The stability of the global financial system hinges on the effective management of risk within financial institutions. From credit defaults to market volatility and operational failures, these entities face a complex web of potential threats. Understanding and mitigating these risks is not merely a compliance exercise; it’s crucial for the long-term health and sustainability of both individual institutions and the broader economy. This exploration delves into the multifaceted world of financial institution risk management, examining key strategies and best practices.

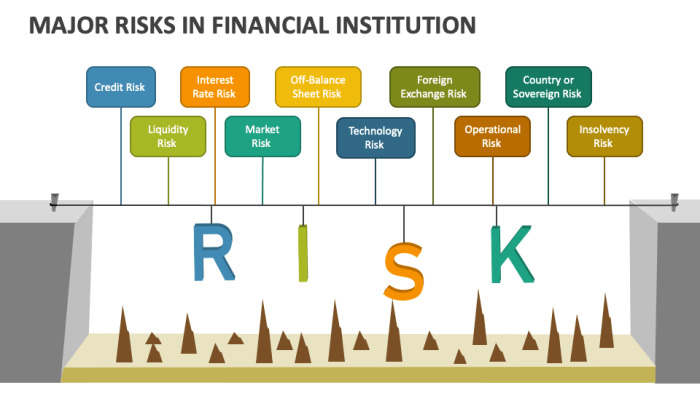

This comprehensive overview covers a range of critical risk categories, including credit, market, operational, and liquidity risks. We will explore regulatory frameworks like Basel III, analyze risk assessment methodologies, and examine various mitigation techniques. The discussion also highlights the vital role of risk governance, a strong risk culture, and robust internal controls in building resilience and ensuring long-term success.

Regulatory Compliance in Financial Institution Risk Management

Effective risk management is paramount for the stability and sustainability of financial institutions. A crucial component of this is adherence to a complex web of national and international regulations designed to protect consumers, maintain market integrity, and prevent systemic crises. These regulations dictate capital adequacy, risk assessment methodologies, and reporting requirements, shaping the operational landscape for financial institutions globally.

Key Regulatory Frameworks Governing Financial Institution Risk Management Globally

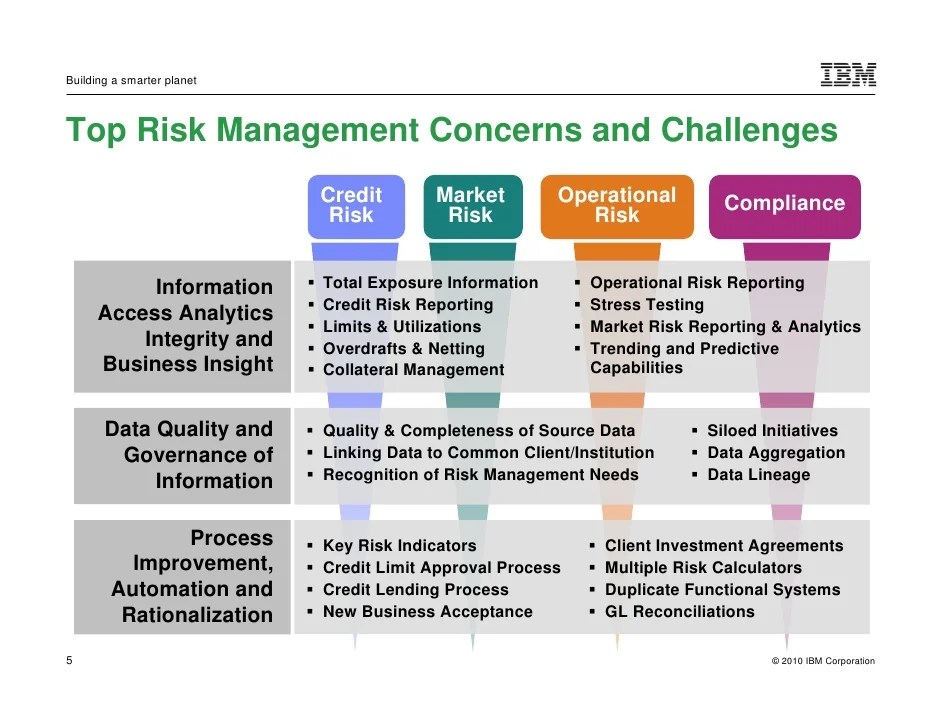

Several key regulatory frameworks govern financial institution risk management globally. These frameworks are often interconnected and influence each other, leading to a harmonized, albeit complex, regulatory environment. The Basel Accords, emanating from the Basel Committee on Banking Supervision (BCBS), represent a cornerstone of international banking regulation. Other significant frameworks include the Dodd-Frank Act in the United States, the European Union’s Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD), and various national regulations in countries across Asia and other regions. These frameworks address a wide range of risks, including credit risk, market risk, operational risk, and liquidity risk, often requiring institutions to implement robust internal risk management systems and report regularly on their risk exposures.

Impact of Basel III Accords on Capital Adequacy and Risk Management Practices

The Basel III accords, introduced in response to the 2008 global financial crisis, significantly strengthened capital adequacy and risk management practices for banks globally. Key features include higher capital requirements, stricter leverage ratios, and enhanced liquidity standards. Basel III aims to improve the resilience of banks by increasing their ability to absorb losses and maintain operations during periods of financial stress. For example, the introduction of the countercyclical capital buffer allows regulators to increase capital requirements during periods of excessive credit growth, mitigating the risk of systemic instability. The implementation of Basel III has led to a significant increase in capital held by banks worldwide, enhancing their ability to withstand economic downturns and promoting greater stability within the financial system. However, the increased capital requirements have also resulted in higher compliance costs for financial institutions.

Comparison of Regulatory Compliance Requirements Across Different Jurisdictions

Regulatory compliance requirements vary significantly across different jurisdictions. The United States, for instance, operates under a relatively fragmented regulatory framework with multiple agencies overseeing different aspects of the financial system. The Dodd-Frank Act, enacted after the 2008 crisis, introduced sweeping reforms, including stricter capital requirements, enhanced consumer protection measures, and increased regulatory oversight. In contrast, the European Union has adopted a more harmonized approach through regulations like CRR/CRD, aiming for a consistent level of regulatory standards across member states. Asian jurisdictions exhibit a diverse regulatory landscape, with some countries adopting international standards like Basel III while others maintain more unique regulatory frameworks tailored to their specific economic contexts. This variation reflects differences in economic structures, risk profiles, and regulatory priorities. For example, some jurisdictions might place a greater emphasis on protecting consumers, while others may prioritize systemic stability.

Key Regulations and Their Implications for Financial Institutions

| Regulation | Jurisdiction | Key Requirements | Implications for Financial Institutions |

|---|---|---|---|

| Basel III | Global | Higher capital requirements, stricter leverage ratios, enhanced liquidity standards | Increased capital buffers, improved risk management practices, higher compliance costs |

| Dodd-Frank Act | United States | Increased regulatory oversight, stricter capital requirements, consumer protection measures | Enhanced compliance programs, increased reporting requirements, potentially higher costs |

| CRR/CRD | European Union | Harmonized capital requirements, stricter risk management standards | Consistent regulatory framework across member states, increased compliance complexity |

| Various National Regulations | Asia (e.g., China, Japan, Singapore) | Vary widely depending on jurisdiction, often incorporating aspects of international standards | Navigating diverse regulatory environments, potential for inconsistencies across markets |

Credit Risk Management in Financial Institutions

Credit risk, the potential for financial loss stemming from a borrower’s failure to repay a debt, is a paramount concern for financial institutions. Effective credit risk management is crucial for maintaining profitability, stability, and regulatory compliance. This section details various methods used to assess and mitigate this risk, highlighting key techniques and real-world examples.

Credit Scoring and Loan Underwriting

Credit scoring models utilize statistical techniques to assess the creditworthiness of individuals or businesses. These models analyze various factors, including credit history, income, debt levels, and collateral, to generate a credit score. A higher score indicates a lower perceived risk of default. Loan underwriting, a more holistic process, involves a deeper evaluation of the borrower’s financial situation, including reviewing financial statements, assessing the purpose of the loan, and evaluating the collateral offered. Underwriters use this information, along with credit scores, to make informed lending decisions, setting appropriate interest rates and loan terms to reflect the assessed risk. The combination of quantitative credit scoring and qualitative underwriting provides a comprehensive approach to credit risk assessment.

The Role of Credit Derivatives in Mitigating Credit Risk Exposure

Credit derivatives are financial contracts whose value is derived from the creditworthiness of an underlying asset or reference entity. These instruments allow financial institutions to transfer or hedge credit risk. For example, a credit default swap (CDS) is a contract where one party pays a periodic fee to another in exchange for protection against a default event on a specific debt obligation. This allows the buyer to mitigate their exposure to potential losses should the borrower default. Other credit derivatives, such as credit-linked notes and collateralized debt obligations (CDOs), offer various ways to manage and transfer credit risk, creating more complex risk profiles. The effective use of credit derivatives requires sophisticated risk management expertise to understand their complexities and potential unintended consequences.

Stress Testing a Financial Institution’s Loan Portfolio

A robust framework for stress testing a loan portfolio involves simulating various economic scenarios to assess the institution’s resilience to adverse events. This typically involves:

- Defining scenarios: Identifying potential economic shocks, such as a recession, a sharp increase in interest rates, or a significant decline in a specific industry.

- Data collection and modeling: Gathering data on the loan portfolio, including loan characteristics, borrower attributes, and macroeconomic factors. Developing models to simulate the impact of chosen scenarios on the portfolio.

- Scenario analysis: Applying the chosen scenarios to the models to estimate potential loan losses under different stress conditions.

- Capital adequacy assessment: Evaluating the institution’s capital adequacy to absorb potential losses, identifying potential capital shortfalls, and developing mitigation strategies.

- Reporting and monitoring: Regularly reporting the results of stress tests to senior management and regulatory authorities, and continuously monitoring the portfolio’s performance and adjusting mitigation strategies as needed.

This iterative process allows for proactive risk management and helps ensure the institution’s stability.

Examples of Real-World Credit Risk Events and Their Impact

Several real-world events highlight the significance of effective credit risk management:

- The 2008 Financial Crisis: The subprime mortgage crisis exposed widespread weaknesses in credit risk management practices. Lax underwriting standards, the proliferation of complex mortgage-backed securities, and inadequate risk models contributed to massive losses for financial institutions and a global economic downturn.

- The Argentine Peso Crisis (2001-2002): The Argentine government’s default on its sovereign debt led to significant losses for international banks that had lent heavily to Argentina. This highlighted the importance of country risk assessment and diversification of lending portfolios.

- The Asian Financial Crisis (1997-1998): The rapid spread of financial contagion across Asian economies demonstrated the interconnectedness of financial markets and the potential for seemingly localized credit risks to escalate into systemic crises.

These events underscore the need for robust credit risk management frameworks that anticipate potential vulnerabilities and incorporate appropriate mitigation strategies.

Market Risk Management in Financial Institutions

Market risk, the potential for losses stemming from movements in market prices, is a critical concern for financial institutions. These institutions are constantly exposed to a wide array of market risks, necessitating robust management strategies to ensure financial stability and profitability. Effective market risk management involves identifying, measuring, and mitigating these risks through a combination of quantitative techniques and qualitative judgments.

Key Market Risks Faced by Financial Institutions

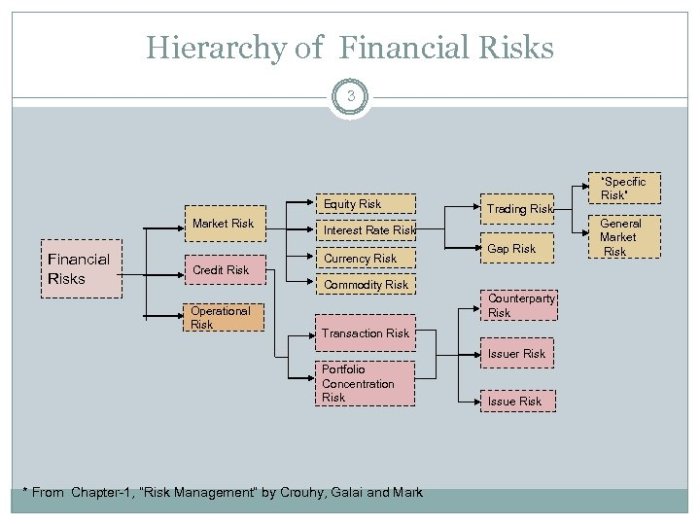

Financial institutions face a diverse range of market risks. Understanding these risks is the first step toward effective management. The most prominent include interest rate risk, equity risk, and foreign exchange risk. Interest rate risk arises from fluctuations in interest rates impacting the value of fixed-income securities and other interest-rate sensitive assets and liabilities. Equity risk reflects the volatility of stock prices, affecting the value of equity holdings. Foreign exchange risk, or currency risk, stems from changes in exchange rates, impacting the value of assets and liabilities denominated in foreign currencies. Other market risks include commodity price risk, credit spread risk, and volatility risk.

Techniques for Measuring and Managing Market Risk

Measuring and managing market risk requires sophisticated techniques. Value at Risk (VaR) is a widely used quantitative method that estimates the potential loss in value of an asset or portfolio over a specific time horizon and confidence level. For example, a VaR of $1 million at a 95% confidence level over a one-day period suggests that there is a 5% chance of losing more than $1 million in one day. Stress testing complements VaR by simulating the impact of extreme market events, such as a sharp downturn in the economy or a sudden spike in volatility, on a portfolio’s value. This provides a more comprehensive understanding of potential losses under adverse scenarios. Scenario analysis, another important technique, involves examining the impact of specific market events, such as a sudden rise in interest rates, on a portfolio’s value. Backtesting, which compares model predictions to actual outcomes, helps to validate and refine risk measurement models.

Hedging Strategies for Market Risk Mitigation

Various hedging strategies can be employed to mitigate market risk exposure. Hedging involves offsetting potential losses from one investment by taking an opposite position in another. For instance, a financial institution holding a large portfolio of bonds might hedge against interest rate risk by entering into interest rate swaps or purchasing interest rate options. Diversification, another crucial strategy, involves spreading investments across different asset classes to reduce the impact of any single market movement. This can help to reduce overall portfolio risk and improve risk-adjusted returns. Liquidity management is also essential, ensuring sufficient liquid assets to meet obligations and withstand unexpected market shocks.

Using Derivatives to Hedge Against Market Risk

Derivatives play a vital role in hedging market risk. These contracts derive their value from an underlying asset, such as a stock, bond, or currency. For example, a financial institution with significant exposure to foreign exchange risk could use currency futures or options to hedge against adverse movements in exchange rates. Interest rate swaps can be used to modify the interest rate profile of a portfolio, reducing exposure to interest rate risk. Options provide flexibility, allowing the institution to protect against downside risk while maintaining the potential for upside gains. The choice of derivative depends on the specific risk profile and the institution’s risk appetite. Effective derivative usage requires careful consideration of the instrument’s characteristics, potential risks, and the overall hedging strategy. It’s crucial to understand that while derivatives can be effective hedging tools, they also introduce their own risks that need careful management.

Operational Risk Management in Financial Institutions

Operational risk, encompassing a broad range of potential events, presents a significant challenge to financial institutions. Effective management of these risks is crucial for maintaining stability, profitability, and regulatory compliance. This section will delve into the key aspects of operational risk management within the financial services sector.

Types of Operational Risks

Financial institutions face a diverse array of operational risks. These can be broadly categorized, but often overlap. Failure to adequately address any of these categories can lead to substantial financial losses, reputational damage, and regulatory penalties.

- Fraud: This includes internal and external fraud, encompassing activities like employee embezzlement, customer account fraud, and identity theft. Sophisticated schemes often exploit vulnerabilities in internal controls or technological systems.

- Cybersecurity Breaches: Data breaches, denial-of-service attacks, and malware infections pose major threats. The consequences can include financial losses, legal liabilities, reputational damage, and disruption of business operations. The increasing reliance on technology makes this a paramount concern.

- System Failures: Failures in IT systems, including hardware, software, and network infrastructure, can disrupt operations, leading to delays in transactions, data loss, and financial losses. This also encompasses failures in internal processes and procedures.

- Business Disruption: Events such as natural disasters, pandemics, and power outages can severely impact operations. Effective business continuity and disaster recovery planning are vital to mitigate the impact of such events.

- Human Error: Mistakes made by employees, whether intentional or unintentional, can lead to operational losses. This highlights the need for thorough training, clear procedures, and strong oversight.

- Third-Party Risks: Reliance on external vendors and service providers introduces risks associated with their performance, security practices, and financial stability. Careful due diligence and ongoing monitoring are essential.

Internal Control Frameworks for Operational Risk Mitigation

A robust internal control framework is the cornerstone of effective operational risk management. This framework should encompass a comprehensive set of policies, procedures, and processes designed to prevent, detect, and respond to operational risks. Key components include segregation of duties, authorization and approval processes, regular audits, and monitoring of key risk indicators. A strong framework fosters a culture of risk awareness and accountability throughout the organization. Regular reviews and updates are vital to ensure the framework remains effective in the face of evolving threats and regulatory changes. The framework’s effectiveness is directly proportional to its adoption and adherence across all levels of the organization.

Methods for Identifying and Assessing Operational Risk

Several methods are used to identify and assess operational risk. A multi-faceted approach is typically employed to gain a comprehensive understanding of the risk landscape.

- Self-Assessment Questionnaires: These questionnaires are distributed to employees across different departments to gather information on potential operational risks within their respective areas. This bottom-up approach provides valuable insights into risks that might otherwise be overlooked.

- Loss Databases: Internal loss databases track past operational losses, providing valuable data for identifying trends, assessing the frequency and severity of different types of risks, and informing risk mitigation strategies. Analysis of this data can reveal patterns and potential weaknesses in existing controls.

- Scenario Analysis: This involves identifying potential events that could disrupt operations and assessing their potential impact. This is a proactive approach that helps organizations prepare for a range of potential scenarios, including low-probability, high-impact events.

- Key Risk Indicators (KRIs): KRIs are metrics that provide early warning signals of potential operational problems. Monitoring KRIs allows organizations to identify emerging risks and take timely action to mitigate them. Examples include transaction error rates, customer complaints, and system downtime.

Business Continuity and Disaster Recovery Planning

A comprehensive business continuity and disaster recovery plan is essential for minimizing the impact of operational disruptions. This plan should Artikel procedures for responding to various types of events, including natural disasters, cyberattacks, and system failures. The plan should include detailed steps for restoring critical business functions, protecting data, and communicating with stakeholders. Regular testing and updates are crucial to ensure the plan remains effective. A well-defined plan should also include clear roles and responsibilities, communication protocols, and alternative work locations or systems. For instance, a financial institution might have a detailed plan outlining procedures for data backup and recovery in the event of a server failure, including the use of offsite data storage and redundant systems. Similarly, they might have procedures in place to continue processing transactions through alternative channels in case of a major system outage.

Liquidity Risk Management in Financial Institutions

Maintaining adequate liquidity is paramount for the survival and stability of any financial institution. Insufficient liquidity can lead to a cascade of negative consequences, including inability to meet obligations, loss of confidence from depositors and counterparties, potential for fire sales of assets at distressed prices, and ultimately, insolvency. Effective liquidity risk management is therefore crucial for mitigating these risks and ensuring the ongoing viability of the institution.

The Importance of Maintaining Adequate Liquidity to Meet Obligations

Financial institutions face a constant flow of inflows and outflows of funds. Meeting these obligations, which include customer withdrawals, payments to creditors, and settlement of transactions, requires sufficient readily available funds. A shortfall in liquidity can trigger a domino effect, potentially leading to a liquidity crisis. For example, a bank experiencing a sudden surge in withdrawals may be unable to meet its obligations if it lacks sufficient liquid assets, causing panic and potentially a bank run. Maintaining adequate liquidity buffers acts as a safeguard against such events, providing a cushion to absorb unexpected shocks and maintain operational stability.

Assessing a Financial Institution’s Liquidity Position Using Liquidity Ratios

Several liquidity ratios are used to assess a financial institution’s ability to meet its short-term obligations. These ratios provide a quantitative measure of liquidity and allow for comparison across institutions and over time. Analyzing these ratios alongside qualitative factors provides a comprehensive assessment of liquidity risk.

- Liquidity Coverage Ratio (LCR): This ratio measures the institution’s ability to withstand a significant liquidity stress scenario over a 30-day period. It’s calculated as the ratio of high-quality liquid assets (HQLA) to total net cash outflows over the 30-day period. A higher LCR indicates a stronger liquidity position. For example, an LCR of 120% suggests that the institution has 120% of the required HQLA to cover its net cash outflows for 30 days.

- Net Stable Funding Ratio (NSFR): This ratio measures the institution’s ability to fund its assets and activities with stable funding over a one-year period. It assesses the proportion of stable funding to the amount of required stable funding for assets and activities. A higher NSFR indicates greater resilience to funding shocks. For instance, an NSFR of 110% means that the institution has 110% of the required stable funding.

- Loan-to-Deposit Ratio: This ratio indicates the proportion of loans relative to deposits. A high ratio suggests that a significant portion of the institution’s funding is reliant on borrowed funds, potentially increasing liquidity risk. A lower ratio generally indicates a more stable and liquid position. For example, a loan-to-deposit ratio of 80% indicates that 80% of the bank’s loans are funded by deposits.

Sources of Liquidity Available to Financial Institutions

Financial institutions can access liquidity from various sources, each with its own advantages and disadvantages. Diversifying these sources is crucial for mitigating liquidity risk.

- Cash and Cash Equivalents: These are the most liquid assets and are readily available to meet immediate obligations.

- Marketable Securities: These are readily tradable securities that can be quickly converted to cash. However, their value can fluctuate depending on market conditions.

- Unsecured Borrowing: This involves borrowing funds from other financial institutions or the central bank. The cost and availability of such borrowing can vary depending on market conditions and the institution’s creditworthiness.

- Secured Borrowing: This involves pledging assets as collateral to secure borrowing. This can be a more reliable source of liquidity, but the pledged assets may be unavailable for other purposes.

- Deposit Mobilization: Attracting and retaining deposits from customers provides a relatively stable source of funding, but it can be sensitive to changes in market interest rates and customer confidence.

Liquidity Risk Management Framework

A robust liquidity risk management framework is essential for ensuring that a financial institution maintains adequate liquidity to meet its obligations. This framework should encompass policies, procedures, and monitoring mechanisms.

- Liquidity Risk Policy: This policy Artikels the institution’s overall approach to managing liquidity risk, including its risk appetite, liquidity targets, and stress testing methodologies. It should define responsibilities and reporting lines.

- Liquidity Stress Testing: Regular stress tests simulate various adverse scenarios to assess the institution’s ability to withstand liquidity shocks. These tests should consider various factors, such as unexpected deposit outflows, market disruptions, and counterparty defaults. The results of these tests inform the institution’s liquidity planning and contingency measures.

- Liquidity Monitoring and Reporting: The institution should continuously monitor its liquidity position using various metrics, including liquidity ratios and cash flow projections. Regular reports should be prepared for senior management and regulatory authorities.

- Contingency Planning: The institution should develop contingency plans to address various liquidity stress scenarios. These plans should Artikel the actions to be taken in the event of a liquidity shortfall, including access to emergency funding sources and asset sales strategies.

Model Risk Management in Financial Institutions

Model risk, the potential for losses stemming from the flaws or limitations of quantitative models used in financial risk management, is a significant concern for financial institutions. These models, while crucial for decision-making, are not infallible and can introduce substantial risk if not properly managed throughout their lifecycle. Understanding and mitigating this risk is paramount for maintaining financial stability and regulatory compliance.

Potential Risks Associated with Quantitative Models

The use of quantitative models in financial risk management introduces several potential risks. Inaccurate model outputs can lead to poor decision-making, resulting in losses from unexpected market movements or credit defaults. Overreliance on models can mask underlying weaknesses in the institution’s risk management framework, creating a false sense of security. Furthermore, model complexity can make it difficult to understand the underlying assumptions and limitations, potentially leading to unintended consequences. For instance, a flawed credit scoring model could lead to the extension of credit to high-risk borrowers, resulting in significant loan defaults. Similarly, an inaccurate market risk model might underestimate potential losses during periods of high volatility. These scenarios highlight the need for rigorous model validation and ongoing monitoring.

The Importance of Model Validation and Independent Review

Model validation and independent review are critical components of effective model risk management. Validation involves a systematic process of assessing the model’s accuracy, completeness, and reliability. This typically includes testing the model’s assumptions, comparing its outputs to historical data, and evaluating its sensitivity to changes in input parameters. An independent review, conducted by a team separate from the model developers, provides an objective assessment of the model’s strengths and weaknesses, identifying potential biases or flaws that might have been overlooked during the initial development and validation stages. For example, an independent review might uncover coding errors or identify data quality issues that could significantly impact model accuracy. This ensures objectivity and strengthens confidence in the model’s reliability.

The Role of Data Quality in Model Accuracy and Reliability

Data quality is fundamental to the accuracy and reliability of risk models. Garbage in, garbage out is a common adage that perfectly encapsulates the importance of using high-quality, accurate, and complete data. Inaccurate, incomplete, or inconsistent data can lead to biased model outputs and flawed risk assessments. For example, missing or erroneous historical data on loan defaults could lead to an inaccurate credit risk model, underestimating the probability of future defaults. Similarly, the use of outdated market data in a market risk model could lead to significant underestimation of potential losses. Therefore, robust data governance processes are crucial for ensuring data quality and reliability, supporting the development and use of accurate risk models. These processes should include data cleansing, validation, and ongoing monitoring to identify and address data quality issues promptly.

Best Practices for Managing Model Risk Throughout the Model Lifecycle

Effective model risk management requires a comprehensive approach that addresses the entire model lifecycle, from development to retirement. This includes establishing a clear model governance framework, defining roles and responsibilities, and implementing robust processes for model development, validation, and monitoring. Regular model reviews should be conducted to assess the model’s performance and identify any potential issues. Furthermore, documentation of the model’s development, validation, and usage should be meticulously maintained to ensure transparency and traceability. A well-defined model inventory helps track and manage the institution’s entire collection of models. Finally, a robust escalation process should be in place to address any significant model-related issues promptly. Following these best practices helps ensure that models are used appropriately and that the associated risks are effectively managed.

Risk Governance and Culture in Financial Institutions

Effective risk governance and a robust risk culture are paramount for the long-term health and stability of any financial institution. These elements act as the foundation upon which a comprehensive risk management framework is built, ensuring that risk is appropriately identified, assessed, mitigated, and monitored throughout the organization. A strong governance structure provides clear accountability and oversight, while a positive risk culture encourages proactive risk identification and responsible decision-making at all levels.

The Roles of the Board of Directors and Senior Management in Overseeing Risk Management

The board of directors holds ultimate responsibility for overseeing the institution’s risk management framework. This involves setting the risk appetite, approving the risk strategy, and reviewing the effectiveness of risk management processes. Senior management, in turn, is responsible for implementing the board’s directives, managing day-to-day risk activities, and reporting regularly to the board on the institution’s risk profile. Clear lines of accountability and reporting are crucial to ensure effective oversight. For example, a well-defined delegation of authority ensures that decisions are made at the appropriate level, and regular reporting to the board allows for timely intervention if necessary. Failure to establish clear roles and responsibilities can lead to gaps in oversight and increased risk exposure.

The Importance of a Strong Risk Culture within a Financial Institution

A strong risk culture is characterized by a commitment to ethical conduct, a proactive approach to risk identification and mitigation, and a willingness to learn from past mistakes. This culture permeates all levels of the organization, from the board of directors to front-line employees. Employees at all levels should understand their individual roles in managing risk and feel empowered to raise concerns without fear of retribution. A culture of open communication and collaboration is essential for identifying and addressing potential risks effectively. For instance, a culture that values open communication will encourage employees to report potential compliance violations or operational weaknesses, thereby mitigating potential losses. Conversely, a culture of fear and retribution will likely lead to underreporting and increased risk exposure.

Establishing Effective Communication and Reporting Channels for Risk Management Information

Effective communication and reporting channels are essential for ensuring that risk information flows smoothly throughout the organization. This involves establishing clear reporting lines, using standardized reporting formats, and employing appropriate communication technologies. Regular risk reports should be prepared and disseminated to relevant stakeholders, including the board of directors, senior management, and relevant committees. These reports should provide a clear and concise overview of the institution’s risk profile, including key risks, mitigation strategies, and performance indicators. For example, the use of a centralized risk management information system (RMIS) can facilitate efficient data collection, analysis, and reporting. Furthermore, regular risk meetings and workshops can foster open communication and collaboration among stakeholders.

Measuring and Monitoring the Effectiveness of the Risk Management Framework

Measuring and monitoring the effectiveness of the risk management framework is crucial for ensuring its ongoing relevance and efficacy. This involves establishing key risk indicators (KRIs), conducting regular risk assessments, and reviewing the effectiveness of risk mitigation strategies. The results of these monitoring activities should be reported to the board of directors and senior management on a regular basis. A framework for evaluating the effectiveness of the risk management framework could include both quantitative and qualitative measures, such as loss ratios, regulatory compliance rates, and employee satisfaction surveys. Regular review and updates to the risk management framework, based on these measurements, are crucial for ensuring its continued effectiveness. For instance, a financial institution might track its operational loss ratio as a key indicator of the effectiveness of its operational risk management program. Significant increases in this ratio would trigger a review of the program and potential adjustments.

Final Thoughts

Effective financial institution risk management is not a static process; it requires continuous adaptation and improvement in response to evolving market conditions and emerging threats. By implementing robust frameworks, fostering a strong risk culture, and embracing technological advancements, financial institutions can enhance their resilience, protect their stakeholders, and contribute to the stability of the global financial system. The journey towards robust risk management is ongoing, demanding vigilance, innovation, and a commitment to best practices.

Question Bank

What is the role of technology in financial institution risk management?

Technology plays a crucial role, enabling advanced analytics for risk assessment, automated monitoring systems for early warning signals, and enhanced cybersecurity measures to protect against fraud and breaches.

How does climate change impact financial institution risk management?

Climate change introduces new risks, such as physical damage from extreme weather events and transition risks related to the shift towards a low-carbon economy. Institutions must integrate climate-related risks into their overall risk management strategies.

What are the consequences of inadequate risk management?

Inadequate risk management can lead to financial losses, reputational damage, regulatory penalties, and even insolvency. It can also undermine public trust and confidence in the financial system.