The digital age has revolutionized commerce, and at the heart of this transformation lie online payment systems. These systems, encompassing everything from credit card transactions to mobile wallets, have fundamentally altered how we buy and sell goods and services. This exploration delves into the intricacies of these systems, examining their security protocols, integration processes, global trends, and the user experience they provide. We will uncover the complexities and innovations shaping the future of online transactions.

From understanding the various types of payment systems available to merchants and consumers, to navigating the crucial security measures protecting sensitive financial data, this overview aims to provide a holistic understanding of the landscape of online payments. We’ll also consider the regulatory frameworks impacting global operations and explore the innovative technologies continuously improving security and user experience.

Types of Online Payment Systems

Online payment systems have revolutionized how businesses and consumers conduct transactions, offering speed, convenience, and global reach. Understanding the various types available is crucial for both merchants seeking to optimize their sales processes and customers looking for secure and efficient ways to pay. This section will explore the different categories of online payment systems, highlighting their functionalities, advantages, and disadvantages.

Categorization of Online Payment Systems by Transaction Method

The diverse landscape of online payment systems can be broadly categorized based on their underlying transaction methods. This classification provides a clear understanding of how each system operates and the technologies involved.

| Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Credit/Debit Card Payments | Transactions processed using credit or debit card details, typically through a payment gateway. This involves verifying card details and authorizing the payment. | Widely accepted, familiar to consumers, relatively secure with proper security measures. | Transaction fees can be high, susceptible to fraud if security is not robust, potential for chargebacks. |

| E-Wallets | Digital wallets storing financial information, enabling quick and secure online payments. Examples include PayPal, Apple Pay, and Google Pay. | Fast and convenient checkout, enhanced security features, often offer buyer protection. | Requires account creation, potential for account compromise if security isn’t maintained, reliance on specific apps or platforms. |

| Bank Transfers | Direct transfers of funds from a consumer’s bank account to a merchant’s account. Often involves online banking platforms or dedicated payment services. | Generally low fees, secure for both parties, suitable for large transactions. | Can be slower than other methods, requires bank account details, may not be available in all regions. |

| Mobile Payments | Payments made via smartphones using NFC technology (e.g., Apple Pay, Google Pay) or mobile apps (e.g., Venmo, Zelle). | Convenient and fast, contactless payment, often integrated with other apps and services. | Requires smartphone and compatible apps, potential for security vulnerabilities if not properly secured, not universally accepted. |

Merchant Accounts vs. Payment Gateways

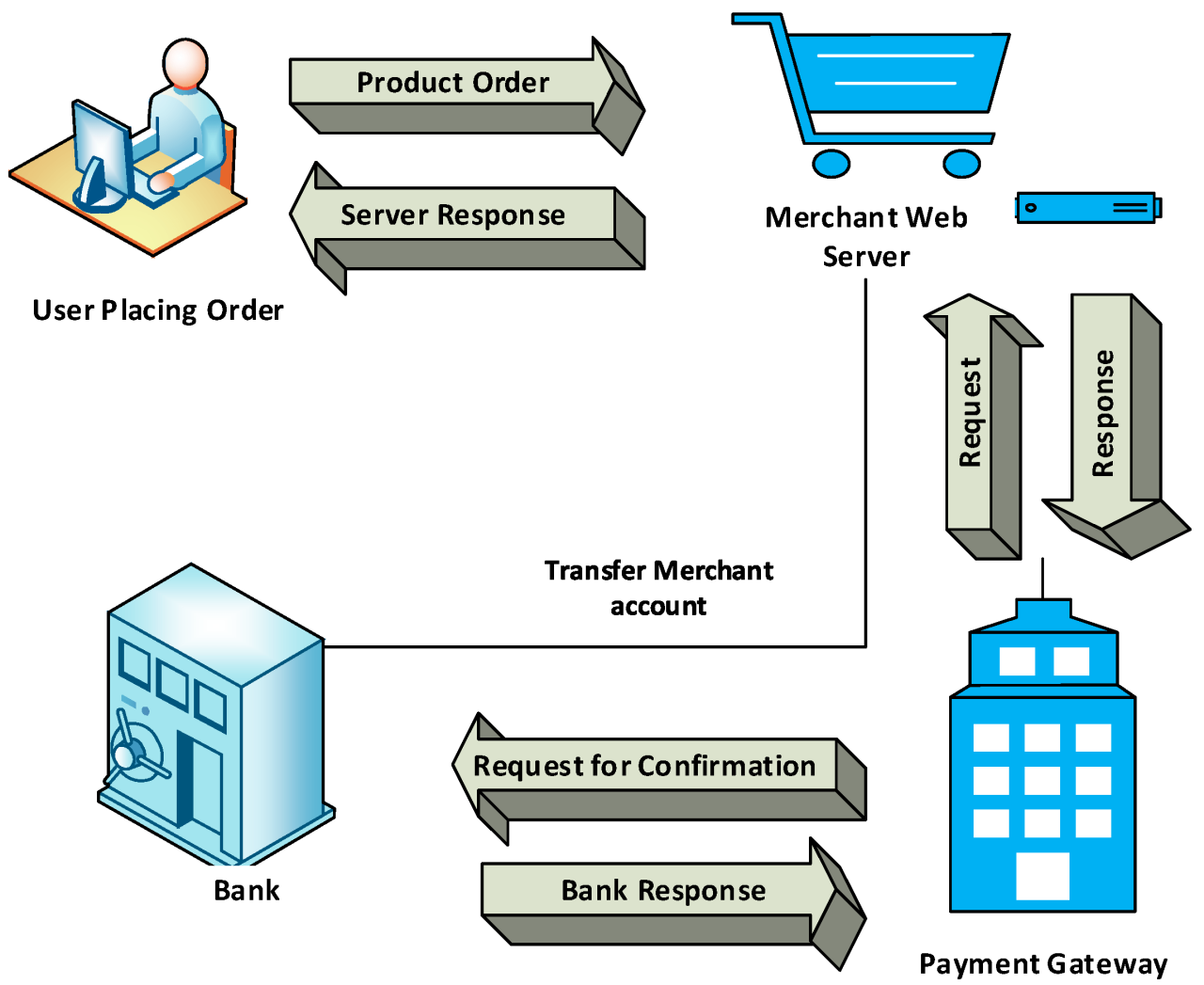

Understanding the difference between merchant accounts and payment gateways is crucial for businesses accepting online payments. These two components work together but serve distinct purposes.

The key distinctions are as follows:

- Merchant Account: A business bank account that allows merchants to receive payments directly from customers. It provides a dedicated infrastructure for processing transactions.

- Payment Gateway: A software application that facilitates the transfer of payment information between a merchant’s website and the payment processor. It acts as an intermediary, securely handling sensitive data.

In essence, a merchant account is the destination for the funds, while the payment gateway is the secure conduit that ensures the funds reach the account safely and efficiently. A merchant account is necessary to receive payments, while a payment gateway is necessary to process payments through various methods (credit cards, e-wallets, etc.).

Functionality of Each Payment System Type

Each payment system type involves a specific interaction between consumers and merchants. For instance, with credit/debit card payments, the consumer enters their card details on the merchant’s website, which are then processed through a payment gateway and authorized by the card issuer. E-wallets streamline this process by allowing consumers to pay using their stored credentials, while bank transfers require the consumer to initiate a transfer from their bank account. Mobile payments leverage smartphone technology for quick and contactless transactions. Each system offers varying levels of speed, security, and convenience, shaping the overall consumer experience and influencing merchant choices.

Security Measures in Online Payment Systems

Online payment systems handle sensitive financial data, making robust security paramount. A breach can have devastating consequences for both businesses and consumers, leading to financial losses, reputational damage, and legal repercussions. Therefore, a multi-layered approach to security is crucial, encompassing preventative measures, detection systems, and incident response plans. This section will explore common threats and the security protocols employed to mitigate them.

Common Security Threats

Online payment systems face a range of threats, each demanding specific countermeasures. Fraudulent activities, such as unauthorized transactions and identity theft, are major concerns. Hacking attempts, targeting vulnerabilities in the system’s software or infrastructure, pose a significant risk. Data breaches, resulting in the exposure of sensitive customer information, can have far-reaching consequences, including legal penalties and loss of customer trust. Denial-of-service (DoS) attacks can disrupt the availability of the payment system, preventing legitimate users from accessing services. Malware infections can compromise system integrity and steal sensitive data. Phishing attacks, attempting to trick users into revealing their credentials, are a persistent threat. These threats necessitate a comprehensive security strategy encompassing various protective measures.

Security Protocols and Their Effectiveness

Several security protocols are implemented to protect online payment transactions. The effectiveness of each protocol varies depending on its implementation and the sophistication of the threats it faces. Below is a table summarizing some key protocols:

| Protocol | Description | Strengths | Weaknesses |

|---|---|---|---|

| Encryption (e.g., TLS/SSL) | Scrambles data during transmission, making it unreadable without the decryption key. | Protects data in transit from eavesdropping. Widely adopted and well-understood. | Relies on the security of the encryption keys. Vulnerable to attacks if keys are compromised. Does not protect data at rest. |

| Tokenization | Replaces sensitive data with non-sensitive tokens, reducing the risk of exposure. | Reduces the impact of a data breach by protecting actual card numbers. Simplifies PCI DSS compliance. | Requires robust token management and secure storage of the token-to-data mapping. |

| Two-Factor Authentication (2FA) | Requires users to provide two forms of authentication, such as a password and a one-time code from a mobile device. | Significantly enhances account security by adding an extra layer of protection. Makes it harder for attackers to gain unauthorized access. | Can be inconvenient for users. Susceptible to SIM swapping attacks if not implemented carefully. |

| Biometric Authentication | Uses unique biological characteristics (fingerprint, facial recognition) for authentication. | Highly secure and difficult to replicate. Offers a more user-friendly experience compared to passwords. | Privacy concerns regarding the storage and use of biometric data. Vulnerable to spoofing attacks. |

Hypothetical Security Architecture for a New Online Payment System

A robust security architecture for a new online payment system would incorporate multiple layers of defense. This would begin with secure coding practices and regular security audits to identify and address vulnerabilities in the system’s software. Data encryption, both in transit and at rest, would be mandatory. Tokenization would be used to protect sensitive cardholder data. Multi-factor authentication would be implemented to verify user identities. Intrusion detection and prevention systems would monitor network traffic for suspicious activity. Regular security awareness training for employees would be conducted to reduce the risk of insider threats. A comprehensive incident response plan would be in place to handle security breaches effectively. The system would also comply with relevant industry standards and regulations, such as PCI DSS. Regular penetration testing and vulnerability assessments would be conducted to proactively identify and mitigate potential weaknesses. Finally, a robust logging and monitoring system would track all transactions and system activity, providing valuable data for security analysis and incident investigation.

Integration and Development of Online Payment Systems

Integrating an online payment system into an e-commerce website is crucial for facilitating secure and efficient transactions. This process involves selecting a suitable payment gateway, setting up a merchant account, and implementing the payment gateway’s API into your website’s code. Careful planning and execution are essential to ensure a smooth and user-friendly checkout experience.

The integration process itself can vary depending on the chosen payment gateway and the e-commerce platform used. However, the core principles remain consistent, involving technical setup, security configuration, and testing to ensure functionality and compliance with industry standards. This section will explore the key steps involved in this integration process and the considerations for different API integration methods.

Setting Up a Merchant Account with a Payment Processor

Establishing a merchant account is the foundational step in accepting online payments. This involves applying with a payment processor (like Stripe, PayPal, or Square) who will assess your business and determine your eligibility. The application process typically requires providing business information, banking details, and potentially undergoing identity verification checks. Once approved, you’ll receive merchant credentials, including API keys and other necessary information for integration.

- Application and Approval: Complete the online application form provided by your chosen payment processor, supplying accurate and complete business information. This usually includes your business legal structure, address, banking details, and a description of your business activities. Expect a review period, which can vary in length depending on the payment processor and the complexity of your business.

- Contract Negotiation and Agreement: Review the merchant agreement carefully before signing. This contract Artikels the terms and conditions of your relationship with the payment processor, including fees, responsibilities, and dispute resolution processes. Pay close attention to details regarding transaction fees, chargeback policies, and any potential penalties for non-compliance.

- Account Setup and Configuration: After approval, you’ll need to set up your merchant account within the payment processor’s platform. This involves configuring your payment methods (credit cards, debit cards, etc.), setting up payout schedules, and potentially integrating with other services.

Comparing Different API Integrations for Various Payment Gateways

Different payment gateways offer various API integration methods, each with its strengths and weaknesses. Choosing the right integration method depends on factors such as your technical expertise, the complexity of your website, and the specific features offered by the payment gateway.

| API Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| REST API | A widely used standard for building web services, offering flexibility and scalability. | Highly flexible, well-documented, and supports various programming languages. | Can require more development effort compared to simpler methods. |

| Hosted Payment Page | Redirects customers to the payment gateway’s secure payment page for processing. | Easy to implement, requiring minimal coding. | Less customization options compared to direct integrations. |

| Javascript SDK | Provides pre-built components for integrating payment functionality directly into your website’s frontend. | Faster checkout experience, enhanced user interface customization. | Requires more technical expertise for implementation. |

Choosing the right API integration method is crucial for optimizing the checkout experience and ensuring a seamless transaction process. Consider factors like development resources, customization needs, and the overall security implications of each method.

Global Trends and Regulations in Online Payments

The landscape of online payments is constantly evolving, driven by technological advancements and a growing need for secure and efficient transactions across borders. This dynamic environment is shaped by emerging technologies and a complex web of international and regional regulations, creating both opportunities and challenges for businesses and consumers alike. Understanding these trends and regulations is crucial for navigating the complexities of the modern digital economy.

Emerging Trends in Online Payment Technologies

Several key technologies are reshaping the online payment landscape. Biometric authentication, for instance, offers enhanced security by utilizing unique biological characteristics such as fingerprints or facial recognition to verify user identity. This moves beyond traditional password-based systems, reducing the risk of fraud and unauthorized access. Blockchain technology, with its decentralized and transparent nature, offers the potential for faster, cheaper, and more secure cross-border transactions, eliminating the need for intermediaries in some cases. Its immutability also enhances trust and security. Another significant trend is the rise of mobile payment systems, which are rapidly gaining popularity due to their convenience and accessibility, especially in regions with high smartphone penetration. These systems often integrate with other services, creating a seamless user experience.

Impact of Global Regulations on Online Payment Systems

Global regulations significantly influence the design, implementation, and operation of online payment systems. The Payment Services Directive 2 (PSD2) in Europe, for example, aims to increase competition and innovation in the payments market by opening up access to customer account information to third-party providers (TPPs). This has spurred the development of new payment initiation services (PIS) and account information services (AIS), offering consumers greater choice and control over their finances. Similarly, the General Data Protection Regulation (GDPR) emphasizes data privacy and security, requiring businesses to obtain explicit consent for data processing and implement robust security measures to protect customer information. Compliance with these regulations is not only legally mandated but also crucial for building and maintaining customer trust. Non-compliance can lead to significant financial penalties and reputational damage. These regulations, while sometimes complex, ultimately aim to create a safer and more transparent environment for online transactions.

Timeline of Online Payment System Evolution

The evolution of online payment systems can be charted through several key phases:

| Period | Key Developments |

|---|---|

| Early 1990s | Emergence of early online payment gateways, often relying on credit card processing through dial-up connections. Security was a major concern. |

| Late 1990s – Early 2000s | Growth of e-commerce and the widespread adoption of secure protocols like SSL/TLS. Online payment platforms like PayPal begin to gain traction. |

| Mid-2000s – Present | Mobile payments become increasingly prevalent with the rise of smartphones and mobile wallets (Apple Pay, Google Pay). The adoption of EMV chip cards improves security. The emergence of alternative payment methods like Bitcoin and other cryptocurrencies. Increased focus on fraud prevention and regulatory compliance. |

User Experience and Design in Online Payment Systems

A seamless and secure user experience is paramount for the success of any online payment system. Poor design can lead to frustrated users, abandoned transactions, and ultimately, damage to a business’s reputation. Conversely, a well-designed system fosters trust and encourages repeat usage. This section explores key aspects of user experience and design within the context of online payment systems, focusing on mobile applications and checkout optimization.

Mobile Payment App User Interface Design

This section details the design of a hypothetical mobile payment application, prioritizing ease of use and robust security. The app’s visual design employs a clean, minimalist aesthetic with a focus on clear typography and intuitive iconography. The color palette is calming and professional, avoiding jarring contrasts. The primary navigation utilizes a tab bar at the bottom, providing quick access to key functions: Home, Send/Receive, Transactions, and Settings.

The user flow for sending money begins with a simple search bar to locate recipients (by name, phone number, or email). Once a recipient is selected, the user enters the amount and optionally adds a note. A clear summary screen displays the transaction details before final confirmation. Throughout the process, prominent visual cues reinforce security measures, such as encryption indicators and two-factor authentication prompts. The app incorporates biometric authentication (fingerprint or facial recognition) for convenient and secure login. Error messages are clear, concise, and provide helpful guidance for resolution. A dedicated help section is easily accessible, providing FAQs and contact information.

Checkout Process Optimization to Reduce Cart Abandonment

Optimizing the checkout process is critical for minimizing cart abandonment. Several best practices contribute to a smoother, faster checkout experience. A streamlined process with minimal steps reduces friction and increases the likelihood of completion. Guest checkout options allow users to complete purchases without creating an account, catering to those who prefer a quicker process. Clear and concise display of total costs, including taxes and shipping fees, avoids unexpected charges that might deter users. Multiple payment options (credit cards, debit cards, digital wallets) provide flexibility and cater to diverse user preferences. Progress indicators visually track the user’s progress through the checkout process, offering a sense of completion. Finally, prominent placement of a “Proceed to Checkout” button encourages users to complete their purchase.

Communication of Transaction Fees and Security Policies

Transparent and easily understandable communication regarding transaction fees and security policies is crucial for building user trust. All fees should be clearly displayed upfront, avoiding hidden charges that can lead to negative user experiences. A detailed breakdown of fees, including any applicable percentages or fixed amounts, should be provided. Security policies should be written in plain language, avoiding technical jargon. Key aspects, such as data encryption methods, fraud prevention measures, and user data protection practices, should be clearly explained. Prominent display of security certifications (e.g., PCI DSS compliance) builds confidence and reassures users about the security of their transactions. A readily available FAQ section addressing common security concerns further enhances transparency and user trust.

Case Studies of Successful Online Payment Systems

The success of online payment systems hinges on a variety of factors, including security, user experience, and strategic partnerships. Analyzing successful examples provides valuable insights into best practices and the key elements driving market dominance. This section examines two prominent players in the online payment landscape: PayPal and Stripe, highlighting their distinct strategies and contributing factors to their success.

PayPal’s Market Dominance and Key Features

PayPal’s enduring success stems from its early adoption and continuous evolution. It boasts a massive user base and significant market share globally, solidifying its position as a leading online payment processor. A key factor in its success is its user-friendly interface and broad acceptance by merchants worldwide. PayPal’s integration with various e-commerce platforms and its robust security measures have also contributed to its widespread adoption. The system’s functionality extends beyond simple transactions, offering features like buyer and seller protection, dispute resolution, and international money transfers, fostering trust and security for both users and businesses. Its early mover advantage allowed it to establish a vast network effect, making it the default choice for many online transactions.

Stripe’s Developer-Focused Approach and API-Driven Growth

In contrast to PayPal’s consumer-centric approach, Stripe has focused on building a robust and developer-friendly platform. Its success is largely attributed to its comprehensive Application Programming Interface (API), which allows developers to seamlessly integrate payment processing into their applications. This strategy has attracted a significant number of businesses, particularly those in the technology sector, leading to impressive market penetration. Stripe’s emphasis on developer tools, customizability, and clear documentation has positioned it as a preferred choice for businesses seeking tailored payment solutions. While lacking PayPal’s massive consumer base, Stripe’s strength lies in its ability to empower businesses to build sophisticated and integrated payment systems.

Comparative Analysis of PayPal and Stripe Strategies

PayPal and Stripe, despite both achieving significant success, employed vastly different strategies. PayPal prioritized broad user adoption through a consumer-focused interface and widespread merchant acceptance, leveraging a network effect to solidify its market dominance. Stripe, on the other hand, targeted developers with a powerful API and customizable solutions, attracting businesses seeking flexible and integrated payment options. While PayPal focuses on ease of use and broad accessibility, Stripe prioritizes developer experience and scalability. Both strategies have proven highly effective, illustrating that success in the online payment sector can be achieved through different, yet equally compelling approaches.

Closing Notes

In conclusion, online payment systems are not merely transactional tools; they are the intricate arteries of the modern digital economy. Their evolution reflects advancements in technology, security, and user expectations. As technology continues to evolve, so too will the methods by which we conduct online transactions, demanding constant adaptation and innovation to maintain security and efficiency while providing seamless user experiences. The future of online payments promises further integration, increased security, and a continued drive towards frictionless commerce.

Helpful Answers

What is a merchant account?

A merchant account allows businesses to accept credit and debit card payments directly. It’s a bank account specifically designed for processing electronic transactions.

What is a payment gateway?

A payment gateway is the technology that facilitates the transfer of funds between a buyer and seller. It acts as an intermediary, processing the payment information and communicating with the payment processor.

How can I reduce cart abandonment?

Optimize the checkout process for speed and simplicity, offer multiple payment options, and clearly display shipping costs and fees upfront.

What are some examples of biometric authentication in online payments?

Fingerprint scanning, facial recognition, and voice recognition are all examples of biometric authentication used to enhance security.