Strategic financial management is the cornerstone of any successful organization, guiding its financial health and long-term prosperity. It’s more than just balancing the books; it’s about proactively shaping the financial future, aligning resources with strategic goals, and navigating the complexities of the modern business landscape. This guide explores the key principles and practices that empower businesses to make informed financial decisions, optimize resource allocation, and achieve sustainable growth.

From forecasting and planning to investment appraisal and risk management, we will delve into the multifaceted aspects of strategic financial management. We will examine various techniques and models, providing practical examples and case studies to illustrate their application in real-world scenarios. Understanding these concepts is crucial for anyone seeking to lead a financially sound and thriving organization.

Defining Strategic Financial Management

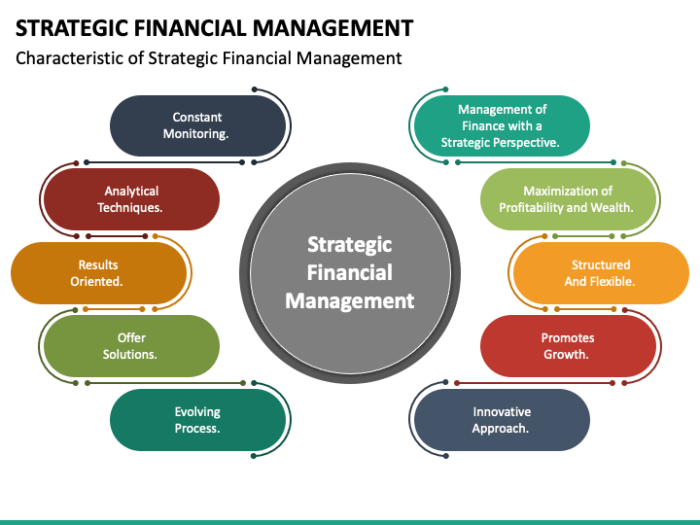

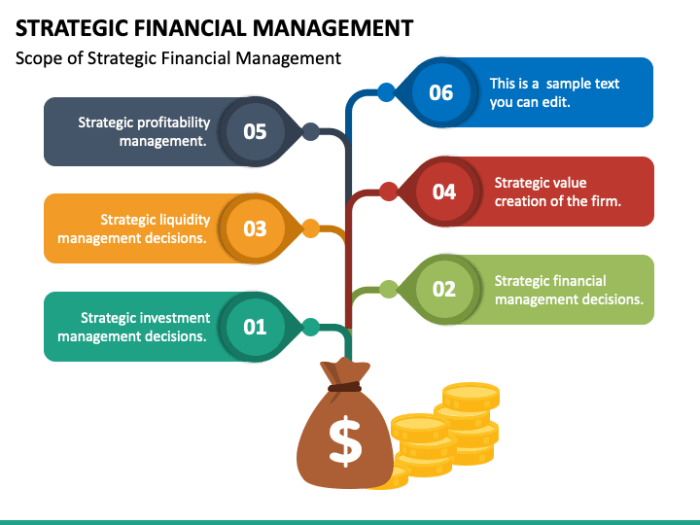

Strategic financial management is the process of aligning a firm’s financial strategies with its overall business objectives. It’s about making long-term financial decisions that create and sustain competitive advantage, ultimately driving shareholder value. This differs significantly from the day-to-day operational focus of traditional financial management.

Strategic financial management incorporates a broader perspective than simply maximizing short-term profits. It considers the entire financial landscape, including external factors like market trends, competitive pressures, and regulatory changes, to inform decisions about capital allocation, investment, financing, and risk management. The core principles emphasize value creation, long-term vision, and proactive adaptation to a dynamic environment.

Core Principles of Strategic Financial Management

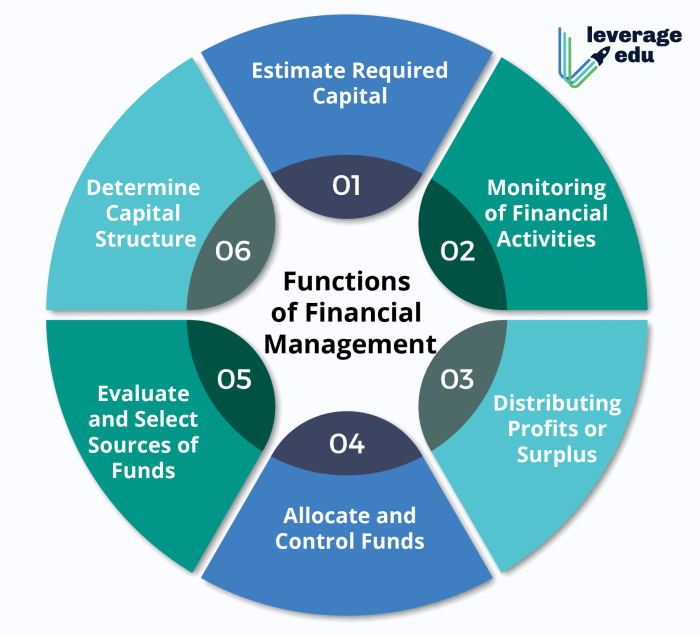

The core principles underpinning strategic financial management include value maximization, which goes beyond short-term profits to consider the long-term growth and sustainability of the firm. This involves efficient capital allocation, ensuring resources are directed to projects with the highest potential returns. Proactive risk management is crucial, identifying and mitigating potential threats to the firm’s financial stability. Finally, a strong emphasis on stakeholder engagement ensures the firm considers the interests of all relevant parties, not just shareholders. These principles work together to create a robust and resilient financial framework.

Differences Between Strategic and Operational Financial Management

Strategic and operational financial management are distinct but interconnected functions. Operational financial management focuses on the day-to-day financial activities of a business, such as managing cash flow, accounts receivable, and payable. It is primarily concerned with efficiency and short-term financial performance. In contrast, strategic financial management takes a longer-term perspective, focusing on major financial decisions that shape the future direction of the company. For example, operational management would handle invoice processing, while strategic management would determine whether to pursue a major acquisition or divest a business unit.

Approaches to Strategic Financial Management

Several approaches exist for implementing strategic financial management. One common approach is the value-based management (VBM) approach, which focuses on maximizing shareholder value through efficient capital allocation and performance measurement. Another is the agency theory approach, which considers the potential conflicts of interest between managers and shareholders and seeks mechanisms to align their goals. A third approach, the stakeholder theory approach, recognizes the interests of all stakeholders—employees, customers, suppliers, and the community—in addition to shareholders. Each approach offers a unique perspective and set of tools for guiding financial decision-making. The optimal approach often depends on the specific context of the organization and its industry.

Impact of Strategic Financial Management on Organizational Success

Effective strategic financial management significantly impacts organizational success. For example, a well-defined capital budgeting process, a key component of strategic financial management, allows companies to invest in projects that align with their long-term goals, leading to increased profitability and market share. Proactive risk management can help companies avoid financial crises and protect their value during economic downturns. Companies like Berkshire Hathaway, known for its long-term investment strategy and prudent risk management, exemplify the positive impact of strategic financial management on sustained organizational success. Their consistent outperformance demonstrates the power of a well-defined and executed financial strategy.

Financial Forecasting and Planning

Effective financial forecasting and planning are crucial for a company’s long-term success. They provide a roadmap for achieving strategic objectives, enabling proactive resource allocation and informed decision-making. Accurate forecasts allow businesses to anticipate challenges, capitalize on opportunities, and maintain financial stability.

Financial forecasting involves projecting future financial performance based on historical data, current trends, and anticipated changes. This process is inherently uncertain, but rigorous methodologies and careful consideration of various factors can improve forecast accuracy. Planning, on the other hand, translates the forecasts into actionable strategies, budgets, and operational plans to guide the organization towards its financial goals.

Designing a Comprehensive Financial Forecasting Model

A comprehensive financial forecasting model for a hypothetical company, let’s call it “InnovateTech,” a software development firm, would incorporate several key financial statements. These include projected income statements, balance sheets, and cash flow statements. The model would begin with sales forecasts, which could be derived using regression analysis (relating sales to marketing spend, economic indicators, etc.) or time series analysis (identifying trends and seasonality in past sales data). These sales projections would then feed into the cost of goods sold (COGS) calculation, considering factors like labor costs, materials, and overhead. Operating expenses would be projected based on historical data and planned initiatives, such as hiring or marketing campaigns. The income statement would then be used to calculate projected net income. This net income would then be incorporated into the projected balance sheet, affecting retained earnings and other equity accounts. Finally, the cash flow statement would be built, projecting cash inflows and outflows from operating, investing, and financing activities. The model would also incorporate sensitivity analysis to assess the impact of various scenarios (e.g., changes in sales growth, interest rates, or competitor actions).

Utilizing Forecasting Techniques

Regression analysis helps establish relationships between dependent and independent variables. For InnovateTech, a regression model could predict software sales based on marketing expenditure and the growth rate of the tech industry. For example, a model might show that a 10% increase in marketing leads to a 5% increase in sales, while a 1% growth in the tech industry results in a 2% increase in sales. Time series analysis, on the other hand, focuses on identifying patterns and trends in historical data. For InnovateTech, analyzing past sales data might reveal a seasonal pattern, with higher sales during the fourth quarter due to year-end budget allocations by clients. This analysis would help in forecasting sales for future quarters. Other techniques, such as qualitative forecasting (incorporating expert opinions and market research), can complement these quantitative methods.

Best Practices for Developing Realistic and Achievable Financial Plans

Developing realistic and achievable financial plans requires a collaborative approach, involving various departments within the organization. This ensures buy-in and alignment across different functions. The plans should be based on thorough market research, competitor analysis, and realistic assumptions about future conditions. Regular monitoring and evaluation are essential to identify deviations from the plan and make necessary adjustments. Contingency planning for unforeseen circumstances is also crucial, allowing for flexibility and adaptability. Finally, linking financial plans to strategic goals ensures that the plans directly contribute to the overall success of the company.

A Step-by-Step Guide to the Financial Planning Process

The financial planning process typically involves several key steps. First, defining strategic objectives: What are the company’s long-term goals? Second, conducting a comprehensive financial analysis: What is the current financial position of the company? Third, developing financial forecasts: What are the projected financial statements? Fourth, creating a budget: How will resources be allocated to achieve the objectives? Fifth, implementing the budget: How will the budget be monitored and controlled? Sixth, monitoring and evaluating performance: How will progress be tracked and adjustments made? Seventh, refining the plan: How will the plan be adapted based on actual performance and changing market conditions? Budget creation involves detailed allocation of resources across various departments and activities, based on the projected financial statements and strategic priorities. For example, InnovateTech might allocate a larger portion of its budget to research and development in a year where it plans to launch a new product.

Capital Budgeting and Investment Decisions

Capital budgeting, the process of evaluating and selecting long-term investments, is crucial for a firm’s sustainable growth and profitability. Effective capital budgeting ensures that resources are allocated to projects that maximize shareholder value. This involves a systematic approach to analyzing potential investments, considering various financial techniques and qualitative factors.

Capital Budgeting Techniques: A Comparison

Several methods exist for evaluating investment projects, each with its strengths and weaknesses. The most common techniques include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. Understanding the nuances of each is essential for making informed decisions.

- Net Present Value (NPV): NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over a project’s life. A positive NPV indicates that the project is expected to generate more value than it costs, thus increasing shareholder wealth. The formula is:

NPV = Σ (Ct / (1 + r)t) – C0

where Ct represents the net cash inflow during period t, r is the discount rate, and C0 is the initial investment.

- Internal Rate of Return (IRR): IRR represents the discount rate at which the NPV of a project equals zero. It indicates the project’s profitability as a percentage. A higher IRR generally suggests a more attractive investment. However, IRR can be problematic when dealing with unconventional cash flows (multiple sign changes).

- Payback Period: The payback period is the time it takes for a project to recoup its initial investment. It’s a simple method focusing on liquidity, but it ignores the time value of money and cash flows beyond the payback period. This makes it less comprehensive than NPV or IRR.

Critical Factors in Investment Evaluation

Beyond the quantitative analysis provided by capital budgeting techniques, several qualitative factors significantly influence investment decisions. A comprehensive evaluation considers both financial and non-financial aspects.

- Strategic Fit: Does the investment align with the company’s overall strategic goals and objectives?

- Risk Assessment: What are the potential risks associated with the investment, and how can they be mitigated? This includes market risk, technological risk, and operational risk.

- Management Expertise: Does the company possess the necessary expertise to manage and execute the investment project successfully?

- Regulatory and Legal Considerations: Are there any legal or regulatory hurdles that could impede the project?

- Environmental and Social Impact: What is the environmental and social impact of the investment?

Comprehensive Investment Appraisal Process

A robust investment appraisal involves a structured process:

1. Idea Generation: Identifying potential investment opportunities.

2. Preliminary Screening: Initial assessment of feasibility and alignment with strategic goals.

3. Detailed Analysis: Conducting thorough financial analysis using techniques like NPV, IRR, and Payback Period.

4. Qualitative Assessment: Evaluating non-financial factors.

5. Sensitivity Analysis: Assessing the impact of changes in key variables on project profitability.

6. Decision Making: Selecting the optimal investment project based on the overall evaluation.

7. Post-Audit: Monitoring and evaluating the project’s performance after implementation.

Hypothetical Investment Proposal: New Production Line

Let’s consider a hypothetical investment proposal for a new production line. This line will produce a new product with high market demand.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Initial Investment | -$1,000,000 | ||

| Revenue | $500,000 | $750,000 | $1,000,000 |

| Operating Costs | -$200,000 | -$250,000 | -$300,000 |

| Net Cash Flow | $300,000 | $500,000 | $700,000 |

| NPV (10% discount rate) | $853,000 | ||

| IRR | 35% | ||

| Payback Period | 1.8 years | ||

This hypothetical project shows a strong positive NPV, a high IRR, and a relatively short payback period, suggesting it is a financially viable investment. However, a full qualitative assessment would be needed to ensure strategic fit and risk mitigation strategies are in place.

Financing Decisions and Capital Structure

A company’s capital structure, the mix of debt and equity financing it uses, significantly impacts its financial health and overall performance. The optimal capital structure balances the benefits of debt (tax deductibility, financial leverage) with the risks associated with higher financial leverage (increased financial distress and bankruptcy risk). Understanding the implications of different capital structures is crucial for effective strategic financial management.

The choice of financing significantly affects a firm’s risk profile, return potential, and financial flexibility. A well-structured capital plan considers both short-term and long-term funding needs, aligning with the company’s growth strategy and overall business objectives. A poorly designed capital structure can hinder growth, limit opportunities, and even threaten the company’s survival.

Implications of Different Capital Structures on Financial Health

Different capital structures carry varying levels of risk and return. A high debt-to-equity ratio, indicating a reliance on debt financing, magnifies the returns to equity holders during periods of profitability due to financial leverage. However, it also amplifies the impact of economic downturns, potentially leading to financial distress or even bankruptcy if the company is unable to meet its debt obligations. Conversely, a low debt-to-equity ratio, signifying a preference for equity financing, provides greater financial stability but may limit growth potential due to lower leverage and potentially higher cost of equity. For example, a highly leveraged airline might experience exceptional profitability in periods of high demand, but struggle severely during recessions due to fixed debt payments. Conversely, a more conservatively financed airline might show more consistent but lower profitability across different economic cycles.

Comparison of Various Sources of Financing

Companies can access capital through various sources, each with its own characteristics.

Debt financing includes bank loans, bonds, and other forms of borrowing. These options typically involve fixed interest payments and repayment schedules, creating a fixed financial obligation. Debt financing offers tax advantages because interest payments are usually tax-deductible. However, excessive debt can increase financial risk and limit financial flexibility.

Equity financing involves issuing shares of stock, which dilutes ownership and potentially reduces earnings per share for existing shareholders. However, equity financing doesn’t require repayment and doesn’t create fixed financial obligations. Equity financing also typically results in a lower risk of financial distress.

Hybrid instruments combine features of both debt and equity. Convertible bonds, for example, can be converted into equity at a specified price and time, offering investors the potential for upside participation while providing the issuer with debt financing. These instruments offer a balance between the advantages and disadvantages of debt and equity.

Factors Influencing Optimal Capital Structure Decisions

Several key factors influence a company’s optimal capital structure. These include:

* Company size and industry: Larger, more established companies often have easier access to debt financing at lower interest rates than smaller, newer companies. Industry norms also play a significant role, as some industries are more heavily leveraged than others.

* Tax rates: The tax deductibility of interest payments makes debt financing more attractive in higher tax environments.

* Financial risk tolerance: Companies with higher risk tolerance may opt for more debt financing to leverage returns, while more conservative companies may prefer equity financing.

* Growth prospects: Companies with strong growth prospects may be willing to take on more debt to finance expansion, while companies with slower growth prospects may prioritize financial stability.

* Access to capital markets: Companies with easy access to capital markets may find it easier to raise equity or debt financing, providing greater flexibility in capital structure decisions.

Financing Strategy for a Company Aiming for Expansion

Imagine a technology startup aiming for rapid expansion. To fund its growth, a balanced approach might be optimal. Initially, it could leverage venture capital or angel investors to obtain equity financing, providing capital without immediate repayment obligations. This would mitigate the risk of high debt levels during the early, high-risk stages. As the company matures and demonstrates profitability, it could then gradually incorporate debt financing, such as bank loans or bonds, to fund further expansion and take advantage of tax benefits. This strategy balances the benefits of equity’s flexibility and debt’s tax advantages, supporting the company’s aggressive growth strategy while managing financial risk. This phased approach allows the company to gradually increase its leverage as its financial position strengthens and risk reduces.

Working Capital Management

Effective working capital management is crucial for a company’s financial health and overall success. It involves efficiently managing current assets (cash, accounts receivable, and inventory) and current liabilities (accounts payable, short-term debt) to ensure smooth operations and maximize profitability. A well-managed working capital cycle allows a business to meet its short-term obligations, invest in growth opportunities, and weather economic downturns.

The Importance of Efficient Working Capital Management

Efficient working capital management is paramount for several reasons. Firstly, it ensures the company has sufficient liquidity to meet its immediate obligations, preventing defaults and maintaining a positive credit rating. Secondly, it optimizes the use of resources, minimizing the need for expensive short-term financing. Thirdly, it allows for better forecasting and planning, enabling the company to make informed decisions regarding investments and expansion. Finally, efficient working capital management directly contributes to improved profitability by reducing financing costs and maximizing the return on assets.

Strategies for Optimizing Cash Flow and Minimizing Working Capital Needs

Several strategies can be employed to optimize cash flow and minimize working capital requirements. These include implementing robust accounts receivable management systems to expedite collections, negotiating favorable payment terms with suppliers to extend payable periods, optimizing inventory levels to minimize storage costs and reduce obsolescence, and exploring cost-effective financing options to bridge temporary cash shortfalls. For instance, a company might implement an automated invoice processing system to reduce the time it takes to collect payments from customers, or negotiate extended payment terms with key suppliers to free up cash for other purposes.

Risks Associated with Inadequate Working Capital Management

Inadequate working capital management exposes businesses to significant risks. A shortage of working capital can lead to missed payment deadlines, damaging the company’s credit rating and hindering its ability to secure future financing. It can also disrupt operations, forcing production delays or even temporary shutdowns. Conversely, excessive working capital ties up funds that could be used more productively in other areas of the business, reducing overall profitability. For example, a company holding excessive inventory might face losses due to obsolescence or spoilage.

Examples of How Effective Working Capital Management Improves Profitability

Effective working capital management directly boosts profitability. By reducing the need for expensive short-term borrowing, it lowers financing costs. Efficient inventory management minimizes storage costs and reduces losses from obsolescence. Faster collection of accounts receivable improves cash flow, allowing for quicker reinvestment in the business. For example, a company that successfully reduces its days sales outstanding (DSO) from 60 to 45 days frees up significant capital that can be used for expansion or debt reduction, thereby improving profitability.

Key Performance Indicators (KPIs) for Monitoring Working Capital

Monitoring key performance indicators (KPIs) is essential for effective working capital management. Regularly tracking these metrics provides insights into the efficiency and effectiveness of working capital strategies.

- Days Sales Outstanding (DSO): Measures the average number of days it takes to collect payment after a sale.

- Days Payable Outstanding (DPO): Measures the average number of days it takes to pay suppliers.

- Days Inventory Outstanding (DIO): Measures the average number of days inventory remains in stock before being sold.

- Cash Conversion Cycle (CCC): Represents the time it takes to convert raw materials into cash from sales (DIO + DSO – DPO).

- Current Ratio: A liquidity ratio that compares current assets to current liabilities (Current Assets / Current Liabilities).

- Quick Ratio: A more stringent liquidity ratio that excludes inventory from current assets ( (Current Assets – Inventory) / Current Liabilities).

- Working Capital Turnover: Measures how efficiently a company uses its working capital to generate sales (Sales / Working Capital).

Risk Management and Financial Control

Effective risk management and robust financial controls are crucial for the long-term success and stability of any organization. These elements work in tandem to protect against financial losses, ensure regulatory compliance, and maintain investor confidence. A proactive approach to risk identification and mitigation, coupled with a strong internal control framework, allows businesses to navigate uncertainties and achieve their strategic financial goals.

Common Financial Risks Faced by Organizations

Organizations face a wide spectrum of financial risks, broadly categorized as market risk, credit risk, liquidity risk, operational risk, and compliance risk. Market risk encompasses fluctuations in interest rates, exchange rates, and commodity prices, impacting profitability and asset values. Credit risk stems from the possibility of borrowers defaulting on their obligations, leading to potential losses for lenders. Liquidity risk arises from the inability to meet short-term obligations due to insufficient cash flow or access to credit. Operational risk involves internal failures, fraud, or external events disrupting business operations and causing financial losses. Finally, compliance risk refers to the potential for penalties and legal action due to non-compliance with regulations and laws. For example, a retail company might face market risk from fluctuating consumer spending, credit risk from unpaid customer accounts, liquidity risk from unexpected supply chain disruptions, operational risk from data breaches, and compliance risk from failing to adhere to labor laws.

Risk Mitigation Strategies

Various strategies can effectively mitigate financial risks. Diversification, for instance, reduces market risk by spreading investments across different asset classes or geographic regions. A bank, for example, might diversify its loan portfolio across various industries to lessen the impact of a downturn in a single sector. Hedging utilizes financial instruments like derivatives to offset potential losses from adverse price movements. An airline might hedge against fluctuating fuel prices by purchasing fuel futures contracts. Insurance transfers the financial burden of specific risks to an insurance company. A manufacturing company might insure its factory against fire damage. Improved internal controls and robust risk assessment procedures can significantly mitigate operational and compliance risks. Regular audits and employee training programs help strengthen internal controls, reducing the likelihood of fraud and errors. Stress testing, which involves simulating various adverse scenarios, allows organizations to assess their resilience and develop contingency plans. A financial institution might conduct stress tests to determine its ability to withstand a significant economic downturn.

The Importance of Internal Controls in Maintaining Financial Integrity

Internal controls are the processes and procedures designed to safeguard assets, ensure the reliability of financial reporting, promote operational efficiency, and encourage compliance with laws and regulations. Strong internal controls contribute to the accuracy and reliability of financial statements, fostering trust among stakeholders. They also help prevent fraud and errors, protecting the organization’s assets and reputation. Effective internal controls typically include segregation of duties, authorization procedures, physical safeguards, performance reviews, and independent audits. Segregation of duties, for instance, ensures that no single individual has complete control over a transaction, reducing the risk of fraud. Regular reconciliations of bank statements and internal records help identify discrepancies and prevent errors. A robust system of authorization ensures that transactions are properly approved before being processed.

Hypothetical Risk Assessment Framework for the Renewable Energy Industry

This framework assesses risks faced by a solar panel manufacturing company. The framework categorizes risks by likelihood and impact, using a matrix with four quadrants: Low Likelihood/Low Impact, Low Likelihood/High Impact, High Likelihood/Low Impact, and High Likelihood/High Impact.

| Risk Category | Specific Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|---|

| Market Risk | Fluctuations in demand for solar panels | High | High | Diversify product offerings, explore new markets |

| Operational Risk | Supply chain disruptions | Medium | Medium | Develop multiple sourcing options, build strategic partnerships |

| Credit Risk | Customer defaults on payments | Low | Medium | Implement robust credit checks, offer flexible payment options |

| Compliance Risk | Changes in environmental regulations | Medium | High | Engage with regulatory bodies, stay updated on policy changes |

Performance Evaluation and Reporting

Effective performance evaluation and reporting are crucial for strategic financial management. They provide insights into a company’s financial health, identify areas for improvement, and inform strategic decision-making. By analyzing key financial statements and ratios, businesses can track progress towards goals, assess risk, and demonstrate accountability to stakeholders.

Interpreting Key Financial Statements

Financial statements—the balance sheet, income statement, and cash flow statement—offer a comprehensive view of a company’s financial position. The balance sheet presents a snapshot of assets, liabilities, and equity at a specific point in time. The income statement summarizes revenues, expenses, and profits over a period. The cash flow statement tracks the movement of cash both into and out of the business during a given period. Analyzing these statements together provides a holistic understanding of the company’s financial performance. For example, a company might show strong profits on the income statement but have low cash reserves on the balance sheet, indicating potential liquidity issues. Conversely, a company with high cash flow might still be unprofitable if it has high expenses relative to its revenue.

Financial Ratio Analysis for Performance Evaluation

Financial ratios provide a standardized way to compare a company’s performance over time or against industry benchmarks. Ratios can be categorized into several groups, including liquidity ratios (e.g., current ratio, quick ratio), profitability ratios (e.g., gross profit margin, net profit margin, return on assets), solvency ratios (e.g., debt-to-equity ratio, times interest earned), and efficiency ratios (e.g., inventory turnover, accounts receivable turnover). For instance, a high current ratio suggests strong short-term liquidity, while a low debt-to-equity ratio indicates lower financial risk. Analyzing trends in these ratios over time helps identify emerging strengths and weaknesses.

Best Practices for Creating Effective Financial Reports

Effective financial reports should be clear, concise, and easily understood by the intended audience. They should accurately reflect the company’s financial position and performance, adhering to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). Reports should include key performance indicators (KPIs) aligned with the company’s strategic objectives. Visual aids such as charts and graphs can enhance understanding and make the data more accessible. Regular and timely reporting is crucial for effective monitoring and control. Finally, reports should be tailored to the specific needs of different stakeholders, such as investors, creditors, and management.

Performance Dashboard Design

A performance dashboard provides a visual overview of key financial metrics, enabling quick identification of trends and potential issues. The following table presents a sample dashboard design:

| Metric | Current Value | Target Value | Variance |

|---|---|---|---|

| Net Profit Margin | 15% | 20% | -5% |

| Return on Equity (ROE) | 12% | 15% | -3% |

| Current Ratio | 2.0 | 2.5 | -0.5 |

| Debt-to-Equity Ratio | 0.5 | 0.4 | +0.1 |

This dashboard uses a simple table format to display key financial metrics, comparing current values against target values and highlighting variances. A more sophisticated dashboard might incorporate interactive charts and graphs for a more dynamic and engaging presentation. Color-coding could be used to highlight areas requiring attention, such as significant negative variances. The specific metrics included would depend on the company’s strategic priorities and the needs of its stakeholders.

Strategic Financial Decisions in Mergers and Acquisitions

Mergers and acquisitions (M&A) are significant strategic financial decisions impacting a company’s future trajectory. Successful M&A requires careful planning, thorough due diligence, and a sound understanding of the financial implications involved. This section will explore the key financial considerations, valuation methods, and the due diligence process integral to successful M&A transactions.

Financial Considerations in Mergers and Acquisitions

Several critical financial aspects must be considered during the M&A process. These include evaluating the target company’s financial health, assessing synergies and potential cost savings, determining the appropriate acquisition price, and securing financing for the transaction. Careful analysis of financial statements, cash flow projections, and debt levels is essential to make informed decisions. Understanding the tax implications of the merger or acquisition is also crucial, as it can significantly impact the overall financial outcome. Post-merger integration planning, including the consolidation of financial systems and operations, should also be considered. Failure to adequately address these aspects can lead to significant financial challenges post-transaction.

Valuation Methods in Mergers and Acquisitions

Determining the fair market value of the target company is a critical step in any M&A transaction. Various valuation methods are employed, each with its strengths and limitations. These include discounted cash flow (DCF) analysis, which projects future cash flows and discounts them back to their present value; comparable company analysis, which compares the target company’s valuation multiples (e.g., Price-to-Earnings ratio) to those of similar publicly traded companies; and precedent transactions analysis, which examines the acquisition prices paid for similar companies in past transactions. The selection of the most appropriate valuation method depends on the specific circumstances of the transaction and the availability of relevant data. Often, a combination of methods is used to arrive at a comprehensive valuation.

Due Diligence in Mergers and Acquisitions

Due diligence is a critical process that involves a thorough investigation of the target company’s financial and operational aspects. This process aims to verify the accuracy of the information provided by the seller and to identify any potential risks or liabilities associated with the acquisition. Due diligence typically involves reviewing financial statements, legal documents, operational data, and conducting interviews with key personnel. The depth and scope of due diligence will vary depending on the size and complexity of the transaction. Thorough due diligence is essential to mitigate risks and ensure that the acquisition is a financially sound investment. Any significant discrepancies or red flags uncovered during this process can lead to renegotiation of the acquisition price or even termination of the deal.

Hypothetical Merger Scenario: Financial Aspects

Let’s consider a hypothetical merger between Company A, a large established firm in the technology sector, and Company B, a smaller, innovative startup specializing in artificial intelligence.

- Step 1: Initial Assessment and Valuation: Company A conducts a thorough financial analysis of Company B, employing DCF analysis and comparable company analysis to determine a fair acquisition price. They identify synergies, such as access to new technology and expanded market reach.

- Step 2: Due Diligence: Company A performs comprehensive due diligence on Company B, examining its financial records, intellectual property, legal compliance, and customer contracts. They discover a minor legal issue related to a patent, which is successfully addressed through negotiation.

- Step 3: Negotiation and Agreement: Based on the valuation and due diligence findings, Company A negotiates an acquisition price with Company B’s shareholders. A definitive agreement is signed, outlining the terms of the merger.

- Step 4: Financing and Closing: Company A secures financing for the acquisition, potentially through a combination of debt and equity. The transaction closes, and Company B becomes a subsidiary of Company A.

- Step 5: Post-Merger Integration: Company A integrates Company B’s operations and financial systems. They realize the projected synergies, leading to increased profitability and market share.

The Role of Technology in Strategic Financial Management

Technological advancements have profoundly reshaped the landscape of strategic financial management, impacting every aspect from forecasting and planning to risk management and performance evaluation. The integration of technology not only streamlines processes but also unlocks new levels of efficiency, accuracy, and insight, ultimately enabling more informed and effective decision-making.

The increasing sophistication of financial technology (FinTech) solutions offers significant opportunities for businesses of all sizes. However, successful implementation requires careful consideration of both the benefits and challenges involved. A strategic approach is crucial to maximize the positive impacts and mitigate potential risks.

Impact of Technological Advancements on Financial Management Practices

Technological advancements have automated many previously manual tasks, leading to increased efficiency and reduced operational costs. Data analytics tools provide deeper insights into financial performance, allowing for more accurate forecasting and better informed strategic decisions. Cloud computing enables secure and accessible data storage and sharing, facilitating collaboration and improving decision-making speed. The rise of artificial intelligence (AI) and machine learning (ML) is further transforming the field, enabling sophisticated risk modeling, fraud detection, and algorithmic trading. For example, AI-powered systems can analyze vast datasets to identify patterns and anomalies that might be missed by human analysts, leading to earlier detection of potential financial problems. Similarly, ML algorithms can be used to optimize investment portfolios and improve pricing strategies.

Benefits and Challenges of Implementing Financial Technology (FinTech) Solutions

The benefits of implementing FinTech solutions are substantial, including improved accuracy, efficiency, and decision-making. Automation reduces manual errors and frees up financial professionals to focus on higher-value tasks such as strategic analysis and planning. Real-time data and analytics provide a more comprehensive understanding of financial performance, allowing for proactive adjustments to strategy. Enhanced security measures can also help to protect against fraud and other financial risks. However, challenges exist, including the high initial investment costs associated with implementing new technologies, the need for specialized expertise to manage and maintain these systems, and the potential for data security breaches. Furthermore, the rapid pace of technological change necessitates ongoing investment in training and development to keep up with the latest advancements. Successful implementation requires careful planning, a phased approach, and ongoing evaluation of the effectiveness of the technology.

Improving Financial Forecasting, Planning, and Control with Technology

Technology significantly enhances financial forecasting, planning, and control. Advanced analytics platforms can process large volumes of data to identify trends and patterns, leading to more accurate forecasts. Scenario planning tools allow for the simulation of different future outcomes, enabling businesses to develop contingency plans and make more robust decisions. Real-time dashboards provide up-to-the-minute visibility into key financial metrics, facilitating proactive monitoring and control. For instance, a company using predictive analytics might forecast potential cash flow shortages weeks in advance, allowing them to adjust their spending or secure additional financing to avoid financial difficulties. Similarly, real-time monitoring of sales data can help a company identify emerging market trends and adjust its production and marketing strategies accordingly.

Skills and Competencies Required for Financial Professionals in a Technology-Driven Environment

The increasing reliance on technology demands a new set of skills and competencies for financial professionals. Strong analytical skills are crucial for interpreting data generated by sophisticated analytical tools. Proficiency in data management and visualization is essential for effectively communicating financial information. Understanding of programming languages and data science techniques is becoming increasingly important. Furthermore, financial professionals need to develop strong problem-solving skills to identify and resolve technical issues, and adaptability to embrace new technologies and methodologies. The ability to collaborate effectively with technology specialists is also essential. For example, a financial analyst might need to collaborate with a data scientist to build a predictive model for forecasting sales revenue, requiring strong communication and collaboration skills.

Summary

Mastering strategic financial management is not merely about understanding financial statements; it’s about developing a holistic perspective that integrates financial strategies with overall business objectives. By implementing the principles and techniques discussed, organizations can enhance their decision-making processes, mitigate financial risks, and ultimately achieve sustainable competitive advantage. The journey towards financial excellence requires continuous learning, adaptation, and a commitment to proactive financial stewardship.

Key Questions Answered

What is the difference between strategic and operational financial management?

Strategic financial management focuses on long-term goals and overall financial health, while operational financial management deals with day-to-day financial activities and short-term objectives.

How can I improve my company’s cash flow?

Improve cash flow by optimizing accounts receivable, managing inventory effectively, negotiating favorable payment terms with suppliers, and exploring alternative financing options.

What are some common financial risks?

Common financial risks include credit risk, market risk, liquidity risk, operational risk, and regulatory risk. Effective risk management strategies are crucial to mitigate these.

What are some key performance indicators (KPIs) for financial health?

Key financial KPIs include profitability ratios (e.g., net profit margin), liquidity ratios (e.g., current ratio), solvency ratios (e.g., debt-to-equity ratio), and efficiency ratios (e.g., inventory turnover).