Indonesia’s burgeoning financial technology (Fintech) sector is rapidly transforming its economy, offering both immense opportunities and significant challenges. This exploration delves into the multifaceted landscape of Teknologi Finansial, examining its impact on financial inclusion, economic growth, and the regulatory environment. We will explore the innovative trends shaping the future of finance in Indonesia, alongside the hurdles that must be overcome for continued success.

From mobile payment systems revolutionizing daily transactions to innovative lending platforms expanding access to credit, Fintech is reshaping how Indonesians interact with money. This dynamic sector is not without its complexities, however, including regulatory considerations, cybersecurity threats, and the need for sustainable growth. This analysis provides a comprehensive overview of the current state of Teknologi Finansial in Indonesia, offering insights into its past, present, and future potential.

Definition and Scope of Teknologi Finansial (Financial Technology) in Indonesia

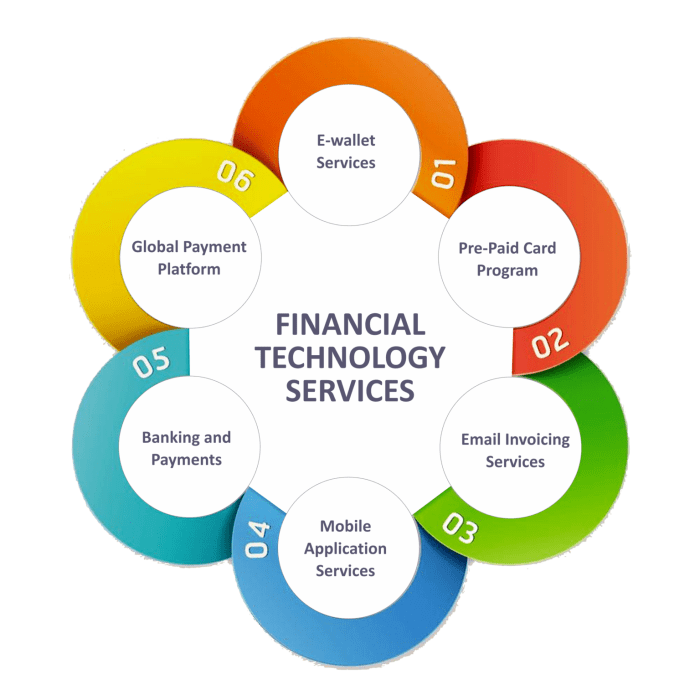

Teknologi Finansial, or Fintech, in Indonesia refers to the application of technology to improve and automate financial services and processes. This encompasses a wide range of activities, from digital payments and lending platforms to investment apps and insurance solutions. It’s driven by the increasing smartphone penetration, internet access, and a burgeoning digital-savvy population, making Indonesia a fertile ground for Fintech innovation.

Fintech companies in Indonesia are characterized by their reliance on technology to deliver financial services, often with a focus on reaching underserved populations or offering more convenient and efficient solutions than traditional financial institutions. They typically leverage mobile technology, big data analytics, and artificial intelligence to personalize services, streamline operations, and reduce costs. A key differentiator is their agility and ability to adapt quickly to evolving market demands and technological advancements. This contrasts with the often slower pace of innovation within established banking systems.

Sectors within the Indonesian Fintech Landscape

The Indonesian Fintech landscape is diverse and dynamic, encompassing several key sectors. The following table organizes these sectors for clarity. Note that some companies may operate across multiple sectors.

| Payments | Lending | Investments | Insurance |

|---|---|---|---|

| Digital wallets (e.g., GoPay, OVO, Dana) facilitating peer-to-peer transfers and online payments. These platforms often integrate with e-commerce platforms and ride-hailing services, creating a seamless payment ecosystem. | Peer-to-peer (P2P) lending platforms (e.g., Investree, Amartha) connecting borrowers directly with lenders, often focusing on micro, small, and medium-sized enterprises (MSMEs). These platforms utilize credit scoring algorithms and technology to assess risk and facilitate loan disbursement. | Online brokerage platforms (e.g., Bibit, Ajaib) offering access to investment products such as mutual funds and stocks, often targeting younger, less experienced investors through user-friendly interfaces and educational resources. | Insurtech platforms (e.g., PasarPolis) offering various insurance products online, often focusing on microinsurance and providing simpler, more accessible insurance options compared to traditional insurers. |

| Online banking platforms offering digital account management, fund transfers, and bill payments, often with enhanced security features and user-friendly interfaces. | Buy Now, Pay Later (BNPL) services (e.g., Kredivo, Akulaku) offering short-term financing for online purchases, often integrated with e-commerce platforms. These services often rely on credit scoring and risk assessment algorithms. | Robo-advisors providing automated investment advice based on individual risk profiles and financial goals. These platforms leverage algorithms and data analytics to optimize investment portfolios. | Digital health insurance platforms offering simplified online enrollment, claims processing, and policy management. These platforms leverage technology to streamline processes and enhance customer experience. |

Impact of Teknologi Finansial on the Indonesian Economy

The rise of financial technology (Fintech) in Indonesia has profoundly impacted the nation’s economy, creating both significant opportunities and challenges. Its influence spans across various sectors, from individual consumers to large corporations, reshaping the financial landscape and driving economic growth in unprecedented ways. Understanding this dual impact is crucial for navigating the future of Indonesia’s financial ecosystem.

Fintech’s positive contributions to Indonesia’s economy are undeniable. Increased efficiency, financial inclusion, and access to credit are key areas where Fintech has demonstrated its transformative potential.

Positive Economic Impacts of Fintech Adoption in Indonesia

The adoption of Fintech solutions has led to increased efficiency in financial transactions, reducing costs and processing times for both businesses and consumers. Digital payment systems, for example, have streamlined transactions, minimizing reliance on cash and reducing the operational costs associated with traditional banking methods. This efficiency translates directly into economic growth by freeing up resources and improving productivity across various sectors. Furthermore, Fintech has fostered innovation, encouraging the development of new financial products and services tailored to the specific needs of the Indonesian market. This innovation cycle creates jobs and stimulates economic activity. The improved access to credit through peer-to-peer lending platforms and microfinance initiatives has also empowered small and medium-sized enterprises (SMEs), a vital component of the Indonesian economy, allowing them to access capital previously unavailable through traditional banking channels.

Fintech’s Contribution to Financial Inclusion in Indonesia

Fintech has played a pivotal role in expanding financial inclusion in Indonesia, particularly in underserved rural areas and among low-income populations. Traditional banking infrastructure often lacks reach in these regions, leaving a significant portion of the population unbanked. Mobile money platforms, for instance, have provided millions of Indonesians with access to basic financial services like payments, transfers, and savings, previously out of reach. This increased access to financial services has empowered individuals, allowing them to participate more fully in the economy, fostering entrepreneurship, and improving overall living standards. The GoPay and OVO platforms, for example, have become ubiquitous in Indonesia, facilitating transactions for millions of users who may not have had access to traditional banking services.

Potential Negative Economic Consequences of Rapid Fintech Growth in Indonesia

The rapid expansion of Fintech in Indonesia, while largely beneficial, also presents potential risks that need careful management.

- Increased Cybercrime and Fraud: The digital nature of Fintech transactions makes them vulnerable to cyberattacks and fraudulent activities, potentially leading to significant financial losses for individuals and businesses. Robust cybersecurity measures are essential to mitigate this risk.

- Data Privacy and Security Concerns: The collection and use of personal data by Fintech companies raise concerns about data privacy and security. Strict regulations and ethical practices are needed to protect consumer data and prevent misuse.

- Financial Instability: The rapid growth of Fintech lending platforms can potentially destabilize the financial system if not properly regulated. Over-indebtedness and defaults could have negative ripple effects throughout the economy.

- Regulatory Challenges: The speed of Fintech innovation often outpaces the capacity of regulators to keep up, creating a regulatory gap that can lead to market inefficiencies and risks.

- Exacerbation of Inequality: While Fintech can promote financial inclusion, it also has the potential to exacerbate existing inequalities if access to technology and digital literacy remains unevenly distributed.

Regulatory Landscape of Teknologi Finansial in Indonesia

Indonesia’s burgeoning Fintech sector operates within a dynamic and evolving regulatory framework. The government strives to balance fostering innovation with protecting consumers and maintaining financial stability. This necessitates a nuanced approach that adapts to the rapid technological advancements within the industry.

The primary regulatory bodies overseeing Fintech in Indonesia include Otoritas Jasa Keuangan (OJK), Bank Indonesia (BI), and the Ministry of Communication and Information Technology (Kominfo). OJK primarily regulates non-bank financial institutions, including peer-to-peer (P2P) lending platforms, digital payment providers, and crowdfunding platforms. BI focuses on payment systems and digital currencies, while Kominfo addresses data protection and cybersecurity aspects. This multi-agency approach, while aiming for comprehensive oversight, can sometimes lead to overlapping jurisdictions and regulatory complexities.

Current Fintech Regulatory Framework in Indonesia

The regulatory framework for Fintech in Indonesia is primarily based on existing financial regulations adapted to address the unique characteristics of Fintech businesses. Specific regulations have been introduced for P2P lending, digital payments, and other Fintech sub-sectors. These regulations cover areas such as licensing, capital requirements, consumer protection, data privacy, and anti-money laundering (AML) and combating the financing of terrorism (CFT). For example, P2P lending platforms are required to obtain a license from OJK and adhere to strict lending practices to mitigate risks of over-indebtedness and fraud. Digital payment providers must comply with regulations related to transaction security, data protection, and interoperability. The ongoing challenge lies in keeping these regulations up-to-date with the rapid evolution of Fintech technologies and business models.

Comparison with Southeast Asian Fintech Regulatory Environments

Indonesia’s Fintech regulatory environment can be compared to those of other Southeast Asian nations, revealing both similarities and differences. Countries like Singapore and Malaysia have established relatively mature and comprehensive regulatory frameworks, often prioritizing a sandbox approach to allow for experimentation and innovation while mitigating risks. These frameworks tend to be more streamlined than Indonesia’s multi-agency approach. However, other countries in the region, such as Vietnam and the Philippines, are still developing their regulatory frameworks, often lagging behind Indonesia in terms of specific regulations for certain Fintech sub-sectors. The level of regulatory clarity and enforcement also varies across the region, impacting the ease of doing business for Fintech companies. Generally, there is a move towards greater harmonization of regulatory standards across the ASEAN region, aiming to facilitate cross-border Fintech activities.

Hypothetical Regulatory Improvement: A Unified Fintech Regulatory Agency

One potential improvement to the Indonesian Fintech regulatory landscape would be the establishment of a unified Fintech regulatory agency. This agency would consolidate the responsibilities currently divided among OJK, BI, and Kominfo, streamlining the regulatory process and reducing overlapping jurisdictions. This would create a more efficient and consistent regulatory environment, potentially attracting more foreign investment and fostering greater innovation.

Potential Benefits: Reduced regulatory complexity, improved efficiency, enhanced investor confidence, increased innovation, and better consumer protection through a more cohesive and comprehensive regulatory approach.

Potential Drawbacks: The creation of a new agency might lead to initial transitional challenges, potential power struggles, and the need for significant investment in infrastructure and personnel. Concerns might arise regarding potential regulatory capture or a lack of specialized expertise across various Fintech sub-sectors.

Fintech Innovations and Emerging Trends in Indonesia

Indonesia’s Fintech sector is experiencing rapid growth, driven by a young, tech-savvy population and increasing smartphone penetration. This dynamic environment fosters continuous innovation, leading to the emergence of new trends and the refinement of existing technologies. Understanding these trends is crucial for navigating the future of financial services in the country.

Three Emerging Fintech Trends in Indonesia and Their Potential Impact

Three key emerging trends shaping Indonesia’s Fintech landscape are embedded finance, Buy Now Pay Later (BNPL) services, and the rise of super apps. Embedded finance seamlessly integrates financial services into non-financial platforms, expanding access and convenience. BNPL offers flexible payment options, boosting consumer spending but requiring careful risk management. Super apps consolidate various services, including financial ones, creating a highly convenient ecosystem.

- Embedded Finance: This trend sees financial services integrated into non-financial platforms like e-commerce sites or ride-hailing apps. For example, a customer might pay for a ride directly through their linked bank account within the ride-hailing app, eliminating the need for separate transactions. This enhances user experience and expands financial inclusion by reaching customers who might not otherwise use traditional financial services. The potential impact is increased transaction volume and broader financial access across the population.

- Buy Now Pay Later (BNPL): BNPL services allow consumers to purchase goods and services and pay later in installments. This is particularly appealing to younger demographics with limited access to credit. However, it also presents risks related to debt management and financial responsibility. The impact is a potential surge in consumer spending, but it also requires robust regulatory oversight to mitigate potential negative consequences.

- Super Apps: Super apps, like Gojek and Grab, offer a wide range of services, including ride-hailing, food delivery, and increasingly, financial services like digital payments, lending, and insurance. This creates a highly convenient and integrated ecosystem for users. The impact is a significant shift in how consumers access financial services, potentially leading to a reduction in reliance on traditional banks for certain transactions.

The Role of Artificial Intelligence and Machine Learning in Indonesian Fintech

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming Indonesian Fintech. These technologies are used for fraud detection, credit scoring, personalized financial advice, and customer service automation. The application of AI and ML improves efficiency, reduces costs, and enhances the overall customer experience.

AI and ML algorithms analyze vast datasets to identify patterns and anomalies, enabling more accurate risk assessment and fraud prevention. In credit scoring, these technologies can assess creditworthiness based on alternative data sources, extending access to credit for individuals traditionally excluded from the formal financial system. Furthermore, AI-powered chatbots provide instant customer support, improving responsiveness and reducing operational costs. The overall impact is a more efficient, secure, and inclusive financial system.

Visual Representation of Fintech Evolution in Indonesia (Past 5 Years)

The following text describes a timeline illustrating the evolution of Fintech in Indonesia over the past five years (2019-2023).

2019: The year begins with a relatively established digital payment landscape dominated by established players. OJK (Otoritas Jasa Keuangan) regulations are becoming more defined, creating a more structured environment. Early stages of BNPL adoption are seen.

2020: The COVID-19 pandemic accelerates digital adoption. Digital payments experience explosive growth as physical transactions decrease. BNPL gains significant traction as a payment option. Super apps expand their financial services offerings.

2021: Increased investment in Indonesian Fintech startups. Focus shifts towards financial inclusion and reaching underserved populations. Regulations continue to evolve, addressing data privacy and consumer protection. The use of AI and ML becomes more prominent.

2022: Consolidation within the Fintech sector begins, with mergers and acquisitions becoming more frequent. Emphasis on sustainable and responsible Fintech practices emerges. Embedded finance starts gaining momentum.

2023: Embedded finance and super apps become dominant trends. The use of AI and ML continues to advance, enhancing efficiency and security. Regulations become more sophisticated, balancing innovation with consumer protection. A more mature and diversified Fintech ecosystem is established.

Challenges and Opportunities for Teknologi Finansial in Indonesia

The Indonesian fintech landscape, while exhibiting remarkable growth, faces a complex interplay of challenges and opportunities. Navigating these requires a strategic approach, combining innovation with a deep understanding of the local context. Success hinges on addressing infrastructural limitations, mitigating cybersecurity risks, and fostering strategic partnerships.

Main Challenges Faced by Fintech Companies in Indonesia

The Indonesian fintech sector encounters several significant hurdles. These obstacles, if not properly addressed, can hinder growth and limit the sector’s potential to fully serve the unbanked and underbanked population. Effective solutions require a multi-pronged approach involving government support, industry collaboration, and technological advancements.

- Inadequate Infrastructure: Uneven internet access and digital literacy across the archipelago present a major challenge. Many rural areas lack reliable internet connectivity, limiting the reach of fintech services. This necessitates investment in expanding digital infrastructure and promoting digital literacy initiatives.

- Cybersecurity Threats: The increasing reliance on digital platforms makes fintech companies vulnerable to cyberattacks and data breaches. Robust cybersecurity measures, including advanced encryption and fraud detection systems, are crucial to maintaining customer trust and protecting sensitive financial information. The rising sophistication of cybercriminals demands constant vigilance and investment in cutting-edge security technologies.

- Intense Competition: The Indonesian fintech market is highly competitive, with both domestic and international players vying for market share. This necessitates a strong value proposition, effective marketing strategies, and a focus on differentiation to attract and retain customers. The competitive landscape requires continuous innovation and adaptation to stay ahead of the curve.

- Regulatory Uncertainty: While the Indonesian government is actively working to create a supportive regulatory framework, evolving regulations can create uncertainty for fintech companies. Staying abreast of regulatory changes and ensuring compliance is crucial for long-term sustainability. Proactive engagement with regulators is vital for shaping a conducive regulatory environment.

Examples of Successful Fintech Companies in Indonesia and Their Strategies

Several Indonesian fintech companies have demonstrated remarkable success by strategically navigating these challenges. Their strategies offer valuable lessons for other players in the market.

- GoPay (Gojek): GoPay’s integration within the popular Gojek ride-hailing and delivery app has provided a massive user base and network effect. Their success stems from leveraging existing infrastructure and offering a seamless user experience. They’ve also invested heavily in building trust and security to mitigate cybersecurity concerns.

- OVO (Grab): Similar to GoPay, OVO, integrated into the Grab platform, benefits from a large user base and diverse service offerings. Their strategy focuses on providing a comprehensive suite of financial services, from payments to investments, catering to a wide range of customer needs.

- Dana: Dana has focused on building a strong brand identity and offering competitive features to attract users. Their success is attributed to a combination of strategic marketing, user-friendly interface, and a commitment to financial inclusion.

Overcoming Challenges Through Innovation and Strategic Partnerships

Addressing the challenges facing Indonesian fintech companies requires a combination of innovative solutions and strategic partnerships.

- Investing in Infrastructure: Fintech companies can collaborate with telecommunication providers to expand internet access in underserved areas. This can involve deploying mobile towers in rural regions and offering affordable internet packages.

- Enhancing Cybersecurity: Adopting advanced security protocols, such as multi-factor authentication and blockchain technology, can significantly reduce the risk of cyberattacks. Partnerships with cybersecurity firms can provide expertise and resources to enhance security measures.

- Strategic Partnerships: Collaborating with banks, telecommunication companies, and other businesses can expand reach, access new customer segments, and leverage existing infrastructure. These partnerships can facilitate the development of innovative financial products and services.

- Promoting Financial Literacy: Fintech companies can play a crucial role in educating users about financial products and services, thereby fostering greater trust and adoption. This can involve developing educational materials and conducting workshops to enhance digital literacy.

The Future of Teknologi Finansial in Indonesia

Indonesia’s burgeoning fintech sector is poised for significant growth and transformation over the next 5-10 years, driven by increasing smartphone penetration, expanding internet access, and a young, tech-savvy population. This growth will be shaped by technological advancements, evolving regulatory frameworks, and the ongoing push for greater financial inclusion.

The next decade will likely witness a consolidation of the fintech landscape, with larger players acquiring smaller ones and forming strategic partnerships. This will lead to a more mature and sophisticated ecosystem, characterized by increased competition and innovation. Simultaneously, we can expect a diversification of fintech offerings, moving beyond payments and lending to encompass areas like insurance, wealth management, and supply chain finance.

Further Financial Inclusion Driven by Fintech Advancements

Fintech’s role in expanding financial inclusion in Indonesia is undeniable. The accessibility and convenience offered by digital platforms have already brought millions into the formal financial system. This trend is set to accelerate, with a particular focus on reaching underserved populations in rural areas. Mobile money platforms, for example, are already proving effective in providing financial services to individuals previously excluded from traditional banking. We can expect further development of agent networks, particularly in remote regions, to facilitate transactions and financial literacy programs. The use of biometric authentication will also further enhance accessibility, overcoming challenges related to identification and documentation. This increased access to financial services will have a profound impact on economic empowerment, particularly for women and small businesses.

Technological Advancements Reshaping the Indonesian Financial Landscape

Several technological advancements will significantly reshape Indonesia’s financial landscape. The rise of artificial intelligence (AI) and machine learning (ML) will lead to more personalized and efficient financial services. AI-powered credit scoring systems, for example, can assess creditworthiness more accurately, expanding access to credit for individuals with limited credit history. Blockchain technology will enhance security and transparency in financial transactions, reducing fraud and improving efficiency in cross-border payments. The increasing adoption of open banking APIs will facilitate data sharing between financial institutions, fostering competition and innovation. Furthermore, the integration of fintech with other sectors, such as agriculture and healthcare, will create new opportunities for financial innovation and economic growth. For instance, we might see the emergence of platforms that provide farmers with access to micro-loans and insurance based on real-time crop data analysis. Similarly, the integration of health insurance with wearable technology could lead to more personalized and preventative healthcare solutions.

Outcome Summary

Indonesia’s journey with Teknologi Finansial is a testament to the transformative power of technology in driving economic progress and financial inclusion. While challenges remain, the potential for continued growth and innovation is undeniable. By addressing regulatory complexities, fostering cybersecurity measures, and nurturing strategic partnerships, Indonesia can solidify its position as a regional Fintech leader. The future of finance in Indonesia is undeniably intertwined with the continued evolution and success of its vibrant Fintech sector.

Essential FAQs

What are the biggest risks associated with Indonesian Fintech companies?

Major risks include cybersecurity breaches, data privacy violations, fraud, and the potential for market instability due to rapid growth.

How does Indonesian Fintech regulation compare to other Southeast Asian countries?

Indonesia’s regulatory framework is evolving, and comparisons with other nations require detailed analysis of specific regulations across different sectors. Generally, there’s a trend toward greater regulatory clarity and oversight across the region.

What role does government policy play in the success of Indonesian Fintech?

Supportive government policies, including clear regulations, infrastructure investments, and initiatives promoting digital literacy, are crucial for the continued growth and success of the Indonesian Fintech sector.