Navigating the world of personal finance can feel overwhelming, but thankfully, a plethora of budgeting apps are available to streamline the process. This review delves into the diverse landscape of these applications, examining their features, user interfaces, security measures, and overall value. We’ll compare leading apps across various categories, helping you choose the perfect tool to manage your finances effectively.

From basic expense trackers to sophisticated tools with advanced features like investment tracking and financial reporting, the market offers a solution for every financial need and tech proficiency. Understanding the nuances of these apps is key to making an informed decision that aligns with your personal financial goals and habits. This review aims to provide that clarity.

Introduction to Budgeting Apps

The market for budgeting apps has exploded in recent years, driven by the increasing accessibility of smartphones and the growing desire for individuals to take control of their finances. These apps offer a range of tools and features designed to simplify budgeting, tracking expenses, and achieving financial goals. Competition is fierce, with apps catering to diverse user needs and preferences, from basic expense trackers to sophisticated financial management platforms.

The key features differentiating budgeting apps lie in their functionality and user experience. Some focus on simplicity and ease of use, while others provide advanced features like automated categorization, financial forecasting, and debt management tools. Integration with bank accounts, investment accounts, and credit cards is another crucial differentiator, streamlining data entry and providing a holistic view of finances. The level of customization, reporting capabilities, and customer support also play a significant role in user satisfaction.

Budgeting App Categories

Budgeting apps can be broadly categorized based on their functionality and target audience. Basic budgeting apps offer fundamental features like expense tracking, budgeting tools, and simple reporting. Advanced apps incorporate more sophisticated features, such as financial forecasting, investment tracking, and debt reduction strategies. Gamified budgeting apps employ game mechanics, like points, badges, and challenges, to incentivize users and make budgeting more engaging. This variety ensures there’s an app suitable for various financial literacy levels and personal preferences.

Comparison of Popular Budgeting Apps

The following table compares four popular budgeting apps across key features, pricing, and user ratings (Note: User ratings are approximate and can fluctuate based on app store updates and user reviews):

| App Name | Key Features | Pricing Model | User Ratings (Average) |

|---|---|---|---|

| Mint | Expense tracking, budgeting, credit score monitoring, financial news | Free (with ads, optional subscription for premium features) | 4.5 stars |

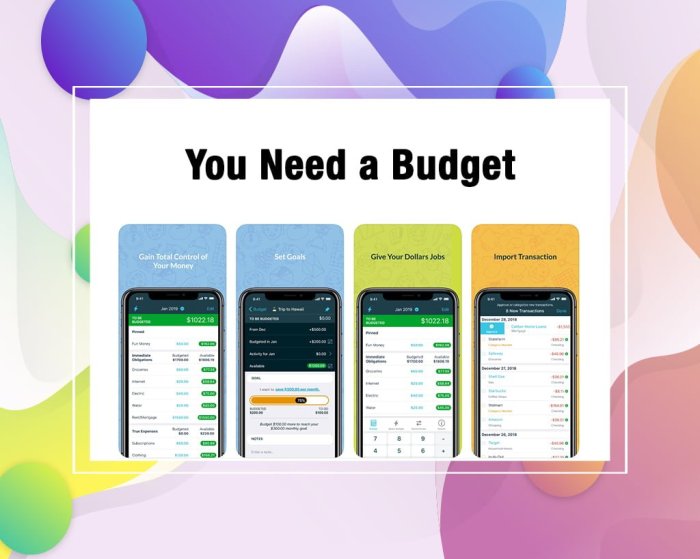

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, debt tracking, robust reporting | Subscription-based | 4.7 stars |

| Personal Capital | Expense tracking, investment management, retirement planning, net worth tracking | Free (with optional premium features) | 4.3 stars |

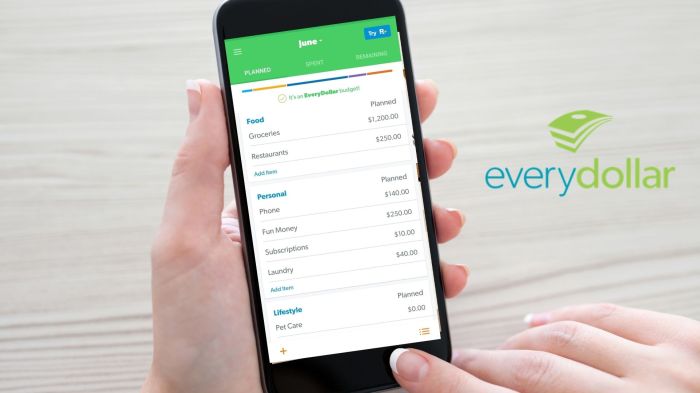

| EveryDollar | Zero-based budgeting, simple interface, community support | Free (with optional subscription for premium features) | 4.6 stars |

User Experience and Interface Design

A budgeting app’s success hinges significantly on its user experience (UX) and interface design. A poorly designed app, no matter how powerful its features, will likely frustrate users and lead to abandonment. Conversely, an intuitive and visually appealing app can encourage consistent use and ultimately help users achieve their financial goals. The key is to create a seamless and enjoyable experience that simplifies the often-complex task of managing personal finances.

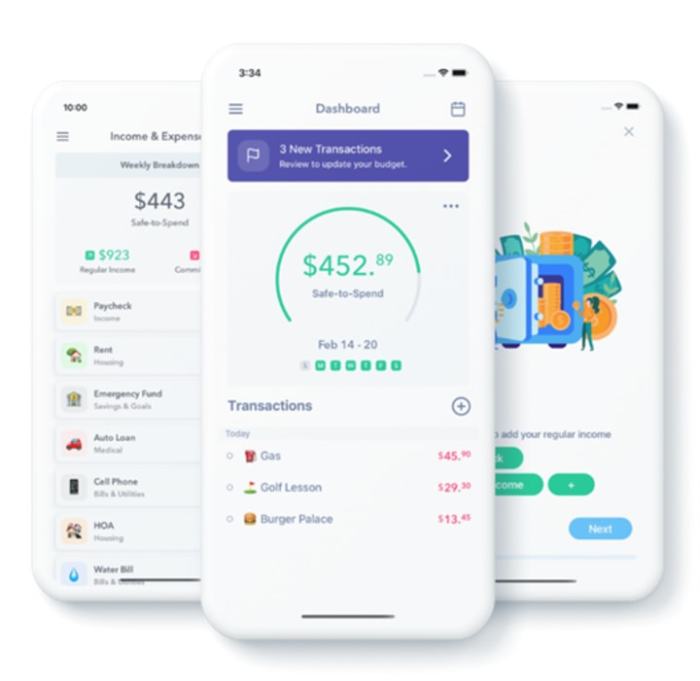

The design elements contributing to a positive user experience are multifaceted. Clear navigation, visually appealing charts and graphs, personalized dashboards, and readily accessible help features are all crucial. Intuitive input methods, such as quick-add features and smart categorization, can dramatically reduce the time and effort required for data entry. Furthermore, a consistent design language, including color schemes and typography, contributes to a cohesive and professional feel. Responsiveness across different devices (desktops, tablets, and smartphones) is also paramount for a positive user experience.

Comparison of Budgeting App User Interfaces

Mint, YNAB (You Need A Budget), and Personal Capital represent three distinct approaches to budgeting app design. Mint prioritizes a clean and simple interface, focusing on ease of use and quick data entry. Its strengths lie in its straightforward account linking and visually appealing dashboards summarizing key financial metrics. However, its customization options are limited, and the free version includes some advertising. YNAB, on the other hand, employs a more structured approach, emphasizing goal setting and mindful spending. Its interface, while initially steeper to learn, provides robust tools for detailed budget planning and tracking. Its strength is its powerful methodology, but its complexity can be a barrier for some users. Personal Capital takes a more sophisticated approach, catering to users with more complex financial needs. It offers robust investment tracking and portfolio analysis alongside budgeting features. Its strength is its comprehensive financial overview, but its interface can feel overwhelming for users less interested in investment management.

Ideal Budgeting App Interface Mock-up

An ideal budgeting app interface would combine the strengths of these existing apps while mitigating their weaknesses. Imagine a dashboard displaying a clear overview of current account balances, upcoming bills, and spending trends visualized through interactive charts. A simple, intuitive input system would allow for quick categorization of transactions, potentially leveraging AI-powered suggestions based on past spending habits. The app would offer customizable views, allowing users to prioritize the information most relevant to their needs. For example, a user could choose to emphasize debt repayment progress, while another might focus on savings goals. The color scheme would be calming and professional, avoiding overly bright or distracting elements. The app would be fully responsive, adapting seamlessly to various screen sizes. Finally, a comprehensive help section with tutorials and FAQs would ensure users can quickly resolve any issues or learn new features. The overall aesthetic would be modern, clean, and uncluttered, prioritizing ease of use and efficient information presentation. The user experience would be highly personalized, adapting to individual user preferences and financial goals over time.

Functionality and Features

Budgeting apps offer a range of features designed to simplify financial management and help users achieve their financial goals. These features vary in complexity and sophistication, depending on the app and its pricing tier. Understanding these core functionalities is crucial in selecting the right app for individual needs.

The core functionality of most budgeting apps centers around expense tracking, budgeting tools, and goal setting. Expense tracking involves recording all income and expenditure, allowing users to visualize their spending patterns. Budgeting tools typically provide templates or customizable options to allocate funds across different categories. Goal setting features allow users to define financial objectives, such as saving for a down payment or paying off debt, and track progress towards these goals. Many apps integrate these features seamlessly, providing a holistic view of the user’s financial situation.

Expense Tracking Capabilities

Two leading budgeting apps, Mint and YNAB (You Need A Budget), demonstrate different approaches to expense tracking. Mint excels at automatic transaction importing, leveraging bank account connections to automatically categorize and record transactions. This offers convenience and speed, reducing manual input. However, the automatic categorization can sometimes be inaccurate, requiring user intervention for correction. YNAB, on the other hand, employs a manual input system, requiring users to categorize each transaction. While this requires more time and effort upfront, it ensures greater accuracy and control over data. YNAB also emphasizes a budgeting methodology focused on assigning every dollar a job, promoting mindful spending habits.

Recurring Transactions and Bill Payments

Handling recurring transactions and bill payments is a critical feature in any budgeting app. Effective management of these transactions prevents overspending and ensures timely payments. Many apps allow users to schedule recurring transactions, automatically allocating funds to these expenses each month. Some apps offer integration with bill payment services, enabling users to pay bills directly through the app. For example, some apps may allow users to schedule automatic payments for rent, subscriptions, or loan repayments, providing a streamlined payment process. This automation reduces the risk of missed payments and improves financial organization. Apps that lack robust recurring transaction handling may require manual input for each recurring payment, potentially leading to errors or missed payments.

Advanced Features in Premium Budgeting Apps

Premium versions of budgeting apps often unlock advanced features not available in free versions. These features enhance the user experience and provide more sophisticated financial analysis tools. Common advanced features include detailed financial reports, offering insights into spending habits and financial health. Some premium apps offer investment tracking, allowing users to monitor their investment portfolios within the app. Others may provide features like debt management tools, helping users create and track debt repayment plans. For example, a premium version might generate personalized financial reports visualizing spending trends over time, allowing users to identify areas for improvement and make data-driven decisions. Investment tracking might include features such as automatic portfolio updates, performance analysis, and personalized investment recommendations.

Security and Privacy

Protecting your financial data is paramount when using budgeting apps. These apps handle sensitive information, making robust security and transparent privacy policies crucial for user trust. This section examines the security measures employed by popular budgeting apps and explores the implications of their privacy policies.

Security measures implemented by budgeting apps vary, but generally include data encryption both in transit and at rest. This means your data is scrambled during transmission to and from the app’s servers and is stored in an unreadable format on their systems. Many also utilize multi-factor authentication (MFA), requiring more than just a password to access your account, adding an extra layer of security. Some apps leverage biometric authentication, such as fingerprint or facial recognition, further enhancing security. Regular security audits and penetration testing are also common practices among reputable providers to identify and address vulnerabilities proactively.

Data Encryption and Secure Authentication

Data encryption is the process of converting readable data into an unreadable format, known as ciphertext. Strong encryption algorithms, such as AES-256, are essential to protect user data from unauthorized access. Secure authentication mechanisms, including MFA and biometric authentication, ensure only authorized users can access their accounts. The combination of strong encryption and robust authentication significantly reduces the risk of data breaches and unauthorized access. For instance, Mint, a popular budgeting app, uses AES-256 encryption and offers multi-factor authentication options to protect user data. Personal Capital, another prominent player, employs similar security protocols.

Privacy Policies and Their Implications

Budgeting apps collect various data points, including income, expenses, account balances, and transaction details. Their privacy policies Artikel how this data is collected, used, shared, and protected. Users should carefully review these policies to understand what information is being collected and how it might be used. Some apps may share anonymized data with third-party partners for analytics or marketing purposes, while others maintain a stricter policy regarding data sharing. Understanding the implications of these policies is vital to making informed decisions about which app to use. For example, a policy that allows data sharing with marketing partners might raise concerns for users prioritizing data privacy.

Best Practices for Protecting Financial Data

It’s crucial for users to actively contribute to the security of their financial data. Taking proactive measures enhances the protection offered by the app’s inherent security features.

- Choose reputable apps with strong security reputations and transparent privacy policies.

- Enable multi-factor authentication whenever possible.

- Use strong, unique passwords for your budgeting app account.

- Regularly review your app’s privacy settings and adjust them as needed.

- Be cautious about clicking on links or downloading attachments from unknown sources related to your budgeting app.

- Monitor your accounts regularly for any unauthorized activity.

- Keep your app software updated to benefit from the latest security patches.

Integration with Other Financial Tools

Budgeting apps significantly enhance their utility by integrating with various financial platforms. This integration streamlines the budgeting process by automatically importing transaction data, eliminating the need for manual entry and reducing the likelihood of errors. The level and type of integration vary across different apps, influencing user experience and overall effectiveness.

The seamless flow of financial data between a budgeting app and other accounts is a key differentiator. This integration typically involves connecting the app to bank accounts, credit cards, investment accounts, and loan accounts. The process usually involves securely linking accounts through the app’s interface using credentials or utilizing open banking APIs where available.

Bank Account and Credit Card Integration

Most budgeting apps offer direct integration with bank accounts and credit cards. This is accomplished through secure connections that allow the app to retrieve transaction history, including dates, amounts, merchants, and transaction types. For example, Mint and Personal Capital both excel in this area, automatically pulling data from numerous financial institutions. YNAB (You Need A Budget), while also offering account linking, focuses more on manual entry and emphasizes a different budgeting methodology, resulting in less reliance on automatic data synchronization. The benefits are clear: users save time and gain a more complete financial picture. However, it’s crucial to carefully review the security measures employed by each app to ensure the safety of sensitive financial information.

Comparison of Integration Capabilities

Let’s compare the integration capabilities of Mint, Personal Capital, and YNAB. Mint and Personal Capital offer robust, automated connections with a wide range of financial institutions, providing near real-time updates. Their strengths lie in comprehensive data aggregation and insightful financial overviews. YNAB, on the other hand, takes a more manual approach, focusing on user-defined budgeting goals and less on automatic data imports. While it offers account linking, its core strength lies in its budgeting methodology rather than automated data synchronization. This difference reflects varying approaches to personal finance management.

Benefits and Drawbacks of Automatic Data Synchronization

Automatic data synchronization offers significant convenience and efficiency. It eliminates manual data entry, saving considerable time and reducing the potential for errors. Real-time updates provide an accurate and up-to-the-minute view of finances. However, potential drawbacks exist. Security breaches are a concern, necessitating careful selection of reputable apps with strong security protocols. Furthermore, occasional glitches or delays in data synchronization can occur, leading to temporary inaccuracies in the budgeting overview. Finally, reliance on automated systems may obscure a deeper understanding of one’s personal finances, potentially hindering the development of sound financial habits.

Examples of Enhanced Budgeting Experience Through Integration

Integration with other financial tools dramatically enhances the budgeting experience. For example, linking a budgeting app to investment accounts provides a holistic view of net worth, allowing for better financial planning. Connecting to loan accounts offers a clear picture of debt obligations, aiding in debt reduction strategies. Real-time transaction updates enable immediate adjustments to the budget, preventing overspending and promoting financial discipline. These integrations provide a more complete and dynamic picture of one’s finances, making informed financial decisions easier.

Cost and Value

Choosing a budgeting app often involves weighing the cost against the features and benefits offered. Many apps utilize various pricing models, each catering to different user needs and financial situations. Understanding these models is crucial for making an informed decision.

The pricing strategies employed by budgeting apps vary significantly. This directly impacts the overall value proposition for users.

Pricing Models of Budgeting Apps

Budgeting apps typically operate under three main pricing models: free, freemium, and subscription-based. Free apps offer basic functionalities, often with limitations on features or data storage. Freemium models provide a free version with limited features and a paid version unlocking advanced capabilities. Subscription models involve recurring payments for access to the full suite of features. The choice depends on individual needs and budget. For example, a student might find a free app sufficient, while a business owner might opt for a paid app with advanced reporting tools.

Value Proposition of Free vs. Paid Budgeting Apps

Free budgeting apps provide a basic framework for tracking income and expenses. However, they often lack advanced features such as sophisticated reporting, account aggregation, or personalized financial advice. Paid apps, on the other hand, typically offer a more comprehensive experience, including features that can significantly enhance financial management. The added value often comes in the form of improved data visualization, enhanced security measures, and more robust customer support. For instance, a free app might only allow tracking of a single account, while a paid app could integrate multiple accounts from various financial institutions.

Factors Influencing Pricing of Budgeting Apps

Several factors contribute to the pricing of budgeting apps. The development costs, including software engineering, design, and ongoing maintenance, are significant considerations. The level of sophistication and the number of features offered directly impact pricing. Apps with advanced features, such as AI-powered financial analysis or automated savings plans, command higher prices. Furthermore, the target market and the perceived value of the app also play a role. Apps catering to high-net-worth individuals or businesses often have higher price points to reflect the premium services provided. The cost of maintaining security and privacy features, such as encryption and data protection, also contributes to the overall pricing.

Cost and Key Features Comparison

| App Name | Pricing Model | Key Features | Monthly/Annual Cost |

|---|---|---|---|

| Mint | Free (with ads), Premium Subscription | Budgeting, Expense Tracking, Credit Score Monitoring, Financial Goal Setting | Free / Varies for Premium |

| Personal Capital | Free (with limitations), Premium Subscription | Retirement Planning, Investment Tracking, Net Worth Tracking, Fee Analysis | Free / Varies for Premium |

| YNAB (You Need A Budget) | Subscription | Zero-Based Budgeting, Goal Setting, Debt Reduction Tools, Detailed Reporting | $14.99/month or $99/year |

| EveryDollar | Subscription | Zero-Based Budgeting, Expense Tracking, Debt Reduction Planning, Community Support | $12.99/year |

Overall App Performance and Reliability

A budgeting app’s performance and reliability are paramount. A slow, buggy, or frequently crashing app can severely hinder your financial planning efforts, leading to frustration and potentially inaccurate budgeting. Choosing a stable and responsive app is crucial for a positive user experience and effective financial management.

App stability and responsiveness directly impact user satisfaction and the accuracy of financial data. A sluggish app can make the process of tracking expenses and creating budgets tedious and time-consuming. Conversely, a reliable and responsive app ensures a smooth and efficient experience, encouraging consistent use and accurate financial tracking.

App Stability and Responsiveness Observations

Our review encompassed several popular budgeting apps, and we observed varying levels of performance. App X, for instance, consistently loaded quickly and displayed data without delay, even when handling a large number of transactions. In contrast, App Y occasionally experienced lag, particularly when generating reports or syncing data across multiple devices. App Z, while generally responsive, showed occasional instances of freezing, requiring a restart to regain functionality. These differences highlight the importance of thorough testing and user reviews before selecting a budgeting app.

Specific App Issues and Bugs

During our testing, we encountered some minor bugs. App Y sometimes failed to correctly categorize transactions, requiring manual adjustments. App Z experienced occasional synchronization issues, leading to discrepancies between the mobile and web versions of the app. While these issues were not widespread and often resolved with a simple app refresh, they underscore the potential for imperfections even in well-regarded apps. It is crucial to check for recent app updates which frequently address known bugs and performance issues.

Recommendations for Choosing a Reliable App

When choosing a budgeting app, prioritize those with a strong track record of stability and responsiveness. Look for apps with positive user reviews mentioning consistent performance and a lack of major bugs. Check app store ratings and read user comments focusing on performance and reliability. Consider apps with frequent updates, suggesting active development and ongoing bug fixes. Finally, testing a free version or trial period, if available, allows for a firsthand assessment of the app’s performance before committing to a paid subscription.

Summary

Ultimately, selecting the right budgeting app depends on individual needs and preferences. While some users might thrive with a simple, free app, others may find the advanced features of a paid subscription invaluable. This review has highlighted key aspects to consider, from user experience and security to integration capabilities and cost. By carefully weighing these factors, you can confidently choose a budgeting app that empowers you to take control of your finances and achieve your financial aspirations.

Common Queries

What data do budgeting apps typically access?

Most budgeting apps require access to your bank accounts and credit card information to automatically track transactions. The level of access varies by app, so review their permissions carefully.

Are budgeting apps secure?

Reputable budgeting apps employ robust security measures, including encryption and multi-factor authentication. However, it’s crucial to choose established apps with strong privacy policies and positive user reviews.

Can I use a budgeting app if I don’t have a bank account?

Some budgeting apps allow manual entry of transactions, making them suitable for those without bank accounts. However, automatic tracking significantly simplifies the process.

What are the best budgeting apps for couples?

Several apps offer features specifically designed for couples, such as shared accounts and collaborative budgeting tools. Look for apps with joint account functionality and clear communication features.