Navigating the complexities of the global economy requires understanding interconnected forces shaping our world. From fluctuating inflation and interest rates to the disruptions in global supply chains and the energy transition, the landscape is dynamic and presents both challenges and opportunities. This exploration delves into key trends, analyzing their impact on various economies and offering insights into potential future scenarios. We will examine the roles of technological advancements, emerging markets, global debt, and geopolitical risks in shaping the economic future.

The analysis presented here aims to provide a balanced perspective, considering both the positive and negative aspects of each trend. By examining these interconnected factors, we can gain a clearer understanding of the current economic climate and the potential pathways for future growth and stability. The discussion will incorporate real-world examples and data to illustrate the key concepts and their implications.

Global Inflation and Interest Rates

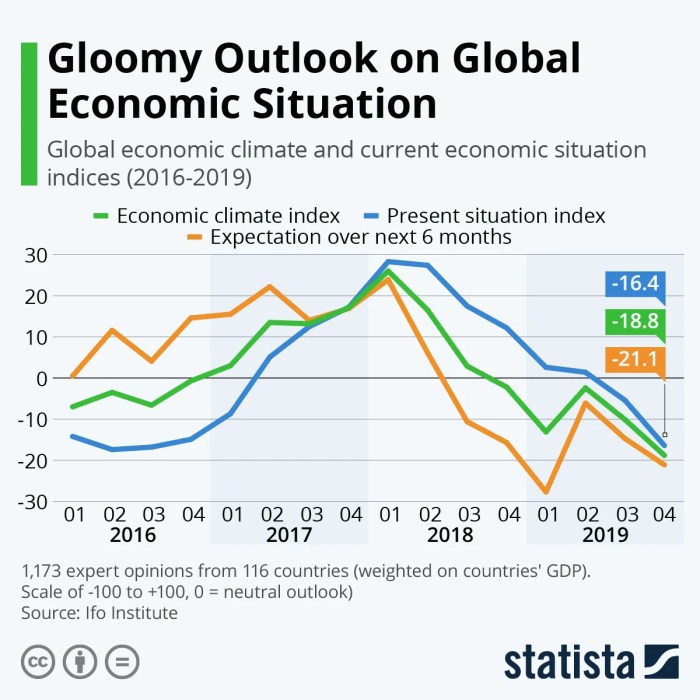

Global inflation and interest rates are intricately linked, shaping the economic landscape worldwide. Currently, many nations are grappling with elevated inflation levels, driven by factors ranging from supply chain disruptions and the lingering effects of the pandemic to the war in Ukraine and robust consumer demand. These inflationary pressures force central banks to adjust their monetary policies, leading to significant consequences for businesses, consumers, and overall economic growth.

The Current Global Inflation Landscape

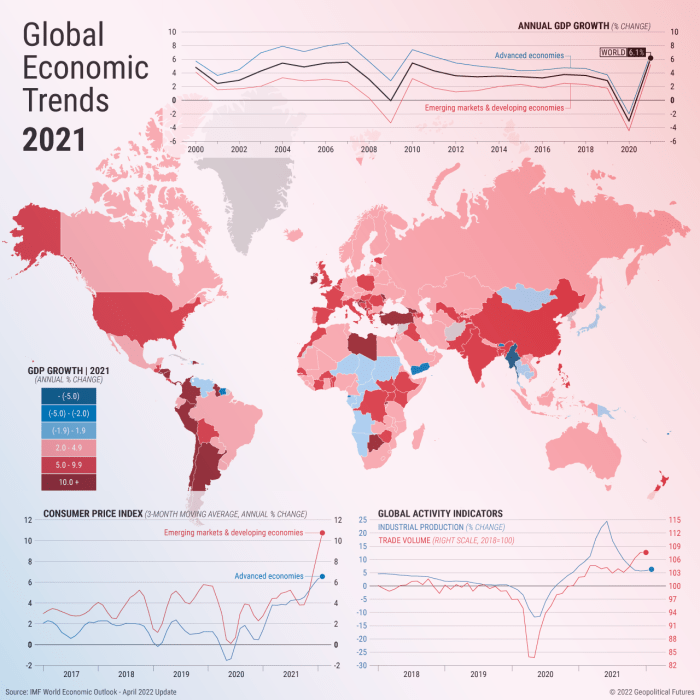

Inflation remains a significant concern globally. While the pace of inflation has slowed somewhat in many advanced economies from its peak in 2022, it continues to exceed central bank targets in numerous countries. The Eurozone, for example, is experiencing persistent inflationary pressures, primarily driven by energy prices and strong domestic demand. Similarly, the United States, while seeing a decline in inflation, still faces higher-than-target inflation rates. Emerging markets often face even greater challenges, with inflation rates frequently exceeding those in developed economies due to a combination of factors including currency depreciation and supply-side constraints. The impact on various economies is varied, with some experiencing slower growth due to higher borrowing costs and reduced consumer spending, while others grapple with social unrest fueled by rising prices for essential goods.

Comparative Analysis of Interest Rate Policies

Major central banks have responded to the inflationary surge with varying degrees of aggressiveness in their interest rate policies. The US Federal Reserve, for instance, has implemented a series of substantial interest rate hikes, aiming to cool down the economy and curb inflation. The European Central Bank (ECB) has also embarked on a tightening cycle, although at a potentially slower pace compared to the Fed. The Bank of England has also increased interest rates significantly. These differing approaches reflect the unique economic circumstances and policy priorities of each region. For example, the ECB’s approach might be more cautious due to the Eurozone’s greater dependence on energy imports and the diverse economic conditions within its member states. The variations in interest rate adjustments highlight the complexity of managing inflation in a globalized world.

Potential Consequences of Prolonged High Inflation and High Interest Rates

Prolonged periods of high inflation and high interest rates can have severe consequences. High inflation erodes purchasing power, reduces consumer confidence, and can lead to wage-price spirals. High interest rates, while intended to combat inflation, can stifle economic growth by increasing borrowing costs for businesses and individuals, potentially leading to reduced investment and job losses. A prolonged period of both high inflation and high interest rates could result in a stagflationary environment – a situation characterized by slow economic growth, high unemployment, and high inflation. This scenario poses a significant challenge for policymakers, requiring a delicate balancing act between controlling inflation and supporting economic activity. The 1970s provide a historical example of the detrimental effects of prolonged stagflation, highlighting the potential severity of this economic predicament.

Hypothetical Scenario: Inflation and Interest Rate Interaction

Imagine a scenario where a country experiences unexpectedly high inflation due to a sudden surge in global commodity prices. To combat this, the central bank aggressively raises interest rates. Initially, this might curb inflation by reducing consumer spending and investment. However, if interest rates are raised too high or for too long, it could trigger a recession, leading to job losses and further economic hardship. Conversely, if the central bank is too slow to react to rising inflation, the inflationary pressures could become entrenched, making it more difficult and costly to bring inflation back down later. This hypothetical scenario demonstrates the delicate balance central banks must strike when managing inflation and interest rates, requiring careful consideration of the potential trade-offs between controlling inflation and supporting economic growth.

Global Supply Chains and Trade

The interconnectedness of the global economy is profoundly reliant on efficient and resilient supply chains. However, recent years have witnessed significant challenges and disruptions, impacting businesses and consumers worldwide. Understanding these disruptions, the strategies employed to mitigate risks, and the influence of geopolitical events on international trade is crucial for navigating the complexities of the modern global marketplace.

Challenges and Disruptions to Global Supply Chains

The past few years have presented unprecedented challenges to global supply chains. The COVID-19 pandemic exposed vulnerabilities in just-in-time manufacturing models, leading to widespread shortages of essential goods. Port congestion, exacerbated by labor shortages and increased demand, further hampered the smooth flow of goods. Simultaneously, natural disasters, such as earthquakes and floods, disrupted transportation networks and production facilities in various regions. Furthermore, the rise of protectionist trade policies and escalating geopolitical tensions have added another layer of complexity, creating uncertainty and increasing costs for businesses. These disruptions highlight the need for greater diversification, resilience, and adaptability within global supply chains.

Strategies for Mitigating Supply Chain Risks

Businesses are increasingly adopting proactive strategies to mitigate supply chain risks. Diversifying sourcing locations is a common approach, reducing reliance on single suppliers or regions vulnerable to disruptions. Investing in advanced technologies, such as blockchain and AI, enhances transparency and improves traceability, enabling better inventory management and faster response times to disruptions. Building stronger relationships with suppliers, fostering collaboration and information sharing, helps to anticipate and address potential problems proactively. Furthermore, robust risk assessment and management frameworks are being implemented to identify and evaluate potential vulnerabilities, enabling businesses to develop contingency plans and make informed decisions. For example, companies like Nike have diversified their manufacturing base to reduce dependence on any single country, while others are leveraging blockchain technology to track goods and improve transparency throughout their supply chains.

Impact of Geopolitical Events on International Trade Patterns

Geopolitical events significantly impact international trade patterns. The ongoing conflict in Ukraine, for instance, has disrupted global energy markets and caused significant price increases. Trade sanctions imposed on Russia have altered global trade flows, forcing businesses to seek alternative suppliers and markets. Similarly, escalating tensions between the United States and China have led to trade disputes and increased tariffs, impacting the flow of goods between these two major economic powers. These events underscore the interconnectedness of global politics and economics, highlighting the importance of proactive risk management and diversification strategies for businesses operating in a volatile geopolitical environment.

Regional Trade Performance Comparison

| Region | Export Growth (%) | Import Growth (%) | Trade Balance (USD Billion) |

|---|---|---|---|

| North America | 5 | 6 | -800 |

| Europe | 3 | 4 | -500 |

| Asia | 7 | 8 | 1000 |

| Africa | 2 | 3 | -200 |

*Note: These figures are illustrative and not based on specific real-time data. Actual trade performance varies considerably depending on the specific year and various economic factors.*

Energy Markets and Transition

The global energy landscape is undergoing a profound transformation, driven by a confluence of factors including climate change concerns, geopolitical instability, and technological advancements. Understanding the dynamics of energy markets and the ongoing energy transition is crucial for navigating the economic challenges and opportunities that lie ahead. This section will explore the key drivers of energy price fluctuations, compare renewable energy sources, analyze the role of government policies, and assess the potential economic impacts of a rapid shift towards renewables.

Factors Influencing Global Energy Prices

Several interconnected factors significantly influence global energy prices. Geopolitical events, such as wars or political instability in major oil-producing regions, can drastically disrupt supply chains and lead to price spikes. The level of global economic activity is another key determinant; strong economic growth typically increases energy demand, putting upward pressure on prices. Technological advancements in energy production and efficiency can also impact prices, as can government policies, such as taxes, subsidies, and regulations. Finally, the interplay of supply and demand within specific energy markets, including oil, natural gas, and coal, plays a crucial role in determining prices. For instance, the unexpected reduction in Russian gas exports to Europe in 2022 caused a sharp increase in natural gas prices across the continent.

Comparison of Renewable Energy Sources

Renewable energy sources offer a diverse range of options for decarbonizing the global energy system. Solar power, harnessing sunlight through photovoltaic cells, is highly scalable and geographically diverse, but its intermittency (dependence on sunlight) requires effective energy storage solutions. Wind power, utilizing wind turbines to generate electricity, is also widely applicable but faces challenges related to land use and the variability of wind resources. Hydropower, using the flow of water to generate electricity, is a mature technology but its environmental impact, particularly on river ecosystems, needs careful consideration. Geothermal energy, tapping into the Earth’s internal heat, offers a reliable and consistent source of energy but its geographic limitations restrict its widespread adoption. Finally, biomass energy, derived from organic matter, presents a versatile option but concerns regarding sustainability and greenhouse gas emissions need careful management.

Government Policies Promoting Energy Transition

Government policies play a pivotal role in accelerating the energy transition. Subsidies and tax incentives can make renewable energy technologies more economically competitive compared to fossil fuels. Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, incentivize emissions reductions by placing a cost on carbon pollution. Regulations and standards can drive the adoption of energy-efficient technologies and the phasing out of fossil fuel-based infrastructure. Investing in research and development of new energy technologies is also crucial for fostering innovation and driving down costs. For example, the significant growth of the solar energy sector in China has been largely attributed to substantial government support, including generous subsidies and supportive policies.

Economic Impacts of a Rapid Shift to Renewable Energy

A rapid shift to renewable energy could have significant economic impacts, both positive and negative. Job creation in the renewable energy sector is expected to be substantial, as is the growth of related industries, such as battery storage and smart grids. However, there will also be job losses in the fossil fuel industry, necessitating effective retraining and diversification strategies. The initial investment costs for renewable energy infrastructure can be high, but the long-term operating costs are typically lower than for fossil fuel-based systems. Furthermore, reduced reliance on volatile global energy markets could enhance energy security and price stability for many nations. The transition will also likely stimulate innovation and technological advancements across various sectors, leading to overall economic growth. The successful implementation of the Green New Deal in the United States, for instance, would require massive investment in renewable energy infrastructure and could create millions of jobs while also significantly reducing greenhouse gas emissions.

Technological Advancements and Automation

Technological advancements and automation are profoundly reshaping the global economic landscape, driving productivity gains while simultaneously presenting significant challenges. The integration of artificial intelligence (AI) and sophisticated robotics is accelerating this transformation, leading to both unprecedented opportunities and considerable societal adjustments. This section explores the multifaceted impact of these advancements on global economic productivity, focusing on specific industry examples, strategies for managing job displacement, and the long-term economic implications.

Technological advancements significantly boost global economic productivity by enhancing efficiency, improving quality, and enabling the creation of entirely new goods and services. Automation streamlines production processes, reducing labor costs and increasing output. AI-powered systems analyze vast datasets to optimize resource allocation, predict market trends, and personalize customer experiences. These improvements translate into higher output per unit of input, leading to economic growth and increased competitiveness for businesses that successfully integrate these technologies.

Industries Significantly Impacted by Automation and AI

The manufacturing, transportation, and customer service sectors are among those experiencing the most significant impact from automation and AI. In manufacturing, robotic assembly lines and automated quality control systems have dramatically increased efficiency and reduced production costs. Self-driving vehicles and automated logistics systems are transforming the transportation industry, promising greater efficiency and safety. AI-powered chatbots and virtual assistants are becoming increasingly prevalent in customer service, handling routine inquiries and freeing up human agents to focus on more complex tasks. Furthermore, the finance sector utilizes AI for fraud detection and algorithmic trading, while the healthcare sector employs AI for diagnostics and personalized medicine.

Strategies for Managing Job Displacement Due to Automation

The potential for job displacement due to automation is a major concern. However, proactive strategies can mitigate this risk. Retraining and upskilling programs are crucial to equip workers with the skills needed for the jobs of the future. Focusing on education and training initiatives that emphasize adaptability and continuous learning is paramount. Governments and businesses can collaborate to develop programs that support workers transitioning to new roles. Investing in education and training related to AI, data science, and other emerging fields is essential. Furthermore, exploring alternative economic models, such as universal basic income, could provide a safety net for those displaced by automation. A shift towards a more flexible labor market, promoting part-time work and gig economy opportunities, could also help to absorb some of the impact.

Long-Term Economic Implications of Technological Advancements

The long-term economic implications of technological advancements are multifaceted and complex.

- Increased productivity and economic growth: Automation and AI will lead to significant increases in productivity and economic growth, creating new opportunities and wealth.

- Changes in the labor market: Job displacement in some sectors will be inevitable, requiring significant workforce retraining and adaptation.

- Increased income inequality: The benefits of technological advancements may not be evenly distributed, potentially exacerbating income inequality.

- New industries and business models: Technological advancements will create entirely new industries and business models, leading to innovation and economic diversification.

- Enhanced global competitiveness: Countries that effectively embrace technological advancements will gain a significant competitive advantage in the global economy.

- Ethical considerations: The development and deployment of AI and automation raise significant ethical concerns, requiring careful consideration and regulation.

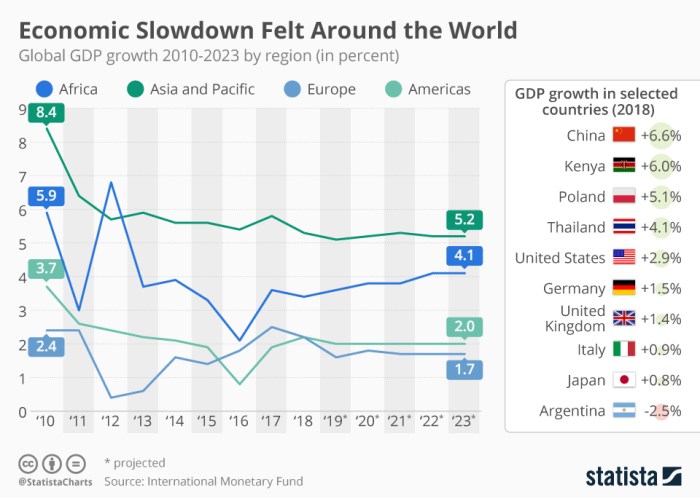

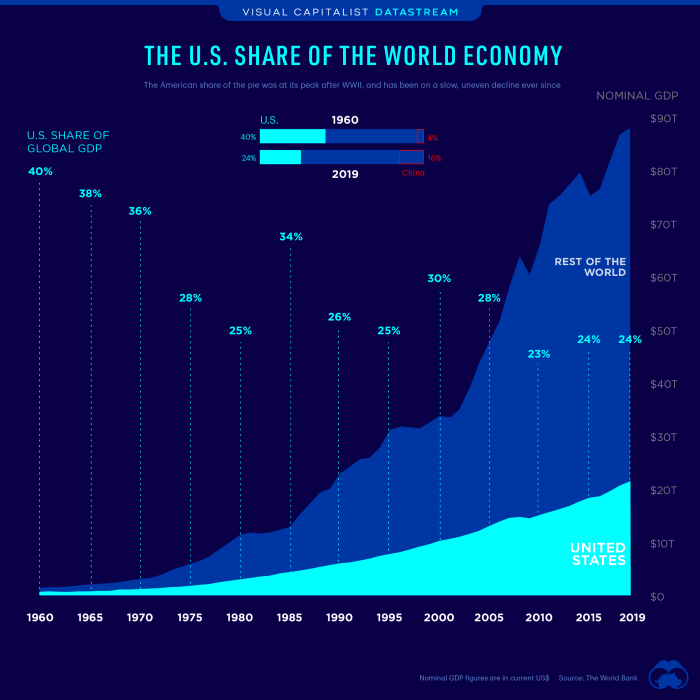

Emerging Market Economies

Emerging market economies represent a significant portion of the global economy, exhibiting diverse growth trajectories and facing unique challenges. Their economic performance significantly impacts global stability and offers substantial investment opportunities, albeit with inherent risks. Understanding their growth prospects, challenges, and the role of foreign direct investment is crucial for navigating the complexities of the global economic landscape.

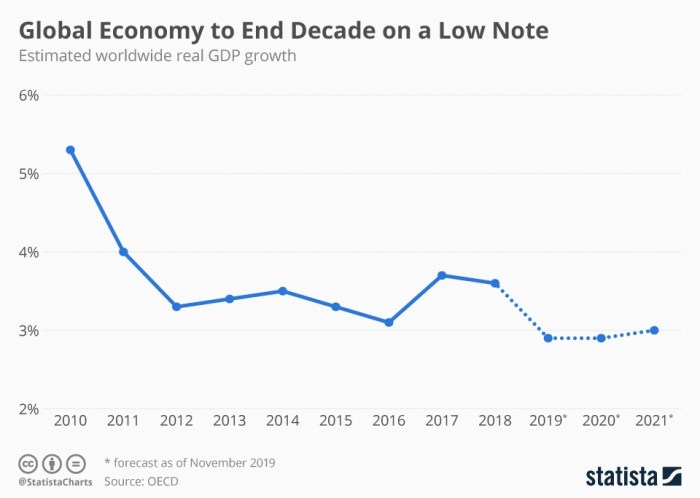

Growth Prospects of Key Emerging Market Economies

Several key emerging market economies demonstrate strong growth potential, driven by factors such as a young and growing population, increasing urbanization, and rising levels of education and technological adoption. India, for instance, benefits from a large and increasingly skilled workforce, fostering growth in the IT and services sectors. Similarly, Indonesia’s vast natural resources and burgeoning consumer market contribute to its economic dynamism. Sub-Saharan Africa, while facing significant developmental hurdles, holds immense potential fueled by its rapidly expanding population and untapped resources. However, the growth trajectory of each economy is subject to various internal and external factors, including political stability, infrastructure development, and global economic conditions. China, despite recent economic slowdown, remains a significant player, although its future growth will depend on its ability to successfully transition to a more consumption-driven economy.

Challenges Faced by Emerging Markets in Achieving Sustainable Growth

Emerging markets often grapple with significant challenges that hinder sustainable growth. These include infrastructure deficits, hindering efficient transportation and communication; corruption and weak governance, undermining investor confidence and resource allocation; and high levels of income inequality, limiting domestic consumption and creating social instability. Furthermore, vulnerability to external shocks, such as commodity price fluctuations and global financial crises, poses a significant threat. Environmental concerns, including climate change and resource depletion, also pose substantial long-term challenges to sustainable development. Managing these multifaceted challenges requires comprehensive policy reforms, investment in human capital, and sustainable development strategies.

The Role of Foreign Direct Investment in Driving Economic Development

Foreign direct investment (FDI) plays a crucial role in fostering economic development within emerging markets. FDI inflows bring much-needed capital, technology, and expertise, contributing to increased productivity and job creation. Moreover, FDI can stimulate competition, improve efficiency, and facilitate technology transfer, ultimately boosting economic growth. However, the effectiveness of FDI depends on several factors, including the investment climate, policy frameworks, and the absorptive capacity of the recipient economy. For example, FDI in infrastructure projects can significantly improve connectivity and access to markets, while FDI in manufacturing can boost export capacity and create jobs. Strategic partnerships between foreign investors and local businesses can also foster knowledge transfer and skill development.

A Scenario Illustrating the Potential Risks and Opportunities Associated with Investing in Emerging Markets

Consider a hypothetical scenario involving an investment in a renewable energy project in a Southeast Asian emerging market. The opportunity lies in the rapidly growing demand for clean energy and the government’s supportive policies. However, risks include political instability, regulatory uncertainty, and potential infrastructure limitations. A successful investment would require thorough due diligence, including a comprehensive assessment of the political and regulatory environment, a detailed analysis of project feasibility, and a robust risk mitigation strategy. Failure to adequately address these risks could lead to significant financial losses, while successful navigation of these challenges could yield substantial returns, contributing to both economic development in the host country and investor profitability. This scenario highlights the inherent trade-off between high potential returns and substantial risks associated with emerging market investments.

Global Debt and Financial Stability

Global debt levels have reached unprecedented heights, raising significant concerns about financial stability worldwide. The rapid accumulation of debt, fueled by low interest rates and increased government spending in response to various crises (including the COVID-19 pandemic), has created a complex and potentially volatile landscape. Understanding the current state of global debt and its implications is crucial for navigating the challenges ahead.

Global debt levels are staggering, encompassing sovereign debt, corporate debt, and household debt. The International Monetary Fund (IMF) and other organizations regularly track these figures, providing valuable insights into the distribution and potential risks associated with this debt. A significant portion of this debt is held by governments, particularly in developed economies, reflecting years of fiscal expansion and, more recently, pandemic-related spending. This increase in public debt has raised concerns about future fiscal sustainability and the potential for sovereign debt crises.

Global Debt Levels and Distribution

The distribution of debt varies significantly across countries and regions. Advanced economies generally have higher levels of overall debt, both public and private, compared to emerging market and developing economies. However, the composition of debt differs. Developed nations often have a larger proportion of public debt, while emerging markets may have a higher proportion of private sector debt. For instance, countries in the Eurozone have faced significant challenges related to sovereign debt, while several emerging market economies have experienced periods of rapid private sector credit growth, followed by periods of financial stress. This uneven distribution highlights the varying vulnerabilities and the need for tailored policy responses.

Potential Consequences of a Major Sovereign Debt Crisis

A major sovereign debt crisis could have severe global repercussions. The consequences could include: a sharp contraction in global economic activity, as lenders become more risk-averse and reduce lending; increased volatility in financial markets, potentially leading to a sharp decline in asset prices; and increased protectionist measures as countries struggle to protect their domestic economies. A specific example could be a repeat or worsening of the 2008 financial crisis, where a failure to adequately address the build-up of debt in the housing market led to a widespread global recession. The interconnected nature of global finance means that a crisis in one country could quickly spread to others, triggering a domino effect.

The Role of International Financial Institutions

International financial institutions (IFIs), such as the IMF and the World Bank, play a critical role in managing global debt and preventing crises. These institutions provide financial assistance to countries facing debt distress, offering loans and technical assistance to help them implement reforms and restore macroeconomic stability. They also monitor global financial conditions and provide early warning signals of potential crises. The IMF, for example, provides surveillance and lending programs to help countries manage their debt levels and prevent crises. The effectiveness of IFIs, however, depends on their ability to adapt to evolving global financial landscapes and the willingness of member countries to cooperate and implement necessary reforms. The ongoing debates about the effectiveness and potential reform of these institutions are vital in ensuring global financial stability.

Geopolitical Risks and Uncertainty

Geopolitical risks represent a significant and increasingly volatile factor influencing global economic trends. The interconnected nature of modern economies means that instability in one region can quickly ripple outwards, impacting trade, investment, and overall growth. Understanding these risks and their potential consequences is crucial for businesses and policymakers alike.

Escalating geopolitical tensions, whether stemming from territorial disputes, ideological clashes, or shifts in global power dynamics, can have profound economic consequences. These consequences are multifaceted and often unpredictable, making effective risk management a complex challenge.

Key Geopolitical Risks Impacting the Global Economy

Several key geopolitical risks pose significant threats to global economic stability. These include, but are not limited to, major power rivalries (such as the US-China relationship), regional conflicts (like the ongoing war in Ukraine), the proliferation of weapons of mass destruction, cyber warfare, and climate change-related geopolitical tensions. Each of these carries the potential to disrupt global supply chains, trigger financial market volatility, and negatively impact international trade and investment.

Economic Consequences of Escalating Geopolitical Tensions

Escalating geopolitical tensions can lead to a range of negative economic consequences. Increased uncertainty can dampen investor confidence, leading to reduced investment and slower economic growth. Disruptions to global supply chains, often caused by sanctions, conflict, or political instability, can lead to shortages of essential goods and increased inflation. Trade wars and protectionist policies, frequently employed as geopolitical tools, can restrict market access and harm international trade flows. Furthermore, increased military spending, often a response to heightened tensions, diverts resources from other productive sectors of the economy. The Ukraine conflict, for instance, serves as a stark example, demonstrating the potential for significant economic disruption due to sanctions, energy price shocks, and supply chain bottlenecks.

Business Adaptation to Geopolitical Uncertainty

Businesses are increasingly recognizing the need to adapt to geopolitical uncertainty. Many are diversifying their supply chains to reduce reliance on single countries or regions. Others are investing in robust risk management frameworks that incorporate geopolitical factors into their decision-making processes. Some companies are also engaging in proactive diplomacy and stakeholder engagement to navigate complex geopolitical landscapes. For example, multinational corporations are increasingly developing strategies that allow them to maintain operations even amidst political instability or sanctions, perhaps by relocating production or diversifying their customer base. This adaptation often involves significant investment in planning and contingency measures.

Interconnectedness of Global Economies and Geopolitical Events

Imagine a complex web. Each node represents a national economy, interconnected by countless threads representing trade, investment, and financial flows. Geopolitical events, represented by disruptive forces acting upon the web, can cause ripples throughout the entire system. A major conflict in one region might sever certain threads, disrupting trade routes and causing shortages in distant markets. Sanctions imposed on one country can impact its trading partners, leading to cascading economic effects. Similarly, a sudden shift in global power dynamics could alter investment patterns and reshape the global financial landscape. The strength and resilience of the web depend on the robustness of its individual nodes and the flexibility of its connections. A highly interconnected system is both efficient and vulnerable, highlighting the need for both global cooperation and robust national risk management strategies.

Epilogue

In conclusion, understanding global economic trends is crucial for navigating the complexities of the modern world. The interconnectedness of inflation, supply chains, energy markets, technology, emerging economies, debt, and geopolitical risks highlights the need for a holistic approach to economic analysis. While challenges remain significant, opportunities for growth and innovation also abound. By proactively addressing these trends and fostering international cooperation, we can work towards a more stable and prosperous global economy.

Essential Questionnaire

What is the likely impact of climate change on global economic trends?

Climate change poses significant risks, potentially disrupting supply chains, impacting agricultural yields, and increasing the frequency and severity of extreme weather events, leading to economic instability and requiring substantial investment in adaptation and mitigation.

How do demographic shifts affect global economic growth?

Aging populations in developed nations and rapidly growing populations in developing nations create both challenges (e.g., increased healthcare costs, labor shortages) and opportunities (e.g., expanding consumer markets) for global economic growth.

What role does technological innovation play in mitigating economic risks?

Technological advancements offer potential solutions to various economic challenges, such as improving supply chain efficiency, developing renewable energy sources, and automating tasks to enhance productivity. However, careful management is needed to address potential job displacement.