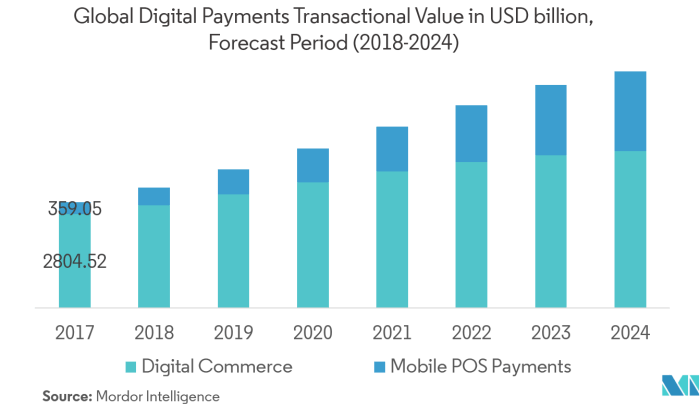

The financial landscape is undergoing a dramatic transformation, driven by the rapid advancement of financial technology (Fintech). From emerging markets embracing mobile payments to established economies leveraging AI for personalized financial advice, Fintech is reshaping how we interact with money and financial services. This exploration delves into the key trends defining this dynamic sector, examining both the opportunities and challenges that lie ahead.

This analysis will cover several pivotal areas, including the rise of Fintech in emerging markets, the implications of open banking and data sharing, the expanding role of artificial intelligence, the disruptive potential of blockchain technology and cryptocurrencies, the innovations within Insurtech, and the crucial importance of cybersecurity in this rapidly evolving digital ecosystem. We will examine the impact of these trends on consumers, businesses, and the broader financial system.

Rise of Fintech in Emerging Markets

The rapid expansion of financial technology (fintech) is transforming financial services globally, but its impact is particularly profound in emerging markets. These regions, often characterized by limited access to traditional banking infrastructure and a large unbanked population, present both significant challenges and unparalleled opportunities for fintech companies. The innovative solutions developed to overcome these challenges are reshaping financial inclusion and economic growth in these dynamic regions.

Unique Challenges and Opportunities in Emerging Markets

Emerging markets offer a vast, untapped market for financial services. However, several unique challenges hinder fintech adoption. These include limited internet and mobile penetration in certain areas, a lack of robust digital infrastructure, varying levels of financial literacy, and regulatory frameworks that are often still developing and adapting to the rapid pace of technological change. Conversely, the sheer size of the unbanked population, the high demand for affordable and accessible financial services, and the potential for rapid growth create immense opportunities for companies willing to navigate these complexities. Successful fintechs often leverage partnerships with local businesses and community leaders to build trust and overcome infrastructural limitations.

Examples of Successful Fintech Innovations

Several fintech companies have successfully tailored their offerings to meet the specific needs of emerging markets. For example, M-Pesa in Kenya revolutionized mobile money transfers, providing access to financial services for millions previously excluded from the formal banking system. Its success lies in its simplicity, reliability, and widespread agent network. Similarly, companies like Paytm in India have leveraged mobile technology to provide a wide range of financial services, including payments, investments, and insurance, to a large and diverse customer base. These examples demonstrate the power of fintech to address specific local contexts and drive financial inclusion.

Regulatory Landscapes: Developed vs. Developing Economies

The regulatory environments for fintech in developed and developing economies differ significantly. Developed economies generally have more established regulatory frameworks, though these are often complex and can stifle innovation. Developing economies, on the other hand, often grapple with a lack of clear regulatory guidelines, leading to uncertainty for fintech companies. This can create both risks and opportunities. While the lack of clear regulations can allow for quicker innovation, it also presents challenges in terms of consumer protection and financial stability. A balanced approach that fosters innovation while ensuring consumer protection is crucial for the sustainable growth of fintech in emerging markets.

Impact of Mobile Penetration on Fintech Adoption

Mobile penetration is a crucial driver of fintech adoption in emerging markets. The widespread availability of mobile phones, even in areas with limited internet access, has enabled the development and deployment of mobile money services and other fintech solutions. This bypasses the need for extensive physical infrastructure, making financial services accessible to a much larger population. However, the success of mobile-based fintech solutions is highly dependent on the quality and reliability of mobile networks and the availability of affordable data plans. Increasing mobile penetration, coupled with improvements in mobile network infrastructure, will continue to fuel the growth of fintech in emerging markets.

Fintech Sector Dominance in Emerging Markets

| Emerging Market | Dominant Fintech Sector | Key Players/Examples | Challenges |

|---|---|---|---|

| Kenya | Mobile Money | M-Pesa, Airtel Money | Maintaining network reliability and expanding financial literacy. |

| India | Payments & Digital Lending | Paytm, PhonePe, Bajaj Finserv | Balancing rapid growth with regulatory compliance and consumer protection. |

| Nigeria | Mobile Money & Digital Payments | Opay, Palmpay, Flutterwave | Addressing infrastructural limitations and improving financial literacy. |

Open Banking and Data Sharing

Open banking represents a significant shift in the financial landscape, driven by the increasing availability and utility of consumer financial data. It empowers consumers to share their financial data with third-party providers, fostering innovation and competition within the financial services sector. However, this increased data sharing also necessitates a robust discussion surrounding data privacy and security.

Open banking fundamentally alters the relationship between consumers, financial institutions, and third-party providers. It allows consumers more control over their financial data, enabling them to access and share it with various apps and services, beyond their primary bank. This transparency and control are key drivers of its potential, but also raise crucial considerations regarding data protection.

Implications of Open Banking on Consumer Financial Data Privacy

The increased sharing of financial data inherent in open banking presents both opportunities and risks concerning consumer privacy. While open banking frameworks often incorporate robust security measures and data encryption, the potential for data breaches or misuse remains. Regulations like the GDPR in Europe and CCPA in California aim to mitigate these risks by mandating transparency and consent mechanisms. However, the effectiveness of these regulations in practice depends on consistent enforcement and consumer awareness. Successful implementation hinges on clear communication regarding data usage and robust security protocols, ensuring consumers understand how their data is being handled and protected.

Innovative Financial Products and Services Enabled by Open Banking

Open banking has spurred the development of a wide array of innovative financial products and services. For example, personalized financial management tools can now access data from multiple accounts to provide a comprehensive overview of a consumer’s financial health, offering tailored advice and budgeting assistance. Similarly, lending platforms can use open banking data to assess creditworthiness more accurately and efficiently, potentially offering better loan terms to underserved populations. Furthermore, the rise of embedded finance – integrating financial services into non-financial applications – is directly facilitated by open banking, allowing for seamless transactions and financial management within existing platforms. For instance, a retailer might offer buy-now-pay-later options directly through their app, leveraging open banking for secure and instant payment processing.

Potential for Increased Competition and Improved Customer Experiences

Open banking’s potential to foster competition is substantial. By enabling third-party providers to access and utilize consumer financial data, it levels the playing field, allowing smaller, more agile companies to compete with established financial institutions. This competition can translate to improved customer experiences through more innovative products, lower fees, and better customer service. Consumers benefit from a wider range of choices and potentially more favorable terms, ultimately driving greater efficiency and innovation within the financial sector. The increased competition also encourages existing institutions to improve their own offerings to remain competitive.

Key Technological Hurdles in Implementing Open Banking Effectively

Implementing open banking effectively requires overcoming several technological hurdles. The secure and reliable transmission of sensitive financial data necessitates robust APIs and secure communication protocols. Interoperability between different banking systems and third-party providers is crucial, requiring standardization and collaboration across the industry. Ensuring data security and preventing fraud are paramount, necessitating the implementation of advanced security measures such as multi-factor authentication and fraud detection systems. The need for scalable and reliable infrastructure capable of handling large volumes of data transactions presents another significant challenge.

Benefits and Risks Associated with Open Banking

The implementation of open banking presents a complex interplay of benefits and risks for both consumers and businesses.

For Consumers:

- Benefits: Increased control over financial data, access to personalized financial management tools, potential for better financial products and services, increased competition leading to lower fees and better rates.

- Risks: Potential for data breaches and misuse, concerns about data privacy and security, complexity of managing multiple financial accounts and services.

For Businesses:

- Benefits: Access to a wider pool of customer data for developing innovative products and services, opportunities for increased revenue and market share, potential for improved customer relationships and loyalty.

- Risks: Increased regulatory compliance requirements, potential for security breaches and reputational damage, competition from new market entrants.

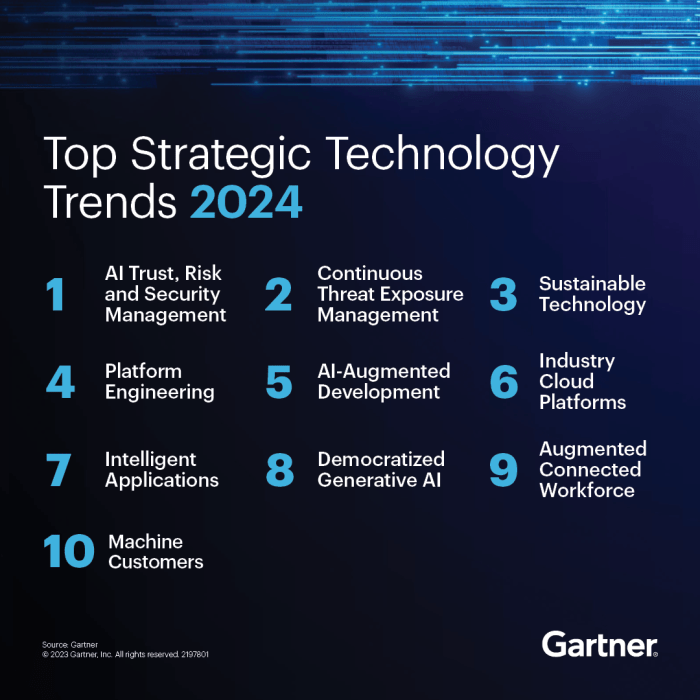

Artificial Intelligence (AI) in Finance

Artificial intelligence is rapidly transforming the financial services industry, impacting everything from fraud detection to personalized financial advice. Its ability to process vast amounts of data and identify patterns invisible to the human eye offers significant advantages in efficiency, accuracy, and risk mitigation. This section explores several key applications of AI within the financial sector, highlighting both its benefits and associated ethical considerations.

AI in Fraud Detection and Risk Management

AI algorithms, particularly machine learning models, are proving highly effective in detecting fraudulent activities. These algorithms analyze transactional data, identifying unusual patterns and anomalies that might indicate fraudulent behavior. For example, a system might flag a transaction as suspicious if it involves an unusually large sum of money transferred to an unfamiliar account, or if it originates from a location geographically distant from the account holder’s usual activity. Furthermore, AI enhances risk management by predicting potential risks, such as loan defaults or market volatility. By analyzing historical data and incorporating various economic indicators, AI models can assess the creditworthiness of borrowers with greater accuracy and provide more tailored risk assessments. This leads to more informed lending decisions and reduces overall financial risk for institutions.

AI-Powered Personalized Financial Advice Tools

The rise of robo-advisors exemplifies the application of AI in providing personalized financial advice. These platforms utilize AI algorithms to analyze an individual’s financial situation, risk tolerance, and investment goals to create a customized investment portfolio. For example, a robo-advisor might recommend a more conservative investment strategy for a risk-averse client nearing retirement, while suggesting a more aggressive approach for a younger investor with a longer time horizon. This personalized approach enhances customer engagement by providing tailored solutions and increasing accessibility to financial planning services, particularly for individuals who might not otherwise have access to professional financial advisors. The impact is seen in increased customer satisfaction and improved financial outcomes for users.

Comparison of AI Algorithms in Algorithmic Trading and Portfolio Management

Various AI algorithms are employed in algorithmic trading and portfolio management. Reinforcement learning, for example, is used to develop trading strategies that optimize returns based on past market performance and simulated scenarios. Meanwhile, supervised learning models are trained on historical data to predict future market trends and inform investment decisions. A key difference lies in their approach: reinforcement learning focuses on learning through trial and error in a simulated environment, while supervised learning relies on pre-labeled data to make predictions. The choice of algorithm depends on the specific application and the availability of relevant data. For instance, high-frequency trading might leverage reinforcement learning to adapt quickly to rapidly changing market conditions, whereas long-term portfolio management might benefit more from supervised learning models trained on historical market data.

Ethical Considerations of AI in Financial Decision-Making

The increasing reliance on AI in financial decision-making raises several ethical concerns. Bias in algorithms, stemming from biased training data, can lead to discriminatory outcomes. For instance, an AI system trained on historical data reflecting existing societal biases might inadvertently discriminate against certain demographic groups in loan applications. Furthermore, the lack of transparency in some AI models (particularly deep learning models) makes it difficult to understand the reasoning behind their decisions, raising concerns about accountability and potential for manipulation. Addressing these concerns requires careful consideration of data quality, algorithm design, and regulatory oversight to ensure fairness, transparency, and responsible use of AI in the financial sector.

AI-Enhanced Customer Service in Banking

Imagine a scenario where a customer contacts their bank’s customer service through a chatbot. This AI-powered chatbot, trained on a vast database of customer inquiries and banking procedures, can instantly address common questions about account balances, transaction history, and loan applications. For more complex issues, the chatbot can escalate the conversation to a human representative, providing them with relevant context and previous interactions to facilitate a faster and more efficient resolution. This AI-enhanced customer service system improves response times, reduces wait times, and provides 24/7 availability, significantly enhancing customer satisfaction and operational efficiency for the bank. The integration of AI also allows for personalized interactions, tailoring responses based on the customer’s past interactions and preferences.

Blockchain Technology and Cryptocurrencies

Blockchain technology, initially conceived as the foundation for cryptocurrencies like Bitcoin, offers a transformative potential that extends far beyond digital currencies. Its decentralized, secure, and transparent nature is reshaping various sectors, particularly finance, promising increased efficiency and trust.

Blockchain’s decentralized ledger system, where transactions are recorded across multiple computers, eliminates the need for a central authority, such as a bank. This inherent characteristic has significant implications for financial transactions, especially in areas traditionally plagued by inefficiencies and high costs.

Blockchain’s Impact on Cross-Border Payments and Remittances

The high fees and slow processing times associated with traditional cross-border payments are significant obstacles for individuals and businesses. Blockchain technology offers a solution by enabling faster, cheaper, and more transparent international transfers. By bypassing intermediaries, blockchain reduces transaction costs and processing time, potentially saving billions of dollars annually in remittance fees. For example, Ripple, a blockchain-based payment network, facilitates near real-time cross-border payments for several financial institutions, reducing processing time from days to seconds. This increased efficiency significantly benefits migrant workers sending money back home.

Regulatory Uncertainty Surrounding Cryptocurrencies

The decentralized and global nature of cryptocurrencies presents challenges for regulators worldwide. The lack of a unified regulatory framework creates uncertainty for investors and businesses, hindering widespread adoption. Concerns regarding money laundering, tax evasion, and market manipulation necessitate the development of clear and consistent regulatory guidelines. Different jurisdictions are taking varied approaches, leading to a fragmented regulatory landscape that creates complexities for cross-border cryptocurrency transactions. This regulatory uncertainty poses a significant barrier to the wider adoption of cryptocurrencies in mainstream finance.

Successful Blockchain Applications Beyond Cryptocurrencies

Blockchain’s applications extend far beyond cryptocurrencies. Supply chain management is one area where blockchain’s transparency and immutability are proving invaluable. By recording every step of a product’s journey on a shared, secure ledger, blockchain enhances traceability, combats counterfeiting, and improves efficiency. Similarly, in the financial industry, blockchain is being used for secure identity verification, streamlining KYC (Know Your Customer) processes, and reducing fraud. Examples include trade finance platforms using blockchain to improve transparency and efficiency in international trade transactions.

Security and Transparency Comparison: Blockchain vs. Traditional Systems

Blockchain technology offers enhanced security and transparency compared to traditional financial systems. The decentralized nature of blockchain makes it highly resistant to single points of failure and cyberattacks. The cryptographic hashing and consensus mechanisms ensure data integrity and prevent unauthorized alterations. Furthermore, the public nature of many blockchain networks (though not all) provides transparency, allowing anyone to view transaction history (while maintaining user privacy through cryptographic techniques). In contrast, traditional financial systems rely on centralized databases that are vulnerable to hacking and manipulation. The lack of transparency in these systems can also lead to trust issues and reduced accountability. The immutability of the blockchain, where once recorded transactions cannot be altered, stands in stark contrast to the potential for manipulation in traditional systems.

Visual Representation of a Blockchain Transaction

Imagine a network of interconnected computers (nodes). Alice wants to send Bob 10 units of a cryptocurrency. First, Alice initiates a transaction, providing Bob’s public key and the amount. This transaction is broadcast to the network. The network’s nodes verify the transaction using cryptographic techniques, checking Alice’s digital signature and ensuring she has sufficient funds. Once verified, the transaction is grouped with others into a block. This block is then added to the existing blockchain, a chronological chain of blocks, using a consensus mechanism (e.g., Proof-of-Work). Each block contains a cryptographic hash of the previous block, creating an immutable chain. The updated blockchain is then replicated across all the network nodes, making the transaction permanently recorded and visible to all participants. The actors involved are Alice (sender), Bob (receiver), and the network nodes (validators).

Insurtech and the Future of Insurance

Insurtech, the intersection of insurance and technology, is revolutionizing the industry, offering innovative solutions that improve customer experience, streamline processes, and expand access to insurance for underserved populations. This transformation is driven by advancements in data analytics, artificial intelligence, and mobile technology, leading to more efficient risk assessment, personalized products, and a more customer-centric approach.

Innovative Approaches to Customer Experience

Insurtech companies are prioritizing customer experience through user-friendly digital platforms, personalized communication, and seamless claims processes. Many offer mobile apps for policy management, instant quotes, and 24/7 customer support, creating a more convenient and accessible experience compared to traditional methods. The focus is on creating a frictionless journey for the customer, from initial quote to claim settlement. This includes features like chatbot assistance for quick answers to common questions and proactive notifications regarding policy renewals or potential risks.

Data Analytics for Risk Assessment and Pricing

Insurtech leverages the power of big data and advanced analytics to refine risk assessment and pricing models. By analyzing vast amounts of data from various sources, including telematics, wearables, and social media, Insurtech companies can develop more accurate risk profiles for individuals and businesses. This allows for more precise pricing, offering customized premiums based on individual risk levels and leading to fairer and more competitive insurance products. For example, a driver using a telematics device that tracks their driving habits might receive a lower premium if their driving is consistently safe.

Impact on Traditional Insurance Business Models

The rise of Insurtech is forcing traditional insurance companies to adapt their business models. Many are investing in digital transformation initiatives, partnering with Insurtech startups, or acquiring Insurtech companies to gain access to new technologies and capabilities. The traditional reliance on extensive paperwork and manual processes is being challenged by Insurtech’s automated and efficient systems. This disruption is driving innovation across the entire insurance value chain, from underwriting and claims processing to customer service and product development. The industry is becoming more agile and customer-focused as a result.

Challenges in Regulation and Consumer Trust

Insurtech companies face challenges related to regulation and consumer trust. The rapid pace of technological advancements often outpaces the development of regulatory frameworks, creating uncertainty and potential compliance issues. Building consumer trust requires demonstrating transparency, data security, and ethical data practices. Concerns about data privacy and the potential for algorithmic bias are significant hurdles that need to be addressed to ensure widespread adoption of Insurtech solutions. Strong regulatory oversight and clear industry standards are crucial for fostering trust and ensuring responsible innovation.

Micro-insurance Models Expanding Access

Micro-insurance models, facilitated by Insurtech, are expanding access to insurance for underserved populations. These models offer small, affordable insurance products tailored to the specific needs and financial capabilities of low-income individuals and communities.

- Mobile-based micro-insurance: Policies are purchased and managed through mobile phones, eliminating the need for physical offices or intermediaries.

- Pay-as-you-go insurance: Premiums are paid in small, regular installments, making insurance more accessible to those with limited disposable income.

- Index-based insurance: Coverage is linked to an index, such as rainfall or crop yields, providing protection against weather-related risks for farmers and other vulnerable populations.

- Community-based micro-insurance: Policies are offered through community organizations or microfinance institutions, leveraging existing social networks and trust.

The Growing Importance of Cybersecurity in Fintech

The rapid expansion of financial technology (Fintech) has brought unprecedented convenience and efficiency to the financial world. However, this digital transformation has also significantly increased the vulnerability of financial institutions and their customers to sophisticated cyberattacks. The interconnected nature of Fintech systems, coupled with the vast amounts of sensitive personal and financial data they handle, makes cybersecurity a paramount concern, demanding constant vigilance and robust defensive measures.

Unique Cybersecurity Threats Faced by Fintech Companies

Fintech companies face a unique set of cybersecurity threats that differ from traditional financial institutions. These threats are amplified by their reliance on cloud-based infrastructure, mobile applications, and the use of APIs for third-party integrations. The decentralized nature of many Fintech platforms also presents challenges in maintaining consistent security protocols across various systems and partners. Furthermore, the constant innovation within the Fintech sector often leads to a race between developing new technologies and securing them against potential vulnerabilities. This rapid pace of change can leave security measures lagging behind, creating opportunities for exploitation.

Examples of Recent High-Profile Cybersecurity Breaches in the Fintech Industry and Their Consequences

Several high-profile cybersecurity breaches have underscored the critical importance of robust security measures in the Fintech industry. For instance, the 2017 Equifax breach, while not strictly a Fintech company, significantly impacted the financial data of millions, highlighting the devastating consequences of data breaches. The breach exposed sensitive personal information, including Social Security numbers and credit card details, leading to identity theft and financial losses for numerous individuals and resulting in significant legal and financial repercussions for Equifax. Similarly, various smaller Fintech companies have experienced breaches, often involving the compromise of customer accounts and the theft of funds. These incidents have not only caused financial losses but have also damaged the reputation and trust of the affected companies. The consequences can include hefty fines, regulatory scrutiny, loss of customers, and diminished investor confidence.

The Role of Regulatory Bodies in Ensuring the Cybersecurity of Financial Institutions

Regulatory bodies play a crucial role in establishing and enforcing cybersecurity standards within the Fintech industry. Organizations like the Financial Conduct Authority (FCA) in the UK and the Securities and Exchange Commission (SEC) in the US have issued guidelines and regulations aimed at improving the cybersecurity posture of financial institutions. These regulations often mandate specific security controls, such as data encryption, access control measures, and incident response plans. Furthermore, regulatory bodies conduct regular audits and inspections to ensure compliance with these standards. The penalties for non-compliance can be severe, including substantial fines and legal action. The evolving regulatory landscape reflects the growing awareness of the risks and the need for proactive measures to mitigate them.

Best Practices for Securing Financial Data and Protecting Against Cyberattacks

Securing financial data and protecting against cyberattacks requires a multi-layered approach. This includes implementing robust authentication and authorization mechanisms, such as multi-factor authentication (MFA) and strong password policies. Regular security audits and penetration testing are essential to identify vulnerabilities and ensure that security controls are effective. Data encryption, both in transit and at rest, is crucial for protecting sensitive information. Employee training and awareness programs are also vital in mitigating the risk of insider threats and phishing attacks. Furthermore, adopting a zero-trust security model, which assumes no implicit trust, can significantly enhance security posture. Finally, maintaining up-to-date security software and patching systems promptly are critical to preventing exploitation of known vulnerabilities.

A Hypothetical Cybersecurity Incident Response Plan for a Fintech Company

A well-defined incident response plan is crucial for minimizing the impact of a cybersecurity breach. The plan should Artikel clear procedures for detecting, responding to, and recovering from security incidents.

- Detection: Establish robust monitoring systems to detect suspicious activity, including intrusion detection systems (IDS) and security information and event management (SIEM) tools.

- Analysis: Upon detection of a potential incident, conduct a thorough analysis to determine the nature and scope of the breach.

- Containment: Isolate affected systems to prevent further damage and data exfiltration.

- Eradication: Remove the threat and restore compromised systems to a secure state.

- Recovery: Restore data from backups and resume normal operations.

- Post-Incident Activity: Conduct a thorough post-incident review to identify lessons learned and improve future preparedness.

- Communication: Establish clear communication protocols to inform stakeholders, including customers and regulatory bodies, as appropriate.

Last Recap

In conclusion, the future of finance is inextricably linked to the continued evolution of Fintech. The trends discussed—from the democratizing potential of mobile money to the complex challenges of AI ethics and cybersecurity—present both immense opportunities and significant risks. Navigating this landscape requires a proactive approach from regulators, businesses, and consumers alike. By understanding and adapting to these transformative forces, we can harness the power of Fintech to create a more inclusive, efficient, and secure financial system for all.

Essential Questionnaire

What are the biggest risks associated with Fintech adoption?

Major risks include data breaches, regulatory uncertainty, systemic failures, and the potential for increased financial exclusion if not implemented inclusively.

How is Fintech impacting traditional financial institutions?

Traditional institutions are facing increased competition and pressure to innovate, adopting Fintech solutions themselves or risking obsolescence. Many are partnering with or acquiring Fintech companies.

What role does regulation play in the Fintech industry?

Regulation is crucial for consumer protection, preventing fraud, and ensuring the stability of the financial system. However, striking a balance between fostering innovation and mitigating risks is a significant challenge.

What is the future of payments in the age of Fintech?

The future likely involves a diverse range of payment methods, including mobile payments, digital wallets, and potentially even cryptocurrency-based systems, with a focus on speed, security, and convenience.