Effectively managing your finances requires a structured approach. This Financial Goal Setting Template provides a roadmap to achieving your financial aspirations, whether it’s buying a home, retiring comfortably, or simply building a stronger financial foundation. By outlining your goals, setting realistic timelines, and tracking your progress, you gain control over your financial future and significantly increase your chances of success.

This template guides you through the process of defining SMART goals, prioritizing them based on your individual needs, and implementing effective strategies to reach them. We’ll explore various goal-setting methodologies, budgeting techniques, and methods for tracking your progress visually. The template is designed to be adaptable to different life stages and financial situations, ensuring it remains relevant and helpful throughout your financial journey.

Defining Financial Goals

Setting clear and achievable financial goals is fundamental to building a secure financial future. Without defined objectives, your efforts may be scattered and unproductive, leaving you feeling frustrated and without a sense of progress. This section Artikels the process of defining, prioritizing, and categorizing your financial goals to create a robust financial plan.

The Importance of SMART Goal Setting in Financial Planning

SMART goals – Specific, Measurable, Achievable, Relevant, and Time-bound – provide a structured approach to financial planning. A vague goal like “save more money” is far less effective than a SMART goal like “save $10,000 for a down payment on a house within two years.” The specificity and measurability of SMART goals allow you to track progress, adjust your strategy as needed, and ultimately achieve your objectives more efficiently. The “Achievable” aspect ensures your goals are realistic given your current financial situation, while “Relevant” ensures they align with your overall life goals and values. Finally, the “Time-bound” element creates a sense of urgency and helps you stay focused.

Examples of Different Types of Financial Goals

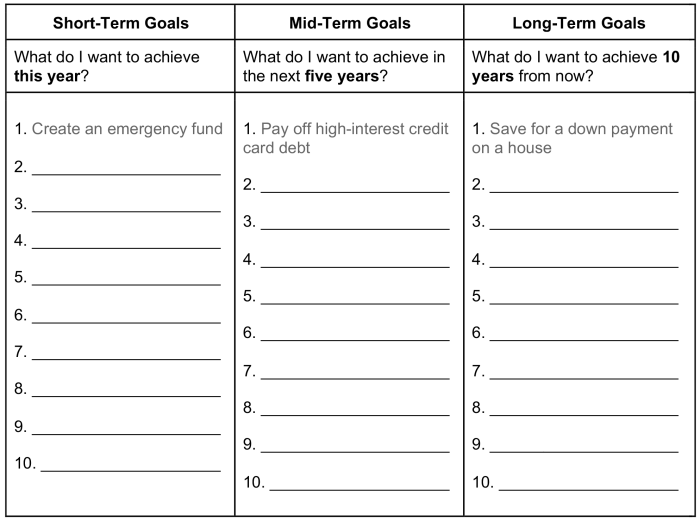

Financial goals can be categorized by their time horizon. Short-term goals typically involve achieving objectives within one year, such as paying off a credit card balance or saving for a vacation. Mid-term goals span one to five years and might include saving for a down payment on a car or paying off student loans. Long-term goals extend beyond five years and could involve saving for retirement, buying a home, or funding a child’s education. For example, a short-term goal could be saving $1,000 for an emergency fund in six months, while a long-term goal could be accumulating $1 million in retirement savings by age 65.

Prioritizing Financial Goals Based on Urgency and Importance

Prioritizing your financial goals is crucial, especially when resources are limited. A useful framework is the Eisenhower Matrix (Urgent/Important Matrix), which categorizes tasks based on urgency and importance. High-urgency, high-importance goals (e.g., preventing foreclosure) should be addressed immediately. High-importance, low-urgency goals (e.g., long-term investing) should be scheduled for the future. Low-importance tasks should be delegated or eliminated. This prioritization ensures that you focus your efforts on the most critical aspects of your financial well-being. For example, paying off high-interest debt would generally be prioritized over investing, even though investing is important for long-term growth.

A Framework for Categorizing Financial Goals

A simple framework for categorizing financial goals includes: Debt Reduction, Saving, and Investing. Debt reduction focuses on eliminating high-interest debts like credit card balances and personal loans. Saving involves building an emergency fund, saving for short-term purchases, and setting aside money for larger future expenses. Investing focuses on long-term growth through various instruments like stocks, bonds, and real estate. This categorization helps to structure your financial plan and track your progress across different areas. For example, a goal to pay off $5,000 in credit card debt falls under Debt Reduction, while a goal to save $10,000 for a down payment falls under Saving, and a goal to invest $500 monthly in a retirement account falls under Investing.

Template Structure and Components

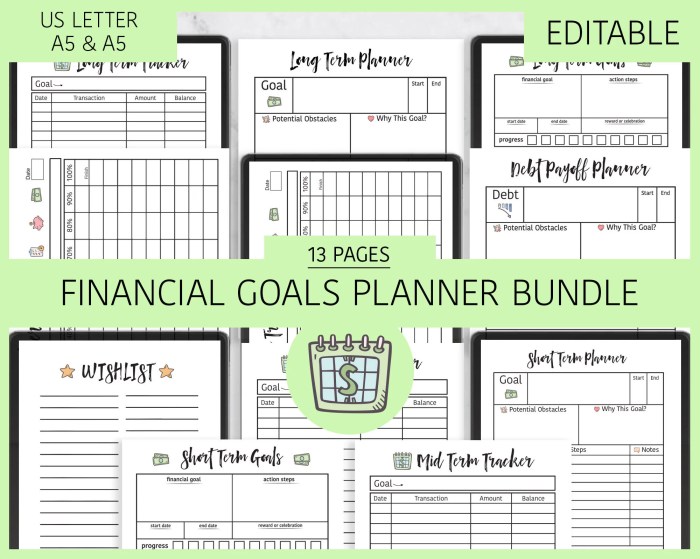

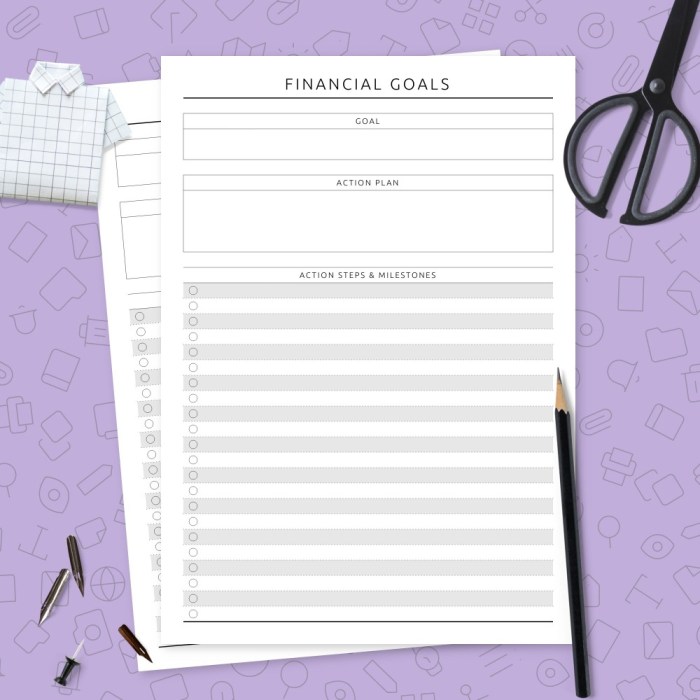

A well-structured financial goal setting template is crucial for effectively tracking progress and achieving your financial aspirations. This section details the essential components of a robust template, focusing on organization, visualization, and regular review. A clear and user-friendly design will greatly improve your ability to stay on track and motivated.

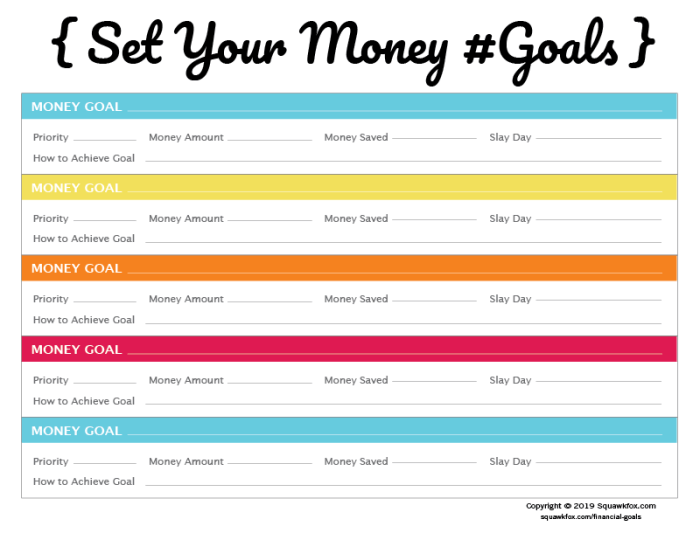

Sample Financial Goal Setting Template

Creating a simple yet effective template involves organizing your goals in a clear and concise manner. The following table illustrates a basic structure:

| Goal | Target Amount | Timeline | Action Steps |

|---|---|---|---|

| Pay off credit card debt | $5,000 | 12 months | Create a debt repayment plan; increase monthly payments; explore balance transfer options; track progress weekly. |

| Save for down payment on a house | $20,000 | 24 months | Increase savings rate; explore high-yield savings accounts; create a dedicated savings account; automate savings transfers. |

| Invest in retirement | $100,000 | 10 years | Maximize employer matching contributions; contribute regularly to a 401(k) or IRA; diversify investments; review portfolio annually. |

| Emergency fund | $10,000 | 6 months | Automate transfers to a dedicated savings account; prioritize saving until target is reached; review progress monthly. |

Visual Representation of Progress

Visual aids significantly enhance the effectiveness of a financial goal-setting template. Progress bars provide a clear, at-a-glance indication of how far along you are in achieving each goal. For example, a progress bar for paying off credit card debt could visually show the percentage of the debt that has been repaid. Charts, such as bar charts or pie charts, can also be used to compare progress across multiple goals or to visualize the allocation of funds towards different objectives. A pie chart could effectively show the proportion of savings allocated to different goals like retirement, house down payment, and emergency fund.

Regular Review Mechanisms

Incorporating regular review mechanisms is vital for staying on track and making necessary adjustments. The template should include designated spaces for periodic reviews (e.g., monthly, quarterly, annually). During these reviews, assess your progress against your goals, identify any roadblocks, and adjust your action steps accordingly. For instance, a monthly review might involve checking your savings balance, reviewing your spending habits, and making adjustments to your budget.

Tracking Income and Expenses

Integrating a section for tracking income and expenses is crucial for monitoring your financial health and ensuring your goals are aligned with your actual cash flow. This section could include a simple table or a linked spreadsheet where you record your income sources and expenses categorized by type (e.g., housing, transportation, food). This data will allow you to see where your money is going and identify areas where you can potentially save or increase your income to support your financial goals. Regularly updating this section will provide a comprehensive overview of your financial situation, enabling informed decision-making and adjustments to your financial plan as needed.

Goal Setting Methods and Strategies

Effective financial goal setting requires more than just identifying what you want to achieve; it necessitates a strategic approach to ensure your objectives are attainable and progress is measurable. This section explores various goal-setting methodologies and provides practical strategies for breaking down large goals, overcoming obstacles, and utilizing budgeting techniques to support your financial aspirations.

Comparing Goal-Setting Methodologies

Different methodologies offer unique advantages for achieving financial goals. Cascading goals, for example, involve setting overarching goals and then breaking them down into smaller, more manageable objectives at each organizational level (in a personal context, this might be breaking down a long-term goal like retirement into yearly savings targets, then monthly contributions). This ensures alignment and facilitates progress tracking across different timeframes. Conversely, Objectives and Key Results (OKRs) focus on setting ambitious yet achievable objectives with measurable key results. For instance, an objective might be “Improve financial literacy,” with key results including “Complete a personal finance course” and “Track expenses for three months using a budgeting app.” While both methods are effective, cascading goals emphasize a hierarchical breakdown, while OKRs prioritize measurable outcomes and ambitious targets.

Breaking Down Large Financial Goals

Large financial goals, such as buying a house or paying off debt, can feel overwhelming. A key strategy is to break them down into smaller, actionable steps. For example, saving for a house down payment could be broken down into monthly savings targets, research on mortgage options, and steps to improve credit score. Each step should have a clear deadline and associated tasks. Using a project management tool or spreadsheet can help visualize progress and maintain motivation. This phased approach makes the overall goal less daunting and provides a sense of accomplishment as each smaller goal is achieved.

Addressing Potential Obstacles and Challenges

Achieving financial goals often involves navigating unexpected obstacles. Unforeseen expenses (e.g., car repairs, medical bills) can derail progress. Lifestyle inflation (spending increases with income increases) can also hinder savings. To mitigate these challenges, building an emergency fund is crucial. This fund acts as a buffer against unexpected expenses, preventing the need to dip into savings intended for long-term goals. Regularly reviewing and adjusting the budget based on income and expenses is equally important. Additionally, developing strategies to manage impulsive spending, such as creating a waiting period before making non-essential purchases, can significantly improve financial discipline.

Utilizing Budgeting Techniques

Effective budgeting is essential for achieving financial goals. The 50/30/20 rule suggests allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a simple framework for managing expenses and prioritizing savings. Zero-based budgeting, on the other hand, involves starting each budgeting period with a zero balance and allocating every dollar to a specific category. This method requires meticulous tracking of expenses and forces conscious decision-making about spending. Choosing the right budgeting method depends on individual preferences and financial situations; both offer valuable tools for managing finances and reaching goals. For instance, someone with high debt might benefit from zero-based budgeting to meticulously track expenses and prioritize debt repayment, while someone with established savings habits might find the 50/30/20 rule sufficient.

Illustrative Examples and Case Studies

This section provides practical examples of how a financial goal-setting template can be used effectively to achieve financial objectives. We will examine a case study showcasing successful goal attainment, illustrate a visual representation of goal progression, identify common financial goal-setting pitfalls, and explore template adaptation for diverse life circumstances.

Successful Application of a Financial Goal-Setting Template: Case Study

Sarah, a 28-year-old marketing professional, utilized a financial goal-setting template to purchase a condo within five years. Her template Artikeld three primary goals: saving a 20% down payment ($40,000), paying off $10,000 in student loan debt, and increasing her credit score to 750. Her strategies included automating monthly savings transfers to a high-yield savings account, creating a detailed student loan repayment plan, and diligently paying all bills on time. Within three years, she achieved her student loan goal and had saved $35,000 towards her down payment. While a job change temporarily impacted her savings rate, she adjusted her budget and accelerated her savings in the final two years, successfully reaching her down payment goal and purchasing her condo.

Visual Representation of Goal Progression

Imagine a line graph charting Sarah’s savings progress towards her $40,000 down payment. The x-axis represents time (in years), and the y-axis represents the total savings amount. The line starts at $0 and steadily increases, showing consistent progress for the first two years. Around year three, a slight dip in the line represents the temporary setback caused by the job change. However, the line then resumes its upward trajectory, rising more steeply in the final two years as Sarah intensified her savings efforts. The graph culminates at $40,000 at the five-year mark, illustrating the successful achievement of her goal, despite a temporary challenge. Key milestones shown on the graph include reaching the halfway point at year two and overcoming the savings dip in year four.

Common Financial Goal-Setting Mistakes and Template Mitigation

A well-structured financial goal-setting template can help avoid several common mistakes.

The following are five frequent errors individuals make when setting financial goals, along with how the template helps prevent them:

- Unrealistic Goals: Setting goals too ambitious or lacking specificity. The template promotes realistic goal setting through detailed planning and breakdown into smaller, manageable steps.

- Lack of a Timeline: Failing to establish clear deadlines. The template provides a framework for setting realistic timelines and tracking progress against those deadlines.

- Ignoring Unexpected Expenses: Not accounting for unforeseen costs. The template encourages incorporating a buffer for unexpected expenses into the budget.

- Insufficient Monitoring: Failing to regularly review progress and make adjustments. The template promotes regular review and adjustment of goals and strategies based on progress and changing circumstances.

- Lack of a Contingency Plan: Not having a backup plan for setbacks. The template facilitates the development of contingency plans to address potential obstacles and maintain progress towards goals.

Adapting the Template to Different Life Stages and Financial Situations

The template’s flexibility allows for adaptation across various life stages and financial situations. A young single professional might focus on debt reduction and building an emergency fund, while a married couple might prioritize saving for a house or children’s education. Retirees may concentrate on managing existing assets and ensuring a steady income stream. The core elements of goal setting – defining specific, measurable, achievable, relevant, and time-bound (SMART) goals – remain constant, but the specific goals and strategies will differ based on individual circumstances. For example, a young professional’s template might emphasize aggressive savings and investment, while a retiree’s might focus on risk management and income diversification.

Advanced Features and Considerations

This section delves into more sophisticated aspects of financial goal setting, moving beyond the basics to incorporate dynamic strategies and tools for enhanced success. We will explore how to integrate investment strategies, leverage technology for effective tracking, adapt to changing circumstances, and proactively manage risk.

Investment Strategy Integration

Integrating investment strategies directly into your financial goal-setting template is crucial for long-term success. This involves aligning your investment choices with your specific goals and timelines. For example, a short-term goal like a down payment on a house might benefit from a low-risk, high-liquidity investment strategy, such as a high-yield savings account or money market fund. Conversely, long-term goals like retirement might justify a more aggressive approach incorporating stocks and bonds, aiming for higher returns over a longer timeframe. The template should include sections for specifying asset allocation, risk tolerance, and expected returns for each goal. This allows for a holistic view of your financial picture and ensures your investments actively contribute to achieving your objectives.

Utilizing Financial Software and Apps

Numerous financial software programs and mobile applications offer robust tools for goal tracking and management. These tools often include features like budgeting tools, expense trackers, investment portfolio monitoring, and automated savings plans. For example, Mint or Personal Capital provide comprehensive overviews of your financial health, allowing you to visualize progress toward your goals. YNAB (You Need A Budget) focuses on budgeting and mindful spending, helping you allocate funds effectively. Such software simplifies the process of monitoring your financial progress, identifying areas for improvement, and making necessary adjustments to your plan. The choice of software depends on individual needs and preferences, but integrating these tools into your workflow can significantly enhance your goal-achieving capabilities.

Regular Goal Review and Adjustment

Regularly reviewing and adjusting your financial goals is not merely advisable; it’s essential. Life circumstances change—job loss, unexpected expenses, salary increases, changes in family structure—all impacting your financial landscape. A static plan is unlikely to remain effective in the face of such fluctuations. Your financial goal-setting template should incorporate a schedule for periodic reviews (e.g., annually or semi-annually). These reviews should involve reassessing your progress, identifying any deviations from the plan, and making necessary adjustments to your goals, timelines, or strategies. For example, if you experience a significant income reduction, you might need to adjust savings targets or postpone certain goals. This iterative approach ensures your plan remains relevant and achievable.

Incorporating Risk Management Strategies

Long-term financial goals are inherently exposed to various risks, including market volatility, inflation, and unexpected life events. Therefore, integrating risk management strategies into your template is critical. This might involve diversifying your investments across different asset classes to mitigate losses, building an emergency fund to cushion against unexpected expenses, or purchasing insurance to protect against unforeseen circumstances. For instance, a comprehensive insurance plan covering health, disability, and life can significantly reduce financial risks associated with unforeseen events. Similarly, diversifying investments across stocks, bonds, and real estate can help mitigate the impact of market downturns. Thorough risk assessment and the implementation of appropriate mitigation strategies are vital components of successful long-term financial planning.

Wrap-Up

Successfully navigating the world of personal finance requires planning and consistent effort. This Financial Goal Setting Template provides the tools and structure you need to define, track, and achieve your financial goals. By using this template, you’ll not only gain clarity on your financial objectives but also develop the discipline and strategies necessary to make them a reality. Remember, consistent review and adaptation are key to long-term success. Embrace the journey, and watch your financial aspirations blossom.

FAQ Guide

Can I use this template for business goals as well?

While designed for personal finance, the principles and structure can be adapted for business goals. Adjust the categories and metrics to suit your business needs.

How often should I review my financial goals?

Regular review is crucial. Aim for at least a quarterly review to assess progress and adjust your strategies as needed. Life circumstances change, and your goals should adapt accordingly.

What if I don’t meet my goals on schedule?

Don’t be discouraged! Analyze why you fell short, adjust your timeline or strategies, and recommit to your goals. Flexibility and perseverance are key.

Is this template suitable for all income levels?

Yes, the template’s adaptability allows it to be used regardless of income. The focus is on the process of goal setting and tracking, not the specific amount of money.