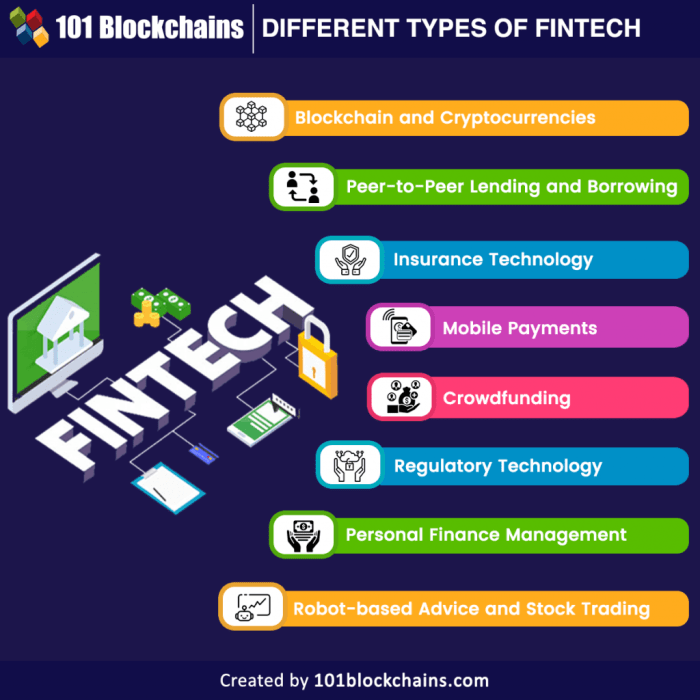

The financial technology (Fintech) sector is experiencing explosive growth, reshaping how we interact with money. From mobile payments to AI-driven investment strategies, Fintech innovations are revolutionizing traditional financial services, increasing accessibility, and enhancing efficiency. This exploration delves into key examples, showcasing the transformative impact of these advancements.

We’ll examine how various Fintech solutions are addressing longstanding challenges in areas such as payments, lending, investment, insurance, and personal finance management. The discussion will cover the technological underpinnings, the benefits and drawbacks of each innovation, and the regulatory landscapes shaping their development and adoption.

Payment Technologies

The rapid advancement of technology has revolutionized the way we make payments, leading to a surge in innovation within the Fintech sector. This section explores the evolution of payment technologies, focusing on mobile payments, contactless systems, and the role of blockchain. We will analyze the security implications and advantages/disadvantages of these innovations, ultimately illustrating their impact on financial inclusion and the broader financial landscape.

Mobile Payment System Evolution and Financial Inclusion

The evolution of mobile payment systems has dramatically increased financial inclusion, particularly in underserved communities. Early mobile payment systems relied on SMS-based transactions, allowing users with basic mobile phones to transfer money. The emergence of smartphones and faster internet speeds paved the way for more sophisticated apps offering peer-to-peer (P2P) transfers, mobile wallets, and integration with point-of-sale (POS) systems. This accessibility has empowered individuals without traditional bank accounts to participate in the formal financial system, facilitating economic activity and improving financial literacy. For example, M-Pesa in Kenya has significantly broadened financial access, enabling millions to conduct transactions and save money digitally.

Security Features of Contactless Payment Methods

Various contactless payment methods, including Near Field Communication (NFC) technology used in Apple Pay, Google Pay, and Samsung Pay, offer varying levels of security. These systems typically utilize tokenization, replacing actual card numbers with unique digital tokens for transactions. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security. However, vulnerabilities exist. Skimming devices can potentially capture data from NFC-enabled devices, highlighting the importance of regularly updating software and being mindful of potentially compromised POS terminals. Contactless cards, while generally secure, can be more vulnerable to theft or loss compared to traditional chip-and-PIN cards due to the lack of a PIN requirement for low-value transactions.

Advantages and Disadvantages of Blockchain in Payment Processing

Blockchain technology offers potential advantages in payment processing, primarily through enhanced security and transparency. Decentralized ledger technology eliminates the need for intermediaries, potentially reducing transaction fees and processing times. The immutability of blockchain records minimizes the risk of fraud and double-spending. However, scalability remains a significant challenge. The processing speed of many blockchain networks is currently insufficient to handle the volume of transactions processed by traditional payment systems. Furthermore, regulatory uncertainty and the complexity of integrating blockchain technology into existing financial infrastructure pose obstacles to widespread adoption. The energy consumption associated with some blockchain networks also raises environmental concerns.

Comparison of Mobile Payment Apps

The following table compares four popular mobile payment apps, highlighting their key features, fees, and security protocols.

| App | Features | Fees | Security Protocols |

|---|---|---|---|

| Apple Pay | Peer-to-peer payments, in-app purchases, contactless payments at POS terminals | Generally no fees for users, merchants may incur processing fees | Tokenization, biometric authentication (Touch ID/Face ID), device encryption |

| Google Pay | Peer-to-peer payments, in-app purchases, contactless payments at POS terminals, loyalty programs integration | Generally no fees for users, merchants may incur processing fees | Tokenization, biometric authentication (fingerprint/facial recognition), device encryption |

| PayPal | Peer-to-peer payments, online payments, merchant payments, international transfers | Fees vary depending on transaction type and location | Two-factor authentication, encryption, fraud monitoring systems |

| Venmo | Peer-to-peer payments, social features | Generally no fees for users, merchants may incur processing fees | Two-factor authentication, encryption |

Lending and Borrowing Platforms

The rise of online lending and borrowing platforms represents a significant disruption to traditional banking models. These platforms leverage technology to streamline the lending process, often offering greater accessibility and potentially more competitive interest rates than traditional banks. This shift has led to increased competition and innovation within the financial sector, impacting both borrowers and lenders.

Peer-to-peer (P2P) lending platforms, in particular, have fundamentally altered the landscape. They connect borrowers directly with individual lenders, bypassing the intermediary role of banks. This direct connection can lead to lower costs and greater efficiency, but also introduces unique challenges related to risk assessment and regulatory oversight.

Disruption of Traditional Banking Models by Peer-to-Peer Lending

P2P lending platforms disrupt traditional banking by eliminating the need for a central financial institution to act as an intermediary. This reduces overhead costs, potentially leading to lower interest rates for borrowers and higher returns for lenders. Traditional banks often have stringent lending criteria and lengthy approval processes, while P2P platforms frequently offer a more streamlined and quicker application process. This increased accessibility opens up lending opportunities to individuals and businesses that might be excluded from traditional banking channels. Furthermore, P2P platforms often utilize sophisticated algorithms and data analysis to assess creditworthiness, sometimes offering more nuanced evaluations than traditional credit scoring methods. The increased transparency and competition fostered by P2P platforms put pressure on traditional banks to innovate and improve their own offerings.

Innovative Approaches to Credit Scoring and Risk Assessment

Several innovative approaches to credit scoring and risk assessment are employed by online lending platforms. Beyond traditional credit scores (like FICO), these platforms often incorporate alternative data sources such as bank transaction history, social media activity, and even utility payment records. This alternative data can provide a more comprehensive picture of a borrower’s creditworthiness, especially for individuals with limited credit history. Machine learning algorithms are frequently used to analyze this vast dataset, identifying patterns and predicting the likelihood of loan default more accurately than traditional methods. For instance, some platforms use behavioral scoring, analyzing spending habits and financial responsibility to assess risk. Another approach involves using a combination of traditional and alternative data, creating a hybrid credit scoring system that balances established metrics with newer, more dynamic indicators.

Regulatory Challenges Faced by Online Lending Platforms

Online lending platforms face a unique set of regulatory challenges. The rapid growth of this sector has outpaced the development of comprehensive regulatory frameworks in many jurisdictions. Concerns around consumer protection, data privacy, and the prevention of predatory lending practices are paramount. Ensuring compliance with existing regulations, such as those related to interest rate caps and fair lending practices, can be complex. The cross-border nature of many online lending platforms further complicates regulatory oversight. Additionally, the use of alternative data in credit scoring raises concerns about bias and fairness, requiring careful consideration of potential discriminatory outcomes. Regulatory uncertainty can hinder the growth of the industry, while inadequate regulation can lead to consumer harm.

Loan Application Process via Robo-Advisor Platform

A flowchart illustrating the process of obtaining a loan through a robo-advisor platform:

[A textual description of a flowchart is provided below as image generation is not permitted]

Start –> Application Submission (Personal Information, Financial Data) –> Automated Credit Assessment (Algorithmic Scoring, Data Analysis) –> Loan Offer (Interest Rate, Terms) –> Acceptance/Rejection –> Loan Disbursement (Funds Transfer) –> Repayment Schedule (Automated Payments) –> Account Monitoring (Performance Tracking) –> End

Investment and Wealth Management

The rise of Fintech has dramatically reshaped the investment and wealth management landscape, making sophisticated financial tools and strategies more accessible to a broader range of individuals. This accessibility, driven by technological advancements and innovative business models, is fostering greater financial inclusion and empowering individuals to take control of their financial futures. This section explores key Fintech innovations within this sector.

Fintech’s impact on investment and wealth management is multifaceted, encompassing robo-advisors, AI-driven portfolio management, and diverse investment platforms. These innovations are not only improving efficiency and reducing costs but also fundamentally altering how individuals interact with their investments.

Robo-Advisors and Accessibility to Investment Services

Robo-advisors have democratized access to investment management. These automated platforms utilize algorithms to create and manage investment portfolios based on an individual’s risk tolerance, financial goals, and investment timeframe. Previously, access to professional portfolio management was largely limited to high-net-worth individuals. Robo-advisors have lowered the barrier to entry, allowing individuals with smaller investment amounts to benefit from professionally managed portfolios. Examples include Betterment and Wealthfront, which have made sophisticated investment strategies available to the masses through user-friendly interfaces and low minimum investment requirements. This increased accessibility has led to a significant growth in the number of people actively participating in the investment market.

Artificial Intelligence in Portfolio Management

Artificial intelligence (AI) is transforming portfolio management by enhancing efficiency, accuracy, and personalization. AI algorithms can analyze vast datasets of market information, economic indicators, and individual investor profiles to identify optimal investment strategies. This includes real-time adjustments to portfolios based on changing market conditions, exceeding the capabilities of human portfolio managers who are limited by time and cognitive constraints. AI also enables personalized portfolio recommendations tailored to individual risk profiles and goals, further enhancing the overall investment experience. For instance, AI can identify undervalued assets or predict market trends with greater accuracy than traditional methods, potentially leading to higher returns.

Comparison of Investment Platforms

Different investment platforms offer varying features and benefits. Traditional brokerage firms often provide a wider range of investment options but may charge higher fees and require higher minimum investment amounts. Robo-advisors typically offer lower fees and simpler interfaces, making them suitable for beginners. Direct-indexing platforms provide granular control over investments but may require a higher level of financial literacy. The optimal platform depends on individual needs, investment goals, and risk tolerance. Factors to consider include fees, investment choices, platform user-friendliness, and customer support.

Top Five Fintech Companies in the Investment Space

The following companies represent significant players in the Fintech investment landscape, each with its unique selling proposition:

- Betterment: Focuses on automated portfolio management with a user-friendly interface and low fees, catering to a broad range of investors.

- Wealthfront: Offers similar services to Betterment, but also incorporates tax-loss harvesting and other advanced features.

- Robinhood: Known for its commission-free trading and user-friendly mobile app, popular among younger investors.

- Fidelity: A long-standing financial institution that has successfully integrated Fintech features into its offerings, providing a blend of traditional and modern services.

- Schwab: Similar to Fidelity, Schwab offers a robust platform combining traditional brokerage services with advanced technology and digital tools.

Insurance Technologies (Insurtech)

The insurance industry, traditionally known for its slow pace of innovation, is undergoing a rapid transformation driven by technological advancements. Insurtech, the convergence of insurance and technology, is reshaping how policies are underwritten, claims are processed, and customer experiences are delivered. This transformation is fueled by several key trends, leading to greater efficiency, personalization, and customer satisfaction.

Key Trends Driving Insurtech Innovation

Several factors are propelling the growth and innovation within the insurtech sector. These include the increasing availability and affordability of data analytics tools, the rise of mobile technology and its impact on customer expectations, the growing adoption of cloud computing for improved scalability and efficiency, and the increasing demand for personalized and customized insurance products. Furthermore, regulatory changes in many jurisdictions are also fostering a more competitive and innovative insurance landscape. These combined forces are creating a dynamic environment where new business models and technologies are constantly emerging.

Telematics and Personalized Insurance Premiums

Telematics, the use of technology to collect and analyze data from vehicles, is revolutionizing the auto insurance industry. Devices installed in vehicles, or smartphone apps, track driving behavior such as speed, acceleration, braking, and mileage. This data is then used to create a personalized risk profile for each driver. Drivers with safer driving habits, as evidenced by the telematics data, are rewarded with lower premiums, incentivizing safer driving practices. For example, a driver who consistently maintains a low speed and avoids harsh braking will likely receive a discount compared to a driver with a more aggressive driving style. This system fosters a more equitable and accurate pricing model based on individual risk rather than broad demographic categories.

Artificial Intelligence in Fraud Detection and Risk Management

AI is playing a crucial role in improving the efficiency and accuracy of fraud detection and risk assessment within the insurance sector. Machine learning algorithms can analyze vast amounts of data, identifying patterns and anomalies indicative of fraudulent claims or risky behaviors. This technology can detect inconsistencies in claim information, compare claims against historical data, and identify potential red flags that might be missed by human reviewers. For example, AI can identify patterns in claims originating from specific geographical areas or involving specific types of injuries, potentially revealing organized fraud rings. In risk management, AI can analyze policyholder data to better predict the likelihood of future claims, enabling insurers to price policies more accurately and manage their risk portfolios more effectively.

Blockchain Technology and Enhanced Insurance Claims Processing

Imagine a system where insurance claims are processed transparently and efficiently, minimizing delays and disputes. This is the potential of blockchain technology in insurance claims processing. A visual representation would show a simplified flow: A claim is submitted and recorded on a shared, immutable blockchain ledger. All relevant parties – the insured, the insurer, and potentially third-party assessors – can access and verify the claim information in real-time. Each step in the claims process, from initial submission to final settlement, is recorded as a transaction on the blockchain, creating a complete and auditable record. This eliminates the need for multiple intermediaries, reduces the risk of fraud, and speeds up the claims settlement process. The blockchain’s decentralized nature ensures transparency and trust among all parties involved. This streamlined process leads to faster payouts for policyholders and reduced administrative costs for insurers.

Financial Data Analytics and Personal Finance Management

The convergence of financial data analytics and personal finance management is revolutionizing how individuals interact with their finances. Open banking initiatives, coupled with advancements in artificial intelligence (AI), are empowering consumers with unprecedented levels of control and insight into their financial well-being. This section explores the impact of these technologies on personal finance management, highlighting specific applications and future trends.

Open Banking Initiatives Foster Innovation in Personal Finance Management

Open banking, which mandates banks to share customer financial data with third-party providers, has unlocked a wealth of opportunities for innovation in personal finance management. By granting access to aggregated financial data, users can gain a comprehensive view of their spending, savings, and investments across multiple accounts. This consolidated view allows for more accurate budgeting, insightful financial planning, and personalized recommendations. The enhanced data accessibility fosters competition and drives innovation among fintech companies, leading to the development of more sophisticated and user-friendly personal finance tools.

Applications Using Financial Data Analytics for Personalized Financial Advice

Several applications leverage financial data analytics to provide tailored financial advice. These apps analyze spending patterns, income streams, and debt levels to offer personalized recommendations on budgeting, saving, and investing. For instance, some applications identify recurring subscriptions that could be reduced, suggest better investment strategies based on risk tolerance and financial goals, or provide alerts for potential overspending. Others offer sophisticated simulations to project future financial scenarios, assisting users in making informed decisions about major purchases or long-term investments. A key example is Mint, which aggregates user accounts and provides personalized insights and budgeting tools. Another example is Personal Capital, which offers comprehensive financial planning tools and investment management services.

AI-Enhanced Budgeting Apps and Improved User Financial Literacy

Many budgeting apps now incorporate AI to enhance user engagement and improve financial literacy. AI algorithms can analyze spending habits, identify areas for improvement, and offer personalized recommendations for budgeting strategies. These apps often provide predictive analytics, forecasting future spending based on past trends. Through gamification and interactive visualizations, AI can make the process of budgeting more engaging and less daunting. For example, some apps offer personalized financial challenges or reward users for achieving their savings goals, fostering positive financial habits. The AI-powered insights and personalized feedback provided by these apps contribute significantly to improving user financial literacy.

Personal Finance App User Interface Mockup

The app’s home screen displays a summarized overview of the user’s current financial status, including total assets, liabilities, and net worth. A circular progress bar shows the user’s progress towards their savings goals. Below this summary, there are three main sections: “Spending Analysis,” “Budgeting Tools,” and “AI Insights.” The “Spending Analysis” section uses interactive charts and graphs to visualize spending patterns categorized by merchant, category, and time period. The “Budgeting Tools” section provides tools for setting budgets, tracking expenses, and scheduling transfers between accounts. The “AI Insights” section displays personalized recommendations, such as potential savings opportunities, suggested investment strategies, or warnings about potential overspending. A chatbot interface is also available for quick questions and personalized support. The overall design is clean, intuitive, and uses color-coded visuals to improve data comprehension.

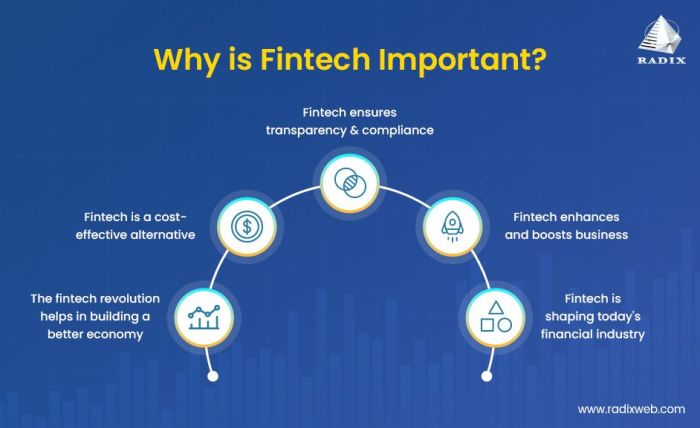

Closure

Fintech’s transformative influence on the financial world is undeniable. The examples explored highlight the dynamism and innovation within the sector, promising further advancements that will continue to redefine financial services and enhance user experiences. As technology evolves, so too will the landscape of Fintech, creating exciting opportunities and challenges in the years to come. The future of finance is undoubtedly intertwined with the continued evolution of these technologies.

Expert Answers

What are the biggest risks associated with Fintech innovations?

Risks include cybersecurity vulnerabilities, data privacy concerns, regulatory uncertainty, and potential for market manipulation.

How is Fintech impacting financial inclusion?

Fintech is expanding access to financial services for underserved populations through mobile banking, micro-lending platforms, and digital payment systems.

What is the role of regulation in the Fintech space?

Regulation aims to balance innovation with consumer protection, addressing issues like data security, fraud prevention, and fair lending practices.

What are some emerging trends in Fintech?

Open banking, embedded finance, decentralized finance (DeFi), and the use of blockchain technology are prominent emerging trends.