Understanding and managing financial risk is paramount for the success of any organization, from small businesses to multinational corporations. This assessment delves into the multifaceted nature of financial risk, exploring various types, their interconnectedness, and the methods employed to identify, quantify, and mitigate them. We will examine both qualitative and quantitative approaches, highlighting the importance of data analysis and the strategic implementation of risk mitigation strategies.

This guide provides a practical framework for navigating the complexities of financial risk, equipping readers with the knowledge and tools necessary to make informed decisions and safeguard their financial well-being. We will cover everything from defining core risk components and analyzing relevant data to communicating findings effectively and ensuring regulatory compliance. The goal is to empower individuals and organizations to proactively manage financial risks and achieve sustainable growth.

Defining Financial Risk

Financial risk represents the potential for financial loss or the failure to achieve expected financial returns. It’s an inherent part of any financial undertaking, stemming from various sources and impacting diverse stakeholders. Understanding its core components and the interplay of different risk types is crucial for effective financial management and decision-making.

Financial risk encompasses several key components: the magnitude of potential loss, the probability of that loss occurring, and the time horizon over which the loss might materialize. These components interact to define the overall risk profile of an investment or business. A high probability of a small loss might be considered less risky than a low probability of a catastrophic loss. Similarly, the time until a potential loss impacts the overall assessment; a potential loss far in the future is generally less concerning than an immediate threat.

Types of Financial Risk

Financial risk manifests in various forms, each with its own characteristics and implications. Effective risk management requires a comprehensive understanding of these different types.

- Market Risk: This refers to the potential for losses due to fluctuations in market prices. These fluctuations can stem from various factors such as changes in interest rates, exchange rates, or the overall market sentiment. For example, a decline in the stock market can significantly reduce the value of a portfolio invested in equities.

- Credit Risk: This is the risk of loss resulting from a borrower’s failure to repay a debt. This risk is particularly relevant to lenders, such as banks and bondholders. A company’s credit rating is a key indicator of its credit risk; a lower credit rating suggests a higher probability of default.

- Liquidity Risk: This represents the risk of not being able to convert assets into cash quickly enough to meet immediate obligations. A company facing liquidity risk may struggle to pay its bills, even if it is ultimately profitable. This is often exacerbated during times of market stress.

- Operational Risk: This encompasses the risk of losses stemming from inadequate or failed internal processes, people, and systems, or from external events. This could include risks from fraud, cyberattacks, or natural disasters impacting business operations. For instance, a major cyberattack disrupting a bank’s operations could lead to significant financial losses.

Impact of Economic Factors on Financial Risk

Economic conditions significantly influence the level and type of financial risk faced by businesses and investors. For example, periods of high inflation typically increase interest rates, impacting the value of fixed-income securities and increasing borrowing costs. Recessions can lead to increased credit risk as businesses struggle to meet their financial obligations, and market downturns amplify market risk. Conversely, periods of economic expansion can lead to increased inflation, thus impacting market risk through rising interest rates. Economic uncertainty itself increases overall financial risk as it makes forecasting future cash flows more challenging.

Hypothetical Scenario Illustrating Interplay of Financial Risks

Imagine a small manufacturing company heavily reliant on exports. A global recession (macroeconomic factor) reduces demand for their products (market risk), leading to lower sales and cash flow. Simultaneously, a key supplier defaults on its contract (credit risk), disrupting production and further impacting sales. The company struggles to secure short-term financing (liquidity risk) due to its reduced creditworthiness, ultimately leading to bankruptcy. This scenario illustrates how various financial risks can interact and amplify each other, resulting in severe consequences.

Risk and Return Relationship

Generally, there’s a positive relationship between risk and return. Higher potential returns often come with higher risk. This can be represented by a simple model:

Expected Return = Risk-Free Rate + Risk Premium

The risk-free rate represents the return on a risk-free investment (e.g., government bonds), while the risk premium reflects the additional return investors demand for taking on higher levels of risk. A higher risk premium compensates investors for the increased probability of losses. For example, investing in a high-growth technology company (higher risk) might offer a higher potential return than investing in a stable utility company (lower risk). However, the higher-growth company also carries a greater chance of significant losses.

Risk Assessment Methods

Effective financial risk assessment relies on employing appropriate methodologies to identify, analyze, and evaluate potential risks. The choice of method depends on factors such as the complexity of the financial situation, the available data, and the resources available. Broadly, these methods can be categorized as qualitative or quantitative.

Qualitative and quantitative risk assessment methods offer distinct approaches to evaluating financial risks. Qualitative methods focus on subjective judgments and descriptive assessments, often utilizing expert opinions and experience. Quantitative methods, conversely, rely on numerical data and statistical analysis to provide a more precise, albeit potentially less nuanced, evaluation. The best approach often involves a combination of both.

Qualitative and Quantitative Risk Assessment Methods Compared

Qualitative methods, such as checklists and expert interviews, offer a flexible and cost-effective way to assess risks, particularly when data is limited. However, their reliance on subjective judgment can lead to inconsistencies and biases. Quantitative methods, such as scenario analysis and Monte Carlo simulations, provide more precise numerical results but require significant data and computational resources. The selection of the most suitable method hinges on the specific context and the nature of the risks being assessed. For instance, a small business might find a qualitative approach sufficient for initial risk assessment, while a large financial institution would likely require a more sophisticated quantitative analysis.

Sensitivity Analysis in Financial Risk Assessment

Sensitivity analysis is a technique used to determine how changes in one or more input variables affect a particular output variable. In financial risk assessment, this might involve examining how changes in interest rates, exchange rates, or commodity prices impact profitability or the value of an investment. For example, a sensitivity analysis could reveal that a 1% increase in interest rates would reduce a company’s net income by 5%, highlighting the vulnerability of the company’s financial performance to interest rate fluctuations. This helps prioritize risk mitigation strategies by focusing on the most influential variables. The results are often presented graphically, such as in a sensitivity chart, to visualize the impact of variable changes.

Scenario Planning in Financial Risk Assessment

Scenario planning involves developing multiple plausible scenarios that represent different potential future states. Each scenario considers a specific combination of key risk factors and their potential impacts. For example, a bank might develop scenarios reflecting a mild recession, a severe recession, or a period of rapid economic growth. By analyzing the financial performance under each scenario, the bank can assess its resilience to different economic conditions and identify potential vulnerabilities. This proactive approach allows for the development of contingency plans and strategic adjustments to mitigate potential losses and capitalize on opportunities.

Limitations of Risk Assessment Techniques

All risk assessment techniques possess inherent limitations. Qualitative methods are susceptible to bias and lack precision, while quantitative methods often rely on assumptions that may not hold true in reality and require significant data availability. Furthermore, unforeseen events, often referred to as “black swan” events, can significantly impact financial outcomes and are difficult to incorporate into any risk assessment model. The complexity of financial systems and the dynamic nature of market conditions also present challenges in accurately predicting future outcomes.

Comparison of Risk Assessment Methods

| Method | Advantages | Disadvantages | Suitability |

|---|---|---|---|

| Qualitative (Checklists) | Simple, inexpensive, easy to understand. | Subjective, imprecise, lacks numerical data. | Preliminary assessments, small businesses. |

| Qualitative (Expert Interviews) | Captures expert knowledge and insights. | Relies on subjective opinions, potential bias. | Complex situations where data is limited. |

| Quantitative (Sensitivity Analysis) | Identifies key risk drivers, provides numerical results. | Relies on assumptions about variable relationships. | Understanding the impact of specific variables. |

| Quantitative (Scenario Planning) | Considers multiple future states, proactive risk management. | Requires significant data and resources, complex to implement. | Strategic planning, large organizations. |

| Quantitative (Monte Carlo Simulation) | Provides probability distributions of outcomes, incorporates uncertainty. | Computationally intensive, requires extensive data and assumptions. | Complex financial models, portfolio risk management. |

Data Collection and Analysis for Risk Assessment

Effective financial risk assessment hinges on the meticulous collection and analysis of relevant data. A robust assessment requires a comprehensive understanding of the entity’s financial health, market conditions, and operational environment. The accuracy and completeness of the data directly impact the reliability of the risk assessment.

Essential Data Points for Financial Risk Assessment

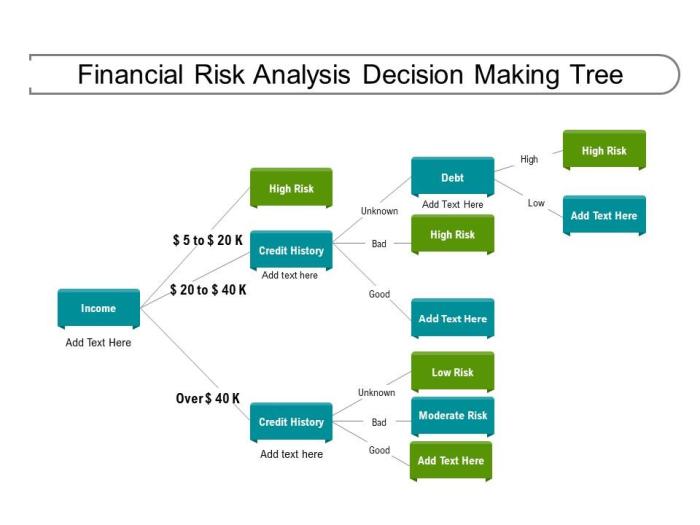

Gathering the right data is crucial for a comprehensive assessment. The specific data points will vary depending on the type of risk being assessed (e.g., credit risk, market risk, operational risk), but generally include financial statements (balance sheets, income statements, cash flow statements), industry benchmarks, macroeconomic indicators, and qualitative information regarding the entity’s management, governance, and operations. For example, assessing credit risk for a loan applicant requires detailed information on their income, debt levels, and credit history. Analyzing market risk for an investment portfolio demands data on asset prices, volatility, and correlation.

Data Cleaning and Validation for Financial Risk Analysis

Raw financial data is rarely perfect. Before analysis, it undergoes a critical cleaning and validation process. This involves identifying and correcting errors, inconsistencies, and missing values. Data cleaning may include handling outliers (extreme values that may skew results), dealing with missing data (using imputation techniques or removing data points), and ensuring data consistency across different sources. Validation ensures the data is accurate and reliable, potentially involving comparing data from multiple sources to identify discrepancies. For instance, a discrepancy between reported revenue and accounts receivable could signal an error needing investigation.

Statistical Methods Used in Analyzing Financial Risk Data

Several statistical methods are employed to analyze financial risk data. Descriptive statistics (mean, median, standard deviation) provide a summary of the data’s characteristics. Regression analysis helps to model the relationship between variables, allowing for predictions of future outcomes. Time series analysis is used to identify trends and patterns in financial data over time. Furthermore, probability distributions (e.g., normal distribution) are used to model the likelihood of different outcomes, crucial for calculating probabilities of default or other adverse events. For example, a bank might use regression analysis to predict loan defaults based on factors like borrower credit score and loan amount.

Interpreting Key Financial Ratios and Metrics

Financial ratios and metrics are vital for interpreting financial data and assessing risk. Liquidity ratios (e.g., current ratio, quick ratio) measure the ability to meet short-term obligations. Solvency ratios (e.g., debt-to-equity ratio, times interest earned) indicate the ability to meet long-term obligations. Profitability ratios (e.g., gross profit margin, net profit margin) reflect the entity’s ability to generate profits. These ratios, when compared to industry benchmarks or historical trends, provide valuable insights into an entity’s financial health and risk profile. For instance, a consistently declining current ratio might signal increasing liquidity risk.

Step-by-Step Guide for Collecting and Preparing Financial Data for Risk Analysis

- Identify Data Needs: Define the specific risks being assessed and the data required to evaluate them.

- Data Sources: Identify relevant sources, including financial statements, industry reports, macroeconomic data, and internal documents.

- Data Collection: Gather the necessary data from identified sources. Ensure data accuracy and completeness.

- Data Cleaning: Identify and correct errors, inconsistencies, and missing values. Handle outliers appropriately.

- Data Validation: Verify the accuracy and reliability of the data through cross-checking and comparison with other sources.

- Data Transformation: Convert data into a suitable format for analysis (e.g., spreadsheets, databases).

- Data Analysis: Apply appropriate statistical methods to analyze the data and identify key risk factors.

Risk Mitigation Strategies

Effective risk mitigation is crucial for maintaining financial stability and achieving business objectives. A well-defined strategy proactively addresses potential financial threats, minimizing their impact and maximizing opportunities. This involves a combination of preventative measures, reactive responses, and a continuous monitoring process.

Diversification as a Risk Reduction Tool

Diversification is a fundamental principle in finance, aiming to reduce overall portfolio risk by spreading investments across various asset classes, sectors, and geographies. By not putting all your eggs in one basket, the impact of a negative event affecting one investment is lessened by the potential positive performance of others. For example, a portfolio heavily invested in technology stocks might experience significant losses during a tech downturn. However, a diversified portfolio including real estate, bonds, and international equities would likely experience a less severe impact due to the potential for positive performance in other asset classes. The key is to carefully select assets that are not highly correlated, meaning their price movements are not strongly linked.

Risk Transfer Mechanisms: Insurance and Other Methods

Transferring risk involves shifting the burden of potential financial losses to a third party. Insurance is a prime example. Businesses can purchase various insurance policies—property insurance, liability insurance, business interruption insurance—to protect against specific risks. The premium paid represents the cost of transferring the risk to the insurance company. Other risk transfer mechanisms include hedging, where financial instruments are used to offset potential losses from price fluctuations, and surety bonds, which guarantee the performance of a contract. For instance, a construction company might purchase a surety bond to ensure completion of a project, protecting the client from potential losses if the contractor defaults.

Limitations and Trade-offs of Risk Mitigation Strategies

While risk mitigation strategies offer significant benefits, they also have limitations and involve trade-offs. Diversification, for example, may reduce overall risk but can also lead to lower potential returns compared to a concentrated portfolio. Insurance, while offering protection, involves ongoing premium payments, and the policy’s coverage may not be comprehensive enough to cover all potential losses. Hedging strategies can be complex and expensive, requiring specialized knowledge and potentially incurring transaction costs. The effectiveness of each strategy also depends on the specific nature of the risk and the accuracy of risk assessments.

Risk Mitigation Plan for a Hypothetical Small Business

Let’s consider “Cozy Coffee,” a small coffee shop. Their key financial risks include theft, property damage, liability lawsuits, and fluctuations in coffee bean prices.

| Risk | Mitigation Strategy | Timeline | Responsible Party |

|---|---|---|---|

| Theft | Install security cameras and alarm system; employee background checks | Within 3 months | Owner/Manager |

| Property Damage | Comprehensive property insurance; regular maintenance checks | Within 1 month (insurance); Ongoing (maintenance) | Owner/Manager; Maintenance staff |

| Liability Lawsuits | General liability insurance; staff training on safety procedures | Within 1 month (insurance); Ongoing (training) | Owner/Manager; designated trainer |

| Fluctuations in Coffee Bean Prices | Secure long-term contracts with suppliers; explore alternative sourcing options | Within 6 months (contracts); Ongoing (sourcing) | Purchasing Manager |

Communicating Risk Assessment Findings

Effectively communicating the results of a financial risk assessment is crucial for informing decision-making and ensuring appropriate actions are taken. This requires tailoring the message to the specific audience and using clear, concise language alongside compelling visual aids. The complexity of financial data necessitates a strategic approach to ensure understanding and engagement across different stakeholder groups.

Effective Communication Methods for Diverse Audiences

Communicating complex financial risk information requires adapting the style and content to the audience’s level of financial literacy and their specific interests. For senior management, a concise executive summary highlighting key risks and recommendations is sufficient. For operational teams, a more detailed explanation of specific risks and mitigation strategies is necessary. Visual aids, such as charts and graphs, are essential for simplifying complex data and facilitating understanding across all audiences. For example, a heatmap could visually represent the likelihood and impact of various risks, while a bar chart could compare the relative importance of different risk factors. Finally, interactive dashboards allow stakeholders to explore the data at their own pace and focus on areas of specific interest.

Visual Aids for Enhancing Clarity

Visual aids significantly enhance the clarity and impact of risk assessment reports. A well-designed chart can convey information more effectively than pages of text. For instance, a radar chart can effectively illustrate the relative strengths and weaknesses of different risk mitigation strategies. A simple bar chart could compare the potential financial impact of various identified risks, clearly highlighting the most significant threats. A waterfall chart can illustrate the cumulative effect of different risk events on the overall financial position of the organization. Pie charts can represent the proportion of risk exposure across different business units or investment portfolios. Using clear labels, legends, and consistent scales is vital to ensure accuracy and avoid misinterpretations.

Structuring a Risk Assessment Report

A well-structured risk assessment report should follow a logical flow, starting with an executive summary and concluding with recommendations. The executive summary should provide a concise overview of the assessment’s key findings and recommendations, highlighting the most critical risks. The methodology section should detail the approach used for the assessment, including the data sources, risk assessment techniques employed, and any assumptions made. The findings section should present the identified risks, their likelihood and potential impact, and any supporting evidence. The recommendations section should propose specific actions to mitigate or manage the identified risks, prioritizing them based on their severity and feasibility. Appendices can be included to provide additional detail or supporting data.

Sample Risk Assessment Report

Executive Summary: This assessment identified three key financial risks: credit risk, market risk, and operational risk. Credit risk presents the highest potential impact, requiring immediate attention. We recommend implementing stricter credit approval processes and diversifying the client portfolio.

Methodology: This assessment used a qualitative approach, combining expert judgment with historical data analysis. Key risk indicators (KRIs) were identified and analyzed to determine the likelihood and impact of each risk.

Findings: Credit risk was identified as the highest priority risk, with a high likelihood and significant potential impact. Market risk was assessed as medium likelihood and medium impact. Operational risk was deemed low likelihood and low impact.

Recommendations: Implement stricter credit scoring models. Diversify the loan portfolio geographically and across industry sectors. Invest in robust operational risk management systems.

Importance of Clear and Concise Language

Using clear and concise language is paramount in communicating financial risk assessments. Technical jargon should be minimized or explained, ensuring the report is accessible to all stakeholders. Complex concepts should be simplified using analogies or examples, making them easier to understand. The use of bullet points, numbered lists, and headings improves readability and helps readers quickly grasp the key messages. Avoid ambiguity and ensure that the language is unambiguous and leaves no room for misinterpretation. Precise wording is critical, especially when communicating quantitative data and financial projections. The overall tone should be objective and professional, maintaining a balance between providing sufficient detail and avoiding unnecessary complexity.

Regulatory Compliance and Financial Risk

Effective financial risk management is inextricably linked to regulatory compliance. Failure to adhere to relevant regulations can lead to significant financial penalties, reputational damage, and even business failure. This section examines the regulatory landscape governing financial risk, focusing on the banking sector, and explores best practices for maintaining compliance.

Regulatory Frameworks in Banking

The banking industry operates under a complex web of regulations designed to protect depositors, maintain financial stability, and prevent systemic risk. Key regulatory frameworks vary by jurisdiction but commonly include Basel Accords (for capital adequacy), Dodd-Frank Act (in the US), and the European Union’s Capital Requirements Directive (CRD) and Capital Requirements Regulation (CRR). These frameworks dictate capital requirements, liquidity standards, risk management practices, and reporting obligations. For instance, Basel III sets minimum capital requirements for banks based on their risk profile, aiming to ensure they have enough capital to absorb potential losses. The Dodd-Frank Act, enacted in response to the 2008 financial crisis, introduced stricter regulations on financial institutions, including increased oversight and limitations on certain financial activities. Similarly, the CRD and CRR in the EU aim to harmonize capital requirements across member states and enhance the stability of the European banking system.

Implications of Non-Compliance

Non-compliance with financial risk regulations carries severe consequences. These can include hefty fines, legal action, reputational damage impacting customer trust and investor confidence, operational disruptions, and even license revocation leading to business closure. For example, a bank failing to meet minimum capital requirements might face penalties and restrictions on its operations, potentially limiting its ability to lend and grow. Similarly, a failure to adequately report risk exposures could lead to regulatory scrutiny and enforcement actions. The reputational damage from such incidents can be long-lasting, affecting a bank’s ability to attract customers and raise capital.

Best Practices for Regulatory Compliance

Maintaining regulatory compliance requires a proactive and multi-faceted approach. This includes establishing a robust risk management framework, implementing effective internal controls, conducting regular audits and assessments, providing comprehensive training to employees, and maintaining detailed records of compliance activities. Furthermore, fostering a strong culture of compliance within the organization, where employees understand and prioritize regulatory requirements, is crucial. Regular reviews of regulatory changes and updates to internal policies and procedures are essential to adapt to evolving regulatory expectations. Independent audits by external experts can provide an objective assessment of compliance efforts and identify areas for improvement.

Key Regulatory Requirements for Risk Reporting and Disclosure

Financial institutions are subject to stringent reporting and disclosure requirements related to their risk exposures. These requirements often mandate regular reporting to regulatory bodies on capital adequacy, liquidity positions, credit risk, market risk, operational risk, and other relevant risk areas. The information disclosed must be accurate, timely, and comprehensive, allowing regulators to effectively monitor the financial health and stability of the institution. For example, banks are typically required to submit regular reports on their capital ratios, stress test results, and significant risk events. These disclosures are crucial for maintaining transparency and accountability in the financial system.

Key Regulatory Bodies and Their Roles

Several key regulatory bodies play a crucial role in overseeing financial risk. These include national banking regulators (e.g., the Federal Reserve in the US, the Bank of England in the UK, the European Central Bank in the Eurozone), international organizations like the Basel Committee on Banking Supervision (BCBS), and other specialized agencies focusing on specific aspects of financial risk. The BCBS, for instance, develops international standards for banking regulation, while national regulators enforce these standards and adapt them to their specific jurisdictions. These bodies monitor compliance, conduct inspections, and take enforcement actions when necessary, ensuring the stability and integrity of the financial system.

Conclusive Thoughts

Effective financial risk assessment is not merely a compliance exercise; it’s a proactive strategy for sustainable success. By understanding the various types of financial risks, employing robust assessment methods, and implementing appropriate mitigation strategies, organizations can enhance their resilience and navigate economic uncertainties. This guide has provided a foundation for understanding these crucial elements, empowering you to build a more secure financial future. Remember that ongoing monitoring and adaptation are key to maintaining a strong risk management framework in a constantly evolving economic landscape.

FAQ Corner

What is the difference between market risk and credit risk?

Market risk refers to losses stemming from fluctuations in market values (e.g., stocks, bonds). Credit risk involves the potential for losses due to borrowers’ inability to repay debt.

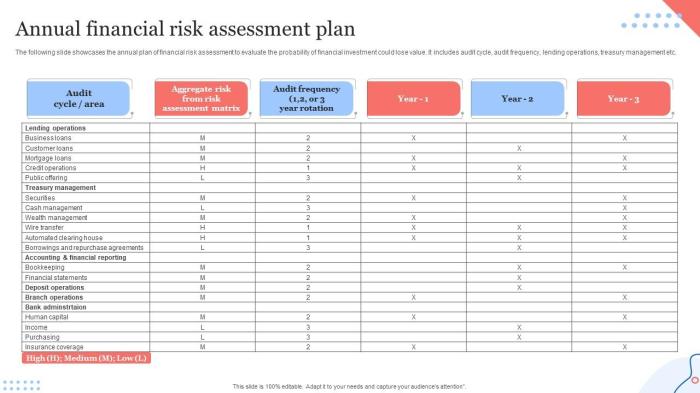

How often should a financial risk assessment be conducted?

The frequency depends on the organization’s size, industry, and risk profile. Regular assessments, at least annually, are generally recommended, with more frequent reviews for higher-risk entities.

What are some common mistakes in financial risk assessment?

Common mistakes include neglecting qualitative factors, using outdated data, failing to consider interdependencies between risks, and insufficient communication of findings.

What role does technology play in financial risk assessment?

Technology, including advanced analytics and AI, significantly enhances data processing, model building, and scenario planning, leading to more accurate and efficient risk assessments.