG factors into all aspects of investment decision-making, from portfolio construction to risk management, is becoming increasingly prevalent.

Growth Opportunities in Sustainable Investment

The sustainable investment sector presents numerous growth opportunities. The increasing availability of green bonds and other sustainable debt instruments offers investors a diversified range of options. Furthermore, the growing demand for sustainable infrastructure projects, such as renewable energy and green buildings, creates significant investment potential. The development of innovative sustainable investment strategies, such as impact investing and ESG integration, also presents opportunities for growth. For example, the rise of green fintech companies is creating new avenues for investment and innovation. Companies developing technologies that improve energy efficiency or promote sustainable agriculture are attracting significant investor interest.

The Role of Technology in Advancing Sustainable Finance

Technology plays a crucial role in driving the growth of sustainable finance. Big data analytics enables investors to assess ESG risks and opportunities more effectively. Blockchain technology can enhance transparency and traceability in supply chains, improving the accuracy and reliability of ESG data. Artificial intelligence (AI) can be used to develop sophisticated ESG scoring models and identify investment opportunities. For instance, AI-powered platforms can analyze vast datasets to identify companies with strong ESG profiles, streamlining the investment process. Furthermore, fintech companies are developing innovative platforms that allow investors to easily access and manage their sustainable investments.

Innovative Sustainable Investment Strategies

Several innovative sustainable investment strategies are emerging. Impact investing, which aims to generate both financial returns and positive social and environmental impact, is gaining traction. This approach often involves investing in companies or projects that address specific social or environmental challenges. For example, investing in companies developing renewable energy technologies or providing access to clean water in underserved communities. Another innovative strategy is the integration of ESG factors into traditional investment strategies, incorporating ESG data into portfolio construction and risk management processes. This allows investors to manage ESG risks and capitalize on ESG opportunities, potentially leading to improved risk-adjusted returns. The use of thematic investing, focusing on specific sectors such as renewable energy or sustainable agriculture, allows for targeted investments in companies driving positive change. This allows for a more focused approach to achieving sustainable investment goals.

Case Studies of Successful Sustainable Funds

Examining the performance of successful sustainable investment funds provides valuable insights into effective strategies and the potential for both financial returns and positive environmental and social impact. Several funds have demonstrated that integrating ESG factors into investment decisions can lead to strong performance while aligning with ethical and sustainability goals. This section will delve into specific examples.

Parnassus Endeavor Fund

The Parnassus Endeavor Fund is a long-term, actively managed fund that screens companies based on ESG criteria, avoiding those involved in controversial industries such as tobacco, alcohol, gambling, and weapons manufacturing. Their investment strategy prioritizes companies with strong environmental and social records, and they engage with companies to promote positive change. The fund has consistently outperformed its benchmark, demonstrating that a sustainable investment approach can be financially successful. Their success is attributed to a rigorous screening process, active engagement with portfolio companies, and a long-term investment horizon. This approach minimizes risk associated with companies exhibiting poor ESG performance while capitalizing on opportunities within companies committed to sustainability.

Impax Asset Management

Impax Asset Management focuses on investments in companies addressing global environmental challenges. Their funds invest across various sectors, including renewable energy, clean technology, and sustainable agriculture. Impax’s success stems from their deep understanding of the environmental markets and their ability to identify companies poised for growth within the burgeoning sustainable economy. Their performance has consistently reflected the growth trajectory of the clean energy and sustainable technology sectors. Their long-term perspective and expertise in identifying and analyzing opportunities within these specific sectors are key factors in their success.

Aviva Investors Global ESG Equity Fund

Aviva Investors Global ESG Equity Fund integrates ESG factors into its investment process across its entire portfolio. They use a combination of quantitative and qualitative analysis to assess the ESG performance of companies. Their approach goes beyond simple exclusionary screening; they actively engage with companies to improve their ESG performance. The fund’s strong performance demonstrates the potential of integrating ESG factors into traditional investment strategies. The fund’s success highlights the importance of comprehensive ESG integration, encompassing both investment selection and active engagement with companies.

Summary of Successful Sustainable Funds

The following table summarizes the key characteristics of the discussed funds:

| Fund Name | Investment Focus | Key Performance Metric (Example) | Key Success Factors |

|---|---|---|---|

| Parnassus Endeavor Fund | ESG-screened companies, excluding controversial industries | Consistent outperformance of benchmark index | Rigorous screening, active engagement, long-term horizon |

| Impax Asset Management Funds | Companies addressing environmental challenges (renewable energy, clean technology, etc.) | Strong performance reflecting growth in sustainable sectors | Deep sector expertise, identification of growth opportunities |

| Aviva Investors Global ESG Equity Fund | Global equities with integrated ESG analysis | Competitive returns with positive ESG impact | Comprehensive ESG integration, active engagement |

Impact Measurement and Reporting

Impact measurement and reporting are crucial for demonstrating the effectiveness of sustainable investment strategies. They provide evidence of a fund’s contribution to positive social and environmental outcomes, fostering transparency and accountability to investors and stakeholders. Robust impact measurement allows for continuous improvement and informs future investment decisions, ultimately driving greater positive change.

The importance of impact measurement and reporting stems from the need to verify the claims made by sustainable investment funds. Investors increasingly demand evidence that their investments are truly making a difference, beyond simply avoiding negative impacts. Accurate reporting allows for comparisons between different funds and strategies, helping investors make informed choices aligned with their values. Furthermore, strong impact measurement helps attract capital to the most effective sustainable initiatives, accelerating the transition to a more sustainable future.

Methodologies for Measuring Social and Environmental Impact

Several methodologies exist for measuring the social and environmental impact of investments, each with its strengths and limitations. These range from simple metrics to complex models, reflecting the multifaceted nature of impact. The choice of methodology depends on the specific investment strategy, the type of impact being measured, and the data available.

- Quantitative Metrics: These involve numerical data, such as the reduction in greenhouse gas emissions (measured in tons of CO2 equivalent), the increase in renewable energy capacity (measured in megawatts), or the number of jobs created. These metrics are easily understood and comparable but may not capture the full complexity of the impact.

- Qualitative Metrics: These assess non-numerical aspects of impact, such as improvements in community well-being, enhanced biodiversity, or increased access to essential services. Qualitative data, often gathered through surveys, interviews, or case studies, provide richer insights but can be more challenging to quantify and compare.

- Integrated Approaches: Many impact measurement frameworks combine quantitative and qualitative data to provide a more holistic picture. This might involve using a weighted scoring system that incorporates both types of data, or developing a narrative report that integrates quantitative findings with qualitative insights. Examples include the Global Reporting Initiative (GRI) Standards and the Sustainability Accounting Standards Board (SASB) standards.

Challenges of Accurately Measuring and Reporting Impact

Accurately measuring and reporting impact presents several significant challenges. Data availability and quality are often limitations, especially for qualitative data which can be subjective and difficult to verify. Attributing specific outcomes to a particular investment can also be complex, especially in cases where multiple factors contribute to the observed impact. Furthermore, establishing appropriate baselines and defining meaningful targets are crucial but can be difficult, particularly for long-term investments with complex, indirect effects. The lack of standardized methodologies also hinders comparability between different funds and investments. Finally, the challenge of measuring unintended consequences, both positive and negative, highlights the need for robust and comprehensive impact assessments.

Framework for Measuring and Reporting Impact

A robust framework for measuring and reporting impact should include several key elements. First, it should clearly define the fund’s investment objectives and the types of impact it seeks to achieve. This involves identifying specific environmental and social goals and setting measurable targets. Second, it should select appropriate methodologies for collecting and analyzing data, considering both quantitative and qualitative aspects of impact. Third, it should establish a robust data collection and management system, ensuring data quality and accuracy. Fourth, it should develop a transparent and consistent reporting process, communicating findings clearly and honestly to investors and stakeholders. Finally, the framework should include a mechanism for ongoing monitoring and evaluation, allowing for continuous improvement and adaptation based on feedback and evolving best practices. A well-structured impact report might include a summary of the fund’s investment strategy, the chosen methodologies, the data collected, the results achieved, and a discussion of limitations and challenges. It should also present a plan for future improvements and continued monitoring of impact.

Epilogue

The journey into sustainable investment funds reveals a compelling narrative of financial responsibility interwoven with positive social and environmental outcomes. While challenges remain in areas like standardized ESG data and impact measurement, the growing investor demand and evolving regulatory frameworks signal a future where sustainable investing will be not just a niche but a mainstream approach. By understanding the various fund types, integrating ESG factors effectively, and managing risks proactively, investors can contribute to a more sustainable future while achieving their financial goals.

Essential FAQs

What are the typical fees associated with sustainable investment funds?

Fees vary depending on the fund manager and the specific fund, but generally align with those of traditional investment funds. Expect expense ratios, management fees, and potentially transaction fees.

How can I assess the authenticity of a fund’s sustainability claims?

Look for independent third-party verification of ESG data and impact reports. Transparency in investment strategies and clear disclosure of holdings are also crucial indicators of authenticity.

Are sustainable investment funds suitable for all investors?

Sustainable investing, like any investment strategy, carries risk. It’s crucial to align your investment choices with your risk tolerance and financial goals. Consider consulting a financial advisor to determine suitability.

How do I find a sustainable investment fund that aligns with my values?

Research fund prospectuses carefully, focusing on their investment philosophies, ESG integration methods, and impact reporting. Consider using online resources and screening tools that allow you to filter funds based on your specific values and preferences.