Sustainable finance is rapidly evolving, transforming how we invest and manage capital. It integrates environmental, social, and governance (ESG) factors into financial decision-making, aiming to create a more equitable and sustainable future. This exploration delves into the core principles, investment strategies, regulatory landscapes, and technological advancements shaping this crucial field.

From green bonds and impact investing to the role of blockchain and artificial intelligence, we examine the diverse approaches driving positive change. We’ll analyze both successes and failures, offering insights into best practices and future trends. The goal is to provide a clear understanding of sustainable finance’s potential to address global challenges while fostering economic growth.

Defining Sustainable Finance Initiatives

Sustainable finance initiatives represent a rapidly growing field focused on aligning financial decisions with environmental and social goals. This approach seeks to integrate environmental, social, and governance (ESG) factors into investment decisions, aiming for long-term value creation while mitigating risks associated with climate change and social inequalities. The core principles underpinning these initiatives are interconnected and essential for their success.

Sustainable finance initiatives are guided by several core principles. Firstly, there’s a strong emphasis on long-term value creation, recognizing that environmental and social factors significantly impact a company’s long-term viability and profitability. Secondly, a focus on materiality ensures that only the most significant ESG issues impacting a business are considered. Thirdly, transparency and accountability are paramount, requiring clear reporting and verification of ESG performance. Finally, stakeholder engagement is crucial, fostering collaboration among investors, businesses, and communities to achieve shared goals.

Types of Sustainable Finance Initiatives

Several distinct types of sustainable finance initiatives exist, each playing a vital role in directing capital towards sustainable activities. These initiatives range from green bonds, which finance specific environmental projects, to impact investing, which prioritizes measurable social and environmental impact alongside financial returns. Sustainable finance also encompasses socially responsible investing (SRI), which screens investments based on ESG criteria, and microfinance, which provides small loans to individuals and businesses in developing countries to foster economic growth and social development. Furthermore, there is a growing emphasis on sustainable supply chain finance, encouraging businesses to incorporate ESG considerations into their supply chains.

Examples of Successful Sustainable Finance Projects

The renewable energy sector provides numerous examples of successful sustainable finance projects. For instance, the development of large-scale solar and wind farms has been significantly fueled by green bonds, attracting substantial investment from institutional investors committed to environmental sustainability. In the transportation sector, electric vehicle manufacturers have benefited from sustainable investments, driving innovation and reducing carbon emissions. Similarly, sustainable agriculture projects, focused on improving farming practices and reducing deforestation, have attracted significant funding through impact investing initiatives, demonstrating the positive impact of sustainable finance on various sectors. Finally, in the urban development sphere, green building initiatives have seen increased funding through green bonds and other sustainable finance instruments, leading to the construction of energy-efficient and environmentally friendly buildings.

Measuring the Impact of Sustainable Finance Initiatives

Measuring the impact of sustainable finance initiatives presents a complex challenge. Various approaches exist, each with strengths and limitations. Traditional financial metrics, such as return on investment (ROI), can be supplemented by ESG ratings and impact assessments. However, these approaches often struggle to capture the full complexity of environmental and social impacts. Some initiatives utilize standardized frameworks like the Global Reporting Initiative (GRI) standards or the Sustainability Accounting Standards Board (SASB) standards to enhance transparency and comparability. Furthermore, increasingly sophisticated data analytics and modelling techniques are being employed to better quantify the impact of sustainable investments on climate change and other relevant factors. A key challenge remains in establishing consistent and universally accepted metrics for measuring and comparing the impact of different sustainable finance initiatives across diverse sectors and geographies.

Investment Strategies in Sustainable Finance

Sustainable finance offers a compelling blend of financial returns and positive societal impact. Investors are increasingly incorporating environmental, social, and governance (ESG) factors into their decision-making processes, recognizing the interconnectedness of financial performance and sustainability. This shift reflects a growing awareness of the long-term risks associated with unsustainable practices and the opportunities presented by the transition to a more sustainable economy.

The Role of ESG Factors in Investment Decisions

ESG factors are now integral to evaluating investment opportunities. Environmental considerations encompass a company’s carbon footprint, resource efficiency, and waste management practices. Social aspects include labor standards, human rights, community engagement, and product safety. Governance factors focus on board diversity, executive compensation, corruption prevention, and shareholder rights. A strong ESG profile can signal lower risk and greater resilience, potentially leading to improved financial performance in the long run. Conversely, companies with weak ESG performance may face increased regulatory scrutiny, reputational damage, and ultimately, lower returns. Many investors now use ESG ratings and data to screen investments, integrating these factors into their quantitative models alongside traditional financial metrics.

Examples of Investment Strategies Focused on Sustainable Development Goals (SDGs)

Investment strategies aligned with the UN’s SDGs target specific areas of sustainable development. For instance, investments in renewable energy (SDG 7: Affordable and Clean Energy) aim to reduce reliance on fossil fuels and mitigate climate change. Investments in sustainable agriculture (SDG 2: Zero Hunger) focus on improving food security and reducing environmental impacts. Furthermore, investments in affordable housing (SDG 11: Sustainable Cities and Communities) contribute to inclusive urban development. Impact investing, a specific strategy, seeks to generate measurable social and environmental impact alongside financial returns. For example, a microfinance institution providing loans to women entrepreneurs in developing countries contributes to SDG 5: Gender Equality while generating a financial return for investors.

Challenges and Opportunities of Investing in Sustainable Infrastructure Projects

Sustainable infrastructure projects, such as green buildings, renewable energy grids, and efficient public transportation systems, present both challenges and opportunities. Challenges include the higher upfront capital costs compared to traditional infrastructure, longer project timelines due to regulatory approvals and technological complexities, and the need for innovative financing mechanisms to attract investors. However, the opportunities are substantial. These projects offer the potential for long-term, stable returns, contribute to economic growth and job creation, and deliver significant environmental and social benefits. Government incentives, such as tax breaks and subsidies, can mitigate some of the upfront cost challenges and stimulate investment in this sector. Moreover, the growing demand for sustainable infrastructure globally presents a significant market opportunity for investors.

Risk and Return Profiles: Traditional vs. Sustainable Investments

| Investment Type | Risk Profile | Return Profile | Long-Term Outlook |

|---|---|---|---|

| Traditional Investments (e.g., fossil fuels) | Potentially high, especially considering climate-related risks and regulatory changes. | Historically high, but potentially volatile and declining due to increasing competition and sustainability concerns. | Uncertain, with increasing risks associated with climate change and shifting societal preferences. |

| Sustainable Investments (e.g., renewable energy) | Moderate to high, depending on the specific project and technology. | Potentially high and stable, driven by growing demand and government support. | Positive, with strong growth potential driven by global sustainability trends. |

Regulatory Frameworks and Policies

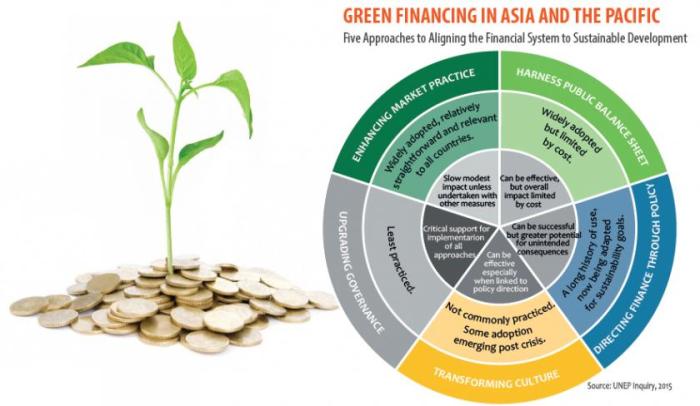

The global push towards sustainable finance is increasingly supported by a complex web of regulatory frameworks and policies. These initiatives aim to channel investment towards environmentally and socially responsible projects, mitigating risks associated with climate change and fostering a more equitable financial system. Understanding these frameworks is crucial for investors, businesses, and policymakers alike.

Key Global Regulatory Frameworks and Policies

Several significant regulatory frameworks and policies are driving the growth of sustainable finance worldwide. These initiatives vary in scope and approach, but share a common goal: to integrate environmental, social, and governance (ESG) factors into financial decision-making. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) mandates specific disclosures related to ESG risks and opportunities, increasing transparency for investors. Similarly, the Task Force on Climate-related Financial Disclosures (TCFD) provides a framework for companies to disclose climate-related risks and opportunities, influencing investment decisions based on climate resilience. In the United States, while a comprehensive federal framework is still developing, various initiatives at the state and agency levels are promoting sustainable finance, including regulations related to green bonds and ESG investing. These examples highlight the growing international momentum toward standardizing and enhancing sustainable finance reporting and practices.

Impact of Carbon Pricing Mechanisms on Investment Decisions

Carbon pricing mechanisms, such as carbon taxes and emissions trading schemes (ETS), significantly influence investment decisions by internalizing the environmental cost of carbon emissions. A carbon tax directly increases the cost of carbon-intensive activities, making cleaner alternatives more economically attractive. Conversely, an ETS creates a market for carbon emissions allowances, where companies can buy and sell permits to emit. This market-based approach incentivizes emissions reductions by making allowances more expensive as demand increases. The impact on investment decisions is evident in sectors like energy, transportation, and manufacturing, where companies are increasingly investing in renewable energy, energy efficiency, and carbon capture technologies to reduce their carbon footprint and comply with regulations. For example, the European Union Emissions Trading System (EU ETS) has driven significant investment in renewable energy projects across Europe.

International Collaborations in Shaping Sustainable Finance Regulations

International collaborations play a vital role in harmonizing sustainable finance regulations and fostering a globally consistent approach. Organizations like the Network for Greening the Financial System (NGFS) bring together central banks and supervisors to share best practices and coordinate policies related to climate change and sustainable finance. The International Sustainability Standards Board (ISSB) aims to develop a globally consistent baseline of sustainability-related disclosure standards, reducing the complexity and costs associated with complying with different national regulations. These collaborations ensure a more integrated and effective response to the global challenges of climate change and sustainable development, preventing regulatory fragmentation and promoting a level playing field for businesses operating internationally.

Hypothetical Policy Framework to Incentivize Sustainable Lending Practices

A hypothetical policy framework to incentivize sustainable lending could incorporate several key elements. First, a tiered system of preferential regulatory capital treatment could be implemented, offering lower capital requirements for banks that meet specific targets for sustainable lending. This would reduce the cost of capital for sustainable lending, making it more attractive for banks. Second, government-backed guarantees or subsidized loan programs could be established for projects meeting pre-defined sustainability criteria. This would reduce the risk associated with sustainable lending, encouraging greater participation from banks. Third, mandatory sustainability assessments for loan applications could be introduced, ensuring that environmental and social considerations are integrated into lending decisions. This transparency would further incentivize sustainable lending practices and inform investment choices. Finally, a public reporting mechanism could track and disclose banks’ performance in sustainable lending, promoting competition and accountability. Such a framework would incentivize banks to shift their lending portfolios towards more sustainable projects, contributing to broader economic and environmental goals.

Measuring and Reporting Sustainability Performance

Accurately measuring and reporting the sustainability performance of investments is crucial for driving genuine positive impact and fostering trust among stakeholders. This involves a multifaceted approach encompassing both environmental and social considerations, relying on robust methodologies and standardized frameworks to ensure transparency and comparability.

Methods for Measuring Environmental and Social Impact

Various methods exist to quantify the environmental and social impact of investments. These range from established metrics like carbon footprint calculations and greenhouse gas emissions accounting to more nuanced assessments of social equity and community development. For example, the carbon footprint of an investment in renewable energy can be calculated by measuring the direct and indirect greenhouse gas emissions associated with its construction and operation. Social impact might be measured using qualitative methods such as stakeholder surveys or quantitative indicators such as job creation or improvements in local infrastructure. Life Cycle Assessments (LCAs) provide a comprehensive analysis of environmental impacts across a product or service’s entire lifecycle, from raw material extraction to disposal. Similarly, Social Life Cycle Assessments (S-LCAs) examine the social impacts throughout this lifecycle. The selection of appropriate methods depends heavily on the specific investment and its associated impacts.

Standardized Reporting Frameworks for Sustainable Finance

Several standardized reporting frameworks provide a common language and structure for communicating sustainability performance. The Global Reporting Initiative (GRI) Standards offer a widely used framework for sustainability reporting, covering a broad range of environmental, social, and governance (ESG) issues. The Sustainability Accounting Standards Board (SASB) Standards focus on financially material ESG issues specific to different industries. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations encourage companies to disclose climate-related risks and opportunities. The European Union’s Corporate Sustainability Reporting Directive (CSRD) mandates sustainability reporting for a large number of companies within the EU, further emphasizing the growing importance of standardized frameworks. These frameworks provide a structured approach to data collection, analysis, and disclosure, promoting greater transparency and comparability across investments.

Challenges in Ensuring Transparency and Accuracy

Despite the availability of standardized frameworks, several challenges hinder the achievement of complete transparency and accuracy in sustainability reporting. Data availability and quality remain significant hurdles. Consistent data collection methodologies are often lacking, leading to inconsistencies in reporting. The complexities of measuring certain ESG factors, such as social equity or biodiversity, can also pose challenges. Furthermore, “greenwashing,” or the misrepresentation of sustainability performance, remains a significant concern, undermining the credibility of sustainability reporting. Ensuring the independence and expertise of verification bodies is also critical for building trust in reported data. Finally, the evolving nature of ESG standards and regulations adds another layer of complexity, requiring continuous adaptation and improvement.

Best Practices for Effective Sustainability Performance Reporting

Effective sustainability performance reporting requires a commitment to robust data collection, rigorous analysis, and transparent disclosure. Best practices include setting clear, measurable, achievable, relevant, and time-bound (SMART) targets for sustainability performance. This should be followed by using a standardized reporting framework to ensure consistency and comparability. Regular independent verification of reported data is essential to enhance credibility. Engaging with stakeholders throughout the reporting process can foster trust and improve the quality of information provided. Finally, continuous improvement and adaptation of reporting practices are necessary to address emerging challenges and incorporate evolving best practices. This proactive approach ensures that sustainability performance reporting is a dynamic and effective tool for driving positive change.

The Role of Technology in Sustainable Finance

Technology is rapidly transforming the landscape of sustainable finance, offering innovative solutions to address environmental and social challenges while driving economic growth. Its impact spans from enhancing transparency in supply chains to improving risk management and fostering more impactful investments. This section explores the key technological advancements facilitating this transformation.

Blockchain Technology and Supply Chain Transparency

Blockchain’s decentralized and immutable nature offers significant potential for enhancing transparency and traceability within complex supply chains. By recording every transaction and movement of goods on a shared, secure ledger, blockchain technology can help verify the sustainability claims made by companies. This includes tracking the origin of materials, ensuring ethical labor practices, and monitoring environmental impacts throughout the production process. For instance, a company using blockchain could track the journey of coffee beans from farm to cup, verifying fair trade practices and sustainable farming methods. This increased transparency allows consumers and investors to make informed choices and hold companies accountable for their sustainability commitments. The potential for reduced fraud and improved efficiency further strengthens its appeal.

Fintech Driving Innovation in Sustainable Finance

Fintech companies are developing a range of innovative financial products and services that support sustainable initiatives. This includes crowdfunding platforms specifically designed for green projects, mobile banking applications promoting responsible consumption, and robo-advisors incorporating ESG (Environmental, Social, and Governance) factors into investment portfolios. For example, several fintech platforms now offer green bonds or impact investments, allowing individual investors to directly support sustainable projects. These innovations are making sustainable finance more accessible and appealing to a broader range of investors.

Big Data and AI in Sustainability Risk Management

Big data analytics and artificial intelligence (AI) are powerful tools for improving sustainability risk management. By analyzing vast amounts of data from various sources – including satellite imagery, sensor data, and social media – AI algorithms can identify and assess environmental and social risks more accurately and efficiently than traditional methods. This allows financial institutions to better understand and manage the potential financial impacts of climate change, resource depletion, and other sustainability challenges. For example, AI can be used to predict the likelihood of extreme weather events impacting a company’s operations, enabling investors to make more informed decisions. Similarly, AI can analyze social media sentiment to identify potential reputational risks related to a company’s sustainability performance.

Technological Advancements Facilitating Sustainable Finance

The following technological advancements are playing a crucial role in the growth of sustainable finance:

- Blockchain technology: Enhancing transparency and traceability in supply chains.

- Artificial intelligence (AI): Improving sustainability risk assessment and prediction.

- Big data analytics: Providing comprehensive insights into environmental and social impacts.

- Internet of Things (IoT): Monitoring environmental conditions and resource usage in real-time.

- Cloud computing: Enabling efficient data storage and processing for sustainability reporting.

- Fintech platforms: Offering innovative financial products and services that support sustainable initiatives.

- Remote sensing technologies: Monitoring deforestation, pollution, and other environmental changes.

Case Studies of Sustainable Finance Successes and Failures

Sustainable finance, while promising a more equitable and environmentally conscious future, has seen both remarkable successes and notable failures. Examining these case studies provides valuable insights into the factors driving success and the pitfalls to avoid. Understanding these dynamics is crucial for future initiatives aiming to integrate sustainability into financial practices.

Triodos Bank: A Success Story in Sustainable Banking

Triodos Bank, a Dutch ethical bank, exemplifies a successful sustainable finance initiative. Founded on the principle of integrating social and environmental considerations into its core business model, Triodos has consistently demonstrated strong financial performance while maintaining its commitment to sustainability. The bank actively avoids financing industries deemed harmful to the environment or society, such as fossil fuels and weapons manufacturing. Instead, it prioritizes investments in renewable energy, sustainable agriculture, and social enterprises. Its success stems from a combination of factors: a clearly defined mission, a loyal customer base attracted to its values, and a robust risk management framework that accounts for both financial and environmental/social risks. This approach has fostered long-term growth and profitability, proving that sustainable finance can be both ethically sound and financially viable.

The Failure of the Green Climate Fund’s Initial Investment Strategy

While the Green Climate Fund (GCF) aims to channel climate finance to developing countries, its initial investment strategy faced significant challenges. One notable failure stemmed from a complex and bureaucratic application process that discouraged smaller, community-based projects from participating. Furthermore, the initial focus on large-scale projects, while potentially impactful, often neglected the crucial role of local communities in project design and implementation. This resulted in a slower disbursement of funds than initially projected and a limited reach in terms of benefiting vulnerable populations. The lack of sufficient capacity building support for recipient countries also contributed to project failures. The GCF has since revised its strategy, simplifying the application process and emphasizing local ownership, demonstrating the importance of adaptive management in addressing the complexities of climate finance.

Comparing the Strategies of Triodos Bank and the ASN Bank

Triodos Bank and ASN Bank, both Dutch ethical banks, represent successful sustainable finance initiatives, but their strategies differ in certain aspects. Triodos emphasizes direct financing of sustainable projects, actively selecting and managing its portfolio. ASN Bank, while also avoiding harmful industries, employs a broader strategy incorporating both direct investments and shareholder engagement in existing companies to promote sustainable practices. Both banks prioritize transparency and rigorous impact measurement, but their approaches to achieving sustainability within their investment portfolios differ. Triodos’ direct investment model provides greater control over environmental and social impacts, while ASN’s shareholder engagement model offers a broader reach, potentially influencing a larger number of companies.

The Descriptive Narrative of the Investment in Community Solar Projects

A successful sustainable finance project involved the financing of community solar projects in several rural communities. The initial challenge was securing funding for these relatively small-scale projects, as traditional investors often favored larger, more established renewable energy ventures. However, through innovative financing mechanisms, such as crowdfunding and partnerships with community development financial institutions (CDFIs), sufficient capital was raised. Another significant challenge involved navigating complex regulatory frameworks and obtaining necessary permits. However, through collaboration with local authorities and advocacy groups, these hurdles were overcome. The project demonstrated significant success in expanding access to clean energy in underserved communities, creating local jobs, and reducing reliance on fossil fuels. The key lesson learned was the importance of engaging local communities throughout the project lifecycle, ensuring their needs and priorities were integrated into the design and implementation phases.

Future Trends in Sustainable Finance

Sustainable finance is rapidly evolving, driven by increasing environmental concerns, stricter regulations, and growing investor demand for responsible investments. The future trajectory is marked by significant shifts in investment strategies, technological integration, and the growing influence of climate change considerations on financial decision-making.

The integration of environmental, social, and governance (ESG) factors into investment decisions is no longer a niche practice but a mainstream approach. This trend is expected to accelerate, influencing all aspects of the financial sector, from asset management to lending and insurance. The increasing awareness of climate-related risks is also profoundly impacting investment strategies, pushing investors to reassess their portfolios and seek opportunities aligned with a low-carbon future.

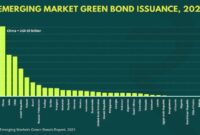

Green Bonds and Impact Investing

Green bonds, debt instruments specifically earmarked for financing environmentally friendly projects, are experiencing exponential growth. Impact investing, which aims to generate measurable social and environmental impact alongside financial returns, is also gaining significant traction. This shift reflects a growing investor preference for investments that contribute to a more sustainable world. The market for both green bonds and impact investments is projected to continue its upward trajectory, driven by increasing regulatory support, technological advancements, and the growing awareness of the interconnectedness of environmental, social, and economic factors. For example, the issuance of green bonds has increased significantly over the past decade, with many governments and corporations utilizing them to fund renewable energy projects, sustainable infrastructure, and climate change mitigation initiatives. Similarly, impact investing has seen a surge in interest from both institutional and individual investors, with various funds and initiatives emerging to support this growing sector.

Climate Change and the Financial Sector

Climate change poses significant risks to the financial sector. Physical risks, such as extreme weather events and rising sea levels, can directly damage assets and disrupt business operations. Transition risks, stemming from the shift towards a low-carbon economy, can lead to stranded assets and decreased profitability for companies heavily reliant on fossil fuels. Financial institutions are increasingly incorporating climate-related risks into their risk management frameworks and stress-testing exercises to assess their vulnerability and develop appropriate mitigation strategies. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are playing a crucial role in promoting greater transparency and consistency in climate-related risk reporting. Examples of the impact include insurance companies facing increased payouts due to more frequent and severe weather events, and banks facing higher credit risks from companies in carbon-intensive industries.

Predictions for the Future of Sustainable Finance

The future of sustainable finance is bright, with several key predictions emerging. Firstly, ESG integration will become even more pervasive, influencing all aspects of investment decision-making. Secondly, technology will play a crucial role in enhancing transparency, efficiency, and accessibility within the sustainable finance sector. Thirdly, regulatory frameworks will continue to evolve, promoting greater standardization and accountability. Finally, sustainable finance will become increasingly intertwined with global sustainability goals, such as the UN Sustainable Development Goals (SDGs). For instance, we can expect to see a continued rise in the use of blockchain technology to enhance the transparency and traceability of sustainable investments, as well as a greater focus on measuring and reporting the impact of investments on social and environmental outcomes.

Projected Growth in Sustainable Finance

A visual representation would show a steep upward trend line for various segments of sustainable finance, including green bonds, impact investing, and ESG-integrated funds. The graph would illustrate exponential growth over the next decade, with different areas showing varying rates of expansion reflecting different market dynamics and investor preferences. Specific numbers would be difficult to provide with complete accuracy due to the dynamic nature of the market, but the overall trend would be clearly upward, reflecting a significant increase in capital flowing towards sustainable initiatives. This visualization would highlight the increasing importance of sustainable finance in the global economy.

Conclusive Thoughts

Sustainable finance is not merely a trend; it’s a fundamental shift in how we approach financial markets. By integrating ESG factors and leveraging technological innovation, we can create a more resilient and responsible financial system. This journey through the landscape of sustainable finance initiatives reveals a complex yet promising path toward a future where economic prosperity and environmental stewardship are inextricably linked. The challenges are significant, but the potential rewards – a healthier planet and a more equitable society – are immeasurable.

FAQ Corner

What is the difference between green bonds and social bonds?

Green bonds finance environmentally friendly projects, while social bonds fund projects with social benefits, such as affordable housing or education.

How can I assess the sustainability performance of an investment?

Look for companies with strong ESG ratings, transparent reporting, and alignment with relevant sustainability frameworks like the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB).

What are the risks associated with sustainable investments?

Risks include greenwashing (misrepresenting sustainability efforts), regulatory uncertainty, and potential for lower short-term returns compared to some traditional investments. However, long-term risks associated with climate change and social instability may outweigh these.

What is the role of governments in promoting sustainable finance?

Governments play a crucial role through regulations, incentives (e.g., tax breaks for green investments), and the creation of supportive policy frameworks that encourage sustainable practices.