The financial technology (Fintech) sector is rapidly transforming how we interact with money, from payments to investments. This evolution is driven by technological advancements, shifting consumer expectations, and a growing need for financial inclusion. This exploration delves into key areas of Fintech innovation, examining both the opportunities and challenges presented by these groundbreaking developments.

From the rise of mobile payment systems and the use of alternative data in lending to the impact of AI on wealth management and the increasing role of Regtech in compliance, Fintech is reshaping the financial landscape at an unprecedented pace. We will explore several examples of these innovations, highlighting their practical applications and potential future impact.

Payment Technologies

The rapid advancement of payment technologies has revolutionized how we conduct financial transactions, significantly impacting both businesses and consumers. This evolution has been driven by the increasing accessibility of mobile devices, the development of sophisticated security protocols, and the growing demand for faster, more convenient payment methods. This section will explore key aspects of this evolution, focusing on mobile payment systems, biometric authentication, peer-to-peer (P2P) payments, and a comparative analysis of leading mobile payment applications.

Mobile Payment System Evolution and Financial Inclusion

The evolution of mobile payment systems has progressed from simple SMS-based transactions to complex, integrated platforms supporting a wide range of financial services. Early mobile payment systems primarily focused on transferring funds between mobile accounts. However, the integration of near-field communication (NFC) technology enabled contactless payments, significantly enhancing convenience and adoption rates. The rise of mobile wallets, such as Apple Pay and Google Pay, further streamlined the process, allowing users to store payment information securely and make purchases with a simple tap. This evolution has had a profound impact on financial inclusion, particularly in developing countries with limited access to traditional banking infrastructure. Mobile money services, like M-Pesa in Kenya, have provided millions of unbanked individuals with access to financial services, fostering economic growth and reducing reliance on cash. This accessibility has enabled participation in the formal economy, facilitating transactions for everyday needs and small business operations.

Biometric Authentication Methods in Fintech

Several biometric authentication methods are employed in fintech applications to enhance security and user experience. These methods leverage unique biological characteristics to verify user identity, offering a more secure alternative to traditional password-based systems. Fingerprint scanning is widely adopted, offering a relatively simple and cost-effective solution. Facial recognition technology, utilizing advanced algorithms to identify individuals based on facial features, is becoming increasingly prevalent, particularly in mobile payment applications. Voice recognition, analyzing unique vocal patterns, provides another layer of security, while iris scanning offers a highly accurate and secure method, though often requiring specialized hardware. Each method presents trade-offs regarding accuracy, cost, user convenience, and privacy concerns. For instance, while facial recognition is convenient, it can be susceptible to spoofing, highlighting the ongoing need for robust security measures to mitigate potential vulnerabilities.

Security Features and Challenges of Peer-to-Peer Payment Platforms

Peer-to-peer (P2P) payment platforms, such as Venmo and PayPal, have gained immense popularity, facilitating quick and easy money transfers between individuals. However, the convenience of P2P payments comes with inherent security challenges. Robust security features are crucial to mitigating these risks. These include encryption of transaction data, multi-factor authentication, fraud detection systems, and robust account monitoring. Challenges include the potential for unauthorized access due to compromised credentials or phishing scams, the risk of fraudulent transactions, and the difficulty in resolving disputes. Regulations and industry best practices play a critical role in addressing these challenges, ensuring user protection and maintaining the integrity of the P2P payment ecosystem. Furthermore, the anonymity associated with some P2P platforms can be exploited for illicit activities, emphasizing the need for effective monitoring and reporting mechanisms.

Comparison of Mobile Payment Apps

The following table compares the functionalities and user experience of three major mobile payment apps: Apple Pay, Google Pay, and Samsung Pay.

| Feature | Apple Pay | Google Pay | Samsung Pay |

|---|---|---|---|

| Supported Devices | Apple iPhones and iPads | Android devices and web browsers | Samsung Galaxy devices |

| Payment Methods | Credit/debit cards, Apple Cash | Credit/debit cards, bank accounts, loyalty programs | Credit/debit cards, bank accounts, loyalty programs |

| Security Features | Tokenization, biometric authentication | Tokenization, biometric authentication | Tokenization, biometric authentication, MST technology |

| User Experience | Intuitive and seamless | Versatile and widely accepted | Wide range of device compatibility, MST for older terminals |

Lending and Borrowing

The fintech revolution has significantly impacted the lending and borrowing landscape, offering innovative solutions that cater to a wider range of borrowers and lenders. Traditional credit scoring methods are being challenged by alternative data sources, and blockchain technology is emerging as a potential game-changer for secure and transparent transactions. This section will explore these advancements and their implications for individuals and businesses.

Alternative Data Sources for Credit Scoring

Many fintech companies now leverage alternative data sources to assess creditworthiness, moving beyond traditional credit reports. This includes analyzing transactional data from bank accounts, mobile phone usage patterns, and online purchasing behavior. For example, a borrower’s consistent payment history on utility bills or subscription services can indicate responsible financial management, even if they lack a formal credit history. This approach allows lenders to reach underserved populations who may not have access to traditional credit products, fostering financial inclusion. The advantages include broader access to credit and more accurate risk assessments, while disadvantages include potential privacy concerns and the need for robust data security measures. The accuracy and fairness of these alternative scoring models also remain subjects of ongoing scrutiny and development.

Blockchain Technology in Lending

Blockchain’s decentralized and transparent nature offers several potential benefits for lending processes. Smart contracts, self-executing agreements written in code, can automate loan origination, disbursement, and repayment. This can reduce processing times and costs, while simultaneously increasing transparency and security. For example, a peer-to-peer (P2P) lending platform could utilize blockchain to record all loan transactions on a public ledger, making it readily auditable and reducing the risk of fraud. However, scalability issues and regulatory uncertainties surrounding blockchain technology in finance remain significant hurdles to widespread adoption. The integration with existing financial infrastructure also presents a challenge.

Microloans and Their Impact

Fintech companies are playing a crucial role in providing microloans to small businesses and underserved communities. These small loans, often offered through mobile platforms, enable entrepreneurs to access capital they might not otherwise receive from traditional banks. Companies like Kiva and Tala utilize mobile technology and alternative data to assess creditworthiness and disburse loans quickly and efficiently. The impact on small businesses is significant, fostering economic growth and job creation, particularly in developing economies. For underserved communities, access to microloans can provide opportunities for financial empowerment and improved livelihoods. However, concerns regarding high interest rates and potential for over-indebtedness need careful consideration and responsible lending practices.

Applying for a Loan Through a Fintech Platform

The process of applying for a loan through a fintech platform is generally streamlined and efficient. The following steps Artikel a typical application process:

- Create an Account: Register with the fintech lending platform, providing necessary personal information.

- Complete Application: Fill out the loan application form, providing details about the loan amount, purpose, and repayment terms.

- Provide Documentation: Upload supporting documents, such as proof of income, identity verification, and bank statements.

- Credit Check: The platform will perform a credit check, potentially utilizing alternative data sources.

- Loan Approval/Denial: Receive notification regarding loan approval or denial, along with the terms and conditions.

- Loan Disbursement: If approved, the loan amount will be disbursed to your designated account.

- Repayment: Make timely repayments according to the agreed-upon schedule.

Investment and Wealth Management

The rise of technology has dramatically reshaped the investment and wealth management landscape, making sophisticated financial tools and strategies more accessible than ever before. This accessibility, driven by fintech innovation, empowers individuals to take a more active role in managing their financial futures. We’ll explore some key aspects of this transformation, focusing on robo-advisors, investment platforms, and AI-powered tools.

Robo-Advisors and the Evolution of Wealth Management

Robo-advisors are automated investment platforms that utilize algorithms to create and manage investment portfolios based on a client’s risk tolerance, financial goals, and time horizon. Their impact on wealth management is significant, primarily due to their lower fees compared to traditional financial advisors and their ability to provide personalized investment strategies to a broader audience. This democratization of wealth management allows individuals with smaller portfolios, who may not have previously had access to professional financial advice, to benefit from sophisticated investment strategies. The ease of use and transparency of these platforms also contribute to their growing popularity. For example, Betterment and Wealthfront, two prominent robo-advisors, have significantly lowered the barrier to entry for many investors seeking professional portfolio management.

Investment Platforms Offering Fractional Shares

Several investment platforms now offer fractional shares, allowing investors to purchase small portions of high-priced stocks or exchange-traded funds (ETFs). This feature is particularly appealing to retail investors because it reduces the minimum investment requirement, enabling participation in companies or asset classes that might have been previously inaccessible due to high share prices. Platforms like Robinhood and Fidelity offer fractional share trading, broadening the investment opportunities available to a wider range of individuals. The ability to invest smaller amounts regularly also aligns well with dollar-cost averaging strategies, which can mitigate risk over time.

AI-Powered Investment Tools for Portfolio Optimization

Artificial intelligence (AI) is rapidly transforming portfolio management. AI-powered investment tools utilize machine learning algorithms to analyze vast amounts of market data, identifying trends and patterns that can inform investment decisions. These tools can optimize portfolios by automatically rebalancing assets based on market fluctuations, adjusting allocations to maintain the desired risk profile, and identifying potential investment opportunities. Furthermore, AI can provide personalized insights and recommendations based on an individual’s investment goals and risk tolerance, leading to more efficient and potentially higher-performing portfolios. The use of AI also helps to mitigate human biases that can negatively impact investment performance.

Comparison of Robo-Advisors

The following table compares the fees and services offered by three different robo-advisors. Note that fees and services can change, so it’s crucial to check the provider’s website for the most up-to-date information.

| Robo-Advisor | Annual Fee | Minimum Investment | Key Features |

|---|---|---|---|

| Betterment | 0.25% – 0.40% | $0 | Tax-loss harvesting, socially responsible investing options, financial planning tools |

| Wealthfront | 0.25% | $500 | Automated portfolio rebalancing, tax-loss harvesting, financial planning tools |

| Schwab Intelligent Portfolios | 0% | $5,000 | No advisory fees, access to Schwab’s brokerage services, portfolio management tools |

Insurance Technology (Insurtech)

The insurance industry is undergoing a significant transformation driven by technological advancements. Insurtech, the intersection of insurance and technology, is revolutionizing how insurance products are designed, distributed, and managed, leading to increased efficiency, improved customer experience, and expanded access to insurance coverage. This section will explore key areas of Insurtech innovation, focusing on telematics, artificial intelligence, microinsurance, and blockchain technology.

Telematics in Auto Insurance and Risk Assessment

Telematics, the use of technology to collect and analyze data from vehicles, is significantly impacting auto insurance risk assessment. By integrating GPS tracking, accelerometers, and other sensors into vehicles, insurers can gather detailed driving behavior data, such as speed, braking patterns, mileage, and time of day driving. This data allows insurers to create more accurate risk profiles for individual drivers, leading to personalized premiums based on actual driving habits rather than broad demographic categories. For example, a driver with consistently safe driving behavior, as measured by telematics data, might qualify for lower premiums, incentivizing safer driving practices. Conversely, risky driving behavior may result in higher premiums. This approach moves away from traditional actuarial models based on age and location to a more precise, data-driven assessment of risk.

Artificial Intelligence in Fraud Detection and Claims Processing

Artificial intelligence (AI) is playing an increasingly crucial role in combating insurance fraud and streamlining claims processing. AI algorithms can analyze vast datasets of claims information, identifying patterns and anomalies indicative of fraudulent activity. This includes comparing claims data with other sources of information, such as social media activity and medical records, to detect inconsistencies and potential fraud. Furthermore, AI-powered chatbots and virtual assistants are improving the customer experience by providing instant support and guidance throughout the claims process. For example, AI can automate the initial stages of a claim, such as verifying the identity of the claimant and collecting necessary documentation, significantly reducing processing times and improving efficiency. The use of AI in claims processing also minimizes human error and biases, leading to more consistent and fair claim settlements.

Microinsurance Products and Expanding Insurance Coverage

Microinsurance products are designed to provide affordable insurance coverage to low-income individuals and communities traditionally underserved by the insurance industry. These products typically offer smaller coverage amounts and simpler policy structures, making them accessible to populations with limited financial resources. The use of mobile technology plays a crucial role in the distribution and management of microinsurance products, allowing for easy enrollment and claim filing through mobile phones. For example, farmers in developing countries can use mobile phones to purchase crop insurance, protecting their livelihoods against weather-related risks. The scalability and accessibility of microinsurance, facilitated by technology, have the potential to significantly expand insurance coverage to billions of people worldwide who currently lack access to vital financial protection.

Blockchain Technology and Insurance Claims Processing

Blockchain technology, known for its decentralized and transparent nature, offers the potential to revolutionize insurance claims processing. By recording claims information on a shared, immutable ledger, blockchain can enhance transparency and security, reducing the risk of fraud and disputes. This technology can streamline the claims process by automating verification of information and reducing the need for intermediaries. For example, a car accident claim could be automatically processed by smart contracts triggered by data from telematics devices and police reports recorded on the blockchain. This eliminates the need for manual verification and significantly reduces processing time. The increased transparency and efficiency provided by blockchain can lead to faster claim settlements and improved customer satisfaction.

Regulatory Technology (Regtech)

Regtech, or regulatory technology, is rapidly transforming the financial industry by leveraging technology to improve compliance processes. Financial institutions face increasingly complex and evolving regulatory landscapes, necessitating efficient and effective solutions to manage compliance risks. Regtech offers a powerful suite of tools and platforms designed to streamline these processes, reducing costs, mitigating risks, and improving operational efficiency.

Regtech solutions are assisting financial institutions in meeting compliance requirements by automating and optimizing various aspects of regulatory compliance. This includes automating tasks like data collection and analysis, monitoring transactions for suspicious activity, and generating reports for regulatory bodies. By leveraging advanced technologies like artificial intelligence (AI) and machine learning (ML), Regtech allows firms to proactively identify and address potential compliance issues, reducing the likelihood of penalties and reputational damage.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance Tools

Regtech plays a critical role in enhancing AML and KYC compliance. These tools utilize sophisticated algorithms and data analytics to identify potentially suspicious transactions and verify customer identities. This helps financial institutions comply with regulations designed to prevent money laundering, terrorist financing, and other financial crimes.

Examples of Regtech tools used for AML and KYC compliance include transaction monitoring systems that analyze vast amounts of data in real-time to detect unusual patterns. These systems can flag potentially suspicious transactions for further investigation, significantly reducing the manual workload involved in traditional AML compliance. KYC solutions utilize various data sources, including government databases and commercial identity verification services, to verify customer identities and screen for politically exposed persons (PEPs) or individuals on sanctions lists. These automated processes greatly accelerate the KYC onboarding process while ensuring accuracy and minimizing risk.

Challenges and Opportunities in Regtech Adoption

The adoption of Regtech presents both challenges and opportunities for the financial industry. One significant challenge is the initial investment required to implement Regtech solutions. This includes the cost of software, hardware, and integration with existing systems. Furthermore, maintaining and updating these systems requires ongoing investment and expertise. Data security and privacy are also crucial considerations, as Regtech solutions often handle sensitive customer data. Ensuring compliance with data protection regulations is paramount.

Despite these challenges, the opportunities presented by Regtech are significant. Improved compliance efficiency leads to cost savings and reduces the risk of regulatory penalties. Enhanced data analytics provides valuable insights into business operations and helps identify potential risks proactively. The ability to automate previously manual processes frees up staff to focus on more strategic initiatives. Furthermore, Regtech solutions can enhance the customer experience by streamlining onboarding processes and making financial services more accessible.

Visual Representation of a Regtech-Streamlined KYC Process

Imagine a flowchart. The process begins with a customer submitting their application. This data is then fed into a Regtech KYC solution. The solution automatically verifies the customer’s identity using various data sources (government databases, credit bureaus, etc.), cross-referencing the information to detect discrepancies or red flags. A risk score is generated based on this verification. If the risk score is low, the customer is automatically approved, and the onboarding process is completed. If the risk score is high, the application is flagged for manual review by a compliance officer. This officer can then access all relevant data and documentation within the Regtech platform to make an informed decision. The entire process, from application submission to approval or rejection, is significantly faster and more efficient than traditional manual methods. This automated workflow minimizes manual intervention, reduces errors, and accelerates the overall KYC process while ensuring compliance with regulatory requirements. The visual representation would clearly show the streamlined flow of information and decision-making, highlighting the efficiency gains achieved through Regtech.

Final Thoughts

Fintech innovations are not merely technological advancements; they represent a fundamental shift in how financial services are delivered and accessed. By leveraging technologies like AI, blockchain, and biometrics, the Fintech sector is driving efficiency, transparency, and accessibility within the financial world. As these technologies mature and regulations adapt, we can anticipate even more transformative changes in the years to come, promising a more inclusive and user-friendly financial ecosystem.

FAQ Section

What is the biggest challenge facing Fintech innovation?

Balancing innovation with robust security and regulatory compliance remains a significant challenge. Data breaches and the need to meet evolving KYC/AML regulations are key concerns.

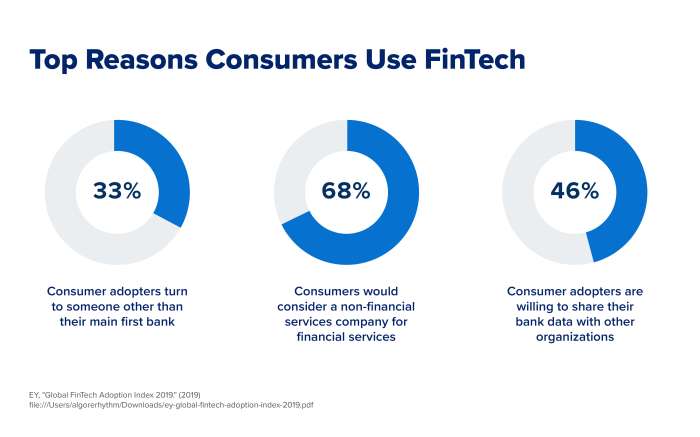

How does Fintech impact financial inclusion?

Fintech expands access to financial services for underserved populations through mobile banking, microloans, and alternative credit scoring methods, bridging the gap for those traditionally excluded from the formal financial system.

What are the ethical considerations of AI in Fintech?

Ethical concerns surrounding AI in Fintech include potential biases in algorithms, data privacy issues, and the need for transparency in decision-making processes.