Secure your financial future with a well-defined plan. This guide provides a comprehensive framework for setting and achieving your financial goals, regardless of your current financial standing or life stage. We’ll explore effective strategies for budgeting, resource allocation, and progress tracking, ensuring you stay motivated and on track towards financial success.

From defining SMART goals to utilizing various budgeting methods and overcoming common obstacles, this template empowers you to take control of your finances and build a secure financial future. We’ll examine different goal-setting methodologies and provide practical examples to help you tailor a plan that works best for you.

Defining Financial Goals

Financial goal setting is the process of identifying your financial aspirations and creating a structured plan to achieve them. It involves defining specific objectives, allocating resources effectively, and monitoring progress over time to ensure you stay on track towards financial well-being. This systematic approach allows for proactive management of your finances, minimizing risks and maximizing opportunities for growth.

The importance of establishing clear and well-defined financial goals cannot be overstated. Without a roadmap, your financial journey can become aimless and unproductive. This is where the SMART goal framework proves invaluable.

SMART Goals in Financial Planning

SMART goals provide a structured approach to defining objectives. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. A financial goal should clearly state what you aim to achieve (Specific), how you’ll measure progress (Measurable), whether it’s realistically attainable given your resources (Achievable), whether it aligns with your overall financial objectives (Relevant), and when you plan to achieve it (Time-bound). For example, instead of a vague goal like “save more money,” a SMART goal would be “save $10,000 by December 31, 2024, by setting aside $200 per week and investing any bonuses received.” This level of specificity increases your likelihood of success.

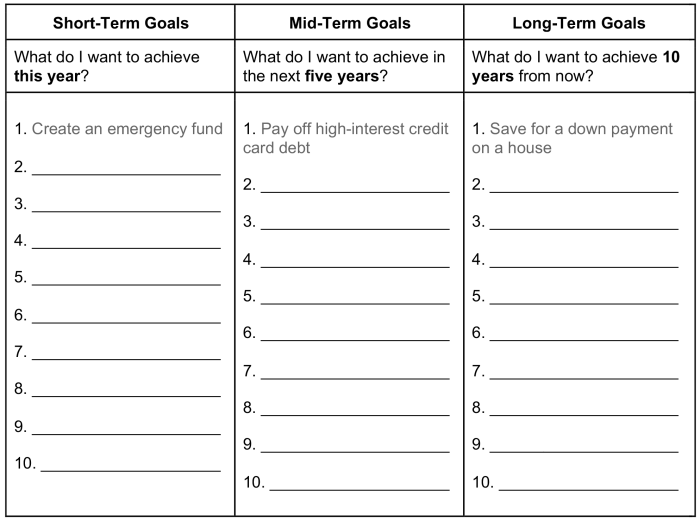

Types of Financial Goals

Financial goals can be categorized based on their timeframe. Short-term goals are typically achieved within one year, while long-term goals extend beyond that period. Intermediate-term goals fall between these two extremes. Examples of short-term goals include paying off credit card debt or saving for a down payment on a car. Long-term goals might include purchasing a home, funding retirement, or saving for a child’s education. Intermediate goals could involve paying off student loans or saving for a significant vacation. It’s beneficial to have a mix of all three types to maintain balance and momentum.

Comparison of Goal-Setting Methodologies

Different approaches to goal setting can enhance effectiveness. Two common methods are cascading and backward planning.

| Methodology | Description | Advantages | Disadvantages |

|---|---|---|---|

| Cascading | Starts with overarching long-term goals, which are then broken down into smaller, more manageable short-term and intermediate goals. | Provides a clear hierarchy and alignment of goals; fosters a sense of purpose and direction. | Can be complex to implement; requires careful planning and coordination. |

| Backward Planning | Starts with the desired end result and works backward, identifying the necessary steps and timelines required to achieve it. | Helps visualize the path to success; highlights potential roadblocks early on. | Can be overly rigid; may not adapt well to unexpected changes or circumstances. |

Components of a Financial Goal Setting Template

A robust financial goal setting template is crucial for effectively planning and achieving your financial aspirations. It provides a structured framework to break down complex goals into manageable steps, track progress, and stay motivated. A well-designed template ensures clarity, accountability, and ultimately, success in reaching your financial objectives.

Key Elements of a Financial Goal Setting Template

A comprehensive financial goal setting template should incorporate several key elements to ensure its effectiveness. These elements work together to provide a holistic view of your financial goals and the steps needed to achieve them. Omitting any of these crucial components can hinder the process and reduce the chances of success.

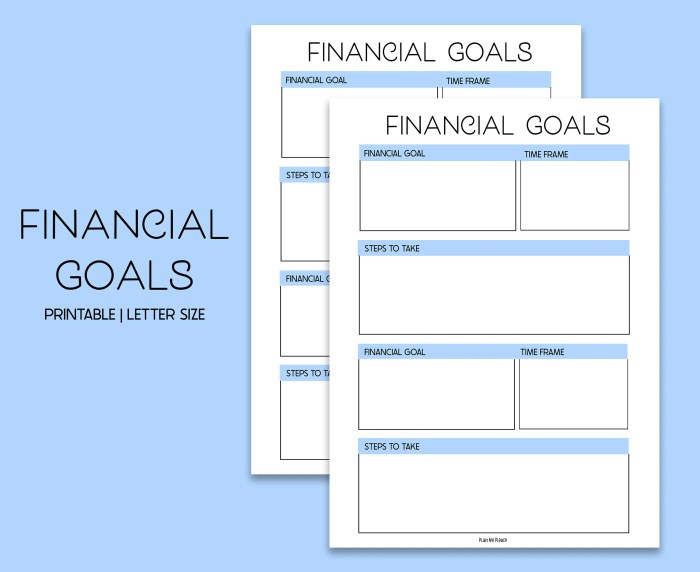

Goal Description

This section requires a clear and concise articulation of your financial goal. It should specify the nature of the goal (e.g., saving for a down payment, paying off debt, investing for retirement), the desired outcome (e.g., saving $20,000, paying off $10,000 in credit card debt, accumulating $1 million in retirement savings), and the rationale behind the goal (e.g., buying a house, improving credit score, securing financial future). For example, a goal description might read: “Save $20,000 for a down payment on a house within two years to achieve homeownership and build equity.”

Timeline and Deadlines

Establishing a realistic timeline with specific deadlines is essential for maintaining momentum and achieving your financial goals. This section should Artikel the timeframe for achieving the goal, broken down into smaller, manageable milestones. For instance, for the $20,000 savings goal, milestones could include saving $5,000 by the end of the first six months, $10,000 by the end of the year, and so on. Setting specific deadlines promotes accountability and helps track progress effectively.

Budget Allocation

This section Artikels how you plan to allocate resources towards your financial goal. It involves detailing the amount of money you intend to save or invest regularly, along with the sources of funds (e.g., salary, side hustle income, investment returns). A detailed budget will also include anticipated expenses and potential adjustments needed throughout the process. For the $20,000 savings goal, this might involve allocating $833.33 per month from your salary.

Resources and Strategies

This section identifies the resources and strategies you will employ to achieve your financial goals. This could include identifying high-yield savings accounts, exploring investment opportunities, creating a budget, or seeking financial advice from a professional. For the savings goal, this might include opening a high-yield savings account and automatically transferring a set amount each month.

Metrics and Milestones for Progress Tracking

Regularly monitoring your progress is critical to ensuring you stay on track. This section details the key metrics you’ll use to measure progress (e.g., total amount saved, debt reduction, investment growth) and the milestones you’ll reach along the way. For the $20,000 savings goal, milestones could be set at $5,000, $10,000, $15,000, and finally $20,000, with regular reviews to assess progress against the timeline and budget. Tracking these metrics allows for timely adjustments to the plan if needed.

Sample Financial Goal Setting Template

| Goal Description | Timeline | Budget Allocation | Resources & Strategies | Metrics & Milestones |

|---|---|---|---|---|

| Save $10,000 for a down payment on a car within 12 months | 12 months (monthly milestones) | $833.33 per month from savings | High-yield savings account, reduce non-essential spending | Monthly savings total, review savings progress every three months |

| Pay off $5,000 credit card debt within 6 months | 6 months (bi-monthly milestones) | $833.33 per month from additional income | Debt snowball method, increased income from side hustle | Outstanding debt balance, review progress every two months |

| Invest $5,000 in index funds within 3 months | 3 months (monthly milestones) | $1666.67 per month from savings | Online brokerage account, research index funds | Investment account balance, review investment performance monthly |

Budgeting and Resource Allocation

Effective budgeting and resource allocation are crucial for achieving your financial goals. Without a well-defined plan for how you’ll spend and save your money, even the most ambitious goals can remain elusive. This section Artikels different budgeting methods, strategies for allocating resources across multiple goals, and practical tools to help you build a realistic budget.

Budgeting Methods

Several budgeting methods can help you track your income and expenses effectively. Choosing the right method depends on your personal preferences and financial situation. Each approach offers a unique way to visualize your spending habits and identify areas for improvement.

- Zero-Based Budgeting: This method allocates every dollar of your income to a specific category, ensuring your expenses equal your income. This leaves no money unaccounted for and promotes mindful spending.

- 50/30/20 Budget: This popular rule of thumb allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It provides a simple framework for balancing essential spending with discretionary spending and financial goals.

- Envelope System: This cash-based method involves allocating cash to different envelopes representing various spending categories. Once the cash in an envelope is gone, spending in that category stops for the month. This can be particularly helpful in curbing impulsive spending.

- Value-Based Budgeting: This method prioritizes spending based on your values and goals. It encourages you to allocate more resources to activities and purchases that align with your priorities, even if they seem expensive.

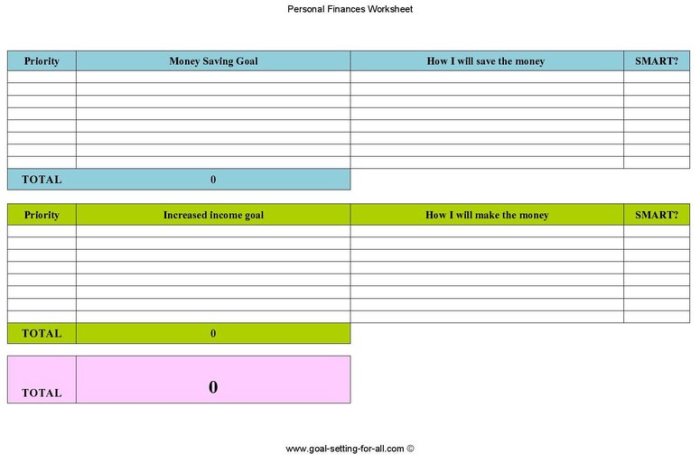

Resource Allocation Across Multiple Goals

Effectively allocating resources across multiple financial goals requires prioritization and strategic planning. It’s essential to consider the urgency and importance of each goal when deciding how to distribute your funds.

- Prioritize Goals: Rank your financial goals based on urgency and importance. For instance, emergency fund creation often takes precedence over long-term goals like retirement savings.

- Allocate Funds Proportionally: Divide your available resources proportionally among your prioritized goals. Consider assigning larger portions to high-priority, shorter-term goals.

- Regularly Review and Adjust: Your financial situation and goals may change over time. Regularly review your budget and resource allocation to ensure it still aligns with your priorities and progress.

Budgeting Tools and Techniques

Numerous tools and techniques can assist in creating and managing your budget. These range from simple spreadsheets to sophisticated budgeting software.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): Spreadsheets offer a flexible and customizable way to track income, expenses, and progress toward your goals. They allow for detailed categorization and analysis of spending patterns.

- Budgeting Apps (e.g., Mint, YNAB, Personal Capital): These apps automate many aspects of budgeting, providing features like automatic transaction categorization, expense tracking, and goal-setting tools.

- Financial Planning Software: More comprehensive software packages offer advanced features such as retirement planning, investment tracking, and tax optimization, aiding in long-term financial goal management.

Creating a Realistic Budget

Building a realistic budget involves a step-by-step process:

- Track Your Spending: For at least a month, meticulously record all your income and expenses. This provides a baseline understanding of your current financial habits.

- Categorize Expenses: Group your expenses into meaningful categories (e.g., housing, transportation, food, entertainment). This helps identify areas where you can potentially reduce spending.

- Set Realistic Goals: Establish specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. This ensures clarity and direction in your budgeting efforts.

- Allocate Resources: Distribute your income across your expenses and savings goals based on your priorities and the chosen budgeting method.

- Regularly Review and Adjust: Continuously monitor your spending against your budget. Make adjustments as needed to ensure you stay on track toward achieving your financial goals.

Tracking Progress and Adjustments

Regularly monitoring and evaluating your financial progress is crucial for ensuring you stay on track toward achieving your goals. Without consistent oversight, you risk drifting off course and missing opportunities to make necessary adjustments. This section details effective methods for tracking your progress and adapting your plan as needed.

Consistent monitoring allows for early detection of potential problems and provides opportunities for proactive solutions. By regularly reviewing your financial status against your established milestones, you can identify areas where you’re exceeding expectations and areas needing improvement. This iterative process enhances the likelihood of achieving your financial objectives.

Methods for Tracking Progress

Effective progress tracking requires a systematic approach. Several methods can be employed, depending on your preference and the complexity of your financial goals. These methods can be used individually or in combination for a comprehensive overview. For example, you might use a spreadsheet for detailed tracking and a visual dashboard for a quick overview.

- Spreadsheet Tracking: A spreadsheet allows for detailed recording of income, expenses, and investments against your projected targets. You can easily calculate variances and identify trends over time. For instance, you could track monthly savings towards a down payment, comparing actual savings against the planned savings for each month. Color-coding cells could highlight areas needing attention.

- Budgeting Apps: Many budgeting apps offer automated tracking features, providing real-time insights into spending habits and progress towards goals. These apps often offer visual representations of your budget and progress, making it easy to see where you stand. Examples include Mint, YNAB (You Need A Budget), and Personal Capital.

- Financial Goal Journals: Maintaining a journal can provide a more holistic view of your financial journey. This allows for reflection on your progress, challenges faced, and lessons learned. It can also be a valuable tool for maintaining motivation and accountability.

Strategies for Adjusting Goals and Plans

Life is unpredictable; unforeseen circumstances can significantly impact your financial situation. Therefore, flexibility is key to successful financial goal setting. Regular review and adjustment of your plan are not signs of failure, but rather indicators of adaptability and a commitment to achieving your goals, even in the face of unexpected events.

- Re-evaluate Goals: Periodically review your goals to ensure they remain relevant and aligned with your current circumstances and aspirations. Significant life events such as marriage, job changes, or unexpected expenses might necessitate reevaluating your goals and timelines.

- Adjust Budgeting: If you’re consistently falling short of your savings targets, analyze your spending habits and identify areas where you can cut back. Conversely, if you’re exceeding your targets, you may consider accelerating your savings or investing more aggressively.

- Seek Professional Advice: Don’t hesitate to seek guidance from a financial advisor if you’re struggling to manage your finances or adjust your goals. A professional can provide personalized advice and strategies tailored to your specific situation.

Progress Tracking Dashboard

Imagine a dashboard divided into sections. The top section displays a summary of your overall financial health, including net worth, total savings, and investment portfolio value. Below this, individual sections would track progress towards specific goals, such as a down payment on a house or retirement savings. Each section would use a bar graph to visually represent progress against the target, with the bar’s length indicating the percentage of the goal achieved. Key performance indicators (KPIs) like monthly savings rate and investment returns would be prominently displayed. A color-coded system (green for on track, yellow for caution, red for behind schedule) would provide a quick visual assessment of your overall progress. Finally, a notes section would allow for recording of any significant events or adjustments made to the plan.

Examples of Financial Goal Setting Templates

Effective financial goal setting requires a structured approach. Choosing the right template can significantly simplify the process and increase your chances of success. The ideal template will depend on your individual circumstances, financial situation, and life stage. Below are three examples illustrating templates tailored to different life stages.

Financial Goal Setting Template: Young Adult (Ages 20-35)

This template focuses on building a foundation for long-term financial health. The target audience is young adults entering the workforce, possibly managing student loan debt, and beginning to save for larger purchases and long-term goals.

- Short-Term Goals (0-2 years): Emergency fund establishment (3-6 months of living expenses), paying off high-interest debt (credit cards), saving for a down payment on a car or a larger purchase.

- Mid-Term Goals (2-5 years): Increasing emergency fund, paying off student loans, saving for a down payment on a house, investing in a retirement account (e.g., 401k or Roth IRA).

- Long-Term Goals (5+ years): Investing in a diversified portfolio, paying off mortgage, significant investments, saving for major life events (marriage, children).

- Unique Features: Emphasis on debt reduction, building an emergency fund, and starting early with retirement savings. Includes sections for tracking income and expenses, and a simple budgeting tool.

- Target Audience: Young adults starting their careers, managing debt, and beginning to save for significant future expenses.

Financial Goal Setting Template: Family (Ages 35-55)

This template is designed for families with children, focusing on balancing immediate needs with long-term financial security. The target audience includes individuals with mortgages, children’s education expenses, and ongoing family needs.

- Short-Term Goals (0-2 years): Maintaining an adequate emergency fund, budgeting for household expenses, saving for family vacations or home improvements.

- Mid-Term Goals (2-5 years): Saving for children’s college education (529 plan contributions), paying down mortgage principal, investing for retirement, planning for potential life insurance needs.

- Long-Term Goals (5+ years): Securing retirement income, paying off mortgage, planning for children’s financial independence, potential estate planning.

- Unique Features: Includes sections for tracking children’s education expenses, retirement planning tools, and budgeting for family expenses. Considers life insurance and estate planning needs.

- Target Audience: Families with children, balancing current household needs with long-term financial security.

Financial Goal Setting Template: Retiree (Ages 55+)

This template focuses on managing retirement income and ensuring financial stability during retirement. The target audience includes individuals who have retired or are nearing retirement.

- Short-Term Goals (0-2 years): Managing retirement income, adjusting to reduced income, planning for healthcare expenses.

- Mid-Term Goals (2-5 years): Maintaining a comfortable lifestyle, adjusting investment strategy for lower risk tolerance, planning for potential long-term care needs.

- Long-Term Goals (5+ years): Ensuring long-term financial security, managing legacy and estate planning, maintaining a healthy lifestyle within budget.

- Unique Features: Includes sections for tracking retirement income and expenses, managing healthcare costs, and planning for long-term care. Considers estate distribution and legacy planning.

- Target Audience: Individuals who are retired or nearing retirement, focusing on managing retirement income and ensuring long-term financial stability.

Overcoming Obstacles and Challenges

Setting and achieving financial goals is rarely a smooth, linear process. Life throws curveballs, and unexpected events can derail even the most meticulously planned budgets. Understanding and proactively addressing potential obstacles is crucial for long-term success. This section will explore common challenges, effective strategies for overcoming them, and the valuable role of external support.

Successfully navigating the path to financial well-being requires resilience and a proactive approach to problem-solving. Procrastination, unforeseen expenses, and a lack of understanding can all hinder progress. However, with the right strategies and support, these obstacles can be overcome.

Strategies for Overcoming Procrastination and Maintaining Motivation

Procrastination is a common enemy of financial goal setting. It stems from various factors, including feeling overwhelmed by the task, fear of failure, or simply a lack of clarity on the steps involved. Combatting procrastination requires a multi-pronged approach. Breaking down large goals into smaller, more manageable steps makes the overall process seem less daunting. Celebrating small wins along the way provides positive reinforcement and maintains momentum. Visualizing the positive outcomes associated with achieving the goals—a comfortable retirement, a down payment on a house, or financial freedom—can serve as powerful motivators. Finally, building accountability by sharing your goals with a trusted friend or family member can significantly improve adherence to the plan.

The Role of Financial Advisors and Resources

Financial advisors offer invaluable expertise and support in navigating the complexities of personal finance. They can provide personalized guidance tailored to individual circumstances, helping to create a comprehensive financial plan, identify potential risks, and make informed investment decisions. Beyond professional advisors, numerous online resources, including government websites, educational institutions, and non-profit organizations, offer free or low-cost financial education and tools. These resources can help individuals learn about budgeting, investing, debt management, and other essential financial skills. Utilizing these resources empowers individuals to make sound financial decisions and increase their chances of achieving their goals.

Potential Challenges and Corresponding Solutions

Understanding potential roadblocks is key to successful financial planning. Here’s a list of common challenges and practical solutions:

- Challenge: Unexpected job loss or significant income reduction. Solution: Develop an emergency fund (ideally 3-6 months of living expenses) to cover unexpected expenses. Explore options for supplemental income, such as freelance work or part-time jobs. Consider negotiating with creditors for temporary payment adjustments.

- Challenge: High levels of consumer debt (credit cards, loans). Solution: Create a debt repayment plan, prioritizing high-interest debts. Explore debt consolidation options to lower interest rates and simplify payments. Cut back on non-essential spending to free up more money for debt repayment.

- Challenge: Lack of financial literacy and understanding. Solution: Take advantage of free or low-cost financial education resources available online and in your community. Read books and articles on personal finance. Consider attending workshops or seminars on financial planning.

- Challenge: Unrealistic or overly ambitious goals. Solution: Break down large goals into smaller, more achievable milestones. Set realistic timelines and adjust goals as needed based on progress and changing circumstances. Seek feedback from a financial advisor or trusted friend.

- Challenge: Emotional spending and impulsive purchases. Solution: Track spending meticulously to identify spending patterns. Develop a budget and stick to it. Use cash instead of credit cards to limit spending. Practice mindfulness and consider the long-term consequences before making impulsive purchases.

Last Recap

Mastering financial goal setting is a journey, not a destination. By implementing the strategies and templates Artikeld in this guide, you’ll gain the tools and confidence needed to navigate your financial path effectively. Remember, consistent monitoring, adaptation, and a proactive approach are key to achieving lasting financial success. Embrace the power of planning and watch your financial dreams materialize.

Commonly Asked Questions

What if my goals change over time?

Flexibility is crucial. Regularly review and adjust your goals and budget as your circumstances or priorities evolve. The template is designed to accommodate these changes.

How often should I review my progress?

Ideally, review your progress monthly to track milestones and make necessary adjustments. More frequent reviews may be beneficial for short-term goals.

What if I don’t have a lot of savings to start?

Start small! Even modest savings contribute to long-term growth. Focus on building good financial habits and gradually increasing your savings as your income allows.

Are there any software or apps that can help?

Yes, numerous budgeting apps and software programs can assist with tracking expenses, managing budgets, and monitoring progress towards your financial goals.