Indonesia’s journey towards sustainable development hinges significantly on the adoption and effective implementation of “Keuangan Berkelanjutan,” or sustainable finance. This evolving field integrates environmental, social, and governance (ESG) factors into traditional financial decision-making, creating a paradigm shift towards responsible investment and economic growth. Understanding its principles, strategies, and regulatory landscape is crucial for navigating this transformative era.

This exploration delves into the core tenets of Keuangan Berkelanjutan, examining its unique application within the Indonesian context. We will analyze diverse investment strategies, regulatory frameworks, and the pivotal role of financial institutions in driving this transition. Furthermore, we will assess the challenges and opportunities presented by this rapidly evolving sector, highlighting its potential to foster both economic prosperity and environmental stewardship.

Defining Sustainable Finance (“Keuangan Berkelanjutan”)

Sustainable finance, or “Keuangan Berkelanjutan” in Indonesian, integrates environmental, social, and governance (ESG) considerations into financial decision-making. It aims to create long-term value by balancing financial returns with positive social and environmental impacts. This approach is gaining significant traction globally, and Indonesia, with its rich biodiversity and developing economy, is actively embracing this paradigm shift.

Core Principles of Sustainable Finance in the Indonesian Context

The core principles of sustainable finance in Indonesia align with global best practices but are tailored to address the country’s specific challenges and opportunities. These include promoting inclusive growth, mitigating climate change risks, conserving natural resources, and fostering good governance. Key aspects focus on responsible resource management, particularly in sectors like palm oil and mining, where sustainability concerns are paramount. Furthermore, initiatives promoting financial inclusion for marginalized communities are also considered crucial. The Indonesian government actively supports sustainable finance through various policies and regulations, encouraging both public and private sector participation.

Key Differences Between Traditional Finance and Sustainable Finance

Traditional finance primarily focuses on maximizing short-term financial returns with limited consideration for ESG factors. Sustainable finance, conversely, takes a long-term perspective, incorporating ESG factors into investment decisions to create both financial and societal value. Traditional finance often overlooks environmental and social risks, potentially leading to unforeseen financial losses in the long run. Sustainable finance actively identifies and manages these risks, viewing them as opportunities for innovation and positive impact. The assessment of a project’s viability differs significantly; traditional finance relies heavily on quantitative financial metrics, while sustainable finance employs a more holistic approach, encompassing qualitative ESG assessments.

Examples of Successful Sustainable Finance Initiatives in Indonesia

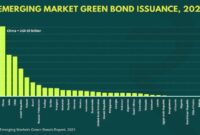

Several successful initiatives showcase Indonesia’s commitment to sustainable finance. For example, the development of green bonds to finance renewable energy projects has gained momentum, attracting both domestic and international investors. Microfinance institutions have played a significant role in providing financial access to underserved communities, promoting social inclusion and economic empowerment. Furthermore, several companies have adopted sustainable business practices, attracting investors who value ESG performance. These initiatives demonstrate a growing recognition of the interconnectedness between financial performance and sustainable development.

ESG Factors Considered in Sustainable Finance

The following table provides a breakdown of the environmental, social, and governance (ESG) factors considered in sustainable finance:

| Environmental (E) | Social (S) | Governance (G) |

|---|---|---|

| Greenhouse gas emissions | Labor standards and practices | Board diversity and independence |

| Water usage and management | Community relations and engagement | Executive compensation and incentives |

| Waste management and pollution | Human rights and ethical sourcing | Corruption prevention and compliance |

| Biodiversity conservation | Product safety and quality | Risk management and transparency |

Investment Strategies in Sustainable Finance

Sustainable finance offers a diverse range of investment strategies that align financial returns with positive environmental and social impacts. These strategies go beyond traditional investment approaches by explicitly considering ESG (Environmental, Social, and Governance) factors and aiming to contribute to a more sustainable future. The key is to understand the nuances of each strategy and the associated risks and opportunities before making investment decisions.

Types of Sustainable Investment Strategies

Several distinct investment strategies fall under the umbrella of sustainable finance. These strategies vary in their approach, ranging from integrating ESG factors into traditional investment analysis to directly investing in projects with measurable social and environmental benefits. Understanding the differences is crucial for tailoring an investment portfolio to specific goals and risk tolerances.

- ESG Integration: This involves incorporating ESG factors into traditional investment analysis alongside financial metrics. This allows investors to identify companies with strong ESG profiles and potentially lower long-term risks. For example, an investor might prioritize companies with robust climate change mitigation strategies, ethical labor practices, and strong corporate governance.

- Negative Screening: This approach excludes companies involved in specific activities deemed unsustainable, such as those with high carbon emissions, poor labor practices, or involvement in controversial weapons. This allows investors to align their portfolios with their values and avoid companies that present significant ESG risks.

- Positive Screening: This strategy focuses on investing in companies or projects that demonstrably contribute to environmental and social good. This might include renewable energy companies, sustainable agriculture businesses, or organizations promoting social inclusion.

- Impact Investing: This approach aims to generate measurable social and environmental impact alongside a financial return. Investors actively seek opportunities to address specific social or environmental challenges while earning a competitive return. This could involve investing in microfinance institutions, community development projects, or companies focused on clean technologies.

- Thematic Investing: This strategy focuses on investing in companies and projects within specific sectors aligned with sustainable development goals, such as renewable energy, green technology, or sustainable agriculture. It allows for targeted investments in areas deemed crucial for a sustainable future.

Risks and Opportunities in Sustainable Investing

Sustainable investing, while offering significant opportunities, also presents unique risks. A thorough understanding of both is crucial for informed decision-making.

Opportunities: Sustainable investments can offer long-term growth potential, driven by the increasing demand for sustainable products and services. Companies with strong ESG profiles often demonstrate greater resilience and adaptability to changing market conditions. Furthermore, governments and international organizations are increasingly promoting sustainable finance, leading to supportive policies and regulations. The potential for positive social and environmental impact is another significant driver for investors.

Risks: Sustainable investments can sometimes be subject to higher volatility than traditional investments due to their focus on emerging sectors and technologies. The measurement and verification of social and environmental impact can also be challenging, potentially leading to “greenwashing” where companies exaggerate their sustainability credentials. There is also the risk of regulatory changes affecting the sustainability of certain investments. Finally, illiquidity in certain sustainable investment markets can pose a challenge for investors.

Sustainable Investment Vehicles: A Comparison

Various financial instruments facilitate sustainable investing. Each has its own characteristics, benefits, and risks.

Green Bonds: These are debt securities specifically issued to finance environmentally friendly projects, such as renewable energy infrastructure or energy efficiency improvements. They offer a fixed income stream and contribute to sustainable development. However, they can be subject to market risks and interest rate fluctuations.

Impact Investing Funds: These funds pool capital from multiple investors to invest in projects with measurable social and environmental impact. They offer diversification and professional management but may have higher fees than traditional investment funds. The impact measurement process can be complex and require specialized expertise.

Sustainable Equity Funds: These funds invest in publicly traded companies that meet specific ESG criteria. They offer diversification and liquidity, but their performance can be influenced by broader market trends. The selection of companies within the fund is crucial for aligning with specific sustainability goals.

Hypothetical Sustainable Investment Portfolio for a Mid-Sized Indonesian Company

Let’s consider a hypothetical sustainable investment portfolio for a mid-sized Indonesian company with a moderate risk tolerance and a commitment to sustainability.

The portfolio would diversify across different asset classes and sustainable investment strategies to balance risk and return. A potential allocation might include:

- 30% Green Bonds: Investing in Indonesian green bonds financing renewable energy projects would contribute to the country’s sustainable development goals while generating a stable income stream.

- 30% Sustainable Equity Funds: Investing in regional sustainable equity funds focused on companies with strong ESG profiles in sectors like sustainable agriculture and tourism would provide diversification and exposure to growth opportunities.

- 20% Impact Investing Funds: Allocating funds to impact investing funds focusing on microfinance and community development projects in Indonesia would generate social impact alongside a financial return. This would support local communities and contribute to poverty reduction.

- 20% ESG Integrated Equity: Direct investment in Indonesian companies with strong ESG profiles across various sectors would provide exposure to the local market and align with the company’s sustainability values.

This portfolio aims to balance financial returns with social and environmental impact, reflecting the company’s commitment to sustainability while managing risk through diversification. The specific asset choices within each category would be carefully selected based on thorough due diligence and risk assessment.

Regulatory Landscape and Policy

Indonesia’s burgeoning sustainable finance sector is significantly shaped by its evolving regulatory landscape and government policies. A comprehensive understanding of these frameworks is crucial for investors, businesses, and policymakers alike to navigate the opportunities and challenges presented by this rapidly growing field. This section delves into the specifics of Indonesian regulations, compares them to regional counterparts, and highlights key government initiatives.

Existing Indonesian regulations and policies supporting sustainable finance are multifaceted and increasingly sophisticated. The Financial Services Authority (Otoritas Jasa Keuangan or OJK) plays a central role, issuing various regulations and guidelines promoting environmentally and socially responsible investments. These regulations cover various aspects of the financial sector, including banking, capital markets, and insurance, encouraging the integration of Environmental, Social, and Governance (ESG) factors into investment decisions and corporate practices. Furthermore, the government actively promotes sustainable infrastructure projects through various funding mechanisms and tax incentives.

Indonesian Regulations Supporting Sustainable Finance

The OJK has issued numerous regulations and guidelines directly related to sustainable finance. These include regulations on green bonds, social bonds, and sustainable finance disclosures. For instance, regulations mandate certain disclosures related to ESG factors for publicly listed companies, pushing for greater transparency and accountability. The OJK also provides guidance on the development of sustainable finance products and services, encouraging financial institutions to integrate ESG considerations into their risk management frameworks. These regulations are continuously being updated and refined to align with international best practices and the evolving needs of the Indonesian economy.

Challenges and Opportunities in Strengthening the Regulatory Framework

While Indonesia has made significant strides in developing its sustainable finance regulatory framework, challenges remain. Harmonizing regulations across different sectors and agencies is crucial to avoid inconsistencies and regulatory arbitrage. Furthermore, enhancing the capacity of regulators and market participants to understand and implement complex ESG standards is necessary. Opportunities lie in strengthening collaboration between government agencies, the private sector, and international organizations to develop robust standards and guidelines. This includes fostering greater transparency and data availability on ESG performance, which will attract more investment and improve market efficiency. A key opportunity also lies in leveraging technology to enhance monitoring and enforcement of regulations.

Comparative Analysis of Indonesia’s Sustainable Finance Regulations with Other ASEAN Countries

Compared to other ASEAN countries, Indonesia’s regulatory framework for sustainable finance is relatively well-developed, though the pace of implementation and enforcement varies. Countries like Singapore and Malaysia have established themselves as regional leaders in green finance, boasting more mature regulatory frameworks and a larger pool of green bonds. However, Indonesia’s vast potential and commitment to sustainable development offer significant opportunities for growth. The country’s unique challenges, such as its high dependence on natural resources and the need for inclusive growth, provide a specific context that requires tailored regulatory approaches. Further comparative studies focusing on specific regulatory areas like green taxonomy, disclosure requirements, and enforcement mechanisms would provide a more granular understanding of the relative strengths and weaknesses of different ASEAN countries.

Key Government Initiatives Promoting Sustainable Finance in Indonesia

The Indonesian government has launched several initiatives to boost sustainable finance:

- National Action Plan for Sustainable Finance: This comprehensive plan Artikels strategies and targets for integrating sustainability into the financial system.

- Tax Incentives for Green Investments: The government offers various tax incentives to encourage investment in green projects and sustainable businesses.

- Development of Green Sukuk: Indonesia has been a pioneer in issuing green sukuk (Islamic bonds), attracting global investment in sustainable infrastructure.

- Strengthening ESG Disclosure Requirements: Regulations mandate greater transparency on ESG performance for publicly listed companies.

- Capacity Building Programs: The government supports training programs to enhance the knowledge and skills of market participants in sustainable finance.

The Role of Financial Institutions

Financial institutions play a pivotal role in the transition to a sustainable economy. Their lending, investment, and insurance activities have a significant impact on the allocation of capital, directly influencing the trajectory of economic development and environmental protection. By integrating Environmental, Social, and Governance (ESG) factors into their core business strategies, these institutions can effectively channel capital towards sustainable projects and incentivize businesses to adopt more responsible practices.

Financial institutions, including banks, insurance companies, and asset managers, are increasingly recognizing the financial risks associated with unsustainable practices and the opportunities presented by the growing demand for sustainable investments. This shift is driven by a combination of factors, including growing investor awareness of ESG issues, increasing regulatory pressure, and a rising recognition of the long-term financial benefits of sustainable business models.

Banks’ Integration of ESG Factors in Lending

Banks are integrating ESG factors into their credit risk assessments and lending decisions. This involves evaluating the environmental and social impacts of potential borrowers and incorporating those assessments into their lending criteria. For example, banks may offer preferential lending rates to companies with strong ESG performance or refuse to finance projects with significant negative environmental or social consequences, such as those contributing to deforestation or human rights violations. This approach mitigates risks associated with unsustainable activities and aligns lending portfolios with broader sustainability goals. Many banks now conduct due diligence processes that incorporate ESG considerations into their loan approval processes. These processes might involve reviewing a company’s environmental permits, assessing its social impact, and verifying its governance structures.

Insurance Companies and Sustainable Investments

Insurance companies are increasingly incorporating ESG factors into their investment portfolios and underwriting decisions. By investing in companies with strong ESG profiles, they can both reduce their exposure to environmental and social risks and generate returns from the growth of the sustainable investment market. In underwriting, insurance companies can assess the risks associated with climate change and other environmental hazards, adjusting premiums accordingly and potentially incentivizing risk mitigation measures by their clients. For example, insurance companies might offer discounts to businesses that implement energy-efficient technologies or adopt sustainable practices.

Measuring and Managing Environmental and Social Impacts

Effective measurement and management of environmental and social impacts are crucial for financial institutions to demonstrate their commitment to sustainability. This involves developing robust methodologies for assessing the ESG performance of their investments and lending activities. Such methodologies often incorporate internationally recognized standards and frameworks, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) standards. Financial institutions are increasingly using data analytics and other advanced technologies to monitor and track the environmental and social impacts of their activities, allowing for continuous improvement and more informed decision-making. Regular reporting on ESG performance to stakeholders builds transparency and accountability.

Case Study: Bank Rakyat Indonesia (BRI) and Sustainable Finance

Bank Rakyat Indonesia (BRI), one of Indonesia’s largest banks, has actively incorporated sustainable finance principles into its operations. BRI has developed a dedicated sustainable finance unit that focuses on financing projects related to renewable energy, sustainable agriculture, and environmental conservation. The bank has also implemented stringent ESG criteria for its lending and investment decisions, prioritizing projects that align with the Sustainable Development Goals (SDGs). Furthermore, BRI actively promotes financial inclusion by providing access to financial services for underserved communities, contributing to social sustainability. BRI’s commitment to sustainable finance is evident in its increasing portfolio of green loans and investments, as well as its public reporting on its ESG performance. This demonstrates a proactive approach to integrating sustainability into core banking operations and contributes to Indonesia’s broader sustainable development goals.

Measuring and Reporting Sustainability Performance

Accurately measuring and reporting a company’s sustainability performance is crucial for attracting investors, managing risks, and demonstrating a commitment to environmental, social, and governance (ESG) principles. This involves selecting appropriate metrics, utilizing established frameworks, and transparently communicating findings to stakeholders. The process allows businesses to track progress, identify areas for improvement, and build trust with investors concerned about the long-term sustainability of their investments.

The methods used to measure and report sustainability performance are diverse, reflecting the multifaceted nature of ESG considerations. They range from qualitative assessments of ethical practices to quantitative analyses of environmental impacts and social contributions. Effective reporting requires a combination of both.

Methods for Measuring and Reporting Sustainability Performance

Several approaches exist for measuring and reporting sustainability performance. These include self-assessment questionnaires, materiality assessments, life cycle assessments (LCAs), and the use of standardized reporting frameworks. Self-assessment questionnaires provide a basic overview of a company’s sustainability practices. Materiality assessments identify the ESG issues most relevant to a company’s business and stakeholders. LCAs evaluate the environmental impacts of a product or service throughout its entire life cycle, from raw material extraction to disposal. Standardized reporting frameworks, like GRI and SASB, offer a structured approach to disclosing sustainability information.

Key Performance Indicators (KPIs) for Sustainable Finance in Indonesia

Identifying relevant KPIs is crucial for effective sustainability reporting. In Indonesia, key indicators might include greenhouse gas emissions (Scope 1, 2, and 3), water consumption and efficiency, waste generation and management, biodiversity impact, labor practices (including fair wages and working conditions), community engagement initiatives, and adherence to Indonesian environmental regulations. Specific KPIs will vary depending on the industry and the company’s specific operations. For example, a palm oil company would prioritize deforestation rates and land use change, while a banking institution would focus on its lending practices related to environmentally sensitive sectors.

Comparison of Sustainability Reporting Frameworks

Several frameworks provide guidance on sustainability reporting. The Global Reporting Initiative (GRI) is a widely used framework offering comprehensive guidelines on a broad range of ESG issues. The Sustainability Accounting Standards Board (SASB) focuses on financially material ESG issues specific to different industries. GRI offers a more holistic approach, covering a wider range of topics, while SASB emphasizes materiality, focusing on issues that significantly impact a company’s financial performance. Both frameworks promote transparency and comparability but differ in their scope and emphasis.

Sustainability Report Template for an Indonesian Company

A comprehensive sustainability report for an Indonesian company should include:

| Section | Key Metrics and Disclosures |

|---|---|

| Executive Summary | Overview of sustainability performance, key achievements, and challenges. |

| Governance | Board oversight of sustainability, sustainability policies and strategies. |

| Environmental Performance | Greenhouse gas emissions (Scope 1, 2, and 3), water usage, waste management, energy consumption, biodiversity impact, compliance with environmental regulations. |

| Social Performance | Labor standards, human rights, community engagement, health and safety, supply chain sustainability. |

| Economic Performance | Economic contributions, job creation, tax payments, stakeholder engagement. |

| Materiality Assessment | Identification of key ESG issues impacting the company’s business and stakeholders. |

| Assurance | Independent verification of reported data. |

It is crucial that the report be transparent, verifiable, and consistent with internationally recognized standards. This builds trust and credibility with stakeholders.

Challenges and Opportunities

Sustainable finance in Indonesia faces a complex interplay of challenges and opportunities. While the country possesses significant potential for growth in this sector, several hurdles need to be overcome to unlock its full capacity. Addressing these challenges effectively will pave the way for innovative solutions and substantial progress towards a more sustainable financial ecosystem.

Major Challenges Hindering Growth

Several key factors impede the expansion of sustainable finance in Indonesia. These include a lack of standardized metrics and reporting frameworks, limited awareness and understanding among investors and businesses, and insufficient access to capital for sustainable projects. Furthermore, regulatory frameworks, while evolving, still require further development and clarity to fully support sustainable finance initiatives. The relatively underdeveloped green bond market also poses a significant challenge.

Opportunities for Growth and Innovation

Despite the challenges, Indonesia presents a wealth of opportunities for growth and innovation in sustainable finance. The country’s rapidly growing economy, coupled with its substantial renewable energy potential and increasing focus on environmental, social, and governance (ESG) factors, creates a fertile ground for investment. The development of green infrastructure projects, particularly in renewable energy, sustainable agriculture, and eco-tourism, presents significant investment opportunities. Moreover, the burgeoning digital economy provides a platform for innovative financial solutions that can support sustainable practices. Indonesia’s large population also presents a vast market for green products and services.

Technological Advancements Supporting Sustainable Finance

Technological advancements are crucial for scaling up sustainable finance initiatives in Indonesia. Fintech solutions can enhance access to finance for small and medium-sized enterprises (SMEs) involved in sustainable activities. Blockchain technology can improve transparency and traceability in supply chains, enabling better monitoring of ESG performance. Big data analytics and artificial intelligence (AI) can be leveraged to assess risks and opportunities related to sustainability, leading to more informed investment decisions. For example, AI-powered platforms can analyze satellite imagery to monitor deforestation and assess the environmental impact of various projects.

Visual Representation of Challenges and Opportunities

The visual representation would be a two-sided balance scale. On one side, representing “Challenges,” would be several weighted objects symbolizing the key obstacles: a locked padlock (representing regulatory hurdles), a question mark (representing lack of awareness), a small pile of coins (representing limited capital), and a fragmented jigsaw puzzle (representing lack of standardized metrics). On the other side, representing “Opportunities,” would be similarly weighted objects: a rising sun (representing economic growth), a lush green plant (representing renewable energy potential), a network of interconnected nodes (representing technological advancements), and a large upward-pointing arrow (representing market growth). The scale would be slightly tilted towards the “Opportunities” side, indicating the overall positive potential despite the existing challenges. The visual would clearly communicate the balanced nature of the situation, highlighting both the obstacles and the promising prospects for sustainable finance in Indonesia.

Last Recap

The integration of Keuangan Berkelanjutan into Indonesia’s financial system presents a compelling narrative of responsible growth and sustainable development. While challenges remain in strengthening regulatory frameworks and fostering widespread adoption, the opportunities for innovation and positive impact are immense. By embracing ESG principles and strategically integrating sustainable finance practices, Indonesia can pave the way for a more equitable and environmentally conscious future, attracting responsible investment and fostering long-term economic prosperity.

Clarifying Questions

What are the potential risks of investing in sustainable projects?

While offering significant opportunities, sustainable investments also carry certain risks, including potential lower returns compared to traditional investments in the short-term, greenwashing (misrepresentation of sustainability efforts), and regulatory uncertainty.

How can I identify greenwashing in sustainable finance?

Look for transparent and verifiable ESG data, independent certifications, and clear articulation of the project’s environmental and social impact. Be wary of vague or overly optimistic claims lacking specific metrics.

What are some examples of successful sustainable finance initiatives outside Indonesia?

Examples include the European Union’s Taxonomy for sustainable activities, the green bond markets in various developed countries, and numerous corporate sustainability initiatives focused on carbon reduction and social responsibility.