Understanding your business’s financial health is paramount, and that understanding begins with tracking Key Performance Indicators (KPIs). This guide delves into the world of Financial KPI Tracking, providing a practical framework for small businesses to monitor, interpret, and leverage their financial data for strategic growth. We’ll explore various methods for tracking KPIs, from simple spreadsheets to sophisticated software solutions, and discuss how to visualize and interpret this data to make informed business decisions. Get ready to unlock the power of your financial data!

We will cover defining key financial KPIs relevant to various business models, examining leading and lagging indicators, and outlining effective tracking methodologies. The guide also explores the use of technology to streamline the process, emphasizing data visualization and interpretation techniques to drive informed strategic planning. By the end, you’ll have a clear understanding of how to effectively track, analyze, and utilize your financial KPIs to enhance business performance.

Defining Key Financial KPIs

Understanding and tracking key financial KPIs (Key Performance Indicators) is crucial for the success of any small business. These metrics provide a clear picture of your financial health, allowing for informed decision-making and strategic planning. Regular monitoring helps identify areas needing improvement and track progress towards financial goals.

Ten Essential Financial KPIs for Small Businesses

Choosing the right KPIs depends on your specific business goals and industry. However, several metrics are universally valuable for small businesses. Below are ten essential KPIs, along with their calculations and significance.

- Revenue: The total income generated from sales. Calculation: Total sales – Returns. Significance: Measures overall business performance and growth.

- Gross Profit: Revenue minus the cost of goods sold (COGS). Calculation: Revenue – COGS. Significance: Shows the profitability of your products or services before operating expenses.

- Net Profit: Revenue minus all expenses (including COGS, operating expenses, taxes, and interest). Calculation: Revenue – COGS – Operating Expenses – Taxes – Interest. Significance: The ultimate measure of profitability, representing the actual profit after all costs are considered.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer. Calculation: Total marketing and sales costs / Number of new customers acquired. Significance: Helps evaluate the effectiveness of marketing and sales efforts.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate throughout their relationship with your business. Calculation: Average purchase value x Average purchase frequency x Average customer lifespan. Significance: Helps understand the long-term value of each customer.

- Burn Rate: The rate at which a company spends its cash. Calculation: Total monthly expenses – Total monthly revenue. Significance: Crucial for startups and businesses with limited funding, indicating how long the business can operate without additional funding.

- Debt-to-Equity Ratio: Measures the proportion of a company’s financing that comes from debt compared to equity. Calculation: Total Debt / Total Equity. Significance: Indicates the level of financial risk and leverage.

- Inventory Turnover: How quickly inventory is sold and replenished. Calculation: Cost of Goods Sold / Average Inventory. Significance: Important for businesses with physical inventory, indicating efficiency in managing stock.

- Current Ratio: Measures a company’s ability to pay its short-term liabilities with its short-term assets. Calculation: Current Assets / Current Liabilities. Significance: A key indicator of short-term liquidity.

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost. Calculation: (Net Profit / Cost of Investment) x 100. Significance: Helps evaluate the effectiveness of various investments and initiatives.

Leading and Lagging KPIs

Leading KPIs predict future performance, while lagging KPIs reflect past performance. Using both types provides a comprehensive view of business health.

Leading KPIs, such as marketing campaign reach or number of sales leads, offer early warnings of potential issues or successes. Lagging KPIs, like net profit or customer churn rate, provide a retrospective analysis of performance. Effective businesses use leading indicators to anticipate and adjust to potential problems before they impact lagging indicators.

- Leading KPI Examples: Website traffic, number of marketing leads, customer satisfaction scores, new product development progress.

- Lagging KPI Examples: Revenue, profit margin, customer churn rate, market share.

Key Financial KPI Comparison Across Business Models

The relative importance of KPIs varies across different business models. The following table compares five key KPIs across three common business models: e-commerce, SaaS (Software as a Service), and brick-and-mortar retail.

| KPI | E-commerce | SaaS | Brick-and-Mortar |

|---|---|---|---|

| Revenue | High volume, potentially lower margins | Recurring revenue, high margins | Variable, dependent on location and seasonality |

| Customer Acquisition Cost (CAC) | Can be high due to online advertising | Can be high due to sales cycles | Moderately high, dependent on marketing strategies |

| Customer Lifetime Value (CLTV) | Variable, depends on customer retention strategies | High potential due to subscription models | Moderate, dependent on customer loyalty programs |

| Gross Profit Margin | Variable, depends on product pricing and sourcing | High, due to low cost of goods sold | Variable, depends on product pricing and inventory management |

| Inventory Turnover | High, due to efficient online inventory management | Not applicable | Variable, depends on product demand and seasonality |

Methods for KPI Tracking

Effective KPI tracking is crucial for informed decision-making and achieving financial goals. Choosing the right method depends on factors such as the size of your business, the complexity of your financial data, and your budget. This section Artikels three common approaches, highlighting their respective strengths and weaknesses.

Spreadsheet Software for KPI Tracking

Spreadsheet software, such as Microsoft Excel or Google Sheets, provides a straightforward method for tracking KPIs. This approach is particularly suitable for smaller businesses with simpler financial data. Data is manually entered and formulas are used to calculate KPIs and create charts.

- Advantages: Cost-effective (often already available), readily accessible, allows for customization and flexibility in data presentation.

- Disadvantages: Prone to human error, time-consuming for manual data entry, limited scalability for large datasets, difficulty in real-time monitoring, and lacks advanced analytical capabilities.

Dedicated Financial Software Solutions

Dedicated financial software packages offer automated KPI tracking and advanced analytical features. These solutions typically integrate with accounting software and other business systems, streamlining data collection and analysis. Examples include Xero, QuickBooks Online, and specialized business intelligence (BI) tools.

- Advantages: Automated data collection, real-time monitoring, advanced analytics and reporting capabilities, improved accuracy, scalability for larger datasets.

- Disadvantages: Higher initial and ongoing costs compared to spreadsheets, steeper learning curve, potential for vendor lock-in, may require integration with existing systems.

Custom-Built KPI Tracking Systems

For organizations with highly specific needs or complex data structures, a custom-built KPI tracking system might be necessary. This typically involves working with software developers to create a bespoke solution tailored to the organization’s unique requirements.

- Advantages: Highly tailored to specific needs, optimal integration with existing systems, maximum flexibility and customization.

- Disadvantages: High initial development costs, ongoing maintenance costs, requires specialized technical expertise.

Spreadsheet Tracking vs. Automated Software

Manual spreadsheet tracking, while initially cost-effective, becomes increasingly inefficient as the volume of data grows. The risk of errors increases with manual data entry, impacting the reliability of the KPIs. Automated software solutions, on the other hand, offer significant advantages in terms of accuracy, efficiency, and the ability to analyze larger datasets. They provide real-time insights and advanced analytical features unavailable in spreadsheets, facilitating data-driven decision-making. However, the higher initial investment and potential learning curve should be considered.

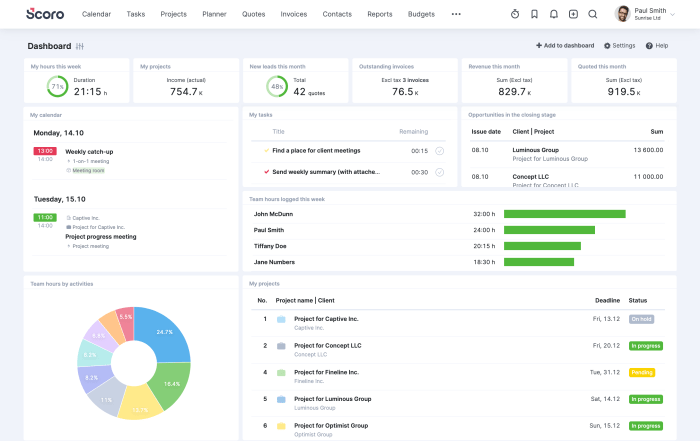

Setting Up a Basic KPI Dashboard in Spreadsheet Software

Creating a basic KPI dashboard in a spreadsheet involves several steps:

- Data Collection: Gather relevant financial data from your accounting system or other sources.

- KPI Calculation: Use spreadsheet formulas to calculate your chosen KPIs (e.g., Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue).

- Data Visualization: Create charts and graphs (bar charts, line graphs, pie charts) to visually represent your KPIs. Consider using conditional formatting to highlight key performance levels (e.g., green for exceeding targets, red for falling short).

- Dashboard Design: Arrange the charts and key figures on a single sheet to create a clear and concise overview of your financial performance.

- Regular Updates: Establish a schedule for regularly updating the dashboard with new data. Automation can be partially achieved through features like data import from external sources or using macros for repetitive tasks.

For example, a simple dashboard might include charts showing monthly revenue, profit margin, and customer acquisition cost. Conditional formatting could highlight months where revenue exceeded targets or profit margins fell below a predefined threshold. This visual representation allows for quick identification of trends and areas needing attention.

Interpreting KPI Data

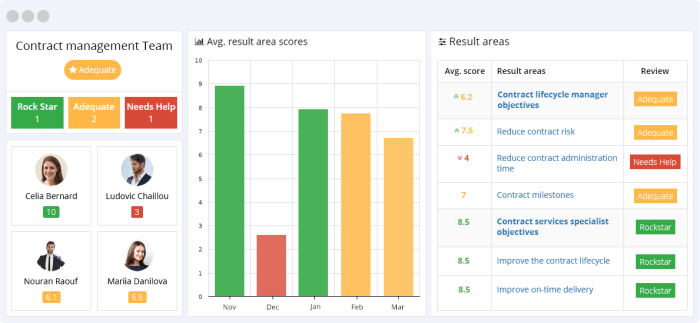

Understanding your key financial performance indicators (KPIs) isn’t just about collecting the numbers; it’s about interpreting the data to gain actionable insights. This involves identifying trends, understanding fluctuations, and ultimately using this information to guide strategic decision-making. By analyzing KPI data over time, businesses can proactively address challenges and capitalize on opportunities.

Analyzing KPI data involves more than just looking at individual data points. Effective interpretation requires examining the data over time to identify trends and patterns. This may involve using charting tools to visualize changes, calculating moving averages to smooth out short-term fluctuations, and comparing performance against previous periods or industry benchmarks. Looking for consistent upward or downward trends is crucial, as is recognizing seasonal variations or other cyclical patterns. The goal is to move beyond simply observing the current state of affairs to understanding the direction of the business and anticipating future performance.

Identifying Trends and Patterns in KPI Data Over Time

Effective trend analysis involves employing various techniques to reveal underlying patterns within the KPI data. Visual representations, such as line graphs, are particularly useful for identifying upward or downward trends. These graphs allow for a clear visualization of the KPI’s movement over time, highlighting significant changes and potential turning points. Further analysis might involve calculating moving averages, which smooth out short-term fluctuations and reveal longer-term trends. Comparing performance against previous periods or industry benchmarks provides context and helps determine whether the observed trend is positive, negative, or simply in line with expectations. Finally, advanced statistical methods can be employed for deeper insights, particularly in identifying complex patterns or correlations between multiple KPIs.

Hypothetical Scenario: Negative Trend in a Key KPI

Let’s imagine a retail company’s key KPI, “Average Transaction Value,” shows a consistent decline over the past six months. Three possible explanations for this negative trend include:

- Increased competition: New competitors may have entered the market, offering similar products or services at lower prices, thereby reducing the company’s ability to command higher prices.

- Changes in consumer behavior: Consumers may be shifting their spending habits, opting for more budget-friendly options or delaying larger purchases due to economic uncertainty.

- Ineffective marketing campaigns: Recent marketing efforts may have failed to resonate with the target audience, resulting in a decrease in sales of higher-priced items and a consequent drop in the average transaction value.

Using KPI Data to Inform Strategic Business Decisions

KPI data provides the foundation for data-driven decision-making. For instance, if the “customer churn rate” KPI shows a significant increase, this signals a problem with customer retention. This insight might lead to an investigation into customer satisfaction levels, prompting the development of improved customer service strategies or loyalty programs. Similarly, a consistent decline in “website traffic” might suggest the need for adjustments to the company’s digital marketing strategy, perhaps necessitating a review of practices or the implementation of new social media campaigns. By carefully analyzing KPI data, businesses can identify areas requiring attention, allocate resources effectively, and make informed decisions to optimize performance and achieve their strategic goals.

Tools and Technologies for KPI Tracking

Effective financial KPI tracking relies heavily on the right tools and technologies. Choosing the appropriate software can significantly streamline the process, automating data collection, analysis, and reporting, ultimately leading to more informed decision-making. The selection process should consider factors such as the size of your business, the complexity of your financial data, and your budget.

Selecting the right KPI tracking tool is crucial for efficient financial management. Several software solutions offer a range of features to suit various business needs and scales. The choice depends on factors such as budget, integration requirements, and the desired level of automation.

Popular KPI Tracking Software

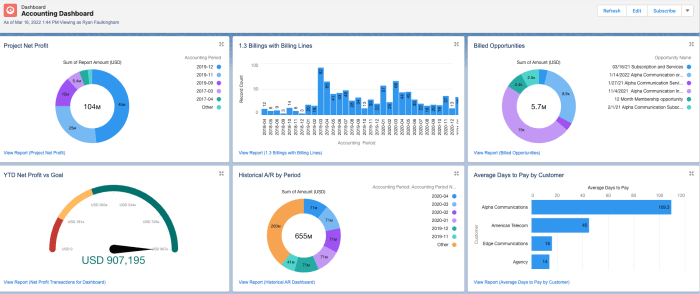

The market offers various software options for KPI tracking. Here are five popular choices, each with its strengths and pricing model:

- Tableau: A powerful data visualization tool, Tableau excels at creating interactive dashboards to display financial KPIs. It offers robust data connectivity, allowing integration with various data sources. Pricing is subscription-based, ranging from individual licenses to enterprise-level solutions. Its strength lies in its ability to present complex data in an easily understandable and actionable format.

- Power BI: Microsoft’s Power BI is another popular choice, known for its user-friendly interface and strong integration with other Microsoft products. It offers a similar range of features to Tableau, including interactive dashboards and data visualization capabilities. Pricing is also subscription-based, with various plans available depending on the number of users and required features. Its ease of use makes it a particularly attractive option for businesses with limited technical expertise.

- Google Data Studio: A free option, Google Data Studio provides a good balance of features and affordability. While not as feature-rich as Tableau or Power BI, it’s a suitable choice for smaller businesses with simpler KPI tracking needs. It integrates seamlessly with other Google services and offers a user-friendly interface. Its free pricing makes it accessible to a wider range of businesses.

- Zoho Analytics: Zoho Analytics offers a comprehensive suite of business intelligence tools, including KPI tracking. It provides features such as data visualization, reporting, and predictive analytics. Pricing is subscription-based, with various plans offering different levels of functionality and storage capacity. Its all-in-one approach can be beneficial for businesses using other Zoho products.

- Qlik Sense: Qlik Sense is a powerful business intelligence platform known for its associative data analysis capabilities. It allows users to explore data relationships intuitively and uncover insights that might be missed with other tools. Its pricing is subscription-based and typically caters to larger enterprises. Its strength lies in its ability to handle very large datasets and complex analyses.

KPI Tracking Tool Integration with Accounting Software

Seamless integration between KPI tracking tools and accounting software is crucial for efficient data flow. Most modern KPI tracking tools offer integration capabilities with popular accounting software such as Xero, QuickBooks, and Sage. This integration typically involves connecting the tools through APIs, allowing for automatic data import and updates. This eliminates the need for manual data entry, reducing the risk of errors and saving valuable time. For example, QuickBooks Online integrates directly with many KPI dashboards, automatically pulling in financial data for real-time analysis.

Setting Up Automated Alerts and Notifications

Automated alerts and notifications are essential for proactive financial management. Most KPI tracking tools allow users to set thresholds for their KPIs. When a KPI deviates significantly from the set threshold (e.g., exceeding a budgeted expense or falling short of a sales target), the system automatically generates an alert, notifying relevant personnel via email, SMS, or in-app notifications. This enables timely intervention and corrective action, preventing potential financial issues from escalating. For instance, if a company sets an alert for when its customer acquisition cost exceeds a certain amount, the marketing team is immediately notified, allowing them to adjust their strategies accordingly.

Visualizing KPI Data

Effective visualization is crucial for understanding and communicating financial KPI performance. Raw data, while informative, often lacks the impact of a well-designed visual representation. By transforming numerical data into charts and graphs, we can quickly identify trends, outliers, and areas requiring attention, making complex financial information accessible to a wider audience. This section explores methods for visualizing KPI data and best practices for creating effective dashboards.

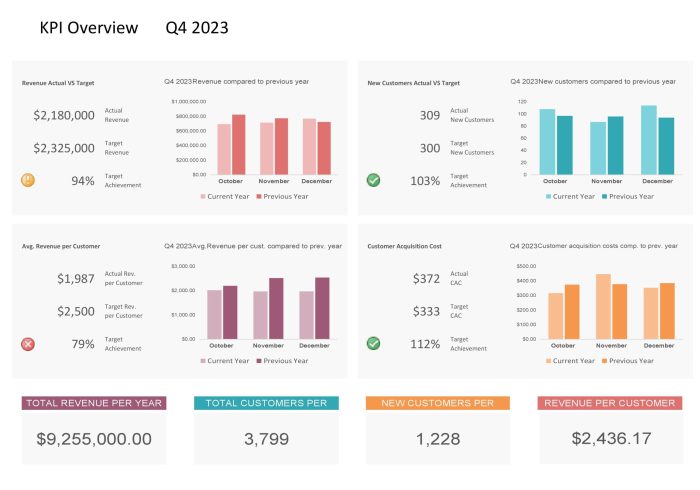

A compelling way to showcase KPI performance is through a combined chart. For instance, consider a chart illustrating the performance of Revenue, Profit Margin, and Customer Acquisition Cost (CAC) over a 12-month period. This chart could utilize a line graph for revenue and profit margin, overlaid on a bar chart for CAC. The X-axis would represent the months (January to December), while the Y-axis would display the respective values for each KPI (Revenue in currency, Profit Margin as a percentage, and CAC in currency). Each line would be clearly labeled with its corresponding KPI, using a legend for easy identification. Data points for each month would be displayed, allowing for a clear comparison of performance across the year. For example, a dip in revenue during a specific month could be correlated with a simultaneous increase in CAC, highlighting a potential area needing investigation. Similarly, a high profit margin in a specific month could indicate the success of a particular marketing campaign.

Sample Chart Description

The chart would feature three lines representing Revenue (in USD), Profit Margin (as a percentage), and Customer Acquisition Cost (CAC, in USD). The x-axis represents the twelve months of the year, from January to December. The y-axis scales appropriately for each KPI, using different scales to accurately reflect the magnitude of each metric. For instance, revenue might be in the millions, profit margin between 0% and 30%, and CAC in the hundreds or thousands. The lines would be distinctly colored and labeled in the legend, with data points clearly marked for each month. The overall chart would be clean, uncluttered, and easily interpretable, highlighting key trends and relationships between the KPIs.

The importance of clear and concise visualizations cannot be overstated. Stakeholders, whether executives, investors, or team members, often lack the time or expertise to delve into raw data. Effective visualizations translate complex information into easily digestible formats, fostering quicker understanding and informed decision-making. Ambiguous or overly complex charts can lead to misinterpretations and hinder effective communication, ultimately impacting strategic planning and resource allocation. A well-designed visualization allows for rapid identification of trends and anomalies, enabling timely interventions and maximizing business opportunities.

Creating effective KPI dashboards requires careful consideration of several best practices. The following points highlight key aspects to consider:

- Prioritize Key Metrics: Focus only on the most critical KPIs relevant to the audience and business objectives. Avoid overwhelming the dashboard with unnecessary data.

- Use Appropriate Chart Types: Select chart types that best represent the data and facilitate easy interpretation. Line graphs are ideal for trends, bar charts for comparisons, and pie charts for proportions.

- Maintain Visual Consistency: Use a consistent color scheme, font style, and layout throughout the dashboard for a professional and cohesive look.

- Provide Clear Labels and Legends: Ensure all axes, data points, and chart elements are clearly labeled and explained in a concise manner.

- Regularly Update and Maintain: Keep the dashboard current with the latest data and make necessary adjustments to ensure accuracy and relevance.

Improving KPI Tracking Processes

Effective KPI tracking is crucial for informed decision-making and achieving business objectives. However, several challenges can hinder the process, leading to inaccurate data and ineffective strategies. Addressing these challenges requires a proactive approach focused on data accuracy, reliable collection methods, and efficient reporting systems.

Common Challenges in Financial KPI Tracking and Their Solutions

Businesses often encounter difficulties in accurately tracking financial KPIs. Three common challenges include inconsistent data entry, lack of real-time data access, and insufficient integration between different data sources. Addressing these issues requires a multi-pronged strategy involving process improvements, technological upgrades, and employee training.

- Inconsistent Data Entry: Human error during data entry is a significant source of inaccuracy. Solutions include implementing data validation rules within the tracking system to automatically flag inconsistencies and errors. Investing in automated data entry tools can also minimize manual input and the associated risks. Finally, providing comprehensive training to employees on data entry procedures and the importance of accuracy can significantly improve data quality.

- Lack of Real-Time Data Access: Delayed access to data hampers timely decision-making. Implementing real-time dashboards and reporting tools that automatically update with the latest data can provide immediate insights into key performance indicators. Cloud-based solutions and data integration platforms can also facilitate access to real-time data from various sources.

- Insufficient Data Integration: Data silos from different departments or systems can create a fragmented view of the business’s financial performance. Integrating data from various sources into a centralized system provides a holistic view. This requires using data integration tools and establishing clear data governance protocols to ensure data consistency and accuracy across all systems.

The Role of Data Accuracy and Reliability in Effective KPI Tracking

Accurate and reliable data is the cornerstone of effective KPI tracking. Inaccurate data leads to flawed analyses, incorrect interpretations, and ultimately, poor business decisions. For example, if the sales figures used to calculate revenue growth are inaccurate due to errors in order processing or reporting, the resulting KPI will be misleading, potentially leading to incorrect strategic adjustments. Data reliability ensures the KPIs reflect the true state of the business, allowing for sound strategic planning and resource allocation. This reliability is built through rigorous data validation, regular audits, and the use of reliable data sources.

Strategies for Improving Data Collection and Reporting Processes

Improving data collection and reporting processes is essential for enhancing KPI accuracy. This involves implementing standardized data collection procedures, automating data entry wherever possible, and regularly validating data for accuracy and completeness. For example, implementing a standardized sales reporting template across all sales teams ensures consistency in data format and reduces the risk of errors. Automated data extraction from various sources, such as CRM and ERP systems, eliminates manual data entry, minimizing human error. Regular data validation, including automated checks and manual reviews, helps identify and correct inconsistencies before they impact KPI calculations. Finally, clear reporting processes, including defined reporting frequencies and distribution channels, ensure timely and accessible information for decision-making.

End of Discussion

Effective Financial KPI Tracking isn’t just about numbers; it’s about gaining a clear, actionable understanding of your business’s performance. By implementing the strategies and tools Artikeld in this guide, you can transform raw financial data into valuable insights, driving strategic decision-making and fostering sustainable growth. Remember, consistent monitoring, accurate data, and insightful interpretation are the cornerstones of successful KPI tracking. Start tracking today and watch your business thrive.

FAQ Corner

What if I don’t have accounting software?

Spreadsheet software like Excel or Google Sheets can be used for basic KPI tracking, although dedicated software offers more advanced features and automation.

How often should I review my KPIs?

The frequency depends on your business and KPIs, but daily or weekly reviews for critical KPIs are common. Monthly reviews are generally sufficient for others.

What are some common pitfalls to avoid?

Common pitfalls include inaccurate data entry, neglecting to define clear goals for KPIs, and failing to regularly review and adjust the tracking process.

How can I improve data accuracy?

Implement robust data validation procedures, automate data entry where possible, and regularly reconcile data with other sources.

How do I choose the right KPIs for my business?

Consider your business goals, industry benchmarks, and the specific aspects of your operations you want to monitor. Start with a few key KPIs and gradually add more as needed.