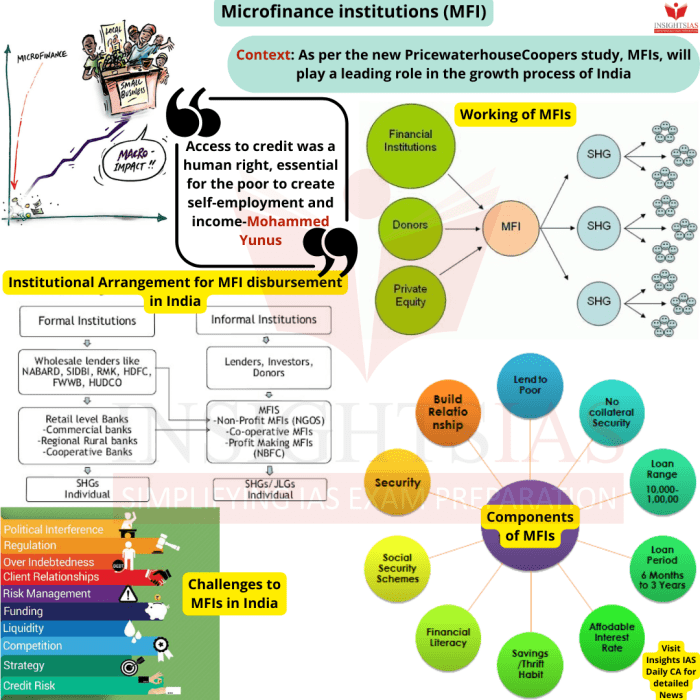

Microfinance institutions (MFIs) have emerged as powerful agents of change, impacting economies, societies, and environments across the globe. Their role in providing financial services to underserved populations, particularly women and small business owners, is undeniable. However, understanding the full scope of their influence requires a nuanced examination of both positive and negative consequences, considering economic growth, social equity, and environmental sustainability. This exploration delves into the multifaceted impact of MFIs, analyzing their successes, challenges, and future potential.

This analysis will navigate the complexities of MFI impact, examining its economic contributions through job creation and poverty reduction, its social effects on gender empowerment and community development, and its environmental implications, including sustainable lending practices. We will also explore the regulatory frameworks that govern MFIs and the crucial role of responsible lending in ensuring long-term positive outcomes. The ultimate aim is to provide a comprehensive understanding of MFIs’ influence, highlighting both their transformative potential and the critical need for responsible implementation.

Defining Microfinance Institution (MFI) Impact

Microfinance institutions (MFIs) aim to alleviate poverty and empower individuals through access to financial services. However, assessing their true impact is complex, requiring a nuanced understanding of economic, social, and environmental consequences, both positive and negative. A comprehensive evaluation needs to move beyond simple measures of loan repayment rates to encompass a broader range of outcomes.

The multifaceted nature of MFI impact necessitates a holistic approach. Economic impacts are readily apparent, focusing on increased income, improved business performance, and reduced poverty. However, social impacts, such as improved health, education, and gender empowerment, are equally significant, often intertwined with economic progress. Furthermore, environmental considerations, including sustainable business practices and resource management, are increasingly recognized as crucial aspects of responsible microfinance.

Economic Impacts of MFIs

Economic impacts are often the primary focus of MFI evaluations. Successful interventions lead to increased household income, enabling borrowers to invest in their businesses, improve living standards, and potentially escape the poverty cycle. For example, studies in Bangladesh have shown significant increases in household income among women who received microloans for small-scale businesses. Conversely, negative economic impacts can arise from high interest rates, inappropriate loan products, or unsustainable business models leading to debt traps and financial distress. Over-indebtedness, particularly in vulnerable communities, is a serious concern requiring careful regulation and responsible lending practices.

Social Impacts of MFIs

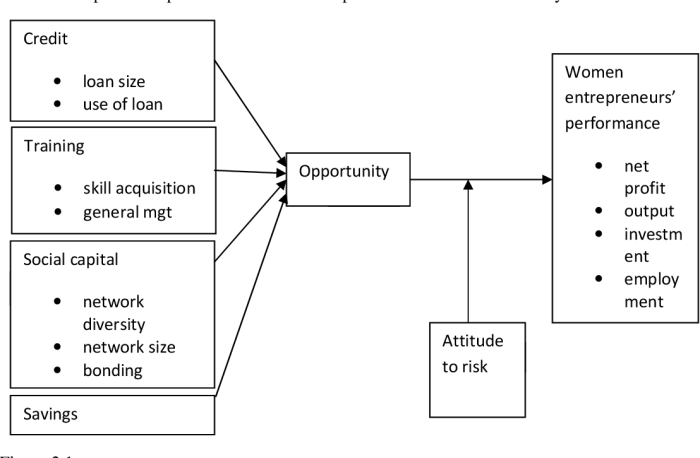

MFIs can generate significant positive social change. Access to credit empowers women, allowing them to participate more fully in the economy and make decisions regarding their families’ well-being. Improved household incomes can lead to better nutrition, healthcare, and educational opportunities for children. However, unintended negative consequences can occur. For instance, increased workloads for women managing businesses alongside household responsibilities can strain their time and well-being, highlighting the importance of considering the social context within which MFIs operate. Similarly, the social fabric of communities might be affected by increased competition or inequality.

Environmental Impacts of MFIs

The environmental footprint of MFIs is often overlooked but increasingly important. Sustainable microfinance initiatives promote environmentally friendly business practices, supporting investments in renewable energy, sustainable agriculture, and eco-tourism. For instance, MFIs in rural areas might provide loans for water conservation techniques or organic farming. Conversely, negative environmental impacts could result from unsustainable lending practices, leading to deforestation or pollution if not properly managed. Responsible lending practices that incorporate environmental considerations are crucial to ensure long-term sustainability.

Challenges in Measuring MFI Impact

Accurately measuring the impact of MFIs presents several challenges. Data limitations are a significant hurdle, with many MFIs operating in areas with weak data infrastructure. Furthermore, methodological issues arise from the difficulty in isolating the impact of microfinance from other factors influencing economic and social development. Attributing causality between MFI interventions and observed outcomes requires robust research designs that account for confounding variables and selection bias. For example, it is challenging to definitively determine whether an observed increase in income is solely due to the microloan or also influenced by external factors like market conditions or government policies. Moreover, the long-term impacts of MFIs are often difficult to assess, requiring longitudinal studies that can track changes over extended periods.

Economic Impacts of MFIs

Microfinance institutions (MFIs) have a profound and multifaceted impact on the economies of developing countries. Beyond simply providing access to credit, MFIs contribute significantly to economic growth, poverty reduction, and social development by fostering entrepreneurship, creating jobs, and empowering marginalized communities. This section will explore the various economic impacts of MFIs, examining their role in promoting economic activity and improving livelihoods.

MFIs and Entrepreneurship and Job Creation

MFIs play a crucial role in promoting entrepreneurship and job creation, particularly among low-income individuals and women who often lack access to traditional financial services. Small loans provided by MFIs enable individuals to start or expand businesses, leading to increased economic activity and employment opportunities. This injection of capital into the local economy stimulates growth and improves the overall standard of living. The accessibility of microloans allows individuals to invest in their businesses, leading to higher productivity and increased profits. This, in turn, creates a ripple effect, generating jobs not only for the business owners but also for their employees and those involved in the supply chain.

| Socioeconomic Group | Average Income Change (%) | Business Creation Rate (%) | Debt Levels (as % of income) |

|---|---|---|---|

| Rural Women | 25-40 | 30-45 | 20-30 |

| Urban Men | 15-30 | 20-35 | 15-25 |

| Rural Men | 10-25 | 15-30 | 10-20 |

| Urban Women | 20-35 | 25-40 | 18-28 |

*Note: These figures are illustrative averages based on various studies and may vary significantly depending on the specific MFI, geographical location, and socioeconomic context.*

MFIs and Poverty Reduction and Income Inequality

The impact of MFIs on poverty reduction is substantial. By providing access to credit and financial services, MFIs empower individuals to generate income, improve their living standards, and escape the cycle of poverty. This is particularly true for women, who often constitute a significant portion of MFI clients and are frequently excluded from traditional banking systems. Furthermore, MFIs can contribute to a reduction in income inequality by providing opportunities for entrepreneurship and economic growth among marginalized populations. The increased income and economic empowerment lead to improved access to education, healthcare, and other essential services, further contributing to poverty reduction and a more equitable society.

Case Studies of Economic Empowerment Through MFI Services

One example is the Grameen Bank in Bangladesh, renowned for its pioneering work in microfinance. Grameen Bank’s microcredit programs have enabled millions of impoverished individuals, primarily women, to start small businesses, leading to significant improvements in their income and living standards. Their success demonstrates the potential of MFIs to empower marginalized communities and promote economic development. Another example is the Self-Employed Women’s Association (SEWA) in India, which provides a range of financial and social services to women working in the informal sector. SEWA’s support has enabled many women to gain economic independence and improve their livelihoods. These case studies highlight the transformative potential of MFIs in promoting economic empowerment and reducing poverty.

Social Impacts of MFIs

Microfinance institutions (MFIs) extend far beyond their purely economic contributions; they exert a significant influence on the social fabric of communities they serve. Access to credit and financial services offered by MFIs has profound implications for individuals and families, particularly concerning gender dynamics and overall social well-being. This section explores the multifaceted social impacts of MFIs, focusing on their role in empowering women, fostering social inclusion, and improving health and education outcomes.

MFIs’ social impact is deeply intertwined with their economic effects. Increased income and financial stability resulting from access to microcredit lead to improvements in various aspects of life, creating a ripple effect that positively influences families and communities. However, the extent and nature of these social impacts can vary considerably based on cultural contexts and societal norms.

Gender Empowerment and Women’s Economic Participation

The empowerment of women is frequently cited as a key social benefit of MFIs. By providing women with access to credit and financial services, MFIs challenge traditional gender roles and dynamics within households and communities. Studies have consistently shown that women who receive microloans are more likely to control household income, make decisions related to family welfare, and experience an increase in their self-esteem and confidence. This increased agency translates into improved health and education outcomes for their children and families. For example, a study in Bangladesh demonstrated that women who participated in MFI programs experienced a significant rise in their decision-making power within the household, leading to better nutrition and healthcare for their children. The success of such initiatives underscores the importance of considering gender-specific needs and designing programs that are culturally appropriate and sensitive.

Comparative Social Impacts Across Cultures

The social impact of MFIs varies significantly across different cultural and societal contexts. In some cultures, where women traditionally have limited access to financial resources and decision-making power, MFIs can act as a powerful catalyst for change, leading to increased gender equality and economic independence. In other cultures, where social norms are more egalitarian, the impact of MFIs may be less dramatic, but still significant in terms of improving overall economic well-being and strengthening community resilience. For instance, while MFIs in South Asia have demonstrably improved women’s economic participation and empowerment, their impact in societies with already strong gender equality may focus more on supporting small business development and community growth. The crucial aspect is tailoring MFI programs to specific cultural norms and sensitivities to maximize positive social outcomes.

Contributions to Improved Health, Education, and Social Inclusion

MFIs contribute to improved health, education, and social inclusion in several ways:

- Improved Health: Increased income allows families to afford better healthcare, nutritious food, and sanitation facilities, leading to improved health outcomes, particularly for children and women. This can translate to reduced rates of infant and maternal mortality, and improved overall health and well-being.

- Enhanced Education: Access to funds enables families to invest in their children’s education, including school fees, uniforms, and educational materials. This investment in human capital leads to improved literacy rates, increased educational attainment, and better future opportunities for children.

- Increased Social Inclusion: MFIs often target marginalized and vulnerable populations, including women, ethnic minorities, and people living in poverty. By providing access to financial services, MFIs help to integrate these groups into the mainstream economy and reduce social exclusion. This promotes social cohesion and strengthens community resilience.

Environmental Impacts of MFIs

Microfinance institutions (MFIs), while striving to alleviate poverty, can inadvertently contribute to environmental degradation if their lending practices aren’t carefully considered. The pursuit of economic growth, without incorporating environmental sustainability, can lead to unsustainable resource use and ecological damage, ultimately undermining the long-term benefits of microfinance. This section explores the potential environmental consequences of MFI operations and Artikels strategies for integrating environmental sustainability into their core functions.

The environmental impacts of MFIs are multifaceted and often indirect. Lending to businesses involved in resource-intensive activities, such as unsustainable agriculture or deforestation, can accelerate environmental damage. Furthermore, a lack of environmental awareness among borrowers or inadequate monitoring by MFIs can exacerbate these issues. For instance, loans for expanding agricultural production might lead to increased pesticide use or deforestation for land clearing, impacting water quality and biodiversity. Similarly, lending to businesses involved in unsustainable fishing practices can deplete fish stocks and harm marine ecosystems.

Environmental Consequences of MFI Lending Practices

The environmental consequences of MFI lending practices are often linked to unsustainable resource extraction and management. For example, loans provided to smallholder farmers without proper training on sustainable agricultural techniques can lead to soil degradation, water pollution from chemical fertilizers and pesticides, and biodiversity loss due to monoculture farming. Similarly, loans for businesses involved in logging or mining operations can contribute to deforestation and habitat destruction if not accompanied by stringent environmental safeguards. The lack of environmental risk assessments in loan applications further exacerbates these problems. This results in a range of negative environmental externalities that impact local communities and the wider environment. Examples include increased greenhouse gas emissions from unsustainable agricultural practices, reduced water availability due to deforestation, and the loss of valuable ecosystems.

Integrating Environmental Sustainability into MFI Operations

Integrating environmental sustainability into MFI operations requires a multi-pronged approach. This includes incorporating environmental considerations into loan appraisal processes, providing environmental training to borrowers, and promoting environmentally friendly business practices. MFIs can develop specific environmental lending criteria, requiring borrowers to demonstrate a commitment to sustainable practices. This could involve assessing the environmental impact of the proposed business activities and requiring borrowers to implement mitigation measures. Furthermore, MFIs can partner with environmental NGOs and government agencies to provide technical assistance and training to borrowers on sustainable business practices. This could include training on sustainable agriculture, water management, waste management, and energy efficiency. The integration of environmental performance indicators into loan monitoring and evaluation processes is also crucial to track progress and identify areas for improvement.

Supporting Environmentally Friendly Business Ventures

MFIs have a crucial role to play in supporting environmentally friendly business ventures and promoting sustainable development goals. By prioritizing loans to businesses involved in renewable energy, sustainable agriculture, and eco-tourism, MFIs can contribute to environmental protection and economic development simultaneously. This approach not only reduces the environmental footprint of their lending activities but also creates new opportunities for economic growth and job creation. For example, providing microloans to farmers adopting organic farming techniques or to entrepreneurs developing renewable energy solutions can foster both environmental and economic sustainability. By strategically targeting their lending portfolios, MFIs can stimulate the growth of green businesses and contribute to a more sustainable future. This requires a shift in focus from purely financial returns to a holistic approach that considers both financial and environmental sustainability.

MFI Sustainability and Long-Term Impact

The long-term success and societal impact of microfinance institutions (MFIs) hinge on their ability to achieve financial sustainability while simultaneously delivering positive social and environmental outcomes. This requires a multifaceted approach encompassing robust operational models, responsible lending practices, and a commitment to financial inclusion. Without these elements, even the most well-intentioned MFIs risk becoming unsustainable, undermining their ability to provide crucial services to vulnerable populations.

MFIs require a delicate balance between profitability and social mission. While profit generation is essential for long-term survival, the pursuit of profit alone can compromise the ethical considerations central to microfinance. A truly sustainable MFI prioritizes both financial health and the well-being of its clients, ensuring that its operations contribute to broader economic development and social progress.

Factors Contributing to MFI Sustainability

Several key factors contribute to the long-term sustainability of MFIs. These include efficient operational management, diversification of funding sources, robust risk management strategies, and a strong focus on client relationships. Effective technology adoption, particularly in areas like mobile banking and digital lending, can also significantly enhance operational efficiency and reach. Furthermore, a commitment to transparency and accountability, both internally and externally, builds trust with stakeholders and enhances the institution’s reputation. A well-defined and effectively implemented strategy for human resource management, ensuring adequately trained and motivated staff, is also critical.

Examples of Successful and Unsuccessful MFI Models

The Grameen Bank in Bangladesh, founded by Muhammad Yunus, serves as a prime example of a successful MFI model. Its focus on group lending, coupled with its strong emphasis on women’s empowerment and community development, has resulted in significant poverty reduction and economic growth in rural Bangladesh. Their success can be attributed to their robust operational structure, effective risk management practices, and a deeply ingrained social mission. In contrast, some MFIs, particularly those that prioritized rapid expansion over responsible lending, have experienced difficulties. These often involved aggressive lending practices that led to high default rates and ultimately financial instability. A lack of proper due diligence in client selection and a failure to adequately assess creditworthiness contributed to these failures. The aggressive pursuit of profit without sufficient attention to social impact has frequently proven unsustainable in the long run.

The Importance of Responsible Lending Practices and Financial Inclusion

Responsible lending practices are paramount to MFI sustainability and long-term impact. This includes thorough client assessment, transparent loan terms, and flexible repayment options tailored to the borrowers’ circumstances. Avoiding predatory lending practices and ensuring fair interest rates are crucial for protecting vulnerable clients and fostering trust. Financial inclusion, the provision of financial services to underserved populations, is intrinsically linked to MFI sustainability. By reaching marginalized communities and providing them with access to credit and other financial services, MFIs not only empower individuals but also create a broader market for their services, enhancing their long-term viability. A focus on client education and financial literacy programs further strengthens the impact and sustainability of the MFI by equipping borrowers with the skills and knowledge necessary to manage their finances effectively.

Regulatory Framework and Policy Implications

Government regulations and policies play a crucial role in shaping the effectiveness and impact of microfinance institutions (MFIs). A supportive regulatory environment can foster responsible lending practices, promote financial inclusion, and ultimately enhance the positive social and economic effects of MFIs. Conversely, an overly restrictive or poorly designed regulatory framework can stifle innovation, limit access to credit, and even lead to negative consequences.

The regulatory landscape for MFIs varies significantly across countries, reflecting differing economic development levels, political contexts, and institutional capacities. These variations influence the operational efficiency, outreach, and overall impact of MFIs within each specific context.

Regulatory Differences Across Countries

Regulatory frameworks for MFIs range from highly permissive environments, where MFIs operate with minimal oversight, to strictly regulated systems with extensive reporting requirements and capital adequacy standards. For example, some developing countries may have simpler regulatory frameworks due to limited administrative capacity, potentially leading to higher risks but also greater flexibility for MFIs to adapt to local needs. In contrast, developed countries often have more comprehensive regulations designed to protect consumers and maintain financial stability, which can sometimes increase operational costs and limit the reach of MFIs to underserved populations. The specific regulations often cover areas such as licensing, capital requirements, interest rate caps, loan-to-value ratios, and reporting obligations. These vary widely depending on the country’s overall financial regulatory system and its priorities regarding financial inclusion and risk management.

Policy Recommendations for Optimizing MFI Impact

Effective policy interventions are essential for maximizing the positive contributions of MFIs. A well-structured policy framework should balance the need for protecting borrowers with the imperative of fostering a dynamic and sustainable MFI sector.

- Promote a supportive legal and regulatory environment: This includes simplifying licensing procedures, establishing clear regulatory guidelines, and fostering collaboration between regulatory bodies and MFIs. A streamlined licensing process, for example, can encourage the entry of new MFIs and increase competition, leading to better services and lower costs for borrowers.

- Develop tailored regulatory frameworks: Regulations should be adapted to the specific context of each country, taking into account factors such as the level of economic development, the prevalence of poverty, and the capacity of the regulatory authorities. A “one-size-fits-all” approach may not be effective and could stifle innovation in some contexts.

- Strengthen consumer protection mechanisms: Clear guidelines on responsible lending practices, transparent pricing, and effective dispute resolution mechanisms are essential to protect borrowers from exploitation. This could include regulations limiting interest rates to prevent usury and establishing mechanisms for borrowers to easily file complaints.

- Promote financial literacy and education: Empowering borrowers with financial knowledge can improve their ability to manage their finances effectively and avoid debt traps. Government-led financial literacy programs can complement the efforts of MFIs in this area.

- Foster innovation and technology adoption: Policies should encourage the adoption of technology by MFIs to improve efficiency, reach more clients, and reduce costs. This might include tax incentives for investment in fintech solutions or supportive regulations for mobile banking and digital lending platforms.

- Support capacity building for MFIs and regulators: Providing training and technical assistance to MFIs and regulatory bodies can enhance their capacity to operate effectively and responsibly. This is particularly crucial in developing countries where institutional capacity may be limited.

Challenges and Limitations of MFI Impact

Assessing and maximizing the positive impact of microfinance institutions (MFIs) presents significant challenges. While MFIs demonstrably contribute to economic growth and poverty reduction in many contexts, accurately measuring their full impact and mitigating potential negative consequences requires careful consideration of various factors. The complexities involved in data collection, the diversity of MFI operations, and the inherent limitations of impact evaluation methodologies all contribute to the difficulty of achieving a comprehensive understanding.

Over-indebtedness among borrowers is a critical limitation of MFI impact. The rapid expansion of MFIs, coupled with aggressive lending practices in some instances, has led to situations where borrowers find themselves overwhelmed by debt. This can have severe consequences, pushing vulnerable households further into poverty and potentially leading to asset stripping and social disruption. The issue is exacerbated by a lack of financial literacy among some borrowers, leading to poor debt management and an inability to anticipate unexpected economic shocks.

Over-indebtedness and its Consequences

Over-indebtedness, arising from multiple loans or high-interest rates, severely impacts borrowers’ livelihoods. It can lead to the forced sale of assets, reduced household consumption, and increased stress levels within families. The inability to repay loans can result in social stigma and exclusion from future credit opportunities. In extreme cases, it can contribute to a downward spiral of poverty, making it difficult for individuals and families to escape the cycle of debt. For example, a study in [insert country/region] revealed that [insert percentage]% of borrowers experienced significant financial distress due to over-indebtedness, resulting in [insert specific consequence, e.g., loss of livestock, inability to send children to school]. The consequences extend beyond the individual borrower, impacting the broader community and potentially undermining the overall development goals of the MFI.

Strategies for Mitigating Risks and Promoting Responsible Lending

Mitigating the risks associated with MFI lending and promoting responsible financial practices requires a multi-pronged approach. This includes strengthening regulatory frameworks, promoting financial literacy among borrowers, and implementing robust credit scoring and risk assessment systems within MFIs. Furthermore, encouraging transparency in lending practices and implementing clear debt management strategies can empower borrowers to make informed decisions and avoid over-indebtedness.

The development of ethical lending guidelines and codes of conduct, coupled with independent monitoring and evaluation of MFI operations, is crucial. MFIs should also actively engage in client protection mechanisms, such as providing accessible grievance redressal channels and promoting financial education programs. Examples of successful strategies include group lending models that emphasize peer support and collective responsibility, and the integration of microinsurance products to help borrowers manage unforeseen risks and reduce the likelihood of default. Implementing these measures not only safeguards borrowers from financial distress but also enhances the long-term sustainability and positive impact of the MFI itself.

Future Directions and Innovations in Microfinance

The microfinance sector is undergoing a period of significant transformation, driven by technological advancements, evolving client needs, and a growing understanding of the complexities of sustainable impact. This evolution necessitates a re-evaluation of existing models and the exploration of innovative approaches to ensure the continued relevance and effectiveness of microfinance in addressing poverty and promoting financial inclusion.

Emerging trends point towards a more inclusive and technologically driven future for microfinance. This includes a greater emphasis on digital financial services, personalized financial products, and the integration of microfinance with other development initiatives. Simultaneously, the sector grapples with issues of over-indebtedness, financial sustainability, and the need for robust regulatory frameworks.

Innovative Microfinance Models

A hypothetical MFI model designed to address the challenges of existing models could incorporate several key features. First, a strong emphasis on client education and financial literacy would be paramount, aiming to prevent over-indebtedness and promote responsible borrowing habits. This would involve providing comprehensive training programs tailored to the specific needs and literacy levels of the clients. Second, the model would integrate a robust credit scoring system incorporating alternative data sources beyond traditional credit history, such as mobile money transaction data or social network analysis, to better assess creditworthiness, particularly for those lacking formal credit histories. Third, the MFI would offer a diversified portfolio of financial products beyond microloans, including savings accounts, insurance products, and access to digital payment systems. This diversification would enhance financial inclusion and provide clients with a more comprehensive suite of financial tools. Finally, the model would prioritize strong partnerships with other development organizations and government agencies to create a synergistic approach to poverty alleviation, leveraging the strengths of each partner. For example, collaborations with agricultural extension services could provide crucial support to clients engaged in agricultural activities.

Technological Advancements Enhancing MFI Operations

Technological advancements are rapidly transforming the microfinance landscape, enhancing operational efficiency and broadening access to financial services. Mobile banking, for instance, has revolutionized the delivery of microfinance services, particularly in underserved areas with limited access to traditional banking infrastructure. Mobile money platforms allow for seamless transactions, reducing costs and improving the speed and convenience of loan disbursement and repayment. M-Pesa in Kenya, for example, serves as a successful case study of how mobile money can significantly expand financial inclusion. Furthermore, the use of biometric identification systems enhances security and reduces fraud, while data analytics can provide valuable insights into client behavior and risk assessment, enabling MFIs to tailor their services more effectively. The adoption of cloud-based platforms also improves data management and facilitates collaboration among different stakeholders. Finally, the use of artificial intelligence (AI) and machine learning (ML) holds significant potential for automating processes, improving credit scoring accuracy, and personalizing financial advice, ultimately making microfinance services more efficient and accessible.

Conclusive Thoughts

In conclusion, the impact of microfinance institutions is a multifaceted and dynamic phenomenon. While MFIs have demonstrably contributed to economic growth, poverty reduction, and social empowerment in many contexts, their success hinges on responsible lending practices, robust regulatory frameworks, and a commitment to sustainable development. Addressing challenges such as over-indebtedness and ensuring financial inclusion are crucial for maximizing the positive impact and mitigating potential negative consequences. The future of microfinance lies in innovation and adaptation, leveraging technology and evolving models to reach underserved populations effectively and sustainably.

Q&A

What are the common risks associated with MFI lending?

Common risks include over-indebtedness, loan defaults, and the potential for exploitation of vulnerable borrowers. Effective risk mitigation strategies are crucial.

How do MFIs measure their social impact?

MFIs utilize various methods, including surveys, interviews, and statistical analysis, to assess their social impact. Key indicators include changes in household income, improved health outcomes, and increased access to education.

What role does technology play in modern microfinance?

Technology, such as mobile banking and digital lending platforms, significantly enhances MFI operations by expanding reach, reducing costs, and improving efficiency.

How can MFIs promote environmental sustainability?

MFIs can integrate environmental considerations into their lending criteria, supporting green businesses and promoting sustainable resource management practices.