Understanding global economic trends is crucial in today’s interconnected world. This analysis delves into the multifaceted factors shaping the global economy, from fluctuating growth rates and inflationary pressures to the impact of technological disruption and geopolitical instability. We will explore the interplay of monetary policy, international trade, and emerging market dynamics, offering insights into both challenges and opportunities.

The following sections provide a comprehensive overview of key economic indicators, policy responses, and future projections. We examine the contributions of different regions to global GDP growth, analyze the effectiveness of various monetary policy tools in managing inflation, and assess the impact of technological advancements on industries and labor markets. Furthermore, the analysis considers the significant role of geopolitical risks and climate change in shaping the global economic landscape.

Global Economic Growth and its Determinants

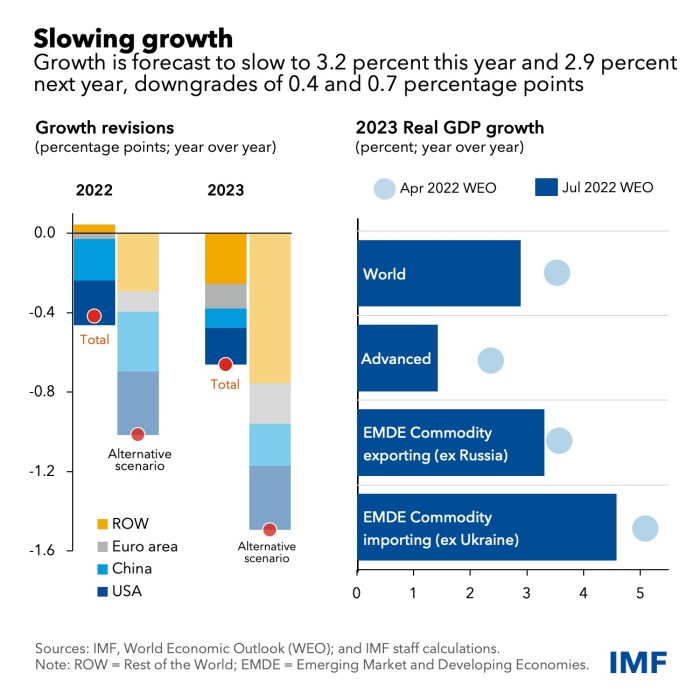

Global economic growth over the past decade has been a complex and uneven phenomenon, shaped by a confluence of factors. While periods of robust expansion have been punctuated by significant setbacks, understanding the underlying drivers is crucial for navigating future economic landscapes. This analysis examines the key determinants of global growth, focusing on the contributions of developed and developing economies, regional disparities, and future projections.

Factors Influencing Global Economic Growth in the Last Decade

The past decade witnessed a diverse range of factors impacting global economic growth. Technological advancements, particularly in digital technologies and automation, boosted productivity in many sectors. However, this progress was unevenly distributed, exacerbating existing inequalities. Global trade, while generally positive, faced challenges from protectionist policies and supply chain disruptions. Demographic shifts, including aging populations in developed countries and a growing working-age population in developing nations, significantly influenced labor markets and consumption patterns. Furthermore, macroeconomic policies, including monetary and fiscal measures implemented by governments, played a critical role in stimulating or dampening economic activity. Finally, geopolitical events, such as the 2008 financial crisis, the COVID-19 pandemic, and the ongoing war in Ukraine, created significant volatility and uncertainty.

Contributions of Developed and Developing Economies to Global GDP Growth

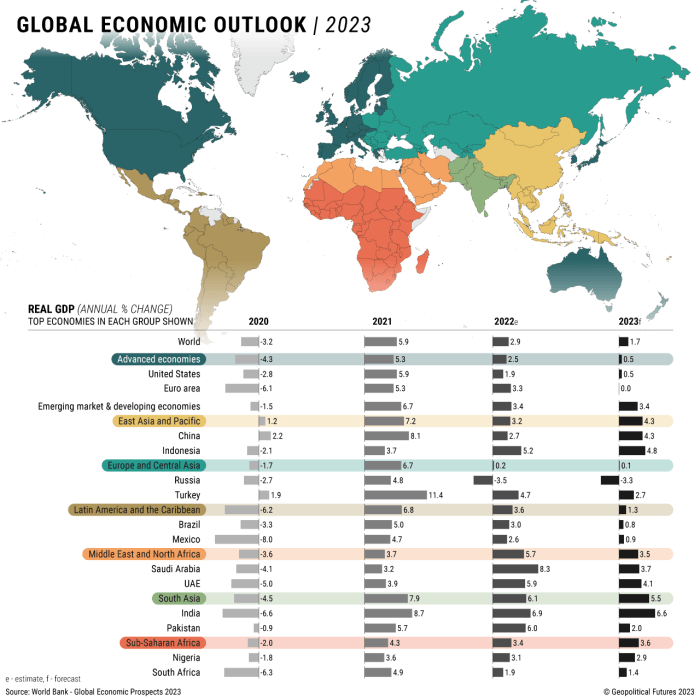

Developed economies, while generally experiencing slower growth rates than developing economies, still contribute significantly to global GDP. Their large economic size means even modest growth translates into substantial absolute increases in GDP. However, developing economies have shown faster growth rates, driven by factors such as industrialization, urbanization, and rising incomes. China, in particular, has been a major engine of global growth. The relative contributions fluctuate yearly, depending on the performance of key economies within each group. For example, during periods of strong growth in emerging markets like India or Brazil, their contribution to global GDP growth surpasses that of some developed nations.

Comparison of Economic Growth Trajectories Across Regions

Asia has consistently demonstrated robust economic growth, largely driven by China and other emerging economies in the region. This growth has been fueled by industrialization, foreign investment, and a large, growing workforce. Europe, while experiencing slower growth than Asia, has remained a significant contributor to the global economy, although it faces challenges related to aging populations and economic disparities among member states. North America, particularly the United States, has shown moderate growth, influenced by factors such as technological innovation and consumer spending. However, its growth has been less consistent than that of Asia, affected by cyclical economic fluctuations and geopolitical events. Africa, while possessing significant potential, has faced challenges related to infrastructure development, political instability, and economic diversification, resulting in more varied growth patterns across individual nations.

GDP Growth Rates of Major Economies (2019-2023)

The following table provides estimated GDP growth rates for selected major economies over the past five years. Note that these figures are estimates and may vary slightly depending on the source and methodology used.

| Economy | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| United States | 2.3% | -3.4% | 5.7% | 2.0% |

| China | 6.1% | 2.3% | 8.1% | 3.0% |

| Japan | 0.7% | -4.8% | 1.7% | 1.1% |

| Germany | 0.6% | -4.9% | 2.7% | 1.9% |

Inflationary Pressures and Monetary Policy Responses

The current global economic landscape is significantly shaped by persistent inflationary pressures, demanding a careful examination of their causes and the effectiveness of monetary policy responses. The interplay between supply chain disruptions, rising energy prices, and robust consumer demand has created a complex challenge for central banks worldwide. Understanding these dynamics is crucial for navigating the potential consequences of prolonged inflation.

Global supply chain disruptions have significantly contributed to inflationary pressures. The pandemic, geopolitical instability, and extreme weather events have all played a role in creating bottlenecks and shortages, driving up the prices of goods and services. This impact is particularly evident in sectors reliant on global trade, such as manufacturing and technology. Increased transportation costs, port congestion, and shortages of raw materials have cascaded through the supply chain, resulting in higher prices at the consumer level.

The Impact of Global Supply Chain Disruptions on Inflation

Supply chain disruptions have exacerbated inflationary pressures by limiting the availability of goods and increasing transportation costs. For instance, the semiconductor shortage during the pandemic led to higher prices for electronics and automobiles. Similarly, disruptions to agricultural supply chains caused increases in food prices globally. The ripple effect of these disruptions has been far-reaching, impacting various sectors and contributing to a broader inflationary environment. The resulting higher prices for businesses also impact the cost of producing goods and services, leading to a wage-price spiral.

Central Bank Responses to Rising Inflation

Central banks globally have employed a range of monetary policy tools to combat rising inflation. A primary response has been to increase interest rates. The US Federal Reserve, the European Central Bank, and the Bank of England, among others, have implemented a series of rate hikes to cool down overheated economies and curb inflation. These rate hikes aim to reduce borrowing and spending, thereby dampening demand-pull inflation. In addition to interest rate adjustments, some central banks have employed quantitative tightening (QT), reducing their balance sheets by selling off government bonds. This aims to decrease the money supply and further curb inflation.

Effectiveness of Monetary Policy Tools

The effectiveness of monetary policy tools in managing inflation varies depending on the specific economic context and the nature of the inflationary pressures. While interest rate hikes are a traditional and widely used tool, their effectiveness can be limited if inflation is primarily driven by supply-side shocks. In such cases, increasing interest rates may not address the root cause of inflation and could even lead to a recession without significantly impacting prices. Quantitative tightening (QT) also has its limitations; its impact can be slow and difficult to predict, and it can potentially negatively impact economic growth. The lag effect between policy implementation and its impact on inflation is another challenge.

Potential Consequences of Prolonged High Inflation

Prolonged high inflation can have several detrimental consequences:

- Reduced purchasing power: High inflation erodes the value of money, making it more expensive to purchase goods and services.

- Economic uncertainty: High and unpredictable inflation makes it difficult for businesses to plan for the future and invest, hindering economic growth.

- Increased inequality: Inflation disproportionately affects low-income households, who spend a larger share of their income on essential goods and services.

- Social unrest: High inflation can lead to social unrest and political instability, as people struggle to cope with rising prices.

- Currency depreciation: High inflation can lead to a depreciation of the domestic currency, making imports more expensive and potentially fueling further inflation.

Global Trade and Investment Flows

Global trade and foreign direct investment (FDI) are fundamental pillars of the global economy, significantly influencing economic growth, development, and interconnectedness. Understanding the trends in these flows, the impact of policy interventions, and the strategic choices of multinational corporations is crucial for navigating the complexities of the international economic landscape.

Global trade and FDI have experienced significant shifts in recent years. These shifts are shaped by a confluence of factors including technological advancements, evolving geopolitical dynamics, and the implementation of various trade policies.

Major Trends in Global Trade and Foreign Direct Investment

Global trade volumes have shown periods of robust growth followed by contractions, often mirroring the overall health of the global economy. The rise of e-commerce has facilitated cross-border trade in goods and services, while advancements in logistics and transportation have lowered costs and increased efficiency. Foreign direct investment (FDI) flows have also been dynamic, with shifts in investment preferences towards specific regions and sectors. Emerging markets have increasingly attracted FDI, although developed economies remain significant recipients. The COVID-19 pandemic disrupted global supply chains and caused a temporary decline in both trade and FDI, highlighting the interconnectedness and vulnerability of the global economic system. Post-pandemic, there has been a surge in certain sectors, but overall recovery has been uneven across different regions and industries.

Impact of Protectionist Policies on Global Trade Flows

Protectionist policies, such as tariffs and trade barriers, significantly impact global trade flows. The imposition of tariffs, for instance, increases the cost of imported goods, potentially leading to reduced trade volumes and higher prices for consumers. Such policies can also trigger retaliatory measures from other countries, escalating trade tensions and harming global economic growth. The impact of protectionism varies across sectors and countries, with some industries benefiting from increased domestic demand while others face reduced export opportunities. The recent trend towards protectionism in certain regions has raised concerns about the potential for a decline in global trade and increased economic fragmentation. Examples include the US-China trade war, which led to significant tariff increases on billions of dollars worth of goods, impacting global supply chains and consumer prices.

Multinational Corporation Investment Strategies in Different Regions

Multinational corporations (MNCs) adopt diverse investment strategies depending on the specific characteristics of different regions. Factors influencing these strategies include market size, regulatory environment, infrastructure, labor costs, and access to resources. In regions with large and growing consumer markets, such as Asia, MNCs often focus on market-seeking FDI, establishing production facilities or distribution networks to cater to local demand. In regions with abundant natural resources or low labor costs, MNCs may prioritize resource-seeking or efficiency-seeking FDI, respectively. Regulatory environments and political stability also play a crucial role, with MNCs often preferring regions with stable political systems and supportive regulatory frameworks. For example, investment in renewable energy technologies is higher in regions with supportive government policies and strong environmental regulations.

Global Trade and FDI Data

| Year | Global Trade Volume (USD Trillion) | Global FDI Inflows (USD Trillion) | Note |

|---|---|---|---|

| 2018 | 19.5 | 1.5 | Approximate figures; data varies slightly across sources. |

| 2019 | 19.0 | 1.3 | Slight decline due to trade tensions. |

| 2020 | 18.0 | 1.0 | Significant drop due to the COVID-19 pandemic. |

| 2021 | 22.0 | 1.6 | Strong recovery post-pandemic. |

Emerging Market Dynamics

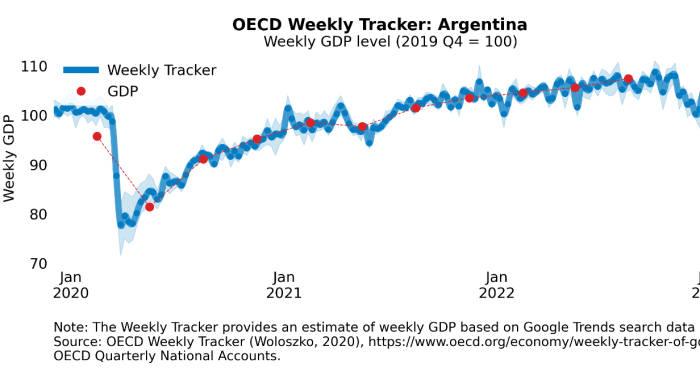

Emerging market economies represent a diverse group of nations, each navigating a unique set of economic challenges and opportunities. Their growth trajectories are significantly influenced by global factors, domestic policies, and technological advancements. Understanding these dynamics is crucial for comprehending the broader global economic landscape.

Economic Challenges and Opportunities Facing Emerging Market Economies

Emerging markets face a complex interplay of challenges and opportunities. Challenges include volatile capital flows susceptible to shifts in global investor sentiment, infrastructure deficits hindering productivity and economic diversification, and the need for substantial investment in education and human capital to enhance competitiveness. Opportunities, however, exist in the form of large and growing populations providing a substantial consumer base and workforce, abundant natural resources in many regions, and the potential for rapid technological adoption to leapfrog developed economies in certain sectors. For example, the rise of mobile money in sub-Saharan Africa demonstrates the potential for technological innovation to address financial inclusion challenges and drive economic growth.

The Role of Technology in Driving Economic Growth in Emerging Markets

Technology plays a transformative role in the economic development of emerging markets. Mobile technology, for instance, has revolutionized access to financial services, communication, and information, fostering entrepreneurship and economic activity in previously underserved areas. E-commerce platforms have opened up new markets for businesses, while advancements in agricultural technology are improving yields and food security. However, challenges remain in bridging the digital divide, ensuring equitable access to technology, and developing the necessary digital skills within the workforce. India’s success with IT services demonstrates the potential for emerging markets to leverage technological capabilities to compete globally.

Comparison of Economic Development Strategies of Different Emerging Markets

Emerging markets adopt diverse economic development strategies. Some, like China, have pursued export-oriented growth models, focusing on manufacturing and attracting foreign direct investment. Others, such as Brazil, have emphasized resource-based economies, leveraging their natural endowments. Still others, like many in Southeast Asia, have focused on developing specific technological niches and attracting high-value-added industries. These varying strategies reflect differences in resource endowments, institutional frameworks, and geopolitical contexts. The success of each strategy depends on effective implementation and adaptation to evolving global conditions. For example, China’s Belt and Road Initiative represents a large-scale infrastructural investment strategy aimed at fostering economic integration across Eurasia.

Impact of Global Commodity Prices on Emerging Market Economies

Global commodity prices exert a significant influence on emerging market economies, many of which are heavily reliant on the export of raw materials. Fluctuations in commodity prices can lead to considerable volatility in export earnings, impacting government revenues, investment levels, and overall economic growth. Countries heavily dependent on a single commodity are particularly vulnerable to price shocks. For example, oil-exporting nations in the Middle East and Africa experienced both booms and busts linked to the global oil price cycle. Diversification of exports and economic structures is crucial for mitigating the risks associated with commodity price volatility.

Technological Disruption and its Economic Impact

Technological advancements are profoundly reshaping the global economic landscape, driving both unprecedented opportunities and significant challenges. This transformation is impacting industries, labor markets, and the very fabric of how we live and work, necessitating a careful examination of its multifaceted consequences.

Technological disruption manifests in the rapid adoption of new technologies that fundamentally alter existing industries and business models. This process often leads to increased efficiency, productivity gains, and the creation of entirely new markets, but it can also cause significant job displacement and require substantial workforce adaptation.

Industries Significantly Impacted by Technological Disruption

The impact of technological disruption varies considerably across sectors. Some industries are experiencing more profound changes than others, largely dependent on their susceptibility to automation and the ease with which digital technologies can be integrated into their processes. For instance, the manufacturing sector has witnessed significant automation through robotics and advanced manufacturing techniques, leading to increased output but also job losses in certain roles. Similarly, the transportation sector is undergoing a transformation with the rise of autonomous vehicles and ride-sharing services, challenging traditional taxi and trucking businesses. The retail sector is another prime example, with e-commerce significantly impacting brick-and-mortar stores and altering consumer behavior. Finally, the media and entertainment industries have been revolutionized by digital streaming services and the proliferation of online content.

Economic Implications of Automation and Artificial Intelligence

Automation and artificial intelligence (AI) are two of the most transformative technologies currently reshaping the global economy. Automation, through robotics and software, is increasing productivity and efficiency in various sectors, leading to cost reductions and potentially higher profits for businesses. However, this increased efficiency often comes at the cost of job displacement, particularly for roles involving repetitive or manual tasks. AI, on the other hand, offers the potential for even greater transformative impact. AI-powered systems can analyze vast amounts of data to identify patterns and make predictions, leading to improvements in areas such as healthcare, finance, and customer service. The economic implications of AI are complex, with potential benefits in terms of productivity and innovation, but also risks related to job displacement and ethical concerns surrounding bias and accountability. For example, the increased use of AI in customer service has led to job losses for human customer service representatives, while simultaneously improving efficiency and potentially reducing costs for businesses.

Comparative Impact of Technological Disruption Across Sectors

| Sector | Impact on Productivity | Impact on Employment | Examples |

|---|---|---|---|

| Manufacturing | High (increased automation) | Mixed (job losses in some areas, job creation in others) | Robotics in assembly lines, 3D printing |

| Transportation | High (autonomous vehicles, optimized logistics) | Significant disruption (potential job losses for drivers) | Self-driving trucks, ride-sharing services |

| Retail | Mixed (increased efficiency in e-commerce, decreased efficiency in some brick-and-mortar stores) | Significant disruption (job losses in traditional retail, job creation in e-commerce) | Online shopping, automated checkout systems |

| Finance | High (algorithmic trading, fraud detection) | Mixed (job losses in some areas, job creation in others) | AI-powered investment platforms, robo-advisors |

Global Debt and Financial Stability

Global debt levels have reached unprecedented heights, raising significant concerns about financial stability worldwide. The distribution of this debt across countries and sectors varies considerably, influencing the vulnerability of different economies to potential crises. Understanding the dynamics of global debt and the interconnectedness of financial systems is crucial for effective policymaking and risk mitigation.

Global debt encompasses public debt (owed by governments), private debt (owed by corporations and households), and international debt (owed between countries). High levels of debt, particularly in the public sector, can constrain government spending on essential services like healthcare and education, while high levels of private debt can increase the risk of financial distress for households and businesses. The interplay between these debt types and their interaction with macroeconomic factors creates a complex landscape that requires careful analysis.

Levels and Distribution of Global Debt

Global debt has been steadily rising for decades, significantly accelerating following the 2008 financial crisis and further amplified by the COVID-19 pandemic. Data from the Institute of International Finance (IIF) indicates that global debt-to-GDP ratio reached record highs in recent years. This debt is not evenly distributed. Advanced economies generally have higher levels of public debt relative to their GDP compared to emerging market economies, although the latter have experienced rapid increases in private sector debt. For instance, China’s corporate debt has been a significant area of concern, while many European nations grapple with high public debt burdens inherited from previous financial crises. The distribution across sectors also varies significantly, with the financial sector playing a key role in the transmission of debt-related risks.

Risks Associated with High Debt Levels

High levels of debt, both public and private, present several significant risks to global financial stability. Excessive public debt can lead to sovereign debt crises, characterized by difficulties in servicing debt obligations, potentially resulting in defaults and economic instability. High private debt can increase the vulnerability of households and businesses to economic shocks, potentially triggering a wave of defaults and bankruptcies. Furthermore, the interconnectedness of global financial markets means that a crisis in one region can quickly spread to others, creating a domino effect. For example, the 2008 financial crisis, originating in the US subprime mortgage market, rapidly spread globally, demonstrating the systemic risks associated with high levels of debt and interconnected financial systems. This interconnectedness highlights the need for international cooperation in addressing global debt issues.

Measures to Address Global Financial Stability Concerns

Various measures have been implemented to address global financial stability concerns related to high debt levels. These include fiscal consolidation efforts by governments to reduce budget deficits and public debt, as well as structural reforms aimed at improving the efficiency and resilience of financial institutions. International organizations like the International Monetary Fund (IMF) play a crucial role in providing financial assistance and policy advice to countries facing debt distress. Regulatory reforms, such as stricter capital requirements for banks and increased transparency in financial markets, have also been implemented to mitigate systemic risks. The Basel Accords, for instance, represent a significant attempt to strengthen the global banking system through enhanced capital and liquidity standards. These efforts aim to create a more robust and resilient global financial system, better equipped to handle future shocks.

Impact of Rising Interest Rates on Global Debt Levels

Rising interest rates increase the cost of servicing debt, putting further strain on already indebted governments, corporations, and households. Higher interest rates make it more expensive to borrow new funds, potentially hindering economic growth. The impact is likely to be felt disproportionately by countries with high levels of debt and those with limited fiscal space. The recent interest rate hikes by central banks around the world to combat inflation have already started to impact global debt levels, making it more expensive for countries to manage their debt obligations and potentially exacerbating existing financial vulnerabilities. This creates a challenging environment for policymakers who must balance the need to control inflation with the risk of triggering a debt crisis. For example, emerging market economies, which often borrow in foreign currencies, are particularly vulnerable to rising interest rates, as the cost of servicing their debt increases in their own currency terms.

Climate Change and its Economic Consequences

Climate change presents a significant and multifaceted challenge to the global economy, impacting various sectors and regions in diverse ways. The economic costs associated with increasingly frequent and intense extreme weather events, coupled with the long-term effects of rising sea levels and shifting climate patterns, are substantial and growing. Conversely, the transition to a low-carbon economy also offers considerable economic opportunities, fostering innovation and creating new markets and jobs.

Economic Costs of Climate Change

The economic costs of climate change are far-reaching and manifest in numerous ways. Extreme weather events, such as hurricanes, floods, droughts, and wildfires, cause significant damage to infrastructure, disrupt supply chains, and lead to substantial losses in agricultural output. For instance, Hurricane Katrina in 2005 caused an estimated $160 billion in damages, highlighting the immense financial burden imposed by such events. Beyond immediate impacts, the gradual effects of climate change, including sea-level rise and desertification, pose long-term threats to coastal communities and agricultural productivity, leading to displacement, reduced economic output, and increased humanitarian costs. These costs are not evenly distributed, with developing nations often bearing a disproportionate burden despite contributing less to greenhouse gas emissions.

Economic Opportunities in a Low-Carbon Economy

The shift towards a low-carbon economy presents substantial economic opportunities. Investment in renewable energy technologies, energy efficiency measures, and sustainable infrastructure creates new markets and jobs, stimulating economic growth. The development and deployment of electric vehicles, smart grids, and carbon capture technologies are driving innovation and fostering competition in various sectors. Furthermore, the growing demand for sustainable products and services creates new business opportunities, particularly in sectors like green building, sustainable agriculture, and eco-tourism. Countries that successfully embrace this transition stand to gain a competitive advantage in the global marketplace.

Comparative Analysis of Climate Change Mitigation Policies

Different countries have adopted diverse approaches to mitigate climate change. The European Union, for example, has implemented a comprehensive Emissions Trading System (ETS), placing a price on carbon emissions to incentivize emissions reductions. China, the world’s largest emitter of greenhouse gases, has invested heavily in renewable energy infrastructure and is actively promoting energy efficiency. The United States, under the Biden administration, has rejoined the Paris Agreement and is pursuing policies to incentivize renewable energy development and reduce emissions from transportation and other sectors. These varied approaches reflect different national circumstances, priorities, and political landscapes, highlighting the complexity of international cooperation on climate action.

Illustrative Image: Economic Impacts of Climate Change on Agriculture

Imagine a split image. One side depicts a lush, vibrant agricultural landscape – green fields teeming with crops, healthy livestock grazing peacefully. This represents a pre-climate change scenario, showcasing high agricultural yields and economic prosperity in the agricultural sector. The other half shows a stark contrast: parched fields, withered crops, and emaciated livestock. This side illustrates the impact of climate change – droughts and extreme heat waves have decimated crops, leading to significant economic losses for farmers and impacting food security. This image clearly illustrates the devastating effects of climate change on agriculture, particularly in vulnerable regions dependent on rain-fed agriculture. The economic consequences are apparent: reduced crop yields, increased food prices, rural poverty, and potential mass migration due to livelihood insecurity. This visual representation emphasizes the urgent need for climate change mitigation and adaptation strategies to protect this vital sector.

Geopolitical Risks and their Economic Impact

Geopolitical risks represent a significant and increasingly unpredictable threat to global economic stability. These risks, stemming from international tensions and conflicts, can disrupt established trade routes, trigger capital flight, and significantly impact investor confidence, ultimately hindering economic growth. Understanding these risks and their potential consequences is crucial for navigating the complexities of the modern global economy.

Geopolitical tensions and conflicts have far-reaching economic consequences. The disruption of supply chains, for example, can lead to shortages of essential goods and services, driving up prices and fueling inflation. Similarly, sanctions imposed on countries involved in conflicts can severely impact their economies and those of their trading partners. Furthermore, the uncertainty created by geopolitical instability can deter investment, hindering economic development and growth.

Major Geopolitical Risks and their Economic Impacts

Several major geopolitical risks pose significant threats to the global economy. These include, but are not limited to, large-scale armed conflicts, escalating trade wars, the proliferation of nuclear weapons, and significant shifts in global power dynamics. The economic impact of each of these varies considerably depending on the scale and duration of the event, as well as the specific countries and regions involved. For instance, a major war in a strategically important region could trigger a global recession, while a prolonged trade war might lead to slower but more sustained economic decline. The potential for cascading effects across various sectors further exacerbates the economic vulnerability.

The Influence of Geopolitical Events on Global Trade and Investment Flows

Geopolitical events exert a powerful influence on global trade and investment flows. Increased political instability often leads to reduced foreign direct investment (FDI) as investors become hesitant to commit capital to uncertain environments. Trade flows are also significantly impacted, with disruptions to supply chains and increased protectionist measures resulting in reduced trade volumes and increased costs. This is particularly evident in situations involving sanctions or boycotts, where trade with targeted countries is severely restricted. The imposition of tariffs and other trade barriers further complicates international trade, leading to higher prices for consumers and reduced economic efficiency. For example, the ongoing tensions between the US and China have significantly impacted global trade flows and investment patterns.

Potential Economic Effects of a Major Geopolitical Crisis

The potential economic effects of a major geopolitical crisis are severe and multifaceted. Consider the following potential impacts:

- Sharp decline in global economic growth: A major crisis could trigger a global recession, with significant job losses and reduced consumer spending.

- Increased inflation: Disruptions to supply chains and increased energy prices could lead to a surge in inflation, eroding purchasing power.

- Increased volatility in financial markets: Uncertainty and fear could lead to significant volatility in stock markets and currency exchange rates.

- Increased government debt: Governments may need to increase spending on defense and humanitarian aid, leading to higher levels of public debt.

- Increased risk of financial instability: A major geopolitical crisis could trigger a financial crisis, as banks and other financial institutions face increased losses.

- Humanitarian crisis: Displacement of populations and disruption of essential services could lead to a major humanitarian crisis, requiring significant international aid.

Epilogue

In conclusion, analyzing global economic trends reveals a complex and dynamic system influenced by a multitude of interconnected factors. While challenges such as inflation, geopolitical instability, and climate change present significant headwinds, opportunities exist through technological innovation, strategic investments in emerging markets, and sustainable economic policies. A comprehensive understanding of these trends is vital for informed decision-making by governments, businesses, and individuals alike, enabling proactive adaptation and strategic planning in an ever-evolving global environment.

Key Questions Answered

What are the limitations of using GDP growth as a sole indicator of economic health?

GDP growth alone doesn’t capture income inequality, environmental sustainability, or social well-being. A holistic view requires considering additional metrics.

How can individuals prepare for potential economic downturns?

Individuals can prepare by diversifying investments, building emergency funds, developing marketable skills, and staying informed about economic trends.

What role does technology play in mitigating the effects of climate change?

Technology plays a crucial role through renewable energy solutions, improved resource management, and the development of climate-resilient infrastructure.