ESG investment strategies are rapidly transforming the financial landscape, moving beyond traditional financial metrics to incorporate environmental, social, and governance (ESG) factors into investment decisions. This shift reflects a growing awareness of the interconnectedness between financial performance and sustainability, recognizing that companies with strong ESG profiles often demonstrate better long-term resilience and profitability. This guide explores the core principles of ESG investing, its practical application, and its implications for the future of finance.

We delve into various approaches to integrating ESG factors, from negative and positive screening to thematic investing, examining both the challenges and opportunities involved. We’ll also cover crucial aspects such as materiality assessments, risk management, robust reporting frameworks, and performance measurement, providing a practical framework for investors seeking to incorporate ESG considerations into their portfolios.

Defining ESG Investment Strategies

ESG investing, or Environmental, Social, and Governance investing, represents a growing trend in the financial world, moving beyond traditional financial metrics to consider a company’s impact on the environment, society, and its own governance structures. This approach aims to generate positive social and environmental outcomes alongside financial returns, recognizing the interconnectedness of these factors in long-term business sustainability.

Core Principles of ESG Investing

ESG investing operates on the core principle that a company’s long-term value is influenced by its environmental, social, and governance practices. Investors believe that companies with strong ESG profiles are better positioned to manage risks, innovate, and attract and retain talent, ultimately leading to superior financial performance. This approach integrates ESG factors into the investment decision-making process, assessing not just financial data but also the company’s overall sustainability and ethical conduct. This contrasts with traditional investment approaches that primarily focus on financial metrics alone.

The Three Pillars of ESG and Their Interrelation

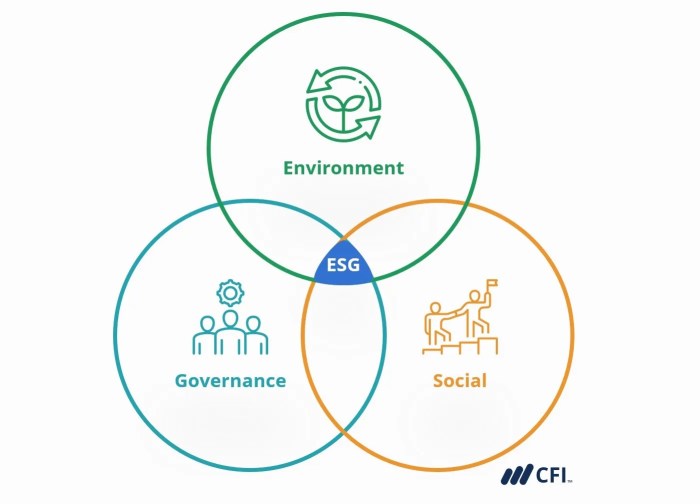

The three pillars – Environmental, Social, and Governance – are interconnected and mutually reinforcing. Strong performance in one area often positively impacts the others.

Environmental (E): This focuses on a company’s impact on the environment, including its carbon footprint, waste management, resource consumption, and pollution levels. Companies with strong environmental performance often demonstrate a commitment to sustainability, reducing operational risks associated with climate change and resource scarcity.

Social (S): This pillar considers a company’s relationships with its employees, customers, suppliers, and the wider community. Key aspects include labor practices, human rights, product safety, community engagement, and diversity and inclusion. Companies with strong social performance tend to have better employee morale, stronger customer loyalty, and a positive brand reputation.

Governance (G): This examines a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Strong governance practices ensure transparency, accountability, and ethical decision-making, reducing the risk of scandals and reputational damage. Good governance fosters trust with investors and stakeholders.

The interrelation is clear: a company with strong environmental practices (e.g., reducing emissions) might attract socially conscious consumers (S) and enhance its reputation, leading to improved investor confidence (G). Conversely, poor governance (G) can lead to environmental damage (E) and social unrest (S).

Examples of Companies Demonstrating Strong ESG Performance

Many companies across various sectors are demonstrating strong ESG performance. For example, Patagonia (apparel) is known for its commitment to environmental sustainability and fair labor practices. Unilever (consumer goods) has a strong track record in sustainable sourcing and promoting diversity and inclusion. Microsoft (technology) is investing heavily in renewable energy and promoting digital inclusion. These examples showcase that strong ESG performance is achievable across various industries and business models.

Comparison of ESG Rating Methodologies

Different organizations use various methodologies to assess and rate a company’s ESG performance. These ratings are not standardized, and differences in methodologies can lead to variations in scores. It’s crucial to understand the strengths and limitations of each methodology when using them for investment decisions.

| Methodology | Focus | Data Sources | Strengths |

|---|---|---|---|

| MSCI ESG Ratings | Comprehensive ESG assessment | Publicly available data, company disclosures | Widely used, covers a large universe of companies |

| Sustainalytics ESG Risk Ratings | Material ESG risks | Company disclosures, news articles, industry data | Focus on financially material ESG issues |

| Refinitiv ESG Scores | ESG performance across various dimensions | Company disclosures, news, third-party data | Provides a range of ESG metrics and scores |

| Bloomberg ESG Data | Comprehensive ESG data and analytics | Company disclosures, news, third-party data | Integrates ESG data with financial data |

ESG Integration in Investment Processes

Integrating Environmental, Social, and Governance (ESG) factors into investment processes is no longer a niche strategy; it’s becoming a mainstream approach for many investors. This integration reflects a growing awareness of the materiality of ESG factors to long-term value creation and risk management. By considering ESG data alongside traditional financial metrics, investors aim to identify opportunities and mitigate potential downsides.

Different Approaches to ESG Integration

Several distinct approaches exist for incorporating ESG considerations into investment decisions, each with its own strengths and weaknesses. Understanding these approaches is crucial for selecting the most suitable strategy based on an investor’s goals and risk tolerance.

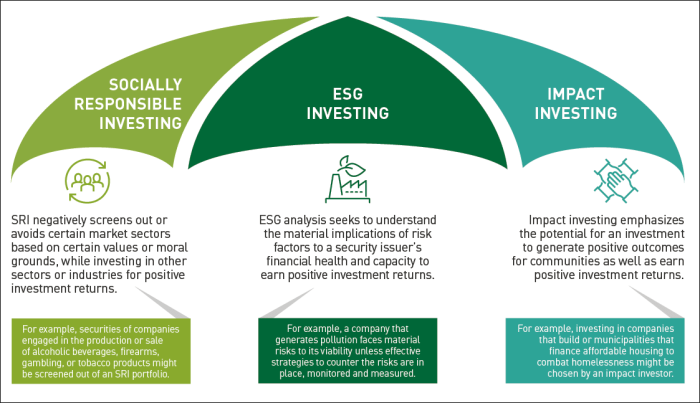

Negative Screening

Negative screening involves excluding companies involved in specific controversial activities from a portfolio. This might include companies with poor environmental records, those engaged in unethical labor practices, or those involved in the production of weapons. This approach focuses on avoiding investments deemed socially or environmentally irresponsible. For example, an investor might exclude companies with significant greenhouse gas emissions or those involved in deforestation.

Positive Screening

Conversely, positive screening focuses on identifying and investing in companies demonstrating strong ESG performance. This approach actively seeks out businesses with exemplary environmental, social, and governance practices. Examples include companies with robust sustainability programs, those committed to diversity and inclusion, or those with strong corporate governance structures. An investor might prioritize companies with high scores on ESG rating agencies.

Best-in-Class

The best-in-class approach selects the top-performing companies within specific sectors based on their ESG profiles. This approach acknowledges that even within industries with inherently higher ESG risks, some companies manage these risks more effectively than others. For example, an investor seeking exposure to the energy sector might choose the companies with the most aggressive renewable energy transition plans.

Thematic Investing

Thematic investing focuses on specific ESG themes, such as renewable energy, sustainable agriculture, or green technology. This strategy allows investors to target companies directly contributing to positive environmental or social outcomes. For example, an investor might concentrate their portfolio on companies developing innovative solutions for climate change mitigation.

Challenges and Opportunities of ESG Integration

Integrating ESG factors into traditional investment frameworks presents both challenges and opportunities.

Challenges of ESG Integration

One major challenge is the lack of standardization and comparability in ESG data. Different rating agencies and data providers use varying methodologies, making it difficult to compare the ESG performance of companies across different sectors and geographies. Another challenge lies in the difficulty of quantifying the impact of ESG factors on financial performance. While there is growing evidence of a positive correlation, establishing a direct causal link remains complex. Finally, the integration of ESG factors can increase the complexity of investment analysis and require specialized expertise.

Opportunities of ESG Integration

Despite these challenges, ESG integration offers significant opportunities. By considering ESG factors, investors can potentially identify companies better positioned for long-term success. Companies with strong ESG profiles may be more resilient to regulatory changes, reputational risks, and shifts in consumer preferences. Furthermore, ESG integration can enhance a portfolio’s risk-adjusted returns by identifying and mitigating potential risks related to climate change, social unrest, or governance failures. A focus on ESG can also lead to improved stakeholder engagement and a stronger corporate reputation.

A Step-by-Step Process for ESG Portfolio Construction

A structured approach is necessary to effectively incorporate ESG considerations into portfolio construction.

Step-by-Step ESG Integration

- Define ESG objectives and materiality: Clearly articulate the specific ESG goals and identify the ESG factors most relevant to the investment strategy. This may involve considering the investor’s values, risk tolerance, and long-term objectives.

- Select ESG data and analytics providers: Choose reputable data providers that align with the defined ESG objectives and use robust methodologies.

- Screen and select investments: Apply the chosen ESG integration approach (e.g., negative screening, positive screening, best-in-class) to filter potential investments based on their ESG performance.

- Integrate ESG factors into financial analysis: Incorporate ESG data and insights into the traditional financial valuation process, considering both risks and opportunities.

- Monitor and report on ESG performance: Regularly track the ESG performance of the portfolio and report on the progress towards achieving the defined ESG objectives.

Examples of ESG Integration Enhancing Risk Management and Portfolio Performance

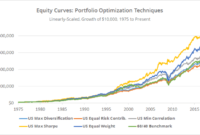

Numerous studies suggest a positive correlation between strong ESG performance and financial performance.

Examples of Enhanced Risk Management and Performance

Companies with robust environmental management practices may be better equipped to navigate climate-related risks, potentially reducing their vulnerability to regulatory changes and physical impacts. Similarly, companies with strong social policies, such as fair labor practices and diversity initiatives, may experience lower employee turnover and enhanced brand reputation, leading to improved operational efficiency and profitability. Effective corporate governance, characterized by transparency and accountability, can minimize the risk of scandals and reputational damage, protecting shareholder value. These examples highlight how incorporating ESG factors can lead to improved risk management and potentially enhanced portfolio performance. For instance, studies have shown that companies with higher ESG ratings tend to exhibit lower volatility and higher long-term returns compared to their lower-rated peers. However, it’s crucial to remember that correlation doesn’t equal causation, and further research is needed to fully understand the complex interplay between ESG factors and financial outcomes.

Materiality and ESG Risk Assessment

Understanding material ESG factors and conducting thorough risk assessments are crucial for successful ESG investing. Materiality refers to the significance of ESG issues to a company’s financial performance and long-term value. A robust risk assessment identifies and evaluates potential negative impacts, allowing investors to make informed decisions and potentially mitigate future losses.

Identifying key ESG factors requires a sector-specific approach. What constitutes a material ESG risk for a technology company differs significantly from that of a fossil fuel producer. For example, data privacy and cybersecurity are paramount for technology firms, whereas carbon emissions and climate change resilience are critical for energy companies. A thorough assessment considers both the direct and indirect impacts of ESG factors.

Key ESG Factors by Sector

The identification of material ESG factors is a dynamic process, influenced by evolving regulatory landscapes, technological advancements, and societal expectations. However, some general trends can be observed. For instance, the financial sector faces increasing scrutiny regarding its role in financing environmentally damaging projects, while the manufacturing sector faces pressure to reduce its carbon footprint and improve worker safety. The consumer goods sector is increasingly assessed on its supply chain ethics and sustainability practices. Analyzing industry-specific reports and sustainability indices provides valuable insights into material ESG factors for each sector.

ESG Risk Assessment Methodology

A comprehensive ESG risk assessment involves a multi-step process. It begins with identifying potential ESG risks relevant to a specific company or investment, drawing on publicly available information, such as company sustainability reports, news articles, and industry analyses. Next, the likelihood and potential impact of each risk are assessed. This often involves a qualitative evaluation, but quantitative methods can be employed where data allows. Finally, the assessment culminates in a prioritization of risks based on their combined likelihood and impact, guiding subsequent investment decisions or engagement strategies.

Quantifying and Evaluating ESG Risks and Opportunities

Various methods exist for quantifying and evaluating ESG risks and opportunities. One approach is to use ESG ratings and scores provided by specialized agencies like MSCI or Sustainalytics. These ratings offer a comparative view of a company’s ESG performance relative to its peers. Another method involves analyzing financial metrics related to ESG performance, such as carbon emissions intensity, water usage, or employee turnover. Furthermore, scenario analysis can be employed to assess the potential financial impacts of different ESG-related scenarios, such as a carbon tax or a significant climate-related event. These quantitative approaches provide a more objective assessment, supplementing qualitative analysis.

Resources for ESG Due Diligence

Conducting robust ESG due diligence requires access to reliable data and analytical tools. Several resources are available:

- ESG rating agencies: MSCI, Sustainalytics, Refinitiv, Bloomberg

- Sustainability reporting databases: Global Reporting Initiative (GRI), CDP

- Industry-specific reports and publications: Reports from organizations like the World Economic Forum, the UN Global Compact, and various industry associations offer valuable insights.

- Academic research: Academic journals and research papers provide valuable perspectives on ESG issues and their financial implications.

- Company disclosures: Direct engagement with companies to obtain information about their ESG practices is a critical element of due diligence.

Utilizing these resources in conjunction with internal expertise and external consultants allows investors to perform a comprehensive ESG assessment.

ESG Reporting and Transparency

Robust ESG reporting and transparency are crucial for building trust and attracting investment. Investors increasingly demand clear, consistent, and comparable information about a company’s environmental, social, and governance performance. Without this transparency, it becomes difficult to assess the true ESG risks and opportunities associated with an investment, hindering informed decision-making.

ESG reporting allows investors to understand how a company manages its ESG impacts, fostering accountability and driving improvements. This transparency also contributes to a more efficient allocation of capital towards sustainable and responsible businesses.

ESG Reporting Frameworks: A Comparison

Several frameworks guide ESG reporting, each with its strengths and weaknesses. The Global Reporting Initiative (GRI) offers a comprehensive, widely adopted standard covering a broad range of ESG issues. The Sustainability Accounting Standards Board (SASB) focuses on financially material ESG factors specific to different industries, providing a more industry-specific approach. The Task Force on Climate-related Financial Disclosures (TCFD) focuses specifically on climate-related risks and opportunities, emphasizing the financial implications of climate change. GRI provides a holistic view, while SASB and TCFD offer more targeted, materiality-focused perspectives. Many companies use a combination of frameworks to meet diverse stakeholder needs.

Best Practices for ESG Data Collection and Disclosure

Effective ESG data collection requires a systematic approach. This involves establishing clear data collection protocols, utilizing both internal and external data sources, and ensuring data accuracy and completeness. Best practices include conducting regular materiality assessments to identify the most relevant ESG factors for the business, utilizing technology for data management and analysis, and verifying data through third-party assurance. Transparent disclosure involves clearly communicating data methodologies, limitations, and any discrepancies found during the data collection process. For example, a company might disclose its greenhouse gas emissions using a specific methodology, highlighting any uncertainties or estimations involved. Another example would be a company openly reporting its employee diversity metrics, explaining its approach to data collection and acknowledging any limitations in its data.

Key Elements of a Comprehensive ESG Report

A comprehensive ESG report should provide a clear and concise overview of a company’s ESG performance, strategy, and management. Below is a list of key elements that should be included:

- Executive Summary: A high-level overview of the company’s ESG performance and key achievements.

- Governance Structure: Details on the company’s board oversight of ESG matters and its internal ESG management structure.

- Material ESG Issues: Identification of the most significant ESG issues relevant to the company’s business and stakeholders.

- ESG Performance Data: Quantitative and qualitative data on the company’s performance across key ESG indicators.

- Targets and Goals: Ambitious, time-bound targets for improving ESG performance.

- Stakeholder Engagement: Description of how the company engages with its stakeholders on ESG matters.

- Assurance: Independent verification of ESG data, enhancing credibility and transparency.

ESG Performance Measurement and Benchmarking

Measuring and benchmarking ESG performance is crucial for investors seeking to understand and compare the sustainability profiles of different companies and investment portfolios. This involves analyzing a range of environmental, social, and governance factors and translating them into quantifiable metrics that allow for meaningful comparisons. However, the landscape of ESG measurement is complex, with a variety of methodologies and a lack of complete standardization posing challenges.

ESG performance measurement utilizes a range of quantitative and qualitative methods. Quantitative methods often involve scoring systems, where companies receive ratings based on their performance across various ESG criteria. These scores are then used to compare companies within the same sector or asset class. Qualitative methods, on the other hand, often involve analyzing company disclosures, news articles, and other forms of information to gain a deeper understanding of their ESG performance. These approaches often include analyzing the quality of a company’s ESG reporting and its alignment with international standards.

Methods for Measuring and Benchmarking ESG Performance Across Different Asset Classes

Different asset classes present unique challenges for ESG measurement. For example, measuring the carbon footprint of a real estate portfolio requires different methodologies than evaluating the labor practices of a technology company. However, several common approaches exist. For equities, ratings agencies such as MSCI, Sustainalytics, and Refinitiv provide ESG scores and ratings based on various factors. For fixed income, investors may analyze issuers’ environmental risks, such as exposure to climate change, or social risks, such as human rights violations within their supply chains. In the case of private equity, ESG due diligence is often conducted on a case-by-case basis, focusing on the specific environmental and social impacts of individual investments. Benchmarking typically involves comparing the ESG performance of a portfolio or specific assets against relevant industry peers or broader market indices, like the MSCI KLD 400 Social Index or the Dow Jones Sustainability Index.

Limitations of Current ESG Metrics and the Need for Improved Standardization

Current ESG metrics suffer from several limitations. The lack of universally accepted standards leads to inconsistencies in measurement and reporting, making comparisons between companies and asset managers difficult. Data availability also varies significantly across different sectors and geographies, particularly for smaller companies or those operating in emerging markets. Furthermore, the weighting given to different ESG factors can differ across rating agencies, making it challenging to interpret the results consistently. Finally, the focus on backward-looking data may not accurately reflect future ESG performance. Improved standardization, such as through the adoption of common metrics and reporting frameworks, is crucial to enhance the reliability and comparability of ESG data. The International Sustainability Standards Board (ISSB) is working towards global standardization of ESG reporting.

Interpreting ESG Ratings and Scores in the Context of Investment Decisions

ESG ratings and scores should be viewed as one factor among many in the investment decision-making process, not as the sole determinant of investment worth. While a high ESG rating may suggest a company’s strong commitment to sustainability, it doesn’t guarantee superior financial performance. Investors should consider the methodology used by the rating agency, the specific ESG factors assessed, and the limitations of the ratings. Furthermore, a holistic assessment should incorporate other financial and qualitative factors, such as management quality, financial stability, and strategic positioning. Analyzing the trend of ESG scores over time can provide insights into a company’s improvement or deterioration in ESG performance. For example, a company with a consistently improving ESG score may indicate a strong commitment to sustainability.

Examples of Innovative Approaches to ESG Performance Measurement and Reporting

Several innovative approaches are emerging to improve ESG performance measurement and reporting. The use of big data and artificial intelligence (AI) allows for the analysis of vast amounts of data from diverse sources, leading to more comprehensive and nuanced assessments of ESG performance. Blockchain technology can enhance the transparency and traceability of ESG data, making it more reliable and verifiable. Moreover, the integration of ESG factors into existing financial models and the development of more sophisticated scenario analysis techniques can help investors better understand the financial implications of ESG risks and opportunities. For example, some firms are developing climate scenario models to assess the potential impact of climate change on different investment portfolios. Another innovative approach involves integrating ESG data into portfolio construction and risk management processes, allowing investors to actively manage ESG risks and integrate ESG considerations into their investment strategy.

The Future of ESG Investing

The field of ESG investing is rapidly evolving, driven by increasing investor demand, regulatory changes, and technological advancements. While significant progress has been made, several challenges and opportunities remain, shaping the future trajectory of this crucial investment approach. The coming years will witness a continued expansion of ESG integration across various asset classes and geographies, alongside a heightened focus on data quality, standardization, and the development of innovative investment strategies.

Emerging trends indicate a growing emphasis on measuring and managing the impact of investments, moving beyond simple ESG ratings to a more holistic assessment of positive and negative externalities. This shift necessitates the development of robust impact measurement frameworks and methodologies, enabling investors to track and report on the tangible contributions of their portfolios to sustainable development. Furthermore, the increasing scrutiny of greenwashing necessitates greater transparency and accountability from companies and investment managers.

Technological Advancements in ESG Data Collection and Analysis

Technology plays a pivotal role in enhancing the efficiency and accuracy of ESG data collection and analysis. Artificial intelligence (AI) and machine learning (ML) algorithms are being deployed to process vast amounts of unstructured data, including news articles, social media posts, and satellite imagery, to identify ESG-relevant events and trends. Natural language processing (NLP) is used to extract insights from textual data, while advanced analytics techniques enable the identification of correlations between ESG factors and financial performance. For example, AI-powered platforms can analyze a company’s supply chain to identify potential environmental risks or social injustices, allowing investors to make more informed decisions. This allows for a more comprehensive understanding of a company’s ESG performance than traditional methods, resulting in more accurate risk assessments and improved investment strategies.

Innovation in ESG Investment Strategies and Product Development

The future of ESG investing will likely see the emergence of more sophisticated and nuanced strategies. For instance, thematic investing focused on specific sustainability challenges, such as climate change mitigation or renewable energy, will continue to gain traction. Impact investing, which prioritizes measurable social and environmental outcomes alongside financial returns, is also poised for significant growth. Furthermore, the development of innovative financial products, such as green bonds and sustainable ETFs, will provide investors with more options for aligning their portfolios with their ESG values. One example of innovation is the development of blockchain technology for improved transparency and traceability in supply chains, allowing investors to verify the authenticity of ESG claims made by companies.

Impact of ESG Investing on Sustainable Development Goals (SDGs)

ESG investing has the potential to significantly contribute to the achievement of the UN Sustainable Development Goals (SDGs). By directing capital towards companies and projects that align with the SDGs, investors can play a crucial role in addressing global challenges such as climate change, poverty, and inequality. For example, investments in renewable energy technologies contribute directly to SDG 7 (Affordable and Clean Energy), while investments in sustainable agriculture can contribute to SDG 2 (Zero Hunger) and SDG 12 (Responsible Consumption and Production). The growing integration of ESG factors into investment decision-making is driving companies to improve their sustainability performance, leading to positive externalities that benefit society and the environment. The collective impact of numerous investors incorporating ESG considerations into their investment decisions creates a powerful force for positive change, accelerating progress towards achieving the SDGs. For example, the divestment movement from fossil fuels has driven investment towards renewable energy sources, contributing to the reduction of greenhouse gas emissions and a transition towards a low-carbon economy.

Last Point

In conclusion, ESG investment strategies represent a significant paradigm shift in the financial world, fostering a more sustainable and responsible approach to investing. While challenges remain, particularly concerning data standardization and the complexity of ESG assessments, the increasing demand for transparency and the growing body of evidence linking strong ESG performance to financial success suggest a promising future. By understanding and effectively implementing ESG considerations, investors can contribute to a more sustainable future while potentially enhancing their portfolio’s long-term performance and resilience.

User Queries

What are the potential downsides of ESG investing?

Potential downsides include the lack of standardized ESG metrics, the possibility of “greenwashing” (misrepresenting ESG performance), and the potential for underperformance compared to traditional investments in the short term. However, these risks are mitigated by thorough due diligence and a long-term investment horizon.

How can I find reliable ESG data?

Reliable ESG data can be sourced from various providers, including MSCI, Sustainalytics, Refinitiv, and Bloomberg. It’s important to compare data from multiple sources to get a comprehensive picture and account for potential biases.

Is ESG investing only for institutional investors?

No, ESG investing is accessible to individual investors as well. Many mutual funds, ETFs, and other investment products incorporate ESG factors into their investment strategies.

How does ESG investing contribute to the UN Sustainable Development Goals (SDGs)?

ESG investing directly supports several SDGs by promoting environmentally responsible practices, social equity, and good governance within companies. By investing in companies aligned with these goals, investors can contribute to positive global impact.