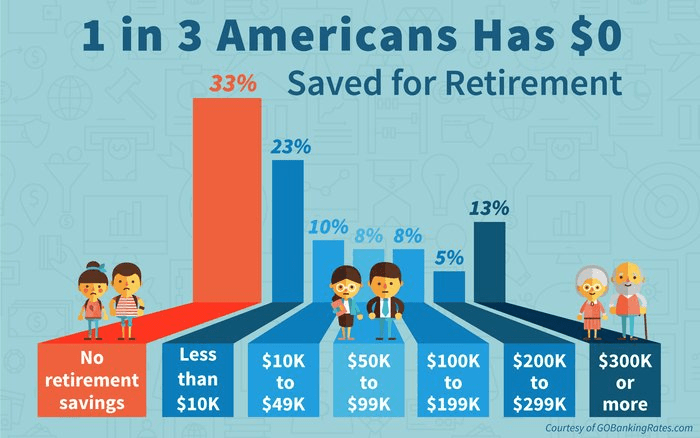

Planning for a comfortable retirement requires a proactive and strategic approach. Securing your financial future involves more than simply saving money; it demands a comprehensive understanding of various savings vehicles, investment strategies, and tax implications. This guide delves into the key elements of effective retirement planning, empowering you to navigate the complexities and build a secure financial foundation for your later years.

From defining your retirement goals and assessing your current financial situation to choosing the right savings accounts and developing a sound investment strategy, we will explore each step of the process. We’ll also address crucial aspects like managing retirement expenses, planning for healthcare costs, and the importance of estate planning. By the end, you’ll have a clearer roadmap to achieving your retirement aspirations.

Defining Retirement Goals

Setting clear and realistic retirement goals is crucial for successful financial planning. Without defined objectives, saving becomes a nebulous process, making it difficult to track progress and adjust strategies as needed. Understanding your desired lifestyle, potential healthcare expenses, and the persistent impact of inflation are all key components in crafting a comprehensive retirement plan.

Defining retirement goals involves a thorough self-assessment of your aspirations and financial realities. This process allows you to translate your vision of retirement into concrete, measurable targets that drive your savings efforts. Different approaches exist, focusing either on a desired income level or a targeted net worth at retirement. Both methods require careful consideration of various factors to ensure your goals are achievable and sustainable.

Factors Influencing Retirement Goal Setting

Several factors significantly influence the setting of retirement goals. These include desired lifestyle, healthcare costs, and inflation. A comfortable retirement may mean maintaining a similar lifestyle to your pre-retirement years, perhaps even upgrading to travel more or pursue hobbies. Conversely, some individuals may envision a simpler lifestyle with reduced expenses. However, regardless of the desired lifestyle, healthcare costs represent a substantial and often unpredictable expense in retirement. Finally, inflation steadily erodes the purchasing power of savings, necessitating higher savings targets to maintain the same standard of living over time.

Retirement Goal Approaches: Income vs. Net Worth

Individuals can approach retirement goal setting from two primary perspectives: targeting a specific income or a specific net worth. A target income approach focuses on determining the annual income needed to support your desired lifestyle in retirement. This approach requires careful budgeting and forecasting of expenses, factoring in inflation and potential healthcare costs. Alternatively, a target net worth approach focuses on accumulating a specific amount of assets by retirement. This approach provides flexibility, allowing you to choose how to generate income from your accumulated wealth, whether through withdrawals, investments, or a combination of both.

Translating Life Goals into Quantifiable Objectives

Translating life goals into quantifiable retirement savings objectives requires a systematic approach. For example, if your goal is to travel extensively in retirement, you might estimate the annual cost of travel, including flights, accommodation, and activities. Then, you would factor in inflation over the expected duration of your retirement and calculate the total savings needed to cover these expenses. Similarly, if you aim to leave an inheritance, you would determine the desired inheritance amount and work backward to determine the necessary savings and investment growth needed to achieve this goal. Consider a scenario where someone wants to maintain their current $80,000 annual spending in retirement. To account for inflation at an assumed 3% annual rate over 20 years, they would need to save significantly more than $1.6 million (20 years of spending). This simplified example highlights the critical role of inflation in retirement planning. More sophisticated calculations may incorporate variable inflation rates, varying spending needs across retirement years, and potential investment returns.

Assessing Current Financial Situation

Understanding your current financial health is a crucial first step in developing a robust retirement savings strategy. A clear picture of your assets, liabilities, and cash flow will illuminate your financial strengths and weaknesses, guiding you toward more effective savings and investment choices. This assessment involves creating a personal balance sheet and calculating key financial ratios.

Personal Balance Sheet: Calculating Net Worth

A personal balance sheet provides a snapshot of your net worth – the difference between your assets (what you own) and your liabilities (what you owe). Creating one involves listing all your assets, including bank accounts, investment accounts, retirement accounts, real estate, and personal property. Liabilities include mortgages, loans, credit card debt, and any other outstanding obligations. Subtracting your total liabilities from your total assets yields your net worth. For example, if your assets total $500,000 and your liabilities total $100,000, your net worth is $400,000. Regularly updating your balance sheet (at least annually) is essential to track progress and identify areas needing attention.

Debt-to-Income Ratio Calculation and Significance

The debt-to-income (DTI) ratio is a crucial indicator of your financial health and your ability to manage debt. It’s calculated by dividing your total monthly debt payments (excluding mortgage payments) by your gross monthly income. For example, if your total monthly debt payments are $2,000 and your gross monthly income is $8,000, your DTI ratio is 25% (2000/8000 = 0.25). A lower DTI ratio indicates better financial health. In retirement planning, a lower DTI ratio is highly desirable, as it signifies less financial strain and greater financial flexibility during retirement. A high DTI ratio might necessitate adjustments to spending habits or debt repayment strategies before retirement. A target DTI ratio for retirement planning would ideally be significantly below 36%, the commonly used threshold for mortgage qualification, to ensure comfortable financial management.

Tracking and Categorizing Monthly Expenses

Accurately tracking and categorizing your monthly expenses is essential for identifying areas where you can potentially reduce spending and increase savings. Use budgeting apps, spreadsheets, or even a simple notebook to record every expense. Categorize expenses (e.g., housing, transportation, food, entertainment) to gain insights into your spending patterns. Analyzing these categories will highlight areas where you might be overspending. For instance, you might discover that dining out accounts for a significant portion of your budget, suggesting potential for savings by cooking more meals at home. This detailed expense tracking allows for informed decision-making regarding budget adjustments and savings allocation for retirement.

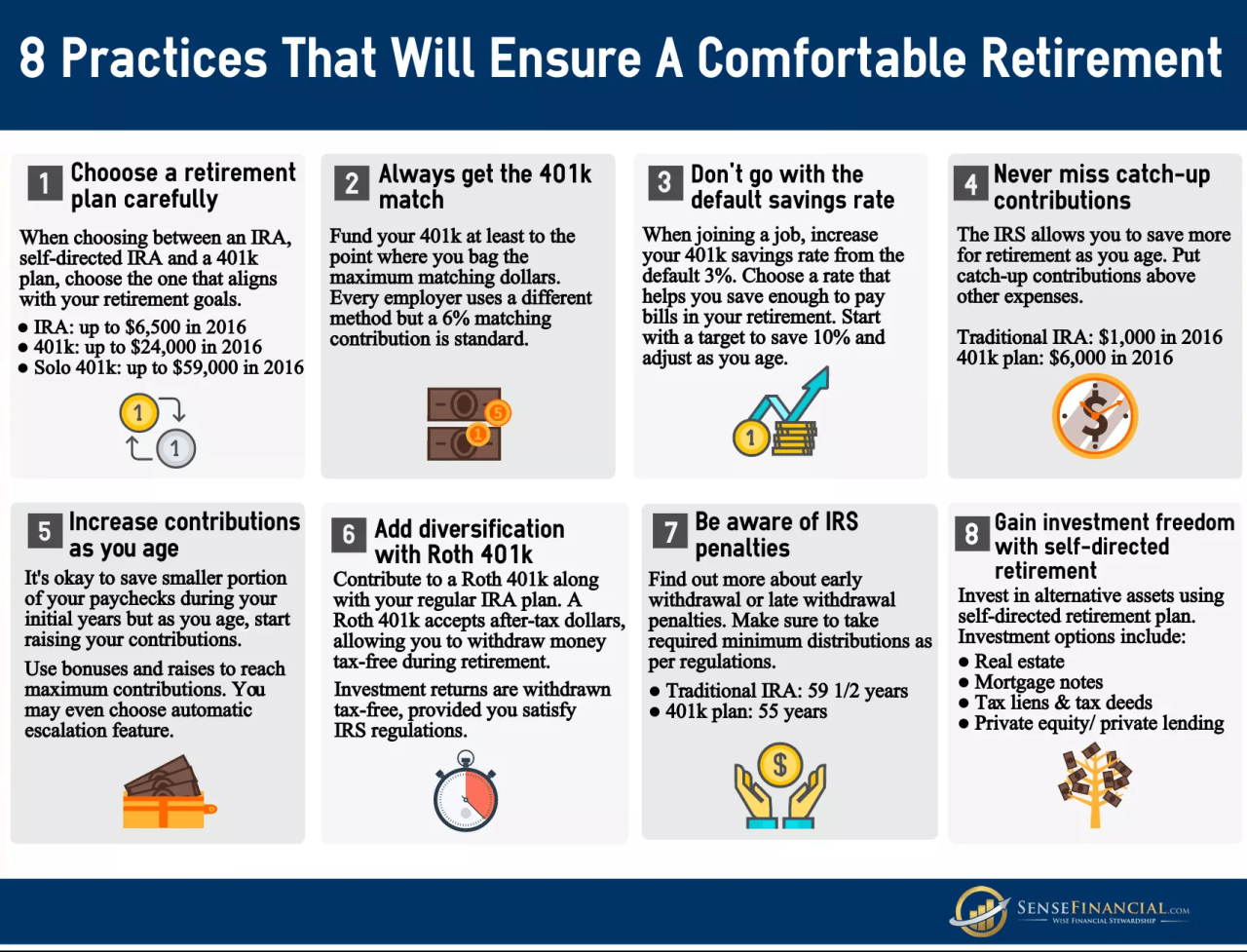

Retirement Savings Vehicles

Choosing the right retirement savings vehicles is crucial for securing your financial future. Understanding the differences between various accounts and employer-sponsored plans is essential for maximizing your savings and minimizing tax burdens. This section will Artikel the key features of several popular options, helping you make informed decisions about your retirement planning.

Comparison of Retirement Savings Accounts

The following table compares three common retirement savings accounts: 401(k)s, traditional IRAs, and Roth IRAs. Remember that contribution limits and tax laws are subject to change, so it’s always advisable to consult the most up-to-date information from the IRS.

| Account Type | Contribution Limits (2023 – Example, subject to change) | Tax Advantages | Withdrawal Rules |

|---|---|---|---|

| 401(k) | $23,000 (employee contribution) + $7,500 (age 50+) | Contributions are often pre-tax, reducing current taxable income. Investment earnings grow tax-deferred. | Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus income tax. Required minimum distributions (RMDs) begin at age 73 (75 for those born in 1960 or later). |

| Traditional IRA | $6,500 (individual contribution) + $1,000 (age 50+) | Contributions may be tax-deductible, reducing current taxable income. Investment earnings grow tax-deferred. | Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus income tax. RMDs begin at age 73 (75 for those born in 1960 or later). |

| Roth IRA | $6,500 (individual contribution) + $1,000 (age 50+) | Contributions are made after tax, but qualified withdrawals in retirement are tax-free. Investment earnings are also tax-free in retirement. | Withdrawals of contributions are always tax-free and penalty-free. Withdrawals of earnings before age 59 1/2 are generally subject to a 10% penalty, plus income tax, unless certain exceptions apply. No RMDs. |

Employer-Sponsored Retirement Plans: Benefits and Drawbacks

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, offer several advantages. Many employers offer matching contributions, essentially providing free money towards retirement. These plans also often come with lower administrative fees than individual accounts. However, portability can be an issue if you change jobs, and investment options may be limited compared to those available in individual retirement accounts. Furthermore, the level of employer matching and the overall plan quality can vary significantly between employers. For example, a company might offer a 50% match up to 6% of your salary, while another might only match 25% up to 3%. This difference substantially impacts the potential growth of your retirement savings.

Traditional vs. Roth Accounts: Tax Implications

The choice between traditional and Roth accounts hinges on your current and projected future tax brackets. If you expect to be in a lower tax bracket in retirement than you are now, a traditional account is generally more advantageous because you pay taxes later, in retirement, when your income is likely lower. Conversely, if you anticipate being in a higher tax bracket in retirement, a Roth account is preferable as you pay taxes now, at your lower current income, and enjoy tax-free withdrawals later. For instance, someone starting their career might choose a Roth IRA expecting higher income and a higher tax bracket in retirement. Someone nearing retirement, on the other hand, might prefer a traditional IRA if they anticipate a lower tax bracket in retirement. This decision is highly personalized and depends on individual circumstances and predictions about future income and tax rates.

Investment Strategies for Retirement

Planning your investment strategy for retirement requires careful consideration of your risk tolerance, time horizon, and financial goals. A well-structured approach will help you maximize your returns while mitigating potential losses. This section explores various investment strategies and provides examples to guide your decision-making.

Asset Allocation and Diversification

Asset allocation involves dividing your investment portfolio across different asset classes, such as stocks, bonds, and cash. Diversification, a key component of asset allocation, spreads your investments across various assets to reduce risk. By not putting all your eggs in one basket, you lessen the impact of poor performance in any single asset class. A well-diversified portfolio aims to balance risk and reward, aligning with your individual circumstances. For instance, a younger investor with a longer time horizon might tolerate higher risk and allocate a larger portion of their portfolio to stocks, while an older investor closer to retirement might favor a more conservative approach with a greater allocation to bonds.

Index Funds and Actively Managed Funds

Index funds passively track a specific market index, such as the S&P 500, offering broad market exposure at low costs. Actively managed funds, on the other hand, are managed by professional fund managers who aim to outperform the market by selecting specific stocks or bonds. Actively managed funds typically come with higher expense ratios. The choice between index funds and actively managed funds depends on your investment goals, risk tolerance, and resources. Index funds are often preferred for their lower costs and simplicity, while actively managed funds might appeal to those seeking higher potential returns, though with the acceptance of greater risk.

Sample Portfolio Allocations

The following examples illustrate how portfolio allocation can vary based on risk tolerance and time horizon. These are illustrative examples and should not be considered financial advice. Individual circumstances should always be considered when making investment decisions.

| Asset Class | Conservative Investor (Low Risk) | Moderate Investor (Medium Risk) | Aggressive Investor (High Risk) |

|---|---|---|---|

| Stocks (Equities) | 20% | 50% | 80% |

| Bonds (Fixed Income) | 70% | 30% | 10% |

| Cash | 10% | 20% | 10% |

For example, a conservative investor nearing retirement might prioritize capital preservation and choose a portfolio heavily weighted towards bonds, minimizing potential losses. Conversely, a younger, aggressive investor with a longer time horizon might allocate a larger portion to stocks, aiming for higher growth potential despite increased risk. A moderate investor would strike a balance between these two extremes. It’s important to remember that these are just examples, and individual circumstances will dictate the optimal asset allocation. Professional financial advice is always recommended for personalized portfolio construction.

Managing Retirement Expenses

Retirement, while a time of well-deserved rest and relaxation, often presents unforeseen financial challenges. Careful planning and proactive strategies are crucial to ensure a comfortable and secure retirement, free from the anxieties of unexpected costs. Understanding potential expenses and implementing effective management techniques is paramount to achieving this goal.

Unexpected Expenses During Retirement and Mitigation Strategies

Unexpected expenses can significantly impact retirement budgets. These often stem from health issues, home maintenance, or unforeseen travel needs. For example, a sudden illness requiring extensive medical care can quickly deplete savings. Similarly, unexpected home repairs, such as a roof replacement or plumbing emergency, can create substantial financial strain. To mitigate these risks, comprehensive insurance coverage is essential. This includes robust health insurance, homeowners’ or renters’ insurance with adequate coverage, and possibly supplemental insurance policies like long-term care insurance. Furthermore, establishing an emergency fund specifically designed to cover unexpected expenses can provide a crucial safety net. This fund should ideally hold enough to cover 3-6 months of essential living expenses. Regularly reviewing and adjusting insurance policies to reflect changing needs and circumstances is also crucial.

Projecting Future Healthcare Costs

Healthcare expenses are a major concern for retirees. Costs can vary greatly depending on individual health conditions, location, and the type of insurance coverage. To project future healthcare costs, individuals can utilize online calculators and tools available from various financial institutions and government agencies. These tools often require inputting factors such as age, health status, and anticipated medical needs. For instance, a 65-year-old couple with average health might anticipate annual healthcare costs exceeding $20,000, excluding long-term care. To incorporate these projections into retirement planning, it’s crucial to factor these estimated expenses into the overall retirement budget and savings goals. Consider exploring options like Medicare supplemental insurance (Medigap) to help cover out-of-pocket costs. Furthermore, consulting with a financial advisor specializing in retirement planning can provide personalized guidance on managing healthcare costs effectively.

Strategies for Reducing Expenses During Retirement

Reducing expenses during retirement is a key strategy for maximizing financial security. Careful budgeting and lifestyle adjustments can significantly impact overall spending. For example, downsizing to a smaller home can reduce property taxes, maintenance costs, and utility bills. Alternatively, relocating to a lower cost-of-living area can provide substantial savings on everyday expenses. Consider carefully reviewing monthly subscriptions and memberships, eliminating unnecessary ones. Exploring options for reducing energy consumption, such as installing energy-efficient appliances, can also lead to cost savings. Planning for travel and leisure activities well in advance can allow for better deals and discounts. Finally, exploring opportunities to supplement retirement income through part-time work or investments can further alleviate financial pressure.

Tax Implications of Retirement Savings and Withdrawals

Understanding the tax implications of retirement savings and withdrawals is crucial for maximizing your retirement income. Different retirement accounts offer varying levels of tax advantages, and your withdrawal strategy can significantly impact your tax liability in retirement. Careful planning can help minimize your tax burden and preserve more of your hard-earned savings.

Tax implications vary considerably depending on the type of retirement account used.

Tax Implications of Different Retirement Accounts

Traditional IRAs and 401(k)s offer tax-deferred growth, meaning you don’t pay taxes on the earnings until you withdraw them in retirement. However, contributions may be tax-deductible, depending on your income and participation in employer-sponsored plans. In contrast, Roth IRAs and Roth 401(k)s involve contributing after-tax dollars, but withdrawals in retirement are generally tax-free. This means you pay taxes upfront but avoid taxes later. The best choice depends on your current and projected tax bracket. For example, a younger individual in a lower tax bracket might prefer a Roth IRA to benefit from tax-free withdrawals in retirement, while someone in a higher tax bracket might opt for a traditional IRA to reduce their current taxable income.

Tax-Efficient Investment Strategies for Retirement Savings

Tax-efficient investing focuses on minimizing the taxes paid on investment returns. One key strategy is to hold investments in tax-advantaged accounts like 401(k)s and IRAs to defer or eliminate capital gains taxes. Another approach involves strategically harvesting tax losses to offset capital gains, reducing your overall tax liability. For example, selling a losing investment to offset gains from another investment can minimize your tax burden. Additionally, choosing investments with lower tax burdens, such as municipal bonds (for those in higher tax brackets), can also prove beneficial. The specific strategy will depend on individual circumstances and risk tolerance.

Impact of Tax Brackets and Tax Laws on Retirement Income

Your tax bracket significantly influences your retirement income. High earners may face higher tax rates on withdrawals from traditional retirement accounts. Conversely, those in lower tax brackets may find that the tax burden is less significant. Furthermore, tax laws are subject to change, which can impact your retirement planning. For example, changes in tax rates or deductions could affect the amount of taxes you pay on your retirement income. Therefore, it’s essential to stay informed about tax law changes and adjust your strategy accordingly. It’s prudent to consult with a financial advisor to understand the implications of current and potential future tax laws on your specific retirement plan.

Planning for Healthcare Costs in Retirement

Healthcare expenses represent a significant and often unpredictable factor in retirement planning. Failing to adequately account for these costs can severely impact your retirement lifestyle and financial security. Understanding your healthcare options and developing strategies to mitigate potential expenses is crucial for a comfortable and financially stable retirement.

Retirement brings significant changes to healthcare coverage. Most retirees rely heavily on Medicare, the federal health insurance program for people 65 and older and certain younger people with disabilities. However, Medicare doesn’t cover all medical expenses, and its coverage can be complex. Understanding the intricacies of Medicare, including its various parts (Part A, Part B, Part D, and Medigap), is essential. Supplemental insurance, such as Medigap policies or Medicare Advantage plans, can help fill the gaps in Medicare coverage, offering additional benefits and potentially lower out-of-pocket costs. Choosing the right combination of Medicare and supplemental insurance is a crucial decision that should be carefully considered based on individual needs and financial circumstances.

Medicare and Supplemental Insurance Options

Medicare Part A covers hospital insurance, including inpatient care, skilled nursing facilities, and hospice. Part B covers medical insurance, including doctor visits, outpatient care, and some preventive services. Part D covers prescription drugs. Medigap policies, offered by private insurance companies, help pay for some of the costs Medicare doesn’t cover, such as co-pays, deductibles, and coinsurance. Medicare Advantage plans (Part C) are offered by private companies and provide all Medicare benefits through a managed care network. These plans often include additional benefits like vision, hearing, and dental coverage, but they typically require using in-network providers.

Estimating Long-Term Healthcare Expenses

Accurately estimating long-term healthcare costs is challenging due to their unpredictable nature. However, using various resources and considering personal health history can provide a reasonable estimate. Online calculators and financial planning tools offer estimates based on factors such as age, health status, and geographic location. Consulting with a financial advisor specializing in retirement planning can provide personalized projections. For example, a 65-year-old couple retiring today might estimate annual healthcare costs of $15,000 to $25,000, increasing over time with inflation and potential health issues. This estimate should be adjusted for individual circumstances, and it is crucial to factor in potential long-term care needs, which can be significantly more expensive.

Strategies for Protecting Retirement Savings from Healthcare Costs

Protecting your retirement savings from the impact of healthcare costs requires a proactive and multifaceted approach. Several strategies can help mitigate these risks and ensure financial security throughout retirement.

- Maximize Medicare Coverage: Understanding and utilizing all aspects of Medicare coverage, including preventive services, is crucial to minimize out-of-pocket expenses.

- Consider Supplemental Insurance: Evaluating Medigap or Medicare Advantage plans can significantly reduce unexpected healthcare costs and provide broader coverage.

- Build a Robust Healthcare Savings Account: Setting aside funds specifically for healthcare expenses in a dedicated savings account can help absorb unexpected costs.

- Plan for Long-Term Care: Investigate long-term care insurance or explore options for paying for potential long-term care needs, as these costs can be substantial.

- Diversify Investments: A well-diversified investment portfolio can help protect your savings against market fluctuations and inflation, ensuring sufficient funds for healthcare expenses.

- Maintain a Healthy Lifestyle: Promoting good health through proper diet, exercise, and regular checkups can potentially reduce healthcare costs in the long run.

Estate Planning and Retirement

Securing your financial future during retirement involves not only diligently saving and investing but also thoughtfully planning for the eventual distribution of your assets. Estate planning plays a crucial role in ensuring your wishes are carried out, protecting your loved ones, and minimizing potential tax burdens after your passing. Failing to plan can lead to unintended consequences, such as protracted legal battles, unnecessary taxes, and significant financial hardship for your heirs.

Effective estate planning ensures a smooth transition of your assets, minimizing stress and complications for your family during an already difficult time. It allows you to maintain control over your legacy even after you’re gone, enabling you to provide for your dependents and charitable causes in a manner consistent with your values. This process becomes even more critical in retirement, as your accumulated assets are likely at their peak.

Estate Planning Tools and Their Implications for Retirement Assets

A range of tools can facilitate effective estate planning, each with specific implications for how your retirement assets are handled. These tools allow for varying degrees of control and flexibility in determining how and when your assets are distributed. Choosing the right tools depends on your individual circumstances, including the size and complexity of your estate, family dynamics, and tax implications.

Wills

A will is a legal document outlining how you wish to distribute your assets after your death. It designates an executor to manage the probate process, which involves verifying the will, paying debts, and distributing assets according to your instructions. Retirement accounts held in individual accounts, such as traditional and Roth IRAs, are typically subject to probate unless designated otherwise through beneficiary designations. Failure to have a will results in intestate succession, where the state determines the distribution of your assets, potentially leading to outcomes differing from your wishes. A well-drafted will provides clarity and minimizes potential conflicts among heirs.

Trusts

Trusts offer a more sophisticated approach to estate planning, providing greater control and flexibility compared to wills. A trust involves transferring assets to a trustee who manages them according to your instructions for the benefit of designated beneficiaries. Different types of trusts exist, such as living trusts (which take effect during your lifetime) and testamentary trusts (which take effect upon your death). Trusts can offer significant tax advantages, asset protection, and probate avoidance, particularly valuable for substantial retirement assets. For example, a revocable living trust allows you to manage assets during your lifetime and avoids probate upon your death, ensuring a more efficient transfer of your retirement accounts. An irrevocable trust offers even greater asset protection and tax benefits, but relinquishes control to the trustee.

Creating a Will or Trust

The process of creating a will or trust typically involves consulting with an estate planning attorney. The attorney will guide you through the process, ensuring the document accurately reflects your wishes and complies with all legal requirements. This involves gathering necessary information about your assets, beneficiaries, and desired distribution methods. The attorney will draft the document, and you’ll review and sign it in the presence of witnesses (as required by law). Regular review and updates are crucial, especially as your circumstances change, such as marriage, divorce, or the birth of grandchildren. This ensures your estate plan remains aligned with your current goals and wishes. Failure to update your will or trust can lead to unintended consequences and significant complications for your heirs.

Adjusting Retirement Strategies Over Time

Retirement planning isn’t a set-it-and-forget-it proposition. Life is full of unexpected turns, and your financial goals and circumstances will inevitably evolve over time. Regularly reviewing and adjusting your retirement plan is crucial to ensuring you stay on track to achieve your desired retirement lifestyle. Failing to adapt your strategy can lead to significant shortfalls or missed opportunities.

Regular review allows for proactive adjustments, mitigating potential risks and maximizing returns. Market fluctuations, changes in personal circumstances, and unforeseen events necessitate a dynamic approach to retirement planning. By staying informed and adaptable, you can navigate these challenges effectively and maintain a secure financial future.

Investment Strategy Adaptation

Adapting investment strategies is a key component of successful long-term retirement planning. Your asset allocation—the mix of stocks, bonds, and other investments in your portfolio—should reflect your risk tolerance, time horizon, and financial goals. As you approach retirement, you’ll generally shift towards a more conservative allocation, reducing risk and protecting accumulated savings. Conversely, a younger investor with a longer time horizon might tolerate a higher level of risk to potentially achieve greater long-term growth. This adaptation should be guided by professional advice, taking into account individual circumstances and market conditions. For example, during periods of high market volatility, a prudent strategy might involve shifting a portion of the portfolio to more stable, lower-risk investments like bonds to protect capital. Conversely, during periods of market downturn, a strategic approach might involve rebalancing the portfolio by buying more of the assets that have decreased in value, taking advantage of lower prices.

Responding to Life Events

Life throws curveballs. Significant life events can necessitate adjustments to your retirement plan. A job loss, for instance, may require you to reassess your savings timeline and potentially reduce your spending or find additional income streams. Unexpected medical expenses can similarly disrupt your plans, highlighting the importance of having adequate health insurance and emergency funds. A major home repair or unexpected family expenses can also demand a review and potential adjustments to your budget and investment strategy. Conversely, positive events, such as receiving an inheritance or a significant pay raise, can provide opportunities to accelerate your savings or adjust your retirement timeline. These adjustments might involve increasing contributions to your retirement accounts, investing in higher-growth assets, or accelerating debt repayment.

Example Scenarios Requiring Plan Adjustments

Consider a scenario where an individual experiences an unexpected job loss just ten years before their planned retirement. This event would likely necessitate a reassessment of their retirement timeline and potentially require them to delay retirement, find part-time employment, or reduce their planned retirement lifestyle. Conversely, an individual who receives an unexpected inheritance could accelerate their retirement plans, either by increasing their contributions or retiring earlier than originally planned. Another example involves an individual experiencing a significant health issue requiring expensive treatments. This scenario might necessitate a review of their health insurance coverage and potentially necessitate drawing down on their retirement savings earlier than anticipated, or exploring additional sources of income to cover healthcare costs. In all these cases, professional financial advice is invaluable in navigating these changes and making informed decisions.

Final Review

Building a secure retirement isn’t a one-size-fits-all endeavor. It requires careful planning, consistent effort, and a willingness to adapt your strategy over time. By understanding your financial situation, defining clear goals, and leveraging the appropriate savings and investment vehicles, you can significantly increase your chances of enjoying a comfortable and financially secure retirement. Remember, consistent review and adjustments to your plan are vital to navigate life’s unexpected turns and maintain your progress towards your retirement objectives.

Quick FAQs

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions but taxes withdrawals in retirement. A Roth IRA doesn’t offer upfront tax deductions, but withdrawals are tax-free in retirement.

How much should I be saving for retirement?

The recommended savings amount varies depending on individual circumstances, but a common guideline is to aim for saving at least 15% of your pre-tax income.

When should I start withdrawing from my retirement accounts?

The age at which you can begin withdrawing from retirement accounts without penalty is typically 59 1/2, although early withdrawals may incur penalties.

What is asset allocation, and why is it important?

Asset allocation is the strategy of diversifying your investments across different asset classes (stocks, bonds, real estate, etc.) to manage risk and optimize returns. It’s crucial for long-term investment success.

How can I protect my retirement savings from inflation?

Consider investments that historically outpace inflation, such as stocks and real estate, and regularly rebalance your portfolio to account for inflation’s impact.