Effective credit risk management is crucial for the financial health of any organization, from small businesses to multinational corporations. Understanding and mitigating credit risk involves a multifaceted approach, encompassing risk assessment, mitigation strategies, regulatory compliance, and the strategic use of technology. This guide explores these key areas, providing a framework for navigating the complexities of credit risk and ensuring sustainable financial stability.

This exploration delves into the various types of credit risk, including default risk, concentration risk, and operational risk, examining real-world examples to illustrate their impact. We will also delve into the methodologies used for assessing credit risk, such as credit scoring and financial statement analysis, comparing their strengths and weaknesses. Furthermore, we’ll discuss effective mitigation techniques, regulatory compliance, and the transformative role of technology in modern credit risk management.

Defining Credit Risk

Credit risk is the potential for financial loss stemming from a borrower’s failure to repay a debt, either in full or on time. It’s a fundamental concern for any entity that extends credit, from banks and credit card companies to individual lenders. Understanding the various facets of credit risk is crucial for effective risk management and the overall financial health of an organization.

Fundamental Components of Credit Risk

Credit risk is multifaceted and comprises several key components. These include the probability of default (the likelihood a borrower will fail to meet their repayment obligations), the exposure at default (the amount of money at risk should a default occur), and the recovery rate (the percentage of the outstanding debt that can be recovered in case of default). Interplay between these components determines the overall credit risk profile of a borrower or a portfolio of loans.

Types of Credit Risk

Several distinct types of credit risk exist, each presenting unique challenges and requiring specific mitigation strategies.

Default Risk

Default risk, also known as insolvency risk, is the risk that a borrower will be unable to repay its debt obligations. This can stem from various factors, including economic downturns, mismanagement, or unforeseen circumstances. For example, a small business facing a sudden drop in sales due to a pandemic might struggle to repay its bank loan, resulting in a default.

Concentration Risk

Concentration risk arises when a significant portion of a lender’s portfolio is exposed to a single borrower, industry, or geographic region. If that specific borrower, industry, or region experiences financial distress, the lender faces substantial losses. A prime example is a bank heavily invested in the real estate market of a specific city. A sudden housing market crash in that city could trigger significant losses for the bank.

Migration Risk

Migration risk refers to the risk of a borrower’s creditworthiness deteriorating over time. A borrower with a high credit rating initially might experience a decline in their financial health, leading to a higher probability of default. This is common in situations where a company’s financial performance declines, causing rating agencies to downgrade their credit rating.

Counterparty Risk

Counterparty risk is the risk that the other party in a financial transaction will fail to fulfill its obligations. This is particularly relevant in derivative transactions or other complex financial instruments. For example, if a financial institution enters into a derivatives contract with another institution that subsequently defaults, the first institution could face substantial losses.

Table Comparing Credit Risk Types

| Risk Type | Description | Example | Mitigation Strategy |

|---|---|---|---|

| Default Risk | Risk of borrower failing to repay debt. | Small business failing to repay loan due to economic downturn. | Thorough credit analysis, loan covenants, diversification. |

| Concentration Risk | Risk of excessive exposure to a single borrower or sector. | Bank heavily invested in one geographic region’s real estate. | Diversification of loan portfolio, stress testing. |

| Migration Risk | Risk of borrower’s creditworthiness declining. | Company’s credit rating downgraded due to poor financial performance. | Regular monitoring of borrower’s financial health, early warning systems. |

| Counterparty Risk | Risk of other party in a transaction failing to fulfill obligations. | Financial institution losing money due to a counterparty’s default on a derivative contract. | Credit checks on counterparties, collateralization, netting agreements. |

Credit Risk Assessment Methods

Effective credit risk assessment is crucial for lenders to make informed decisions and minimize potential losses. A robust assessment process considers various factors and employs different methodologies to evaluate the creditworthiness of borrowers. The choice of method often depends on the type of loan, the borrower’s profile, and the lender’s risk appetite.

Credit Scoring Models

Credit scoring models utilize statistical techniques to assign a numerical score representing a borrower’s creditworthiness. These scores are based on various factors extracted from credit reports and other data sources. Higher scores indicate a lower probability of default. The models are designed to predict the likelihood of repayment, helping lenders to quickly assess a large number of applications.

Financial Statement Analysis

Financial statement analysis involves a detailed examination of a borrower’s financial statements—balance sheets, income statements, and cash flow statements—to assess their financial health and ability to repay debt. This method provides a more in-depth understanding of the borrower’s financial position compared to credit scoring alone. Ratios such as liquidity ratios, profitability ratios, and leverage ratios are calculated and analyzed to evaluate the borrower’s financial strength and risk profile.

Qualitative Assessment

Qualitative assessment involves evaluating non-financial factors that can influence a borrower’s creditworthiness. This includes factors such as management experience, industry trends, competitive landscape, and the overall business strategy. Qualitative assessments often rely on subjective judgment and require expertise in the specific industry or sector. This approach is particularly important for smaller businesses where financial data may be limited or less reliable.

Comparison of Credit Scoring Models

The following table compares three common credit scoring models: FICO Score, VantageScore, and a hypothetical model focusing on small business cash flow. Note that specific weighting and factors can vary considerably between implementations of these models.

| Feature | FICO Score | VantageScore | Small Business Cash Flow Model |

|---|---|---|---|

| Primary Data Source | Credit reports (primarily Experian, Equifax, TransUnion) | Credit reports (Experian, Equifax, TransUnion) | Bank statements, accounting records |

| Key Factors | Payment history, amounts owed, length of credit history, credit mix, new credit | Payment history, age and type of credit, amounts owed, new credit, available credit | Monthly cash inflow, outflow, operating cash flow, debt service coverage ratio |

| Strengths | Widely used and accepted, readily available | Considers more recent credit activity, potentially more forgiving of past mistakes | Directly assesses repayment capacity for small businesses |

| Weaknesses | May not capture nuances of small business financials | Relatively new, less established than FICO | Requires access to detailed financial records, potentially more subjective |

Hypothetical Credit Risk Assessment Process for a Small Business Loan

This process Artikels a hypothetical assessment for a small business loan application. It combines quantitative and qualitative assessments to provide a comprehensive evaluation of credit risk.

- Application Review: Initial review of the loan application, verifying completeness and accuracy of information.

- Credit Score Check: Obtain a credit score for the business owner(s) and the business itself, if available. This provides a quick overview of credit history.

- Financial Statement Analysis: Detailed review of the last three years of financial statements (balance sheet, income statement, cash flow statement). Key ratios will be calculated and compared to industry benchmarks.

- Cash Flow Projection: Analyze the business’s projected cash flow for the next 12-24 months to assess its ability to service the loan.

- Qualitative Assessment: Evaluate the management team’s experience, the business plan, market conditions, and competitive landscape. This includes assessing the business’s overall viability and sustainability.

- Collateral Assessment (if applicable): Evaluate the value and liquidity of any collateral offered as security for the loan.

- Credit Risk Rating: Assign a credit risk rating based on the combined quantitative and qualitative assessment. This rating will inform the loan decision and interest rate.

Credit Risk Mitigation Techniques

Effective credit risk mitigation is crucial for the financial health of any lending institution or business extending credit. Strategies employed aim to minimize potential losses arising from borrowers’ inability or unwillingness to repay their obligations. A multifaceted approach, combining preventative and reactive measures, is generally most effective.

Credit risk mitigation strategies can be broadly categorized into preventative and reactive measures. Preventative techniques focus on minimizing the likelihood of defaults occurring in the first place, while reactive techniques aim to reduce the impact of defaults that do occur.

Preventative Credit Risk Mitigation Techniques

These strategies aim to proactively reduce the probability of borrowers defaulting on their loans. A robust preventative approach significantly reduces the need for reactive measures later.

- Thorough Credit Scoring and Assessment: Employing sophisticated credit scoring models and rigorous due diligence processes helps identify borrowers with a higher likelihood of repayment. This involves analyzing credit history, financial statements, and other relevant data points to assess creditworthiness.

- Diversification of Loan Portfolio: Spreading loans across different borrowers, industries, and geographic locations reduces the impact of concentrated losses. If one sector experiences a downturn, the overall portfolio’s risk is lessened.

- Setting Appropriate Credit Limits and Interest Rates: Careful consideration of a borrower’s capacity to repay should inform the loan amount and interest rate. Higher-risk borrowers may require higher interest rates or lower loan amounts to compensate for the increased risk.

- Strong Contractual Agreements: Clearly defined loan agreements with comprehensive terms and conditions, including collateralization and repayment schedules, minimize ambiguity and potential disputes.

- Regular Monitoring and Reporting: Continuous monitoring of borrower performance, financial health, and market conditions enables early detection of potential problems and allows for timely intervention.

Reactive Credit Risk Mitigation Techniques

These strategies are implemented after a loan has been granted and are designed to minimize losses in the event of a default or deterioration in the borrower’s creditworthiness.

- Collateral Management: This involves securing assets as collateral against the loan. In case of default, the lender can seize and liquidate the collateral to recover some or all of the outstanding debt. (Further details on collateral management are provided below.)

- Debt Restructuring: Negotiating with borrowers facing financial difficulties to modify loan terms, such as extending repayment periods or reducing interest rates, can help prevent defaults.

- Loan Sales or Securitization: Transferring the risk of default to another party by selling the loan or packaging it into a securitized product can reduce exposure to specific borrowers or loan types.

- Insurance: Credit default swaps (CDS) and other forms of credit insurance can transfer the risk of default to an insurance provider.

- Write-offs and Charge-offs: In cases where recovery is unlikely, writing off the loan as a loss and charging it off against earnings is a necessary step.

Collateral Management as a Risk Mitigation Strategy

Collateral management is a critical reactive risk mitigation technique. It involves the careful selection, valuation, and monitoring of assets pledged by borrowers as security for a loan. The effectiveness of collateral depends on several factors, including its liquidity, market value, and ease of seizure and liquidation.

Effective collateral management includes:

- Careful Appraisal: Independent valuation of collateral is essential to ensure its value accurately reflects the loan amount. Over-collateralization is often employed to account for potential fluctuations in asset values.

- Due Diligence: Thorough investigation of the collateral’s ownership, encumbrances, and potential legal issues is crucial to avoid future disputes or difficulties in liquidation.

- Monitoring and Maintenance: Regular monitoring of the collateral’s condition and market value is essential to ensure it continues to adequately secure the loan. This might involve periodic inspections or reassessments.

- Liquidation Planning: Having a clear plan for the liquidation of collateral in the event of default is essential to minimize losses. This includes understanding the legal processes and potential market conditions affecting the sale.

For example, a bank lending to a small business might require the business owner to pledge their real estate as collateral. If the business defaults, the bank can foreclose on the property and sell it to recover its losses. Similarly, a car loan often uses the car itself as collateral; if payments are not made, the lender repossesses the vehicle.

Regulatory and Compliance Aspects

Effective credit risk management is inextricably linked to a robust understanding and adherence to relevant regulations and compliance requirements. Failure to comply can lead to significant financial penalties, reputational damage, and even legal action. This section explores the key regulatory landscape and the crucial role of credit reporting agencies.

Relevant Regulations and Compliance Requirements

Numerous laws and regulations govern credit risk management, varying significantly depending on jurisdiction and the type of institution involved. For example, banks are subject to stringent capital adequacy requirements under Basel accords, aimed at ensuring they hold sufficient capital to absorb potential credit losses. These regulations dictate minimum capital ratios based on risk assessments, influencing lending practices and risk appetite. Similarly, consumer protection laws, such as the Fair Credit Reporting Act (FCRA) in the United States, mandate transparency and accuracy in credit reporting and lending practices, safeguarding borrowers’ rights. These regulations often require institutions to implement comprehensive credit risk management frameworks, including policies, procedures, and internal controls, to ensure compliance. Non-compliance can result in substantial fines, restrictions on operations, and damage to an institution’s reputation.

The Role of Credit Bureaus and Credit Reporting Agencies

Credit bureaus and credit reporting agencies (CRAs) play a vital role in the credit risk management ecosystem. They collect and compile credit information from various sources, including lenders, creating comprehensive credit reports that reflect an individual’s or a company’s creditworthiness. These reports are used by lenders to assess credit risk, inform lending decisions, and set interest rates. CRAs operate under strict regulatory oversight, ensuring the accuracy and fairness of the information they provide. They are responsible for investigating and resolving disputes regarding credit information, maintaining data integrity, and adhering to data privacy regulations. The accuracy and reliability of information provided by CRAs are crucial for informed credit risk assessment. For instance, an inaccurate credit report could lead to a loan application being unfairly rejected, illustrating the importance of CRA accuracy and regulatory compliance.

Consequences of Non-Compliance with Credit Risk Regulations

Non-compliance with credit risk regulations carries significant consequences. Financial penalties can be substantial, ranging from monetary fines to operational restrictions. Reputational damage can severely impact an institution’s ability to attract customers and secure funding. Legal action, including lawsuits from affected individuals or regulatory bodies, is a potential outcome. In severe cases, non-compliance can lead to the suspension or revocation of operating licenses, effectively shutting down the institution’s operations. For instance, a bank failing to meet capital adequacy requirements might face regulatory intervention, potentially including enforced capital injections or restrictions on lending activities. The consequences underscore the critical importance of a robust compliance program.

Regulatory Compliance Process in Credit Risk Management

The following flowchart illustrates the cyclical nature of regulatory compliance in credit risk management:

[Diagram Description: The flowchart begins with “Risk Identification and Assessment,” leading to “Policy and Procedure Development.” This then flows into “Implementation and Monitoring,” which branches into “Internal Audits” and “Regulatory Reporting.” Both “Internal Audits” and “Regulatory Reporting” feed back into “Policy and Procedure Development,” creating a continuous loop of improvement and adaptation. The entire process is overseen by a “Compliance Officer” who is responsible for ensuring adherence to all relevant regulations.]

Credit Risk Modeling and Forecasting

Credit risk modeling is crucial for financial institutions to understand and manage their exposure to potential losses. These models employ statistical techniques to quantify credit risk, enabling proactive risk mitigation strategies and more informed decision-making. By predicting the likelihood of borrowers defaulting and the potential losses associated with such events, institutions can optimize their lending practices and capital allocation.

Statistical models are fundamental to credit risk assessment. They leverage historical data on borrower characteristics, economic conditions, and past default rates to build predictive models. These models employ various statistical methods, including logistic regression, linear discriminant analysis, and survival analysis, to estimate the probability of default (PD) for individual borrowers or portfolios. The complexity of the model depends on the data available and the specific needs of the institution. Simpler models might focus on a few key variables, while more sophisticated models incorporate numerous factors and interactions.

Probability of Default (PD) and Expected Loss (EL)

Probability of Default (PD) represents the likelihood that a borrower will fail to meet their debt obligations within a specified timeframe. Expected Loss (EL), on the other hand, quantifies the anticipated financial loss from a default event. It considers both the probability of default and the potential loss given default (LGD). The formula for calculating EL is:

EL = PD * LGD * EAD

where EAD represents the exposure at default, which is the outstanding loan amount at the time of default.

Expected Loss Calculation

Let’s illustrate EL calculation with a hypothetical example. Suppose a bank has lent $100,000 to a borrower. Based on the bank’s credit scoring model, the PD for this borrower is estimated to be 5% (0.05) over the next year. The bank assesses the LGD to be 40% (0.40), meaning that if the borrower defaults, the bank expects to recover only 60% of the loan amount. Therefore, the EAD is $100,000. The expected loss is calculated as follows:

EL = 0.05 * 0.40 * $100,000 = $2,000

This indicates that the bank anticipates a loss of $2,000 on this loan over the next year.

Merton Model

The Merton model is a structural model that uses option pricing theory to estimate the probability of default. It assumes that a firm’s assets follow a geometric Brownian motion, and default occurs when the firm’s asset value falls below a certain threshold (the face value of its debt). The model’s key assumptions include: the firm’s assets follow a diffusion process, debt is a zero-coupon bond, and the firm’s value is publicly observable or can be reliably estimated. The probability of default is then calculated as the probability that the firm’s asset value will fall below the debt value within a given time horizon. This probability is determined using the Black-Scholes option pricing model, treating the firm’s equity as a call option on its assets. The model’s outputs are sensitive to the inputs, particularly the estimates of asset volatility and the risk-free rate. For example, a higher asset volatility would increase the probability of default. While elegant in its theoretical framework, the Merton model relies on assumptions that may not always hold true in practice, especially regarding the observability of firm asset values. Furthermore, the model may not accurately capture the complexities of real-world credit risk, such as the impact of macroeconomic factors or idiosyncratic events.

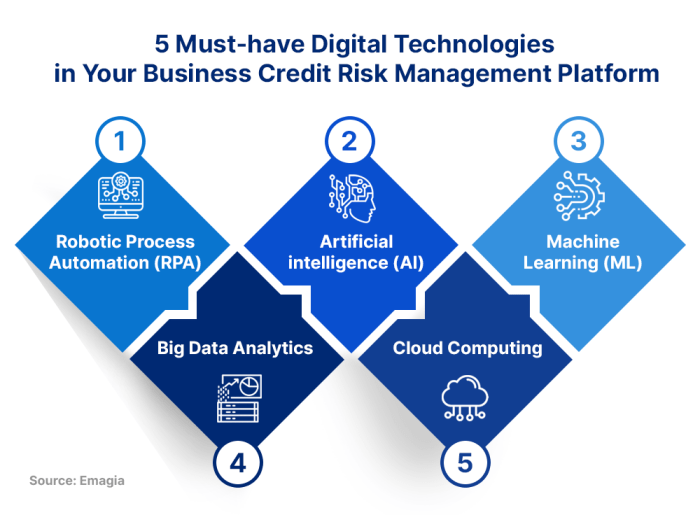

Technological Advancements in Credit Risk Management

The integration of technology has revolutionized credit risk management, enabling financial institutions to assess risk more accurately, efficiently, and proactively. Advanced analytical tools and vast data processing capabilities are transforming how creditworthiness is evaluated and managed, leading to improved decision-making and reduced losses. This section explores the significant role of technology in modern credit risk management.

Technology significantly enhances credit risk management practices by automating processes, improving data analysis, and enabling more sophisticated risk modeling. This leads to faster and more accurate credit decisions, reduced operational costs, and better risk mitigation strategies. The increased efficiency allows credit departments to focus more on strategic initiatives rather than manual, time-consuming tasks.

Machine Learning and Artificial Intelligence in Credit Risk Assessment

Machine learning (ML) and artificial intelligence (AI) are transforming credit risk assessment by analyzing vast datasets to identify patterns and predict default probabilities with greater accuracy than traditional methods. AI algorithms can process complex, unstructured data, such as social media activity and alternative data sources, providing a more holistic view of a borrower’s creditworthiness. For example, AI can identify subtle indicators of risk that might be missed by human analysts, leading to more accurate credit scoring and reduced defaults. This technology also enables the development of personalized credit offerings based on individual risk profiles.

Big Data Analytics in Credit Risk Management

Big data analytics plays a crucial role in credit risk management by enabling the processing and analysis of massive datasets from diverse sources, including internal transactional data, external market data, and alternative data sources such as social media and mobile phone usage. This comprehensive analysis allows for a more granular understanding of borrower behavior and market trends, improving the accuracy of risk models and enabling more effective risk mitigation strategies. For example, analyzing social media data can help identify early warning signs of financial distress in borrowers. The ability to correlate various data points provides a more comprehensive risk profile, going beyond traditional credit scoring methods.

Fintech Innovations in Credit Risk Management

Fintech companies are at the forefront of innovation in credit risk management, leveraging advanced technologies to develop new approaches to credit scoring and risk assessment. They often utilize alternative data sources and advanced analytical techniques to assess creditworthiness for individuals and businesses traditionally underserved by traditional financial institutions. For example, some fintech lenders use mobile phone data to assess creditworthiness, providing access to credit for individuals with limited or no credit history. Others employ blockchain technology to enhance transparency and security in credit transactions, improving the efficiency and reducing the risks associated with lending. These innovations are expanding access to credit while also improving risk management practices.

Case Studies in Credit Risk Management

Analyzing real-world examples of effective and ineffective credit risk management provides valuable insights for practitioners. These case studies highlight the critical importance of robust risk assessment, mitigation strategies, and regulatory compliance in achieving financial stability. By examining both successes and failures, we can identify best practices and avoid costly mistakes.

Effective Credit Risk Management Preventing Significant Losses: The Case of Wells Fargo’s Enhanced Underwriting in 2008

During the 2008 financial crisis, many financial institutions suffered substantial losses due to defaults on mortgages and other credit products. However, Wells Fargo, while not entirely unscathed, demonstrated a relatively stronger performance partly attributed to its enhanced underwriting standards implemented several years prior. Before the crisis hit, Wells Fargo focused on rigorous credit scoring, thorough due diligence, and a conservative lending approach. They prioritized borrowers with strong credit histories and stable incomes, minimizing exposure to high-risk borrowers. This proactive approach, although potentially limiting short-term growth, significantly reduced their losses compared to competitors who had adopted more lenient lending practices. Their stringent criteria, coupled with a diversified loan portfolio, enabled them to weather the storm more effectively. The meticulous documentation and risk assessment processes allowed for better identification and management of troubled loans. This case highlights the importance of a long-term perspective on risk management, prioritizing stability over short-term gains.

Consequences of Poor Credit Risk Management: The Collapse of Lehman Brothers

Lehman Brothers’ collapse in 2008 serves as a stark reminder of the devastating consequences of inadequate credit risk management. The firm’s aggressive pursuit of high-yield investments, coupled with insufficient diversification and inadequate risk assessment, led to a significant buildup of exposure to subprime mortgages. Lehman Brothers relied heavily on complex financial instruments and leveraged transactions, which obscured the true extent of their risk exposure. Their risk models failed to accurately predict the severity of the housing market downturn, and their internal controls were insufficient to prevent excessive risk-taking. A lack of transparency and a culture that prioritized short-term profits over long-term stability contributed to the firm’s downfall. The absence of adequate stress testing and contingency planning exacerbated the impact of the crisis, ultimately leading to bankruptcy and significant losses for investors and creditors. The lack of a robust early warning system and insufficient capital reserves compounded the problem.

Comparison of Case Studies: Key Lessons Learned

The contrasting experiences of Wells Fargo and Lehman Brothers highlight the crucial role of proactive and robust credit risk management. Wells Fargo’s conservative approach, emphasis on due diligence, and diversified portfolio minimized losses during the 2008 crisis. In contrast, Lehman Brothers’ aggressive risk-taking, lack of transparency, and inadequate risk assessment led to its collapse. Key lessons include the importance of thorough due diligence, conservative lending practices, accurate risk modeling, strong internal controls, diversified portfolios, stress testing, and a risk-averse corporate culture. Effective communication and transparency within the organization are also crucial for successful credit risk management. Furthermore, maintaining sufficient capital reserves to absorb potential losses is vital.

Hypothetical Case Study: Credit Risk Management in the Renewable Energy Sector

Imagine a hypothetical solar energy company, “SolarBright,” seeking financing to expand its operations. SolarBright is evaluating various financing options, including bank loans and green bonds. To effectively manage credit risk, SolarBright would conduct a comprehensive credit risk assessment, considering factors such as project feasibility, technological risks, regulatory changes (e.g., government subsidies), and the variability of energy production (weather dependence). Mitigation strategies could include diversifying project locations, securing long-term power purchase agreements, and obtaining insurance to cover potential losses. SolarBright would also develop robust financial models to forecast cash flows and assess the sensitivity of their projects to various risk factors. Regular monitoring and reporting would be essential to identify and address emerging risks promptly. Compliance with relevant environmental regulations and reporting standards would also be crucial. By implementing a comprehensive credit risk management framework, SolarBright can effectively manage its financial risks and secure sustainable growth in the renewable energy sector.

Last Recap

Successfully managing credit risk requires a proactive and comprehensive strategy that blends robust assessment methodologies, effective mitigation techniques, and a deep understanding of regulatory compliance. By leveraging technological advancements and continuously adapting to evolving market dynamics, organizations can significantly reduce their exposure to credit risk and enhance their overall financial resilience. This guide provides a foundation for developing such a strategy, empowering organizations to make informed decisions and build a sustainable future.

General Inquiries

What is the difference between default risk and concentration risk?

Default risk is the risk that a borrower will fail to repay a loan. Concentration risk is the risk of significant losses arising from an over-reliance on a limited number of borrowers or industries.

How often should credit risk assessments be updated?

The frequency depends on various factors, including the borrower’s risk profile and the economic environment. Regular reviews, at least annually, are generally recommended, with more frequent updates for higher-risk borrowers.

What are the consequences of inaccurate credit scoring?

Inaccurate credit scoring can lead to incorrect lending decisions, resulting in increased losses due to defaults or missed opportunities for profitable lending. It can also damage a borrower’s creditworthiness unfairly.