Effectively managing investments requires diligent tracking and analysis. This guide explores the diverse landscape of investment tracking tools, from simple spreadsheets to sophisticated software, helping you navigate the options and select the best fit for your needs. We’ll delve into key features, security considerations, and integration capabilities, ultimately empowering you to make informed financial decisions.

Understanding the nuances of different investment tracking tools is crucial for optimizing your portfolio performance. Whether you’re a seasoned investor or just starting, the right tool can significantly simplify your investment management process, allowing you to focus on strategic decisions rather than tedious manual calculations and record-keeping. This guide aims to provide the knowledge necessary to make that crucial choice.

Types of Investment Tracking Tools

Choosing the right investment tracking tool can significantly simplify your financial life, offering a clearer picture of your portfolio’s performance and helping you make informed decisions. The market offers a variety of options, each with its own strengths and weaknesses, catering to different levels of investment experience and technological comfort. Understanding these differences is crucial for selecting the tool that best suits your needs.

Categorization of Investment Tracking Tools

Investment tracking tools can be broadly categorized into three main types: spreadsheet-based solutions, dedicated software, and mobile applications. Each offers a unique set of features and functionalities, impacting ease of use, data security, and overall cost.

| Tool Name | Category | Key Features | Pricing Model |

|---|---|---|---|

| Microsoft Excel/Google Sheets | Spreadsheet-based | Customizable, allows for complex calculations, free (for basic versions) | Subscription or one-time purchase (depending on the software) |

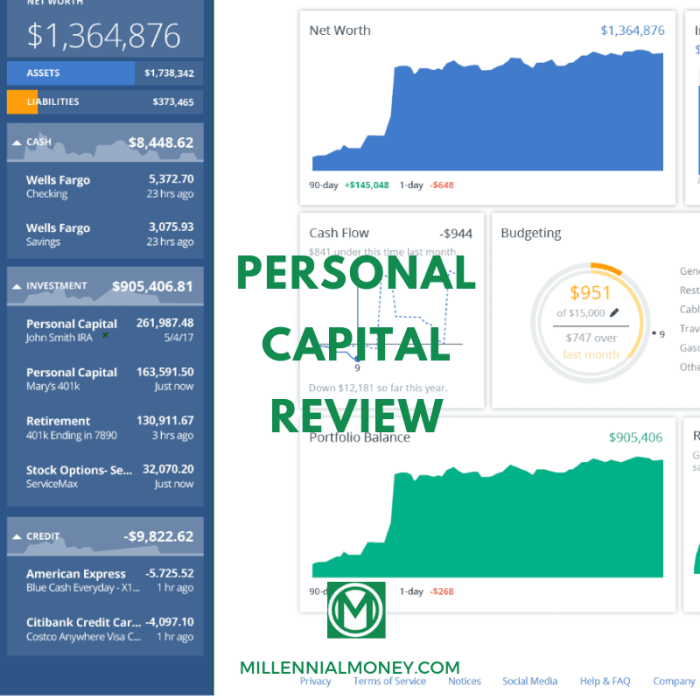

| Personal Capital | Dedicated Software | Aggregated account view, retirement planning tools, investment analysis | Free (basic); Premium subscription available |

| Mint | Mobile Application | Budgeting tools, expense tracking, investment monitoring | Free (with ads); Premium subscription available |

| Quicken | Dedicated Software | Comprehensive financial management, investment tracking, tax preparation support | One-time purchase or subscription |

| Yahoo Finance Portfolio Tracker | Mobile Application and Web-based | Real-time quotes, portfolio performance tracking, charting tools | Free |

Advantages and Disadvantages of Investment Tracking Tool Categories

Spreadsheet-based solutions, like Microsoft Excel or Google Sheets, offer the advantage of complete customization and control. Users can design their own tracking systems, incorporating specific formulas and calculations tailored to their investment strategies. However, they require a certain level of technical expertise and manual data entry, which can be time-consuming and prone to errors.

Dedicated software packages provide a more user-friendly interface and often include advanced features such as automated data import, sophisticated analytics, and comprehensive reporting. However, these tools typically come with a higher price tag and may have a steeper learning curve than spreadsheet solutions.

Mobile applications offer convenience and accessibility, allowing users to track their investments anytime, anywhere. Many free applications are available, but paid versions usually offer additional features like enhanced analytics and premium customer support. A potential disadvantage is that the features might be limited compared to dedicated software or spreadsheets.

Comparison of Popular Investment Tracking Tools

The following table compares five popular investment tracking tools, highlighting their unique selling propositions:

| Tool Name | Unique Selling Proposition | Strengths | Weaknesses |

|---|---|---|---|

| Personal Capital | Comprehensive financial planning tools integrated with investment tracking | Excellent retirement planning features, aggregated account view | Limited international support |

| Mint | User-friendly interface and robust budgeting features alongside investment tracking | Easy to use, good for beginners | Can be slow to update, limited advanced analytics |

| Quicken | Comprehensive financial management software with robust investment tracking capabilities | Very detailed financial overview, extensive features | Can be expensive, complex interface |

| Yahoo Finance Portfolio Tracker | Free, real-time data, simple interface | Free, easy to use, real-time data | Limited features compared to paid options |

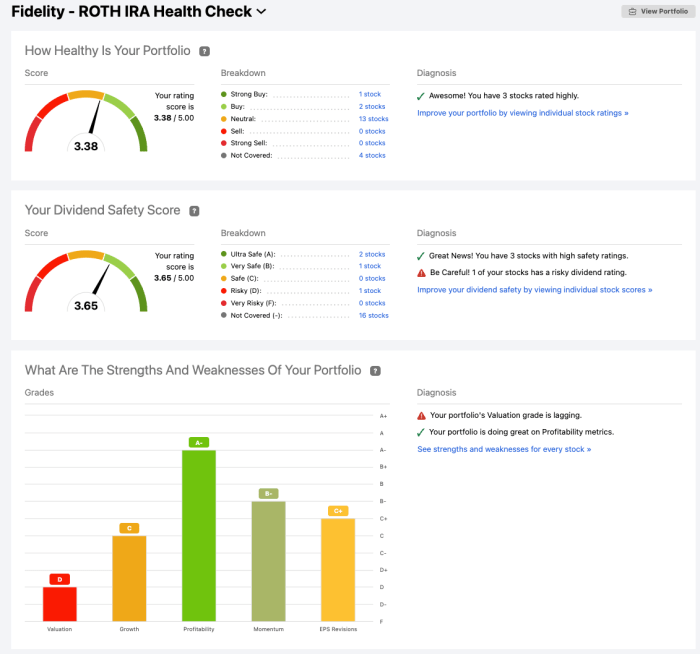

| Morningstar | In-depth investment research and analysis integrated with portfolio tracking | Excellent research tools, detailed portfolio analysis | Can be expensive, complex interface for beginners |

Key Features of Investment Tracking Tools

Effective investment management relies heavily on the capabilities of the tools used. A robust investment tracking tool provides more than just a record of your holdings; it empowers informed decision-making through comprehensive features designed to streamline the entire investment process. These features go beyond simple record-keeping, offering powerful analytical tools and automated functionalities to enhance efficiency and optimize returns.

A well-designed investment tracking tool should offer a core set of essential features, complemented by advanced functionalities for sophisticated investors. The core features provide the foundational framework for tracking and managing your investments, while advanced features offer greater automation and analytical depth. Understanding the capabilities of both is crucial for selecting the right tool to meet your specific needs.

Essential Features of Investment Tracking Tools

Essential features form the bedrock of any effective investment tracking tool. These core functionalities ensure accurate record-keeping, provide a clear picture of portfolio performance, and offer basic analytical capabilities. Without these, the tool’s effectiveness is significantly diminished.

- Portfolio Valuation: This feature provides a real-time or near real-time overview of your portfolio’s total value, calculated based on the current market prices of your assets. This allows you to easily monitor your gains and losses.

- Transaction Recording: Accurate and detailed recording of all buy, sell, and dividend transactions is crucial for tax reporting and performance analysis. The tool should allow for easy input of transaction details, including date, quantity, price, and fees.

- Performance Analysis: This feature goes beyond simply showing your portfolio’s value. It provides insights into your investment returns over various periods, allowing you to assess the performance of individual assets and your overall portfolio. Common metrics include annualized returns, Sharpe ratios, and alpha.

- Tax Reporting Capabilities: Generating tax reports is a time-consuming task. A good investment tracking tool simplifies this process by automatically compiling the necessary data for tax filings, reducing the likelihood of errors and saving significant time.

- Alert Functionalities: Customizable alerts can notify you of significant events, such as price drops below a specified threshold for a particular asset, exceeding a predefined risk level, or upcoming dividend payments. This proactive approach enables timely responses to market fluctuations.

Advanced Features of Premium Investment Tracking Tools

Premium investment tracking tools often incorporate advanced features designed to automate tasks and provide more sophisticated analytical capabilities, significantly enhancing investment management. These features move beyond basic tracking and offer proactive strategies for optimization.

- Automated Rebalancing: This feature automatically adjusts your portfolio’s asset allocation to maintain your desired target allocation. For example, if your stock allocation drifts above your target percentage, the tool might suggest selling some stocks and buying bonds to rebalance.

- Asset Allocation Optimization: This feature uses algorithms to suggest optimal asset allocation strategies based on your risk tolerance, investment goals, and market conditions. This can help you build a more diversified and efficient portfolio.

- Integration with Brokerage Accounts: Seamless integration with your brokerage accounts eliminates the need for manual data entry. The tool automatically downloads transaction history and current holdings, saving considerable time and reducing the risk of data entry errors. This often includes real-time updates on your portfolio value.

Benefits of Utilizing Investment Tracking Tool Features

The features described above contribute significantly to improved investment management in several ways.

- Enhanced Transparency and Control: Real-time portfolio valuation and detailed transaction history provide a clear picture of your investments, giving you greater control over your financial situation.

- Improved Decision-Making: Performance analysis and asset allocation optimization tools enable data-driven decisions, leading to more effective portfolio management.

- Increased Efficiency: Automated features like rebalancing and brokerage account integration save time and reduce manual effort.

- Reduced Risk: Alert functionalities help you respond quickly to market changes, minimizing potential losses.

- Simplified Tax Reporting: Automated tax reporting capabilities streamline the tax filing process, reducing errors and saving time.

Choosing the Right Investment Tracking Tool

Selecting the ideal investment tracking tool requires careful consideration of several key factors. The right tool will streamline your investment management, providing clarity and efficiency. A poorly chosen tool, however, can lead to frustration and potentially hinder your investment success. This section Artikels the crucial aspects to evaluate when making your decision.

Factors to Consider When Selecting an Investment Tracking Tool

Choosing the right investment tracking tool hinges on several interconnected factors. These factors should be carefully weighed against your specific investment needs and technological proficiency. A tool that’s perfect for a seasoned investor with complex portfolios might be overwhelming for someone just starting out.

- User-Friendliness: The interface should be intuitive and easy to navigate, regardless of your technical expertise. A clear, uncluttered dashboard displaying essential information is crucial. Look for tools with helpful tutorials and readily available customer support.

- Cost: Investment tracking tools range from free, basic options to sophisticated, subscription-based services with advanced features. Consider your budget and the features you require. A more expensive tool isn’t necessarily better; it’s essential to assess whether the extra features justify the added cost.

- Security Features: Protecting your sensitive financial data is paramount. Choose a tool with robust security measures, including encryption, two-factor authentication, and regular security updates. Look for tools that comply with industry security standards.

- Data Import Capabilities: Efficient data import is vital to save time and effort. The tool should seamlessly integrate with your brokerage accounts and other financial institutions, automatically downloading transaction data. Manual data entry should be minimized.

- Reporting Options: Comprehensive reporting features allow you to analyze your investment performance and make informed decisions. Look for tools that generate customizable reports, including performance summaries, tax reports, and portfolio allocations.

Step-by-Step Guide to Evaluating Investment Tracking Tools

Evaluating different investment tracking tools systematically ensures a well-informed decision. Following these steps will help you narrow down your options and select the tool that best suits your requirements.

- Define Your Needs: Begin by clearly outlining your investment goals, the complexity of your portfolio, and your technical skills. Are you a beginner or an experienced investor? Do you need advanced features like tax optimization or sophisticated performance analysis?

- Research and Identify Potential Tools: Explore different investment tracking tools available online, reading reviews and comparing features. Consider both free and paid options to find the best fit for your needs and budget.

- Test the Tools: Many tools offer free trials or demos. Take advantage of these opportunities to test the user interface, data import capabilities, and reporting features. Ensure the tool is user-friendly and meets your specific needs.

- Compare Features and Pricing: Create a comparison table to analyze the features and pricing of different tools. This will help you identify the tool that offers the best value for your money.

- Make Your Decision: Based on your evaluation, select the tool that best aligns with your needs, budget, and technical capabilities. Remember that the best tool is the one you will consistently use.

Decision-Making Matrix: Comparing Investment Tracking Tools

This matrix compares three hypothetical investment tracking tools – “InvestWise,” “PortfolioPro,” and “TrackMyAssets” – based on the previously discussed criteria. Note that these are examples and actual tool features and pricing will vary.

| Criterion | InvestWise | PortfolioPro | TrackMyAssets |

|---|---|---|---|

| User-Friendliness | Excellent | Good | Fair |

| Cost | $10/month | $20/month | Free (with limitations) |

| Security Features | High (2FA, encryption) | Medium (encryption) | Low |

| Data Import | Excellent (automatic) | Good (manual and automatic) | Fair (manual) |

| Reporting Options | Excellent (customizable) | Good | Basic |

Data Management and Security

Protecting your financial data is paramount when using investment tracking tools. These tools often hold highly sensitive information, making robust security measures crucial to prevent unauthorized access, data breaches, and potential financial losses. The importance of data security cannot be overstated; a compromise could have severe consequences.

The security and privacy of your investment data depend heavily on the tool you choose and your own practices. Reputable providers invest significantly in security infrastructure and protocols to protect user data. However, users also play a critical role in maintaining the security of their own information. Understanding and implementing best practices is essential for mitigating risk.

Data Encryption and Storage

Data encryption is a fundamental security measure used by reputable investment tracking tools. This involves converting your sensitive financial information into an unreadable format using complex algorithms. Only authorized users with the correct decryption keys can access the data. Many tools utilize both data-at-rest encryption (protecting data stored on servers) and data-in-transit encryption (protecting data as it travels between your device and the tool’s servers). For example, a tool might use AES-256 encryption, a widely recognized and robust standard. Secure storage practices, including regular backups and redundancy, further protect against data loss.

User Authentication and Access Control

Strong user authentication is crucial for preventing unauthorized access. This typically involves a combination of methods, such as passwords, multi-factor authentication (MFA), and potentially biometric verification. MFA adds an extra layer of security by requiring users to verify their identity through a secondary method, such as a one-time code sent to their phone or email. Access control mechanisms limit access to specific data based on user roles and permissions. For instance, a tool might allow users to set different access levels for different accounts or portfolio views, preventing unauthorized users from seeing sensitive information.

Security Audits and Compliance

Regular security audits and compliance with industry standards are vital for maintaining a high level of security. Reputable investment tracking tools undergo periodic security assessments to identify and address vulnerabilities. Compliance with standards like SOC 2 (System and Organization Controls 2) demonstrates a commitment to data security and privacy. These audits verify that the tool’s security practices meet rigorous standards. Transparency regarding security measures and compliance certifications builds trust with users. For example, a provider might publicly display their SOC 2 Type II report, demonstrating their commitment to data security.

Data Backup and Disaster Recovery

Robust data backup and disaster recovery plans are essential to protect against data loss due to technical failures, natural disasters, or cyberattacks. Regular backups should be stored securely, ideally in geographically separate locations, to ensure data availability even in the event of a major incident. Disaster recovery plans Artikel procedures for restoring data and services in the event of a disruption. This ensures business continuity and minimizes disruption to users. Many tools employ automated backup systems that run regularly and securely store backups in the cloud or other secure locations.

Integration with Other Financial Tools

Investment tracking tools are increasingly designed to work seamlessly with other financial applications, creating a more holistic and efficient approach to personal finance management. This integration streamlines data flow, reduces manual input, and provides a more comprehensive view of your financial health. The benefits extend beyond simple convenience, offering valuable insights and enabling more informed financial decisions.

The integration capabilities of investment tracking tools vary depending on the specific platform, but generally, they connect with budgeting apps, tax software, and financial planning tools. This interoperability allows for the automatic transfer of relevant data, such as investment performance, income, and expenses, eliminating the need for manual data entry and reducing the risk of errors. The resulting consolidated financial picture allows users to make more informed decisions across various aspects of their financial lives.

Examples of Seamless Integrations

Effective integration allows for the automated flow of information between different financial tools. For example, an investment tracking tool might automatically import transaction data from your brokerage account and then feed that data into your budgeting app to accurately reflect your investment activity in your overall spending and saving picture. Similarly, the realized gains and losses from your investment portfolio, as tracked by your investment tool, could be automatically transferred to your tax software, simplifying tax preparation. A financial planning tool might utilize data from both the investment tracking tool and the budgeting app to create a more accurate projection of your future financial status and help you visualize your progress towards your financial goals.

Benefits of Integrated Financial Tools: A Hypothetical Scenario

Imagine Sarah, a young professional diligently tracking her investments using an integrated financial management system. Her investment tracking tool automatically imports her brokerage account transactions. This data is then automatically reflected in her budgeting app, providing a clear picture of her net worth and cash flow, including investment gains and losses. At tax time, the same investment data seamlessly transfers to her tax software, reducing the time and effort spent on tax preparation. Furthermore, her financial planning tool uses the combined data from her investment tracker and budgeting app to create a realistic projection of her retirement savings, allowing her to adjust her investment strategy or savings plan as needed. Without integration, Sarah would have to manually input data across multiple platforms, increasing the risk of errors and significantly increasing the time and effort required for financial management. The integrated system provides a more accurate, efficient, and insightful financial management experience.

Illustrative Examples of Investment Tracking in Action

Investment tracking tools offer a powerful way to visualize and manage your financial health. By providing a centralized platform to monitor various asset classes, these tools simplify complex financial data, enabling informed decision-making and effective tax planning. Let’s explore a hypothetical scenario to illustrate their practical application.

Hypothetical Portfolio and Asset Tracking

Imagine Sarah, a 35-year-old investor, utilizing an investment tracking tool to manage her diversified portfolio. Her portfolio includes stocks, bonds, real estate investment trusts (REITs), and a small allocation to cryptocurrency. The tool allows her to input and update the details of each investment, including purchase date, quantity, and initial cost. For example, she might enter the following data:

| Asset Class | Investment | Quantity | Purchase Date | Initial Cost per Unit |

|---|---|---|---|---|

| Stocks | Company A | 100 | 2023-01-15 | $50 |

| Stocks | Company B | 50 | 2023-03-20 | $100 |

| Bonds | Government Bond X | 10 | 2023-05-10 | $1000 |

| REITs | REIT Fund Y | 200 | 2023-07-01 | $25 |

| Cryptocurrency | Bitcoin | 0.5 | 2023-09-15 | $25000 |

The tool automatically calculates the current market value of each asset based on real-time data feeds (or user-provided updates), providing a clear overview of her total portfolio value.

Performance Tracking and Return Calculation

The investment tracking tool automatically tracks the performance of each asset and the portfolio as a whole. It calculates returns using various metrics, such as:

- Total Return: The overall percentage change in the portfolio’s value over a specified period.

- Annualized Return: The average annual return, smoothing out short-term fluctuations.

- Time-Weighted Return: A measure of investment performance that adjusts for cash flows, providing a more accurate representation of investment skill.

The tool presents this data in clear charts and graphs, making it easy for Sarah to visualize her portfolio’s growth and compare the performance of different asset classes. For instance, the tool might show that her stock investments outperformed her bond investments over the past year, while her cryptocurrency investment experienced significant volatility.

Report Generation and Tax Planning

The tool generates comprehensive reports, summarizing portfolio performance, asset allocation, and realized gains and losses. These reports are invaluable for tax planning. For example, the tool can automatically calculate capital gains and losses for each asset, helping Sarah to prepare her tax returns accurately and potentially identify tax-loss harvesting opportunities. The reports can be customized for different time periods and include detailed breakdowns of transactions, making it easier to track expenses and income related to her investments.

Financial Decision-Making

By providing a comprehensive view of her financial situation, the investment tracking tool empowers Sarah to make informed financial decisions. She can use the data to rebalance her portfolio, adjust her investment strategy based on her risk tolerance and financial goals, and track her progress toward achieving those goals. For example, if her stock investments have significantly outperformed her target allocation, she might use the tool to sell some stocks and reinvest the proceeds in bonds or other asset classes to maintain her desired asset allocation.

Ending Remarks

From spreadsheets to dedicated software, the world of investment tracking tools offers a solution for every investor. By carefully considering factors like user-friendliness, security, and integration capabilities, you can select a tool that aligns perfectly with your investment strategy and financial goals. Ultimately, effective investment tracking empowers you to monitor performance, optimize your portfolio, and make confident decisions for long-term financial success.

Questions Often Asked

What is the difference between free and paid investment tracking tools?

Free tools typically offer basic features like portfolio tracking and transaction recording, while paid tools provide advanced features such as automated rebalancing, tax reporting, and integration with brokerage accounts. The choice depends on your investment complexity and needs.

How do I ensure the security of my financial data in an investment tracking tool?

Choose reputable tools with robust security measures, including encryption, two-factor authentication, and regular security updates. Avoid sharing your login credentials and be mindful of phishing attempts.

Can investment tracking tools help with tax preparation?

Many advanced tools offer tax reporting features that generate reports summarizing your investment income and expenses, simplifying the tax preparation process. However, always consult with a tax professional for accurate tax advice.