Navigating the complex world of corporate taxation can feel like traversing a labyrinth. Understanding the intricacies of tax structures, deductions, and international regulations is crucial for businesses aiming to maximize profitability and ensure compliance. This guide provides a comprehensive overview of corporate tax strategies, empowering businesses to make informed decisions and optimize their financial health.

From choosing the optimal corporate structure (C-corp, S-corp, or LLC) to leveraging tax deductions and credits, we explore practical strategies for minimizing tax liabilities and maximizing financial returns. We’ll delve into international tax planning, considering the unique challenges faced by multinational corporations, and discuss the importance of proactive tax compliance and audit preparation. The evolving landscape of corporate taxation, including emerging trends and the influence of globalization and digitalization, will also be examined.

Understanding Corporate Tax Structures

Choosing the right corporate tax structure is a crucial decision for any business, significantly impacting its tax liabilities and long-term financial health. The structure you select dictates how your business is taxed, its administrative burden, and its liability exposure. Understanding the nuances of each structure is paramount to making an informed choice.

Corporate Tax Structures: C-Corporations, S-Corporations, and LLCs

Three common corporate tax structures are C-corporations, S-corporations, and limited liability companies (LLCs). Each offers distinct tax implications, advantages, and disadvantages. Selecting the optimal structure depends heavily on factors like the business’s size, anticipated profitability, and the number of owners.

C-Corporations

C-corporations are considered separate legal entities from their owners, offering limited liability protection. This means the personal assets of the shareholders are shielded from business debts and lawsuits. However, C-corporations face double taxation: the corporation pays taxes on its profits, and shareholders pay taxes again on any dividends received. This can significantly reduce overall profitability compared to other structures. Large, established companies often choose this structure due to its established legal framework and access to capital markets.

S-Corporations

S-corporations, unlike C-corporations, avoid double taxation. Profits and losses are passed through directly to the owners’ personal income tax returns, eliminating the corporate-level tax. This structure is popular among small and medium-sized businesses seeking to minimize tax burdens. However, there are limitations on the number and type of shareholders allowed, making it less suitable for larger, more complex businesses. The IRS has strict rules regarding S-corp eligibility.

LLCs

LLCs offer the flexibility to choose how they’re taxed. They can elect to be taxed as a sole proprietorship, partnership, S-corporation, or C-corporation. This adaptability is a major advantage, allowing businesses to tailor their tax structure to their specific circumstances and optimize tax efficiency. Like C-corporations, LLCs provide limited liability protection to their owners. The choice of taxation method significantly influences the overall tax burden.

Comparison of C-Corps, S-Corps, and LLCs

| Feature | C-Corporation | S-Corporation | LLC |

|---|---|---|---|

| Taxation | Double taxation (corporate and shareholder level) | Pass-through taxation | Flexible; can choose pass-through or C-corp taxation |

| Liability | Limited liability | Limited liability | Limited liability |

| Shareholder Restrictions | No restrictions | Strict restrictions on shareholder type and number | No restrictions (generally) |

| Administrative Complexity | High | Moderate | Moderate to High (depending on chosen tax structure) |

Tax Deductions and Credits

Understanding available tax deductions and credits is crucial for minimizing a corporation’s tax liability. Effectively leveraging these provisions can significantly impact a company’s bottom line, freeing up capital for reinvestment and growth. This section will explore common deductions, the specifics of claiming research and development credits, the implications of depreciation and amortization, and examples of specific tax credits.

Common Corporate Tax Deductions

Businesses can deduct various expenses from their gross income to arrive at their taxable income. These deductions reduce the amount of profit subject to tax. Common deductible expenses include salaries and wages, rent, utilities, office supplies, marketing and advertising costs, and interest on business loans. The specifics of what is deductible and the limitations on those deductions are governed by tax law and can be complex. It’s important to maintain accurate records of all business expenses to support deduction claims during tax filings.

Research and Development Tax Credits

Research and Development (R&D) tax credits incentivize businesses to invest in innovation. To claim these credits, companies must demonstrate that they incurred qualified research expenses. These expenses typically include salaries of researchers, costs of materials consumed in the research process, and contract research expenses. Crucially, the research must meet specific criteria defined by the relevant tax authorities, often involving the pursuit of new or improved products, processes, or technologies. The credit amount is usually a percentage of qualified R&D expenses, and the exact percentage can vary depending on jurisdiction and specific regulations. Detailed documentation, including project proposals, progress reports, and expense records, is essential for successful claim substantiation.

Depreciation and Amortization

Depreciation and amortization allow businesses to deduct the cost of long-term assets over their useful life. Depreciation applies to tangible assets like machinery and equipment, while amortization applies to intangible assets such as patents and copyrights. Several methods exist for calculating depreciation and amortization, each with its own implications for tax liability. Choosing the appropriate method can significantly influence the timing and amount of tax deductions. For example, accelerated depreciation methods allow for larger deductions in the early years of an asset’s life, while straight-line depreciation spreads the deduction evenly over the asset’s lifespan.

Examples of Specific Tax Credits

Several tax credits are available to businesses, depending on their activities and location. For instance, the work opportunity tax credit incentivizes hiring individuals from specific disadvantaged groups. Eligibility criteria include meeting specific employment requirements and documentation of the employee’s status. Another example is the investment tax credit, which encourages investments in certain types of equipment or infrastructure. This credit often depends on the type of investment made and may have limitations on the amount of credit that can be claimed. The availability and specifics of these credits can vary significantly by jurisdiction and are subject to change.

Hypothetical Scenario: Impact of Deductions on Tax Burden

Let’s consider a hypothetical company, “InnovateTech,” with a gross income of $1 million. Without considering any deductions or credits, assuming a 25% corporate tax rate, their tax liability would be $250,000. However, if InnovateTech has $200,000 in deductible expenses (salaries, rent, etc.) and qualifies for a $50,000 R&D tax credit, their taxable income reduces to $750,000 ($1,000,000 – $200,000). Applying the 25% tax rate to this reduced income results in a tax liability of $187,500 ($750,000 * 0.25). Further reducing this by the $50,000 R&D credit yields a final tax liability of $137,500. This example illustrates the significant impact that deductions and credits can have on a company’s overall tax burden. Proper planning and accurate record-keeping are vital to maximizing these benefits.

International Tax Planning

Navigating the complex landscape of international taxation is a critical aspect of strategic financial planning for multinational corporations (MNCs). The globalized nature of business creates significant challenges, requiring careful consideration of diverse tax laws, regulations, and treaties. Effective international tax planning aims to minimize tax liabilities while ensuring compliance with all applicable legal frameworks.

Challenges of International Taxation for Multinational Corporations

Multinational corporations face numerous challenges in international taxation. These include differing tax rates across jurisdictions, complex transfer pricing rules, the potential for double taxation, and the administrative burden of complying with multiple tax systems. Inconsistencies in tax laws and interpretations between countries can lead to significant uncertainty and increased compliance costs. Furthermore, the ever-evolving nature of international tax regulations necessitates ongoing monitoring and adaptation of tax strategies. For example, a company with manufacturing in one country, sales offices in another, and a headquarters in a third, faces a significant challenge in accurately allocating profits and expenses for tax purposes across each jurisdiction. This complexity often necessitates specialized tax expertise and sophisticated planning.

Strategies for Minimizing International Tax Liabilities

Several strategies can help MNCs minimize their international tax liabilities. These include utilizing tax treaties to reduce or eliminate double taxation, optimizing the location of intellectual property, leveraging tax incentives offered by various governments, and structuring international transactions efficiently. Careful consideration of the legal and tax implications of foreign investment, including the choice of legal entity structure in different countries, is paramount. For instance, establishing regional headquarters in countries with favorable tax regimes can significantly reduce the overall tax burden. Similarly, strategically allocating intellectual property rights can shift profits to lower-tax jurisdictions, though this must be done in compliance with transfer pricing regulations.

Impact of Transfer Pricing on Tax Obligations

Transfer pricing, the pricing of goods, services, and intangible assets transferred between related entities in different jurisdictions, has a significant impact on a company’s tax obligations. Tax authorities worldwide scrutinize transfer pricing arrangements to ensure that they reflect arm’s-length transactions, meaning the prices would be consistent with those negotiated between independent parties. Non-compliance with arm’s-length principles can result in significant tax adjustments and penalties. Companies must maintain robust transfer pricing documentation, demonstrating the rationale behind their pricing methodologies and ensuring consistency with the Organisation for Economic Co-operation and Development (OECD) guidelines. Failure to do so can lead to disputes with tax authorities in multiple jurisdictions, potentially resulting in substantial financial losses.

Comparison of Tax Treaties and Their Effects on Corporate Taxation

Tax treaties, bilateral agreements between countries, aim to avoid double taxation and promote international tax cooperation. These treaties often include provisions for reducing withholding taxes on dividends, interest, and royalties, as well as providing mechanisms for resolving tax disputes. The specific terms and conditions of each treaty vary, impacting the tax obligations of MNCs operating in the respective countries. For example, a treaty between the US and the UK might stipulate a reduced withholding tax rate on dividends paid from a UK subsidiary to a US parent company. Understanding the intricacies of these treaties is crucial for optimizing tax efficiency in cross-border operations. Differences in the scope and specific provisions of these treaties necessitate careful analysis on a case-by-case basis.

Key Considerations for Businesses Operating Across Multiple Countries

Effective international tax planning requires careful consideration of several key factors.

- Tax Jurisdiction: Determining the tax residency of the business and its subsidiaries.

- Tax Rates and Regulations: Understanding the specific tax rates and regulations in each jurisdiction.

- Tax Treaties: Utilizing tax treaties to minimize double taxation.

- Transfer Pricing: Ensuring compliance with arm’s-length principles.

- Withholding Taxes: Managing withholding taxes on cross-border payments.

- Tax Compliance: Meeting all filing and reporting requirements in each jurisdiction.

- Currency Fluctuations: Accounting for the impact of currency fluctuations on tax liabilities.

- Political and Economic Risks: Assessing the political and economic stability of each operating country.

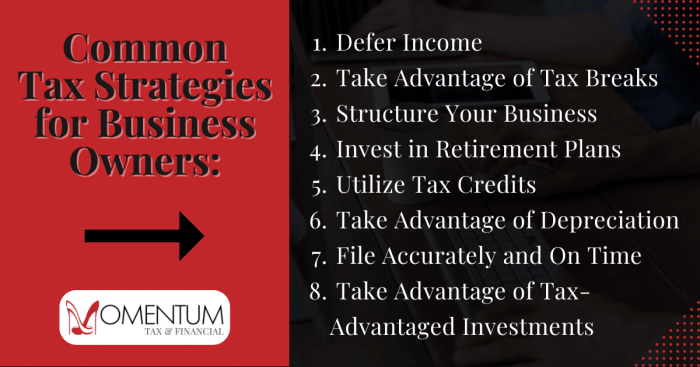

Tax Optimization Strategies

Effective tax planning is crucial for enhancing a company’s financial performance. By strategically minimizing tax liabilities within legal boundaries, businesses can free up capital for reinvestment, expansion, research and development, or increased shareholder dividends, ultimately boosting profitability and shareholder value. This section explores key strategies and the importance of professional guidance in this area.

Improved Financial Performance Through Tax Planning

Strategic tax planning directly impacts a company’s bottom line. Reducing tax burdens increases net income, improving profitability ratios and enhancing the company’s overall financial health. This freed-up capital can then be used to fund growth initiatives, leading to increased market share and long-term sustainability. For example, a company successfully utilizing tax credits for research and development might allocate the resulting savings towards hiring additional engineers, accelerating innovation and securing a competitive edge. Conversely, neglecting tax optimization can lead to missed opportunities and reduced competitiveness.

Tax-Efficient Investment Strategies for Corporations

Several investment strategies can minimize a corporation’s tax liability. These strategies often involve leveraging tax deductions and credits associated with specific investments. For instance, investing in qualified retirement plans for employees offers tax advantages for both the employer and the employees, reducing taxable income. Similarly, investing in energy-efficient equipment or renewable energy sources may qualify for tax credits, further reducing the overall tax burden. Another example is the strategic use of depreciation methods to accelerate the write-off of assets, lowering taxable income in the early years of an asset’s life.

The Role of Tax Advisors in Developing and Implementing Tax Strategies

Experienced tax advisors play a pivotal role in developing and implementing effective tax strategies. They possess in-depth knowledge of tax laws and regulations, allowing them to identify opportunities for tax optimization that might be missed by internal teams. Their expertise extends to proactively adapting strategies to changes in tax legislation, ensuring continued compliance and maximizing tax benefits. Tax advisors also provide crucial guidance on complex tax issues, such as international tax planning and transfer pricing, mitigating potential risks and ensuring compliance with all relevant regulations. They act as a crucial liaison between the company and the tax authorities, ensuring smooth and efficient tax compliance processes.

Accurate Record-Keeping for Tax Compliance

Maintaining accurate and comprehensive financial records is paramount for tax compliance. Meticulous record-keeping simplifies the tax preparation process, reduces the risk of errors, and minimizes the potential for audits and penalties. This includes diligently documenting all financial transactions, receipts, invoices, and supporting documentation related to tax deductions and credits. Regular reconciliation of financial records with tax filings further enhances accuracy and minimizes the risk of discrepancies. Utilizing accounting software and engaging qualified accounting professionals can significantly streamline the record-keeping process and ensure the accuracy of financial information.

Implementing a Comprehensive Tax Optimization Plan: A Step-by-Step Guide

Implementing a comprehensive tax optimization plan requires a systematic approach.

- Assess Current Tax Situation: Begin by thoroughly reviewing the company’s current tax position, identifying areas of potential tax liability and opportunities for optimization.

- Set Clear Objectives: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for tax optimization. This might include reducing the overall tax burden by a certain percentage or freeing up a specific amount of capital for reinvestment.

- Develop a Strategic Plan: Based on the assessment and objectives, develop a detailed plan outlining specific strategies to achieve the desired outcomes. This plan should include timelines, responsibilities, and key performance indicators (KPIs).

- Implement the Plan: Put the plan into action, ensuring that all necessary steps are taken to implement the chosen strategies. This may involve making changes to accounting practices, investment strategies, or internal processes.

- Monitor and Evaluate: Regularly monitor the progress of the plan, tracking KPIs and making adjustments as needed. This ensures that the plan remains effective and aligned with the company’s evolving needs and tax environment.

- Seek Professional Advice: Throughout the process, seek expert guidance from qualified tax advisors to ensure compliance and maximize the effectiveness of the tax optimization strategies.

Tax Compliance and Audits

Maintaining tax compliance is crucial for the long-term health and stability of any corporation. Failure to comply can result in significant financial penalties and reputational damage. Understanding the procedures involved in filing tax returns, responding to audits, and preventing common mistakes is vital for effective tax management.

Corporate Tax Return Filing Procedures

Accurate and timely filing of corporate tax returns is paramount. This involves gathering all necessary financial documents, including profit and loss statements, balance sheets, and supporting schedules. These documents must be meticulously reviewed for accuracy and completeness. The relevant tax forms must then be completed and submitted to the appropriate tax authority by the designated deadline. Extensions may be available in certain circumstances, but it’s crucial to apply for them well in advance. Utilizing tax preparation software or engaging a qualified tax professional can significantly improve accuracy and efficiency in this process. Late filings often incur penalties, emphasizing the importance of careful planning and timely action.

Responding to a Tax Audit

A tax audit involves a detailed examination of a company’s financial records by the tax authorities. Responding effectively requires organization and cooperation. This includes compiling and readily providing all requested documentation, maintaining open communication with the auditors, and accurately addressing any questions or concerns raised. It’s advisable to engage a tax professional to assist in navigating the audit process, ensuring that all information is presented clearly and accurately. Understanding the audit process, including the rights and responsibilities of both the taxpayer and the auditor, is essential for a successful outcome. Failure to cooperate fully can lead to significant penalties.

Common Tax Preparation Mistakes and Avoidance Strategies

Several common mistakes can lead to tax penalties and complications. These include inaccurate record-keeping, neglecting to claim eligible deductions, misclassifying expenses, and failing to file on time. Implementing robust accounting systems, regularly reconciling bank statements, and seeking professional tax advice can significantly reduce the likelihood of such errors. Staying updated on current tax laws and regulations is also critical. Proactive tax planning, involving a thorough review of financial records before filing, can help identify and rectify potential issues.

Penalties for Tax Non-Compliance

Non-compliance with tax laws can result in a range of penalties, including late filing penalties, accuracy-related penalties, and interest charges on underpayments. The severity of penalties can vary depending on the nature and extent of the non-compliance. In some cases, criminal charges may also be filed. Understanding the potential penalties serves as a strong incentive for maintaining strict tax compliance. Proactive measures, such as thorough record-keeping and seeking professional tax advice, are vital in mitigating the risk of penalties. For example, a company failing to file its tax return by the deadline might face a penalty equal to a percentage of the unpaid tax.

Best Practices for Maintaining Accurate and Auditable Financial Records

Maintaining accurate and auditable financial records is essential for both tax compliance and effective business management. This includes using a reliable accounting system, consistently recording all financial transactions, and regularly reconciling accounts. Implementing a system of internal controls, such as segregation of duties, can further enhance accuracy and prevent errors. Proper documentation of all transactions, including invoices, receipts, and bank statements, is crucial. Regularly reviewing financial records for accuracy and completeness is a vital preventative measure. Storing records securely, both physically and electronically, is essential for protecting sensitive information. A well-organized and documented system simplifies the tax filing process and facilitates a smooth audit.

Emerging Trends in Corporate Taxation

The landscape of corporate taxation is in constant flux, driven by globalization, technological advancements, and evolving societal priorities. Understanding these emerging trends is crucial for businesses to adapt their strategies and maintain tax compliance. This section will explore key developments and their implications for corporate tax planning.

Globalization’s Impact on Corporate Tax Strategies

Globalization has significantly impacted corporate tax strategies, leading to increased complexity and the need for sophisticated international tax planning. The rise of multinational corporations (MNCs) with operations across numerous jurisdictions necessitates navigating diverse tax laws and regulations. Transfer pricing, the allocation of profits and expenses between related entities in different countries, has become a critical area of focus for tax authorities worldwide, leading to increased scrutiny and the implementation of stricter rules to prevent profit shifting. For example, the OECD’s Base Erosion and Profit Shifting (BEPS) project aims to address these challenges through international cooperation and the development of standardized guidelines. This necessitates a proactive approach to international tax planning, involving careful consideration of tax treaties, permanent establishment rules, and the application of various tax regimes.

Digitalization’s Effects on Corporate Tax Compliance

The digital transformation of businesses has profoundly impacted tax compliance. The increased reliance on digital platforms and data analytics has created both opportunities and challenges. On one hand, digital tools streamline processes, automate tax calculations, and enhance data accuracy. On the other hand, the vast amounts of data generated necessitate robust systems for data management, security, and compliance. Tax authorities are increasingly using data analytics to identify potential tax risks and non-compliance. Real-time reporting requirements and the use of artificial intelligence (AI) in tax audits are becoming more prevalent, demanding businesses to adopt advanced technology and processes to ensure efficient and accurate tax reporting. For instance, the implementation of e-invoicing systems and digital tax platforms has become commonplace in many countries, forcing businesses to adapt their internal systems accordingly.

The Growing Importance of ESG Factors in Tax Planning

Environmental, Social, and Governance (ESG) factors are increasingly influencing corporate tax strategies. Investors and stakeholders are demanding greater transparency and accountability regarding a company’s environmental and social impact. Tax incentives and regulations are emerging that encourage environmentally sustainable practices. Companies that demonstrate strong ESG performance may find themselves eligible for tax credits or deductions related to investments in renewable energy, carbon capture technologies, or social initiatives. Conversely, companies with poor ESG performance may face increased scrutiny from tax authorities and reputational damage, potentially affecting their access to capital and investor confidence. For example, several jurisdictions are implementing carbon taxes or emissions trading schemes, influencing corporate tax liabilities based on environmental impact.

Forecast of Future Developments in Corporate Taxation

Predicting the future of corporate taxation is challenging, but several trends suggest potential developments. The ongoing focus on international tax cooperation and the implementation of BEPS measures will likely continue to shape the global tax landscape. Further advancements in digital technologies will likely lead to greater automation and data-driven tax administration. The integration of ESG considerations into tax policy will probably become more pronounced, with more incentives and regulations aimed at promoting sustainable practices. Increased use of AI and machine learning by tax authorities will enhance their ability to detect tax evasion and ensure compliance. We can expect a continued shift towards more transparent and globally coordinated tax systems, aiming to reduce tax avoidance and ensure a fairer distribution of tax burdens. The ongoing debate around digital taxation of multinational technology companies will also likely shape future tax legislation.

Final Review

Effective corporate tax planning is not merely about minimizing tax burdens; it’s about strategically aligning tax obligations with overall business objectives. By understanding the various tax structures, deductions, and international regulations, businesses can optimize their financial performance and achieve long-term sustainable growth. Proactive tax compliance and a thorough understanding of emerging trends are vital for navigating the ever-changing tax landscape and ensuring continued success.

FAQ Guide

What is the difference between a C-corp and an S-corp?

A C-corp is a separate legal entity taxed independently, while an S-corp passes its income directly to its owners, avoiding double taxation. The choice depends on factors like ownership structure and profit distribution.

How often should I review my corporate tax strategy?

Regular review, ideally annually, is recommended to account for changes in legislation, business operations, and market conditions. A proactive approach ensures your strategy remains aligned with your goals.

What are the penalties for late tax filing?

Penalties for late filing vary depending on jurisdiction and the extent of the delay. They can include significant financial fines and interest charges. Prompt filing is crucial.

Can I deduct home office expenses?

Yes, if you meet the IRS requirements for a dedicated and regularly used home office space used exclusively for business purposes. Detailed record-keeping is essential for substantiating these deductions.