Financial literacy education is crucial for individual well-being and societal prosperity. Understanding personal finances empowers individuals to make informed decisions about budgeting, saving, investing, and debt management, ultimately leading to improved economic stability and reduced financial stress. This exploration delves into the core components of effective financial literacy education, examining its importance across various age groups and exploring innovative teaching methods and resources.

We will investigate the societal benefits of widespread financial literacy, contrasting them with the negative consequences of financial illiteracy. The discussion will also cover effective assessment methods, addressing challenges in delivering education to underserved populations, and showcasing successful program examples. Ultimately, the goal is to highlight the transformative power of financial literacy education in building a more financially secure future.

Defining Financial Literacy Education

Financial literacy education equips individuals with the knowledge and skills necessary to make informed financial decisions throughout their lives. It’s about understanding money management, from budgeting and saving to investing and borrowing responsibly. A well-rounded approach empowers individuals to achieve their financial goals and navigate the complexities of the modern financial landscape.

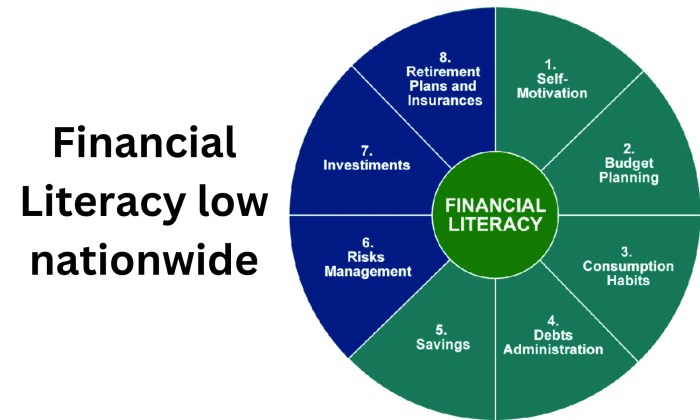

Effective financial literacy education incorporates several core components. These components work together to provide a comprehensive understanding of personal finance.

Core Components of Effective Financial Literacy Education

A successful financial literacy program needs a multi-faceted approach. It should cover budgeting and saving strategies, debt management techniques, understanding credit scores and reports, the basics of investing, and planning for the future, including retirement and insurance. Practical application exercises, real-world case studies, and interactive learning methods are crucial for effective knowledge retention and skill development. The curriculum should also adapt to the specific needs and circumstances of the target audience.

Financial Literacy Education for Different Age Groups

The approach to financial literacy education varies significantly depending on the age group.

Financial Literacy Education for Children

Children’s financial literacy programs focus on foundational concepts like needs versus wants, saving money, and the value of work. Age-appropriate activities, such as using piggy banks and learning about simple transactions, are employed. The emphasis is on building positive attitudes towards money management and establishing good financial habits early in life. For example, a lesson might involve setting a savings goal for a toy, teaching them to track their progress, and celebrating their achievement upon reaching the goal.

Financial Literacy Education for Adults

Adult financial literacy education often addresses more complex topics like budgeting, debt management, investing, and retirement planning. Programs might include workshops on creating a budget, understanding credit scores, choosing appropriate investment strategies, and planning for retirement. These programs frequently incorporate interactive tools and simulations to help adults apply their learning to real-life situations. A practical example would be a workshop on comparing different mortgage options and calculating the total cost of borrowing.

Financial Literacy Education for Seniors

For seniors, financial literacy programs may concentrate on managing retirement income, planning for long-term care, avoiding financial scams, and understanding estate planning. These programs often address issues specific to the aging population, such as managing healthcare costs and protecting against fraud. For instance, a session might focus on identifying and avoiding common scams targeting older adults, providing practical advice on safeguarding their assets.

Approaches to Delivering Financial Literacy Education

Various methods are used to deliver financial literacy education, each with its strengths and weaknesses.

Comparison of Financial Literacy Education Delivery Approaches

| Approach | Strengths | Weaknesses |

|---|---|---|

| Workshops and Seminars | Interactive, allows for Q&A, immediate feedback | Can be expensive, limited reach, requires scheduling |

| Online Courses | Accessible, flexible, cost-effective | Requires self-discipline, lack of immediate interaction |

| One-on-One Counseling | Personalized attention, tailored advice | Time-consuming, expensive, limited availability |

| Community Programs | Reach diverse populations, build community support | Funding may be limited, program quality can vary |

Curriculum for a Basic Financial Literacy Course

This curriculum focuses on fundamental financial concepts and practical skills.

Basic Financial Literacy Course Curriculum

The course will be structured over six weeks, with each week focusing on a key area of personal finance.

- Week 1: Budgeting and Saving: Introduction to budgeting, creating a personal budget, tracking expenses, setting savings goals, and understanding different savings vehicles.

- Week 2: Understanding Debt: Types of debt (credit cards, loans), calculating interest, managing debt effectively, and avoiding high-interest debt.

- Week 3: Credit and Credit Scores: Importance of credit scores, how credit scores are calculated, building and maintaining good credit, and understanding credit reports.

- Week 4: Banking and Financial Institutions: Types of bank accounts, choosing the right bank, understanding fees and charges, and using online banking securely.

- Week 5: Investing Basics: Introduction to investing, different investment options (stocks, bonds, mutual funds), risk tolerance, and diversification.

- Week 6: Financial Planning for the Future: Retirement planning, insurance (health, life, disability), and estate planning.

The Importance of Financial Literacy Education

Financial literacy education is not merely a desirable skill; it’s a fundamental necessity for individual well-being and societal prosperity. A financially literate population contributes to a more stable and robust economy, while a lack of financial understanding can lead to widespread hardship and instability. Investing in comprehensive financial literacy programs is therefore an investment in a stronger future for everyone.

Societal Benefits of Widespread Financial Literacy

A population equipped with strong financial literacy skills experiences numerous societal benefits. Increased financial knowledge leads to improved savings rates, responsible borrowing practices, and more informed investment decisions. This translates to greater economic stability at both the individual and national levels. For example, a population comfortable managing debt is less likely to experience financial crises, reducing the burden on social safety nets and promoting overall economic growth. Furthermore, higher rates of savings contribute to increased capital for investment, fostering innovation and job creation. This ripple effect underscores the crucial role of financial literacy in driving sustainable economic progress.

Negative Consequences of Financial Illiteracy

Conversely, widespread financial illiteracy carries significant negative consequences. Individuals lacking financial knowledge are more vulnerable to predatory lending practices, high-interest debt traps, and scams. This can lead to cycles of poverty, impacting not only individuals but also their families and communities. For instance, individuals who lack understanding of credit scores and interest rates may accumulate substantial debt with crippling interest payments, hindering their ability to achieve financial stability and potentially leading to bankruptcy. Furthermore, a lack of understanding about investing can result in missed opportunities for wealth building, exacerbating existing inequalities. The societal cost of financial illiteracy is therefore substantial, encompassing decreased economic productivity, increased reliance on social welfare programs, and heightened social inequality.

Correlation Between Financial Literacy and Economic Well-being

Numerous studies demonstrate a strong positive correlation between financial literacy and economic well-being. Research consistently shows that individuals with higher levels of financial literacy are more likely to save effectively, manage debt responsibly, and build wealth over time. For example, a study conducted by the Organization for Economic Co-operation and Development (OECD) found a significant positive relationship between financial literacy and household wealth accumulation. Similarly, research from the Federal Reserve has indicated that individuals with greater financial knowledge are less likely to experience financial distress. These findings highlight the crucial role of financial literacy in promoting individual and collective economic prosperity. The data strongly supports the need for increased investment in financial literacy initiatives.

The Case for Increased Investment in Financial Literacy Programs

Given the substantial societal benefits and the demonstrably negative consequences of financial illiteracy, increased investment in comprehensive financial literacy programs is imperative. These programs should be accessible to all members of society, regardless of age, background, or socioeconomic status. This investment will yield significant long-term returns in the form of a more stable economy, reduced inequality, and improved individual well-being. By equipping individuals with the knowledge and skills to manage their finances effectively, we can empower them to build a more secure and prosperous future for themselves and their families. This is not simply a matter of individual responsibility; it is a crucial societal investment that will pay dividends for generations to come.

Methods and Tools for Financial Literacy Education

Effective financial literacy education requires a multifaceted approach, catering to diverse learning styles and leveraging the power of technology and engaging tools. A successful program will incorporate various methods to ensure maximum comprehension and retention of crucial financial concepts.

Effective Teaching Methods for Diverse Learning Styles

Different individuals learn in different ways. Visual learners benefit from charts, graphs, and presentations; auditory learners respond well to lectures, discussions, and audio materials; kinesthetic learners prefer hands-on activities and simulations. A comprehensive financial literacy program should incorporate a variety of methods to accommodate these diverse learning styles. For example, a lesson on budgeting could involve a visual representation of a sample budget, a discussion on budgeting strategies, and a hands-on exercise where participants create their own personal budgets. Similarly, teaching about investing could utilize visual aids illustrating investment growth, audio explanations of different investment options, and a simulated investment game where learners make investment decisions.

The Role of Technology in Financial Literacy Education

Technology plays a crucial role in making financial literacy education accessible, engaging, and effective. Educational apps, interactive online courses, and simulations provide personalized learning experiences. Apps like Mint or Personal Capital allow users to track their spending, budget, and net worth, providing real-time feedback and reinforcing learning. Online resources like Khan Academy offer free courses on various financial topics, catering to a wide range of learners. The use of technology also facilitates the creation of personalized learning paths, adapting to individual needs and progress. Interactive simulations allow learners to experience the consequences of financial decisions in a safe and controlled environment, promoting risk-assessment skills and informed decision-making.

Practical Tools and Resources for Financial Literacy Education

The following table lists some practical tools and resources that can be used to enhance financial literacy education.

| Resource | Description | Target Audience | URL (if applicable) |

|---|---|---|---|

| Khan Academy | Offers free online courses on various financial topics, including budgeting, investing, and debt management. | General public, students | www.khanacademy.org |

| Mint | A personal finance app that helps users track their spending, budget, and net worth. | Individuals, families | www.mint.com |

| Investopedia | A website that provides information on various financial topics, including investing, trading, and economics. | Investors, students, professionals | www.investopedia.com |

| National Endowment for Financial Education (NEFE) | Offers resources and programs on financial literacy for various age groups and demographics. | General public, educators | www.nefe.org |

Gamification to Enhance Engagement in Financial Literacy Learning

Gamification can significantly increase engagement and knowledge retention in financial literacy education. By incorporating game mechanics such as points, badges, leaderboards, and challenges, learning becomes more interactive and enjoyable. For instance, a budgeting game could reward users for creating realistic budgets and achieving financial goals, while a stock market simulation could challenge users to make profitable investment decisions. These game elements not only make learning fun but also motivate learners to actively participate and strive for improvement. The competitive aspect of leaderboards can further incentivize learning, fostering a sense of accomplishment and healthy competition among participants. The immediate feedback provided by gamified elements allows learners to track their progress and identify areas where they need to improve.

Assessing the Effectiveness of Financial Literacy Education

Evaluating the success of financial literacy education programs requires a multifaceted approach that goes beyond simply measuring immediate knowledge gain. A robust assessment strategy should consider both short-term learning outcomes and the long-term impact on participants’ financial behaviors and well-being. This involves employing a range of methods and metrics to provide a comprehensive understanding of program effectiveness.

Methods for Evaluating Program Impact

Effective evaluation of financial literacy programs utilizes a combination of quantitative and qualitative methods. Quantitative methods focus on measurable data, such as changes in knowledge scores or financial behaviors. Qualitative methods, on the other hand, explore participants’ experiences and perspectives, providing richer insights into the program’s impact. A mixed-methods approach, combining both quantitative and qualitative data, often provides the most comprehensive understanding. For instance, pre- and post-program tests can measure knowledge gains (quantitative), while follow-up interviews can explore how participants apply their new knowledge in real-life situations (qualitative).

Key Metrics for Measuring Learning Outcomes and Long-Term Effects

Several key metrics can be used to assess the effectiveness of financial literacy programs. These metrics can be broadly categorized into short-term and long-term measures. Short-term metrics often focus on immediate knowledge acquisition, such as improvements in test scores on financial literacy concepts. Long-term metrics, however, examine the lasting impact on participants’ financial behaviors and well-being, including changes in savings rates, debt levels, and credit scores. For example, a successful program might demonstrate a statistically significant increase in participants’ knowledge of budgeting and saving strategies immediately following the program (short-term), as well as a sustained increase in their savings balances six months or a year later (long-term).

Examples of Effective Assessment Tools and Strategies

A variety of assessment tools can be employed to gauge program effectiveness. Pre- and post-tests, using standardized instruments or questionnaires, can measure changes in knowledge and understanding of key financial concepts. Focus groups and individual interviews can provide qualitative data on participants’ experiences and the practical application of learned skills. Tracking participants’ financial behaviors over time, such as changes in credit scores or savings rates, can offer valuable insights into the program’s long-term impact. For example, a program might use a pre-test to assess participants’ baseline knowledge of budgeting, then administer a post-test immediately after the program and a follow-up test six months later to measure knowledge retention and application. Qualitative data, gathered through interviews, could reveal how participants are using their new budgeting skills in their daily lives.

Rubric for Evaluating Program Success

A rubric can provide a structured framework for evaluating a financial literacy program’s success. This rubric should consider multiple dimensions of program effectiveness, including participant engagement, knowledge gains, changes in financial behaviors, and overall program impact.

| Criterion | Excellent (4 points) | Good (3 points) | Fair (2 points) | Poor (1 point) |

|---|---|---|---|---|

| Knowledge Gains (Pre/Post-Test Scores) | Significant improvement (20% or more) demonstrated by the majority of participants. | Moderate improvement (10-19%) demonstrated by a significant portion of participants. | Minimal improvement (less than 10%) demonstrated by a small portion of participants. | No significant improvement or decline in scores observed. |

| Behavioral Changes (Savings, Debt Reduction) | Significant positive changes in savings, debt reduction, or other relevant financial behaviors reported by a majority of participants and verified through objective data (e.g., bank statements). | Moderate positive changes in financial behaviors reported by a significant portion of participants, with some objective data verification. | Minimal or inconsistent changes in financial behaviors reported. | No significant positive changes in financial behaviors observed. |

| Participant Engagement and Satisfaction | High levels of participant engagement and overwhelmingly positive feedback. | Good levels of participant engagement and mostly positive feedback. | Moderate levels of participant engagement and mixed feedback. | Low levels of participant engagement and largely negative feedback. |

| Program Implementation and Resources | Program implemented effectively with adequate resources and support. | Program implemented with minor issues; resources and support mostly adequate. | Program implementation had significant challenges; resources and support insufficient. | Program poorly implemented with significant lack of resources and support. |

Addressing Specific Financial Topics in Education

Effective financial literacy education requires a practical approach, moving beyond theoretical concepts to address real-world financial situations. This section delves into specific financial topics crucial for equipping individuals with the knowledge and skills to manage their finances responsibly. A comprehensive approach should encompass budgeting and saving, debt management, investing and retirement planning, and insurance and risk management.

Budgeting and Saving Strategies

Teaching effective budgeting involves more than simply tracking expenses; it’s about fostering mindful spending habits and setting realistic financial goals. A practical approach might involve introducing different budgeting methods, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), or zero-based budgeting, where every dollar is assigned a purpose. Students should learn to differentiate between needs and wants, track their spending using budgeting apps or spreadsheets, and create a realistic budget aligned with their income and financial goals. Saving strategies should include emphasizing the power of compounding interest and the importance of setting short-term and long-term savings goals, such as an emergency fund or a down payment on a house. Illustrative examples of saving plans, such as setting aside a specific amount each month or automating transfers to a savings account, can reinforce these concepts.

Debt Management and Credit Scores

Understanding debt management and the significance of credit scores is vital for long-term financial well-being. Education should cover various types of debt (credit cards, student loans, mortgages), the implications of high-interest rates, and the importance of responsible borrowing. Strategies for debt repayment, such as the debt snowball or debt avalanche methods, should be explained, along with the importance of paying bills on time and maintaining a good credit history. The impact of credit scores on loan approvals, interest rates, and even insurance premiums should be clearly explained. Real-life examples, such as comparing loan offers with varying interest rates based on credit scores, can effectively illustrate these concepts. Furthermore, the dangers of predatory lending and high-interest debt traps should be highlighted.

Investing and Retirement Planning

Investing and retirement planning are often complex topics, but simplified explanations can make them accessible. The core concepts of diversification, risk tolerance, and long-term investment strategies should be introduced. Different investment vehicles, such as stocks, bonds, and mutual funds, can be explained in simple terms, emphasizing the importance of aligning investment choices with individual risk profiles and financial goals. Retirement planning should include discussions on various retirement accounts (401(k), IRA), the importance of starting early, and the power of compounding returns over time. Illustrative examples, such as comparing the growth of investments started at different ages, can highlight the benefits of early saving and investing.

Insurance and Risk Management

Insurance and risk management are often overlooked aspects of financial literacy, yet they are crucial for protecting against unforeseen events. Education should focus on the different types of insurance (health, auto, home, life), explaining how they work and the importance of adequate coverage. Risk management should be presented as a proactive approach to identifying and mitigating potential financial risks. Simple examples, such as the cost of replacing a damaged car without auto insurance or the financial burden of a major medical expense without health insurance, can effectively illustrate the importance of insurance. The concept of insurance premiums and deductibles should be explained clearly, along with the benefits of comparing policies and shopping around for the best rates.

Challenges and Opportunities in Financial Literacy Education

Financial literacy education, while crucial for individual and societal well-being, faces significant hurdles in its delivery and accessibility. Overcoming these challenges requires a multifaceted approach involving innovative strategies, collaborative partnerships between the public and private sectors, and a deep understanding of the diverse needs of different communities. Opportunities abound to leverage technology and community engagement to broaden reach and impact.

Barriers to Accessing and Delivering Financial Literacy Education

Several factors hinder the effective delivery and accessibility of financial literacy education. These barriers often intersect and compound each other, creating significant challenges for educators and learners alike. Addressing these barriers requires a nuanced approach that considers the specific context of each community and population group.

Lack of access to quality programs is a significant barrier. Many underserved communities lack access to reputable financial literacy programs due to geographical limitations, language barriers, or a lack of awareness about available resources. Furthermore, program quality can vary significantly, with some offering outdated or ineffective information. This inconsistency can erode trust and reduce the effectiveness of educational efforts. Funding constraints also limit the reach and scope of many programs, preventing them from reaching those most in need. Finally, the complexity of financial concepts can be overwhelming for learners with limited prior knowledge or experience, leading to disengagement and a lack of understanding.

Government and Private Sector Roles in Promoting Financial Literacy

Governments play a vital role in establishing a supportive environment for financial literacy education. This includes funding initiatives, developing national standards for curriculum and teacher training, and promoting public awareness campaigns. For example, the United States government supports various financial literacy programs through agencies like the Consumer Financial Protection Bureau (CFPB). The CFPB provides resources and tools for educators and consumers, focusing on topics such as budgeting, credit, and debt management.

The private sector also contributes significantly through corporate social responsibility initiatives, partnerships with educational institutions, and the development of innovative financial products and services designed to promote financial well-being. Many financial institutions offer free financial literacy workshops and online resources to their customers. Tech companies are developing user-friendly financial management apps and tools to make personal finance more accessible. These collaborative efforts are essential to achieving widespread financial literacy.

Innovative Approaches to Reaching Underserved Populations

Reaching underserved populations requires innovative approaches that address their specific needs and preferences. This includes tailoring programs to meet cultural and linguistic needs, utilizing technology to overcome geographical barriers, and partnering with trusted community organizations to build trust and credibility.

One example is the use of mobile technology to deliver financial literacy education through SMS text messages or mobile apps. This approach is particularly effective in reaching individuals who may not have access to computers or the internet. Another approach is to embed financial literacy education into existing community programs, such as job training initiatives or adult education classes. This allows individuals to acquire financial knowledge within a familiar and supportive context. Finally, peer-to-peer learning, where individuals share their financial experiences and knowledge with others, can be a powerful tool for building confidence and promoting engagement.

Strategy for Promoting Financial Literacy in a Specific Community

To illustrate a concrete strategy, consider a community with a high proportion of immigrant families. A successful program would incorporate:

Firstly, multilingual materials and instructors are crucial to ensure effective communication and understanding. Secondly, culturally relevant examples and case studies will resonate more strongly with the target audience. Thirdly, the program should be delivered in convenient locations and times, considering the work schedules and childcare responsibilities of many immigrant families. Finally, partnerships with community leaders and trusted organizations within the immigrant community will help build trust and encourage participation. This approach recognizes the unique challenges and opportunities presented by this specific demographic and adapts the program accordingly to maximize its impact.

Illustrative Examples of Financial Literacy Programs

Effective financial literacy programs are crucial for empowering individuals and communities. Successful programs typically combine engaging educational methods with practical tools and resources, tailored to the specific needs of their target audience. The following examples showcase different approaches to financial literacy education, highlighting their impact and reach.

The “Smart Spending” Program for Young Adults

This program targets young adults (ages 18-25) transitioning into independent living. It uses interactive workshops, online modules, and one-on-one coaching sessions to cover budgeting, saving, debt management, and understanding credit scores. Participants learn to track their spending, create realistic budgets, and explore different saving strategies. The program also emphasizes the importance of building a positive credit history and avoiding high-interest debt.

An image depicting this program would show a group of young adults actively participating in a workshop, perhaps using laptops to access online modules or working collaboratively on budgeting exercises. They might be engaged in a lively discussion with a facilitator, showcasing the interactive nature of the program. The overall atmosphere would be positive and collaborative, reflecting the supportive environment fostered by the program. The positive outcomes of the “Smart Spending” program include a significant increase in participants’ savings rates (an average increase of 25% reported in post-program surveys), a marked reduction in high-interest debt (an average decrease of 15% in reported debt levels), and improved credit scores (an average increase of 30 points reported six months after program completion). These quantifiable results demonstrate the program’s effectiveness in equipping young adults with the skills and knowledge necessary for sound financial management.

The “Financial Wellness for Seniors” Program

This program focuses on older adults (ages 60+), addressing their unique financial concerns such as retirement planning, managing healthcare costs, and protecting against fraud. It employs a multi-faceted approach, including presentations by financial professionals, group discussions, and individual consultations. The program emphasizes practical strategies for managing income, minimizing expenses, and accessing available resources. The program also includes sessions on identifying and avoiding common scams targeting older adults.

An image accompanying this program might show a group of seniors attentively listening to a financial advisor during a presentation, perhaps with visual aids like charts and graphs. Alternatively, it could depict a one-on-one consultation between a senior and a financial counselor, emphasizing the personalized support offered by the program. The image should convey a sense of trust and understanding, highlighting the program’s focus on providing personalized support and guidance. The “Financial Wellness for Seniors” program reports an increase in participants’ confidence in managing their finances (80% of participants reported increased confidence in post-program surveys) and a reduction in reported instances of financial fraud (a 20% decrease reported over a one-year follow-up period). The program’s success lies in its ability to address the specific needs and vulnerabilities of older adults, empowering them to make informed financial decisions and protect their assets.

Final Review

In conclusion, financial literacy education is not merely a skill; it’s a fundamental right and a key driver of economic empowerment. By implementing effective programs, leveraging technology, and addressing existing barriers, we can foster a society where individuals are equipped to navigate the complexities of personal finance with confidence and achieve their financial goals. The journey towards financial well-being begins with education, and the impact extends far beyond the individual, contributing to a stronger and more prosperous community.

Common Queries

What is the best age to start financial literacy education?

While it’s beneficial at any age, starting early (childhood) allows for the development of strong financial habits.

How can I find free financial literacy resources?

Many non-profit organizations and government agencies offer free online resources, workshops, and educational materials.

Are there financial literacy programs specifically for entrepreneurs?

Yes, many programs cater to entrepreneurs, focusing on business planning, funding, and financial management.

How can I measure the success of a financial literacy program?

Track participant knowledge gains, behavioral changes (e.g., improved saving habits), and long-term financial outcomes.