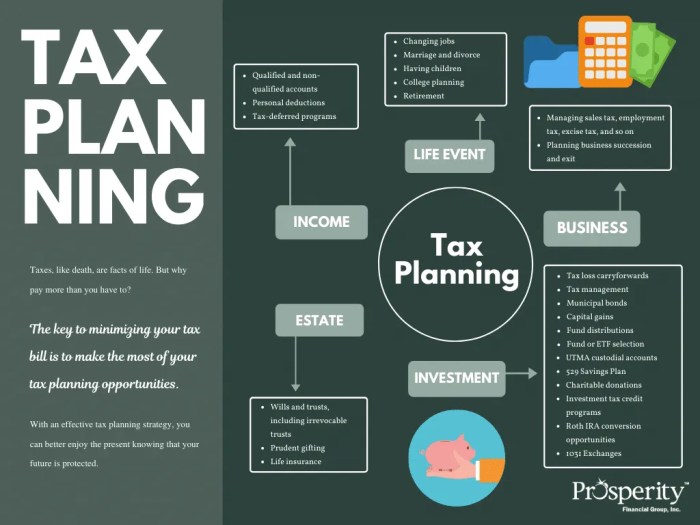

Navigating the complexities of tax laws can feel daunting, but proactive tax planning is crucial for individuals and businesses alike. Effective strategies can significantly reduce your tax burden, freeing up resources for investments, retirement planning, or simply enjoying a higher disposable income. This guide explores a range of proven techniques, from maximizing deductions and credits to implementing tax-efficient investment strategies and minimizing estate taxes. Whether you’re a small business owner, a high-net-worth individual, or simply looking to improve your financial well-being, understanding these strategies is key to achieving long-term financial success.

We’ll delve into the specifics of various tax deductions and credits, comparing itemized deductions to the standard deduction. We’ll then examine retirement planning, exploring the nuances of 401(k)s, IRAs, and Roth IRAs to help you optimize your savings for retirement. Furthermore, we’ll cover tax-efficient investment strategies, estate planning techniques, and the specific tax considerations for small businesses. Finally, we will address how major life events such as marriage, divorce, or homeownership impact your tax obligations.

Tax Deductions and Credits

Understanding tax deductions and credits is crucial for minimizing your tax liability. These provisions, offered by the tax code, allow taxpayers to reduce their taxable income or directly decrease the amount of tax owed. Effectively utilizing these can lead to significant savings.

Common Tax Deductions for Individuals and Small Businesses

Several common deductions are available to both individuals and small businesses. For individuals, these often include deductions for charitable contributions, mortgage interest (on a primary residence), state and local taxes (subject to limitations), and medical expenses exceeding a certain percentage of adjusted gross income (AGI). Small businesses can deduct expenses directly related to their business operations, such as rent, utilities, salaries, supplies, and depreciation of assets. The specific allowable deductions and their limitations are detailed in the tax code and may vary depending on the taxpayer’s circumstances. Accurate record-keeping is essential for claiming these deductions.

Examples of Tax Credits Reducing Tax Liability

Tax credits offer a more impactful reduction than deductions because they directly reduce the amount of tax owed, dollar for dollar. The Child Tax Credit, for example, provides a credit for qualifying children, potentially lowering the tax burden for families. The Earned Income Tax Credit (EITC) benefits low-to-moderate-income working individuals and families. Other credits include the American Opportunity Tax Credit and the Lifetime Learning Credit for higher education expenses. Eligibility requirements and credit amounts vary depending on income, family size, and other factors. It’s important to understand the specific rules for each credit to ensure accurate claiming.

Itemized Deductions versus Standard Deduction

Taxpayers can either itemize their deductions or take the standard deduction. The standard deduction is a fixed amount that varies based on filing status (single, married filing jointly, etc.). Itemizing allows taxpayers to deduct eligible expenses, such as those mentioned previously. A taxpayer should compare the total of their itemized deductions to the standard deduction; they can only claim the larger of the two. For example, a taxpayer with significant medical expenses might choose to itemize, while a taxpayer with few itemizable expenses might find the standard deduction more beneficial.

Requirements and Limitations for Claiming Tax Deductions and Credits

Claiming deductions and credits requires meticulous record-keeping. Taxpayers must maintain documentation to substantiate each deduction or credit claimed. For instance, charitable contributions typically require receipts or canceled checks. Furthermore, many deductions and credits have limitations or phase-outs based on income or other factors. For example, the amount of the state and local tax (SALT) deduction is capped. Failing to meet the requirements or exceeding the limitations can result in penalties or adjustments to the tax return. Consulting a tax professional can be invaluable in navigating these complexities.

Comparison of Tax Deductions

| Deduction | Eligibility | Maximum Amount | Requirements |

|---|---|---|---|

| Charitable Contributions | Individuals and businesses donating to qualified charities | Up to 60% of AGI (for individuals, limitations vary for businesses) | Receipts, bank records |

| Mortgage Interest | Homeowners with a mortgage on their primary residence | Interest paid on up to $750,000 of debt (for loans acquired after 2017) | Mortgage statement |

| Medical Expenses | Individuals with medical expenses exceeding 7.5% of AGI | Amount exceeding 7.5% of AGI | Medical bills, receipts |

| Business Expenses (Small Businesses) | Small business owners | Varies depending on the expense | Detailed records of all business expenses |

Retirement Planning and Tax Optimization

Retirement planning is crucial for securing your financial future, and understanding the tax implications of various retirement vehicles is key to maximizing your savings. Strategic tax planning can significantly increase the amount you accumulate for retirement and minimize the tax burden on withdrawals. This section explores effective strategies for optimizing your retirement savings through tax-advantaged accounts and minimizing your tax liability during retirement.

Tax Advantages of Retirement Accounts

Traditional 401(k)s and IRAs offer immediate tax deductions for contributions, reducing your taxable income in the present. Contributions are not taxed until withdrawal in retirement. Roth IRAs, conversely, involve contributions made after tax, but withdrawals in retirement are tax-free, provided specific guidelines are met. The choice between these accounts depends on your current tax bracket and projections for your future tax bracket. For instance, a younger individual in a lower tax bracket might favor a Roth IRA, expecting a higher tax bracket in retirement. Conversely, someone in a higher tax bracket might find a traditional 401(k) more advantageous.

Minimizing Taxes on Retirement Withdrawals

Careful planning can significantly reduce your tax liability on retirement withdrawals. One strategy is to diversify your retirement assets across different accounts, allowing for strategic withdrawals to minimize your overall tax burden. For example, withdrawing from a Roth IRA first, before tapping into traditional accounts, can significantly reduce your taxable income in retirement. Another strategy involves carefully timing your withdrawals to align with lower tax brackets, potentially reducing the overall amount of tax owed. Consider working with a financial advisor to develop a personalized withdrawal strategy based on your specific circumstances.

Tax Implications of Different Retirement Account Types

The tax implications vary significantly depending on the type of retirement account. Traditional 401(k)s and IRAs offer tax-deductible contributions but subject withdrawals to income tax in retirement. Roth IRAs, however, offer tax-free withdrawals in retirement, provided the contributions have been held for at least five years and the withdrawal is made after age 59 1/2. SEP IRAs, designed for self-employed individuals, also offer tax-deductible contributions. Understanding these distinctions is vital for making informed decisions that align with your individual financial goals and tax situation. For example, a self-employed individual with fluctuating income might find a SEP IRA beneficial due to its flexibility in contribution amounts.

Sample Tax-Efficient Retirement Plan

A hypothetical individual, Sarah, aged 35, earning $80,000 annually, could implement a diversified plan. She could contribute the maximum allowed to her employer-sponsored 401(k), perhaps allocating a portion to a Roth 401(k) option if available. She could also contribute to a Roth IRA, further diversifying her retirement savings. By doing so, she would benefit from both pre-tax contributions (401k) and tax-free withdrawals (Roth IRA) in retirement. This plan would incorporate both immediate tax savings and long-term tax-free growth. This is just an example, and the optimal plan will depend on individual circumstances and risk tolerance.

Pros and Cons of Retirement Savings Vehicles

Understanding the advantages and disadvantages of each retirement savings vehicle is crucial for making informed decisions.

- 401(k):

- Pros: Employer matching contributions, tax-deductible contributions (traditional), potential for high growth.

- Cons: Limited investment options compared to IRAs, potential penalties for early withdrawals.

- IRA (Traditional):

- Pros: Tax-deductible contributions, tax-deferred growth.

- Cons: Taxable withdrawals in retirement, income limitations for deductions.

- Roth IRA:

- Pros: Tax-free withdrawals in retirement, no required minimum distributions (RMDs).

- Cons: Contributions are not tax-deductible, income limitations for contributions.

- SEP IRA:

- Pros: High contribution limits for self-employed individuals, tax-deductible contributions.

- Cons: Limited investment options, less flexibility compared to other IRA types.

Tax-Efficient Investment Strategies

Investing wisely involves not only maximizing returns but also minimizing your tax burden. Strategic tax planning can significantly enhance your overall investment performance. Understanding the tax implications of different investment vehicles and employing effective strategies like tax-loss harvesting can lead to substantial long-term savings.

Favorable Tax Treatments of Different Investment Vehicles

Several investment vehicles offer preferential tax treatment, allowing investors to retain a larger portion of their earnings. Municipal bonds, for example, often generate interest income exempt from federal income tax, and sometimes state and local taxes as well, making them attractive to investors in higher tax brackets. Retirement accounts, such as 401(k)s and IRAs, provide tax advantages depending on the type of account (traditional or Roth), deferring or eliminating tax liability on investment growth until retirement. Tax-advantaged accounts allow for tax-deferred growth, meaning you pay taxes only when you withdraw the money in retirement. This contrasts with taxable accounts, where investment gains are taxed annually.

Tax-Loss Harvesting: Reducing Tax Liability

Tax-loss harvesting is a powerful strategy to offset capital gains taxes. It involves selling investments that have lost value to generate a capital loss, which can then be used to reduce your taxable capital gains. For example, if you sold a stock for $5,000 that you originally purchased for $10,000, you have a $5,000 capital loss. This loss can offset up to $3,000 of capital gains in a single year (or $1,500 if you are married filing separately). Any excess loss can be carried forward to future years. The key is to strategically realize losses to minimize your overall tax liability without significantly impacting your long-term investment strategy. It is crucial to consult with a financial advisor to determine the optimal strategy for your individual circumstances.

Tax Implications of Different Investment Asset Classes

Different asset classes have varying tax implications. Stocks, for example, are subject to capital gains taxes when sold, with rates varying depending on the holding period (short-term or long-term). Dividends received from stocks are also taxable. Bonds, on the other hand, typically generate interest income that is taxed as ordinary income. Real estate investments can involve complexities, including depreciation deductions and capital gains taxes upon sale. Depreciation allows investors to deduct a portion of the property’s cost over its useful life, reducing their taxable income. Understanding these nuances is crucial for effective tax planning.

Implementing a Tax-Efficient Investment Portfolio: A Step-by-Step Guide

Creating a tax-efficient investment portfolio requires a methodical approach.

- Assess Your Current Tax Situation: Determine your current tax bracket and understand your overall financial goals.

- Diversify Your Investments: Spread your investments across different asset classes to reduce risk and potentially optimize tax efficiency.

- Utilize Tax-Advantaged Accounts: Maximize contributions to retirement accounts (401(k)s, IRAs) and other tax-advantaged investment vehicles.

- Implement Tax-Loss Harvesting: Regularly review your portfolio for potential losses and strategically harvest them to offset gains.

- Consult with a Tax Professional: Seek advice from a qualified tax advisor or financial planner to develop a personalized tax-efficient investment strategy.

Tax Implications of Various Investment Options

| Investment Option | Tax Treatment of Income | Tax Treatment of Gains/Losses | Other Tax Considerations |

|---|---|---|---|

| Stocks | Dividends taxed as ordinary income or qualified dividends (lower rates) | Capital gains taxed at various rates depending on holding period | Wash-sale rules apply |

| Bonds | Interest income taxed as ordinary income | Capital gains taxed at various rates depending on holding period | Municipal bonds offer tax exemption on interest |

| Real Estate | Rental income taxed as ordinary income | Capital gains taxed at various rates depending on holding period | Depreciation deductions available |

| Mutual Funds | Dividends and capital gains distributions taxed annually | Capital gains taxed at various rates depending on holding period | Tax-efficient funds available |

Estate Planning and Tax Minimization

Effective estate planning is crucial not only for ensuring your wishes are carried out after your passing but also for minimizing the tax burden on your heirs. Proactive strategies can significantly reduce estate and gift taxes, allowing a greater portion of your wealth to be transferred to your beneficiaries. This section explores key strategies and tools to achieve this.

Minimizing Estate and Gift Taxes

Minimizing estate and gift taxes involves a multifaceted approach that leverages various legal and financial instruments. Key strategies include gifting assets during your lifetime, utilizing the annual gift tax exclusion, and employing sophisticated estate planning techniques such as trusts. The annual gift tax exclusion allows for a certain amount of gifting each year without incurring gift tax liability. Strategic gifting can reduce the overall value of your estate subject to estate tax upon your death. Furthermore, careful consideration of asset allocation and ownership structures can help optimize tax efficiency.

Implications of Estate Planning Tools

Several tools are available to facilitate efficient wealth transfer while minimizing tax consequences. Wills Artikel the distribution of your assets after death, but offer limited tax advantages. Trusts, on the other hand, provide greater control and flexibility. Irrevocable trusts, for instance, remove assets from your estate, reducing the taxable estate’s value. Revocable trusts offer more flexibility during your lifetime but don’t provide the same level of estate tax reduction. The choice between these tools depends on individual circumstances, financial goals, and tax implications.

Efficient Wealth Transfer Examples

Consider the example of a high-net-worth individual with a substantial estate. By strategically gifting assets to family members over several years, utilizing the annual gift tax exclusion, they can significantly reduce the size of their taxable estate. Alternatively, establishing an irrevocable life insurance trust can allow for tax-advantaged growth of the insurance policy’s cash value, ultimately providing a larger death benefit for beneficiaries without impacting the taxable estate. Another example would be using a Qualified Personal Residence Trust (QPRT) to transfer ownership of a valuable home while retaining the right to live in it for a specified period. This can remove the home’s value from the estate after the term expires.

Creating a Comprehensive Estate Plan

Developing a comprehensive estate plan involves several key steps. First, a thorough assessment of your assets and liabilities is necessary. This includes real estate, investments, business interests, and any outstanding debts. Second, clearly define your wishes regarding the distribution of your assets after death. This often involves designating beneficiaries for various accounts and assets. Third, select appropriate estate planning tools, such as wills or trusts, based on your specific circumstances and goals. Fourth, consult with legal and financial professionals to ensure your plan is legally sound and tax-efficient. Finally, regularly review and update your estate plan to reflect changes in your circumstances, family situation, and tax laws.

Estate Planning and Tax Minimization Process

The following flowchart illustrates the process:

[Imagine a flowchart here. The flowchart would begin with “Assess Assets and Liabilities,” branching to “Define Distribution Wishes” and “Identify Tax Implications.” “Define Distribution Wishes” would lead to “Choose Estate Planning Tools (Will, Trust, etc.).” “Identify Tax Implications” would lead to “Implement Tax Minimization Strategies (Gifting, Trusts, etc.).” Both “Choose Estate Planning Tools” and “Implement Tax Minimization Strategies” would converge at “Review and Update Plan Regularly,” which would loop back to “Assess Assets and Liabilities.”]

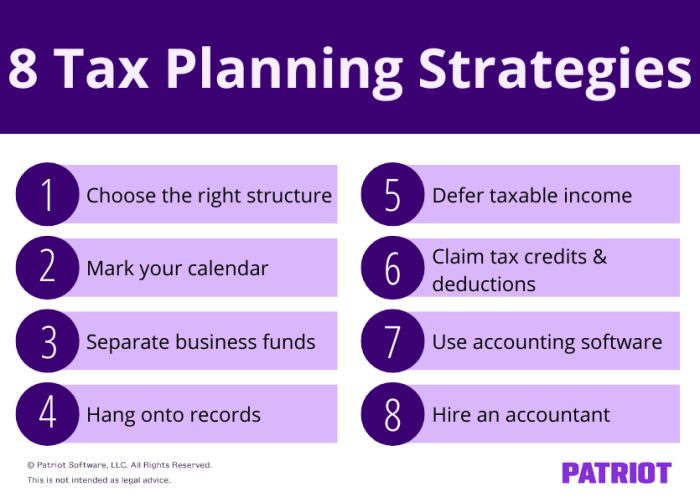

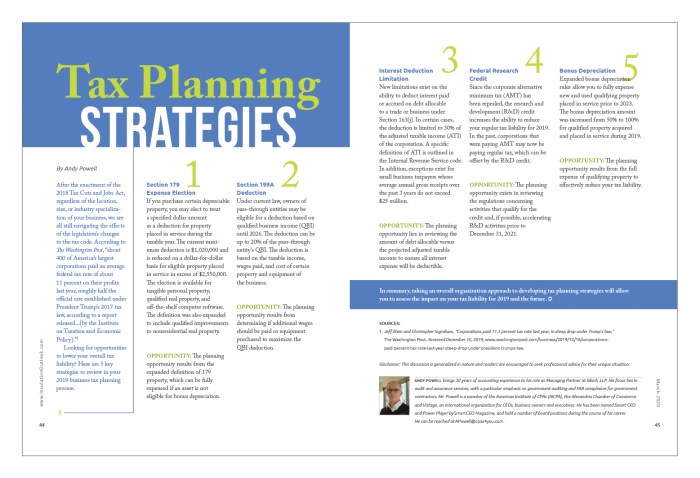

Tax Planning for Small Businesses

Effective tax planning is crucial for the long-term success of any small business. Understanding the various tax structures available and employing smart strategies for minimizing tax liabilities can significantly impact profitability and allow for reinvestment in growth. This section will explore key aspects of tax planning specifically tailored for small businesses.

Choosing the Right Business Structure

Selecting the appropriate legal structure for your small business—sole proprietorship, partnership, limited liability company (LLC), S corporation, or C corporation—has significant tax implications. Each structure offers different levels of liability protection and tax treatment. Sole proprietorships and partnerships are simpler to set up but offer less liability protection, while LLCs, S corps, and C corps provide varying degrees of liability shielding and more complex tax reporting requirements. The optimal choice depends on factors such as liability concerns, the number of owners, and desired tax benefits. For example, an S corporation can offer tax advantages by allowing business owners to pay themselves a salary and distribute profits as dividends, potentially reducing self-employment taxes. Conversely, a C corporation faces double taxation—on corporate profits and again on dividends paid to shareholders.

Minimizing Self-Employment Taxes

Self-employment taxes, encompassing Social Security and Medicare taxes, can represent a substantial portion of a small business owner’s income. Strategies to mitigate these taxes include maximizing deductions, contributing to qualified retirement plans (like SEP IRAs or solo 401(k)s), and carefully structuring compensation to optimize tax efficiency. For example, contributing the maximum allowable amount to a qualified retirement plan reduces taxable income, thereby lowering self-employment taxes.

Tax Deductions and Credits for Small Businesses

Numerous tax deductions and credits are available to small business owners, significantly reducing their tax burden. These include deductions for home office expenses, business-related travel, vehicle expenses, health insurance premiums (for self-employed individuals), and various other operating costs. The specific deductions and credits available will depend on the nature of the business and the applicable tax laws. For instance, the qualified business income (QBI) deduction can significantly reduce the taxable income of many small business owners. Furthermore, certain credits, such as the work opportunity credit or the earned income tax credit (for qualifying businesses and owners), can provide additional tax relief.

Sample Tax Plan for a Small Business

Let’s consider a hypothetical small business, “Acme Consulting,” a sole proprietorship owned by John Smith. Acme Consulting generated $100,000 in revenue in the tax year. John’s business expenses totaled $30,000 (rent, utilities, supplies, etc.). He also contributed $10,000 to a SEP IRA. His net profit is $60,000 ($100,000 – $30,000). After deducting the SEP IRA contribution, his taxable income is $50,000. This simplified example demonstrates how deductions and retirement plan contributions reduce taxable income. A more comprehensive tax plan would incorporate all relevant income streams, expenses, and applicable tax credits. Note that this is a simplified example and actual tax calculations require professional guidance.

Common Tax Mistakes Made by Small Business Owners and How to Avoid Them

Small business owners often make common tax mistakes that can lead to penalties and increased tax liabilities.

- Improperly classifying expenses: Accurately categorizing expenses as business or personal is crucial. Maintain detailed records and consult with a tax professional if unsure.

- Failing to track mileage: Accurate mileage records are essential for deducting vehicle expenses. Use a mileage log and keep receipts for repairs and maintenance.

- Ignoring estimated taxes: Self-employed individuals must pay estimated taxes quarterly to avoid penalties. Accurate income projections are crucial for proper tax estimations.

- Missing deadlines: Failing to file taxes on time can result in penalties. Use tax planning software or consult with a tax professional to ensure timely filing.

- Not taking advantage of all available deductions and credits: Research and understand the tax deductions and credits applicable to your business. A tax professional can help identify opportunities for tax savings.

Tax Implications of Major Life Events

Life’s significant milestones often bring about substantial changes, and understanding their tax implications is crucial for effective financial planning. These events can significantly alter your tax liability, either positively or negatively, depending on the specifics of your situation and how you structure your finances. Careful planning can help mitigate potential tax burdens and maximize available benefits.

Marriage

Marriage can impact your tax liability in several ways. Filing jointly often results in a lower overall tax burden than filing separately, due to the progressive nature of the tax system and the potential for utilizing combined deductions and credits. However, it’s important to consider the combined income and its impact on tax brackets. Spouses may also need to adjust their retirement savings and investment strategies to account for the change in their combined financial picture. For example, a couple merging their 401(k) accounts might find themselves in a higher tax bracket when withdrawing in retirement than if they had kept them separate.

Divorce

Divorce significantly alters tax situations. The division of assets, including retirement accounts and property, has tax implications. Alimony payments, while deductible by the payer in some cases (depending on the divorce date), are considered taxable income for the recipient. Child support payments are not tax-deductible for the payer nor taxable income for the recipient. Careful consideration of these factors is crucial for accurate tax filing and financial planning post-divorce. For instance, the distribution of a jointly-owned IRA could trigger significant tax liabilities if not properly managed.

Having Children

Having children introduces various tax benefits, including the Child Tax Credit and other dependent care credits. These credits can significantly reduce your tax liability. However, it’s important to understand the eligibility requirements and income limitations for these credits. The cost of childcare can also impact taxes through potential deductions or credits, depending on your employment status and other factors. For example, a family with two qualifying children might significantly reduce their tax burden by claiming the full Child Tax Credit.

Homeownership

Homeownership offers several tax advantages. Mortgage interest payments are often deductible, reducing your taxable income. Property taxes are also deductible in many cases. Additionally, some homeowners may be able to deduct points paid on their mortgage. These deductions can significantly reduce your tax liability over the life of your mortgage. For example, a homeowner with a large mortgage could deduct several thousand dollars in interest annually, reducing their taxable income considerably.

Inheritance and Gifts

Inheritance and gifts have unique tax implications. While inheritances are generally not subject to income tax, they can impact your estate tax liability if the value exceeds certain thresholds. Gifts, on the other hand, are subject to gift tax rules and annual gift tax exclusions. Understanding these rules is essential to avoid penalties and ensure proper tax planning. For example, exceeding the annual gift tax exclusion could lead to significant tax liabilities for the giver. Careful estate planning can help minimize these potential tax implications.

Timeline Illustrating Tax Implications of Key Life Events

| Life Event | Tax Implications | Example |

|---|---|---|

| Marriage | Changes in filing status, combined income impacting tax brackets, potential for increased deductions and credits. | A couple merging incomes may move into a higher tax bracket, but may also benefit from increased standard deduction. |

| Divorce | Division of assets, alimony payments (taxable for recipient, potentially deductible for payer), child support (not taxable/deductible). | A divorce settlement involving a retirement account distribution may trigger immediate tax liability for the recipient. |

| Having Children | Child Tax Credit, other dependent care credits, potential childcare deductions. | Claiming the Child Tax Credit can reduce a family’s tax liability by several thousand dollars. |

| Homeownership | Mortgage interest deduction, property tax deduction, potential deduction for mortgage points. | A homeowner with a $300,000 mortgage could deduct several thousand dollars in interest annually. |

| Inheritance/Gifts | Estate tax implications for large inheritances, gift tax rules and annual gift tax exclusions. | Receiving a large inheritance may trigger estate tax liabilities for the beneficiary’s estate. |

Ultimate Conclusion

Strategic tax planning isn’t merely about minimizing your tax bill; it’s about aligning your financial goals with sound tax practices. By understanding and implementing the strategies discussed—from maximizing deductions and credits to optimizing investments and estate planning—you can achieve greater financial security and control over your financial future. Remember that tax laws are complex and ever-changing; consulting with a qualified tax professional is recommended to tailor a plan specifically to your individual circumstances. Proactive planning empowers you to make informed decisions and build a more prosperous future.

Question Bank

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions, but withdrawals are taxed in retirement. A Roth IRA doesn’t offer upfront tax deductions, but withdrawals in retirement are tax-free.

What are some common tax deductions for homeowners?

Common deductions include mortgage interest, property taxes, and points paid on a mortgage.

How often should I review my tax plan?

It’s advisable to review your tax plan annually, or whenever there’s a significant life change (marriage, divorce, new job, etc.).

Can I deduct charitable donations?

Yes, you can deduct cash contributions up to 60% of your adjusted gross income (AGI), with limitations for non-cash donations.