The burgeoning field of online finance education offers a wealth of opportunities for individuals seeking to enhance their financial literacy. From beginner budgeting courses to advanced investment strategies, the digital landscape provides accessible and diverse learning pathways. This review delves into the popularity, curriculum, instructor expertise, student feedback, accessibility, and return on investment associated with various online finance courses, providing a comprehensive overview to help you navigate this expanding educational market.

We analyze leading platforms, compare course structures and teaching methodologies, and examine the factors contributing to a successful learning experience. Our goal is to equip you with the knowledge necessary to select a course that aligns with your individual needs and financial goals, ultimately maximizing your return on investment in terms of both knowledge and career advancement.

Popularity and Trends of Online Finance Courses

The online finance education market has experienced explosive growth in recent years, driven by increased accessibility to technology and a rising demand for financial literacy. This surge reflects a broader societal shift towards self-directed learning and the recognition of the importance of financial knowledge in navigating an increasingly complex economic landscape.

Growth of the Online Finance Education Market

Over the past five years, the online finance education market has shown significant expansion. While precise figures vary depending on the source and definition of “online finance education,” market research consistently points to a compound annual growth rate (CAGR) exceeding 15%. This growth is fueled by factors such as the increasing affordability of online courses compared to traditional classroom settings, the convenience of learning at one’s own pace, and the proliferation of high-quality online course platforms. For example, platforms like Coursera and Udemy have seen a dramatic increase in the number of users enrolled in finance-related courses, indicating a substantial market expansion. This growth is expected to continue, driven by factors such as increasing smartphone penetration and the growing popularity of microlearning formats.

Popular Types of Online Finance Courses

Several categories of online finance courses consistently rank highly in terms of enrollment and popularity. Investing courses, which cover topics like stock market fundamentals, portfolio diversification, and risk management, remain a perennial favorite. Budgeting and personal finance courses, focusing on practical skills like creating a budget, managing debt, and planning for retirement, also attract a large audience. Accounting courses, providing foundational knowledge in bookkeeping, financial statement analysis, and accounting principles, are popular among students pursuing careers in finance or related fields. Finally, courses focusing on specific niches like real estate investing, cryptocurrency, and financial modeling are gaining traction as these areas become increasingly relevant in the modern financial landscape.

Pricing Models of Online Finance Course Providers

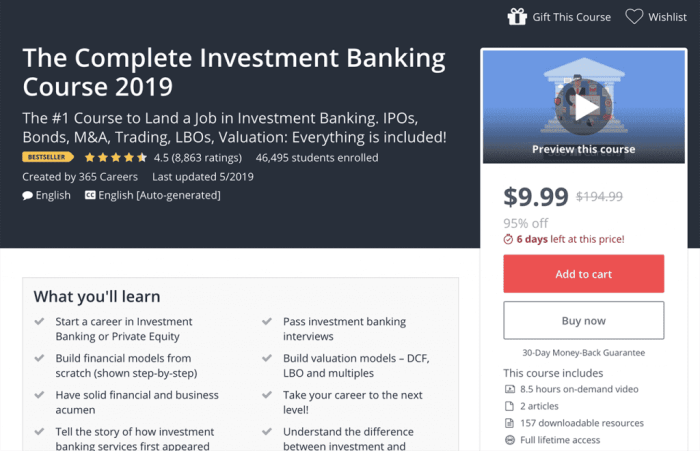

Online finance course providers employ various pricing models to cater to different student needs and budgets. Some platforms, such as Coursera and edX, offer a mix of free courses (often with limited features) and paid courses with certificates of completion. Other platforms, like Udemy and Skillshare, primarily operate on a pay-per-course model, with prices varying widely based on the course length, content, and instructor reputation. Subscription-based models are also emerging, offering access to a library of courses for a recurring fee. Finally, some providers offer bundled packages, combining multiple courses on related topics at a discounted price. The price range can be significant, from free introductory courses to premium courses costing hundreds of dollars.

Top Five Online Finance Course Providers

The ranking of online finance course providers is subjective and depends on the criteria used. However, considering student reviews and course completion rates, a potential top five list (note that rankings fluctuate frequently) might include providers like Coursera, Udemy, edX, Khan Academy (for free introductory content), and Skillshare. These providers generally offer a diverse range of courses, user-friendly platforms, and a robust support system.

| Provider | Course Type | Price | Rating (Example) |

|---|---|---|---|

| Coursera | Investing, Accounting, Financial Modeling | Varies, Free to Hundreds of Dollars | 4.5 stars |

| Udemy | Investing, Budgeting, Personal Finance | Varies, Often Discounted | 4.2 stars |

| edX | Financial Markets, Corporate Finance | Varies, Free to Hundreds of Dollars | 4.4 stars |

| Khan Academy | Basic Finance, Budgeting | Free | 4.7 stars |

| Skillshare | Investing Strategies, Financial Literacy | Subscription Based | 4.1 stars |

Course Content and Curriculum Analysis

Online finance courses cater to a wide range of learners, from complete beginners to experienced professionals seeking to upskill. Understanding the curriculum and teaching methodologies employed is crucial for selecting a course that aligns with individual learning goals and preferences. This section will analyze the typical content and structure of online finance courses, highlighting key differences between introductory and advanced levels and examining various teaching approaches.

Beginner-Level Online Finance Course Curriculum

A typical beginner-level online finance course typically starts with foundational concepts. The curriculum usually covers fundamental financial statements (balance sheets, income statements, and cash flow statements), basic accounting principles, and an introduction to key financial ratios. Students are then introduced to time value of money concepts, including present value and future value calculations, essential for understanding investments and loans. Finally, the course often concludes with an overview of investment basics, such as different asset classes (stocks, bonds, and mutual funds) and risk management principles. This structured approach ensures a solid foundation for further learning in more advanced finance topics.

Curriculum Differences Between Introductory and Advanced Courses

Introductory courses focus on building a foundational understanding of core financial concepts. Advanced courses, conversely, delve into specialized areas and build upon this foundation. For instance, an introductory course might briefly touch upon derivatives, while an advanced course might dedicate significant time to options pricing models, hedging strategies, and risk management techniques specific to derivatives. Similarly, introductory courses might introduce portfolio theory conceptually, whereas advanced courses could involve in-depth analysis of portfolio optimization techniques, including modern portfolio theory (MPT) and factor models. The mathematical rigor also increases significantly in advanced courses, often requiring a strong background in statistics and calculus.

Teaching Methods in Online Finance Courses

Online finance courses utilize a variety of teaching methods to cater to diverse learning styles. Video lectures remain a cornerstone, providing structured instruction and visual aids. Many courses incorporate interactive exercises and quizzes to reinforce learning and provide immediate feedback. Case studies are frequently used to apply theoretical concepts to real-world scenarios, enhancing practical understanding and problem-solving skills. Some courses also leverage simulations, allowing students to experience the consequences of different financial decisions in a risk-free environment. The blend of these methods contributes to a more engaging and effective learning experience.

Examples of Effective Learning Activities in High-Rated Online Finance Courses

Effective learning activities are crucial for knowledge retention and application. High-rated online finance courses often incorporate several key elements:

- Interactive Quizzes and Assessments: Regular quizzes and assessments, often integrated throughout the course, help students track their progress and identify areas needing further attention.

- Real-World Case Studies: Analyzing real-world financial situations, like the 2008 financial crisis or specific company bankruptcies, helps students apply theoretical knowledge to practical contexts. For example, analyzing Enron’s accounting practices can highlight the importance of ethical considerations in finance.

- Financial Modeling Exercises: Courses often include assignments requiring students to build financial models using spreadsheet software (like Excel), simulating investment scenarios or company valuations. This practical application solidifies theoretical understanding.

- Peer-to-Peer Learning Forums: Discussion forums enable students to interact with each other and instructors, fostering collaborative learning and knowledge sharing. This allows for diverse perspectives and problem-solving approaches.

- Guest Lectures from Industry Professionals: Inviting professionals from the finance industry to share their experiences and insights provides students with valuable real-world context and career guidance.

Instructor Expertise and Credibility

The credibility and expertise of the instructors are paramount in determining the quality and value of any online finance course. Students invest their time and money, expecting to learn from experienced professionals who can effectively translate complex financial concepts into accessible learning experiences. Therefore, a thorough evaluation of the instructor’s background is crucial before enrolling.

Credentials that demonstrate a finance instructor’s expertise are varied and impactful. A strong academic background, professional experience, and proven teaching ability all contribute to a compelling profile. For example, holding a Chartered Financial Analyst (CFA) charter, a Certified Public Accountant (CPA) license, or a Master’s or PhD in Finance are all highly respected credentials that signal a deep understanding of the subject matter.

Instructor Credentials Establishing Expertise

Beyond formal qualifications, practical experience significantly enhances an instructor’s ability to provide relevant and insightful instruction. Years spent working in investment banking, portfolio management, financial analysis, or regulatory compliance provide instructors with real-world case studies and practical examples to illustrate theoretical concepts. This practical knowledge bridges the gap between theory and application, making the learning experience more engaging and effective for students.

Importance of Instructor Experience and Real-World Application

Effective online teaching requires more than just subject matter expertise. A skilled online instructor needs to be adept at communicating complex information clearly and engagingly in a digital environment. This includes utilizing effective teaching methodologies, such as interactive exercises, case studies, and real-time Q&A sessions. Strong communication skills, patience, and the ability to adapt to different learning styles are also critical for successful online instruction. The instructor’s ability to create a supportive and interactive learning environment significantly impacts the student learning experience.

Factors Contributing to Effective Online Teaching

The following table compares the backgrounds of instructors from three hypothetical top-rated online finance courses. Note that this is a hypothetical example for illustrative purposes only and does not reflect actual instructors or courses.

| Instructor Name | Credentials | Experience | Teaching Style |

|---|---|---|---|

| Dr. Anya Sharma | PhD in Finance, CFA, 10+ years in Investment Banking | 15+ years teaching experience, 10+ years in industry | Highly structured, lecture-based with interactive case studies |

| Mr. Ben Carter | CPA, MBA, 15+ years in Portfolio Management | 5+ years teaching experience, extensive industry experience | Practical, hands-on approach with real-world examples and simulations |

| Ms. Chloe Davis | CFA, MBA, 8+ years in Financial Analysis | 3+ years teaching experience, strong online teaching skills | Engaging, interactive, utilizes technology effectively for collaborative learning |

Student Reviews and Feedback

Analyzing student reviews offers invaluable insights into the effectiveness and shortcomings of online finance courses. By examining both positive and negative feedback, course providers can identify areas of strength and weakness, ultimately leading to improved learning experiences. This analysis focuses on common themes emerging from student reviews to provide a comprehensive understanding of student perspectives.

Positive Student Review Themes

Positive reviews frequently highlight several key aspects of successful online finance courses. Students often praise the clarity and comprehensiveness of course materials, citing well-structured lessons, readily available resources, and engaging presentations as contributing factors to their positive learning experiences. Many appreciate the accessibility and flexibility of online learning, emphasizing the convenience of studying at their own pace and on their own schedule. Furthermore, supportive and responsive instructors are frequently mentioned, with students highlighting the value of personalized feedback and timely assistance. Finally, the practical application of learned concepts through real-world case studies and projects is another common source of positive feedback. Students appreciate the opportunity to apply their theoretical knowledge to practical scenarios, strengthening their understanding and enhancing their skillset.

Negative Student Review Criticisms

Conversely, negative reviews often center on specific areas needing improvement. Technical difficulties, such as platform glitches or incompatibility issues, are frequently cited. Furthermore, some students express dissatisfaction with the pace of the course, feeling it was either too fast or too slow, hindering their learning process. A lack of sufficient instructor interaction and feedback is another recurring criticism. Students may feel their questions are unanswered or that they lack personalized support. Finally, the perceived lack of practical application or relevance of course material is a common complaint. Students may find the curriculum too theoretical, lacking real-world examples or opportunities for hands-on experience.

Addressing Student Feedback and Course Improvement

Reputable online finance course providers actively solicit and incorporate student feedback to enhance their offerings. This often involves employing various methods, such as post-course surveys, in-course feedback mechanisms (like polls and forums), and regular reviews of student comments on platforms like Coursera or edX. For example, if a significant number of students report difficulty with a specific module, the provider might revise the materials, add supplementary resources, or adjust the teaching methodology. If technical issues are prevalent, the provider may invest in upgrading the learning management system or provide better technical support. Addressing student feedback is a continuous process of improvement, ensuring the course remains relevant, engaging, and effective.

Hypothetical Student Feedback Survey

To systematically gather student feedback, a structured survey could be implemented. This survey would incorporate both quantitative and qualitative data to obtain a comprehensive understanding of the learning experience.

| Question Type | Question |

|---|---|

| Multiple Choice (Rating Scale 1-5) | How would you rate the overall quality of the course materials? |

| Multiple Choice (Rating Scale 1-5) | How would you rate the instructor’s effectiveness in teaching the course content? |

| Multiple Choice (Rating Scale 1-5) | How would you rate the technical aspects of the online platform? |

| Open-Ended | What aspects of the course did you find most valuable? |

| Open-Ended | What aspects of the course could be improved? |

| Multiple Choice | Would you recommend this course to others? (Yes/No) |

| Open-Ended | Please provide any additional comments or suggestions. |

Course Accessibility and Support

Choosing an online finance course requires careful consideration of accessibility and the support systems in place. A successful learning experience hinges not only on the quality of the content but also on the ease with which students can access and engage with it, along with the readily available assistance when needed. This section examines the various aspects of accessibility and support provided by different online finance course providers.

Online finance courses are delivered through a variety of formats to cater to diverse learning styles and preferences. The accessibility of these formats is crucial for ensuring inclusivity and maximizing learning outcomes for all students.

Course Formats and Accessibility Features

Online finance courses typically utilize a blend of media to deliver their curriculum. Video lectures provide dynamic instruction and visual aids, while text-based materials offer a more detailed and easily reviewable learning experience. Downloadable materials, such as presentations, spreadsheets, and case studies, allow for offline study and practical application of concepts. Subtitles and transcripts accompany video lectures to benefit students with hearing impairments or those who prefer to read along. Furthermore, screen reader compatibility is essential for visually impaired learners, enabling them to navigate the course materials effectively. Color contrast adjustments and font size options cater to a wider range of visual needs. Interactive exercises and quizzes are commonly included to reinforce learning and provide immediate feedback.

Technical Support and Communication Strategies

Robust technical support is paramount for a smooth learning experience. Effective course providers offer multiple channels for students to seek assistance, including email support, online forums, live chat features, and frequently asked questions (FAQs) sections. Response times are a key indicator of the quality of support; prompt and helpful responses are essential for addressing student queries and resolving technical issues efficiently.

Effective communication strategies are crucial for keeping students engaged and informed throughout the course. The following examples illustrate successful approaches:

- Regular announcements and updates via email or the learning management system (LMS) keep students informed about deadlines, changes to the schedule, and important resources.

- Interactive forums and discussion boards encourage peer-to-peer learning and create a sense of community among students. Moderated discussions ensure constructive interactions and prevent the spread of misinformation.

- Live Q&A sessions with instructors provide opportunities for students to ask questions in real-time and receive immediate clarification on complex topics. Recordings of these sessions can be made available for those who are unable to attend live.

- Personalized feedback on assignments and assessments helps students identify their strengths and weaknesses and track their progress. Constructive criticism and guidance are key components of effective feedback.

Value and Return on Investment

Choosing the right online finance course requires careful consideration of its value and potential return on investment (ROI). This involves a thorough assessment of the course’s cost against the expected benefits, encompassing both tangible and intangible gains. A high ROI isn’t solely about a high salary increase; it also considers improved financial literacy, enhanced career prospects, and increased confidence in managing personal finances.

Assessing the value of an online finance course requires a multifaceted approach. It’s not simply a matter of comparing tuition fees; the overall cost should include factors like the time commitment, the cost of any required materials (textbooks, software), and any opportunity costs associated with taking the course (e.g., lost income from foregoing work). On the benefit side, consider potential salary increases, promotions, new career opportunities, and even the improved management of personal finances leading to better savings and investment decisions. A robust cost-benefit analysis is crucial for determining true value.

Calculating the Return on Investment

Calculating the ROI of an online finance course involves comparing the net financial gain against the total investment. The net gain is the difference between any salary increase, bonus, or improved investment returns, less the total cost of the course. For example, a course costing $500 that leads to a $2,000 annual salary increase after one year would yield a significant ROI. However, the calculation is more nuanced and requires a longer-term perspective for a complete picture. It’s important to consider the time value of money, discounting future earnings to reflect their present value.

Factors Influencing the ROI of an Online Finance Course

Several factors significantly influence the ROI of an online finance course. These factors can be categorized into those that positively impact ROI and those that negatively impact it. A thorough understanding of these factors is crucial for making an informed decision.

| Factor | Description | Positive Impact | Negative Impact |

|---|---|---|---|

| Course Quality | The overall quality of the course materials, teaching, and assessments. | High-quality courses lead to better knowledge retention and practical skills, increasing the likelihood of career advancement and improved financial management. | Poorly designed courses may waste time and money, offering little to no tangible benefits. |

| Instructor Expertise | The experience and qualifications of the course instructor. | Experienced instructors can provide valuable insights and real-world examples, leading to a more effective learning experience. | Instructors lacking relevant expertise may deliver less valuable content, diminishing the course’s effectiveness. |

| Career Relevance | How well the course content aligns with current industry demands and career goals. | Courses focusing on in-demand skills increase the chances of securing a higher-paying job or promotion. | Courses covering outdated or irrelevant topics may not translate into tangible career benefits. |

| Time Commitment | The amount of time required to complete the course. | Shorter courses allow for quicker skill acquisition and faster ROI. | Longer courses may delay the realization of benefits, potentially reducing the overall ROI. |

| Networking Opportunities | Opportunities to connect with other students and professionals in the field. | Networking can lead to valuable mentorship, job opportunities, and future collaborations. | Limited networking opportunities reduce the potential for long-term career benefits. |

| Course Cost | The total cost of the course, including tuition, materials, and opportunity costs. | Lower course costs increase the potential for a higher ROI. | High course costs can significantly reduce the potential ROI, especially if the benefits are limited. |

Comparison of Different Course Platforms

Choosing the right online learning platform is crucial for a successful finance education. Different platforms cater to various learning styles and offer diverse features, impacting the overall learning experience. This section compares three popular platforms: Coursera, Udemy, and edX, highlighting their strengths and weaknesses.

Platform Feature Comparison

This section details the key features of Coursera, Udemy, and edX, focusing on their functionalities relevant to online finance courses.

| Feature | Coursera | Udemy | edX |

|---|---|---|---|

| Course Selection (Finance) | Wide range, often from top universities, structured programs available. | Vast selection, many independent instructors, varying quality. | Strong selection from reputable universities, focus on structured learning. |

| Pricing Model | Mix of free courses (often audit-only) and paid courses, often with certificates. | Primarily pay-per-course, frequent sales and discounts. | Mix of free and paid courses, often with certificates, some courses are part of larger programs. |

| Platform Interface | Clean, organized interface, easy navigation. | Can feel cluttered, particularly with numerous course options. | Clean and organized, similar to Coursera but with a slightly different aesthetic. |

| Instructor Support | Generally good instructor support through discussion forums and sometimes direct communication. | Support varies widely depending on the instructor. | Generally good instructor support, similar to Coursera. |

| Certificate Recognition | Certificates from reputable universities are highly valued. | Certificate value varies greatly depending on the instructor and course. | Certificates from reputable universities are highly valued, similar to Coursera. |

Platform Strengths and Weaknesses

Each platform possesses unique advantages and disadvantages. Understanding these aspects is vital for selecting the platform that best suits individual learning needs and preferences.

- Coursera: Strengths include high-quality courses from top universities, structured learning paths, and widely recognized certificates. Weaknesses can be higher prices compared to Udemy and a potentially less diverse course selection in niche finance areas.

- Udemy: Strengths include a massive course selection at varying price points, frequent sales, and a wide range of instructor styles. Weaknesses include inconsistent course quality, less emphasis on structured learning, and potentially lower certificate recognition.

- edX: Strengths include a strong selection of university-level courses, structured learning paths, and highly valued certificates. Weaknesses might include a slightly smaller course selection compared to Udemy and potentially higher prices than Udemy for certain courses.

User Experience Comparison

The user experience on each platform significantly influences the overall learning journey. This section describes the user interface of each platform.

User Interface Visual Comparison

Imagine three screens. Coursera’s screen is clean and minimalist, with a clear course listing and navigation bar. The course pages are well-organized, with clear module breakdowns and progress trackers. Udemy’s screen appears more cluttered, with numerous course recommendations and promotional banners. Navigation can feel less intuitive due to the sheer volume of courses. edX’s screen shares similarities with Coursera’s clean design but has a slightly different color scheme and layout, still maintaining a user-friendly and organized approach. The course pages are structured similarly to Coursera, emphasizing a clear learning path.

Wrap-Up

Ultimately, the choice of an online finance course depends on individual learning styles, financial goals, and budget constraints. By carefully considering factors such as curriculum design, instructor credibility, student reviews, accessibility features, and platform usability, prospective students can make informed decisions and select a program that effectively equips them with the financial knowledge and skills needed to achieve their objectives. This review aims to provide a framework for this critical decision-making process, empowering individuals to confidently navigate the world of online finance education.

Questions Often Asked

What are the typical prerequisites for online finance courses?

Prerequisites vary greatly depending on the course level. Beginner courses usually require no prior knowledge, while advanced courses may assume familiarity with basic financial concepts.

How long does it typically take to complete an online finance course?

Completion times range from a few weeks for shorter courses to several months for more comprehensive programs, depending on the course intensity and the student’s commitment.

Are online finance courses accredited?

Accreditation varies. Some courses offer certificates of completion, while others may be affiliated with accredited institutions, providing more formal recognition.

What kind of career advancement opportunities are available after completing an online finance course?

Career opportunities depend on the course’s focus and the student’s prior experience. Possible advancements include improved financial management skills for personal use, or enhanced qualifications for roles in finance, accounting, or related fields.