Indonesia’s vibrant economy relies heavily on a robust financial system. Understanding the intricacies of Perbankan dan Lembaga Keuangan – its banking sector and financial institutions – is crucial to grasping the nation’s economic health and future prospects. This exploration delves into the structure, regulations, and key players shaping Indonesia’s financial landscape, from traditional banks to the burgeoning FinTech sector.

We will examine the diverse range of institutions, their roles in economic development, and the challenges they face in an increasingly dynamic global environment. This includes analyzing the impact of technological advancements, risk management strategies, and the ongoing evolution of the regulatory framework.

Indonesian Banking System Overview

Indonesia’s banking system plays a crucial role in the nation’s economic development, facilitating financial transactions and supporting various sectors. It’s a complex structure with a blend of state-owned and privately-owned institutions, operating under a robust regulatory framework designed to ensure stability and promote growth. This overview will explore the key components and characteristics of this system.

Structure of the Indonesian Banking System

The Indonesian banking system is hierarchical, with Bank Indonesia (BI) at its apex. BI serves as the central bank, responsible for monetary policy, regulating the banking industry, and maintaining financial stability. It oversees a two-tiered banking system: the first tier consists of commercial banks, which directly interact with the public, while the second tier comprises rural banks and other specialized financial institutions. The Financial Services Authority (Otoritas Jasa Keuangan or OJK) is the primary regulatory body responsible for overseeing the overall financial services sector, including banking, insurance, and capital markets. This dual regulatory structure aims to ensure effective oversight and prevent conflicts of interest.

Types of Banks Operating in Indonesia

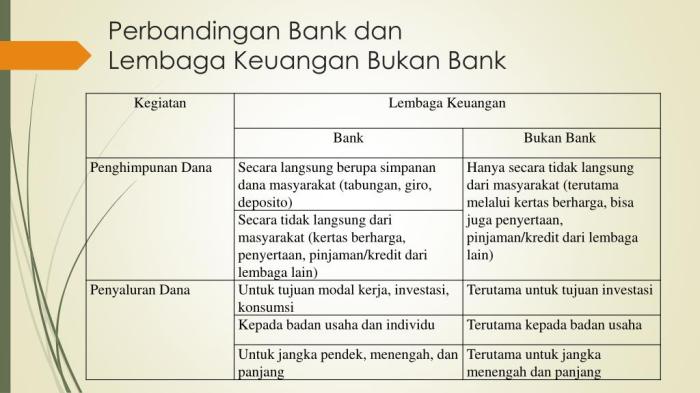

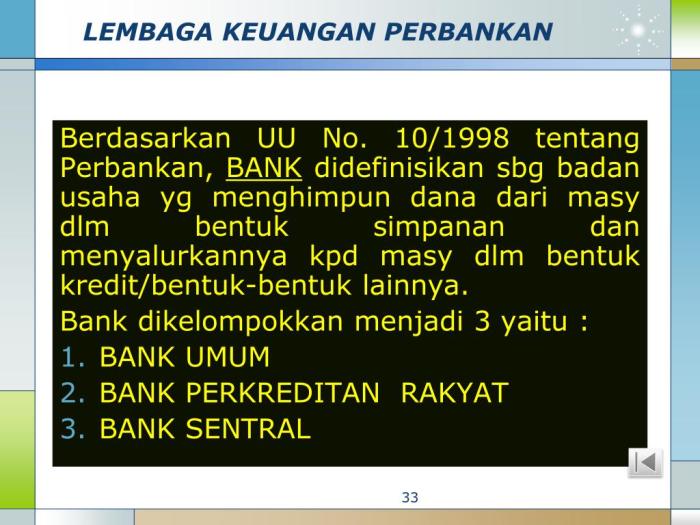

Indonesia’s banking sector is diverse, encompassing various types of banks catering to different needs and market segments. State-owned banks (Bank Umum Negara or BUMN) play a significant role, often focusing on large-scale projects and national development initiatives. Private banks, both domestic and foreign-owned, compete vigorously, offering a wider array of services to individuals and businesses. Islamic banks, adhering to Sharia principles, provide banking services compliant with Islamic law, offering products such as Murabahah (cost-plus financing) and Ijarah (leasing). Each type of bank operates under its own license and specific regulations.

Key Regulations Governing Banking Operations in Indonesia

Indonesian banking operations are governed by a comprehensive set of laws and regulations, primarily overseen by BI and OJK. These regulations cover various aspects, including capital adequacy ratios (CAR), lending limits, risk management practices, and consumer protection. The aim is to maintain financial stability, protect depositors, and prevent systemic risks. Key legislation includes Law No. 7 of 1992 concerning Banking and Law No. 21 of 2011 concerning the OJK. Compliance with these regulations is crucial for all banks operating in Indonesia.

Comparison of Indonesian Bank Types

| Bank Type | Ownership | Focus | Regulation |

|---|---|---|---|

| State-Owned Banks (BUMN) | Government | National development, large-scale projects | BI & OJK |

| Private Domestic Banks | Private Indonesian entities | Broad range of services, retail and corporate | BI & OJK |

| Foreign Banks | Foreign entities | International transactions, corporate clients | BI & OJK |

| Islamic Banks | Private or government | Sharia-compliant financial services | BI & OJK, plus Sharia supervisory boards |

Non-Bank Financial Institutions in Indonesia

Indonesia’s financial landscape extends beyond traditional banks, encompassing a diverse range of non-bank financial institutions (NBFIs) that play a crucial role in the nation’s economic development. These institutions offer a variety of financial services, catering to both individuals and businesses, often filling gaps left by the banking sector. Understanding their functions, regulations, and market presence is key to comprehending the entirety of Indonesia’s financial system.

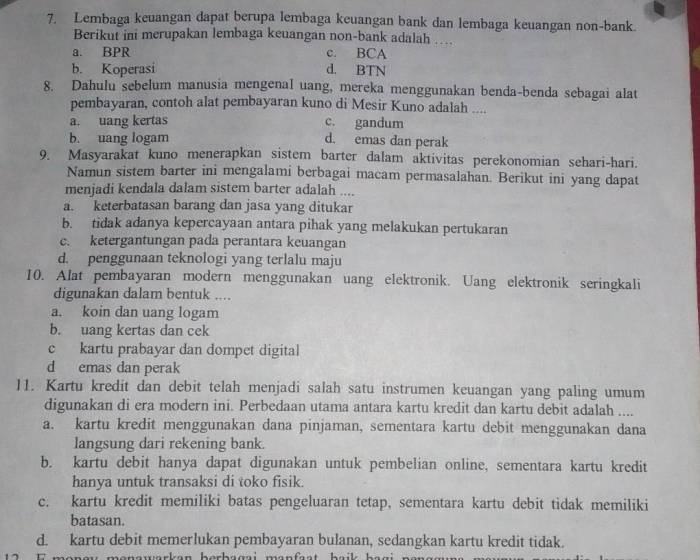

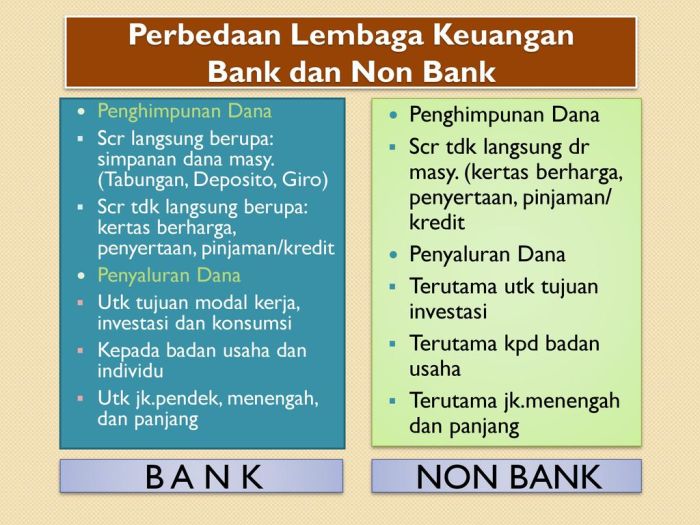

Categorization of Non-Bank Financial Institutions

NBFIs in Indonesia can be broadly categorized based on their primary functions. These categories are not mutually exclusive, and some institutions may operate across multiple segments. Key categories include financing companies, leasing companies, insurance companies, investment management companies, and pawnshops. Financing companies, for example, provide various forms of credit, while leasing companies facilitate the use of assets without outright purchase. Insurance companies manage risk, and investment management companies handle investment portfolios. Pawnshops offer short-term loans secured by personal assets. This diverse range of services highlights the significant contribution NBFIs make to the Indonesian economy.

Comparison of Bank and NBFI Services

While both banks and NBFIs provide financial services, their offerings differ significantly. Banks primarily focus on deposit-taking and lending, offering a wide array of accounts, loans, and other financial products. NBFIs, on the other hand, specialize in specific areas, such as financing, leasing, or insurance. For instance, a financing company might offer specialized financing for motorcycles, whereas a bank might offer a broader range of personal and business loans. Banks generally operate under stricter regulations and have a broader range of services, while NBFIs often cater to niche markets or offer more specialized financial solutions.

Regulatory Framework for NBFIs

The Indonesian government, through the Financial Services Authority (Otoritas Jasa Keuangan or OJK), regulates NBFIs to ensure stability and protect consumers. The OJK sets licensing requirements, capital adequacy standards, and operational guidelines for each category of NBFI. These regulations vary depending on the type of institution and the risks associated with its operations. Compliance with these regulations is crucial for the continued operation of NBFIs in Indonesia. Stringent oversight aims to prevent systemic risks and maintain consumer confidence within the non-bank financial sector.

Examples of Prominent NBFIs and Their Market Segments

Several prominent NBFIs operate successfully in Indonesia, serving diverse market segments. For example, PT Adira Finance Indonesia Tbk is a leading financing company specializing in the automotive sector, offering financing for motorcycles and cars. Meanwhile, PT Mandiri Tunas Finance Tbk focuses on providing financing for various types of vehicles and equipment. In the insurance sector, PT Asuransi Allianz Life Indonesia and PT Prudential Life Assurance are major players, offering life insurance and other related products. These examples illustrate the breadth and depth of the NBFI sector’s contribution to the Indonesian economy, demonstrating the significant role they play in providing financial solutions to a wide range of customers.

Financial Technology (FinTech) and its Impact

Indonesia’s FinTech sector has experienced explosive growth in recent years, driven by a young, tech-savvy population, increasing smartphone penetration, and a burgeoning digital economy. This rapid expansion has significantly impacted the traditional banking landscape, forcing established players to adapt and innovate to remain competitive. The rise of FinTech has also played a crucial role in promoting financial inclusion, reaching previously underserved segments of the population.

The integration of FinTech into Indonesia’s financial system presents both significant challenges and opportunities for all stakeholders. Traditional banks face pressure from agile FinTech companies offering faster, more convenient, and often cheaper services. However, partnerships and collaborations between traditional banks and FinTech firms also offer potential for mutual growth and enhanced service offerings.

The Rise of FinTech in Indonesia and its Influence on Traditional Banking

The Indonesian FinTech landscape is dominated by mobile payment platforms, digital lending platforms, and investment platforms. Companies like GoPay, OVO, and Dana have become household names, processing billions of transactions annually and challenging the dominance of traditional banks in everyday payments. Digital lending platforms offer quick and easy access to credit, particularly to small and medium-sized enterprises (SMEs) and individuals who may lack access to traditional banking services. This has led to increased competition, forcing traditional banks to invest heavily in digital transformation initiatives, improving their mobile banking apps, and developing innovative digital products to retain customers and attract new ones. This competition has also driven down transaction fees and interest rates in some sectors, benefiting consumers.

The Impact of FinTech on Financial Inclusion in Indonesia

FinTech’s impact on financial inclusion in Indonesia has been substantial. Millions of previously unbanked Indonesians now have access to financial services through mobile money platforms and digital lending apps. This increased access to credit has facilitated business growth for SMEs and improved the financial well-being of individuals. The ease of use and accessibility of FinTech platforms, particularly in rural areas with limited access to traditional banking branches, have been key drivers of this progress. Government initiatives supporting digital literacy and financial education have further amplified FinTech’s positive impact on financial inclusion.

Challenges and Opportunities Presented by FinTech for Indonesian Financial Institutions

Indonesian financial institutions face several challenges in navigating the FinTech revolution. These include regulatory uncertainty, cybersecurity risks, data privacy concerns, and the need for significant investment in technology and infrastructure. However, FinTech also presents numerous opportunities. Partnerships with FinTech companies can allow traditional banks to expand their reach, improve their service offerings, and gain access to valuable customer data. Banks can leverage FinTech’s innovative technologies to develop new products and services, enhance customer experience, and improve operational efficiency. Furthermore, the development of open banking frameworks can facilitate collaboration and innovation across the financial ecosystem.

Hypothetical Scenario: Collaboration between a Traditional Bank and a FinTech Company

Imagine Bank XYZ, a large Indonesian bank, partnering with a FinTech company specializing in micro-loans, called PinjamCepat. Bank XYZ provides PinjamCepat with access to its extensive credit scoring database and KYC (Know Your Customer) infrastructure, while PinjamCepat leverages its advanced algorithms and mobile platform to reach underserved borrowers efficiently. This collaboration allows Bank XYZ to expand its reach into the micro-loan market without significant upfront investment, while PinjamCepat benefits from access to a reliable credit assessment system and reduced risk. Both entities share the profits generated, creating a win-win situation and demonstrating the potential for synergistic collaborations in the Indonesian FinTech landscape. This model could significantly increase financial inclusion while mitigating risks associated with micro-lending.

Risk Management in Indonesian Financial Institutions

The Indonesian financial sector, encompassing both banks and non-bank financial institutions (NBFIs), operates in a dynamic and increasingly complex environment. Effective risk management is therefore paramount for maintaining financial stability and protecting the interests of depositors, investors, and the broader economy. This section explores the common risks faced by these institutions, the strategies employed to mitigate them, and best practices for enhancing overall risk management capabilities.

Types of Risks Faced by Indonesian Banks and NBFIs

Indonesian banks and NBFIs face a diverse range of risks, broadly categorized into credit risk, liquidity risk, and operational risk. Credit risk encompasses the potential for losses stemming from borrowers’ failure to repay loans or meet other financial obligations. This risk is particularly significant given the fluctuating economic conditions and varying creditworthiness of borrowers in Indonesia. Liquidity risk refers to the risk that an institution may not be able to meet its short-term obligations as they come due. This can arise from unexpected withdrawals, loan defaults, or difficulties in accessing funding markets. Operational risk, on the other hand, encompasses the potential for losses resulting from inadequate or failed internal processes, people, and systems or from external events. This includes risks related to fraud, cyberattacks, and regulatory non-compliance. The relative importance of each risk type varies depending on the specific institution’s business model, size, and risk appetite.

Risk Management Strategies Employed by Indonesian Financial Institutions

Indonesian financial institutions employ a variety of risk management strategies to mitigate the risks they face. These strategies often involve a combination of quantitative and qualitative techniques. Quantitative techniques include using statistical models to assess and quantify the likelihood and potential impact of various risks. Qualitative techniques involve assessing risks through expert judgment, scenario analysis, and stress testing. For instance, banks regularly conduct credit scoring and stress testing to assess the potential impact of macroeconomic shocks on their loan portfolios. Liquidity risk management typically involves maintaining adequate levels of liquid assets, diversifying funding sources, and establishing lines of credit with other financial institutions. Operational risk management involves implementing robust internal controls, investing in technology to enhance security, and providing training to employees on risk management best practices. Furthermore, the implementation of robust internal audit functions and independent risk assessments plays a critical role in ensuring the effectiveness of these strategies.

Comparison of Risk Management Practices Across Different Types of Financial Institutions

While all financial institutions in Indonesia are subject to regulatory oversight and must adhere to certain risk management standards, there are variations in their specific practices. Banks, due to their deposit-taking nature and systemic importance, tend to have more sophisticated and comprehensive risk management frameworks compared to NBFIs. For example, banks typically have dedicated risk management departments with specialized expertise in various risk areas. NBFIs, on the other hand, may have less formalized risk management structures and rely more heavily on external expertise. However, the increasing complexity and interconnectedness of the financial system are driving NBFIs to adopt more robust risk management practices. The specific risk management practices also vary depending on the type of NBFI, with insurance companies focusing on underwriting risk, while investment firms concentrate on market risk.

Best Practices for Risk Mitigation in the Indonesian Financial Sector

Effective risk mitigation requires a proactive and holistic approach. Several best practices can significantly enhance the resilience of Indonesian financial institutions.

- Strengthening Regulatory Frameworks and Supervision: Robust regulatory frameworks and effective supervision are crucial for ensuring that financial institutions maintain adequate risk management practices. This includes regular inspections, stress tests, and enforcement of regulations.

- Enhancing Data Analytics and Technology: Leveraging advanced data analytics and technology can significantly improve risk identification, measurement, and monitoring. This includes using machine learning for fraud detection and predictive modeling for credit risk assessment.

- Promoting a Strong Risk Culture: A strong risk culture, where risk management is embedded in the organization’s DNA, is essential. This requires promoting risk awareness among all employees and providing adequate training and resources.

- Improving Transparency and Disclosure: Increased transparency and disclosure of risk information can enhance market discipline and promote better risk management practices. This includes providing clear and accurate information to investors and regulators.

- Fostering Collaboration and Information Sharing: Collaboration among financial institutions, regulators, and other stakeholders is essential for effective risk management. Sharing information and best practices can help identify emerging risks and develop more effective mitigation strategies.

The Role of “Perbankan dan Lembaga Keuangan” in Economic Development

Indonesia’s banking and financial system plays a crucial role in driving economic growth and development. Its functions extend beyond simply facilitating transactions; it acts as a vital engine for investment, resource allocation, and overall economic stability. A healthy and efficient financial sector is essential for a nation’s prosperity, and Indonesia is no exception.

The contribution of the banking and financial sector to Indonesia’s economic growth is multifaceted. It acts as an intermediary, channeling savings from individuals and businesses into productive investments. This process fuels capital formation, supporting the expansion of businesses and the creation of jobs. Furthermore, the sector facilitates international trade and investment, connecting Indonesia to the global economy and fostering economic diversification. Access to credit, provided through banks and other financial institutions, enables businesses to expand operations, adopt new technologies, and increase their productivity. This, in turn, leads to higher economic output and improved living standards.

Financial Stability and Economic Development

Financial stability is intrinsically linked to economic development. A stable financial system fosters investor confidence, encouraging both domestic and foreign investment. This influx of capital fuels economic growth and creates opportunities for businesses to thrive. Conversely, financial instability, characterized by crises or significant market volatility, can severely disrupt economic activity, leading to job losses, reduced investment, and a decline in overall economic output. The Indonesian government actively works to maintain financial stability through regulatory frameworks and supervisory measures, recognizing its importance for sustainable economic development. Examples include the implementation of stress tests on banks to assess their resilience to economic shocks and the maintenance of adequate capital buffers to absorb potential losses.

Impact of Monetary Policy on the Indonesian Financial System

Monetary policy, implemented by Bank Indonesia (the central bank), significantly influences the Indonesian financial system. By adjusting interest rates and managing liquidity, Bank Indonesia aims to maintain price stability and support economic growth. Lower interest rates, for instance, can stimulate borrowing and investment, boosting economic activity. However, excessively low rates can also lead to inflation. Conversely, higher interest rates can curb inflation but may slow down economic growth. Bank Indonesia carefully balances these competing objectives, adapting its monetary policy stance in response to evolving economic conditions. The recent implementation of quantitative easing measures, for example, aimed to inject liquidity into the market and alleviate the economic impact of the COVID-19 pandemic.

Financial Sector Support for Specific Sectors

The Indonesian financial sector provides targeted support to various sectors of the economy. For example, the government has implemented programs to increase access to credit for small and medium-sized enterprises (SMEs), particularly in the agricultural sector. These programs often involve subsidized interest rates or loan guarantees, helping farmers and agricultural businesses to invest in improved technologies and expand their operations. Similarly, the tourism sector benefits from financial support through loans and investment in tourism-related infrastructure projects. Banks and financial institutions play a key role in facilitating these investments, contributing to the growth and development of these crucial sectors. The provision of microfinance services also plays a significant role in empowering entrepreneurs and fostering economic inclusion in underserved communities. This ensures that a broader range of individuals and businesses have access to financial resources, stimulating economic activity across different segments of society.

Challenges and Future Trends

The Indonesian banking and financial sector, while experiencing significant growth, faces a complex interplay of challenges and opportunities. Navigating these requires strategic adaptation and a forward-looking approach to leverage emerging technologies and address persistent issues. The sector’s future trajectory will be shaped by its ability to embrace innovation while maintaining financial stability and inclusivity.

Key Challenges Facing the Indonesian Banking and Financial Sector

The Indonesian financial landscape is not without its hurdles. These challenges range from infrastructure limitations to the ever-evolving threat of cybercrime. Addressing these issues effectively is crucial for sustainable growth and the overall health of the economy.

- Infrastructure Gaps: Uneven access to financial services across the archipelago, particularly in rural areas, remains a significant challenge. This limits financial inclusion and hinders economic development in less-developed regions. Improving digital infrastructure and expanding branch networks are key to overcoming this.

- Cybersecurity Threats: The increasing reliance on digital financial services exposes the sector to escalating cyber threats. Data breaches and fraud pose significant risks to both institutions and consumers, demanding robust cybersecurity measures and regulatory oversight.

- Competition from Fintech: The rapid growth of fintech companies presents both opportunities and challenges. While fintech fosters innovation and financial inclusion, it also increases competition and requires traditional banks to adapt their strategies and offerings to remain relevant.

- Regulatory Landscape: Maintaining a balance between fostering innovation and ensuring financial stability requires a dynamic and adaptable regulatory framework. The regulatory landscape needs to keep pace with the rapid changes in the financial technology sector.

- Human Capital Development: The industry needs a skilled workforce to navigate the complexities of modern finance and technology. Investing in education and training programs is crucial to meet the evolving demands of the sector.

Potential Future Trends and Developments

The Indonesian financial sector is poised for significant transformation, driven by technological advancements and evolving consumer preferences. These trends will redefine the industry’s landscape and necessitate proactive strategies from financial institutions.

- Increased Digitalization: The shift towards digital banking and financial services will continue to accelerate, driven by increasing smartphone penetration and internet access. This will lead to greater financial inclusion and efficiency.

- Growth of Fintech: Fintech companies will continue to play a significant role in shaping the financial landscape, offering innovative solutions and expanding access to financial services. Collaboration between traditional banks and fintechs is likely to increase.

- Open Banking: The adoption of open banking principles will enhance data sharing and interoperability, creating a more competitive and customer-centric ecosystem. This will require robust data security and privacy measures.

- Focus on Sustainability: Environmental, social, and governance (ESG) factors will become increasingly important for investors and consumers. Financial institutions will need to integrate sustainability into their operations and investment strategies.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will play an increasingly important role in risk management, fraud detection, and customer service. This will require investment in data analytics capabilities and talent.

Adaptation to Global Changes

Indonesian financial institutions are actively adapting to global changes by embracing innovation, strengthening regulatory frameworks, and fostering collaboration. This multifaceted approach ensures resilience and competitiveness in the global financial arena.

Indonesian banks are investing heavily in digital transformation, upgrading their technological infrastructure, and developing new digital products and services to cater to the evolving needs of their customers. They are also actively engaging with fintech companies, exploring partnerships and collaborations to leverage their innovative technologies. Furthermore, the Indonesian government is actively promoting financial inclusion and digital literacy through various initiatives, aiming to expand access to financial services across the country. Regulatory bodies are working to create a conducive environment for innovation while maintaining financial stability and consumer protection.

Projected Growth of Different Segments

A bar chart illustrating projected growth would show a significant increase in the digital banking segment, surpassing traditional banking in terms of transaction volume within the next five years. The fintech segment, particularly in payments and lending, would also demonstrate substantial growth, exceeding the growth rate of traditional banking. While traditional banking would continue to grow, its rate would be comparatively slower, reflecting the shift towards digitalization. Insurance and investment segments would also show moderate growth, but at a slower pace than the digital banking and fintech segments. The chart’s Y-axis would represent growth percentage, and the X-axis would represent the different segments (traditional banking, digital banking, fintech, insurance, investment). The bars representing digital banking and fintech would be significantly taller than the others, visualizing their projected dominance in the coming years. This visualization highlights the transformative impact of digital technologies and the rise of fintech on the Indonesian financial landscape.

Closing Notes

Indonesia’s Perbankan dan Lembaga Keuangan represent a complex yet dynamic system. The interplay between traditional banking, non-bank financial institutions, and FinTech is driving innovation and fostering economic growth. While challenges remain, the sector’s adaptability and commitment to improving financial inclusion suggest a promising future for Indonesia’s financial landscape. Continued monitoring of regulatory developments and technological advancements will be vital in understanding the ongoing evolution of this critical sector.

Common Queries

What is the role of Bank Indonesia (BI)?

Bank Indonesia serves as the central bank of Indonesia, responsible for monetary policy, regulating banks, and maintaining financial stability.

What are some examples of Islamic banks in Indonesia?

Several prominent Islamic banks operate in Indonesia, offering Sharia-compliant financial services. Examples include Bank Syariah Indonesia (BSI) and other smaller Islamic banking units within larger banks.

How does FinTech impact financial inclusion in Indonesia?

FinTech expands access to financial services, particularly for underserved populations in rural areas, by offering mobile banking, digital payments, and other convenient solutions.

What are the major risks faced by Indonesian financial institutions?

Key risks include credit risk (loan defaults), liquidity risk (ability to meet obligations), operational risk (system failures), and increasingly, cyber security risks.