The allure of cryptocurrency’s potential for high returns has drawn a wave of investors, but beneath the surface of lucrative gains lies a complex landscape of significant risks. Understanding these risks is paramount to making informed decisions and mitigating potential losses. This guide delves into the key challenges facing cryptocurrency investors, providing insights into market volatility, regulatory uncertainty, security threats, technological limitations, and the ever-present danger of scams.

From the unpredictable price swings that characterize the crypto market to the evolving regulatory frameworks globally, the journey into cryptocurrency investing requires a keen awareness of the inherent hazards. This exploration will equip you with the knowledge to navigate these complexities and approach your investments with a balanced perspective, weighing the potential rewards against the considerable risks involved.

Market Volatility and Price Fluctuations

The cryptocurrency market is renowned for its dramatic price swings, presenting both significant opportunities and substantial risks for investors. Understanding the factors driving this volatility is crucial for navigating this dynamic landscape and making informed investment decisions. This section will explore the sources of cryptocurrency volatility, examine historical price movements of major cryptocurrencies, compare their volatility to traditional assets, and illustrate the impact of volatility on different investment strategies.

Factors Contributing to Cryptocurrency Market Volatility

Several interconnected factors contribute to the inherent volatility of the cryptocurrency market. These include regulatory uncertainty, technological advancements, macroeconomic conditions, market manipulation, and the influence of social media and news events. Regulatory changes in different jurisdictions can significantly impact cryptocurrency prices, as can breakthroughs in blockchain technology or the emergence of competing cryptocurrencies. Broader economic trends, such as inflation or recessionary fears, also play a role, influencing investor sentiment and capital flows. Furthermore, the relatively smaller market capitalization of cryptocurrencies compared to traditional assets makes them more susceptible to manipulation by large investors or coordinated trading activities. Finally, the rapid spread of information and opinions through social media can create speculative bubbles and sudden price crashes.

Historical Price Fluctuations of Major Cryptocurrencies

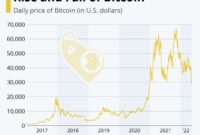

Bitcoin, the first and most well-known cryptocurrency, has experienced periods of both explosive growth and sharp declines. For example, Bitcoin’s price rose from under $1,000 in 2017 to nearly $20,000 by the end of the year, only to plummet significantly in the following months. Similar patterns have been observed in other major cryptocurrencies like Ethereum and Ripple, though their price movements haven’t always mirrored Bitcoin’s trajectory. These fluctuations reflect the speculative nature of the market and the influence of the factors discussed previously. Analyzing historical price charts of these cryptocurrencies reveals a pattern of significant volatility, highlighting the risk associated with investing in this asset class.

Volatility Comparison: Cryptocurrencies vs. Traditional Asset Classes

Compared to traditional asset classes such as stocks and bonds, cryptocurrencies exhibit significantly higher volatility. The daily price swings in cryptocurrencies can be many times larger than those seen in established stock markets. This is largely due to the relatively young age of the cryptocurrency market, its smaller size, and the lack of robust regulatory frameworks. While stocks and bonds can experience volatility, their price movements are generally less dramatic and influenced by a wider range of factors, leading to a more stable, though potentially slower, growth trajectory. This stark contrast underscores the need for a risk-averse approach when investing in cryptocurrencies.

Hypothetical Portfolio: Impact of Volatility on Investment Strategies

Consider two hypothetical portfolios: Portfolio A, a conservative strategy investing 20% in Bitcoin and 80% in a diversified stock portfolio, and Portfolio B, an aggressive strategy investing 80% in Bitcoin and 20% in a diversified stock portfolio. During a period of Bitcoin price increase, Portfolio B would see significantly higher returns, but would also experience far greater losses during a market downturn. Portfolio A, while exhibiting lower returns during bullish periods, would be more resilient during bearish periods due to the stabilizing effect of the diversified stock portfolio. This example illustrates how different investment strategies can be significantly affected by the inherent volatility of cryptocurrencies.

Risk Profiles of Various Cryptocurrencies

| Cryptocurrency | Market Capitalization (USD) | Historical Volatility (Annualized) | Risk Profile |

|---|---|---|---|

| Bitcoin (BTC) | $500 Billion (example) | 80% (example) | High |

| Ethereum (ETH) | $200 Billion (example) | 100% (example) | Very High |

| Solana (SOL) | $20 Billion (example) | 150% (example) | Extremely High |

| Tether (USDT) | $80 Billion (example) | 20% (example) | Medium |

*Note: Market capitalization and volatility figures are examples and can fluctuate significantly. Actual data should be sourced from reliable financial information providers.*

Regulatory Uncertainty and Legal Risks

The cryptocurrency market, while experiencing explosive growth, operates within a largely undefined regulatory landscape. This lack of clarity presents significant challenges and risks for investors, ranging from potential legal battles to complete asset loss. The evolving nature of regulations across different jurisdictions adds another layer of complexity, demanding a cautious and informed approach to investment.

The current regulatory landscape for cryptocurrencies is a patchwork quilt of differing approaches across the globe. Some countries have embraced a relatively permissive stance, allowing for significant cryptocurrency activity with minimal regulation. Others have adopted a more cautious approach, implementing stricter regulations aimed at protecting investors and preventing illicit activities. Still others remain largely undecided, creating a regulatory vacuum that can be both an opportunity and a significant risk. This inconsistency makes navigating the legal complexities of cryptocurrency investment a challenging task.

Legal Challenges Facing Cryptocurrency Investors

Investors face a multitude of legal challenges. These include issues surrounding taxation, securities laws, and anti-money laundering (AML) regulations. The classification of cryptocurrencies as securities, commodities, or currencies varies by jurisdiction, significantly impacting tax obligations and regulatory compliance. Furthermore, the anonymity often associated with cryptocurrency transactions makes them attractive for illicit activities, leading to increased scrutiny and stricter AML regulations. Failure to comply with these regulations can result in significant financial penalties and legal repercussions.

Risks of Investing in Unregulated Cryptocurrencies

Investing in unregulated cryptocurrencies exposes investors to heightened risks. The lack of regulatory oversight increases the potential for fraud, scams, and market manipulation. Without established consumer protection mechanisms, investors may have limited recourse if their investments are lost due to fraudulent activities or unforeseen market events. Furthermore, the absence of regulatory frameworks can lead to greater price volatility and a higher likelihood of sudden market crashes. The potential for rug pulls, where developers abandon a project and abscond with investor funds, is also a significant concern.

Examples of Past Regulatory Actions Impacting Cryptocurrency Markets

Several regulatory actions have significantly impacted cryptocurrency markets. For example, the 2017 crackdown on Initial Coin Offerings (ICOs) by various regulatory bodies led to a significant downturn in the market. Similarly, the ongoing efforts by governments to regulate stablecoins and other cryptocurrencies have created uncertainty and impacted investor sentiment. The recent collapse of FTX, a major cryptocurrency exchange, highlighted the vulnerability of the market to mismanagement and lack of robust regulatory oversight. These events underscore the importance of understanding the regulatory environment before investing.

Potential Future Regulatory Scenarios and Their Implications

The future regulatory landscape for cryptocurrencies remains uncertain. Several potential scenarios exist, each with significant implications for investors. Increased regulatory scrutiny could lead to greater market stability and investor protection, but it could also stifle innovation and limit market growth. Conversely, a lack of clear regulations could continue to attract illicit activities and increase market volatility. A harmonized global regulatory framework would offer greater clarity and consistency, but achieving such an agreement remains a significant challenge. The impact of these different scenarios on investor portfolios could be substantial, necessitating a proactive and adaptable investment strategy.

Security Risks and Hacks

The decentralized nature of cryptocurrencies, while offering benefits, also introduces significant security vulnerabilities. Both exchanges, where users buy, sell, and trade crypto, and individual wallets, used to store crypto assets, are susceptible to various attacks, resulting in substantial financial losses for investors. Understanding these risks and implementing robust security measures is crucial for mitigating potential damage.

Hackers employ sophisticated techniques to exploit weaknesses in security protocols and human error to gain unauthorized access to cryptocurrency holdings. These attacks can target exchanges, leading to large-scale breaches, or individual users, resulting in the theft of their personal funds. The methods used range from highly technical exploits of software vulnerabilities to more social engineering-based attacks relying on deception.

Exchange Security Measures

The security measures employed by cryptocurrency exchanges vary significantly. Factors such as the exchange’s size, reputation, and investment in security infrastructure all play a role in their level of protection. Larger, more established exchanges generally invest more heavily in security, employing advanced technologies like multi-factor authentication (MFA), cold storage for a significant portion of their assets, and robust cybersecurity monitoring systems. Smaller exchanges may have less comprehensive security protocols, potentially leaving them more vulnerable to attacks. Some exchanges are known for their rigorous security practices, incorporating advanced encryption techniques and regular security audits. Others may lag behind in their security implementations, leaving users exposed to greater risk. Comparing security features across different exchanges before choosing one is a vital step in mitigating risk.

Methods Used by Hackers to Steal Cryptocurrencies

Hackers utilize a range of methods to steal cryptocurrencies. Phishing scams, where users are tricked into revealing their login credentials through deceptive emails or websites, remain a common tactic. Exploiting vulnerabilities in exchange software or wallet applications is another prevalent method. These vulnerabilities can range from simple coding errors to more complex exploits that allow hackers to gain unauthorized access to user accounts and funds. Furthermore, sophisticated attacks such as denial-of-service (DoS) attacks can disrupt the functionality of exchanges, making them unavailable to users and creating opportunities for theft. Simpler attacks, such as exploiting weak passwords or using malware to steal private keys, also remain effective. Advanced techniques, such as exploiting smart contract vulnerabilities, are also used to steal significant amounts of cryptocurrency.

Examples of Significant Cryptocurrency Hacks and Their Consequences

The history of cryptocurrencies is unfortunately punctuated by several high-profile hacks. The 2014 Mt. Gox hack, for example, resulted in the loss of hundreds of thousands of Bitcoins, significantly impacting the market and eroding trust in the exchange. The 2016 DAO hack, targeting a decentralized autonomous organization, highlighted vulnerabilities in smart contract technology and resulted in substantial losses for investors. More recently, numerous smaller exchanges have been targeted, demonstrating the ongoing threat of hacks to the cryptocurrency ecosystem. These events often lead to significant financial losses for users and damage to the reputation of the affected exchanges, highlighting the importance of robust security measures.

Security Best Practices for Cryptocurrency Investors

Investing in cryptocurrencies requires a proactive approach to security. A comprehensive security strategy should incorporate several key elements.

It is essential to use strong, unique passwords for all cryptocurrency accounts and exchanges. Employing multi-factor authentication (MFA) adds an extra layer of security, significantly reducing the risk of unauthorized access. Regularly updating software and security patches on all devices used to access cryptocurrency accounts is crucial to protect against known vulnerabilities. Storing cryptocurrencies in hardware wallets, which offer offline storage and enhanced security, is highly recommended for larger holdings. Being wary of phishing scams and other social engineering attacks is also vital. Users should always verify the authenticity of websites and emails before providing any personal or financial information. Diversifying cryptocurrency holdings across multiple exchanges and wallets can also reduce the impact of a single security breach. Finally, keeping up-to-date with the latest security threats and best practices is crucial for maintaining the safety of your investments.

Technological Risks and Scalability Issues

The cryptocurrency landscape is not without its technological hurdles. Beyond the price volatility and regulatory uncertainties, the underlying technology itself presents significant risks that can impact investor confidence and the overall health of the market. These risks stem from the inherent complexities of blockchain technology, its scalability limitations, and the potential for vulnerabilities in smart contracts. Understanding these technological challenges is crucial for any serious cryptocurrency investor.

The scalability of various blockchain networks is a critical factor influencing their ability to handle a large volume of transactions efficiently. This directly affects transaction speeds, costs, and overall user experience. Networks that struggle with scalability can lead to congestion, increased transaction fees, and slower confirmation times, impacting the usability and attractiveness of the cryptocurrency. This, in turn, can affect its price and adoption rate.

Blockchain Network Scalability

Different cryptocurrencies employ different technological approaches to address scalability. Bitcoin, for example, utilizes a relatively slow and energy-intensive proof-of-work consensus mechanism. This limits its transaction throughput compared to newer blockchains like Solana or Cardano, which employ more efficient consensus mechanisms like proof-of-stake. The choice of consensus mechanism directly impacts the speed, cost, and environmental impact of transactions. Ethereum, initially using proof-of-work, is transitioning to proof-of-stake (Ethereum 2.0) to improve scalability and energy efficiency. The success of this transition remains to be seen and presents its own set of risks. A failure to successfully transition could lead to network instability and potentially impact the value of ETH.

Smart Contract Vulnerabilities

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are a cornerstone of many blockchain applications, including decentralized finance (DeFi). However, vulnerabilities in smart contract code can be exploited by malicious actors, leading to significant financial losses. The infamous DAO hack in 2016, where millions of dollars worth of ETH were stolen due to a smart contract vulnerability, serves as a stark reminder of these risks. Thorough auditing and rigorous testing of smart contract code are crucial to mitigating these risks, but even the most meticulously reviewed code can contain unforeseen vulnerabilities. The complexity of smart contract code and the potential for unexpected interactions between different parts of the codebase make complete security extremely difficult to guarantee.

Technological Advancements Mitigating Risks

Several technological advancements are being explored to address these challenges. Layer-2 scaling solutions, such as Lightning Network for Bitcoin and various rollup solutions for Ethereum, aim to improve transaction speeds and reduce costs without altering the underlying blockchain’s core functionality. These solutions process transactions off-chain, reducing the load on the main blockchain. Furthermore, research into more energy-efficient consensus mechanisms and improved cryptographic techniques continues to offer potential solutions for enhancing security and scalability. The development and adoption of these technologies are ongoing processes, and their effectiveness remains to be fully tested in real-world conditions. The successful implementation and widespread adoption of these advancements are crucial for the long-term viability and stability of the cryptocurrency market.

Counterparty Risk and Scams

The cryptocurrency market’s decentralized nature, while offering benefits, also introduces significant counterparty risk and susceptibility to scams. Unlike traditional markets with established regulatory oversight, the crypto space often lacks robust mechanisms to protect investors from fraudulent activities or the failure of counterparties. Understanding these risks is crucial for navigating the complexities of cryptocurrency investments.

Investing in cryptocurrencies involves trusting various entities, from exchanges and custodians to project developers and individual sellers. The potential for failure or malicious intent from any of these parties presents substantial financial risk. This is especially true in the context of unregulated projects and initial coin offerings (ICOs).

Initial Coin Offerings (ICOs) and Unregulated Projects

ICOs, a fundraising mechanism for blockchain projects, have a history fraught with scams. Many ICOs lack transparency, fail to deliver on promised products or services, and operate with minimal regulatory oversight. Investors often lack the means to verify the legitimacy of the project, its technology, or the team behind it. This lack of due diligence creates a fertile ground for fraudulent schemes. The unregulated nature of many crypto projects amplifies this risk, leaving investors vulnerable to rug pulls, pump-and-dump schemes, and other manipulative tactics. Due diligence, thorough research, and understanding of the underlying technology are paramount to mitigating this risk.

Methods Used by Cryptocurrency Scammers

Scammers employ a variety of sophisticated methods to defraud cryptocurrency investors. These tactics often exploit the inherent volatility and lack of regulation in the market. Common techniques include: pump-and-dump schemes (artificially inflating the price of a cryptocurrency before selling it at a profit), phishing attacks (tricking investors into revealing their private keys or seed phrases), fake ICOs (promising unrealistic returns from non-existent projects), and rug pulls (developers abandoning a project and absconding with investors’ funds). Social engineering, utilizing false endorsements or celebrity impersonations, is also frequently used to build trust and lure victims. These scams often involve intricate websites and marketing campaigns designed to appear legitimate.

Examples of Prominent Cryptocurrency Scams

Several high-profile cryptocurrency scams have resulted in significant financial losses for investors. One example is the OneCoin scam, which defrauded investors of billions of dollars through a pyramid scheme disguised as a cryptocurrency investment opportunity. Another is the QuadrigaCX exchange collapse, where the death of the exchange’s founder resulted in the loss of millions of dollars in customer funds, raising questions about the security and transparency of cryptocurrency exchanges. These cases highlight the importance of thorough due diligence and careful selection of investment vehicles.

Risk Comparison Across Cryptocurrency Types

The risks associated with investing in different types of cryptocurrencies vary. Established cryptocurrencies like Bitcoin and Ethereum generally carry lower counterparty risk than newer, less-established altcoins. However, even well-known cryptocurrencies are not immune to market manipulation or security breaches. Altcoins, by their nature, are often more volatile and susceptible to scams due to their smaller market capitalization and less robust infrastructure. Investing in less-established cryptocurrencies significantly increases exposure to counterparty risk and fraud.

Red Flags to Identify Potential Scams

Before investing in any cryptocurrency project, it is essential to be aware of potential red flags. These indicators can help investors identify potential scams and avoid significant financial losses.

- Unrealistic promises of high returns with minimal risk.

- Lack of transparency regarding the project’s team, technology, or financials.

- Pressure to invest quickly or make decisions without proper research.

- Unprofessional website design or poor grammar and spelling.

- Anonymous or untraceable developers.

- Absence of a clear whitepaper outlining the project’s goals and technology.

- Negative reviews or warnings from other investors.

- Requests for personal information or private keys outside of secure channels.

- Promises of guaranteed profits or returns.

- Use of high-pressure sales tactics.

Loss of Private Keys and Irrecoverable Funds

Losing access to your private keys is akin to losing the keys to your house – except the house contains your cryptocurrency. This means complete and irreversible loss of access to your funds, rendering them essentially worthless. The consequences are severe, highlighting the critical importance of robust key management practices.

The consequences of losing private keys are straightforward: your cryptocurrency becomes inaccessible. There is no central authority, like a bank, that can retrieve your funds for you. No customer service representative can reset your password or unlock your account. Once lost, your digital assets are permanently gone. This can result in significant financial losses, depending on the amount of cryptocurrency held. The impact extends beyond monetary loss; it can also involve emotional distress and a loss of trust in the cryptocurrency ecosystem.

Private Key Security Measures

Protecting your private keys requires a multi-faceted approach. It’s not enough to simply write them down; you need a robust strategy that balances security with accessibility. This involves carefully considering where and how you store your keys, and implementing regular backups.

Methods of Storing Private Keys

Several methods exist for storing private keys, each with its own advantages and disadvantages. Hardware wallets, such as Ledger or Trezor devices, offer the highest level of security by storing your keys offline, protected from malware and internet attacks. These devices function as secure, dedicated storage units for your private keys. Software wallets, which are applications running on your computer or smartphone, offer convenience but pose greater security risks if your device is compromised. Paper wallets, where your private keys are printed on paper, offer an offline storage solution, but are vulnerable to physical damage or theft. Cloud-based storage should generally be avoided due to the inherent security risks associated with storing sensitive information online.

Backing Up and Recovering Private Keys

Backing up your private keys is crucial, but it must be done securely. Simply copying and pasting your keys into a document on your computer is not sufficient. A robust backup strategy involves multiple copies stored in different, secure locations. Consider using a combination of methods, such as storing one copy on a hardware wallet, another on a paper wallet, and potentially encrypting a third copy and storing it offline on a secure hard drive. Remember to always prioritize security over convenience when backing up your private keys. The process of recovering your keys should also be carefully planned and documented.

Securing Cryptocurrency Holdings: A Guide

The security of your cryptocurrency holdings hinges on proactive measures. Here’s a guide to help you safeguard your digital assets:

- Use a hardware wallet: Hardware wallets provide the strongest security for your private keys.

- Enable two-factor authentication (2FA): 2FA adds an extra layer of security to your accounts, making unauthorized access significantly more difficult.

- Regularly update your software: Keeping your software up-to-date patches security vulnerabilities that hackers could exploit.

- Use strong, unique passwords: Avoid using easily guessable passwords and use a password manager to help generate and securely store complex passwords.

- Be wary of phishing scams: Never click on suspicious links or provide your private keys to anyone.

- Diversify your holdings: Don’t put all your eggs in one basket. Spreading your investments across different cryptocurrencies and exchanges can mitigate risk.

- Keep your private keys offline: Never store your private keys on a device connected to the internet.

- Regularly back up your private keys: Use multiple backup methods and store them in secure, separate locations.

- Educate yourself: Stay informed about the latest security threats and best practices in cryptocurrency security.

Tax Implications and Reporting Requirements

Investing in cryptocurrencies introduces a new layer of complexity to your financial life, particularly concerning tax obligations. The tax treatment of cryptocurrency varies significantly across jurisdictions, making it crucial to understand the specific rules in your country of residence. Failure to comply with these regulations can lead to significant penalties.

Tax Implications of Cryptocurrency Investments

The tax implications of cryptocurrency transactions depend heavily on how you use them. Buying and selling cryptocurrencies for profit is generally considered a taxable event, similar to trading stocks. However, the specific tax rate applied will depend on your jurisdiction and your individual tax bracket. For example, in some countries, profits from cryptocurrency trading are taxed as capital gains, while in others they may be treated as ordinary income. Furthermore, using cryptocurrency to purchase goods or services is also a taxable event, with the value of the goods or services representing the taxable income. Mining cryptocurrency, on the other hand, may be treated as business income, leading to different tax implications. The frequency of your trades also matters; frequent trading might trigger stricter tax scrutiny.

Reporting Requirements for Cryptocurrency Transactions

Reporting requirements vary widely across jurisdictions. Many countries now require taxpayers to report cryptocurrency transactions on their annual tax returns. This usually involves providing details of all purchases, sales, and trades, including dates, amounts, and the cost basis of the cryptocurrencies. Some countries have specific forms or schedules for reporting cryptocurrency transactions, while others may require you to include this information within existing sections of your tax return. Failure to accurately report your cryptocurrency transactions can result in penalties, including back taxes, interest, and even legal action. It is important to maintain detailed records of all your cryptocurrency transactions, including transaction IDs, dates, and amounts, to ensure compliance.

Comparison of Cryptocurrency Tax Treatment to Traditional Assets

Cryptocurrencies are often compared to other assets like stocks and bonds, but their tax treatment is not always identical. Unlike stocks, which may have specific tax benefits like long-term capital gains rates, cryptocurrencies often fall under more general capital gains or income tax rules. The cost basis calculation for cryptocurrencies can also be more complex than for traditional assets, as it often involves tracking the acquisition cost of each individual unit, considering factors such as the timing and value of multiple purchases. Furthermore, the lack of standardized reporting mechanisms for cryptocurrencies across different exchanges adds to the complexity. For example, some countries allow for the offsetting of capital losses against capital gains, similar to traditional assets, while others may have restrictions.

Examples of Different Tax Scenarios

Consider these scenarios: An investor purchases Bitcoin for $1,000 and sells it a year later for $5,000. The $4,000 profit would be subject to capital gains tax in many jurisdictions. In contrast, if the same investor uses Bitcoin to purchase goods worth $1,000, they would still need to report the $1,000 equivalent as income. A different scenario could involve an investor receiving Bitcoin as payment for services rendered. The value of the Bitcoin received at the time of receipt is considered taxable income. Finally, if an investor mines Bitcoin and sells it immediately, the profit from the mining activity, along with the profit from selling the Bitcoin, would be taxable. The exact tax implications in each scenario would depend on the specific laws of the relevant jurisdiction.

Tax Regulations for Cryptocurrencies in Various Countries

| Country | Tax Treatment | Reporting Requirements | Specific Considerations |

|---|---|---|---|

| United States | Capital gains or ordinary income, depending on circumstances. | Report on Form 8949 and Schedule D. | Complex rules regarding cost basis and wash sales. |

| United Kingdom | Capital gains tax. | Report on Self Assessment tax return. | Specific rules apply to staking and mining. |

| Canada | Capital gains tax. | Report on T1 General Income Tax and Benefit Return. | Consideration of fair market value at time of acquisition and disposal. |

| Australia | Capital gains tax. | Report on tax return. | Specific rules for mining and staking rewards. |

Summary

Investing in cryptocurrencies presents a unique blend of opportunity and risk. While the potential for substantial profits is undeniable, the volatility, regulatory uncertainty, and security concerns necessitate a cautious approach. By thoroughly understanding the challenges Artikeld in this guide – from market fluctuations and technological limitations to security breaches and scams – investors can better manage their risk profiles and make more informed decisions. Ultimately, successful cryptocurrency investment hinges on diligent research, careful risk assessment, and a clear understanding of the potential pitfalls.

Quick FAQs

What is the best way to store my cryptocurrency?

The optimal storage method depends on your security needs and the amount of cryptocurrency you hold. Hardware wallets offer the highest level of security, while software wallets provide greater convenience. Consider diversifying your storage across multiple platforms.

How can I protect myself from cryptocurrency scams?

Be wary of unsolicited investment opportunities, promises of guaranteed returns, and high-pressure sales tactics. Thoroughly research any project before investing and only use reputable exchanges and wallets.

Are cryptocurrencies taxable?

Yes, cryptocurrency transactions are generally taxable. The specific tax implications vary significantly depending on your jurisdiction. Consult a tax professional for personalized advice.

What happens if I lose my private keys?

Losing your private keys means losing access to your cryptocurrency. There is typically no way to recover the funds. Prioritize secure key management practices.