Navigating the complex world of international finance requires understanding currency exchange rate fluctuations. These shifts, driven by a multitude of economic and political factors, significantly impact businesses, investors, and individuals alike. This guide delves into the intricacies of currency exchange rate forecasting, exploring the key influences, forecasting methodologies, major currency pairs, and crucial risk management strategies.

From analyzing the impact of inflation and interest rate changes to understanding the role of geopolitical events and employing sophisticated forecasting techniques, we aim to provide a clear and insightful overview of this dynamic field. We’ll examine both traditional methods like fundamental and technical analysis, and explore the burgeoning use of machine learning and sentiment analysis in predicting future exchange rates.

Factors Influencing Currency Exchange Rates

Currency exchange rates, representing the value of one currency relative to another, are dynamic and influenced by a complex interplay of economic, political, and psychological factors. Understanding these factors is crucial for accurate forecasting and effective financial decision-making. This section will delve into some of the key drivers of exchange rate fluctuations.

Inflation’s Impact on Currency Exchange Rates

Inflation, the rate at which the general level of prices for goods and services is rising, significantly impacts currency exchange rates. High inflation erodes the purchasing power of a currency, making it less attractive to foreign investors and leading to a depreciation in its value. Conversely, low inflation strengthens a currency’s value. For example, during the hyperinflationary period in Weimar Germany in the 1920s, the German Mark experienced a catastrophic devaluation against other currencies as prices spiraled out of control. In contrast, countries with consistently low inflation rates, such as Switzerland, often see their currencies appreciate in value. The difference in inflation rates between two countries is a key determinant of their exchange rate, often explained through purchasing power parity (PPP) theory.

Interest Rates and Currency Values

Interest rates play a crucial role in determining currency values. Higher interest rates attract foreign investment, as investors seek higher returns on their investments. This increased demand for the currency leads to appreciation. Conversely, low interest rates make a currency less attractive, potentially causing it to depreciate. For instance, the US Federal Reserve’s interest rate hikes in 2022 strengthened the US dollar relative to other currencies. In contrast, countries with consistently low interest rates, like Japan during certain periods, have often seen their currency depreciate. The differential in interest rates between two countries is a major factor in determining their exchange rate, reflecting the relative attractiveness of each country’s investment opportunities.

Political Stability and Economic Growth’s Influence on Exchange Rates

Political stability and strong economic growth are essential for a currency’s strength. Political instability, such as civil unrest or regime change, creates uncertainty and can lead to capital flight, causing the currency to depreciate. Economic growth, on the other hand, boosts investor confidence and attracts foreign investment, strengthening the currency. Argentina, for example, has experienced periods of significant currency depreciation due to political and economic instability. In contrast, countries with strong, stable governments and robust economic growth, such as Germany, often enjoy relatively stable and strong currencies.

Government Intervention in Exchange Rates

Governments can intervene in the foreign exchange market to influence their currency’s value. This often involves buying or selling their currency in the market to adjust its value against other currencies, a practice known as currency manipulation. For instance, a government might sell its currency to weaken it, making its exports more competitive. Conversely, it might buy its currency to strengthen it, potentially combating inflation.

Hypothetical Scenario: Imagine Country X is experiencing a significant trade deficit. To boost exports and improve its balance of payments, the government of Country X decides to intervene in the foreign exchange market by selling its currency, say the “X-dollar,” in large quantities. This increased supply of X-dollars in the market would likely lead to a depreciation of the X-dollar against other currencies, making its exports cheaper and potentially more attractive to foreign buyers. However, this intervention could also have unintended consequences, such as fueling inflation or attracting speculation.

Forecasting Methods

Accurately predicting currency exchange rates is a complex undertaking, crucial for businesses and investors alike. Various methods exist, each with its strengths and weaknesses, relying on different data sets and analytical approaches. Understanding these methods is key to making informed decisions in the foreign exchange market.

Comparison of Forecasting Methods

A range of techniques are employed to forecast currency exchange rates. The choice of method depends on the available data, the forecasting horizon, and the desired level of accuracy. The following table compares three prominent approaches: fundamental analysis, technical analysis, and econometric modeling.

| Method | Strengths | Weaknesses | Data Requirements |

|---|---|---|---|

| Fundamental Analysis | Considers macroeconomic factors, providing a long-term perspective; can identify undervalued or overvalued currencies. | Subjective interpretation of economic data; susceptible to unforeseen events; less precise in short-term predictions. | Economic data (GDP, inflation, interest rates, trade balances, government debt), political news, and market sentiment. |

| Technical Analysis | Relatively simple to implement; focuses on price trends and patterns; useful for short-term trading strategies. | Relies heavily on past price movements, ignoring fundamental factors; prone to false signals; susceptible to market manipulation. | Historical price and volume data of the currency pair. |

| Econometric Modeling | Provides a statistically rigorous approach; allows for quantification of relationships between variables; can incorporate multiple factors. | Requires sophisticated statistical knowledge; model accuracy depends on data quality and model specification; may not capture all relevant factors. | Time series data of relevant economic variables (interest rates, inflation, GDP, etc.), potentially including dummy variables for events. |

Econometric Models in Currency Exchange Rate Forecasting

Econometric models use statistical techniques to quantify relationships between economic variables and exchange rates. A simplified example could be a regression model predicting the exchange rate (Y) based on the interest rate differential (X1) and the inflation differential (X2) between two countries:

Y = β0 + β1X1 + β2X2 + ε

Where:

* Y is the exchange rate (e.g., USD/EUR).

* X1 is the interest rate differential (US interest rate – Eurozone interest rate).

* X2 is the inflation differential (US inflation rate – Eurozone inflation rate).

* β0 is the intercept.

* β1 and β2 are the coefficients representing the impact of interest rate and inflation differentials on the exchange rate.

* ε is the error term.

This model suggests that a higher interest rate differential (favoring one country) and a lower inflation differential (favoring one country) would lead to an appreciation of that country’s currency. The coefficients (β1 and β2) would be estimated using statistical methods like Ordinary Least Squares (OLS). More complex models incorporate additional variables and account for potential non-linear relationships.

Sentiment Analysis in Currency Exchange Rate Forecasting

Sentiment analysis gauges the overall mood (positive, negative, or neutral) expressed in news articles and social media concerning a particular currency or economy. This sentiment can act as a leading indicator of future exchange rate movements. For instance, a surge in positive sentiment regarding a country’s economic prospects might lead to increased demand for its currency, causing appreciation.

Hypothetical Example: Suppose a major news outlet publishes a positive report on a country’s economic reforms. This positive sentiment is reflected in a spike in positive social media mentions. Consequently, investors become more optimistic about the country’s future, driving up demand for its currency and causing its value to appreciate against other currencies. Conversely, negative news reports and social media sentiment could lead to a currency depreciation.

Machine Learning Algorithms in Currency Exchange Rate Forecasting

Machine learning algorithms, particularly those based on artificial neural networks and support vector machines, can analyze vast datasets to identify complex patterns and relationships that might be missed by traditional methods. They can incorporate a wide range of variables, including fundamental economic data, technical indicators, and sentiment measures.

Advantages: Ability to handle large datasets; identification of non-linear relationships; potential for higher accuracy compared to traditional methods.

Disadvantages: Requires significant computational resources; model interpretability can be challenging; risk of overfitting (the model performs well on training data but poorly on new data); potential for biased outcomes if the training data is not representative.

Major Currency Pairs and Their Dynamics

Understanding the dynamics of major currency pairs is crucial for navigating the complexities of the foreign exchange market. These pairs, driven by a multitude of interconnected factors, exhibit diverse historical performances and sensitivities to global events. Analyzing their behavior provides valuable insights for investors and businesses operating in the international arena.

The following sections delve into the historical performance of key currency pairs, the specific factors influencing their fluctuations, and the impact of global events on their exchange rates.

Historical Performance of Major Currency Pairs

A review of the historical performance of major currency pairs reveals distinct trends and volatility patterns. These patterns are influenced by economic policies, geopolitical events, and market sentiment. Consideration of these historical trends is vital for informed decision-making in foreign exchange trading.

- EUR/USD: This pair has experienced periods of both significant appreciation and depreciation of the Euro against the US dollar. Factors such as the European Central Bank’s monetary policy, the relative economic performance of the Eurozone and the US, and global risk appetite have all played a role in shaping its trajectory.

- USD/JPY: The USD/JPY pair often reflects the relative strength of the US and Japanese economies and the prevailing global risk sentiment. Periods of global uncertainty often lead to a “safe-haven” flow into the Japanese Yen, causing the USD/JPY rate to fall. Conversely, periods of economic growth in the US may lead to appreciation of the dollar against the Yen.

- GBP/USD: The GBP/USD pair’s performance is heavily influenced by the UK’s economic conditions, particularly Brexit-related uncertainties. The pair’s volatility has been notably high in recent years due to the ongoing impacts of the UK’s exit from the European Union.

Factors Influencing the EUR/USD Exchange Rate

The EUR/USD exchange rate is a complex interplay of numerous factors. Understanding these drivers is essential for forecasting potential movements in the pair.

- Interest Rate Differentials: Differences in interest rates between the Eurozone and the US significantly influence the exchange rate. Higher interest rates in one region attract capital, increasing demand for its currency.

- Economic Growth: Relative economic performance between the Eurozone and the US plays a crucial role. Stronger economic growth in the Eurozone tends to strengthen the Euro.

- Political Stability: Political events within the Eurozone or the US can significantly impact investor confidence and, consequently, the exchange rate. Political uncertainty tends to weaken the affected currency.

- Global Risk Appetite: Periods of global uncertainty often lead to a “flight to safety,” strengthening the US dollar as a safe-haven currency and weakening the Euro.

Potential events causing significant fluctuations in the EUR/USD rate include a major change in ECB monetary policy, a significant recession in either the Eurozone or the US, a major geopolitical event affecting either region, or a sudden shift in global risk sentiment.

The USD and Emerging Market Currencies

The US dollar’s role as the world’s reserve currency significantly influences emerging market currencies. Fluctuations in the USD have cascading effects on these economies.

- Brazilian Real (BRL): The BRL has historically shown a strong inverse relationship with the USD. A strengthening USD often leads to a weakening BRL, and vice-versa.

- Mexican Peso (MXN): Similar to the BRL, the MXN is highly sensitive to USD movements. Economic ties between Mexico and the US amplify this correlation.

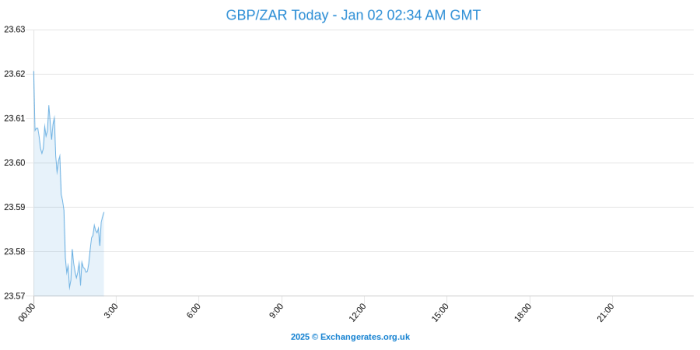

- South African Rand (ZAR): The ZAR is also influenced by the USD, often reflecting global commodity prices and investor sentiment towards emerging markets.

Impact of Global Events on Major Currency Pairs

Global events can trigger significant and often unpredictable shifts in major currency pairs. These events create uncertainty and alter investor behavior, leading to substantial exchange rate fluctuations.

For example, the 2008 Global Financial Crisis drastically impacted numerous currency pairs. The crisis led to a significant flight to safety, strengthening the US dollar (USD) against most other currencies, including the Euro (EUR) and the British Pound (GBP). The USD/JPY pair also experienced significant volatility as investors sought the perceived safety of the Japanese Yen. The resulting depreciation of the EUR and GBP against the USD reflected the increased risk aversion in global markets.

Risk Management in Currency Exchange Rate Forecasting

Accurate currency exchange rate forecasting is crucial for businesses and investors engaged in international transactions. However, inherent uncertainties and complexities in global markets introduce significant risks. Effective risk management is therefore paramount to mitigate potential losses and safeguard financial stability. This section details various risks involved in forecasting and Artikels strategies for effective risk mitigation.

Types of Risks in Currency Exchange Rate Forecasting

Several types of risks can significantly impact the accuracy and reliability of currency exchange rate forecasts. Understanding these risks is the first step towards developing effective risk management strategies.

- Model Risk: This refers to the risk that the forecasting model itself is flawed or inappropriate for the specific circumstances. A model might be based on outdated assumptions, fail to account for crucial variables, or simply be misspecified, leading to inaccurate predictions. For example, a model relying solely on historical data might fail to predict the impact of a sudden geopolitical event.

- Data Risk: Inaccurate, incomplete, or unreliable data used to build and validate the forecasting model can lead to significant errors. Data manipulation, errors in data collection, or the use of data that doesn’t accurately reflect market realities can all contribute to data risk. For instance, using outdated economic indicators or relying on data from a single source can skew the results.

- Market Risk: This encompasses the unpredictable fluctuations in currency exchange rates due to various factors such as economic news, political events, and market sentiment. Even the most sophisticated model cannot perfectly predict these unpredictable swings. For example, unexpected changes in central bank policy can significantly impact exchange rates.

- Operational Risk: This refers to risks associated with the processes and systems used in forecasting, such as errors in data processing, software glitches, or human error in interpreting results. A simple calculation error can lead to significant inaccuracies in the forecast.

Strategies for Mitigating Risks in Currency Exchange Rate Forecasting

Financial institutions employ various strategies to mitigate the risks associated with currency exchange rate forecasting. These strategies focus on improving the accuracy of forecasts, diversifying exposures, and implementing hedging mechanisms.

- Model Validation and Backtesting: Regularly testing the forecasting model against historical data helps identify weaknesses and biases. Backtesting assesses the model’s performance under various market conditions and can highlight areas for improvement.

- Data Quality Control: Implementing rigorous data quality checks, using multiple data sources, and employing data cleansing techniques can minimize the impact of data risk. This includes verifying data accuracy, identifying outliers, and ensuring data consistency.

- Scenario Analysis: Conducting scenario analysis involves simulating various possible market conditions (e.g., best-case, worst-case, and base-case scenarios) to assess the potential impact on the forecast. This allows for better preparedness and more informed decision-making.

- Stress Testing: Stress testing involves subjecting the model to extreme market conditions to assess its resilience and identify potential vulnerabilities. This helps identify potential breaking points and allows for proactive risk mitigation.

Hypothetical Portfolio Hedging Strategy

Imagine a company expecting to receive €1 million in six months. To mitigate the risk of the euro depreciating against the US dollar, they could use a forward contract. This contract locks in a specific exchange rate today for the future transaction. If the euro depreciates more than anticipated, the company’s losses are limited to the difference between the forward rate and the actual spot rate at the time of the transaction. Conversely, if the euro appreciates, the company misses out on potential gains but avoids losses from depreciation. The potential outcomes range from locking in a favorable exchange rate to limiting losses in a depreciating market.

Importance of Diversification in Managing Currency Exchange Rate Risk

Diversification is a cornerstone of effective currency risk management. Instead of concentrating exposure in a single currency, a diversified portfolio spreads risk across multiple currencies. For example, a company with significant transactions in the eurozone, the UK, and Japan might maintain holdings in euros, pounds, and yen, thereby reducing overall vulnerability to adverse movements in any one currency. This reduces the impact of any single currency’s volatility on the overall portfolio value. A diversified portfolio potentially offers better risk-adjusted returns compared to a concentrated one.

Last Word

Predicting currency exchange rates is inherently challenging, fraught with inherent uncertainties. However, by understanding the underlying economic principles, employing robust forecasting methodologies, and implementing effective risk management strategies, we can significantly improve our ability to navigate this complex landscape. This guide has provided a framework for understanding the key factors influencing exchange rates, the diverse methods used for forecasting, and the importance of mitigating risks. By combining theoretical knowledge with practical application, informed decisions can be made in the ever-evolving world of currency markets.

Questions and Answers

What is the most accurate method for forecasting exchange rates?

There’s no single “most accurate” method. Accuracy depends on various factors, including the time horizon, the currency pair, and the economic environment. A combination of fundamental and technical analysis, potentially augmented by machine learning, often yields the best results.

How often should exchange rate forecasts be updated?

The frequency of updates depends on the volatility of the market and the purpose of the forecast. For high-frequency trading, updates may be needed several times a day. For longer-term investment strategies, less frequent updates might suffice.

What are the ethical considerations in currency trading based on forecasts?

Ethical considerations include transparency, avoiding insider trading, and responsible risk management. Manipulating markets or misleading clients is unethical and potentially illegal.