Mastering personal finances can feel daunting, but the right tools can transform the process. Budgeting apps have emerged as invaluable allies in this journey, offering a range of features designed to simplify financial management. From tracking expenses to projecting savings, these apps cater to diverse needs and preferences, empowering users to gain control of their money.

This review delves into the world of budgeting apps, examining their functionalities, security features, and user experiences. We compare popular options, highlighting their strengths and weaknesses to help you choose the app that best aligns with your financial goals and technological comfort level. We’ll also address common concerns about data privacy and explore the integration capabilities these apps offer with other financial platforms.

Introduction to Budgeting Apps

In today’s digital age, managing personal finances effectively is crucial. Budgeting apps have emerged as invaluable tools, simplifying the process and empowering individuals to take control of their spending habits. These apps offer a range of features designed to help users track expenses, plan budgets, and achieve their financial goals. They provide a convenient and accessible way to monitor financial health, offering insights and tools previously only available through complex spreadsheets or manual record-keeping.

Budgeting apps are more than just simple expense trackers; they provide a comprehensive approach to personal finance management. They offer various functionalities tailored to different needs and financial situations.

Types of Budgeting Apps

The market offers a diverse range of budgeting apps, each with its own strengths and features. Categorizing them helps users find the app that best suits their individual requirements. These apps generally fall into three main categories: expense trackers, budgeting planners, and debt management tools. Expense trackers focus primarily on recording transactions, while budgeting planners provide tools for creating and adhering to a budget. Debt management tools specialize in helping users organize and pay down their debts strategically.

Benefits of Using Budgeting Apps

Utilizing budgeting apps offers numerous advantages for personal finance management. These apps provide a clear overview of spending habits, allowing users to identify areas where they can cut back. The automation of data entry saves time and effort compared to manual tracking. Real-time insights into financial health empower users to make informed decisions about spending and saving. Many apps also offer features like goal setting, allowing users to track progress towards financial milestones, such as saving for a down payment or paying off debt. The ability to link bank accounts and credit cards streamlines the data entry process, reducing the likelihood of errors and omissions. Furthermore, many apps offer features like budgeting advice and financial education resources, fostering greater financial literacy among users. For example, an app might suggest ways to reduce spending based on spending patterns, or offer insights into interest rates and debt repayment strategies.

Key Features of Popular Budgeting Apps

Choosing the right budgeting app can significantly impact your financial management success. This section compares the key features, user interfaces, and overall experiences of three popular budgeting apps to help you make an informed decision. We’ll examine their strengths and weaknesses to highlight what makes each app unique.

Comparison of Popular Budgeting Apps

The following table summarizes the key features, pricing, and user ratings of three widely-used budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital. Note that user ratings can fluctuate and are based on average scores across multiple app stores at the time of writing.

| App Name | Key Features | Pricing Model | User Rating (Example) |

|---|---|---|---|

| Mint | Automated transaction tracking, budgeting tools, credit score monitoring, bill payment reminders, financial news integration. | Free (with ads) | 4.5 stars (example average) |

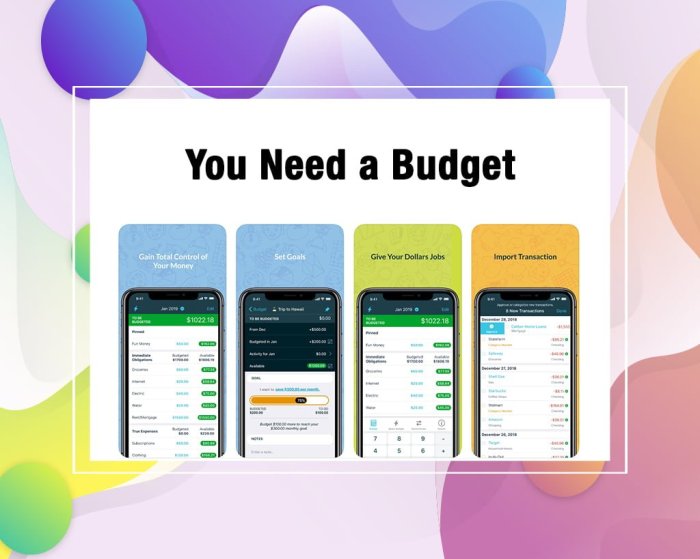

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, scheduled transactions, debt reduction tools, strong community support. | Subscription-based (monthly or annual fee) | 4.7 stars (example average) |

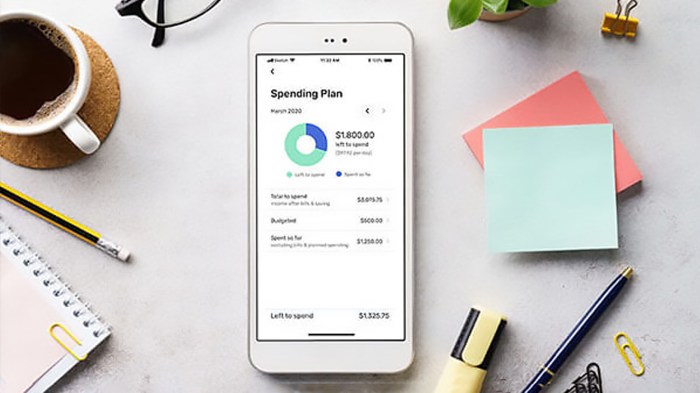

| Personal Capital | Comprehensive financial dashboard, investment tracking, retirement planning tools, fee analysis, budgeting features. | Free (with premium features available for a fee) | 4.3 stars (example average) |

User Interface and User Experience

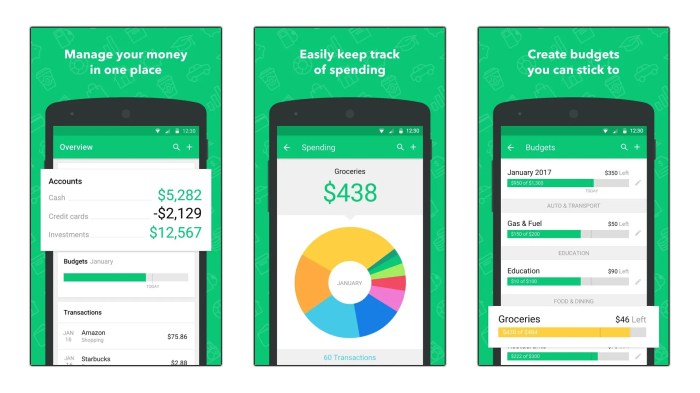

Mint boasts a clean and intuitive interface, making it easy for users of all technical skill levels to navigate and understand their finances. Its dashboard presents a clear overview of spending and budgeting progress. However, some users find the free version’s ads intrusive. YNAB, while powerful, has a steeper learning curve due to its unique zero-based budgeting methodology. The app’s interface is functional but can feel less visually appealing than Mint. Personal Capital offers a sophisticated and detailed dashboard, ideal for users who actively manage investments. However, the wealth of information can be overwhelming for beginners.

Strengths and Weaknesses

Mint’s strength lies in its ease of use and comprehensive free features, particularly its automated transaction tracking and credit score monitoring. However, its reliance on advertising and limited customization options can be drawbacks. YNAB excels in its powerful budgeting methodology and strong community support, but its subscription cost and learning curve may deter some users. Personal Capital shines with its advanced investment tracking and financial planning tools, but its complexity may not be suitable for everyone. Its free features are also limited in scope.

Security and Privacy Concerns

Using budgeting apps offers significant convenience, but it’s crucial to understand the security and privacy implications before entrusting your financial data to these platforms. This section will explore the security measures employed by popular budgeting apps and address potential risks to help you make informed decisions.

The security of your financial information is paramount. Budgeting apps employ various methods to protect your data, ranging from robust encryption protocols to stringent authentication procedures. Understanding these measures and the potential vulnerabilities can help you safeguard your financial well-being.

Data Encryption and Protection Methods

Many reputable budgeting apps utilize robust encryption techniques, such as AES-256 encryption, to protect your data both in transit and at rest. This means your financial information is scrambled and unreadable to unauthorized individuals, even if a breach occurs. Furthermore, many apps employ multi-factor authentication (MFA), adding an extra layer of security beyond just a password. This might involve receiving a one-time code via text message or email, or using a biometric authentication method like fingerprint scanning. Regular security audits and penetration testing are also common practices among reputable providers to identify and address vulnerabilities proactively.

Privacy Policies and Data Handling Practices

Each budgeting app has a privacy policy outlining how your data is collected, used, and protected. It’s vital to carefully review these policies before using any app. Look for transparency regarding data sharing practices with third-party companies, data retention periods, and the measures taken to prevent data breaches. Reputable apps will clearly state their commitment to data privacy and security, adhering to relevant regulations like GDPR or CCPA. Understanding what data is collected and how it’s used allows you to make an informed choice about whether the app’s practices align with your comfort level.

Potential Risks and Mitigation Strategies

While most budgeting apps prioritize security, certain risks remain. One potential risk is phishing attacks, where users are tricked into revealing their login credentials. To mitigate this, only download apps from official app stores and be wary of suspicious emails or text messages requesting login information. Another risk involves vulnerabilities in the app itself. Regular updates from the app developer are crucial to patch security flaws. Keeping your app updated minimizes the risk of exploitation. Finally, consider the potential for data breaches, though reputable apps employ robust security measures to minimize this risk. Choosing apps with strong reputations and established security practices helps reduce this vulnerability. Remember to always be vigilant and report any suspicious activity to the app provider immediately.

Integration with Other Financial Tools

Budgeting apps significantly enhance their utility through seamless integration with various financial platforms. This connectivity allows for automated data import, providing a comprehensive overview of your financial landscape and simplifying the budgeting process. The level and type of integration vary considerably between apps, impacting both the user experience and the app’s overall effectiveness.

The primary integrations involve linking bank accounts, credit cards, and investment accounts. This automated data transfer eliminates the manual entry of transactions, a significant time saver and a major source of error reduction. However, these integrations also introduce potential security and privacy risks that users must carefully consider.

Bank Account and Credit Card Integrations

Linking your bank and credit card accounts to a budgeting app automates the import of transaction data. This feature streamlines the budgeting process, saving users considerable time and effort. Many apps support various account types, including checking, savings, and credit cards from numerous financial institutions. For example, Mint seamlessly integrates with a wide array of banks and credit card companies in the United States, while other apps may have more limited compatibility. The benefits include a real-time view of your spending, enabling quicker adjustments to your budget and improved financial awareness. However, the risk of unauthorized access to your financial information necessitates careful selection of reputable apps with robust security measures.

Integration with Other Financial Platforms

Beyond bank accounts and credit cards, some budgeting apps offer integrations with other financial tools. This could include investment platforms, loan management systems, or even payroll providers. These broader integrations offer a more holistic view of your finances, allowing you to track all aspects of your financial life in one central location. For instance, an app might connect to your investment brokerage account, displaying your portfolio’s performance alongside your spending habits. This consolidated view helps users understand the interconnectedness of their various financial activities, promoting better financial decision-making. However, the complexity of these integrations can lead to performance issues or compatibility problems.

Comparison of App Integrations

The following table summarizes the integration capabilities of several popular budgeting apps. Note that specific features and supported institutions can change over time, so it’s crucial to verify the current capabilities directly with the app provider.

| App Name | Bank Account Integration | Credit Card Integration | Investment Account Integration | Other Integrations |

|---|---|---|---|---|

| Mint | Wide range of US banks | Wide range of US credit cards | Limited (some brokerage accounts) | Loan accounts (some providers) |

| Personal Capital | Wide range of US banks | Wide range of US credit cards | Extensive (many brokerage accounts) | Retirement accounts, 401(k)s |

| YNAB (You Need A Budget) | Limited direct integration; manual import often required | Limited direct integration; manual import often required | No direct integration | None |

| PocketGuard | Wide range of US banks | Wide range of US credit cards | No direct integration | None |

User Reviews and Feedback

User reviews and feedback provide invaluable insights into the real-world usability and effectiveness of budgeting apps. Analyzing this data allows us to understand both the strengths and weaknesses of different applications, ultimately informing consumers’ choices. A comprehensive review of user opinions from various platforms paints a nuanced picture of the user experience.

User feedback across major app stores (Apple App Store, Google Play Store) and online forums reveals several recurring themes. These themes help categorize the overall user sentiment and identify areas where apps excel or fall short.

Common Themes in User Reviews

The volume of user reviews allows for the identification of several prevalent themes. These themes consistently emerge across different platforms and apps, indicating common user experiences.

- Ease of Use and Interface Design: Many users praise intuitive interfaces and straightforward navigation, while others criticize confusing layouts or overly complex features.

- Accuracy and Reliability: The accuracy of data syncing and transaction categorization is a major concern. Users often report discrepancies between app data and their bank statements, leading to frustration and distrust.

- Feature Set and Functionality: The breadth and depth of features offered vary widely across apps. Users appreciate features such as bill reminders, goal setting, and financial reports, while the lack of specific features can lead to negative reviews.

- Customer Support and Responsiveness: The quality and responsiveness of customer support is a key factor influencing user satisfaction. Users often highlight both positive and negative experiences with customer service teams.

- Data Security and Privacy: Concerns about data security and privacy are consistently raised by users. Transparency regarding data handling practices is crucial for building user trust.

Recurring Issues and Complaints

Several issues consistently surface in user reviews, highlighting areas for improvement in budgeting app development.

- Inaccurate Transaction Categorization: Many users report difficulties with automatic transaction categorization, leading to manual corrections and wasted time. This is particularly problematic for users with numerous transactions or complex financial situations.

- Lack of Customization Options: Limited customization options can frustrate users who prefer personalized budgeting approaches. The inability to tailor categories, reports, or notification settings can significantly impact user experience.

- Poor Customer Support Response Times: Slow response times or unhelpful customer support interactions contribute to negative user experiences and can deter users from continuing to use the app.

- Glitches and Bugs: Technical glitches, bugs, and unexpected app crashes are common complaints, particularly impacting users’ confidence in the app’s reliability and data integrity.

Examples of User Experiences

To illustrate the range of user experiences, consider these examples:

Positive Experience: A user reviewing Mint described its intuitive interface and helpful financial reports as game-changers for their personal finance management. They specifically appreciated the ease of linking accounts and the clear visualization of spending habits.

Negative Experience: A user reviewing a lesser-known budgeting app complained about frequent app crashes, inaccurate transaction categorization, and unresponsive customer support. The user ultimately abandoned the app due to these persistent issues, switching to a more established alternative.

Choosing the Right Budgeting App

Selecting the perfect budgeting app can feel overwhelming given the sheer number of options available. However, a systematic approach simplifies the process, ensuring you find an app that aligns with your financial goals and personal preferences. This guide provides a step-by-step process to help you make an informed decision.

Step-by-Step Guide to App Selection

Choosing the right budgeting app involves careful consideration of several key factors. A methodical approach ensures you don’t overlook crucial aspects. The following steps provide a framework for your decision-making process.

- Identify Your Needs: Begin by clearly defining your budgeting goals. Are you aiming to track expenses, create a savings plan, pay off debt, or manage investments? Understanding your primary needs will help you narrow down your options. For example, if your main goal is debt repayment, you might prioritize apps with features like debt snowball or avalanche calculators.

- Research Potential Apps: Based on your needs, research different budgeting apps. Explore popular options and read reviews to get a sense of their features, user-friendliness, and overall effectiveness. Consider apps like Mint, YNAB (You Need A Budget), Personal Capital, and EveryDollar, among others.

- Compare Features: Create a comparison chart listing the features of the apps you’re considering. Include aspects such as expense tracking, budgeting tools, reporting capabilities, account linking, goal setting, and debt management features. This will help you visualize the strengths and weaknesses of each app.

- Assess Pricing and Security: Evaluate the cost of each app. Many offer free versions with limited features, while others require subscriptions. Also, prioritize apps with robust security measures, including encryption and two-factor authentication, to protect your financial data. Check their privacy policies to understand how your data is handled.

- Read User Reviews and Feedback: Thoroughly examine user reviews on app stores and independent review websites. Pay attention to comments regarding ease of use, reliability, customer support, and any recurring issues. Look for consistent patterns in the feedback to gain a more comprehensive understanding of the user experience.

- Test the App (Free Trial): If possible, utilize any free trial periods or free versions offered by the apps. This allows you to experience the app firsthand and determine if it aligns with your workflow and preferences before committing to a paid subscription.

- Make Your Decision: After careful consideration of all the factors, choose the app that best meets your needs and preferences. Remember that the best budgeting app is subjective and depends on individual requirements.

Decision-Making Flowchart

A visual flowchart can streamline the app selection process. Imagine a flowchart starting with “Define Budgeting Goals.” This leads to two branches: “Simple Expense Tracking” and “Advanced Financial Management.” “Simple Expense Tracking” might lead to apps known for their ease of use, while “Advanced Financial Management” could branch into options with features like investment tracking and debt management tools. Each branch would further refine choices based on factors like pricing and security, ultimately leading to a selection of suitable apps for testing.

Factors to Consider

Several key aspects influence the selection of a budgeting app. Understanding these factors is crucial for making an informed decision.

- App Features: Essential features include expense tracking, budgeting tools (like zero-based budgeting or envelope budgeting), report generation, and account linking. Consider additional features like goal setting, debt management tools, and investment tracking based on your needs.

- Pricing Model: Apps vary in pricing, from free versions with limited features to paid subscriptions offering advanced functionality. Evaluate the cost against the features offered to determine the best value for your money.

- Security and Privacy: Prioritize apps with robust security measures, including data encryption and two-factor authentication. Review their privacy policies to ensure your financial information is handled responsibly and securely.

- User Reviews and Ratings: Examine user reviews and ratings on app stores and independent review websites. Look for consistent feedback regarding ease of use, reliability, and customer support. Negative reviews often highlight potential issues to watch out for.

Illustrative Examples of App Usage

Let’s explore how a budgeting app can help someone achieve their financial goals through practical examples. We’ll follow Sarah, a young professional, as she uses a budgeting app to manage her finances.

Sarah, aiming to save for a down payment on a condo, downloads a popular budgeting app. She initially struggles to track her spending manually, often misremembering expenses or overlooking small purchases. The app’s intuitive interface and automated features significantly improve her financial awareness.

Sarah’s Budgeting Journey with the App

Sarah begins by linking her bank accounts and credit cards to the app. The app automatically categorizes her transactions, saving her considerable time and effort. She sets a monthly budget, allocating funds to various categories like rent, groceries, transportation, entertainment, and savings. The app visually represents her budget using a pie chart, clearly showing the proportion of her income allocated to each category. She quickly identifies areas where she can reduce spending, such as eating out less frequently.

Visualizing Spending Patterns and Analyzing Data

The app’s analytics features provide Sarah with insightful visualizations of her spending habits. A line graph illustrates her monthly expenses over time, highlighting fluctuations and trends. This helps her identify seasonal spending patterns, like increased expenses during the holiday season. The app also generates reports summarizing her spending by category, allowing her to compare her actual spending against her budgeted amounts. For instance, she discovers that her entertainment spending consistently exceeds her budget, prompting her to adjust her allocation accordingly.

Tracking Progress Towards Financial Goals

Sarah sets a savings goal within the app – a specific amount to save each month for her condo down payment. The app displays her progress towards this goal with a progress bar, providing visual motivation and a clear indication of her financial trajectory. As she consistently saves and reduces unnecessary spending, the progress bar fills up, reinforcing her positive financial behavior. The app also provides projections based on her current saving rate, estimating when she might reach her goal. This forward-looking approach strengthens her commitment to saving.

Adapting the Budget Based on Real-Time Data

Sarah finds the app particularly useful during unexpected expenses. When her car requires an unexpected repair, she can easily adjust her budget within the app, temporarily reducing spending in other categories to accommodate the expense without derailing her overall financial plan. The app’s flexibility allows her to adapt her budget to real-life circumstances, maintaining a balanced approach to managing her finances. The app also sends her notifications when she is approaching her spending limits in certain categories, providing timely reminders and preventing overspending.

Last Word

Ultimately, the best budgeting app is a personal choice, depending on individual needs and preferences. This review has aimed to provide a balanced perspective, highlighting both the advantages and limitations of various apps. By carefully considering factors such as features, security, user reviews, and integration capabilities, you can select a tool that effectively supports your financial journey. Empowering yourself with the right budgeting app can lead to improved financial literacy, better spending habits, and ultimately, greater financial security.

Query Resolution

Are budgeting apps safe to use?

Reputable budgeting apps employ robust security measures, including encryption and secure authentication. However, it’s crucial to choose established apps with strong privacy policies and read user reviews to assess their security track record.

Do all budgeting apps integrate with my bank?

Not all apps integrate with every bank. Check the app’s compatibility list before downloading to ensure it supports your financial institutions. Some apps offer manual entry as an alternative.

How much do budgeting apps typically cost?

Many budgeting apps offer free versions with limited features, while premium versions with advanced functionalities often involve a subscription fee. The pricing varies considerably across different apps.

What if I don’t like the app after I start using it?

Most apps offer free trials or money-back guarantees. Read the terms and conditions carefully before committing to a paid subscription.