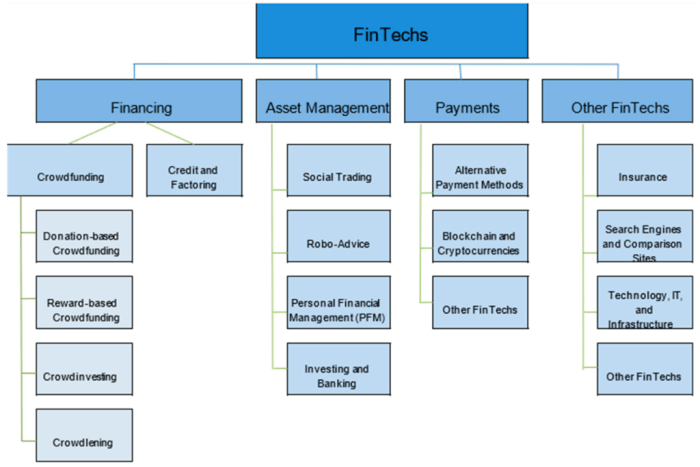

The financial landscape is undergoing a seismic shift, driven by the relentless innovation of Fintech. From mobile payments revolutionizing how we transact to AI-powered robo-advisors reshaping investment strategies, Fintech is disrupting established norms and creating unprecedented opportunities. This exploration delves into key examples of this transformation, examining its impact across various sectors and considering both the benefits and challenges.

We’ll analyze how technologies like blockchain and AI are reshaping lending, borrowing, investment, insurance, and regulatory compliance. We will also explore the implications of these changes for consumers, businesses, and the global financial system, highlighting both the positive advancements and the potential risks involved.

Payment Systems Disruption

The rise of Fintech has fundamentally altered the landscape of payment systems, challenging traditional banking models and offering consumers and businesses a wider array of choices. This disruption stems from innovations in mobile payments, peer-to-peer (P2P) transfers, and enhanced security features, ultimately leading to increased efficiency, convenience, and accessibility.

Mobile Payment Systems’ Impact on Traditional Banking

Mobile payment systems, such as Apple Pay, Google Pay, and Samsung Pay, have significantly impacted traditional banking by offering a faster, more convenient alternative to traditional methods like checks and credit cards. These systems leverage near-field communication (NFC) technology and smartphone integration to enable contactless payments at point-of-sale terminals. This ease of use has driven adoption, reducing reliance on physical cards and prompting banks to integrate mobile payment functionalities into their offerings to remain competitive. The increased speed and reduced friction of mobile payments have also challenged the traditional banking model’s reliance on physical branches and extensive transaction processing times. Furthermore, the rise of mobile wallets has enabled the storage of various payment cards and loyalty programs within a single app, consolidating financial activities into one central location.

Peer-to-Peer (P2P) Payment Platforms and Their Disruptive Effects

The evolution of P2P payment platforms like Venmo, PayPal, and Zelle has revolutionized person-to-person transactions. These platforms offer streamlined, often instant, money transfers directly between individuals, bypassing traditional banking channels. This convenience has led to widespread adoption, particularly among younger demographics, for splitting bills, sending gifts, and settling debts. The disruptive effect is evident in reduced reliance on cash and checks for smaller transactions and the increased competition for traditional banking institutions in the realm of personal finance management. The integration of P2P platforms with social media has further amplified their reach and usage.

Security Features of Fintech Payment Systems

Fintech payment systems employ a variety of security measures to protect user data and transactions. These measures vary depending on the platform but often include tokenization (replacing sensitive data with unique identifiers), encryption (scrambling data to make it unreadable), biometric authentication (using fingerprints or facial recognition), and two-factor authentication (requiring multiple verification steps). While traditional banking systems also utilize security protocols, the emphasis on robust security in Fintech is often more prominent, given the reliance on mobile devices and internet connectivity. For example, many mobile payment systems utilize tokenization to protect card details, making them less vulnerable to theft compared to traditional card-present transactions. However, the reliance on secure internet connections and the potential for phishing scams remain ongoing challenges for all payment systems.

Transaction Fees Across Various Payment Methods

The following table compares transaction fees across several common payment methods. It’s important to note that fees can vary depending on the provider, transaction amount, and specific circumstances. These figures represent approximate averages and may not reflect all possible scenarios.

| Payment Method | Merchant Fee (approx. %) | Consumer Fee (approx.) | Notes |

|---|---|---|---|

| Credit Card | 1.5 – 3.5% | $0 – Variable | Fees vary by card type and network. |

| Debit Card | 0.5 – 2% | Generally $0 | Fees are generally lower than credit cards. |

| Mobile Payment (Apple Pay, Google Pay) | Similar to credit/debit | Generally $0 | Fees depend on the underlying card network. |

| P2P Transfer (Venmo, Zelle) | Generally $0 (for person-to-person) | Generally $0 | Fees may apply for business transactions or certain features. |

Lending and Borrowing Disruption

The traditional lending landscape has undergone a significant transformation, largely fueled by technological advancements and evolving consumer expectations. Fintech innovations have challenged established institutions by offering alternative lending models, improved access to credit, and more personalized investment strategies. This disruption has broadened financial inclusion and created new opportunities for both borrowers and lenders.

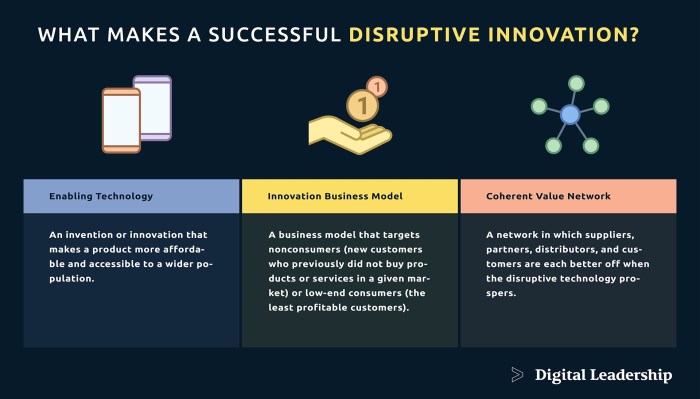

Crowdfunding Platforms and Traditional Lending

Crowdfunding platforms, such as Kickstarter and Indiegogo for reward-based projects, and LendingClub and Prosper for peer-to-peer lending, have significantly disrupted traditional lending practices. These platforms bypass traditional financial intermediaries, connecting borrowers directly with a pool of individual lenders. This democratizes access to capital, particularly for small businesses and individuals who may not qualify for traditional bank loans due to stringent credit requirements or lack of collateral. For example, small businesses previously reliant on bank loans now have an alternative avenue for securing funding, fostering innovation and entrepreneurship. This direct connection also often results in lower interest rates for borrowers compared to traditional high-street lenders, while simultaneously offering lenders potentially higher returns than traditional savings accounts.

Alternative Credit Scoring and Expanded Financial Access

Alternative credit scoring models have played a crucial role in expanding access to finance for underserved populations. Traditional credit scoring systems often rely heavily on credit history, leaving many individuals, particularly those with limited or no credit history, excluded from accessing loans. Alternative models leverage alternative data sources such as banking transactions, utility payments, and even social media activity to assess creditworthiness. This allows lenders to provide loans to individuals who might otherwise be deemed ineligible based on traditional methods, thereby promoting financial inclusion and economic empowerment. Companies like Upstart and ZestFinance utilize these alternative data points to create more comprehensive credit profiles, leading to a more equitable distribution of credit.

Robo-Advisors and Investment Strategies

The rise of robo-advisors has revolutionized investment strategies, particularly for individual investors. These automated platforms utilize algorithms and data analytics to create personalized investment portfolios based on individual risk tolerance, financial goals, and investment timelines. Robo-advisors offer low-cost, convenient, and accessible investment solutions, making professional investment management available to a broader range of individuals who may not have previously had access to such services. The transparency and ease of use of robo-advisors have led to increased participation in investment markets, fostering greater financial literacy and empowerment among individual investors. For instance, Betterment and Wealthfront are prominent examples of robo-advisors that have successfully disrupted the traditional wealth management industry.

Peer-to-Peer Lending Loan Process

A flowchart illustrating the process of obtaining a loan through a peer-to-peer lending platform:

[Diagram description: The flowchart would begin with “Borrower Applies for Loan.” This would branch to “Platform Verifies Information,” then to “Loan Listing Created.” The next step would be “Investors Review and Invest.” If sufficient funding is secured, the process moves to “Loan Funded and Disbursed to Borrower.” If insufficient funding is secured, the process would lead to “Loan Application Rejected.” Finally, both paths converge at “Loan Repayment Process Begins,” where the borrower repays the loan according to the agreed-upon terms.]

Investment and Wealth Management Disruption

The financial technology revolution has profoundly impacted investment and wealth management, offering investors new tools and opportunities while simultaneously presenting challenges. Traditional models are being reshaped by automation, algorithmic trading, and the rise of digital platforms, creating a more accessible and, in some ways, more efficient market. However, these changes also introduce complexities and risks that investors must navigate.

AI in Algorithmic Trading and Market Efficiency

Artificial intelligence is transforming algorithmic trading, enabling faster execution speeds and more sophisticated trading strategies. AI algorithms can analyze vast datasets of market data, news, and social media sentiment to identify patterns and predict price movements with greater accuracy than traditional methods. This increased efficiency can lead to tighter spreads and more liquidity in financial markets, benefiting all participants. However, the dominance of AI-driven trading also raises concerns about market manipulation and the potential for exacerbating volatility. For example, flash crashes, where prices plummet rapidly and unexpectedly, can be partially attributed to the rapid, automated responses of AI-powered trading systems. The increased speed and complexity of AI-driven trading also makes it more challenging for regulators to monitor and control market activity, potentially leading to unforeseen risks.

Key Features of Robo-Advisors and Investor Appeal

Robo-advisors, automated investment platforms, have gained significant popularity due to their low fees, accessibility, and ease of use. Key features contributing to their attractiveness include automated portfolio construction based on risk tolerance and investment goals, ongoing portfolio rebalancing, tax-loss harvesting, and 24/7 access to account information. These platforms often offer a more personalized investment experience than traditional financial advisors, especially for investors with smaller portfolios who might not have access to personalized advice otherwise. The convenience and transparency of robo-advisors are particularly appealing to younger generations of investors. For instance, Betterment and Wealthfront are prominent examples of robo-advisors that have successfully attracted a large customer base by offering these features.

Comparison of Traditional Brokerage Services and Online Investment Platforms

Traditional brokerage services typically involve higher fees, personalized advice from human brokers, and a more hands-on investment experience. Online investment platforms, including both robo-advisors and discount brokers, offer lower fees, greater accessibility, and a wider range of investment options. While traditional brokers provide in-depth financial planning and personalized advice, online platforms emphasize convenience and self-directed investing. The choice between these two models depends largely on the investor’s financial expertise, risk tolerance, and investment goals. For example, an experienced investor comfortable managing their portfolio independently might prefer a discount brokerage, while a less experienced investor might benefit from the guidance of a robo-advisor or a traditional financial advisor.

Advantages and Disadvantages of Cryptocurrency Investment

Cryptocurrencies like Bitcoin and Ethereum have emerged as a new asset class, presenting both significant opportunities and risks for investors. Advantages include the potential for high returns, decentralization, and reduced reliance on traditional financial institutions. However, cryptocurrencies are highly volatile, subject to regulatory uncertainty, and vulnerable to hacking and fraud. The lack of intrinsic value and the speculative nature of cryptocurrency markets make them a high-risk investment. For example, the dramatic price swings of Bitcoin throughout its history illustrate the significant volatility inherent in cryptocurrency investments. Furthermore, the lack of regulatory oversight in many jurisdictions adds to the risk, as there is limited protection for investors in case of fraud or loss.

Insurance Disruption

The insurance industry, traditionally characterized by slow innovation and complex processes, is undergoing a significant transformation driven by Insurtech companies. These firms are leveraging technology to streamline operations, enhance customer experiences, and create entirely new insurance products and services, ultimately disrupting the established market dynamics. This disruption is not just about incremental improvements; it’s about fundamentally altering how insurance is bought, sold, and delivered.

Insurtech companies are employing various technological advancements to improve efficiency and customer experience. Automation is playing a crucial role, reducing manual tasks and speeding up claims processing. Advanced analytics enable more accurate risk assessment, leading to fairer and more competitive pricing. Furthermore, the use of mobile apps and online platforms provides customers with greater accessibility and control over their policies. This increased transparency and ease of interaction fosters a more positive and engaging customer journey, moving away from the often cumbersome processes associated with traditional insurance providers.

Telematics in Auto Insurance

Telematics, the use of technology to collect and analyze data from vehicles, is revolutionizing auto insurance pricing. By installing devices in cars or using smartphone apps, insurers can gather information on driving behavior, such as speed, braking habits, and mileage. This data allows for a more accurate assessment of risk, enabling insurers to offer personalized premiums based on individual driving patterns. Drivers with good driving records, as evidenced by telematics data, can benefit from lower premiums, while those with riskier driving habits may see higher premiums. This shift towards usage-based insurance (UBI) is promoting safer driving habits and fostering a more equitable pricing model. For example, companies like Progressive and Metromile have successfully implemented telematics-based insurance programs, demonstrating the viability and effectiveness of this technology.

Micro-insurance Products

The emergence of micro-insurance products is significantly expanding the reach of the insurance market. These smaller, more affordable policies cater to underserved populations who may not have access to traditional insurance products due to affordability constraints or a lack of suitable options. Micro-insurance often covers specific needs, such as health emergencies or crop failure, providing a safety net for individuals and communities with limited financial resources. The use of mobile technology facilitates the distribution and management of micro-insurance policies, making them easily accessible to a wider range of customers. Examples include mobile-based health insurance schemes in developing countries, which provide crucial coverage to previously uninsured populations.

Types of Insurtech Solutions

The following list Artikels the diverse range of Insurtech solutions currently transforming the insurance landscape:

- Artificial Intelligence (AI) and Machine Learning (ML): Used for fraud detection, risk assessment, and claims processing automation.

- Blockchain Technology: Enabling secure and transparent data management, streamlining claims processes and improving efficiency.

- Internet of Things (IoT): Collecting data from connected devices to provide personalized insurance products and risk assessment.

- Big Data Analytics: Analyzing large datasets to identify patterns, predict risks, and personalize insurance offerings.

- Mobile Apps and Online Platforms: Providing customers with easy access to policies, claims information, and customer support.

Blockchain and Cryptocurrency Disruption

Blockchain technology and cryptocurrencies are fundamentally reshaping the financial landscape, offering alternatives to traditional systems and creating new opportunities for both individuals and businesses. Their decentralized and transparent nature challenges established power structures and opens doors to innovative financial services.

The potential of blockchain technology to revolutionize financial transactions lies in its inherent security and efficiency. Unlike centralized systems reliant on intermediaries like banks, blockchain uses a distributed ledger, making it virtually tamper-proof and significantly reducing the risk of fraud. Transactions are verified by a network of computers, eliminating the need for trusted third parties and speeding up processing times. This increased efficiency translates to lower transaction costs and faster settlement times, benefiting both consumers and businesses.

Impact of Cryptocurrencies on Traditional Financial Markets

Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies designed to work as a medium of exchange. Their decentralized nature and potential for global reach are disrupting traditional financial markets by offering alternative investment vehicles and payment methods. The volatility of cryptocurrencies has drawn significant attention, attracting both investors seeking high returns and regulators concerned about market stability and potential risks. The integration of cryptocurrencies into existing financial systems remains a key area of debate and development. Some traditional financial institutions are beginning to offer cryptocurrency-related services, while others remain hesitant due to regulatory uncertainty and the inherent volatility of the market. For example, the growing acceptance of Bitcoin by some major companies as a form of payment demonstrates the increasing integration of cryptocurrencies into mainstream commerce.

Decentralized Finance (DeFi) Applications and Their Disruptive Potential

Decentralized finance (DeFi) leverages blockchain technology to create financial applications without relying on centralized intermediaries. This paradigm shift offers a range of services, including lending, borrowing, trading, and insurance, all operating on a decentralized and transparent network. The potential for DeFi to disrupt traditional finance is substantial, particularly in areas where access to financial services is limited or where traditional institutions charge high fees. For instance, DeFi platforms allow users to lend and borrow cryptocurrencies directly from each other, bypassing traditional financial institutions and potentially achieving higher interest rates for lenders and lower borrowing costs for borrowers. The absence of intermediaries also fosters greater financial inclusion, as anyone with an internet connection can access these services. However, DeFi also presents challenges, including regulatory uncertainty, security risks, and the potential for scams.

Smart Contract Functionality in a DeFi Application

A smart contract is a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code. In a DeFi application, a smart contract automatically executes predefined actions when specific conditions are met. For example, in a decentralized lending platform, a smart contract might automatically release funds to a borrower once they meet the agreed-upon collateral requirements. Similarly, it might automatically repay a lender upon the borrower’s repayment of the loan. This automation reduces the need for intermediaries and increases transparency and efficiency. The code of a smart contract is publicly available and verifiable, ensuring transparency and accountability. However, the security of smart contracts is crucial, as any flaws in the code could lead to vulnerabilities and exploits. A well-designed smart contract minimizes these risks by incorporating robust security measures and undergoing thorough audits before deployment. The use of smart contracts in DeFi applications is a key driver of its disruptive potential, promising to revolutionize financial transactions through automation and transparency.

Regulatory and Compliance Disruption

The rapid evolution of fintech presents significant challenges for regulators worldwide. Traditional regulatory frameworks, often designed for established financial institutions, struggle to keep pace with the innovative, often borderless, nature of fintech products and services. This mismatch creates a complex landscape requiring nimble regulatory responses to ensure consumer protection, market stability, and the responsible growth of the sector.

Challenges Faced by Regulators in Adapting to Fintech

Regulators face numerous hurdles in adapting to the dynamic fintech landscape. The speed of technological advancements often outpaces the legislative process, leading to regulatory gaps and uncertainty. Moreover, the global nature of many fintech businesses complicates enforcement and necessitates international cooperation. Cross-border data flows, varying national laws, and the potential for regulatory arbitrage all add to the complexity. Finally, understanding the intricacies of new technologies and their associated risks requires regulators to invest in specialized expertise and collaborate closely with industry players. This includes staying abreast of advancements in areas like artificial intelligence (AI), machine learning, and blockchain technology, which introduce unique regulatory considerations.

The Role of Regulatory Sandboxes in Fostering Fintech Innovation

Regulatory sandboxes provide a controlled environment where fintech companies can test their innovative products and services under the supervision of regulators. These initiatives aim to balance innovation with consumer protection by allowing firms to operate with a degree of regulatory flexibility while remaining subject to oversight. This approach fosters experimentation, reduces the risk of failure for startups, and provides valuable data for regulators to inform future policy decisions. Successful sandbox programs often lead to refined regulations that are both effective and supportive of innovation. Examples include the UK’s Financial Conduct Authority (FCA) sandbox and similar programs in Singapore and Australia, which have facilitated the development and deployment of a variety of innovative fintech solutions.

Key Regulatory Concerns Surrounding the Use of AI in Financial Services

The application of AI in financial services raises several key regulatory concerns. Algorithmic bias, leading to discriminatory outcomes, is a significant issue. Ensuring transparency and explainability in AI-driven decision-making is crucial for building trust and accountability. The potential for AI systems to be manipulated or used for malicious purposes, such as fraud, also necessitates robust security measures and oversight. Furthermore, the liability framework for AI-related errors or failures needs to be clearly defined to protect both consumers and financial institutions. Finally, data privacy and security remain paramount concerns, especially given the vast amounts of personal data used to train and operate AI systems.

Key Regulatory Frameworks Governing Fintech in Different Countries

The regulatory landscape for fintech varies significantly across countries. Below is a table summarizing some key frameworks:

| Country | Regulatory Body | Key Regulatory Focus | Notable Initiatives |

|---|---|---|---|

| United States | Various (e.g., OCC, SEC, CFPB) | Consumer protection, data privacy, anti-money laundering | No-action letters, guidance documents |

| United Kingdom | Financial Conduct Authority (FCA) | Innovation, competition, consumer protection | Regulatory sandbox, open banking initiatives |

| Singapore | Monetary Authority of Singapore (MAS) | Financial stability, innovation, cybersecurity | Regulatory sandbox, Fintech Fast Track |

| European Union | European Central Bank (ECB), national regulators | PSD2, GDPR, AML/CFT | Payment Services Directive 2, General Data Protection Regulation |

Last Word

Fintech’s disruptive force is undeniable, reshaping the financial world at an astonishing pace. While challenges remain, particularly concerning regulation and security, the innovations presented offer increased efficiency, accessibility, and choice for consumers and businesses alike. The future of finance is undeniably intertwined with the continued evolution and adaptation of these transformative technologies. Understanding these disruptions is crucial for navigating the evolving financial landscape.

FAQ Summary

What are the biggest risks associated with Fintech disruption?

Key risks include cybersecurity vulnerabilities, data privacy concerns, regulatory uncertainty, and the potential for increased financial inequality if access to these technologies isn’t equitable.

How is Fintech impacting small businesses?

Fintech offers small businesses access to affordable and efficient financial services, including easier access to loans and streamlined payment processing, fostering growth and competitiveness.

What is the future of regulation in the Fintech space?

The future likely involves a balance between fostering innovation and mitigating risks. Expect ongoing development of regulatory frameworks that adapt to the rapidly evolving technological landscape.