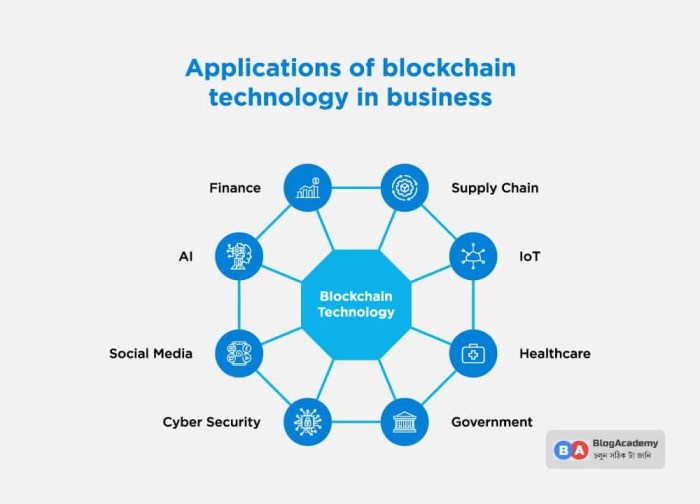

Blockchain technology is rapidly transforming the financial landscape, offering innovative solutions to long-standing challenges. This exploration delves into the diverse applications of blockchain in finance, examining its impact on decentralized finance (DeFi), payment systems, securities tokenization, supply chain management, and digital identity verification. We will explore both the transformative potential and the inherent complexities of integrating this disruptive technology into established financial structures.

From streamlining international payments and enhancing supply chain transparency to enabling new forms of asset ownership and improving KYC/AML compliance, blockchain’s versatility is reshaping how we interact with financial systems. This examination will provide a comprehensive overview of the opportunities and challenges associated with each application, offering insights into the future of finance powered by blockchain.

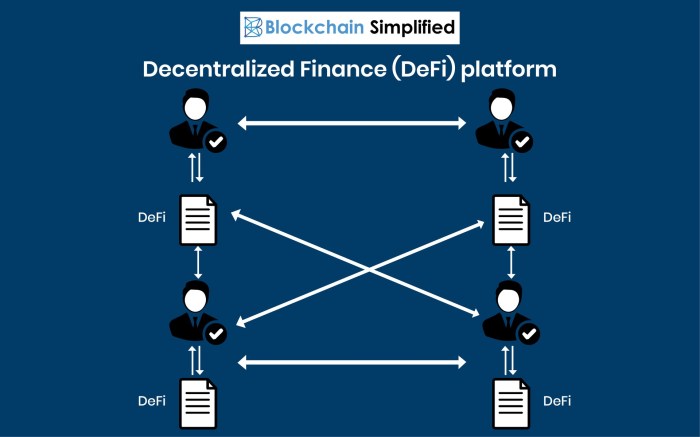

Decentralized Finance (DeFi) Applications

Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to offer a new generation of financial services. These services operate without intermediaries, promising greater transparency, accessibility, and efficiency compared to traditional financial systems. The core of DeFi lies in its decentralized nature, enabling users to interact directly with financial applications without relying on centralized institutions.

The Role of Blockchain in Enabling Decentralized Financial Services

Blockchain technology underpins the functionality of DeFi applications by providing a secure, transparent, and immutable ledger for recording financial transactions. Its decentralized nature eliminates single points of failure and censorship, a key advantage over centralized systems vulnerable to manipulation or control by a single entity. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate the execution of financial agreements, ensuring transparency and eliminating the need for intermediaries. This automated and transparent process increases trust and efficiency in financial transactions.

Examples of DeFi Applications Built on Various Blockchain Platforms

A wide array of DeFi applications exist, each built on different blockchain platforms to leverage their unique strengths. Ethereum, with its mature ecosystem and established smart contract capabilities, hosts numerous DeFi applications, including decentralized exchanges (DEXs) like Uniswap and Aave, a lending and borrowing platform. Solana, known for its high transaction throughput, supports DeFi projects like Raydium, another DEX, and Serum, a decentralized order book. Other platforms like Binance Smart Chain and Polygon also contribute to the burgeoning DeFi ecosystem, each offering distinct advantages in terms of transaction speed, fees, and scalability.

Security and Scalability Comparison of Different DeFi Platforms

The security and scalability of DeFi platforms vary considerably. Ethereum, while a pioneer in DeFi, faces scalability challenges due to network congestion, resulting in higher transaction fees and slower processing times. Solana, in contrast, boasts significantly higher transaction speeds but has experienced periods of network instability, raising concerns about its long-term reliability. Binance Smart Chain, while fast and low-cost, has faced criticisms regarding its level of decentralization. Security considerations include smart contract vulnerabilities, which can be exploited by malicious actors, and the risks associated with holding assets on decentralized exchanges. Rigorous audits and security best practices are crucial for mitigating these risks.

Hypothetical DeFi Application: Decentralized Microloan Platform

This hypothetical DeFi application addresses the financial needs of underserved populations by providing access to microloans. The platform would utilize a decentralized credit scoring system based on on-chain activity and reputation, reducing reliance on traditional credit scores that often exclude individuals with limited financial history. Smart contracts would automate loan disbursement and repayment, ensuring transparency and reducing administrative overhead. Security measures would include multi-signature wallets for managing funds and robust auditing of the smart contracts to prevent vulnerabilities. The platform would incorporate a decentralized governance mechanism allowing community participation in platform development and decision-making.

Comparison of Key Features of Popular DeFi Platforms

| Platform | Transaction Fees | Transaction Speed | Security |

|---|---|---|---|

| Ethereum | Variable, can be high during peak times | Relatively slow | High, mature ecosystem, but susceptible to smart contract vulnerabilities |

| Solana | Generally low | Very fast | High transaction throughput, but has experienced periods of instability |

| Binance Smart Chain | Very low | Fast | High transaction volume, but concerns about centralization |

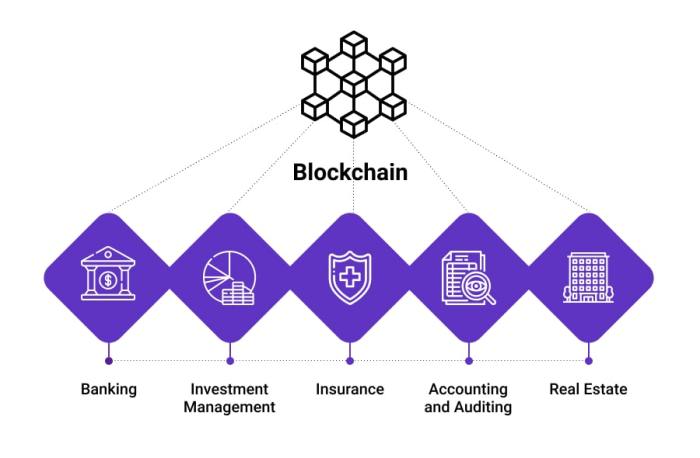

Blockchain-based Payment Systems

Blockchain technology offers a revolutionary approach to payment systems, promising increased security, transparency, and efficiency compared to traditional methods. This stems from its decentralized and immutable nature, which reduces reliance on intermediaries and minimizes the risk of fraud and double-spending. However, challenges remain in widespread adoption and integration into existing financial infrastructures.

Advantages and Disadvantages of Blockchain Payment Systems

Blockchain-based payment systems offer several key advantages over traditional systems. These include enhanced security through cryptographic techniques, reduced transaction fees due to the elimination of intermediaries, faster transaction processing times compared to traditional banking systems, increased transparency through publicly viewable transaction records (depending on the blockchain’s design), and greater accessibility, potentially enabling financial inclusion for underserved populations. However, disadvantages include scalability limitations, which can lead to slower transaction processing during periods of high network activity; regulatory uncertainty, as the legal framework surrounding cryptocurrencies and blockchain technology is still evolving; and the relatively complex technical nature of blockchain technology, which can present a barrier to user adoption for those lacking technical expertise. Furthermore, the volatility of cryptocurrencies used in some blockchain payment systems poses a risk for users and merchants alike.

Examples of Blockchain Payment Systems and Their Real-World Applications

Several blockchain payment systems are already in operation, demonstrating the technology’s potential. RippleNet, for instance, facilitates cross-border payments for banks and financial institutions, streamlining international transactions and reducing processing times. Stellar, another blockchain platform, focuses on micropayments and cross-border transactions, aiming to provide financial services to underserved communities. Bitcoin, while primarily a cryptocurrency, also functions as a decentralized payment system, allowing for peer-to-peer transactions without the need for intermediaries. These systems find applications in various sectors, including remittance services (sending money across borders), supply chain management (tracking goods and payments throughout the supply chain), and microfinance (providing small loans to individuals and businesses).

Challenges Related to Scalability, Regulatory Compliance, and User Adoption

The scalability of blockchain payment systems remains a significant hurdle. Many blockchains struggle to handle a large volume of transactions, resulting in slow processing speeds and high transaction fees. Regulatory compliance is another major challenge. Governments worldwide are grappling with how to regulate cryptocurrencies and blockchain technology, leading to uncertainty for businesses and users. User adoption is also a significant challenge, as the technical complexity of blockchain technology can deter many individuals and businesses from using these systems. Education and user-friendly interfaces are crucial for overcoming this barrier.

Potential Security Vulnerabilities and Mitigation Strategies

While blockchain technology is inherently secure, vulnerabilities can exist at different layers. These include vulnerabilities in smart contracts (the code that governs transactions on a blockchain), private key management (losing access to funds), and exchange hacks (compromising exchanges that hold user funds). Mitigation strategies include rigorous code audits for smart contracts, secure storage of private keys using hardware wallets, and robust security measures for exchanges to protect against hacking attempts. Regular security updates and proactive monitoring of the network for suspicious activity are also crucial for maintaining the security of blockchain payment systems.

Features Contributing to the Security and Efficiency of Blockchain-based Payment Systems

Several features contribute to the security and efficiency of blockchain-based payment systems:

- Cryptographic Hashing: Ensures data integrity and prevents tampering with transaction records.

- Decentralization: Distributes trust across a network of nodes, reducing reliance on a single point of failure.

- Immutability: Prevents alteration of transaction records once they are added to the blockchain.

- Transparency (with privacy features): Allows for public verification of transactions while offering options for enhanced privacy where needed.

- Smart Contracts: Automate and enforce the terms of agreements, reducing the need for intermediaries.

- Consensus Mechanisms: Ensure agreement on the validity of transactions and prevent fraudulent activities.

Securities and Asset Tokenization

The application of blockchain technology to the financial sector is rapidly expanding, with one of the most transformative developments being the tokenization of securities and other assets. This process involves representing traditional assets, such as stocks, bonds, and real estate, as digital tokens on a blockchain, offering several potential advantages over traditional methods. This section will delve into the mechanics of security tokenization, its benefits and drawbacks across various asset classes, the regulatory landscape, and a hypothetical scenario showcasing its efficiency improvements.

Tokenization Process

Tokenizing a security involves several key steps. First, the asset needs to be legally structured and verified. This often involves legal counsel to ensure compliance with securities laws. Next, the asset is represented as a digital token, with specifications such as token type (e.g., ERC-20, ERC-1400), supply, and associated metadata encoded onto the blockchain. This process frequently utilizes smart contracts to automate functions such as dividend distribution or voting rights. Finally, the tokens are distributed to investors through a Security Token Offering (STO). The entire process requires careful attention to detail and compliance with applicable regulations to ensure the legality and validity of the tokenized security.

Benefits and Drawbacks of Tokenizing Different Asset Classes

Tokenization offers varying benefits and drawbacks depending on the asset class. For equities, tokenization can enhance liquidity by allowing for fractional ownership and easier trading. However, regulatory uncertainty remains a significant hurdle. Bonds benefit from increased transparency and efficiency in issuance and trading, but integrating existing bond infrastructure with blockchain technology presents a challenge. Real estate tokenization can unlock liquidity in illiquid assets, but valuation and regulatory compliance remain complex issues. The following table summarizes these points:

| Asset Class | Benefits | Drawbacks |

|---|---|---|

| Equities | Increased liquidity, fractional ownership, reduced transaction costs | Regulatory uncertainty, integration with existing trading systems |

| Bonds | Improved transparency, efficient issuance and trading, reduced settlement times | Integration with existing bond infrastructure, potential for scalability issues |

| Real Estate | Increased liquidity for illiquid assets, fractional ownership, simplified transfer of ownership | Valuation challenges, regulatory compliance, potential for market manipulation |

Regulatory Landscape of Security Token Offerings (STOs)

The regulatory landscape surrounding STOs is still evolving globally. Different jurisdictions have adopted varying approaches, with some embracing a more permissive regulatory framework and others taking a more cautious stance. Compliance with securities laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) requirements is crucial for any STO. The lack of a globally harmonized regulatory framework presents a significant challenge for cross-border STOs. Ongoing developments in regulatory clarity are essential for fostering the growth of the STO market.

Hypothetical Scenario: Improving Securities Trading Efficiency

Imagine a scenario involving a large institutional investor needing to trade a significant quantity of shares in a publicly listed company. Traditionally, this would involve multiple intermediaries, lengthy settlement times (T+2 or even longer), and high transaction costs. Using blockchain, the entire process could be streamlined. The shares are tokenized, and the trade is executed directly between the buyer and seller on a permissioned blockchain. Smart contracts automatically handle the transfer of ownership and settlement, potentially reducing settlement time to near-instantaneous and significantly lowering transaction costs. This hypothetical scenario demonstrates how blockchain can improve efficiency and reduce friction in the securities trading process.

Comparison of Traditional and Tokenized Securities

The following table compares traditional and tokenized securities across key attributes:

| Attribute | Traditional Securities | Tokenized Securities |

|---|---|---|

| Liquidity | Varies depending on the asset and market conditions | Potentially higher liquidity due to fractional ownership and 24/7 trading |

| Transparency | Limited transparency, information asymmetry | Increased transparency through immutable record-keeping on the blockchain |

| Regulatory Compliance | Subject to various regulations, complex compliance procedures | Subject to evolving regulations specific to security tokens, potential for simplified compliance through smart contracts |

Supply Chain Management and Tracking

Blockchain technology offers a revolutionary approach to supply chain management, enhancing transparency and traceability in ways previously unimaginable. Its inherent immutability and security features create a robust system for tracking goods and materials throughout their entire journey, from origin to final consumer. This increased visibility benefits all stakeholders, improving efficiency, reducing fraud, and building greater trust within the supply chain ecosystem.

Enhanced Transparency and Traceability in Supply Chains

Blockchain’s decentralized and immutable ledger provides a single source of truth for all supply chain activities. Each transaction, from raw material sourcing to manufacturing and distribution, is recorded as a cryptographically secured block on the chain. This creates an auditable trail that can be accessed by authorized parties, allowing for complete transparency and traceability of products. This contrasts sharply with traditional systems, often reliant on fragmented and easily manipulated paper-based documentation. The ability to track a product’s entire journey minimizes the risk of counterfeiting, mislabeling, and other fraudulent activities, thereby boosting consumer confidence and brand reputation.

Real-World Applications of Blockchain in Supply Chain Management

Numerous industries are leveraging blockchain’s potential. In the food industry, companies are using blockchain to track the origin and movement of food products, ensuring food safety and preventing outbreaks of foodborne illnesses. For example, Walmart has implemented a blockchain-based system to track the provenance of its leafy greens, enabling faster identification and removal of contaminated products from the market. In the pharmaceutical industry, blockchain is used to combat the problem of counterfeit drugs, allowing for verification of drug authenticity and preventing the distribution of unsafe medications. Similarly, the luxury goods industry uses blockchain to authenticate high-value items, preventing the sale of counterfeit products and protecting brand integrity. The diamond industry also benefits from blockchain’s ability to trace the journey of a diamond from mine to market, ensuring ethical sourcing and combating the trade of conflict diamonds.

Challenges of Implementing Blockchain Solutions in Complex Global Supply Chains

Despite its advantages, implementing blockchain solutions in global supply chains presents several challenges. Interoperability between different blockchain platforms remains a significant hurdle, requiring the development of standardized protocols and data formats. The integration of blockchain technology with existing legacy systems can be complex and costly, requiring significant investment in infrastructure and expertise. Furthermore, achieving widespread adoption requires collaboration across multiple stakeholders, including suppliers, manufacturers, distributors, and retailers, each with their own interests and concerns. Data privacy and security are also crucial considerations, as blockchain systems must be designed to protect sensitive information while maintaining transparency. Finally, the scalability of blockchain networks needs to be addressed to handle the large volume of transactions involved in global supply chains.

System for Tracking a Product’s Journey from Origin to Consumer

A blockchain-based system for tracking a product would involve recording various data points at each stage of the supply chain. This includes the product’s unique identifier (e.g., a serial number or RFID tag), location, date and time of each transaction, supplier information, manufacturing details, transportation information, and ultimately, the point of sale to the consumer. Security protocols would involve the use of cryptographic hashing to ensure data integrity and prevent tampering. Access control mechanisms would limit access to authorized parties only, ensuring data privacy and confidentiality. Smart contracts could automate certain processes, such as payments and the release of goods upon verification of previous steps. Regular audits and data validation would ensure the accuracy and reliability of the information stored on the blockchain.

Stages of a Product’s Journey Through a Supply Chain

| Stage | Location | Date/Time | Verification |

|---|---|---|---|

| Raw Material Sourcing | Mine/Farm | YYYY-MM-DD HH:MM:SS | Geolocation data, supplier certification |

| Manufacturing | Factory | YYYY-MM-DD HH:MM:SS | Production records, quality control checks |

| Packaging and Distribution | Warehouse | YYYY-MM-DD HH:MM:SS | Shipping documentation, tracking numbers |

| Retail Sale | Retail Store | YYYY-MM-DD HH:MM:SS | Point-of-sale data, consumer purchase confirmation |

Digital Identity and KYC/AML Compliance

Blockchain technology offers a transformative approach to digital identity management and KYC/AML (Know Your Customer/Anti-Money Laundering) compliance. Its inherent security and transparency features can significantly improve the efficiency and effectiveness of these crucial processes, while simultaneously mitigating risks associated with fraud and identity theft. This section explores how blockchain can revolutionize these areas.

Blockchain’s decentralized nature allows for the secure storage and management of digital identities. Instead of relying on centralized databases vulnerable to breaches, individuals can control their own identity data, selectively sharing only the necessary information with relevant parties. This empowers individuals while simultaneously strengthening security and compliance.

Blockchain’s Enhancement of Digital Identity Management

Blockchain enhances digital identity management by providing a secure, transparent, and tamper-proof record of an individual’s identity attributes. This eliminates the need for multiple, disparate identity systems, streamlining the verification process and reducing the risk of fraud. The immutable nature of blockchain ensures that once an identity is verified, it remains verifiable across different platforms and applications. This interoperability significantly reduces the burden on users who no longer need to repeatedly prove their identity.

Examples of Blockchain-Based Identity Solutions and Their Impact

Several blockchain-based identity solutions are emerging, demonstrating the technology’s potential to reduce fraud and identity theft. For instance, some systems utilize self-sovereign identity (SSI) models, where individuals hold the keys to their own digital identity data. This allows them to selectively share attributes with organizations, reducing the risk of data breaches and unauthorized access. Another example is the use of blockchain for verifying credentials, such as academic degrees or professional licenses. This eliminates the need for cumbersome and often unreliable paper-based verification methods, leading to faster and more efficient processes. The impact is a decrease in fraudulent credentials and a more streamlined verification process for employers and educational institutions.

Privacy Implications and Proposed Solutions

While blockchain offers significant advantages for digital identity management, privacy concerns remain. The immutability of blockchain means that once data is recorded, it is difficult to erase. This raises concerns about data misuse and potential for surveillance. However, solutions exist to address these concerns. Techniques like zero-knowledge proofs allow individuals to prove their identity without revealing sensitive personal information. Furthermore, implementing robust access control mechanisms and data encryption can further safeguard privacy. Homomorphic encryption, for example, allows computations to be performed on encrypted data without decryption, preserving privacy while enabling verification.

Comparison of Different Approaches to Implementing Blockchain-Based Digital Identity Systems

Different approaches exist for implementing blockchain-based digital identity systems. Some systems rely on public blockchains, offering transparency and decentralization but potentially sacrificing privacy. Others utilize private or permissioned blockchains, providing greater control over data access but potentially compromising decentralization. Hybrid approaches combining aspects of both public and private blockchains are also being explored, seeking to balance the benefits of transparency and privacy. The choice of approach depends on the specific requirements and priorities of the system.

Hypothetical Blockchain-Based KYC/AML System

A hypothetical blockchain-based KYC/AML system could function as follows:

- Data Storage: Identity data, including KYC/AML compliance information, is stored securely on a permissioned blockchain, accessible only to authorized parties.

- Verification Methods: Verification of identity and compliance could leverage various methods, including biometric authentication, document verification using secure digital signatures, and integration with existing KYC/AML databases.

- Security Measures: The system incorporates robust security measures, such as encryption of sensitive data, access control mechanisms based on role-based permissions, and regular security audits. Multi-factor authentication would be implemented for all users. Smart contracts would automate compliance checks and flag suspicious activity.

- Data Minimization: Only essential identity and compliance information would be stored on the blockchain, minimizing privacy risks.

- Audit Trails: All transactions and verifications would be recorded on an immutable ledger, providing a transparent and auditable trail of all activities.

Final Thoughts

The integration of blockchain into the financial sector is poised to redefine traditional models, creating a more efficient, transparent, and secure ecosystem. While challenges remain in areas such as regulation and scalability, the potential benefits are undeniable. As blockchain technology continues to mature and adoption increases, we can expect to see even more innovative applications emerge, further revolutionizing the world of finance.

Top FAQs

What are the main risks associated with DeFi?

DeFi platforms face risks including smart contract vulnerabilities, oracle manipulation, and regulatory uncertainty. Users should carefully research platforms and understand the associated risks before participating.

How does blockchain improve supply chain transparency?

Blockchain creates an immutable record of product movement and provenance, making it difficult to falsify information and improving traceability throughout the supply chain.

What are the regulatory challenges facing blockchain-based payment systems?

Regulatory frameworks are still evolving for blockchain-based payment systems. Issues like anti-money laundering (AML) compliance and Know Your Customer (KYC) regulations need to be addressed to ensure responsible adoption.

Is blockchain truly secure?

While blockchain technology is inherently secure due to its cryptographic design, vulnerabilities can exist in the smart contracts or applications built on top of it. Security best practices and regular audits are crucial.