Navigating the treacherous waters of financial crises requires a robust understanding of risk assessment, mitigation strategies, and effective communication. This guide delves into the core principles of financial crisis management, exploring proactive and reactive approaches, and examining the crucial role of regulatory frameworks and technological advancements in shaping both the causes and solutions to these complex events. From identifying early warning signs to implementing post-crisis recovery plans, we aim to provide a practical framework for navigating these challenging situations.

We’ll explore real-world case studies, analyzing successes and failures in crisis management to offer valuable insights and best practices. Understanding the interplay between financial institutions, regulatory bodies, and the public is critical in mitigating the impact of financial crises and ensuring long-term stability. This guide offers a detailed examination of these interdependencies and provides actionable strategies for effective crisis management.

Defining Financial Crisis Management

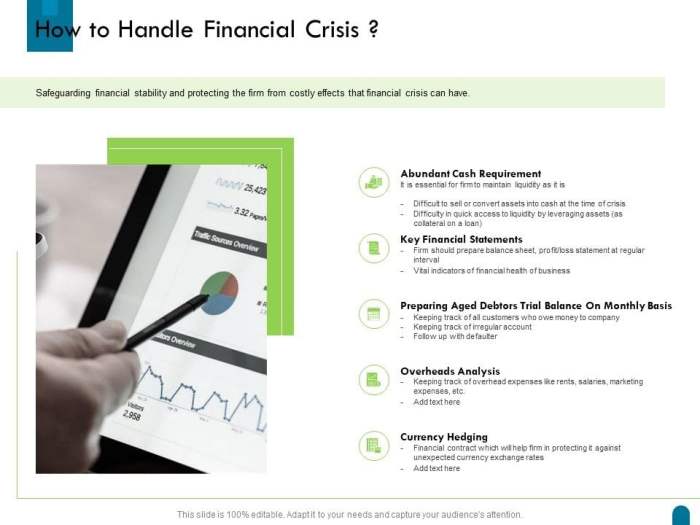

Financial crisis management is a critical discipline encompassing the prevention, mitigation, and resolution of financial disruptions that can impact individuals, businesses, and entire economies. It involves a proactive and reactive approach to identifying vulnerabilities, implementing preventative measures, and responding effectively when crises occur. The core principles underpinning effective management are swift action, transparency, and collaboration.

Effective financial crisis management relies on several core principles. First, proactive risk assessment and management are crucial; identifying potential vulnerabilities before they escalate into crises is paramount. Second, a robust communication strategy is essential for maintaining transparency and confidence amongst stakeholders. Third, strong collaboration between government agencies, financial institutions, and international organizations is vital for a coordinated and effective response. Finally, a well-defined plan of action, including pre-approved emergency measures, is essential to ensure a rapid and efficient response when a crisis hits.

Types of Financial Crises and Their Characteristics

Financial crises manifest in various forms, each with unique characteristics. Banking crises, for example, involve the failure or near-failure of banks, often triggered by asset bubbles, excessive lending, or regulatory failures. The 2008 global financial crisis serves as a prime example, stemming from the subprime mortgage crisis in the United States. Currency crises, characterized by a rapid and significant devaluation of a country’s currency, often result from unsustainable macroeconomic policies or speculative attacks. The Asian financial crisis of 1997-98 is a well-documented case study. Sovereign debt crises occur when a government struggles to meet its debt obligations, potentially leading to defaults and economic instability. Greece’s debt crisis in the early 2010s exemplifies the challenges of managing sovereign debt issues. Finally, systemic crises involve a widespread collapse of financial markets and institutions, often triggered by a cascade of failures across interconnected parts of the financial system. The 2008 global financial crisis again serves as a significant illustration of a systemic crisis.

A Comprehensive Definition of Financial Crisis Management

Financial crisis management encompasses the entire spectrum of activities aimed at preventing, mitigating, and resolving financial crises. Its scope extends to the identification of potential risks, the development and implementation of preventative measures, the design of contingency plans, and the coordination of responses during crises. The objectives are to minimize the negative impacts of financial crises on the economy, maintain financial stability, protect depositors and investors, and restore confidence in the financial system. This involves a multifaceted approach, requiring expertise in areas such as macroeconomics, financial regulation, and crisis communication.

Proactive versus Reactive Approaches to Financial Crisis Management

Proactive financial crisis management emphasizes prevention and preparedness. This approach involves continuous monitoring of the financial system, rigorous stress testing of financial institutions, and the implementation of preventative regulatory measures. A proactive strategy aims to identify and address potential vulnerabilities before they trigger a crisis. Reactive approaches, on the other hand, focus on responding to crises after they have occurred. This involves deploying emergency measures, such as liquidity injections, bailouts, or regulatory interventions, to contain the damage and stabilize the financial system. While both approaches are necessary, a strong emphasis on proactive measures is crucial to minimize the likelihood and severity of future crises. The contrast lies in their timing; proactive management anticipates problems, while reactive management addresses them after they arise. An effective strategy integrates both approaches for a comprehensive and robust response to financial instability.

Risk Assessment and Identification

Effective risk assessment and identification are paramount in preventing and mitigating financial crises. A proactive approach, incorporating diverse methodologies and industry-specific insights, is crucial for maintaining financial stability. This section will explore key risk factors, frameworks for assessment, early warning signals, and best practices in stress testing.

Key Risk Factors Contributing to Financial Crises

Financial crises rarely stem from a single cause but rather a confluence of interconnected factors varying across industries. In the banking sector, excessive leverage, poor risk management practices (such as inadequate loan underwriting), and liquidity mismatches are frequently cited as contributing factors. The housing market, as evidenced by the 2008 global financial crisis, is vulnerable to asset bubbles fueled by speculative investment and lax lending standards. Similarly, the insurance industry faces risks from catastrophic events, inadequate reserving, and complex derivative instruments. The interconnectedness of these sectors magnifies the impact of individual failures, potentially triggering systemic crises. For example, the failure of a major bank can trigger a credit crunch affecting multiple industries, leading to widespread economic downturn.

A Framework for Comprehensive Risk Assessment in Financial Institutions

A robust risk assessment framework should encompass a multi-faceted approach. It begins with identifying all potential risks, categorized by type (e.g., credit risk, market risk, operational risk, liquidity risk, reputational risk, legal risk, strategic risk). This requires a comprehensive inventory of assets, liabilities, and off-balance sheet exposures. Next, the likelihood and potential impact of each risk are assessed, often using quantitative methods like Value at Risk (VaR) calculations or qualitative assessments based on expert judgment. The framework should then establish risk tolerance levels, setting acceptable limits for each risk category. Finally, the institution needs to implement effective risk mitigation strategies, including diversification, hedging, and robust internal controls, regularly monitoring and updating the assessment to reflect changing market conditions and emerging risks. This continuous monitoring allows for timely intervention and adjustment of risk management strategies.

Methods for Identifying Early Warning Signs of Impending Financial Distress

Identifying early warning signs requires meticulous monitoring of various financial and non-financial indicators. Financial indicators include declining profitability, deteriorating asset quality (e.g., rising non-performing loans), increasing leverage, and shrinking liquidity buffers. Non-financial indicators encompass changes in management quality, governance failures, and shifts in regulatory scrutiny. Analyzing trends in these indicators, both individually and collectively, can reveal patterns suggesting potential distress. For instance, a sudden and significant increase in the ratio of non-performing loans to total loans, coupled with declining profitability and reduced capital adequacy, might indicate serious financial vulnerability. Furthermore, significant changes in credit ratings or negative media coverage could also be harbingers of impending problems.

Best Practices for Stress Testing and Scenario Planning

Stress testing and scenario planning are crucial for anticipating potential crises. Stress testing involves subjecting a financial institution’s portfolio to hypothetical adverse scenarios (e.g., a sharp increase in interest rates, a significant market downturn, a major operational disruption). This allows for an evaluation of the institution’s resilience under pressure. Scenario planning complements stress testing by exploring a wider range of potential events, including less probable but potentially highly impactful scenarios, such as geopolitical instability or a pandemic. Best practices include using diverse and realistic scenarios, employing sophisticated modeling techniques, incorporating external data and expert judgment, and regularly reviewing and updating scenarios to reflect changing conditions. The results of stress testing and scenario planning should inform risk management strategies and contingency planning, ensuring the institution is adequately prepared for a range of potential challenges. For example, a bank might adjust its lending policies or increase its liquidity buffers based on the findings of a stress test that simulates a severe economic recession.

Crisis Prevention and Mitigation Strategies

Effective financial crisis management necessitates a proactive approach encompassing both preventative measures and robust mitigation strategies. A well-defined framework allows organizations to identify vulnerabilities, strengthen resilience, and minimize the impact of unforeseen events. This section Artikels key strategies for both preventing crises and mitigating their effects when they inevitably arise.

Preventative Measures to Minimize Financial Crises

Proactive steps significantly reduce the probability of a financial crisis. A comprehensive approach involves strengthening internal controls, diversifying investments, and maintaining adequate liquidity. Regular stress testing and scenario planning further enhance preparedness.

| Strategy | Description | Implementation | Potential Outcomes |

|---|---|---|---|

| Robust Internal Controls | Implementing strong internal controls, including segregation of duties, regular audits, and robust risk management frameworks. | Establish clear policies and procedures, conduct regular training for employees, and implement automated monitoring systems. | Reduced operational risks, improved accuracy of financial reporting, increased investor confidence. |

| Diversification of Investments | Spreading investments across various asset classes and geographies to reduce exposure to specific risks. | Develop a diversified investment portfolio based on risk tolerance and long-term goals, regularly review and rebalance the portfolio. | Reduced portfolio volatility, minimized losses during market downturns, enhanced long-term returns. |

| Maintaining Adequate Liquidity | Ensuring sufficient cash reserves and access to credit lines to meet short-term obligations and withstand unexpected shocks. | Develop a comprehensive liquidity management plan, establish lines of credit with financial institutions, and monitor cash flow regularly. | Enhanced ability to meet financial obligations, reduced risk of insolvency, improved resilience to economic downturns. |

| Stress Testing and Scenario Planning | Regularly assessing the organization’s vulnerability to various economic scenarios, including adverse events. | Develop detailed stress testing models, simulate different crisis scenarios, and identify potential vulnerabilities. | Improved understanding of potential risks, identification of critical vulnerabilities, development of contingency plans. |

Mitigation Strategies for Financial Crises

Even with preventative measures, crises can occur. Mitigation strategies focus on minimizing the impact and facilitating a swift recovery. This includes swift action to contain the damage, effective communication, and a well-defined crisis management team.

| Strategy | Description | Implementation | Potential Outcomes |

|---|---|---|---|

| Rapid Response Team Activation | Establishing a dedicated crisis management team to coordinate responses and decision-making during a crisis. | Develop a detailed crisis management plan, identify key personnel, and establish clear communication protocols. | Faster response to unfolding events, coordinated decision-making, improved efficiency in managing the crisis. |

| Effective Communication | Transparent and timely communication with stakeholders, including employees, customers, investors, and regulators. | Develop a communication plan outlining key messages and target audiences, establish multiple communication channels. | Reduced uncertainty and anxiety, improved stakeholder confidence, enhanced reputation management. |

| Negotiation and Restructuring | Negotiating with creditors, suppliers, and other stakeholders to restructure debts and renegotiate contracts. | Engage in constructive dialogue with stakeholders, explore various restructuring options, seek legal and financial advice. | Improved financial stability, avoidance of bankruptcy, enhanced long-term viability. |

| Government Assistance and Bailouts | Seeking government assistance or bailouts in extreme circumstances. | Prepare a detailed proposal outlining the need for assistance, engage with relevant government agencies, comply with all regulations. | Financial stability, avoidance of systemic risk, but may come with stringent conditions. |

Examples of Successful Crisis Prevention and Mitigation Strategies

Several organizations have successfully navigated financial crises through effective planning and swift action. For example, companies that proactively diversified their revenue streams and maintained substantial cash reserves during the 2008 financial crisis were better positioned to weather the storm compared to those with concentrated revenue sources and limited liquidity. Similarly, organizations with robust communication strategies during the COVID-19 pandemic maintained stronger stakeholder relationships and minimized reputational damage. These examples highlight the importance of both preventative measures and effective crisis management plans.

Crisis Communication and Public Relations

Effective crisis communication is paramount in navigating financial turmoil. A well-defined communication strategy can significantly mitigate reputational damage, maintain stakeholder confidence, and ultimately, influence the outcome of the crisis. Failing to communicate effectively can exacerbate the situation, leading to further losses and lasting damage to the organization’s image.

Designing a Communication Plan for Managing Public Perception During a Financial Crisis

A comprehensive communication plan should be proactive, not reactive. It should Artikel key messages, target audiences, communication channels, and designated spokespeople. The plan needs to address various scenarios, anticipating potential questions and concerns from stakeholders. Regularly updated contact lists are crucial, ensuring messages reach the right people swiftly. Pre-approved statements addressing common concerns can save valuable time during a crisis. For example, a bank facing a liquidity crisis might prepare statements addressing the safety of customer deposits, outlining the steps taken to address the situation, and emphasizing the bank’s commitment to its customers and stability. The plan should also include a process for monitoring media coverage and social media sentiment, allowing for agile adjustments to the communication strategy as the situation evolves.

Best Practices for Communicating with Stakeholders During a Crisis

Clear, concise, and consistent messaging is key. Each stakeholder group (employees, investors, customers) requires a tailored approach. Employees need reassurance regarding job security and the company’s future. Investors need transparent updates on the financial situation and the steps being taken to address the crisis. Customers require assurances about the safety of their investments or accounts. Utilizing multiple communication channels – press releases, internal memos, social media, investor calls – ensures widespread dissemination of information. Regular updates, even if they don’t contain significant new information, help maintain open communication and build trust. For instance, daily updates on a company website during a product recall can prevent rumors and speculation. Active listening and responsiveness to stakeholder concerns are also crucial.

The Importance of Transparency and Honesty in Crisis Communication

Transparency and honesty are fundamental to building and maintaining trust during a crisis. Withholding information or downplaying the severity of the situation will likely backfire, eroding confidence and exacerbating the crisis. Openly acknowledging problems and outlining the steps being taken to address them demonstrates accountability and fosters trust. While acknowledging mistakes, the communication should also highlight the organization’s strengths and resilience. The 2008 financial crisis highlighted the consequences of a lack of transparency, as the delayed disclosure of financial risks contributed to a widespread loss of confidence in the financial system. In contrast, companies that proactively communicated their challenges and recovery plans often fared better.

Examples of Effective and Ineffective Crisis Communication Strategies

An example of effective crisis communication is Johnson & Johnson’s response to the Tylenol tampering incidents in the 1980s. Their immediate recall of the product, coupled with transparent communication and a focus on consumer safety, helped to restore public trust. In contrast, the BP oil spill in 2010 exemplifies ineffective crisis communication. Initial downplaying of the spill’s severity and inconsistent messaging damaged BP’s reputation and fueled public anger. These contrasting examples highlight the critical role of swift, honest, and consistent communication in navigating a crisis. The difference in outcome underlines the long-term implications of choosing transparency and open dialogue versus obfuscation and delayed responses.

Post-Crisis Recovery and Lessons Learned

Effective post-crisis recovery is crucial for restoring financial stability and rebuilding trust. A thorough analysis of the crisis, coupled with the implementation of preventative measures, is essential for mitigating the impact of future events. This involves not only repairing the immediate damage but also learning from mistakes to improve future resilience.

Post-mortem analysis following a financial crisis is a systematic process designed to understand the root causes, contributing factors, and consequences of the event. This involves a comprehensive review of the crisis timeline, key decisions made, and the effectiveness of response strategies. The goal is to identify areas for improvement and develop actionable strategies to prevent similar crises in the future.

Post-Mortem Analysis Methods

A robust post-mortem analysis typically employs several methods. These include detailed interviews with key personnel involved in managing the crisis, a comprehensive review of internal and external documentation (such as emails, reports, and regulatory filings), and the use of quantitative data analysis to identify trends and patterns. External audits and independent reviews can also provide valuable insights and an objective perspective. For example, after the 2008 financial crisis, numerous government inquiries and independent commissions meticulously examined the events leading up to the crisis, the role of various financial institutions, and the effectiveness of regulatory responses. This led to significant regulatory reforms, such as the Dodd-Frank Act in the United States.

Key Lessons Learned from Past Financial Crises

Past financial crises, such as the 1997-98 Asian financial crisis, the 2008 global financial crisis, and the ongoing Eurozone debt crisis, have yielded several critical lessons. These include the importance of robust risk management frameworks, the need for effective regulatory oversight and supervision, the dangers of excessive leverage and systemic risk, and the critical role of transparency and communication in maintaining market confidence. The 2008 crisis, for instance, highlighted the dangers of complex financial instruments and the interconnectedness of the global financial system. The subsequent regulatory reforms aimed to improve transparency and reduce systemic risk.

Rebuilding Trust and Restoring Financial Stability

Rebuilding trust and restoring financial stability after a crisis requires a multi-pronged approach. This includes transparent communication with stakeholders, prompt and decisive action to address immediate problems, and the implementation of long-term reforms to prevent future crises. The government often plays a crucial role in providing liquidity support to the financial system and implementing policies to stimulate economic growth. For instance, following the 2008 crisis, governments worldwide implemented large-scale stimulus packages and provided bailouts to struggling financial institutions. However, such actions must be carefully considered, as they can have both positive and negative consequences. Restoring trust also involves demonstrating accountability for past mistakes and implementing measures to prevent similar events from occurring in the future.

Recommendations for Improving Organizational Resilience

A strong foundation for organizational resilience requires a proactive approach. The following recommendations can significantly improve an organization’s ability to withstand and recover from future financial crises:

- Implement a comprehensive risk management framework that identifies, assesses, and mitigates potential risks.

- Develop robust crisis management plans that Artikel clear procedures and responsibilities in the event of a crisis.

- Enhance regulatory compliance and transparency to build trust with stakeholders.

- Invest in technology and infrastructure to improve the resilience of financial systems.

- Foster a culture of risk awareness and preparedness throughout the organization.

- Diversify funding sources and reduce reliance on short-term debt.

- Regularly conduct stress tests and scenario planning to assess vulnerability to potential shocks.

- Establish clear communication channels to ensure timely and effective information sharing during a crisis.

Regulatory and Legal Frameworks

Effective regulatory and legal frameworks are crucial for preventing and mitigating financial crises. These frameworks establish a robust system of oversight, accountability, and intervention, aiming to maintain stability within the financial system and protect consumers and investors. A well-designed regulatory environment fosters trust and confidence, encouraging responsible financial practices and reducing the likelihood of systemic failures.

Regulatory bodies play a vital role in preventing and managing financial crises through proactive monitoring, the establishment of prudential standards, and timely intervention. Their responsibilities encompass setting capital requirements for financial institutions, overseeing market conduct, and ensuring the stability of payment systems. Furthermore, they often act as a last resort in resolving failing institutions, thereby minimizing the systemic impact of their collapse. The effectiveness of these bodies hinges on their independence, resources, and the strength of the legal framework that supports their actions.

The Role of Regulatory Bodies in Preventing and Managing Financial Crises

Regulatory bodies, such as central banks and financial services authorities, employ a multi-pronged approach to crisis prevention and management. This includes establishing and enforcing rules on capital adequacy, liquidity, risk management, and corporate governance for financial institutions. They conduct regular stress tests to assess the resilience of the financial system to various shocks, and monitor market developments to identify potential vulnerabilities early on. In crisis situations, they can deploy various tools, including liquidity support, emergency lending, and asset purchases, to stabilize the financial system and prevent contagion. Examples of such bodies include the Federal Reserve in the United States, the European Central Bank, and the Bank of England. The actions of these institutions during the 2008 financial crisis highlighted both their importance and the limitations of their powers.

Legal Implications of Financial Crises and Organizational Responsibilities

Financial crises often lead to significant legal ramifications, involving lawsuits against financial institutions, government agencies, and even individuals. Organizations face legal scrutiny regarding their risk management practices, disclosure obligations, and compliance with relevant regulations. The consequences can include substantial fines, reputational damage, and even criminal charges. The Dodd-Frank Act in the United States, enacted in response to the 2008 crisis, is a prime example of legislation aimed at enhancing corporate accountability and strengthening regulatory oversight. It introduced stricter regulations on banks, created new consumer protection agencies, and established mechanisms for resolving failing financial institutions.

Comparison of Regulatory Frameworks Across Countries

Regulatory frameworks vary significantly across countries, reflecting differences in economic structures, political systems, and historical experiences. Some countries have adopted stricter regulations than others, reflecting different approaches to balancing financial innovation with stability. For instance, the United States and the European Union have relatively comprehensive regulatory frameworks, while other countries may have less developed systems. The Basel Accords, a set of international banking regulations, aim to create a more consistent approach to capital adequacy globally, but national variations persist. Differences in enforcement and the effectiveness of regulatory bodies also contribute to variations in the level of financial stability across countries.

Examples of Legislation Designed to Enhance Financial Stability

Numerous legislative measures have been introduced globally to improve financial stability in the wake of past crises. The aforementioned Dodd-Frank Act in the U.S. is a significant example, aiming to prevent future crises by increasing transparency, strengthening consumer protection, and enhancing regulatory oversight. Similarly, the European Union has implemented numerous directives and regulations to harmonize financial regulation within the bloc and improve crisis management capabilities. Other examples include legislation focusing on strengthening capital requirements for banks, improving risk management practices, and enhancing the resolution of failing institutions. These legislative efforts aim to create a more resilient and stable financial system, but their effectiveness is continuously evaluated and adapted in response to evolving risks.

Case Studies of Financial Crises

Analyzing historical financial crises offers invaluable insights into their causes, consequences, and the effectiveness of various management responses. By examining specific examples, we can identify recurring patterns, best practices, and areas needing improvement in crisis prevention and mitigation. This section will explore several case studies, focusing on their unique characteristics and lessons learned.

The Asian Financial Crisis of 1997-98

The Asian Financial Crisis, originating in Thailand, rapidly spread across several East Asian economies. Its causes were multifaceted, including excessive capital inflows, fixed exchange rate regimes that became unsustainable, weak financial regulation, and opaque accounting practices. The consequences were devastating, characterized by currency devaluations, stock market crashes, and banking collapses. The International Monetary Fund (IMF) responded with large-scale bailout packages, often imposing stringent conditions that sparked considerable debate about their effectiveness and long-term impact. The crisis highlighted the interconnectedness of global financial markets and the need for stronger regulatory frameworks, particularly in emerging economies. The rapid spread underscored the importance of early intervention and international cooperation in managing regional financial instability.

The Impact of the 2008 Global Financial Crisis on the Automotive Industry

The 2008 Global Financial Crisis (GFC) had a particularly severe impact on the automotive industry. The collapse of the housing market and the subsequent credit crunch severely reduced consumer spending and disrupted supply chains. Several major automakers faced liquidity crises, requiring government bailouts to avoid bankruptcy. General Motors and Chrysler in the United States, for example, received significant government assistance to restructure their operations and avoid collapse. This crisis highlighted the vulnerability of industries heavily reliant on consumer credit and the systemic risk posed by interconnected financial institutions. The industry’s response involved significant restructuring, cost-cutting measures, and a shift towards more fuel-efficient vehicles. The GFC exposed the need for greater resilience in supply chains and a more robust regulatory framework to manage systemic risk within interconnected industries.

Comparing Responses to the 1998 Russian Financial Crisis and the 2008 Global Financial Crisis

The 1998 Russian financial crisis and the 2008 GFC, while distinct in their origins, offer valuable opportunities for comparative analysis. The Russian crisis was largely driven by internal factors, including unsustainable fiscal policies and a dependence on volatile commodity prices. The GFC, in contrast, was triggered by a complex interplay of factors, including subprime mortgage lending, securitization, and a global credit crunch. The response to the Russian crisis was characterized by a relatively limited international intervention, while the GFC prompted unprecedented coordinated actions by governments and central banks globally. The GFC response involved massive fiscal stimulus packages, quantitative easing, and bank bailouts, demonstrating a greater willingness to intervene directly in financial markets to prevent a complete systemic collapse compared to the more limited intervention during the Russian crisis. This difference highlights the evolution of crisis management approaches and the increased awareness of systemic risk in interconnected global markets.

A Hypothetical Financial Crisis: A Cyberattack on Global Banking Systems

Imagine a coordinated cyberattack targeting the core infrastructure of major global banks. The attack disrupts payment systems, freezes access to accounts, and compromises sensitive customer data. Initial panic leads to a rapid withdrawal of funds, triggering a liquidity crisis. The disruption of financial markets results in widespread uncertainty and a sharp decline in market confidence. This hypothetical scenario illustrates the potential for non-traditional threats to trigger a major financial crisis. The response would require coordinated action from governments, central banks, and the cybersecurity community to contain the attack, restore confidence, and mitigate the economic fallout. The potential consequences include significant economic losses, widespread social unrest, and long-term damage to the reputation of financial institutions. This scenario highlights the increasing importance of cybersecurity preparedness and resilience in maintaining the stability of the global financial system.

Technological Advancements and Financial Crisis Management

The rapid advancement of technology has profoundly reshaped the financial landscape, playing a dual role in both exacerbating and mitigating financial crises. While technological innovations offer powerful tools for risk management and crisis response, they also introduce new vulnerabilities and complexities that require careful consideration. This section explores the intricate relationship between technology and financial crisis management, focusing on the opportunities and challenges presented by technological advancements.

Technological advancements contribute significantly to both the causes and solutions within financial crisis management. The interconnected nature of modern financial systems, facilitated by technology, can amplify the speed and impact of crises. Conversely, technological tools offer sophisticated methods for risk assessment, prediction, and response.

Data Analytics and Artificial Intelligence in Risk Assessment

Data analytics and artificial intelligence (AI) are revolutionizing risk assessment in financial institutions. These technologies allow for the processing and analysis of massive datasets, identifying subtle patterns and anomalies that might indicate impending crises. AI algorithms can analyze market trends, credit scores, and other relevant data points to predict potential defaults, liquidity shortages, or systemic risks with greater accuracy than traditional methods. For instance, AI-powered systems can detect fraudulent transactions in real-time, preventing significant losses and mitigating the potential for widespread fraud-induced crises. Furthermore, predictive modeling using machine learning techniques can help financial institutions proactively adjust their risk profiles and allocate capital more effectively. The use of AI in stress testing, for example, allows for the simulation of various scenarios to evaluate the resilience of financial systems under extreme conditions.

Fintech Innovations and Financial Stability

Fintech innovations, encompassing a wide range of technologies applied to financial services, present both opportunities and challenges to financial stability. While technologies like blockchain and decentralized finance (DeFi) offer potential improvements in transparency and efficiency, they also introduce new regulatory complexities and risks. For example, the lack of centralized oversight in DeFi platforms can make them vulnerable to manipulation and fraud, potentially triggering cascading effects across the financial system. Moreover, the rapid growth of shadow banking facilitated by fintech innovations can create opaque and poorly regulated segments of the financial system, increasing systemic risk. However, fintech also provides tools to enhance financial inclusion and improve access to financial services, potentially reducing vulnerabilities associated with financial exclusion. The development of robust regulatory frameworks that address these risks and harness the benefits of fintech is crucial for maintaining financial stability.

Technology’s Role in Crisis Communication and Coordination

Effective communication and coordination are essential during financial crises. Technology plays a vital role in facilitating rapid information dissemination, collaboration among stakeholders, and timely intervention by regulators. Secure communication platforms allow for efficient information sharing among financial institutions, government agencies, and international organizations. Real-time data visualization tools can provide a clear picture of the evolving crisis, enabling quicker and more informed decision-making. For instance, during the 2008 financial crisis, the lack of effective communication and coordination among institutions significantly hampered the crisis response. Improved technological infrastructure could have facilitated a more coordinated and effective response. The use of advanced communication technologies, including secure messaging apps and video conferencing, can significantly enhance the speed and effectiveness of crisis communication and coordination.

Closing Summary

Effective financial crisis management is not merely a reactive process; it’s a proactive, multifaceted approach that demands meticulous planning, swift execution, and transparent communication. By understanding the diverse range of potential crises, implementing robust risk assessment frameworks, and developing comprehensive mitigation strategies, organizations can significantly reduce their vulnerability and enhance their resilience. The lessons learned from past crises underscore the importance of continuous improvement, adaptation, and a commitment to building a more stable and secure financial landscape.

Questions and Answers

What is the role of insurance in financial crisis management?

Insurance plays a crucial role in mitigating the financial impact of crises. Insurance policies can help cover losses from various events, providing a safety net for individuals and businesses during challenging times.

How can small businesses prepare for a financial crisis?

Small businesses should focus on building strong financial reserves, diversifying revenue streams, and developing contingency plans to address potential disruptions. Regular financial health checks and proactive risk assessment are vital.

What is the impact of geopolitical events on financial crises?

Geopolitical instability can significantly impact financial markets, creating uncertainty and volatility. Events like wars, trade disputes, and political upheaval can trigger or exacerbate financial crises.