Effective budgeting is the cornerstone of any successful business, regardless of size or industry. From startups navigating their initial financial landscape to established corporations managing complex operations, a well-defined budget provides a roadmap for growth, profitability, and long-term sustainability. This guide delves into the multifaceted world of business budgeting, exploring various strategies, techniques, and tools to help you optimize your financial resources and achieve your business objectives.

We’ll examine different budgeting methodologies, including zero-based budgeting, incremental budgeting, and activity-based budgeting, highlighting their respective strengths and weaknesses. We’ll also address the unique challenges faced by businesses across diverse sectors, offering practical advice and adaptable templates. Furthermore, we’ll explore the crucial role of forecasting in budgeting, the importance of monitoring and managing your budget effectively, and the utilization of software and tools to streamline the process. Ultimately, this guide aims to equip you with the knowledge and resources to create and manage a robust budget that aligns with your business goals and fosters sustainable growth.

Defining Budgeting Strategies for Businesses

Effective budgeting is crucial for the financial health and long-term success of any business. A well-structured budget acts as a roadmap, guiding financial decisions and ensuring resources are allocated strategically to achieve organizational goals. It provides a framework for monitoring performance, identifying potential problems early, and making informed adjustments to maintain profitability and sustainability.

Core principles of effective business budgeting include setting realistic and achievable financial goals, accurately forecasting revenue and expenses, regularly monitoring performance against the budget, and promptly addressing any significant variances. Transparency and open communication about the budget throughout the organization are also essential to foster buy-in and accountability.

Different Budgeting Methods

Businesses can employ various budgeting methods, each with its own strengths and weaknesses. The choice of method depends on factors such as the company’s size, industry, and organizational structure. Selecting the most appropriate method is key to maximizing the effectiveness of the budget.

| Name | Description | Advantages | Disadvantages |

|---|---|---|---|

| Zero-Based Budgeting | Each budget cycle starts from zero. Every expense must be justified and approved. | Promotes efficiency by scrutinizing every expense; identifies unnecessary spending; encourages innovation in resource allocation. | Time-consuming and resource-intensive; requires significant managerial oversight; can be disruptive to ongoing operations. |

| Incremental Budgeting | Uses the previous year’s budget as a base and adjusts it based on anticipated changes. | Simple and easy to implement; requires less time and resources than other methods; provides a sense of continuity. | Can perpetuate inefficient spending; may not adapt well to significant changes in the business environment; less likely to identify areas for improvement. |

| Activity-Based Budgeting | Focuses on the costs associated with specific activities or projects. | Provides a more accurate understanding of costs; allows for better cost control; facilitates more informed decision-making. | Complex and requires detailed data collection; can be challenging to implement in organizations with complex operations; requires specialized expertise. |

Setting Realistic Financial Goals

Establishing realistic financial goals is paramount for effective budgeting. This involves a thorough analysis of past performance, market trends, and anticipated changes in the business environment. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of a vague goal like “increase sales,” a SMART goal might be “increase sales by 15% in the next fiscal year by implementing a new marketing campaign targeting a specific demographic.” Regularly reviewing and adjusting goals based on performance and changing circumstances is also crucial to ensure the budget remains relevant and effective. Consider using benchmarking against industry competitors to establish attainable yet ambitious targets. For example, if the average profit margin in your industry is 10%, aiming for 12% could be a realistic and challenging goal.

Budgeting for Different Business Sizes and Industries

Budgeting is a crucial aspect of any business, regardless of size or industry. However, the specific strategies and approaches employed vary significantly depending on these factors. Understanding these differences is vital for effective financial management and long-term success. This section explores how budgeting adapts to different business scales and the unique challenges presented by various sectors.

Budgeting strategies for startups differ dramatically from those of established enterprises. Startups often operate with limited resources and require a highly focused approach to budgeting. Their primary concern is securing enough capital to reach profitability, often prioritizing operational efficiency and lean spending. Established businesses, conversely, possess greater financial flexibility and can afford more sophisticated budgeting techniques, incorporating long-term strategic planning and potentially investing in expansion or research and development. This difference reflects a shift from survival-focused budgeting to growth-oriented budgeting.

Budgeting Challenges Across Industries

Different industries face unique budgeting challenges due to their specific operational characteristics and market dynamics. For instance, the retail sector is highly susceptible to seasonal fluctuations, requiring flexible budgeting that accounts for peak and off-peak periods. Inventory management is another critical factor, demanding accurate forecasting to avoid overstocking or stockouts. The technology industry, on the other hand, is characterized by rapid innovation and high research and development costs, necessitating a budgeting approach that balances short-term profitability with long-term investment in new technologies. The healthcare industry faces complex regulatory environments and significant capital expenditure needs for equipment and facilities, demanding meticulous budgeting and adherence to strict compliance regulations.

Sample Budget Template for a Small Food Service Business

A simple budget template for a small food service business should include key revenue and expense categories. This template is designed to be adaptable and easily modified based on the specific needs of the business.

| Revenue | Amount |

|---|---|

| Food Sales | |

| Beverage Sales | |

| Other Sales (e.g., desserts, merchandise) | |

| Total Revenue |

| Expenses | Amount |

|---|---|

| Cost of Goods Sold (COGS) | |

| Labor Costs (salaries, wages) | |

| Rent | |

| Utilities (electricity, water, gas) | |

| Marketing and Advertising | |

| Supplies (cleaning, packaging) | |

| Insurance | |

| Maintenance and Repairs | |

| Other Expenses | |

| Total Expenses |

Profit = Total Revenue – Total Expenses

This template allows for easy tracking of income and expenditure, facilitating informed decision-making and proactive financial management. The business owner can adapt this by adding or removing categories as needed to reflect the specific operations of their establishment. Regular review and adjustment of this budget are crucial to ensure its ongoing relevance and effectiveness.

Key Components of a Business Budget

A comprehensive business budget is a crucial tool for financial planning and management. It provides a roadmap for achieving financial goals, identifying potential risks, and making informed decisions. A well-structured budget integrates key financial elements to offer a holistic view of the business’s financial health. This allows for proactive adjustments and strategic planning to maximize profitability and sustainability.

A business budget fundamentally comprises three key components: revenue projections, expense categories, and cash flow analysis. These elements work together to create a dynamic financial model that adapts to changing market conditions and internal operational adjustments. Effective use of these components allows for informed decision-making across all aspects of the business.

Revenue Projections

Forecasting revenue accurately is paramount for effective budgeting. This process involves analyzing historical sales data, conducting thorough market research, and considering factors like anticipated market growth, competitive landscape, and planned marketing initiatives. For instance, a small bakery might analyze past sales data to identify seasonal trends (increased sales during holidays) and then use market research (e.g., surveys, competitor analysis) to estimate potential growth based on new product introductions or expansion into a new area. This combined data forms the basis for a realistic revenue projection. The process often involves using various forecasting techniques, such as simple moving averages or more sophisticated statistical models, depending on data availability and complexity. A reliable revenue projection provides a foundation for all subsequent budgeting activities.

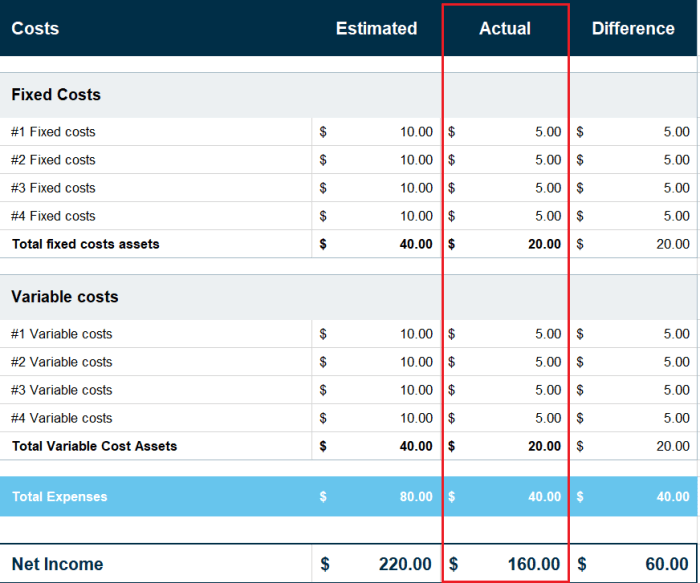

Expense Categories

Understanding and categorizing expenses is crucial for effective cost management. Expenses are broadly classified into fixed and variable costs. Fixed costs remain relatively constant regardless of production or sales volume, such as rent, salaries, and insurance premiums. Variable costs fluctuate with changes in production or sales, such as raw materials, direct labor, and utilities. A small business might categorize expenses as follows:

- Fixed Costs: Rent, insurance, loan payments, salaries, subscriptions (software, marketing).

- Variable Costs: Raw materials, direct labor (if applicable), marketing campaigns (depending on the strategy), shipping costs, utilities (partially variable).

Accurate categorization helps in monitoring spending, identifying areas for cost reduction, and optimizing resource allocation. For example, analyzing variable costs might reveal that raw material costs are unexpectedly high, prompting a search for alternative suppliers or more efficient production methods. A clear understanding of these cost structures is vital for profitability analysis and decision-making.

Cash Flow Analysis

Cash flow analysis projects the inflow and outflow of cash within a specific period. It’s more than just profit; it shows the actual cash available to the business at any given time. This analysis incorporates revenue projections and expense categories, demonstrating when cash surpluses or deficits are anticipated. For example, a seasonal business might experience high revenue during peak seasons but low cash flow during off-seasons due to inventory purchases or other upfront expenses. A robust cash flow projection helps businesses anticipate potential liquidity problems, secure necessary financing, and optimize cash management strategies, ensuring they have enough cash on hand to meet their obligations. This analysis is crucial for short-term financial planning and preventing unexpected financial crises. The formula for cash flow is simple:

Cash Flow = Cash Inflow – Cash Outflow

This straightforward equation, when applied to detailed projections, provides a vital overview of the business’s liquidity and financial stability.

Monitoring and Managing the Budget

Effective budget monitoring and management are crucial for a business’s financial health. Consistent tracking and analysis allow for proactive adjustments, preventing potential financial difficulties and maximizing resource allocation. This involves regularly comparing actual spending to the planned budget, identifying variances, and implementing corrective actions.

Tracking actual spending against budgeted amounts requires a robust system for recording all financial transactions. This can involve using accounting software, spreadsheets, or a combination of both. Regularly (e.g., weekly, monthly, quarterly) comparing these recorded expenses with the budget allows for early detection of overspending or underspending in specific areas. This comparison should be detailed, breaking down expenses by category to pinpoint areas needing attention. For example, comparing actual marketing expenses to the budgeted amount for each marketing campaign allows for a precise understanding of campaign ROI and potential areas for optimization.

Utilizing Key Performance Indicators (KPIs) for Budget Monitoring

KPIs provide quantifiable measures of a business’s performance against its goals. In budget monitoring, they offer a clear picture of progress and potential problem areas. By tracking relevant KPIs, businesses can proactively address issues before they escalate.

Examples of KPIs useful for budget monitoring include:

- Cost of Goods Sold (COGS) as a percentage of revenue: This KPI reveals the efficiency of production and the profitability of sales. A significant increase may indicate rising material costs or production inefficiencies requiring investigation and potential corrective actions.

- Return on Investment (ROI) for marketing campaigns: Tracking ROI helps assess the effectiveness of marketing spend and identify areas for improvement. Low ROI may indicate a need for revised marketing strategies or reallocation of resources.

- Customer Acquisition Cost (CAC): This KPI measures the cost of acquiring a new customer. High CAC can indicate inefficient marketing or sales processes, requiring review and adjustments to reduce costs.

- Gross Profit Margin: This shows the profitability of sales after deducting the cost of goods sold. A declining gross profit margin signals potential issues with pricing, costs, or sales volume requiring immediate attention.

Analyzing Budget Variances and Implementing Corrective Actions

Budget variances represent the difference between the budgeted amount and the actual spending. Analyzing these variances is essential for identifying areas needing improvement and making informed decisions.

Once variances are identified, implementing corrective actions is crucial. The specific actions will depend on the nature and size of the variance.

- Investigate the cause of the variance: Thoroughly understand why the variance occurred. Was it due to unexpected expenses, price increases, inaccurate budgeting, or changes in market conditions?

- Adjust the budget: If the variance is due to unforeseen circumstances, adjust the budget to reflect the new reality. This may involve reallocating funds or seeking additional funding.

- Implement cost-saving measures: Identify areas where costs can be reduced without compromising quality or service. This may involve negotiating better deals with suppliers, streamlining processes, or reducing waste.

- Improve forecasting accuracy: Review the budgeting process to identify areas for improvement in forecasting future expenses. More accurate forecasting can reduce the likelihood of significant variances.

- Re-evaluate strategies: If the variance is due to ineffective strategies, re-evaluate and adjust them accordingly. This may involve changes to marketing, sales, or operations.

Software and Tools for Business Budgeting

Effective budgeting is crucial for business success, and leveraging the right software can significantly streamline the process. Choosing the appropriate tools depends on factors such as business size, complexity, and specific needs. While manual methods might suffice for very small businesses, most will benefit from the efficiency and analytical capabilities offered by dedicated software solutions.

Advantages and Disadvantages of Budgeting Software

Budgeting software offers numerous advantages over manual methods, including increased accuracy, reduced time spent on data entry and calculations, improved collaboration among team members, and enhanced reporting capabilities. Real-time data visualization allows for quicker identification of potential problems and informed decision-making. However, implementing new software requires an initial investment of time and resources for learning and setup. The cost of the software itself can also be a factor, especially for smaller businesses with tighter budgets. Furthermore, reliance on technology introduces the risk of system failures or data loss, necessitating robust backup and recovery plans. Finally, some software might have a steep learning curve, potentially hindering adoption by team members unfamiliar with the platform.

Comparison of Budgeting Software Types

Spreadsheet programs like Microsoft Excel and Google Sheets offer a readily available and cost-effective option for basic budgeting. However, their capabilities are limited compared to dedicated budgeting software, especially for larger or more complex businesses. Dedicated budgeting apps, on the other hand, provide more advanced features, such as forecasting, scenario planning, and integration with other business applications. The choice depends on the specific needs and technical expertise within the organization.

| Feature | Spreadsheet Programs (e.g., Excel, Google Sheets) | Dedicated Budgeting Apps (e.g., Xero, Zoho Books) | Enterprise-Level Budgeting Software (e.g., Anaplan, Vena) |

|---|---|---|---|

| Cost | Relatively low (often included in existing subscriptions) | Subscription-based, varying widely depending on features and user count | High, typically requiring significant upfront investment and ongoing maintenance |

| Ease of Use | Generally easy to learn, but complex budgets can become difficult to manage | User-friendly interfaces, but some learning curve may still exist | Steeper learning curve; requires specialized training and expertise |

| Features | Basic budgeting, charting, and some data analysis capabilities | Advanced features like forecasting, scenario planning, and integration with accounting software | Comprehensive features including advanced analytics, collaboration tools, and real-time dashboards |

| Scalability | Can be challenging to scale for large or complex businesses | Generally scalable to accommodate growing businesses | Highly scalable and adaptable to large, complex organizations |

Essential Features of Budgeting Software

Selecting the right budgeting software requires careful consideration of essential features. The software should seamlessly integrate with existing accounting systems to avoid data duplication and ensure accuracy. Robust reporting and visualization capabilities are crucial for monitoring progress and identifying areas needing attention. Collaboration features allow team members to work together efficiently on the budget, ensuring everyone is on the same page. The software should also offer flexibility to accommodate different budgeting methods, such as zero-based budgeting or incremental budgeting. Finally, security features are paramount to protect sensitive financial data from unauthorized access or breaches. A robust audit trail is also vital for accountability and compliance.

The Role of Forecasting in Budgeting

Accurate financial forecasting is the bedrock of successful business budgeting. Without reliable projections of future revenue and expenses, a budget becomes little more than a guess, potentially leading to financial instability and missed opportunities. Forecasting allows businesses to proactively manage resources, identify potential risks, and make informed decisions about investments and operational strategies. A well-crafted forecast provides a roadmap for achieving financial goals, facilitating better resource allocation and strategic planning.

Forecasting allows businesses to anticipate potential shortfalls or surpluses, enabling proactive adjustments to the budget. This proactive approach minimizes the impact of unexpected events and maximizes the likelihood of achieving financial targets. For example, a business anticipating a seasonal dip in sales can adjust its spending accordingly, preventing unnecessary expenses and maintaining financial stability. Conversely, a business forecasting significant growth can plan for increased resource needs, such as hiring additional staff or expanding facilities.

Revenue Forecasting Techniques

Several methods exist for projecting future revenue. The choice depends on factors such as the industry, business size, and data availability. Simple methods like using historical sales data and applying a growth rate can be suitable for stable businesses with readily available historical data. More sophisticated techniques, such as statistical modeling or market research, may be necessary for businesses operating in volatile markets or launching new products. For instance, a company launching a new product might use market research to estimate potential demand, while an established retailer might rely on past sales data and seasonal trends to forecast revenue for the upcoming year. Sales force estimates, incorporating insights from sales representatives about expected future sales, also play a vital role in revenue forecasting.

Expense Forecasting Techniques

Expense forecasting mirrors revenue forecasting in its reliance on both historical data and future expectations. Analyzing past spending patterns, adjusting for anticipated changes (e.g., inflation, new equipment purchases), and incorporating planned initiatives are crucial. For example, a business planning to expand its marketing efforts should factor in increased advertising and promotional expenses. Similarly, a business anticipating rising energy costs should adjust its budget to reflect these anticipated increases. Zero-based budgeting, a method where every expense is justified from scratch each year, can also be used, particularly for businesses undergoing significant restructuring or change.

The Relationship Between Forecasting Accuracy and Budget Success

The relationship between forecasting accuracy and budget success is directly proportional. A visual representation could be a graph with forecasting accuracy on the x-axis (ranging from low to high) and budget success on the y-axis (ranging from low to high). The graph would show a positive correlation, with a line sloping upward from the bottom left (low accuracy, low success) to the top right (high accuracy, high success). This illustrates that as forecasting accuracy improves, the likelihood of achieving budget targets increases significantly. However, it is important to acknowledge that external factors beyond the control of the business can still influence the final outcome, even with highly accurate forecasting. For example, an unforeseen economic downturn could impact sales despite a well-crafted budget based on accurate forecasts.

Budgeting and Business Growth Strategies

Budgeting is not merely about tracking expenses; it’s a crucial tool for driving strategic business planning and achieving ambitious growth targets. A well-structured budget acts as a roadmap, guiding resource allocation and ensuring that financial resources are aligned with overarching business objectives. By meticulously planning income and expenditures, businesses can confidently pursue expansion, innovation, and market dominance.

A robust budget provides the financial framework for ambitious growth initiatives. It allows businesses to assess the feasibility of expansion plans, evaluate the financial implications of new product development, and determine the optimal investment levels for marketing campaigns. This proactive approach minimizes financial risk and maximizes the chances of successful growth.

Funding Expansion Through Budgeting

Budgeting plays a vital role in funding business expansion. Before committing to opening a new location, acquiring another company, or significantly increasing production capacity, a detailed budget is essential. This budget should clearly Artikel the anticipated costs associated with expansion – including rent or property purchase, equipment upgrades, hiring new staff, and initial marketing expenses – against projected revenue increases. For example, a bakery considering opening a second location would need a budget detailing the costs of leasing a new space, purchasing additional ovens and display cases, hiring additional bakers and staff, and marketing the new location. This budget would then be compared to projected sales from the new location to determine the financial viability of the expansion. Without such a detailed budget, the expansion could quickly become financially unsustainable.

Budgeting for New Product Development

Developing new products often requires significant upfront investment in research and development, marketing, and manufacturing. A well-defined budget allocates resources effectively across these areas, ensuring that funds are used efficiently and that the project stays within the allocated budget. Consider a technology startup developing a new software application. Their budget would encompass costs for software engineers, designers, marketing materials, beta testing, and initial server infrastructure. By meticulously tracking expenses against milestones, the company can identify potential cost overruns early and make necessary adjustments. This prevents costly delays and ensures the product launch remains on schedule and within budget.

Integrating Budgeting into Strategic Planning

Integrating budgeting into the company’s strategic plan is a crucial step toward achieving long-term success. The budget should be directly aligned with the company’s overall goals and objectives. This ensures that financial resources are allocated to initiatives that contribute most significantly to the company’s strategic priorities. For instance, if a company’s strategic goal is to increase market share, a significant portion of the budget might be allocated to marketing and sales initiatives. Conversely, if the strategic goal is to improve operational efficiency, a larger portion of the budget may be allocated to technology upgrades and process improvements. This integrated approach ensures that the financial plan directly supports and facilitates the achievement of the company’s broader strategic objectives. Regular review and adjustments to the budget are necessary to ensure it remains aligned with the evolving strategic direction of the business.

Final Thoughts

Mastering business budgeting is not merely about tracking expenses; it’s about strategic financial planning that fuels growth and resilience. By understanding the principles of effective budgeting, adapting strategies to your specific business needs, and leveraging available tools, you can gain a powerful advantage in navigating the complexities of the business world. From defining realistic financial goals to implementing robust monitoring systems, the journey to financial success begins with a well-crafted and effectively managed budget. Embrace the power of strategic financial planning and pave the way for a thriving and sustainable business future.

Top FAQs

What is the difference between fixed and variable costs?

Fixed costs remain consistent regardless of production or sales volume (e.g., rent), while variable costs fluctuate with production or sales (e.g., raw materials).

How often should a business budget be reviewed?

Ideally, budgets should be reviewed at least monthly to track progress, identify variances, and make necessary adjustments. More frequent reviews might be necessary for startups or businesses in rapidly changing markets.

What are some common pitfalls to avoid in budgeting?

Common pitfalls include unrealistic projections, insufficient contingency planning, neglecting cash flow management, and a lack of regular monitoring and analysis.