Navigating the complexities of personal or business finances requires a well-defined strategy. Financial Strategy Development isn’t just about making money; it’s about understanding your current position, setting realistic goals, and creating a roadmap to achieve them. This guide explores the essential elements of building a robust financial strategy, from defining clear objectives to mitigating potential risks.

We’ll delve into practical methods for assessing your financial health, developing effective budgeting and investment strategies, and managing debt responsibly. The process involves careful planning, consistent monitoring, and adapting to changing circumstances. Ultimately, a strong financial strategy empowers you to take control of your financial future and achieve long-term prosperity.

Defining Financial Goals

Setting clear and achievable financial goals is paramount for both individuals and businesses. A well-defined financial strategy hinges on the establishment of these goals, providing a roadmap for resource allocation and decision-making. Without specific objectives, efforts can be scattered and progress difficult to measure.

The process of establishing effective financial goals typically involves adhering to the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. This ensures that goals are not vague aspirations but concrete targets with clear metrics for success and realistic timelines. The SMART framework promotes accountability and provides a structured approach to financial planning, allowing for consistent monitoring and adjustment along the way.

SMART Goal Setting for Individuals and Businesses

The SMART framework provides a structured approach to goal setting. For individuals, this might involve specifying the desired amount of savings for a down payment on a house, while for businesses, it could mean defining a specific revenue target for a new product launch. Measurable goals incorporate quantifiable metrics, such as a specific dollar amount or percentage increase. Achievable goals are realistic, considering existing resources and constraints. Relevant goals align with overall life or business objectives, and time-bound goals specify a clear deadline for accomplishment.

Examples of Short-Term, Mid-Term, and Long-Term Financial Objectives

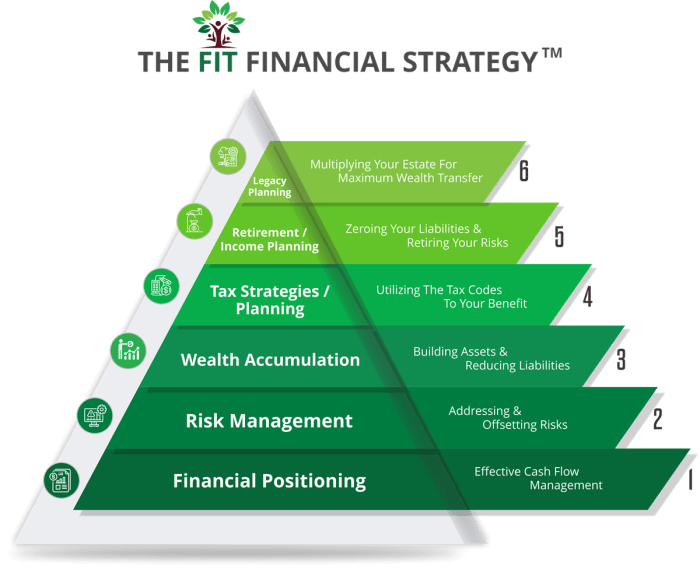

Short-term financial objectives typically focus on immediate needs and are usually achievable within one year. Examples include building an emergency fund of three to six months’ worth of living expenses, paying off high-interest credit card debt, or saving for a planned vacation.

Mid-term goals usually span one to five years. Examples include saving for a down payment on a house, paying off student loans, or funding a child’s education. These goals often require consistent saving and investment strategies.

Long-term financial objectives extend beyond five years and often encompass major life milestones. Examples include retirement planning, funding a child’s college education, or establishing a significant investment portfolio. These require a long-term perspective and a diversified investment approach.

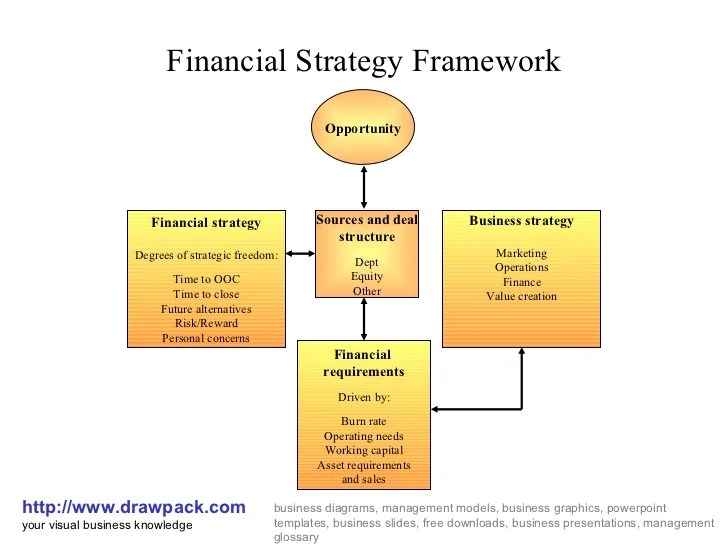

Aligning Financial Goals with Overall Strategic Objectives

Aligning financial goals with broader strategic objectives is crucial for sustained success. For businesses, financial goals should support the overall business strategy, whether it’s market expansion, product development, or increased efficiency. For individuals, financial goals should be consistent with their life goals, such as career advancement, family planning, or charitable giving. This alignment ensures that financial resources are allocated effectively to achieve the desired outcomes. For instance, a business aiming for rapid growth will likely prioritize revenue generation and market share objectives, while a business focused on sustainability might prioritize environmental initiatives and long-term value creation. Similarly, an individual aiming for early retirement will prioritize aggressive savings and investment strategies.

Assessing Current Financial Situation

A thorough assessment of your current financial standing is crucial for developing an effective financial strategy. This involves a comprehensive review of your income, expenses, assets, and liabilities to understand your current financial health and identify areas for improvement. This evaluation will provide the foundation for setting realistic financial goals and developing strategies to achieve them.

Understanding your current financial situation requires a systematic approach. This involves gathering relevant financial data, analyzing that data to identify trends and patterns, and then using this analysis to inform your future financial decisions. A clear picture of your current financial health will enable you to make informed choices and minimize potential risks.

Income Stream Analysis

Analyzing income streams involves identifying all sources of income, both regular and irregular. This includes salary, wages, investment income (dividends, interest), rental income, and any other sources of revenue. For each income stream, it’s important to determine its reliability and projected future growth or decline. For example, a salaried employee might project a steady income based on their current employment contract, while someone with rental income might consider potential vacancy rates and market fluctuations. Careful consideration of income volatility is key to accurate financial planning.

Expense Analysis

A detailed expense analysis is essential for understanding where your money is going. This involves categorizing all expenses, such as housing, transportation, food, utilities, entertainment, debt payments, and savings. Tools like budgeting apps or spreadsheets can be invaluable in tracking expenses. Analyzing spending patterns can reveal areas where you can reduce expenses and free up resources for other financial goals. For instance, someone might discover that dining out constitutes a significant portion of their discretionary spending and choose to reduce this expense to increase savings.

Asset and Liability Evaluation

This step involves creating a balance sheet that lists all your assets (what you own) and liabilities (what you owe). Assets include cash, investments (stocks, bonds, real estate), personal property, and other valuable possessions. Liabilities include mortgages, loans, credit card debt, and other outstanding financial obligations. The difference between your assets and liabilities represents your net worth, a key indicator of your overall financial health. For example, an individual might list their house, car, savings accounts, and investment portfolio as assets, while simultaneously accounting for their mortgage, student loans, and credit card debt as liabilities.

Financial Risk and Opportunity Evaluation

This involves identifying potential risks and opportunities that could impact your financial future. Risks might include job loss, unexpected medical expenses, or market downturns. Opportunities might include promotions, investment returns, or inheritance. A robust financial strategy should incorporate plans to mitigate risks and capitalize on opportunities. For example, building an emergency fund can help mitigate the risk of job loss, while regularly contributing to retirement accounts can capitalize on the opportunity for long-term investment growth. Considering various “what-if” scenarios, such as a potential interest rate hike or a market correction, allows for more resilient financial planning.

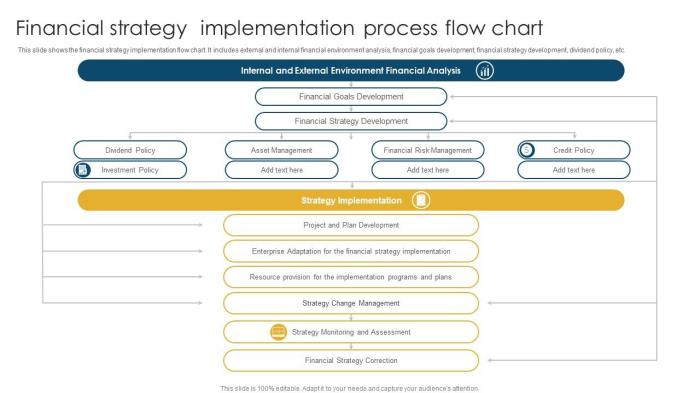

Developing Financial Strategies

Developing a robust financial strategy is crucial for achieving your financial goals. This involves choosing and implementing various approaches tailored to your specific circumstances, risk tolerance, and time horizon. A well-defined strategy acts as a roadmap, guiding your financial decisions and increasing the likelihood of success.

Financial Strategies for Different Situations

Effective financial strategies encompass budgeting, investing, and debt management. Budgeting involves creating a plan for how you will spend your money, ensuring your income exceeds your expenses. Investing involves allocating funds to assets with the expectation of generating returns, potentially increasing wealth over time. Debt management focuses on strategically paying down existing debts to minimize interest payments and improve your overall financial health. For instance, a young professional with a high income and low debt might prioritize investing aggressively in growth stocks, while someone nearing retirement with significant debt might focus on debt reduction and conservative investments. Someone with limited income and high debt might need to focus primarily on budgeting and debt reduction before considering investing.

Investment Strategies: Risk and Time Horizon

Investment strategies vary greatly depending on an individual’s risk tolerance and investment time horizon. Risk tolerance refers to the level of potential loss an investor is willing to accept in pursuit of higher returns. A longer time horizon generally allows for greater risk-taking, as there’s more time to recover from potential losses. For example, a young investor with a long time horizon (e.g., 30+ years) might invest heavily in stocks, which offer higher potential returns but also greater volatility. Conversely, an investor nearing retirement with a shorter time horizon (e.g., 5-10 years) might prefer more conservative investments like bonds, which offer lower returns but greater stability.

Developing a Comprehensive Financial Plan: A Step-by-Step Guide

Creating a comprehensive financial plan requires a systematic approach. The following steps provide a framework for building a personalized strategy:

| Strategy | Description | Risk Level | Time Horizon |

|---|---|---|---|

| Budgeting | Creating a detailed plan for income and expenses to ensure sufficient funds for needs and goals. | Low | Ongoing |

| Debt Management | Developing a strategy for paying down debt efficiently, considering interest rates and repayment terms. This might involve prioritizing high-interest debts or using debt consolidation. | Low to Moderate (depending on the debt strategy) | Short to Medium Term |

| Investing (Stocks) | Allocating funds to stocks, which offer high growth potential but also carry significant risk. | High | Long Term |

| Investing (Bonds) | Allocating funds to bonds, which offer lower returns but greater stability and lower risk compared to stocks. | Low to Moderate | Medium to Long Term |

| Emergency Fund | Building a savings account to cover unexpected expenses, typically 3-6 months of living expenses. | Low | Ongoing |

| Retirement Planning | Developing a strategy to save and invest for retirement, considering factors like expected income, expenses, and social security benefits. | Low to High (depending on investment choices) | Long Term |

Budgeting and Forecasting

Budgeting and forecasting are crucial components of any robust financial strategy. A well-defined budget provides a roadmap for managing finances, ensuring expenses align with income and progress towards financial goals. Forecasting, on the other hand, allows for proactive planning and adaptation to potential future financial scenarios. The integration of these two processes allows for a dynamic and responsive financial management system.

Creating a realistic budget requires a clear understanding of both income and expenses. This involves meticulously tracking all sources of income and categorizing expenses to identify areas for potential savings or adjustments. The budget should then be aligned with previously defined financial goals, ensuring that resource allocation supports the achievement of those objectives. Regular review and adjustment are vital to maintain the budget’s relevance and effectiveness throughout the year.

Budgeting Methods and Tools

Several methods can be employed to create effective budgets. The choice of method often depends on individual preferences and complexity of financial situations. Common approaches include the 50/30/20 rule, zero-based budgeting, and envelope budgeting. Various budgeting tools, from simple spreadsheets to sophisticated financial software applications, can assist in the process.

The 50/30/20 rule suggests allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a straightforward framework for managing income distribution. Zero-based budgeting involves starting with a budget of zero and allocating funds to each expense category based on its importance and necessity. This approach emphasizes mindful spending and avoids overspending. Envelope budgeting involves allocating cash to different expense categories in physical envelopes. Once the cash in an envelope is depleted, spending in that category ceases until the next budgeting cycle. This method can improve spending awareness.

Tools like spreadsheets (e.g., Microsoft Excel, Google Sheets) offer customizable templates and formulas for tracking income and expenses. Dedicated budgeting apps (e.g., Mint, YNAB – You Need A Budget) often provide automated features such as transaction categorization and financial goal tracking. Choosing the right tool depends on personal tech proficiency and the desired level of automation.

The Importance of Financial Forecasting and Scenario Planning

Regular financial forecasting involves projecting future income and expenses based on current trends and anticipated changes. This proactive approach allows for informed decision-making and proactive adjustments to the budget. Scenario planning, a crucial aspect of forecasting, involves developing different financial scenarios, considering various potential outcomes (e.g., job loss, unexpected expenses, interest rate changes). This preparedness allows for flexible financial strategies and minimizes the impact of unforeseen events.

For example, a small business owner might forecast revenue based on past sales data and projected market growth. They could then create several scenarios: a best-case scenario (high growth), a base-case scenario (moderate growth), and a worst-case scenario (low or no growth). Each scenario would inform different resource allocation strategies, ensuring business sustainability under varying conditions. Similarly, an individual might forecast their retirement income, considering potential changes in investment returns and healthcare costs, creating scenarios to ensure adequate retirement savings.

Investment Strategies

Developing a robust investment strategy is crucial for achieving your long-term financial goals. This involves understanding different investment vehicles, assessing their associated risks and potential returns, and constructing a diversified portfolio aligned with your risk tolerance and objectives. Careful consideration of these factors will help you navigate the complexities of investing and maximize your chances of success.

Investment Vehicle Characteristics

This section Artikels the characteristics of several common investment vehicles, highlighting their risk profiles and potential returns. Understanding these differences is fundamental to building a well-rounded investment portfolio.

| Investment Vehicle | Risk Level | Potential Return | Description |

|---|---|---|---|

| Stocks (Equities) | High | High | Represent ownership in a company; returns come from capital appreciation and dividends. Subject to market volatility. |

| Bonds (Fixed Income) | Moderate | Moderate | Represent a loan to a company or government; returns are primarily from interest payments. Generally less volatile than stocks. |

| Real Estate | Moderate to High | Moderate to High | Investment in properties; returns come from rental income, capital appreciation, and potential tax benefits. Can be illiquid and require significant capital investment. |

| Mutual Funds | Variable | Variable | Professionally managed portfolios of stocks, bonds, or other assets; offer diversification and professional management. Risk level depends on the fund’s investment strategy. |

| Exchange-Traded Funds (ETFs) | Variable | Variable | Similar to mutual funds but traded on exchanges like stocks; offer diversification and liquidity. Risk level depends on the ETF’s underlying assets. |

Diversification Strategies

Diversification is a key risk management technique in investing. It involves spreading investments across different asset classes to reduce the impact of any single investment’s poor performance on the overall portfolio. Effective diversification minimizes risk without necessarily sacrificing potential returns.

A well-diversified portfolio might include a mix of stocks, bonds, and real estate, potentially further diversified across different sectors (e.g., technology, healthcare, energy) and geographic regions. For example, a portfolio heavily weighted towards technology stocks might experience significant losses if the technology sector underperforms. A diversified portfolio, however, would mitigate this risk by spreading investments across various sectors. The specific allocation will depend on individual risk tolerance and financial goals.

Portfolio Development Process

Creating an investment portfolio requires a systematic approach. This involves defining your investment goals (e.g., retirement, education), determining your risk tolerance (e.g., conservative, moderate, aggressive), and selecting investments that align with both.

The process typically involves:

1. Defining Investment Goals: Clearly defining short-term and long-term goals provides a framework for investment decisions. For example, a goal of retirement in 20 years requires a different investment strategy than a goal of buying a house in five years.

2. Assessing Risk Tolerance: Understanding your comfort level with potential investment losses is crucial. Conservative investors might prefer lower-risk investments like bonds, while aggressive investors might allocate a larger portion of their portfolio to stocks.

3. Asset Allocation: Determining the proportion of your portfolio to be allocated to different asset classes (stocks, bonds, real estate, etc.) based on your risk tolerance and goals. A younger investor with a longer time horizon might allocate a larger percentage to stocks, while an older investor nearing retirement might favor a more conservative allocation with a higher percentage in bonds.

4. Investment Selection: Choosing specific investments within each asset class based on research and analysis. This might involve selecting individual stocks, bonds, mutual funds, or ETFs.

5. Monitoring and Rebalancing: Regularly reviewing your portfolio’s performance and making adjustments as needed to maintain your desired asset allocation. Market fluctuations may cause your portfolio to drift from its target allocation, requiring rebalancing to restore the desired mix. For instance, if stocks outperform bonds significantly, rebalancing might involve selling some stocks and buying more bonds.

Debt Management Strategies

Effective debt management is crucial for achieving long-term financial well-being. High levels of debt can significantly hinder progress towards financial goals, impacting everything from saving for retirement to purchasing a home. Understanding various debt management strategies and choosing the right approach is essential for regaining control of your finances.

Successful debt management involves a combination of strategic planning, disciplined budgeting, and consistent effort. It’s not just about paying down debt; it’s about developing healthy financial habits that prevent future debt accumulation. This involves understanding your spending patterns, identifying areas for savings, and prioritizing debt repayment.

Effective Strategies for Managing and Reducing Debt

Several effective strategies can help individuals manage and reduce their debt. These strategies often involve prioritizing high-interest debt, negotiating lower interest rates, and exploring debt consolidation options. Careful budgeting and consistent repayment are essential components of any successful debt reduction plan. For example, creating a detailed budget can help identify areas where spending can be reduced, freeing up funds for debt repayment. Negotiating lower interest rates with creditors can significantly reduce the total amount paid over the life of the loan. Debt consolidation, which involves combining multiple debts into a single loan, can simplify repayment and potentially lower interest rates.

Comparison of Debt Repayment Methods

Two popular debt repayment methods are the debt snowball and debt avalanche methods. The debt snowball method involves paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. The debt avalanche method, conversely, focuses on paying off the debt with the highest interest rate first to minimize the total interest paid. The choice between these methods depends on individual preferences and financial situations. The debt snowball method can be more psychologically rewarding, leading to quicker wins and increased motivation. The debt avalanche method, however, often leads to significant long-term savings by reducing the overall interest paid.

Implications of High-Interest Debt and Mitigation Strategies

High-interest debt, such as credit card debt, can quickly spiral out of control, leading to significant financial strain. The high interest rates accrue substantial charges, making it challenging to repay the principal balance. Strategies for mitigating the impact of high-interest debt include transferring balances to cards with lower interest rates (balance transfers), negotiating lower interest rates with creditors, and exploring debt consolidation options to simplify repayment and potentially lower overall interest costs. In some cases, seeking professional financial advice from a credit counselor or debt management company may be beneficial in developing a comprehensive debt reduction plan. Failing to address high-interest debt can result in significant long-term financial consequences, including damaged credit scores, difficulty obtaining loans, and potential legal action from creditors.

Risk Management and Mitigation

Effective financial planning necessitates a robust approach to risk management. Understanding and mitigating potential financial threats is crucial for achieving long-term financial goals and ensuring the stability of your financial health. Ignoring risk can lead to significant setbacks and jeopardize your overall financial well-being.

Financial risks are inherent in any investment or financial undertaking. These risks can manifest in various forms, each demanding a tailored mitigation strategy. Proactive risk management involves identifying potential threats, assessing their likelihood and potential impact, and developing strategies to reduce their negative consequences. This proactive approach protects your assets and helps you maintain control over your financial future.

Common Financial Risks

Several key risks commonly affect personal and business finances. Market fluctuations, driven by economic conditions and investor sentiment, can significantly impact the value of investments. Inflation erodes the purchasing power of money over time, reducing the real value of savings and investments. Changes in interest rates directly influence borrowing costs and the returns on interest-bearing assets. Understanding these risks is the first step towards effective mitigation.

Strategies for Mitigating Financial Risks

Diversification, insurance, and hedging are three core strategies for mitigating financial risks. Diversification involves spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of losses in any single area. Insurance provides a financial safety net against unforeseen events such as accidents, illnesses, or property damage. Hedging involves using financial instruments to offset potential losses from adverse price movements in specific assets. For example, a farmer might use futures contracts to lock in a price for their crop, protecting them against price drops before harvest.

Risk Mitigation Techniques

| Risk Mitigation Technique | Effectiveness | Potential Drawbacks |

|---|---|---|

| Diversification | Reduces the impact of losses in any single investment; improves overall portfolio stability. Effectiveness depends on the breadth and correlation of assets. | May reduce potential for high returns; requires more research and management effort. Complete elimination of risk is impossible. |

| Insurance | Provides financial protection against unexpected events; reduces financial burden of losses. | Requires regular premium payments; may not cover all potential losses; certain events may be uninsurable. |

| Hedging | Reduces exposure to price fluctuations; protects against potential losses. | Can be complex and costly; requires specialized knowledge and understanding of financial markets; may limit potential profits. |

Monitoring and Evaluation

Regular monitoring and evaluation are crucial for the success of any financial strategy. Without consistent tracking and analysis, it’s impossible to determine whether the strategy is achieving its intended goals, identify areas needing adjustment, and ultimately, maximize financial performance. This process ensures the financial plan remains relevant and effective in the face of evolving market conditions and unforeseen circumstances.

Effective monitoring involves tracking key financial metrics against established benchmarks and targets. This allows for early identification of deviations from the plan and provides the opportunity to take corrective action before minor issues escalate into significant problems. Regular review also facilitates proactive adjustments to the strategy, ensuring it remains aligned with the overall business objectives and the changing economic landscape.

Key Performance Indicators (KPIs) Tracking

Tracking key performance indicators (KPIs) is fundamental to effective financial monitoring. KPIs provide quantifiable measures of progress towards financial goals. Examples include return on investment (ROI), net profit margin, debt-to-equity ratio, and cash flow. The specific KPIs selected will depend on the nature of the business and the objectives of the financial strategy. Regular reporting on these KPIs, perhaps monthly or quarterly, allows for timely identification of trends and potential problems. For instance, a consistent decline in ROI might signal the need for a review of investment strategies or operational efficiency. Similarly, a rising debt-to-equity ratio might indicate the need for adjustments to debt management strategies. Visual representations such as charts and graphs can greatly aid in the interpretation of KPI data, making trends and anomalies easier to spot.

Variance Analysis

Variance analysis compares actual financial results against budgeted or forecasted figures. This analysis helps pinpoint the causes of deviations from the plan, whether positive or negative. For example, a significant variance in sales revenue might be due to unexpected market demand, changes in pricing strategies, or unforeseen competition. Understanding the root causes of variances is critical for making informed decisions about necessary adjustments to the financial strategy. A systematic approach to variance analysis, which includes documenting the causes and implementing corrective actions, is essential for continuous improvement.

Financial Strategy Adjustment

The process of adjusting the financial strategy is iterative and based on the insights gained from monitoring and evaluation. This may involve revising budgets, reallocating resources, adjusting investment strategies, or modifying debt management plans. For example, if market conditions indicate a downturn, a company might choose to reduce its investment in high-risk ventures and focus on preserving capital. Conversely, if a particular investment is performing exceptionally well, additional resources might be allocated to it. Flexibility and adaptability are key to effective financial strategy adjustment. Regular reviews of the financial strategy, perhaps annually or semi-annually, provide opportunities for more substantial adjustments to align with long-term goals and changing business needs. These adjustments should be documented and communicated to all relevant stakeholders.

Illustrative Case Study

This case study examines the financial journey of “Sarah’s Sweets,” a fictional bakery experiencing rapid growth but facing challenges in managing its finances effectively. Sarah, the owner, initially focused solely on baking and sales, neglecting the strategic aspects of financial planning. This led to inconsistent profitability and a lack of long-term vision for the business. The following details Sarah’s experience in implementing a comprehensive financial strategy.

Sarah’s Sweets initially lacked a clear financial roadmap. Revenue was inconsistent, and expenses were poorly tracked, resulting in difficulty determining profitability. Through the implementation of a structured financial strategy, Sarah was able to gain control of her finances, leading to improved profitability and sustainable growth.

Defining Goals and Assessing the Current Situation

Sarah’s primary goal was to achieve sustainable profitability and expand her bakery within the next three years. She aimed to open a second location and increase her employee base. An initial assessment revealed inconsistent revenue streams, high operating costs, and limited savings. A detailed analysis of income statements and balance sheets from the past two years highlighted areas needing improvement. Specifically, ingredient costs were high, and marketing efforts were inefficient.

Developing and Implementing Financial Strategies

To address these challenges, a comprehensive financial plan was developed. This included:

- Streamlining Operations: Implementing a more efficient inventory management system to reduce waste and lower ingredient costs. This involved switching to a just-in-time inventory model and negotiating better prices with suppliers.

- Targeted Marketing: Shifting marketing efforts towards social media and local partnerships, resulting in a significant increase in customer reach and brand awareness at a lower cost than previous methods.

- Financial Forecasting: Developing detailed financial projections for the next three years, incorporating revenue growth targets and expense control measures. This included projected income statements, balance sheets, and cash flow statements. This allowed for proactive decision-making regarding investments and resource allocation.

- Securing Funding: Exploring small business loan options to finance the expansion. This involved creating a detailed business plan demonstrating the viability of the expansion and the ability to repay the loan.

Budgeting and Forecasting Results

The implementation of the new budgeting and forecasting system resulted in a significant improvement in financial control. Sarah was able to accurately predict cash flow, allowing for timely payments to suppliers and efficient management of working capital. Within six months, ingredient costs were reduced by 15%, and marketing expenses were reduced by 20% while customer reach increased by 30%.

Investment Strategies and Debt Management

Sarah invested a portion of her increased profits in new baking equipment, enhancing efficiency and production capacity. The loan obtained for expansion was structured with manageable monthly payments, ensuring minimal impact on cash flow. Regular monitoring of debt levels and interest rates was implemented to proactively manage financial risk.

Risk Management and Mitigation

Potential risks, such as fluctuating ingredient prices and economic downturns, were identified and mitigated through strategies such as hedging against price increases and building a financial reserve. Contingency plans were developed to address unexpected events, ensuring business continuity.

Monitoring and Evaluation

Regular monitoring of key financial indicators, including revenue, expenses, and profitability, was established. Monthly financial reports were generated to track progress and identify areas needing adjustments. This continuous monitoring allowed for timely interventions and course corrections, ensuring the financial strategy remained effective. The financial plan’s success was evident in Sarah’s Sweets’ increased profitability and successful expansion.

Ending Remarks

Developing a comprehensive financial strategy is a journey, not a destination. By diligently following the steps Artikeld – defining goals, assessing your current situation, implementing strategies, and continuously monitoring progress – you can build a solid foundation for financial success. Remember, adaptability is key; regularly review and adjust your plan to accommodate life’s changes and market fluctuations. Proactive financial planning ensures a secure and prosperous future.

FAQs

What is the difference between a financial plan and a financial strategy?

A financial plan is a detailed roadmap outlining how you’ll achieve your financial goals. A financial strategy is the overarching approach and principles guiding your plan’s development and execution.

How often should I review my financial strategy?

At least annually, or more frequently if significant life changes occur (job loss, marriage, etc.) or market conditions shift drastically.

What if I don’t have any savings to start investing?

Begin by creating a budget, reducing expenses, and building an emergency fund. Even small, consistent savings can contribute to future investment opportunities.

Where can I find professional help with financial strategy development?

Financial advisors, certified financial planners (CFPs), and accountants can provide valuable guidance and support.