Navigating the world of insurance can feel overwhelming, a maze of policies, premiums, and jargon. This Insurance Planning Guide offers a clear path, demystifying the process and empowering you to make informed decisions that protect your financial well-being. From understanding your individual needs to optimizing costs and integrating insurance into your broader financial strategy, we’ll equip you with the knowledge and tools to build a secure future.

We’ll explore various insurance types, helping you identify the coverage best suited to your life stage—whether you’re a young adult starting out, a family growing, or a retiree planning for the future. We’ll also delve into risk assessment, policy selection, cost-effective strategies, and the crucial role insurance plays in safeguarding your assets and mitigating financial risks. Real-life scenarios will illustrate the tangible benefits of comprehensive insurance planning.

Understanding Insurance Needs

Choosing the right insurance coverage is a crucial step in securing your financial future. Understanding your needs and the various types of insurance available is key to making informed decisions that protect you and your loved ones from unexpected events. This section will explore different insurance options and provide examples of how insurance needs change throughout life.

Types of Insurance Coverage

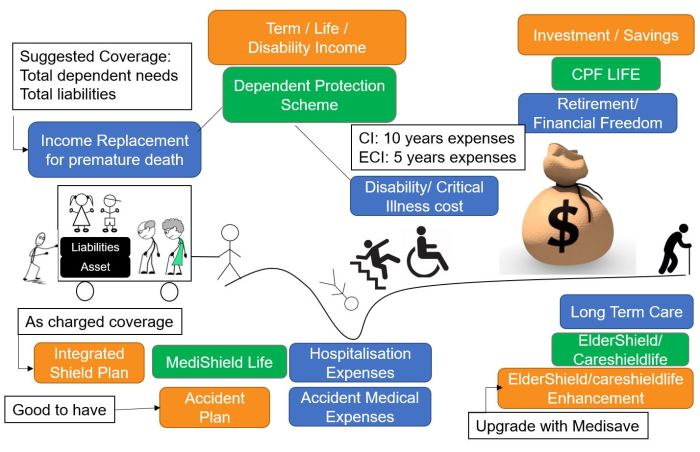

Insurance policies are designed to mitigate various risks. Common types include life insurance, health insurance, auto insurance, homeowners or renters insurance, and disability insurance. Life insurance provides a financial safety net for your dependents in the event of your death. Health insurance covers medical expenses, protecting you from potentially crippling healthcare costs. Auto insurance protects you and others in case of accidents. Homeowners or renters insurance safeguards your property from damage or theft. Disability insurance provides income replacement if you become unable to work due to illness or injury. The specific types and amounts of coverage you need will depend on your individual circumstances and risk tolerance.

Insurance Needs Across Life Stages

Insurance needs evolve significantly as you progress through different life stages.

Young adults, typically focusing on establishing their careers, may prioritize health insurance and possibly life insurance if they have dependents or significant debt. A basic auto insurance policy is also essential. For example, a young professional starting a family might choose a term life insurance policy to cover mortgage payments and provide for their children in case of unexpected death.

Families, with children and mortgages, generally require more comprehensive coverage. This includes health insurance for the entire family, life insurance with a higher death benefit to cover the family’s financial needs, homeowners or renters insurance, and potentially disability insurance to protect the family’s income. A family with two young children might need a larger life insurance policy to cover their education and living expenses if one or both parents pass away.

Retirees, having already accumulated assets, might focus on protecting those assets and their healthcare needs. Health insurance is paramount, and long-term care insurance can become increasingly important to cover potential future nursing home or assisted living expenses. Life insurance may be less crucial unless there are significant estate planning concerns. For example, a retiree with a substantial savings account might want to protect those assets from potential medical expenses through supplemental health insurance.

Term Life Insurance vs. Whole Life Insurance

The choice between term life insurance and whole life insurance depends heavily on individual financial goals and risk tolerance.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | Specific term (e.g., 10, 20, 30 years) | Lifetime coverage |

| Premiums | Generally lower premiums | Generally higher premiums |

| Cash Value | No cash value | Builds cash value that grows tax-deferred |

| Benefits | Affordable coverage for a specific period | Lifetime protection and cash value accumulation |

Assessing Risk and Coverage

Understanding your individual risk profile is crucial for effective insurance planning. This involves a careful evaluation of various factors that could lead to a claim, allowing you to select appropriate coverage levels and manage your premiums effectively. Failing to accurately assess your risk can result in either underinsurance, leaving you vulnerable to significant financial losses, or overinsurance, leading to unnecessary premium expenses.

Individual Risk Factors

Assessing individual risk involves considering a range of personal circumstances and lifestyle choices. These factors vary significantly depending on the type of insurance being considered (e.g., health, auto, home). A comprehensive assessment considers both controllable and uncontrollable elements. For example, a smoker faces higher health insurance premiums than a non-smoker due to increased health risks. Similarly, someone living in a high-crime area might pay more for home insurance than someone in a safer neighborhood. Factors such as age, occupation, and medical history also play a significant role in determining risk. For instance, a young driver with a clean driving record will typically pay less for car insurance than an older driver with a history of accidents. Detailed questionnaires and health assessments are commonly used by insurers to gather this information.

Factors Influencing Premium Costs

Several key factors directly influence the cost of insurance premiums. These factors are often interconnected and influence each other. The insurer’s assessment of risk is paramount. A higher risk profile, as determined by the factors discussed previously, leads to higher premiums. The type and amount of coverage requested also play a major role; more comprehensive coverage naturally costs more. The insurer’s operating costs, including administrative expenses and claims payouts, are factored into premium calculations. Finally, competitive market dynamics and the insurer’s profit margins also influence premium pricing. For instance, a highly competitive market might result in lower premiums, while a period of increased claims payouts could lead to higher premiums across the board.

Determining Appropriate Coverage Levels

Several methods exist for determining the appropriate level of insurance coverage. One common approach is to conduct a needs analysis, which focuses on assessing the potential financial impact of an unforeseen event. This approach might involve estimating the cost of rebuilding a home after a fire or the potential medical expenses associated with a serious illness. Another approach involves comparing coverage levels with industry benchmarks or guidelines. For example, a financial advisor might recommend carrying a certain level of life insurance based on a multiple of your annual income. Finally, many individuals utilize a combination of methods, tailoring their coverage based on a careful assessment of their specific circumstances and risk tolerance. For example, someone with a high net worth might choose higher coverage limits than someone with limited assets.

Choosing the Right Insurance Policies

Selecting the appropriate insurance policies is crucial for safeguarding your financial well-being and protecting yourself against unforeseen circumstances. The right coverage can provide peace of mind, knowing you’re prepared for potential losses. This section will guide you through the process of choosing health, auto, home, and life insurance policies that meet your specific needs and budget.

Choosing the right insurance policy involves careful consideration of several factors. Different policies offer varying levels of coverage, deductibles, premiums, and benefits. Understanding these differences is key to making informed decisions. Furthermore, your personal circumstances, such as your age, health, location, and assets, significantly influence the type and amount of insurance you require.

Health Insurance Policy Selection Factors

Several key factors influence the selection of a health insurance policy. These include the policy’s coverage for various medical services, the deductible amount, the premium cost, and the network of healthcare providers. It is also important to consider the policy’s out-of-pocket maximum, which is the most you will have to pay out-of-pocket for covered services in a given year. For example, a policy with a lower premium might have a higher deductible and out-of-pocket maximum, while a policy with a higher premium might offer more comprehensive coverage and a lower out-of-pocket maximum. Carefully weighing these trade-offs is crucial for finding the best policy for your individual needs.

Auto Insurance Policy Selection Factors

When choosing auto insurance, consider factors like coverage limits, deductibles, and the types of coverage offered. Liability coverage protects you if you cause an accident, while collision and comprehensive coverage protect your vehicle in case of an accident or damage from other causes. Your driving record, the type of vehicle you drive, and your location can all impact your premiums. For instance, drivers with clean records often receive lower premiums compared to those with multiple accidents or traffic violations. Similarly, insuring a high-performance vehicle will usually result in higher premiums than insuring a standard sedan.

Home Insurance Policy Selection Factors

Home insurance protects your property from damage or loss. Factors to consider include the coverage amount, the deductible, and the types of perils covered. Perils covered often include fire, theft, and weather damage. The value of your home and its contents, your location, and the age of your home will influence your premium. For example, homes in areas prone to natural disasters may have higher premiums than those in less risky areas. The level of coverage you choose will also impact your premium; higher coverage typically leads to higher premiums.

Life Insurance Policy Selection Factors

Life insurance provides financial protection for your loved ones in the event of your death. The type of policy you choose—term life, whole life, or universal life—will depend on your needs and budget. Factors to consider include the death benefit amount, the premium cost, and the policy’s cash value (if applicable). Your age, health, and lifestyle will all influence the premiums you’ll pay. For example, a younger, healthier individual will generally qualify for lower premiums than an older individual with pre-existing health conditions.

Obtaining Insurance Quotes from Multiple Providers

A systematic approach is recommended when obtaining quotes. First, identify your insurance needs and the type of coverage you require. Then, research different insurance providers in your area or online. Next, contact each provider to request a quote, providing them with the necessary information about your situation. Compare the quotes you receive, paying close attention to the coverage details, premiums, and any additional fees. Finally, choose the policy that best meets your needs and budget.

Questions to Ask Insurance Agents

Before purchasing a policy, it’s vital to gather all necessary information. Therefore, it’s beneficial to clarify the policy’s coverage details, including specific exclusions and limitations. Also, understanding the claims process and the insurer’s reputation is crucial. Furthermore, it’s important to inquire about discounts and payment options. Finally, asking about the agent’s experience and qualifications ensures a knowledgeable and reliable source of information.

Managing and Reviewing Insurance Policies

Regularly reviewing your insurance policies is crucial for ensuring you have the right coverage at the right price. Your needs and circumstances change over time, and your insurance should reflect those changes. Neglecting this important step could leave you financially vulnerable in the event of an unexpected loss. This section will guide you through the process of understanding and managing your insurance policies effectively.

Understanding and interpreting insurance policy documents can seem daunting, but it’s essential for informed decision-making. These documents are legally binding contracts outlining the terms and conditions of your coverage. Taking the time to familiarize yourself with the key provisions will empower you to make appropriate adjustments to your coverage as your life evolves.

Understanding Insurance Policy Documents

Insurance policies often use specific terminology and legal language. However, with a little effort, you can decipher the key information. Start by reading the policy’s summary or highlights section, which usually provides a concise overview of the coverage. Then, carefully review the declarations page, which lists the insured, policy number, coverage amounts, and effective dates. Finally, delve into the policy’s detailed sections, paying close attention to definitions, exclusions, and limitations. If any terms are unclear, don’t hesitate to contact your insurance provider for clarification. Remember, it’s your right to understand what you’re paying for.

Scenarios Requiring Coverage Adjustments

Several life events often necessitate changes to your insurance coverage. Failing to adjust your policies accordingly could leave significant gaps in your protection.

For example, marriage often triggers a need to review life insurance, health insurance, and potentially homeowners or renters insurance. A new spouse may need to be added to existing policies, or you may need to increase coverage amounts to reflect the combined assets and liabilities of the household. Similarly, childbirth brings significant changes, requiring adjustments to health insurance to cover the newborn and potentially life insurance to reflect the increased financial responsibilities of raising a child. A job change might impact your health insurance coverage, requiring you to enroll in a new plan or consider purchasing individual health insurance if your employer no longer provides it. Retirement also requires a careful review of insurance needs, as your income stream changes and your health care needs may increase. It’s vital to proactively address these changes to maintain adequate protection throughout your life’s journey.

Cost Optimization Strategies

Effective insurance planning involves not only securing adequate coverage but also managing its cost effectively. This section Artikels practical strategies to reduce insurance premiums without sacrificing the level of protection you need. Remember, the goal is to find the optimal balance between cost and coverage.

Several avenues exist for lowering insurance expenses. These strategies involve proactive engagement with your insurer, careful policy selection, and a thorough understanding of your risk profile. By implementing these methods, you can potentially save a significant amount of money over the life of your insurance policies.

Bundling Insurance Policies

Bundling multiple insurance policies, such as home, auto, and umbrella coverage, with a single insurer often results in substantial discounts. Insurers frequently offer package deals that incentivize customers to consolidate their insurance needs. This simplifies administration, reduces paperwork, and, most importantly, leads to lower overall premiums compared to purchasing each policy individually. For example, a homeowner might save 15-20% by bundling their homeowners and auto insurance with the same company. The exact savings vary depending on the insurer, the specific policies bundled, and the individual’s risk profile.

Negotiating Lower Premiums

Directly negotiating with your insurance provider can be a surprisingly effective way to lower your premiums. Before renewing your policy, research competitor rates and use this information as leverage during negotiations. Highlight your long-standing relationship with the company, your clean claims history, and any safety measures you’ve implemented (e.g., security systems for home insurance, defensive driving courses for auto insurance). A polite and well-prepared approach can often lead to a reduction in your premium, even without switching insurers. For instance, demonstrating a consistent history of safe driving and no claims for several years could warrant a significant discount.

Exploring Discounts and Incentives

Many insurers offer a variety of discounts to incentivize responsible behavior and risk mitigation. These discounts can significantly reduce premiums. Examples include discounts for installing security systems (homeowners insurance), completing defensive driving courses (auto insurance), and bundling multiple policies (as discussed above). Furthermore, some insurers provide discounts for good academic standing (for young drivers) or for being a member of certain professional organizations. It’s crucial to proactively inquire about all available discounts to ensure you’re receiving the lowest possible premium.

Increasing Deductibles

Raising your deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – can significantly lower your premiums. This is a common strategy to reduce costs, as a higher deductible reflects a lower risk for the insurer. However, it’s crucial to carefully consider your financial situation before significantly increasing your deductible. Ensure you have sufficient savings to cover the increased out-of-pocket expense in case of a claim. For example, increasing your auto insurance deductible from $500 to $1000 could result in a noticeable reduction in your annual premium, but it also means you’ll be responsible for the first $1000 of any repair costs.

Reviewing Coverage Regularly

Regularly reviewing your insurance coverage is essential to ensure it aligns with your current needs and risk profile. As your life changes (e.g., marriage, homeownership, starting a family), your insurance needs may evolve. This review process might reveal opportunities to reduce unnecessary coverage or adjust your policy to reflect changes in your circumstances. For instance, if you’ve paid off your mortgage, you might consider reducing the coverage amount on your homeowners insurance policy, leading to a lower premium. Conversely, if you’ve acquired valuable assets, you might need to increase your coverage accordingly.

Insurance and Financial Planning

Insurance planning is not a standalone activity; it’s a crucial component of a robust financial strategy. A comprehensive financial plan considers your long-term goals, including retirement, education, and legacy planning, and insurance acts as a safety net, protecting your hard-earned assets and mitigating potential financial setbacks. By integrating insurance into your overall financial plan, you can safeguard your future and achieve financial security with greater confidence.

Integrating insurance into your financial plan ensures that unexpected events don’t derail your progress towards your financial goals. Insurance protects your assets from various risks, such as illness, accidents, property damage, and liability. This protection allows you to maintain financial stability during challenging times, preventing significant financial losses that could otherwise compromise your long-term objectives. It provides a buffer against unforeseen circumstances, allowing you to focus on achieving your goals rather than recovering from unexpected crises.

The Role of Insurance in Protecting Assets and Mitigating Financial Risks

Insurance plays a multifaceted role in safeguarding your financial well-being. It acts as a shield against potential losses, minimizing the financial impact of unexpected events. For example, health insurance protects against the high costs of medical treatment, while life insurance provides financial security for your dependents in the event of your death. Property insurance protects your home and belongings from damage or theft. Liability insurance safeguards you from financial ruin resulting from lawsuits stemming from accidents or injuries. By strategically selecting and managing insurance policies, you can significantly reduce your financial vulnerability and enhance your overall financial security.

Insurance Types within a Comprehensive Financial Plan

The following table illustrates how various insurance types contribute to a comprehensive financial plan. Note that the specific needs and types of insurance will vary depending on individual circumstances, age, income, and assets.

| Insurance Type | Purpose | Assets Protected | Financial Risk Mitigated |

|---|---|---|---|

| Life Insurance | Provides financial support to dependents upon death of the insured. | Income, savings, assets. | Loss of income, debt, educational expenses for children. |

| Health Insurance | Covers medical expenses due to illness or injury. | Savings, assets. | High medical bills, financial strain due to illness. |

| Disability Insurance | Replaces a portion of income lost due to disability. | Income, savings, assets. | Loss of income due to inability to work. |

| Homeowners/Renters Insurance | Protects against property damage or loss. | Home, belongings, personal liability. | Financial losses from fire, theft, accidents, lawsuits. |

| Auto Insurance | Covers damage to vehicle and liability for accidents. | Vehicle, assets. | Vehicle repair costs, liability claims from accidents. |

| Umbrella Liability Insurance | Provides additional liability coverage beyond other policies. | Assets, personal wealth. | Large liability claims exceeding other policy limits. |

Illustrative Scenarios

Understanding the practical implications of insurance is crucial. The following scenarios highlight the significant financial benefits of adequate insurance coverage in real-life situations. These examples demonstrate the potential consequences of insufficient or absent coverage.

Life Insurance: Protecting a Young Family

Consider a young couple, Sarah and Mark, both aged 30, with a one-year-old child. Sarah is a teacher, earning $50,000 annually, while Mark works as a software engineer, earning $100,000 annually. They have a mortgage of $300,000, a car loan of $20,000, and various other debts. They wisely secured a $500,000 life insurance policy on Mark, naming Sarah as the beneficiary. Tragically, Mark passes away unexpectedly. Without adequate life insurance, Sarah would face an immediate and overwhelming financial crisis. The loss of Mark’s income would significantly reduce their household income, creating a considerable shortfall in their monthly budget. They would struggle to meet mortgage payments, car loan payments, and other expenses. Sarah might need to find affordable childcare while working, potentially impacting her job security. She may be forced to sell their home and/or significantly alter her lifestyle to manage their debt. However, with the $500,000 life insurance payout, Sarah receives a substantial sum to cover immediate expenses, pay off debts, and provide financial security for her and her child for years to come. This payout enables her to maintain a stable living situation, provide for her child’s education and future, and potentially avoid significant financial hardship. This illustrates the crucial role life insurance plays in protecting families against unforeseen events.

Comprehensive Health Insurance: Managing Unexpected Medical Expenses

Imagine David, a 45-year-old self-employed consultant. He enjoys good health and believes he doesn’t need comprehensive health insurance, opting for a minimal plan. One day, he experiences severe chest pains and is rushed to the hospital. He is diagnosed with a heart attack requiring immediate surgery, followed by extensive rehabilitation. The medical bills quickly accumulate, exceeding $250,000. Without comprehensive health insurance, David is solely responsible for these enormous costs. He faces financial ruin. He may need to sell assets, deplete his savings, and potentially incur significant debt to cover the medical expenses. His business might suffer due to his inability to work during recovery. His financial future is severely compromised. Conversely, if David had comprehensive health insurance, a large portion of his medical bills would be covered, significantly reducing his out-of-pocket expenses. He would be able to focus on his recovery without the added stress and burden of crippling debt, safeguarding his financial stability and long-term well-being. This highlights the critical importance of comprehensive health insurance in mitigating the financial risks associated with unexpected medical emergencies.

Resources and Further Information

This section provides a curated list of resources to help you delve deeper into the world of insurance planning. Access to reliable and up-to-date information is crucial for making informed decisions about your insurance needs. The resources listed below represent a starting point for your continued learning and research.

This information is intended to supplement the guidance provided in this guide and should not be considered exhaustive. Always consult with a qualified insurance professional for personalized advice tailored to your specific circumstances.

Reputable Websites and Organizations

Finding trustworthy information about insurance can be challenging. The following websites and organizations offer reliable resources and educational materials. It is advisable to cross-reference information from multiple sources to ensure accuracy and a comprehensive understanding.

- The National Association of Insurance Commissioners (NAIC): The NAIC is a U.S.-based organization that provides consumer information and resources on insurance regulations and oversight.

- Your State’s Department of Insurance: Each state has its own Department of Insurance which regulates insurance companies and provides consumer resources specific to that state. Their websites usually contain information on consumer protection, licensing, and complaint procedures.

- The Insurance Information Institute (III): The III offers a wealth of information on various types of insurance, industry trends, and consumer education materials.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources on financial products and services, including insurance, and aims to protect consumers from unfair practices.

Recommended Books and Articles

Further expanding your knowledge through dedicated reading can significantly enhance your insurance planning capabilities. The following list includes books and articles that offer valuable insights and practical advice. Remember that the insurance landscape is constantly evolving, so seeking out recently published materials is recommended.

- “The Insurance Book: Everything You Need to Know About Protecting Yourself and Your Family” by Robert J. Myers: A comprehensive guide covering various insurance types and planning strategies.

- “Protecting Your Assets: A Guide to Insurance Planning” by [Author Name – Replace with actual author if known]: This hypothetical example represents a book that would focus on asset protection through insurance.

- Articles from reputable financial publications: Publications such as the Wall Street Journal, Forbes, and Kiplinger’s Personal Finance regularly publish articles on insurance and financial planning. Searching their online archives for relevant s can yield valuable insights.

Final Wrap-Up

Ultimately, effective insurance planning is about more than just protection; it’s about peace of mind. By understanding your risks, choosing the right policies, and actively managing your coverage, you can secure your financial future and focus on what truly matters. This guide provides a framework for building a strong financial foundation, allowing you to confidently navigate life’s uncertainties and achieve your long-term goals. Remember to regularly review and adjust your plan as your circumstances evolve.

Commonly Asked Questions

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How often should I review my insurance policies?

At least annually, or more frequently if there are significant life changes (marriage, childbirth, job change).

Can I negotiate insurance premiums?

Yes, it’s often possible to negotiate lower premiums by comparing quotes from multiple providers and demonstrating good driving or health habits.

What if I can’t afford comprehensive insurance coverage?

Prioritize essential coverage (health and liability) and explore options like higher deductibles or less comprehensive policies to manage costs. Consider government assistance programs if eligible.