Managing personal finances effectively is crucial for long-term financial well-being. Budgeting apps have emerged as powerful tools to simplify this process, offering a range of features designed to track expenses, create budgets, and achieve financial goals. This review explores the landscape of budgeting apps, comparing popular options, analyzing their features, and highlighting security considerations to help you choose the best app for your needs.

From simple expense trackers to sophisticated budgeting systems with advanced features like automated savings and investment integration, the market offers a diverse range of solutions. Understanding the nuances of each app, its user experience, and its security protocols is key to making an informed decision. This review aims to provide that clarity, guiding you through the process of selecting a budgeting app that aligns with your financial habits and aspirations.

Introduction to Budgeting Apps

Budgeting apps have revolutionized personal finance management, offering convenient and accessible tools to track expenses, create budgets, and achieve financial goals. They provide a digital space to manage your money, offering features far beyond what a traditional paper-based budget can achieve. These apps cater to a wide range of users, from those just starting to manage their finances to experienced investors seeking to optimize their spending habits.

These applications leverage technology to simplify the often-complex process of managing personal finances. They automate many aspects of financial tracking, reducing the time and effort required to maintain a comprehensive budget. This automation, combined with insightful visualizations and reporting features, allows users to gain a clear understanding of their spending patterns and make informed financial decisions.

Types of Budgeting Apps

Budgeting apps fall into several categories, each offering unique features and functionalities. Understanding these differences is crucial for selecting the app that best suits individual needs. A user might prioritize expense tracking, comprehensive budgeting tools, or specialized features for saving and investing.

- Expense Tracking Apps: These apps primarily focus on recording and categorizing transactions. They often integrate with bank accounts and credit cards to automatically import transaction data, minimizing manual input. Many offer features such as creating custom categories, generating reports, and identifying spending trends.

- Budgeting Apps: These apps go beyond simple expense tracking by allowing users to create and manage budgets across different categories. They often incorporate features such as setting budget limits, tracking progress towards goals, and providing alerts when spending exceeds predetermined limits. Some even offer the ability to allocate funds to different savings goals.

- Saving and Investing Apps: These apps are geared towards helping users save and invest their money. They often integrate with investment accounts and offer features such as setting savings goals, automating transfers, and providing investment advice (though this advice should always be considered supplemental and not a replacement for professional financial advice).

Benefits of Using Budgeting Apps

Utilizing budgeting apps offers numerous advantages in managing personal finances. These benefits range from increased financial awareness to improved savings habits and reduced financial stress. The ease of use and accessibility of these apps contribute significantly to their popularity.

- Enhanced Financial Awareness: Budgeting apps provide a clear and concise overview of income and expenses, allowing users to identify areas where they can reduce spending or increase savings. The visualization tools often incorporated offer insights that are difficult to obtain through manual tracking.

- Improved Budgeting and Saving Habits: By setting budget limits and tracking progress, these apps help users stay on track with their financial goals. Automated features such as recurring transfers to savings accounts contribute to building healthy savings habits.

- Reduced Financial Stress: Gaining control of personal finances through budgeting apps can significantly reduce financial stress and anxiety. Having a clear picture of one’s financial situation empowers users to make informed decisions and feel more confident about their future.

- Time Savings: Automation features such as automatic transaction import and categorization save significant time compared to manual budgeting methods. This frees up time that can be spent on other aspects of life.

Key Features of Popular Budgeting Apps

Choosing the right budgeting app can significantly impact your financial management success. Different apps cater to various needs and preferences, offering a range of features and user experiences. This section compares and contrasts three popular options to help you make an informed decision.

Comparison of Popular Budgeting Apps

The following table summarizes key features, pricing, and user feedback for three popular budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital. Note that user reviews are subjective and can vary.

| App Name | Key Features | Pricing Model | User Reviews Summary |

|---|---|---|---|

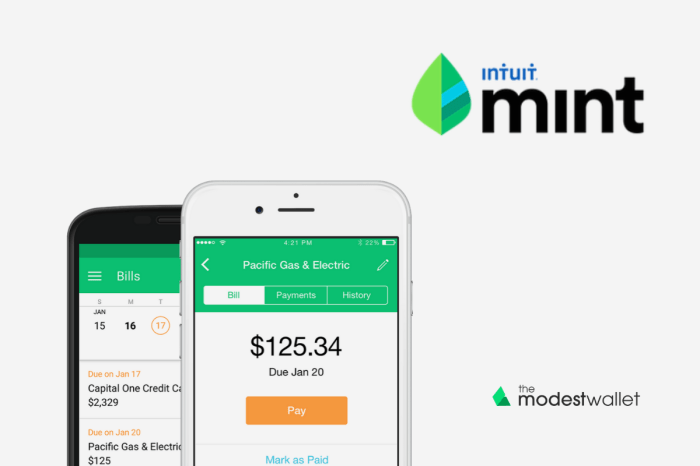

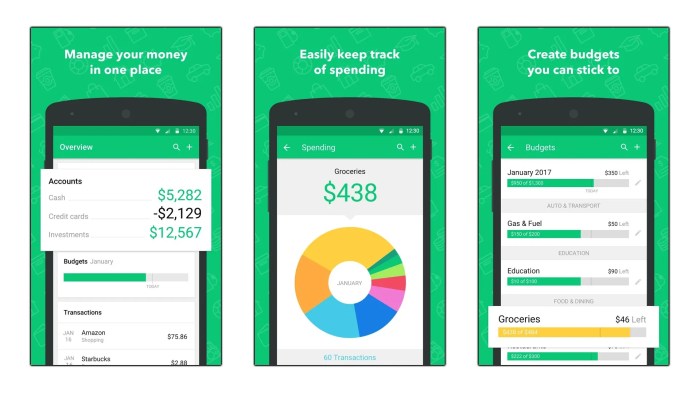

| Mint | Free account aggregation, spending tracking, budgeting tools, bill payment reminders, credit score monitoring. | Free (with ads), premium subscription available for advanced features. | Generally positive reviews for ease of use and free features. Some users report occasional glitches and limitations with the free version. |

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, detailed transaction tracking, helpful community forums, educational resources. | Subscription-based model with a free trial period. | High praise for its budgeting methodology and supportive community. Some users find the learning curve steeper than other apps and the subscription cost a barrier. |

| Personal Capital | Comprehensive financial dashboard, investment tracking, retirement planning tools, fee analysis, budgeting features. | Free for basic features, premium subscription for advanced investment analysis and financial planning tools. | Positive reviews for its robust investment tracking and financial planning capabilities. Some users find the interface cluttered and the free version limited. |

User Interface and User Experience

Mint boasts a clean and intuitive interface, making it easy for beginners to navigate and track their spending. Its visual representations of spending categories are particularly helpful. However, the free version’s reliance on advertisements can be distracting for some users. YNAB, while powerful, presents a steeper learning curve due to its unique zero-based budgeting methodology. The app’s interface is functional but less visually appealing than Mint. Personal Capital offers a more comprehensive, but potentially overwhelming, dashboard that caters to users with more complex financial situations. Its detailed reporting and visualizations can be beneficial for sophisticated investors but might feel unnecessary for simpler needs.

Strengths and Weaknesses of App Features

Mint’s strength lies in its simplicity and accessibility. Its weakness is the limited features in the free version and potential for intrusive advertisements. YNAB’s strength is its powerful zero-based budgeting methodology and supportive community. Its weakness is the subscription cost and potentially steep learning curve. Personal Capital excels in investment tracking and financial planning, but its interface can feel cluttered, and the free version lacks advanced features. Each app’s strengths and weaknesses ultimately depend on the user’s specific financial needs and technological proficiency.

Security and Privacy Considerations

Protecting your financial data is paramount when using budgeting apps. These apps often handle sensitive information, including bank account details, income, and spending habits. Understanding the security measures in place and adopting best practices is crucial to minimizing risk.

The security measures employed by reputable budgeting apps typically involve a multi-layered approach. This often includes robust encryption both in transit (while data travels between your device and the app’s servers) and at rest (while data is stored on the app’s servers). Many apps also utilize two-factor authentication (2FA), adding an extra layer of security by requiring a second verification method, such as a code sent to your phone or email, in addition to your password. Regular security audits and penetration testing are also common practices among reputable providers to identify and address vulnerabilities. Furthermore, many apps comply with industry standards like PCI DSS (Payment Card Industry Data Security Standard) when handling payment information.

Data Encryption Methods Used by Budgeting Apps

Encryption is the cornerstone of data security in budgeting apps. Data encryption transforms readable data into an unreadable format, making it incomprehensible to unauthorized individuals. Symmetric encryption, where the same key is used for both encryption and decryption, is often used for internal data processing. Asymmetric encryption, which employs separate keys for encryption and decryption, is often used for secure communication between your device and the app’s servers. The strength of the encryption used, such as AES-256 (Advanced Encryption Standard with a 256-bit key), significantly impacts the security of your data. A stronger encryption key size means it would take exponentially longer for an attacker to break the encryption.

Best Practices for Protecting Financial Information

Choosing strong, unique passwords for each app is a fundamental best practice. Avoid using easily guessable passwords like “password123” or personal information like your birthday. Consider using a password manager to generate and securely store complex passwords. Regularly review your app’s permissions to ensure it only accesses the necessary data. Be wary of phishing attempts, which often involve fraudulent emails or messages attempting to trick you into revealing your login credentials. Only download budgeting apps from official app stores (like Google Play or the Apple App Store) to minimize the risk of installing malware. Finally, stay updated with the latest security patches and app updates provided by the developers. These updates often include security improvements that address newly discovered vulnerabilities.

Choosing a Secure Budgeting App Based on Privacy Policies

Before using any budgeting app, carefully review its privacy policy. Look for clear statements about data encryption methods, data retention policies (how long the app keeps your data), and data sharing practices (whether your data is shared with third parties). Apps that are transparent about their security practices and comply with relevant data protection regulations (such as GDPR in Europe or CCPA in California) are generally more trustworthy. Look for evidence of independent security audits or certifications. Avoid apps with vague or unclear privacy policies, as this could indicate a lack of commitment to data security. Consider the reputation of the app developer; established companies with a history of responsible data handling are often a safer bet. Pay close attention to the details of the privacy policy; don’t just skim it.

Integration with Other Financial Tools

Budgeting apps significantly enhance their utility through integration with various financial accounts and services. This integration streamlines the budgeting process by automatically importing transaction data, providing a more comprehensive and up-to-date view of your finances. However, the extent and nature of this integration vary considerably across different apps.

The core function of this integration lies in connecting the budgeting app to your bank accounts, credit cards, and other financial institutions. This connection is typically established through secure APIs that allow the app to access your account information without requiring you to manually input every transaction. This automated data import saves significant time and reduces the risk of manual entry errors. Some apps even integrate with investment accounts, loan accounts, and even payment services, offering a holistic view of your complete financial picture.

Levels of Integration Across Budgeting Apps

The depth of integration offered by different budgeting apps varies considerably. Some apps offer basic account linking, allowing for the import of transaction data, while others provide more advanced features, such as automated categorization of transactions and integration with financial planning tools. For example, Mint offers a broad range of integrations, including many major banks and credit card companies, and it automatically categorizes transactions. On the other hand, a simpler app might only support a limited number of financial institutions and require manual categorization. The level of integration is a key factor to consider when choosing a budgeting app, as it directly impacts the convenience and efficiency of the budgeting process. More comprehensive integration usually comes with a more user-friendly experience and less manual work.

Benefits of Integration with Financial Tools

The benefits of integrating budgeting apps with other financial tools are substantial. Primarily, it saves time and effort by automating the data entry process. Imagine manually entering every transaction from multiple accounts – a tedious and error-prone process. Integration eliminates this, providing a real-time view of your finances. Furthermore, this automated data import leads to greater accuracy in tracking expenses and income, which is crucial for effective budgeting. Finally, the consolidated view of your finances across multiple accounts provides a clearer understanding of your overall financial health, facilitating better financial decision-making. For example, seeing all your accounts together can easily highlight areas where you’re overspending or where you might have unexpected expenses.

Drawbacks of Integration with Financial Tools

While integration offers many benefits, it’s important to acknowledge potential drawbacks. The most significant concern is security and privacy. Granting a third-party app access to your financial accounts inherently involves a degree of risk. It’s crucial to choose reputable apps with robust security measures to mitigate this risk. Another potential drawback is the reliance on the app’s accuracy in categorizing transactions. While many apps use sophisticated algorithms, manual review and correction may still be necessary, particularly for less common transaction types. Lastly, some users might find the level of integration overwhelming, especially if they prefer a more manual and hands-on approach to budgeting. For instance, some individuals might feel uncomfortable having all their financial information consolidated in one app.

User Reviews and Ratings

User reviews and ratings provide invaluable insights into the real-world experiences of budgeting app users. Analyzing this feedback helps us understand which apps consistently deliver on their promises and which fall short of expectations. By examining both positive and negative comments, we can gain a clearer picture of each app’s strengths and weaknesses, ultimately informing our choice of the best budgeting tool.

A comprehensive analysis of user reviews across major app stores like Google Play and the Apple App Store reveals recurring themes in user feedback. These themes often center around ease of use, feature functionality, customer support responsiveness, and the overall user experience.

Common Praises and Criticisms

User reviews frequently highlight both the positive and negative aspects of budgeting apps. Below is a summary of common praises and criticisms gleaned from numerous app store reviews.

- Praises: Many users praise the intuitive interfaces, ease of data entry, helpful reporting features (like visual charts and graphs summarizing spending habits), and excellent customer support. Some specifically mention the apps’ ability to seamlessly connect with their bank accounts and credit cards, automating much of the data input process. Others appreciate the motivational features, such as progress tracking and goal-setting tools.

- Criticisms: Recurring criticisms often involve glitches or bugs within the app, poor customer support responsiveness, insufficient customization options, and a lack of certain features (e.g., advanced reporting capabilities, international bank support). Some users also express concerns about the security and privacy of their financial data. A common complaint is related to the app’s stability, with reports of crashes or unexpected shutdowns.

Examples of User Experiences

To illustrate the range of user experiences, let’s consider two hypothetical examples based on common review patterns. These examples are representative of the spectrum of positive and negative feedback frequently found in app store reviews.

- Positive Experience: “I’ve been using ‘BudgetWise’ for six months, and it’s completely transformed my financial habits. The interface is incredibly user-friendly, and the automatic syncing with my bank account is a lifesaver. The charts and graphs make it easy to visualize my spending, and I’ve already saved a significant amount of money. Customer support was also very helpful when I had a minor question.”

- Negative Experience: “I downloaded ‘MoneyTrack’ based on its high rating, but I’ve been incredibly disappointed. The app constantly crashes, and the customer support team has been unresponsive to my multiple inquiries. The interface is clunky, and it lacks several features that other budgeting apps offer. I wouldn’t recommend this app to anyone.”

Recurring Themes in User Feedback

Analyzing a large volume of user reviews reveals several consistent patterns. For instance, the importance of a user-friendly interface is repeatedly emphasized. Users consistently prefer apps with intuitive navigation and easy-to-understand features. Another recurring theme is the need for reliable data synchronization and robust security measures. Users want to ensure their financial data is safe and accessible whenever needed, without experiencing frequent syncing issues or security breaches. Finally, the responsiveness of customer support is a crucial factor in user satisfaction. Prompt and helpful assistance with any technical issues or questions significantly impacts the overall user experience.

Choosing the Right Budgeting App

Selecting the perfect budgeting app can feel overwhelming given the sheer number of options available. However, by carefully considering your specific needs and preferences, you can find a tool that simplifies your financial management and helps you achieve your financial goals. This section will guide you through the decision-making process.

Decision-Making Flowchart for Choosing a Budgeting App

A flowchart can streamline the app selection process. Imagine a simple diagram starting with a central question: “What are my primary budgeting needs?”. Branching out from this, you might have options like “Basic tracking,” “Advanced features (like investment tracking),” or “Specific needs (debt management)”. Each of these branches would then lead to further questions focusing on features, cost, and security preferences. For example, the “Advanced features” branch might ask: “Do I need investment tracking and tax planning tools?” The answers to these questions will eventually lead you to a suitable category of budgeting apps. Finally, the flowchart would conclude with a recommendation to research specific apps within the chosen category based on user reviews and ratings.

Factors to Consider When Choosing a Budgeting App

Several key factors influence the suitability of a budgeting app. These include the app’s features, its cost (free vs. paid), its security measures, and the ease of use of its user interface.

- Features: Consider whether you need basic expense tracking, budgeting tools, bill reminders, savings goals, investment tracking, or debt management features. Some apps offer more comprehensive functionalities than others.

- Cost: Many budgeting apps offer free versions with limited features, while premium versions unlock advanced functionalities. Evaluate whether the additional features justify the cost. Some apps offer a free trial period, allowing you to test the premium features before committing.

- Security: Prioritize apps that utilize robust security measures, such as encryption and two-factor authentication, to protect your sensitive financial data. Check the app’s privacy policy to understand how your data is handled and protected.

- User Interface: A user-friendly interface is crucial for long-term app usage. Choose an app with a clear, intuitive design that is easy to navigate and understand, regardless of your technical expertise. Consider the app’s overall aesthetic appeal, as this can impact your motivation to use it consistently.

Tips for Maximizing the Effectiveness of a Chosen Budgeting App

Once you’ve selected a budgeting app, consistent use and strategic implementation are key to maximizing its effectiveness.

- Accurate Data Entry: The accuracy of your budget depends on the accuracy of your data entry. Make it a habit to record all transactions promptly and meticulously.

- Regular Monitoring: Regularly review your budget to track your progress, identify areas for improvement, and adjust your spending habits accordingly. Many apps provide visual representations of your spending patterns, which can be very helpful.

- Goal Setting: Use the app’s goal-setting features to define specific financial targets (e.g., saving for a down payment, paying off debt). This helps to maintain focus and motivation.

- Integration with Other Financial Tools: Take advantage of the app’s ability to connect with your bank accounts and credit cards for automatic transaction updates. This reduces manual data entry and increases the accuracy of your budget.

Illustrative Examples of App Usage

Budgeting apps offer a powerful tool for managing personal finances, transforming the way individuals approach saving, spending, and achieving financial goals. Their effectiveness is best illustrated through real-world examples showcasing how different users leverage these apps for various financial objectives.

Successful Achievement of Financial Goals

A Successful Savings Journey

Sarah, a young professional, had a long-term goal of saving for a down payment on a house. Initially overwhelmed by tracking expenses manually, she decided to use a budgeting app. She chose an app that allowed her to categorize her spending and set savings goals. Within the app, she meticulously tracked every transaction, from daily coffee purchases to monthly rent. The app’s visual representation of her spending habits helped her quickly identify areas where she could cut back, such as dining out and online shopping. Through consistent tracking and adjustments guided by the app’s insights, Sarah exceeded her savings target within two years, securing a substantial down payment and achieving her dream of homeownership. The app’s features, such as automated savings transfers and progress tracking, were instrumental in her success.

Tracking Spending and Identifying Areas for Improvement

Mark, a freelance graphic designer, often found himself struggling to understand where his money was going each month. He started using a budgeting app to categorize his income and expenses. The app’s reporting features allowed him to visually analyze his spending patterns, revealing that he was spending a significant portion of his income on entertainment and subscription services. The app also highlighted inconsistencies in his income due to the fluctuating nature of freelance work. By understanding these trends, Mark was able to renegotiate some of his subscriptions, reduce his entertainment budget, and plan better for periods of lower income. The app’s insights enabled him to make informed financial decisions, leading to improved financial stability.

Implementing Different Budgeting Methods

Budgeting apps offer flexibility in accommodating various budgeting methods.

50/30/20 Budgeting

The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Many budgeting apps allow users to create custom budgets mirroring this approach. Users can set categories representing needs (housing, groceries, transportation), wants (entertainment, dining out), and savings. The app then tracks spending against these allocated percentages, providing real-time feedback and visual representations of progress.

Zero-Based Budgeting

Zero-based budgeting involves assigning every dollar of your income to a specific category, ensuring that your income equals your expenses. Apps facilitate this by allowing users to allocate their entire income to various categories, from fixed expenses (rent, mortgage) to variable expenses (groceries, entertainment). The app then monitors spending against these allocated amounts, flagging any potential overspending or discrepancies. This method helps users gain a granular understanding of their financial situation and promotes mindful spending.

Conclusive Thoughts

Ultimately, the best budgeting app is the one that best fits your individual needs and preferences. By carefully considering factors such as features, security, user interface, and integration capabilities, you can choose a tool that empowers you to take control of your finances. Remember to regularly review your app’s performance and adapt your budgeting strategies as needed to maximize its effectiveness and achieve your financial objectives. Effective budgeting is a journey, not a destination, and the right app can be a valuable companion along the way.

Question Bank

What data do budgeting apps access?

Most apps require access to your bank accounts and credit cards to automatically track transactions. Always review the app’s privacy policy to understand exactly what data it collects and how it’s used.

Are budgeting apps safe?

Reputable budgeting apps employ robust security measures, including encryption and two-factor authentication. However, it’s crucial to choose apps from trusted developers and follow best practices for online security.

Can I use a budgeting app without linking my bank account?

Some apps allow manual entry of transactions, but automatic syncing with bank accounts significantly streamlines the process and reduces the chance of errors.

What if I change banks or credit cards?

Most apps allow you to easily update your linked accounts. Check the app’s instructions for specific guidance.