Successfully launching a product or service into a new market requires meticulous planning and execution. Market Entry Strategies delve into the multifaceted process, encompassing everything from defining your ideal customer to navigating legal hurdles and crafting a compelling marketing narrative. This guide provides a framework for strategic decision-making, offering insights into various approaches and highlighting the critical considerations for achieving sustainable growth in a foreign market.

From selecting the optimal entry strategy—be it direct export, joint ventures, or franchising—to developing robust pricing and distribution models, this exploration illuminates the key elements for success. Understanding your target market’s cultural nuances, conducting thorough market research, and mitigating potential risks are paramount to building a strong foundation for long-term viability and profitability.

Defining Target Market

Defining your target market is crucial for a successful market entry strategy. A clearly defined target market allows for focused marketing efforts, optimized product development, and ultimately, higher conversion rates. Understanding your ideal customer allows you to tailor your messaging and approach to resonate effectively, maximizing your return on investment.

To effectively penetrate a new market, a thorough understanding of the target customer is paramount. This involves identifying key characteristics, assessing market size and potential, and analyzing their unmet needs.

Ideal Customer Profile Characteristics

Identifying the key characteristics of your ideal customer helps you focus your resources and marketing efforts on the most promising segment. This allows for more effective communication and a higher probability of success.

- Demographics: For example, targeting young professionals (ages 25-35) with a high disposable income and a strong interest in sustainable products.

- Psychographics: Focusing on individuals who value convenience, eco-consciousness, and social responsibility, as demonstrated by their purchasing habits and online activity.

- Behavioral Patterns: Targeting customers who frequently use online shopping platforms, actively engage with social media, and demonstrate a preference for subscription-based services.

Target Market Size and Growth Potential

Assessing the size and growth potential of your target market is essential for determining the viability of your market entry strategy. This involves analyzing market research data and projecting future growth based on various factors.

Let’s consider a hypothetical example: Suppose we are launching a new line of organic, plant-based protein bars. Our target market is health-conscious millennials and Gen Z consumers in the United States. Market research suggests this segment represents approximately 60 million individuals, with an annual growth rate of 5%. This indicates a substantial market opportunity with significant potential for expansion.

Unmet Needs and Pain Points

Understanding the unmet needs and pain points within your target market is crucial for developing a product or service that truly resonates. This requires in-depth market research and a keen understanding of consumer behavior.

In our protein bar example, the unmet needs might include a desire for convenient, healthy snacks that are also environmentally sustainable and ethically sourced. The pain points could include a lack of readily available, affordable, and tasty plant-based protein options that meet these criteria. Our product aims to address these needs and pain points by offering a delicious, convenient, and sustainable protein bar made with ethically sourced ingredients.

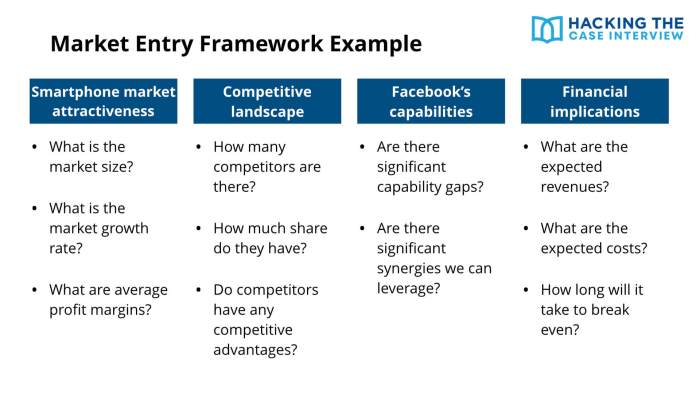

Market Research and Analysis

Thorough market research and analysis are crucial for successful market entry. Understanding the competitive landscape and consumer behavior within the target market is paramount to developing a viable strategy. This section will delve into the methodologies employed and the resulting competitive analysis, culminating in a SWOT analysis to highlight key strategic considerations.

Market Research Methodologies: Qualitative vs. Quantitative

Two primary market research methodologies offer distinct approaches to data collection and analysis: qualitative and quantitative research. Qualitative research focuses on in-depth understanding of consumer attitudes, beliefs, and motivations. This is often achieved through methods like focus groups, in-depth interviews, and ethnographic studies. Quantitative research, conversely, emphasizes numerical data and statistical analysis to identify trends and patterns. Surveys, experiments, and observational studies are common quantitative methods. The choice between these methodologies depends on the specific research objectives. For instance, understanding the emotional connection consumers have with a product might necessitate qualitative methods, while assessing market size and penetration would require quantitative approaches. A balanced approach, incorporating both qualitative and quantitative methods, often provides a more comprehensive understanding of the market.

Competitive Analysis: Key Findings

Our competitive analysis revealed a market characterized by both established players and emerging competitors. The established players, such as Acme Corp and Beta Industries, possess strong brand recognition and extensive distribution networks. Their strengths lie in their established customer base and economies of scale. However, their weaknesses include a perceived lack of innovation and a slower response to evolving consumer preferences. Emerging competitors, such as Gamma Solutions and Delta Innovations, demonstrate a greater agility and focus on niche markets. Their strengths lie in their innovative product offerings and targeted marketing strategies. However, their weaknesses include limited brand awareness and a smaller market share compared to the established players. This competitive landscape presents both opportunities and challenges for market entry.

SWOT Analysis

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Unique product offering with superior functionality | Limited brand recognition and market awareness | Untapped market segments with high growth potential | Aggressive pricing strategies from established competitors |

| Strong team with extensive industry experience | Higher initial investment costs compared to competitors | Strategic partnerships with complementary businesses | Rapid technological advancements and changing consumer preferences |

| Flexible and scalable business model | Dependence on key suppliers and distributors | Government incentives and subsidies for new market entrants | Economic downturn and potential market saturation |

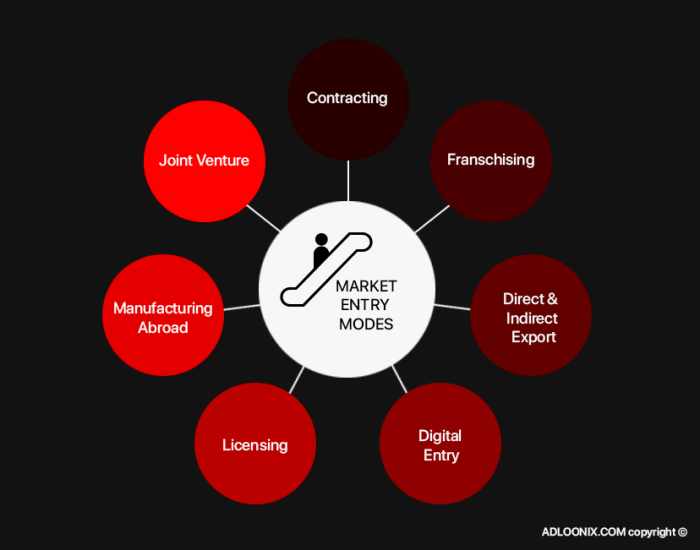

Choosing an Entry Strategy

Selecting the optimal market entry strategy is crucial for success. The choice depends on various factors, including the nature of your product or service, the target market’s characteristics, the level of risk you’re willing to assume, and your available resources. This section will explore different entry strategies and their suitability under varying circumstances.

Direct Exporting versus Indirect Exporting

Direct exporting involves selling your products or services directly to customers in the target market, often through establishing your own sales force or distribution network. Indirect exporting, on the other hand, uses intermediaries such as export management companies or distributors to handle the sales and distribution process.

Direct exporting offers greater control over pricing, branding, and distribution, potentially leading to higher profit margins. However, it requires significant upfront investment in infrastructure, personnel, and market knowledge. It also carries higher risk, particularly if the company lacks experience in international markets. Conversely, indirect exporting requires less initial investment and risk, as intermediaries handle much of the logistical and marketing complexities. However, this comes at the cost of reduced control and potentially lower profit margins due to the intermediary’s fees. For example, a small artisan food producer might choose indirect exporting initially to test the market before committing to the larger investment of direct exporting. A large multinational corporation, however, may find direct exporting more profitable and advantageous due to their existing resources and brand recognition.

Joint Venture Strategy Suitability

A joint venture involves collaborating with a local partner to enter a foreign market. This strategy is particularly suitable when significant local knowledge, resources, or regulatory expertise are needed. For example, a technology company seeking to enter a market with complex regulations might benefit from a joint venture with a local firm familiar with the regulatory landscape. The suitability of a joint venture depends on factors such as the level of local expertise required, the cultural differences between the partners, and the potential for conflict over control and decision-making. A successful joint venture requires careful partner selection, clear agreements on ownership, profit sharing, and management responsibilities. Consider a hypothetical scenario where a US-based coffee roaster wants to enter the Japanese market. A joint venture with an established Japanese coffee distributor could provide access to distribution channels, local market insights, and established customer relationships, mitigating the risks and complexities of independent market entry.

Franchising Strategy Implementation Plan

A franchising strategy involves granting licenses to local businesses to operate under your brand and using your business model. This is a relatively low-risk entry strategy as the franchisee bears most of the financial and operational risks. Successful franchising requires a well-defined business model, strong brand recognition, and robust training and support systems for franchisees.

- Develop a comprehensive franchise package: This includes the franchise agreement, operations manual, training materials, and marketing guidelines.

- Recruit and select qualified franchisees: Thorough screening is crucial to ensure franchisees align with your brand values and possess the necessary skills and resources.

- Provide comprehensive training and support: Ongoing support and training are vital for franchisee success and brand consistency.

- Establish a robust quality control system: Regular inspections and audits ensure franchisees maintain brand standards and operational procedures.

- Develop marketing and advertising strategies: Support franchisees with marketing materials and campaigns to promote brand awareness.

Key milestones include completing the franchise package, recruiting the first franchisees, opening the first franchise location, and achieving a specific number of franchise units. Key metrics to track include franchisee satisfaction, franchise unit profitability, brand awareness, and overall market share. For example, a fast-food chain might set a milestone of opening 10 franchise locations within the first year, and track metrics such as customer satisfaction scores and franchise unit sales volume to assess the success of the strategy.

Pricing and Distribution Strategies

Successful market entry hinges not only on identifying the right target market and selecting an appropriate entry strategy but also on implementing effective pricing and distribution strategies. These two elements are intrinsically linked, influencing profitability, market penetration, and overall brand perception. A well-defined pricing model coupled with a robust distribution network are crucial for achieving sustainable growth.

Pricing Model Comparison

Three common pricing models—cost-plus pricing, value-based pricing, and competitive pricing—offer distinct advantages and disadvantages. Cost-plus pricing, where a fixed markup is added to the cost of goods sold, is simple to implement but may not reflect market realities or customer perceptions of value. Value-based pricing, on the other hand, focuses on the perceived value of the product or service to the customer, allowing for higher profit margins if the value proposition is strong. This approach requires thorough market research to understand customer willingness to pay. Finally, competitive pricing involves setting prices based on competitor offerings. This strategy can be effective for gaining market share quickly, particularly in price-sensitive markets, but may lead to lower profit margins if not managed carefully. The choice of pricing model will significantly impact profit margins and market share; cost-plus generally offers lower margins and slower growth, while value-based pricing can achieve higher margins but may require a longer time to gain market share. Competitive pricing presents a balance between the two, offering a quicker route to market share but potentially sacrificing margins.

Distribution Network Establishment

Establishing a comprehensive distribution network is critical for reaching the target market effectively. This involves selecting appropriate channels, managing logistics, and ensuring efficient delivery of products or services. A multi-channel approach, combining both online and offline channels, often proves most effective. For example, a company might utilize e-commerce platforms, direct sales teams, retail partnerships, and wholesale distributors to reach a wider audience. Logistics management encompasses warehousing, inventory control, transportation, and order fulfillment. Efficient logistics are crucial for minimizing costs and ensuring timely delivery, contributing significantly to customer satisfaction. A well-defined distribution strategy, supported by a strong logistics infrastructure, is essential for gaining a competitive edge and ensuring smooth market penetration. For instance, a company launching a new line of organic cosmetics might choose to partner with specialty beauty stores and high-end department stores (offline) while simultaneously building a strong online presence through its own website and major e-commerce marketplaces (online).

Marketing Materials for Value Proposition

Effective marketing materials are vital for communicating the value proposition to the target market. These materials should clearly articulate the benefits of the product or service, highlighting its unique selling points and addressing the needs and desires of the target customer. Examples include brochures, website content, social media campaigns, and video advertisements. For instance, a brochure for a new line of sustainable clothing could feature high-quality images of the clothing, highlight the use of eco-friendly materials, and emphasize the brand’s commitment to ethical production practices. A website would further elaborate on these points, providing detailed product information, customer testimonials, and possibly an interactive size guide. Social media campaigns could focus on user-generated content, showcasing customers wearing the clothing and highlighting the brand’s values. Video advertisements could feature short, impactful clips emphasizing the clothing’s style, comfort, and sustainability. The key is to create consistent messaging across all channels, ensuring that the target market receives a clear and compelling message about the product or service’s value.

Legal and Regulatory Considerations

Successfully entering a new market requires a thorough understanding and adherence to the local legal and regulatory landscape. Ignoring these aspects can lead to significant financial penalties, operational disruptions, and even the complete failure of the market entry strategy. This section Artikels key legal and regulatory considerations, the process of obtaining necessary permits, and a checklist for ongoing compliance.

Navigating the legal and regulatory environment of a foreign market can be complex and varies significantly by country and industry. Key areas to consider include product safety regulations, intellectual property protection, data privacy laws, labor laws, and taxation. Understanding these requirements is crucial for minimizing risk and ensuring long-term sustainability in the target market. Failure to comply can result in hefty fines, legal battles, and damage to brand reputation.

Product Safety and Standards Compliance

Meeting product safety and quality standards is paramount. These standards vary widely across regions and often involve rigorous testing and certification processes. For example, the European Union has stringent CE marking requirements for many product categories, while the United States has the Consumer Product Safety Commission (CPSC) overseeing product safety. Companies must identify and comply with all relevant standards to ensure their products are legally sold and meet consumer expectations for safety and quality. Failure to comply can lead to product recalls, fines, and legal action. A comprehensive understanding of these standards is critical before initiating sales.

Licensing and Permitting Procedures

Obtaining necessary licenses and permits is a crucial step in the market entry process. The specific requirements depend heavily on the industry, the target market’s regulations, and the nature of the business activities. This process often involves submitting detailed applications, providing documentation, and undergoing inspections. For instance, food and beverage companies may need health permits, while technology companies might need data privacy certifications. The timeline for obtaining licenses and permits can vary significantly, ranging from a few weeks to several months, so planning and proactive engagement with relevant authorities are essential. Delays in obtaining the necessary approvals can significantly delay market entry.

Legal Compliance Checklist

A comprehensive checklist is essential to ensure ongoing legal compliance. This checklist should include regular reviews of relevant laws and regulations, maintaining accurate records, and implementing internal controls to ensure adherence to all legal requirements. The checklist should be tailored to the specific business and market, encompassing areas such as:

- Regular review of all relevant laws and regulations for changes and updates.

- Maintaining accurate records of all licenses, permits, and certifications.

- Implementation of internal controls to ensure compliance with all legal requirements.

- Regular training for employees on relevant legal and regulatory matters.

- Establishment of a process for reporting and addressing compliance issues.

- Development and implementation of a crisis management plan for addressing legal and regulatory challenges.

This checklist should be reviewed and updated periodically to reflect any changes in legislation or best practices. Proactive compliance not only minimizes legal risks but also fosters a strong reputation for ethical and responsible business conduct. Ignoring these steps can result in significant financial and reputational damage.

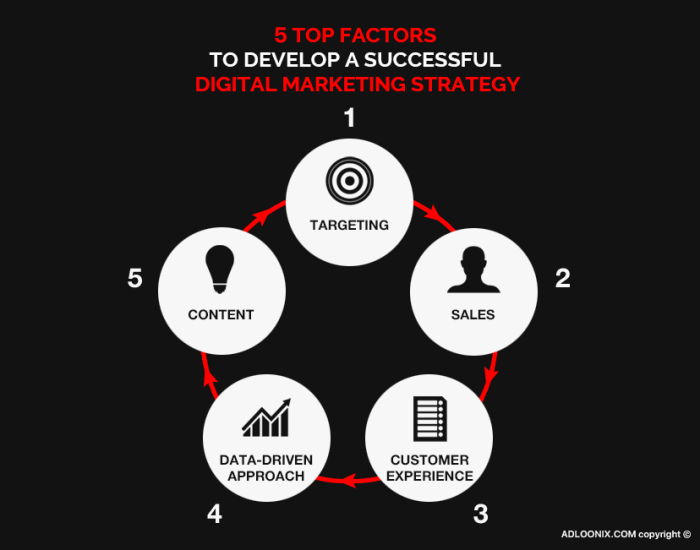

Marketing and Sales Strategies

A successful market entry hinges not only on a well-defined strategy but also on effective marketing and sales execution. This section details the development of a comprehensive marketing and sales plan, crucial for achieving brand awareness, generating leads, and ultimately driving sales within the new market. It will Artikel the key components needed to successfully integrate marketing and sales efforts to support customer acquisition and brand building.

A robust marketing and sales strategy requires a synergistic approach, aligning messaging and channels to resonate with the target audience while simultaneously implementing effective sales techniques to convert leads into customers. This integrated strategy is crucial for maximizing return on investment and establishing a strong market presence.

Target Audience, Messaging, and Marketing Channels

Developing a comprehensive marketing plan begins with clearly defining the target audience. This involves understanding their demographics, psychographics, buying behaviors, and media consumption habits. Once the target audience is defined, messaging should be crafted to resonate with their specific needs and pain points. For example, a technology company targeting businesses might emphasize efficiency and cost savings, while a consumer goods company might focus on convenience and lifestyle benefits. Finally, selecting the appropriate marketing channels—such as social media, digital advertising, content marketing, public relations, or traditional media—is vital for reaching the target audience effectively. A multi-channel approach often yields the best results.

Lead Generation, Qualification, and Closing Techniques

A successful sales strategy begins with generating high-quality leads. This can be achieved through various methods, including inbound marketing (e.g., content marketing, ), outbound marketing (e.g., cold calling, email marketing), and partnerships. Once leads are generated, they must be qualified to identify those most likely to convert into customers. This typically involves assessing factors such as budget, authority, need, and timeline (BANT). Finally, effective closing techniques are essential for converting qualified leads into paying customers. These techniques might include presenting compelling value propositions, addressing objections, and offering incentives. For example, a sales team might offer a free trial or a discount to encourage purchase.

Supporting Brand Building and Customer Acquisition

The marketing and sales strategies described above directly support both brand building and customer acquisition. Effective marketing builds brand awareness and positive perception, creating a foundation for sales efforts. By consistently delivering on brand promises and providing excellent customer service, a strong brand reputation is fostered. Meanwhile, the sales strategy focuses on converting leads into customers, directly driving revenue growth. The combination of these efforts leads to sustainable market penetration and long-term success. For instance, a successful launch of a new product line might involve a comprehensive digital marketing campaign, targeted social media advertising, and a well-trained sales team equipped with effective closing techniques. This integrated approach ensures that the brand is effectively communicated and that sales targets are met.

Financial Projections and Funding

Entering a new market requires a robust financial plan to guide investment and track performance. This section details the projected financials for the first three years, Artikels the chosen funding strategy, and identifies key performance indicators (KPIs) for monitoring success. Accurate forecasting is crucial for securing funding and managing resources effectively.

Three-Year Financial Forecast

The following forecast assumes a phased market entry, starting with a smaller-scale launch and gradually increasing operations based on market response and revenue generation. We project profitability within the second year, contingent upon achieving targeted sales figures and maintaining efficient cost management. This projection is based on comparable market entry data from similar businesses in the same industry.

| Year | Revenue | Cost of Goods Sold (COGS) | Gross Profit | Operating Expenses | Net Income |

|---|---|---|---|---|---|

| Year 1 | $500,000 | $250,000 | $250,000 | $200,000 | $50,000 |

| Year 2 | $1,500,000 | $750,000 | $750,000 | $600,000 | $150,000 |

| Year 3 | $3,000,000 | $1,500,000 | $1,500,000 | $1,200,000 | $300,000 |

Funding Strategy and Sources of Capital

Our funding strategy is a blended approach, combining bootstrapping with external investment. Initially, we will leverage existing company resources and revenue from other market segments to fund the initial stages of market entry. This will minimize initial debt and allow for a more controlled expansion. Following this, we will seek Series A funding from venture capital firms specializing in our industry. This funding will be used to scale operations, expand marketing efforts, and accelerate growth in the new market. We have already identified several potential investors who have shown strong interest in our business plan. For example, a successful funding round for a similar company, “InnovateTech,” resulted in a $2 million investment, enabling rapid expansion into international markets. Their success provides a benchmark for our own fundraising goals.

Key Financial Metrics

Several key financial metrics will be closely monitored to assess the success of our market entry strategy. These include:

- Revenue Growth: Tracking monthly and annual revenue growth will indicate market acceptance and the effectiveness of our sales and marketing strategies.

- Customer Acquisition Cost (CAC): This metric helps evaluate the efficiency of our customer acquisition efforts. A low CAC indicates efficient marketing spend.

- Customer Lifetime Value (CLTV): Measuring the total revenue generated by a customer over their relationship with the company is crucial for long-term profitability.

- Gross Profit Margin: This shows the profitability of our products or services after deducting the cost of goods sold.

- Return on Investment (ROI): This metric measures the profitability of our investment in the new market, comparing the net profit to the total investment.

Regular monitoring and analysis of these metrics will allow us to adapt our strategies as needed, ensuring optimal resource allocation and maximizing our chances of success. For instance, if the CAC is consistently high, we may need to re-evaluate our marketing channels or messaging. Conversely, a high CLTV indicates a successful customer retention strategy.

Risk Assessment and Mitigation

Entering a new market presents inherent risks that can significantly impact a company’s success. A thorough risk assessment is crucial for developing proactive mitigation strategies and a robust contingency plan. This section Artikels potential risks and provides approaches to minimize their impact.

A comprehensive risk assessment should consider both internal and external factors. External factors include market conditions, political and regulatory changes, and competitive landscape. Internal factors include financial resources, managerial expertise, and operational capabilities. Ignoring these risks can lead to significant financial losses and project failure.

Market Risks

Market risks encompass uncertainties related to demand, competition, and pricing. For example, unforeseen changes in consumer preferences or the emergence of a strong competitor could severely impact sales projections. To mitigate these risks, thorough market research is essential, along with flexible marketing strategies that allow for adaptation to changing market conditions. Diversifying product offerings and establishing strong brand loyalty can also help insulate the business from sudden market shifts. Consider, for instance, a company launching a new technology product. If consumer adoption is slower than anticipated, the company might need to adjust its marketing campaign, explore alternative distribution channels, or even reposition the product to better suit the market.

Operational Risks

Operational risks relate to the company’s ability to effectively manage its operations within the new market. This includes logistical challenges, supply chain disruptions, and issues with production or distribution. For example, difficulties in securing reliable suppliers or navigating complex customs regulations could significantly delay product launches or increase costs. Mitigation strategies include establishing strong relationships with local suppliers, implementing robust inventory management systems, and developing contingency plans for supply chain disruptions, such as sourcing alternative suppliers or holding sufficient safety stock. A company expanding into a new region might, for example, build a local warehouse to mitigate logistical challenges and ensure timely delivery to customers.

Financial Risks

Financial risks encompass uncertainties related to funding, profitability, and currency fluctuations. Securing sufficient funding to support market entry initiatives is crucial. Unforeseen cost overruns or slower-than-expected revenue generation could strain the company’s finances. Mitigation strategies include developing detailed financial projections, securing diverse funding sources, and establishing realistic sales targets. Hedging against currency fluctuations can also protect against financial losses due to exchange rate changes. For example, a company could use forward contracts to lock in favorable exchange rates for future transactions.

Contingency Planning

A well-defined contingency plan is vital for addressing unforeseen challenges. This plan should Artikel specific actions to be taken in response to various potential scenarios, such as a sudden drop in sales, a major regulatory change, or a natural disaster. The plan should identify key decision-makers, allocate responsibilities, and establish communication protocols. Regular review and updates to the contingency plan are necessary to ensure its effectiveness in adapting to changing circumstances. For example, the plan could include strategies for reducing operating costs, securing additional funding, or temporarily suspending operations in certain areas. Regularly testing the contingency plan through simulations can identify weaknesses and improve its effectiveness.

Cultural Considerations

Successfully entering a new market requires a deep understanding of the target market’s cultural nuances. Ignoring cultural factors can lead to marketing mishaps, ineffective communication, and ultimately, market failure. This section details the cultural considerations for our target market and Artikels strategies to navigate these complexities.

Understanding the cultural landscape of our target market, specifically [Target Market Name and Location], is paramount to our success. Their cultural values, beliefs, and social norms will significantly influence consumer behavior, purchasing decisions, and responses to our marketing efforts. We will focus on adapting our strategies to resonate authentically with this specific culture, avoiding generalizations and stereotypes.

Cultural Values and Beliefs

The dominant cultural values within [Target Market Name and Location] include [List 3-5 key cultural values, e.g., strong family ties, respect for elders, emphasis on community, etc.]. These values will shape our marketing messaging. For instance, emphasizing family togetherness in our advertising campaigns will resonate more effectively than focusing on individualistic themes. Furthermore, our product packaging and design will reflect these values, potentially incorporating traditional motifs or color schemes associated with positive cultural connotations in the region.

Adapting Product/Service to Cultural Preferences

To ensure our product/service aligns with local preferences, we will conduct thorough ethnographic research to understand consumer behaviors and preferences. For example, if our product is a food item, we will adapt the flavor profile and ingredients to suit local tastes. This might involve incorporating regionally popular spices or adjusting the level of spiciness to align with local preferences. If our service is technology-based, we will ensure that the user interface is intuitive and culturally appropriate, possibly including multilingual support and culturally relevant imagery. For instance, a mobile app might include culturally appropriate illustrations or use culturally sensitive language. Adapting the product or service’s packaging is also crucial. For example, colors and symbols that are considered auspicious or inauspicious in the target culture should be carefully considered.

Cross-Cultural Communication and Collaboration Plan

Effective cross-cultural communication is essential for successful market entry. Our plan includes:

- Hiring Local Talent: We will recruit a team with deep understanding of the local culture, language, and business practices. This ensures authentic communication and avoids cultural misunderstandings.

- Cultural Sensitivity Training: Our team will undergo comprehensive training to enhance cultural awareness and sensitivity. This will equip them to interact respectfully and effectively with local stakeholders.

- Translation and Localization: All marketing materials, including website content, brochures, and advertising copy, will be professionally translated and localized to ensure accurate and culturally appropriate messaging.

- Building Relationships: We will actively engage with local communities and build strong relationships with key stakeholders. This includes engaging with local leaders, community groups, and influencers to gain insights and build trust.

This proactive approach to cultural understanding will minimize potential communication barriers and foster stronger relationships with our target market. We recognize that successful cross-cultural collaboration requires patience, respect, and a genuine commitment to understanding the local culture.

Summary

Entering a new market presents both significant opportunities and considerable challenges. By carefully considering the various factors Artikeld in this guide—from market research and competitive analysis to legal compliance and cultural sensitivity—businesses can significantly enhance their chances of success. A well-defined market entry strategy, built upon a solid understanding of the target market and a proactive approach to risk mitigation, is the cornerstone of sustainable international growth and expansion.

Top FAQs

What is the difference between direct and indirect exporting?

Direct exporting involves selling directly to customers in the target market, while indirect exporting utilizes intermediaries like distributors or agents.

How can I conduct effective competitive analysis?

Effective competitive analysis involves identifying key competitors, analyzing their strengths and weaknesses, and understanding their market positioning and strategies. Tools like SWOT analysis are helpful.

What are some common risks associated with market entry?

Common risks include political instability, economic downturns, regulatory changes, cultural misunderstandings, and competition.

How important is cultural adaptation in market entry?

Cultural adaptation is crucial. Ignoring cultural nuances can lead to marketing failures and damage brand reputation. Adapting products, messaging, and communication styles to local preferences is essential.

What are some key financial metrics to track market entry success?

Key metrics include market share, revenue growth, customer acquisition cost, profit margins, and return on investment (ROI).