Effectively managing your bank account is crucial for maintaining sound personal finances. This guide delves into the multifaceted world of bank account management, from the initial account setup and onboarding process to advanced features and services designed to optimize your financial well-being. We’ll explore strategies for budgeting, security measures to protect your funds, and efficient methods for handling transactions, all while highlighting the benefits and drawbacks of various banking platforms.

Understanding bank fees, navigating customer service, and safely closing or transferring accounts are also covered. Whether you’re a seasoned bank customer or just starting out, this comprehensive resource will equip you with the knowledge and tools necessary for confident and responsible bank account management.

Opening

Bank account management encompasses all activities related to overseeing and controlling your financial resources held within a bank. Effective management ensures your money is secure, accessible, and working for you, minimizing risks and maximizing opportunities. This involves a range of tasks, from monitoring transactions and balances to planning for future financial goals.

Effective bank account management hinges on several key aspects. These include regularly reconciling your account statements with your own records to identify any discrepancies, setting up a system for budgeting and tracking expenses, and understanding the fees and charges associated with your account. Proactive monitoring of your account activity for unauthorized transactions is crucial for security, as is choosing the right type of account to suit your individual financial needs. Finally, understanding and utilizing the available banking tools and services, such as online banking and mobile apps, can greatly simplify the process.

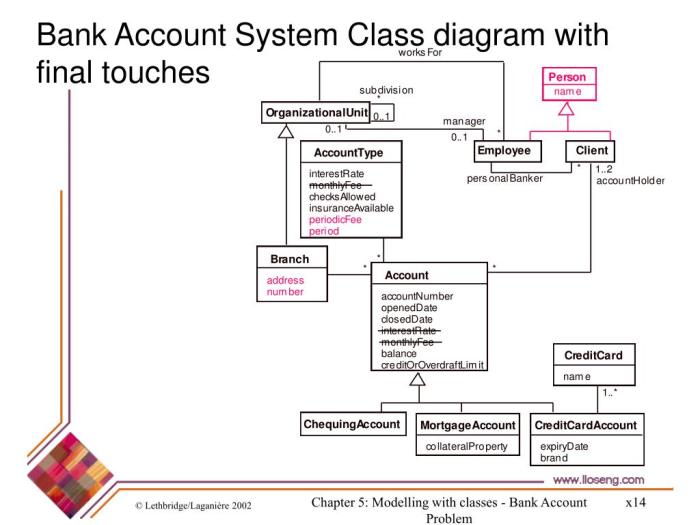

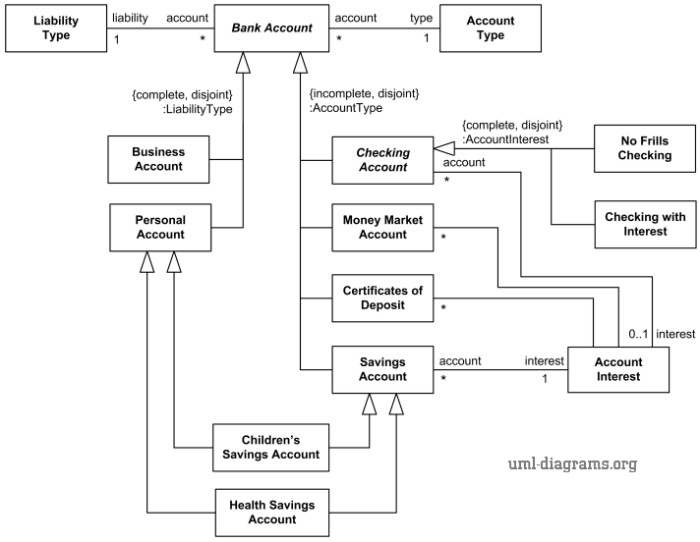

Types of Bank Accounts and Their Management Needs

Different bank accounts cater to various financial needs and, consequently, require different management approaches. A checking account, designed for everyday transactions, necessitates diligent monitoring of balances to avoid overdrafts and careful tracking of expenses to maintain sufficient funds. Savings accounts, on the other hand, prioritize accumulating funds and often benefit from setting up automatic transfers from a checking account to build savings consistently. Money market accounts, which often offer higher interest rates than regular savings accounts, may require a minimum balance and might involve more complex interest calculations that require careful attention. Finally, specialized accounts, such as retirement accounts (like 401(k)s or IRAs) or investment accounts, demand a more strategic approach, often involving long-term planning and careful consideration of investment options. Each account type requires a tailored management strategy to maximize its benefits and minimize potential risks.

Account Setup and Onboarding

Setting up a new bank account can seem daunting, but with a clear understanding of the process, it becomes straightforward. This section Artikels the steps involved, the necessary documentation, and provides a comparison of onboarding experiences across different banks. We’ll also guide you through setting up online banking access.

Opening a new bank account typically involves several key steps, each designed to verify your identity and ensure the security of your funds. These steps vary slightly depending on the bank and the type of account you are opening.

Documentation Required for Account Opening

Banks require specific documentation to verify your identity and address before opening an account. This helps prevent fraud and ensures compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Generally, you’ll need to provide government-issued photo identification, such as a driver’s license or passport, and proof of address, such as a utility bill or bank statement. Additional documentation may be required depending on the account type and the bank’s specific policies. For example, businesses opening accounts will need additional documentation related to their business registration.

Comparison of Onboarding Processes Across Different Banks

The account opening process differs significantly across banks. Some banks offer fully digital onboarding, allowing you to open an account entirely online through their website or mobile app. This typically involves completing an application form, uploading required documents, and verifying your identity through various methods such as video identification or linking your existing accounts. Other banks may require an in-person visit to a branch, involving filling out paper forms and presenting your documentation to a bank representative. Some banks offer a hybrid approach, allowing you to start the process online and complete it in person if necessary. The speed and efficiency of the onboarding process can vary considerably. For instance, a fully digital process might take only a few minutes, while an in-person visit could take considerably longer.

Step-by-Step Guide for Setting Up Online Banking Access

Once your account is opened, accessing it online provides convenient account management. The process typically involves these steps: First, you’ll receive login credentials, often by mail or email. Next, you’ll need to access the bank’s website or mobile app and log in using these credentials. You may be prompted to change your password upon your first login. Then, you’ll likely need to answer security questions or complete a multi-factor authentication process to further secure your account. Finally, once logged in, you can access your account information, make transactions, and manage your account settings. The specific steps may vary depending on the bank and the platform used. Some banks offer additional features such as mobile check deposit, bill pay, and budgeting tools.

Transactions and Budgeting

Effective bank account management involves understanding and managing your transactions to create and maintain a healthy budget. This section will guide you through different transaction types, methods for tracking your finances, and sample budgeting techniques using your bank account information.

Understanding Bank Transactions

Bank transactions represent any activity affecting your account balance. These activities are broadly categorized into deposits and withdrawals. Deposits increase your balance, while withdrawals decrease it. Transfers move funds between accounts, either within the same bank or to different institutions. A deposit might be a paycheck, a direct deposit from a client, or a cash deposit made at an ATM or bank branch. Withdrawals could include paying bills, making purchases with a debit card, or withdrawing cash. Transfers facilitate moving funds to savings accounts, paying off loans, or sending money to other individuals. Understanding these different transaction types is crucial for accurate financial tracking.

Sample Budget Incorporating Bank Account Transactions

A sample budget integrates your income and expenses tracked via your bank statements. Let’s consider a monthly budget:

| Income Source | Amount | Expense Category | Amount |

|————————–|————|———————–|————|

| Salary | $3,000 | Rent | $1,000 |

| Freelance Income | $500 | Utilities | $200 |

| Investment Dividends | $100 | Groceries | $300 |

| | | Transportation | $150 |

| | | Entertainment | $100 |

| | | Savings | $500 |

| | | Debt Repayment | $350 |

| Total Income | $3,600 | Total Expenses | $2,600 |

| Net Income (Savings) | $1,000 | | |

This example shows a balanced budget where income exceeds expenses, allowing for savings. Note that this is a simplified example, and your budget will need to reflect your individual income and expenses.

Tracking Income and Expenses Using Bank Statements

Bank statements provide a detailed record of all transactions, offering a valuable tool for tracking income and expenses. By reviewing your statement regularly, you can identify patterns in spending, monitor your progress towards financial goals, and catch any potential errors or fraudulent activities. Many banks also offer online banking features, allowing you to download your statements electronically and use budgeting apps to categorize your transactions automatically.

Common Transaction Types and Associated Fees

| Transaction Type | Description | Typical Fee | Notes |

|---|---|---|---|

| ATM Withdrawal (In-Network) | Withdrawing cash from your bank’s ATM. | $0.00 | Fees may vary depending on your account type. |

| ATM Withdrawal (Out-of-Network) | Withdrawing cash from a non-affiliated ATM. | $2.50 – $5.00 | Fees vary widely depending on the ATM provider and your bank. |

| Overdraft Fee | Fee charged when you spend more than available funds. | $35.00 – $40.00 | These fees can significantly impact your account balance. |

| Wire Transfer | Electronic transfer of funds between banks. | $25.00 – $50.00 | Fees vary depending on the amount transferred and banks involved. |

Security and Fraud Prevention

Protecting your bank account requires vigilance and understanding of potential threats. This section Artikels common security risks, preventative measures, and methods for identifying and reporting fraudulent activities. Taking proactive steps to safeguard your financial information is crucial for maintaining control over your finances.

Common Security Threats

Several threats can compromise bank account security. Phishing scams, where fraudulent emails or text messages attempt to obtain personal information, are prevalent. Malware, such as keyloggers that record keystrokes, can steal login credentials and account details. Skimming, the unauthorized copying of credit card information, can also lead to fraudulent transactions. Additionally, unauthorized access to online accounts through weak passwords or compromised devices poses a significant risk. Finally, social engineering tactics, manipulating individuals into revealing sensitive data, are increasingly sophisticated.

Best Practices for Protecting Bank Account Information

Strong passwords, incorporating a mix of uppercase and lowercase letters, numbers, and symbols, are essential. Regularly updating passwords and using different passwords for different accounts is highly recommended. Enabling two-factor authentication (2FA), which requires a second verification method like a code sent to your phone, adds an extra layer of security. Being cautious of suspicious emails and websites, verifying the sender’s legitimacy before clicking links, is crucial. Regularly reviewing bank statements for unauthorized transactions is vital. Furthermore, avoiding using public Wi-Fi for online banking, as these networks are often unsecured, is strongly advised. Keeping your antivirus software up-to-date and running regular scans will also help prevent malware infections.

Detecting and Reporting Fraudulent Activity

Regularly monitoring bank statements and online accounts for unusual activity is paramount. Any unfamiliar transactions should be investigated immediately. If fraudulent activity is suspected, contact your bank immediately to report the incident. Banks typically have dedicated fraud departments equipped to handle such situations. Preserve all relevant documentation, such as transaction records and communication with the bank, for future reference. Filing a police report may also be necessary, particularly in cases of significant financial loss.

Security Features Offered by Banks

Many banks offer various security features to protect their customers’ accounts. These include fraud alerts, which notify customers of potentially suspicious activity. Transaction limits can be set to restrict the amount that can be withdrawn or transferred within a specific period. Virtual cards, which generate temporary card numbers for online purchases, enhance security. Biometric authentication, such as fingerprint or facial recognition, provides an additional layer of protection for accessing online accounts. Furthermore, many banks offer security awareness training and resources to educate customers about common threats and preventative measures.

Online and Mobile Banking

Managing your finances has become increasingly convenient with the rise of online and mobile banking. These platforms offer a range of features designed to streamline banking tasks, but understanding their differences and potential drawbacks is crucial for effective and secure financial management. This section will compare the functionalities of online and mobile banking, highlighting the benefits and limitations of each, and providing guidance on secure usage.

Online and mobile banking share many core functionalities, such as checking account balances, viewing transaction history, and transferring funds. However, they differ in accessibility, features, and security considerations.

Online Banking Features and Functionalities

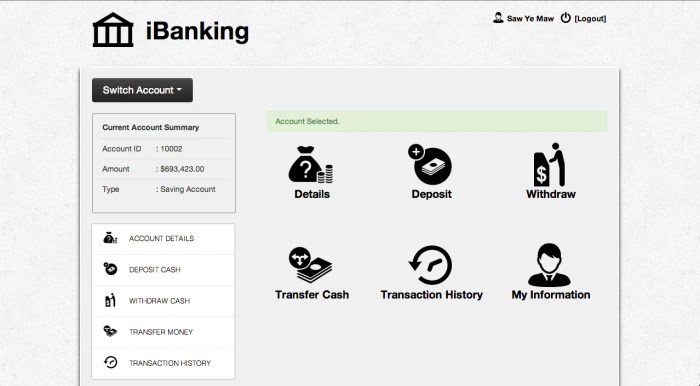

Online banking, accessed via a web browser, typically offers a broader range of features than mobile banking. These include detailed account history, advanced search capabilities for transactions, the ability to download transaction data in various formats (like CSV for spreadsheet use), and often more robust tools for budgeting and financial planning. Many online banking platforms also allow for scheduling recurring payments and managing multiple accounts across different financial institutions. The larger screen size generally makes navigation and data review easier.

Mobile Banking Features and Functionalities

Mobile banking, accessed through a dedicated app on a smartphone or tablet, prioritizes convenience and portability. While offering many of the same core functions as online banking (checking balances, transferring funds), mobile banking often incorporates features specifically designed for on-the-go access. These can include mobile check deposit, near-field communication (NFC) based payments, and location-based services for finding nearby ATMs or branches. The user interface is often designed for quick and easy access to essential information.

Benefits and Drawbacks of Online Banking

- Benefits: Comprehensive account management, detailed transaction history, robust budgeting tools, often better security features due to more complex authentication options.

- Drawbacks: Requires a computer and internet access, potentially less convenient for quick transactions compared to mobile banking, may not be as visually intuitive as mobile apps.

Benefits and Drawbacks of Mobile Banking

- Benefits: Convenience and portability, quick access to essential information, mobile check deposit, often user-friendly interface.

- Drawbacks: Smaller screen size can make detailed reviews more challenging, potentially fewer features than online banking, increased risk of security breaches if not properly secured.

Utilizing Online Banking for Various Tasks

Online banking simplifies many financial tasks. For example, paying bills often involves adding the payee’s information (name and account number) once, then scheduling recurring payments or one-time payments with ease. Account transfers between your own accounts or to external accounts (provided the receiving institution is supported) can be initiated with a few clicks, specifying the amount and account details. Many banks also offer direct deposit options for payroll or other regular income streams, all managed through the online platform.

Mobile Banking App Security Checklist

Before downloading and using any mobile banking app, it’s crucial to verify its security.

- Verify the App’s Authenticity: Download only from official app stores (Google Play Store or Apple App Store) to avoid malicious copies.

- Check App Permissions: Review the permissions requested by the app. Ensure it only requests access necessary for its functionality (e.g., access to your contacts might be unnecessary).

- Strong Password and Multi-Factor Authentication (MFA): Use a strong, unique password and enable MFA (e.g., one-time passwords via SMS or authenticator app) for enhanced security.

- Regular Software Updates: Keep the app updated to benefit from the latest security patches.

- Secure Device: Use a secure device with up-to-date operating system and antivirus software.

- Monitor Account Activity: Regularly review your account statements for any unauthorized transactions.

- Report Suspicious Activity: Immediately report any suspicious activity to your bank.

Customer Service and Support

Maintaining open communication and readily available support is crucial for a positive banking experience. We understand that banking can sometimes be complex, and we’re committed to providing various avenues for assistance and prompt resolution of any issues you may encounter. This section details our customer service channels, dispute resolution processes, and tips for effective communication.

Contacting Customer Service

Several channels are available to connect with our customer service representatives. You can reach us via phone, email, online chat, or in person at one of our branches. Our phone lines are staffed during extended hours, and our online chat offers immediate assistance during business hours. Email support provides a detailed record of your inquiry and response, and in-person assistance allows for a more personalized interaction. Choosing the best method depends on your preference and the urgency of your request.

Resolving Banking Disputes or Errors

Should you encounter a discrepancy in your account, such as an incorrect transaction, unauthorized charge, or billing error, our dispute resolution process is designed to provide a fair and efficient resolution. First, gather all relevant documentation, including transaction details, dates, and amounts. Contact customer service using your preferred method and clearly explain the situation. A dedicated representative will investigate the issue and provide updates on the progress of your claim. In most cases, resolution is achieved within a few business days. For more complex disputes, a formal written complaint may be required, which will be handled by our dedicated disputes team.

Tips for Effective Communication

Clear and concise communication is key to a swift resolution. When contacting customer service, have your account number readily available and clearly state the nature of your inquiry. Provide all relevant details, such as dates, amounts, and transaction references. Remain calm and polite throughout the interaction, even if you are frustrated. If you are not satisfied with the initial response, politely request to speak with a supervisor or escalate the issue to a higher level of support. Keeping a record of all communication, including dates, times, and the names of representatives you speak with, is helpful for tracking the progress of your request.

Common Customer Service Issues and Resolutions

Common issues include forgotten PINs, unauthorized transactions, and questions about account statements. Forgotten PINs are easily reset through our online banking portal or by contacting customer service. Unauthorized transactions require immediate reporting to prevent further losses; our fraud prevention team will investigate and provide guidance. Questions about account statements are typically addressed by reviewing the detailed transaction history available online or through a printed statement, and our representatives are available to clarify any unclear entries. In cases of significant discrepancies, our investigation team will perform a thorough review to ensure accuracy.

Account Closing and Transferring Funds

Closing a bank account and transferring funds are essential processes for managing your finances effectively. Understanding the procedures and implications involved ensures a smooth transition and avoids potential complications. This section details the steps involved in both processes, highlighting important considerations to ensure a seamless experience.

Closing a Bank Account

Closing a bank account involves a straightforward process, but it’s crucial to ensure all outstanding transactions are completed and funds are transferred before finalizing the closure. The steps typically involve contacting your bank, completing a closure form, and confirming the account’s closure. Failure to follow these steps correctly could lead to unexpected fees or difficulties accessing your funds.

Transferring Funds Between Bank Accounts

Transferring funds between bank accounts is a common practice, often used for managing expenses, saving, or paying bills. This can be done through various methods, including online banking platforms, mobile apps, or by visiting a branch in person. Each method offers a convenient and secure way to move funds between accounts, either within the same bank or between different financial institutions. It’s important to note that transfer times may vary depending on the method used and the institutions involved.

Implications of Closing an Account Before Paying Off Debts

Closing a bank account before settling all outstanding debts can have serious financial repercussions. This action could result in late payment fees, damage to your credit score, and even legal action from creditors. It’s imperative to ensure all debts linked to the account are cleared before initiating the closure process. Failure to do so can significantly impact your financial standing and potentially lead to further financial difficulties.

Checklist for Closing a Bank Account

Before initiating the closure process, it’s advisable to meticulously review your account to avoid unforeseen issues. This checklist will help streamline the procedure and ensure a smooth transition.

- Verify the absence of any outstanding direct debits or standing orders.

- Confirm that all pending transactions have been processed.

- Transfer all remaining funds to another account.

- Obtain confirmation of the account closure from the bank in writing.

- Update your records with the new account details (if applicable).

- Notify relevant parties, such as employers or creditors, of the account closure and provide updated banking information.

Understanding Bank Fees and Charges

Managing your bank account effectively involves understanding the associated costs. Bank fees can significantly impact your finances, so it’s crucial to be aware of what you’re paying and how to minimize these expenses. This section will detail common bank fees, compare fee structures across different banks, and offer strategies to reduce your overall banking costs.

Types of Bank Fees

Banks levy various fees to cover operational costs and administrative services. Common fees include monthly maintenance fees, which are recurring charges for simply holding an account. Overdraft fees are charged when you spend more money than is available in your account. Other fees may include ATM fees (for using out-of-network ATMs), wire transfer fees, insufficient funds fees (similar to overdraft fees), foreign transaction fees (for transactions made in foreign currencies), and stop payment fees (for stopping a check payment). Late payment fees are also common for loans or credit card payments. Account closure fees may be applied when closing an account.

Comparing Fee Structures Across Banks

Bank fee structures vary considerably. Some banks offer free checking accounts with minimal fees, while others charge substantial fees for basic services. Large national banks often have more complex fee schedules compared to smaller, local banks or online-only banks. Carefully comparing fee schedules is essential before choosing a bank. Factors such as minimum balance requirements, average monthly balance requirements, and the types of accounts offered (checking, savings, etc.) all play a role in determining the overall cost. It is advisable to compare fee schedules from several banks to find the best fit for your financial needs and habits.

Strategies for Minimizing Bank Fees

Several strategies can help minimize bank fees. Maintaining a minimum balance required to waive monthly maintenance fees is a common approach. Using your bank’s ATMs or those within its network can avoid ATM fees. Careful budgeting and monitoring your account balance can prevent overdraft fees. Choosing an account with a low or no monthly maintenance fee is crucial. Exploring options like online-only banks, which often have lower fees, is another viable strategy. Considering the overall package of services offered relative to the fees charged is important for making an informed decision.

Comparison of Bank Fees

The following table compares the fees charged by three hypothetical banks – Bank A, Bank B, and Bank C. Remember that these are examples and actual fees may vary. Always check the current fee schedule directly with the bank.

| Fee Type | Bank A | Bank B | Bank C |

|---|---|---|---|

| Monthly Maintenance Fee | $10 (waived with $1000 minimum balance) | $5 (waived with $500 minimum balance) | $0 |

| Overdraft Fee | $35 | $30 | $25 |

| ATM Fee (out-of-network) | $2.50 | $2.00 | $1.50 |

| Wire Transfer Fee | $25 | $20 | $15 |

Advanced Features and Services

Many banks offer advanced features beyond basic account management, designed to help you streamline your finances and achieve your financial goals. These tools can significantly improve your financial well-being by automating savings, simplifying budgeting, and providing convenient payment options. Taking advantage of these features can lead to better financial organization and potentially higher returns on your savings.

Many banks offer a range of advanced features designed to simplify financial management and help customers reach their financial objectives. These services often integrate seamlessly with existing account functionalities, providing a comprehensive suite of tools for personal finance management.

Automated Savings Plans

Automated savings plans allow you to automatically transfer a predetermined amount of money from your checking account to a savings account at regular intervals. This removes the need for manual transfers, making saving consistent and effortless. For example, you could set up a weekly transfer of $50, or a monthly transfer of $200, depending on your budget and savings goals. The benefit is consistent saving without requiring constant effort, fostering the habit of saving and helping you reach your financial goals faster.

Investment Options

Some banks offer investment options directly through their online banking platforms. This allows customers to easily invest in various instruments like mutual funds, stocks, or bonds, often with minimal fees. The convenience of managing investments alongside your everyday banking streamlines your financial life. For example, a customer might choose to invest a portion of their savings in a low-cost index fund, diversifying their portfolio and aiming for long-term growth. This integrates investment management into the existing banking platform, reducing the need for separate accounts and management processes.

Budgeting and Financial Planning Tools

Many banks provide budgeting tools and financial planning resources that help you track your spending, set financial goals, and monitor your progress. These tools often offer features such as expense categorization, personalized financial reports, and goal-setting functionalities. For example, a user could input their monthly income and expenses, and the tool would automatically categorize transactions and generate a visual representation of their spending habits. This can identify areas where spending can be reduced, facilitating better financial decision-making. This detailed analysis helps users gain a clear picture of their financial health and make informed decisions about their spending and saving habits.

Recurring Payments

Setting up recurring payments simplifies the process of paying regular bills, such as utilities, subscriptions, or loan payments. This automated payment system ensures timely payments and avoids late fees. You can schedule recurring payments directly through your online banking platform, specifying the amount, frequency, and payee. For instance, a customer could set up recurring payments for their monthly mortgage, ensuring the payment is made on time every month without manual intervention. This eliminates the risk of forgetting payments and the associated penalties, promoting better financial organization and peace of mind.

Closure

Mastering bank account management is a journey, not a destination. By understanding the intricacies of account setup, transaction processing, security protocols, and available customer support channels, you can establish a robust financial foundation. This guide has provided a framework for navigating the complexities of banking, empowering you to make informed decisions and proactively manage your financial resources. Remember to regularly review your account activity, stay updated on security best practices, and leverage the advanced features offered by your bank to maximize your financial well-being.

Expert Answers

What happens if I lose my debit card?

Immediately contact your bank to report the loss and request a replacement card. They will likely cancel your old card to prevent unauthorized use.

How often should I reconcile my bank statements?

Ideally, reconcile your statements at least monthly to catch any discrepancies or errors early.

What is overdraft protection, and how does it work?

Overdraft protection is a service that covers transactions exceeding your account balance. It typically involves linking a savings account or credit line to your checking account. However, fees often apply.

Can I open a bank account online?

Many banks offer online account opening, simplifying the process and eliminating the need for in-person visits. However, specific requirements may vary.