Unexpected life events, from job loss to medical emergencies, can significantly impact financial stability. Proactive emergency fund planning offers a crucial safety net, mitigating the stress and hardship associated with unforeseen circumstances. This guide explores the essential aspects of building and maintaining a robust emergency fund, empowering you to navigate financial uncertainties with confidence and resilience.

We will delve into defining emergency funds, determining the optimal savings amount based on individual circumstances, and outlining effective strategies for building and managing your fund. We’ll also cover crucial topics like protecting your savings from inflation and unnecessary spending, ensuring your emergency fund remains a reliable source of support when needed most.

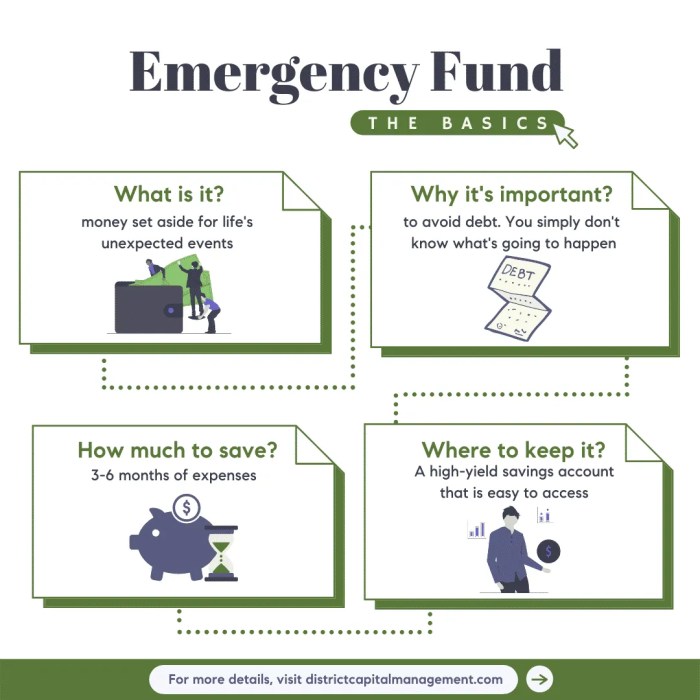

Defining Emergency Funds

An emergency fund is a crucial component of a robust personal financial plan. It acts as a safety net, providing a readily accessible source of funds to cover unexpected expenses, preventing you from accumulating debt or depleting your long-term savings. Building a healthy emergency fund offers peace of mind, knowing you’re prepared for life’s inevitable curveballs.

The key difference between an emergency fund and other savings accounts lies in its intended purpose and accessibility. While other savings accounts might be earmarked for specific goals like a down payment on a house or a future vacation, an emergency fund is solely for unexpected and urgent financial needs. Unlike retirement savings or investment accounts, which often have penalties for early withdrawal, emergency funds should be easily accessible with minimal or no penalties. The goal is quick access to funds, not maximizing returns.

Unexpected Expenses Covered by Emergency Funds

An emergency fund can cover a wide range of unexpected expenses. These can include unexpected medical bills (like a high deductible copay or unexpected surgery), major car repairs (engine failure, accident damage), home repairs (roof leak, burst pipe), job loss (covering living expenses until a new job is secured), or even unforeseen travel costs related to a family emergency. Essentially, any significant, unplanned expense that threatens your financial stability is a candidate for emergency fund use.

Comparison of Emergency Fund Account Types

Choosing the right account type for your emergency fund is important. Different accounts offer varying levels of accessibility, interest rates, and fees. The best choice depends on your individual needs and risk tolerance.

| Account Type | Accessibility | Interest Rate | Fees |

|---|---|---|---|

| High-Yield Savings Account | Easy access, typically via ATM, debit card, or online transfer | Generally higher than traditional savings accounts, but still relatively low | Usually minimal or no fees |

| Money Market Account (MMA) | Easy access, often with check-writing capabilities | Interest rates can fluctuate based on market conditions, potentially higher than savings accounts | May have minimum balance requirements and fees for falling below the minimum |

| Savings Account | Easy access, typically via ATM, debit card, or online transfer | Generally lower interest rates than high-yield savings accounts or MMAs | Usually minimal or no fees |

| Checking Account (Not Recommended as Primary Emergency Fund) | Immediate access | Typically very low or no interest | May have monthly maintenance fees or overdraft fees |

Determining the Right Emergency Fund Size

Building a robust emergency fund is crucial for financial stability. The ideal size, however, isn’t a one-size-fits-all solution; it depends on individual circumstances and risk tolerance. Understanding the factors influencing this decision is key to creating a plan that effectively protects you from unexpected financial setbacks.

Factors influencing the appropriate emergency fund size are multifaceted and interconnected. A comprehensive assessment of these factors ensures a tailored approach, optimizing both security and financial flexibility.

Factors Affecting Emergency Fund Size

Several key factors determine the appropriate size of your emergency fund. These factors should be carefully considered when calculating your target savings amount. Ignoring these elements can lead to either inadequate protection or unnecessarily restrictive savings goals.

- Income: Higher earners can typically afford larger emergency funds, providing a greater safety net against significant unexpected expenses. Someone earning $100,000 annually might comfortably aim for a larger fund than someone earning $30,000.

- Expenses: Monthly expenses significantly impact the necessary emergency fund size. Individuals with high housing costs, significant loan repayments, or substantial childcare expenses will require a larger fund to cover these ongoing obligations during an emergency.

- Family Size: Larger families often face greater potential expenses. More dependents mean a higher likelihood of needing a larger fund to cover medical bills, childcare, or other family-related costs during a crisis.

- Job Security: Individuals in stable, secure employment may require a smaller emergency fund compared to those in precarious or contract-based roles. The risk of job loss influences the duration of emergency coverage needed.

- Debt Levels: High levels of debt increase vulnerability to financial shocks. A larger emergency fund can help mitigate the risk of defaulting on loans or credit cards during an emergency.

The 3-6 Month Rule for Emergency Fund Savings

The commonly cited 3-6 month rule suggests saving enough to cover 3 to 6 months of essential living expenses. This rule provides a general guideline, but its suitability varies based on individual circumstances. While 3 months might suffice for individuals with stable jobs and low debt, 6 months or even more may be necessary for those with less job security or higher debt. The 3-6 month timeframe provides a buffer against unexpected unemployment or significant medical expenses.

Calculating Your Ideal Emergency Fund Target

Calculating your ideal emergency fund target involves a step-by-step process focusing on your specific financial situation. This personalized approach ensures your emergency fund adequately addresses your unique vulnerabilities.

- List Essential Expenses: Compile a list of your essential monthly expenses, including housing, utilities, groceries, transportation, debt repayments, and healthcare premiums.

- Calculate Total Monthly Expenses: Sum up all your essential monthly expenses to determine your total monthly expenditure.

- Determine Your Desired Coverage Period: Decide on the number of months of expenses you want your emergency fund to cover (3-6 months or more). This decision should reflect your risk tolerance and job security.

- Calculate Your Emergency Fund Target: Multiply your total monthly expenses by your chosen coverage period (e.g., Total Monthly Expenses x 6 months).

- Review and Adjust: Regularly review your emergency fund target and adjust it as your circumstances change (e.g., job loss, increased expenses, salary changes).

Budgeting Techniques for Emergency Fund Savings

Effective budgeting is paramount to building a substantial emergency fund. Several techniques can help individuals allocate funds effectively and reach their savings goals.

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Prioritize allocating a portion of the 20% towards your emergency fund.

- Zero-Based Budgeting: Assign every dollar of your income to a specific category, ensuring all income is accounted for. This method helps identify areas for potential savings that can be directed to the emergency fund.

- Envelope System: Allocate cash to envelopes representing different expense categories. This physical method helps visualize spending and track progress towards your emergency fund goal.

Strategies for Building an Emergency Fund

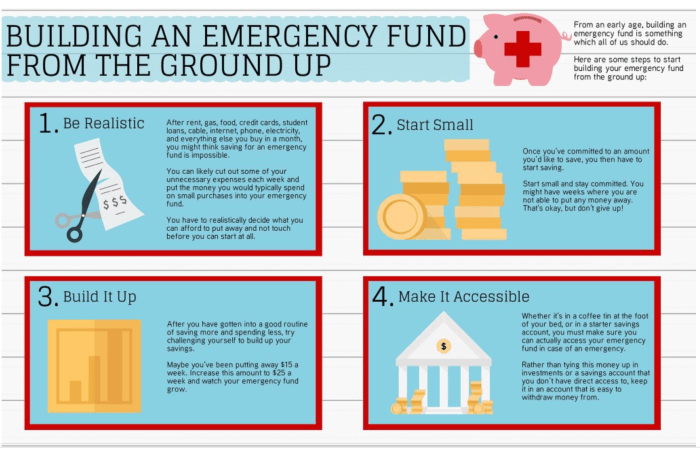

Building an emergency fund requires a strategic approach. Consistency and the right saving methods are key to achieving your savings goals efficiently. This section explores various strategies to help you accumulate your emergency fund effectively.

Methods for Saving for an Emergency Fund

Several methods can be employed to save for emergencies. Choosing the most effective method often depends on individual financial habits and income levels. Understanding these options allows for a personalized approach to building your fund.

- Automatic Transfers: Setting up automatic transfers from your checking account to your savings account is a highly effective method. This ensures consistent contributions without requiring constant manual effort. For example, you could automatically transfer $50 or 10% of your paycheck each payday.

- Budgeting Apps: Numerous budgeting apps offer features to track spending and automate savings. These apps often categorize expenses, identify areas for potential savings, and provide visual representations of your financial progress. Many apps even have built-in savings goals and automated transfer capabilities.

- Side Hustles: Generating additional income through side hustles, such as freelancing, driving for a ride-sharing service, or selling crafts online, can significantly accelerate your savings. The extra income can be directly allocated to your emergency fund.

Comparison of Savings Strategies

Each saving strategy has its advantages and disadvantages. Automatic transfers provide consistency but may not be flexible enough for those with fluctuating incomes. Budgeting apps offer detailed tracking and automated features but require technological proficiency and trust in the app’s security. Side hustles offer faster savings but demand extra time and effort. The best strategy often involves a combination of these methods. For example, combining automatic transfers with a budgeting app provides both consistency and detailed tracking.

Tips for Sticking to a Savings Plan

Maintaining consistency is crucial for successful emergency fund building. Several strategies can help improve adherence to your savings plan.

- Set Realistic Goals: Avoid setting overly ambitious goals that are difficult to maintain. Starting small and gradually increasing contributions is more sustainable.

- Track Your Progress: Regularly monitor your savings progress to stay motivated. Visual representations, such as graphs or charts, can be particularly effective.

- Automate as Much as Possible: Automating savings through direct transfers or budgeting apps removes the need for manual effort and reduces the likelihood of forgetting to contribute.

- Review and Adjust Your Budget: Periodically review your budget to identify areas where you can reduce spending and allocate more funds towards your emergency fund.

- Reward Yourself (Moderately): Celebrate milestones with small, affordable rewards to maintain motivation without undermining your savings progress.

Realistic Savings Goals and Timelines

Establishing realistic savings goals and timelines is vital for effective emergency fund building. The ideal timeframe and savings amount depend on individual circumstances and financial situations.

- Example 1 (Short-term): A person aiming for a $1,000 emergency fund with a monthly savings of $100 can achieve this goal in 10 months.

- Example 2 (Long-term): An individual aiming for a $5,000 emergency fund with a monthly savings of $250 can achieve this goal in 20 months.

Accessing and Managing Emergency Funds

Having a robust emergency fund is only half the battle; knowing how to access and manage it effectively is equally crucial. This section details the process of accessing your emergency funds during a crisis, highlights the importance of readily available information, and explores the financial implications of withdrawals. Proper management ensures your fund remains a reliable safety net.

Accessing your emergency funds should be a straightforward process, designed for speed and ease during stressful situations. The exact method will depend on where your emergency fund is held. For example, a high-yield savings account allows for quick online transfers or ATM withdrawals. A money market account might offer similar accessibility. If your emergency fund is invested, liquidating those assets might take a little longer, potentially involving brokerage fees. Planning for these potential delays is key. Understanding the withdrawal procedures and associated fees for each account is vital before an emergency arises.

Accessing Funds in an Emergency

The process of accessing emergency funds should be pre-planned. Knowing your account numbers, online login details, and contact information for your financial institution is paramount. If you use multiple accounts, clearly designate which one is your primary emergency fund. Consider keeping a physical copy of this information in a safe place, separate from your primary documents, in case of theft or loss. Practice accessing funds in a non-emergency situation to familiarize yourself with the process. This prevents confusion and delays during a genuine crisis.

Importance of Readily Available Emergency Fund Information

Keeping emergency fund information readily accessible is critical. Imagine facing a sudden job loss or unexpected medical bill; the last thing you need is the added stress of searching for account details. Having this information easily accessible—in a secure, yet easily retrievable location—ensures a swift and efficient response to an emergency. This might include storing account details in a password-protected document on your computer, in a secure cloud storage service, or in a fireproof safe. Consider sharing this information with a trusted individual in case of incapacitation.

Implications of Withdrawing from an Emergency Fund

Withdrawing from your emergency fund will naturally reduce its balance. While this is the intended purpose, it’s crucial to replenish the funds as soon as possible. Failing to do so leaves you vulnerable to future emergencies. The speed of replenishment depends on your financial situation and ability to save. However, prioritizing rebuilding the fund to its target level should be a high priority after addressing the immediate crisis. For example, if an unexpected car repair depletes your fund, adjusting your budget to allocate more towards savings will quickly rebuild it. This proactive approach minimizes future risks.

Emergency Fund Withdrawal Checklist

Before withdrawing from your emergency fund, it’s prudent to follow a structured approach. This checklist provides a systematic process to ensure responsible fund management.

- Assess the Situation: Clearly define the emergency and the estimated cost.

- Review Fund Balance: Confirm you have sufficient funds to cover the emergency expenses.

- Choose Withdrawal Method: Select the quickest and most efficient method based on your account type.

- Document the Withdrawal: Record the date, amount, and purpose of the withdrawal in a dedicated emergency fund log.

- Develop a Replenishment Plan: Create a concrete plan to rebuild the fund to its target level as quickly as possible.

Protecting Your Emergency Fund

Building a robust emergency fund is a crucial step towards financial security. However, the work doesn’t end with accumulating the funds; safeguarding them from depletion is equally vital. Protecting your emergency fund requires proactive measures to prevent unnecessary withdrawals and to account for external economic factors.

Protecting your emergency fund from unnecessary spending ensures its availability when a genuine emergency arises. Misusing this crucial safety net can leave you vulnerable to unexpected financial hardships, potentially leading to debt or severely impacting your financial stability. The discipline required to maintain this fund underscores its importance as a cornerstone of responsible financial management.

Preventing Emotional Spending

Emotional spending, driven by impulse or stress, is a significant threat to emergency funds. Developing strategies to curb impulsive purchases is essential for maintaining your financial safety net. This involves mindful spending habits and creating a buffer against emotional triggers. For example, establishing a waiting period before making non-essential purchases allows time for rational consideration. Tracking spending habits using budgeting apps can reveal patterns and trigger points for emotional spending, providing valuable insights for developing coping mechanisms. Alternatively, exploring alternative stress-relief methods that don’t involve spending, such as exercise or meditation, can help prevent emotional spending from depleting your emergency fund.

The Impact of Inflation on Emergency Funds

Inflation erodes the purchasing power of money over time. This means that the value of your emergency fund diminishes if it’s not adjusted for inflation. For example, an emergency fund of $10,000 today might only be able to purchase $9,000 worth of goods and services a year from now if inflation is at 10%. To mitigate this, consider investing a portion of your emergency fund in inflation-hedging assets, such as inflation-protected securities (TIPS) or certain types of mutual funds. Regularly reviewing and adjusting the fund’s size to account for inflation is crucial to maintain its effectiveness. This could involve increasing the fund’s target amount annually to reflect the rising cost of living.

Annual Review and Adjustment of Your Emergency Fund Plan

A yearly review ensures your emergency fund remains adequate and aligned with your evolving financial circumstances. This proactive approach allows for timely adjustments to maintain its effectiveness.

- Assess your current financial situation: Review your income, expenses, and any significant life changes (e.g., job change, marriage, birth of a child).

- Evaluate your emergency fund’s balance: Check the current balance against your target amount. Consider any changes in your expenses or potential risks.

- Adjust your savings goal: Based on your assessment, determine if you need to increase or decrease your emergency fund target. This might involve recalculating based on your current expenses and potential emergencies.

- Review your investment strategy: If you’ve invested a portion of your emergency fund, assess its performance and make adjustments if necessary. Consider if the chosen investments are still aligned with your risk tolerance and inflation-hedging goals.

- Document your changes: Update your financial plan to reflect any adjustments made to your emergency fund strategy. This ensures consistency and facilitates future reviews.

Illustrative Examples of Emergency Fund Scenarios

Understanding the true value of an emergency fund is best illustrated through contrasting scenarios – one where a well-prepared individual navigates a crisis smoothly, and another where the lack of such preparation leads to significant hardship. These examples highlight the importance of proactive financial planning and the potential long-term consequences of neglecting it.

Emergency Fund Proving Invaluable: The Unexpected Job Loss

Sarah, a 32-year-old marketing manager, lost her job unexpectedly due to company restructuring. Her annual salary was $75,000, and she had diligently built an emergency fund equivalent to six months’ worth of expenses – approximately $18,750 (calculated assuming monthly expenses of $3,125). This included rent ($1,500), utilities ($300), groceries ($500), transportation ($250), loan repayments ($375), and other miscellaneous expenses ($200). Upon losing her job, Sarah immediately began applying for new roles but knew it would take time. Her emergency fund provided a crucial safety net, allowing her to pay her bills without accumulating debt during her job search. After three months of searching, she secured a new position with a slightly higher salary, and she had sufficient funds remaining to comfortably transition to her new role.

Lack of Emergency Fund Leading to Negative Consequences: The Major Car Repair

John, a 28-year-old freelance graphic designer, experienced a major car breakdown. His vehicle, essential for commuting to client meetings and transporting equipment, required $4,000 in repairs. John lacked an emergency fund and had to rely on high-interest credit cards to cover the expense. The minimum monthly payments on these cards significantly strained his budget, leaving him with less money for his freelance work expenses and living costs. The debt accumulated quickly, impacting his credit score and creating financial stress that hindered his ability to focus on his work. He faced late payments on rent and utilities, further complicating his financial situation.

Impact of Different Saving Strategies

Had John adopted a consistent savings plan, even saving a small amount each month, he could have avoided this crisis. For example, saving $200 monthly for a year would have yielded $2,400, a substantial contribution towards the repair cost. Alternatively, a high-yield savings account would have allowed his savings to grow faster, potentially covering the entire repair cost within a shorter period. Sarah’s strategy of maintaining six months’ worth of expenses in a readily accessible account provided her with considerable financial security and peace of mind during a challenging period.

Key Lessons Learned

- An emergency fund provides a crucial safety net during unexpected financial crises, minimizing stress and preventing debt accumulation.

- The size of the emergency fund should be tailored to individual circumstances, covering at least three to six months of living expenses.

- Consistent saving, even small amounts, is crucial for building an emergency fund over time.

- High-yield savings accounts and other strategic investment options can accelerate the growth of emergency funds.

- Lack of an emergency fund can lead to significant financial hardship, impacting credit scores, mental health, and overall well-being.

Epilogue

Building an emergency fund is not merely about accumulating savings; it’s about cultivating financial security and peace of mind. By understanding the principles of emergency fund planning, implementing effective strategies, and regularly reviewing your plan, you can build a resilient financial foundation capable of weathering life’s unexpected storms. Remember, a well-managed emergency fund is an investment in your future stability and well-being.

Question Bank

How often should I review my emergency fund?

It’s recommended to review your emergency fund plan at least annually, adjusting it as your circumstances change (income, expenses, family size).

What if I need to access my emergency fund for a non-emergency?

While tempting, accessing your emergency fund for non-emergencies undermines its purpose. Consider alternative financing options first. If absolutely necessary, carefully assess the long-term implications before withdrawing funds.

Can I invest my emergency fund?

No, your emergency fund should be held in readily accessible, low-risk accounts like high-yield savings accounts or money market accounts. Investing it carries the risk of losing funds when you need them most.

What types of expenses does an emergency fund cover?

Unexpected medical bills, job loss, home repairs, car repairs, and other unforeseen expenses are typically covered by an emergency fund.