Effectively managing investments requires diligent tracking and analysis. The right tools can transform a daunting task into a streamlined process, providing valuable insights into portfolio performance and guiding strategic decisions. This guide explores the diverse landscape of investment tracking tools, from simple spreadsheets to sophisticated software solutions, helping you navigate the options and select the best fit for your needs.

We’ll delve into the key features, security considerations, and integration capabilities of these tools, examining how they empower investors to make informed choices and optimize their financial strategies. Whether you’re a seasoned investor or just starting your journey, understanding the available tools is crucial for achieving your financial goals.

Types of Investment Tracking Tools

Choosing the right investment tracking tool can significantly simplify your financial life, providing a clear overview of your portfolio’s performance and helping you make informed decisions. The market offers a variety of options, each with its own strengths and weaknesses. Understanding these differences is crucial for selecting the tool that best suits your needs and investment strategy.

Categorization of Investment Tracking Tools

Investment tracking tools are broadly categorized into three main types: spreadsheet-based solutions, dedicated software, and mobile applications. Each category offers a distinct set of features and functionalities, catering to different user preferences and technical expertise.

| Tool Name | Category | Key Features | Pricing Model |

|---|---|---|---|

| Microsoft Excel/Google Sheets | Spreadsheet-based | Customizable tracking, basic calculations, offline access. | Subscription (for cloud storage) or one-time purchase (for software). |

| Personal Capital | Dedicated Software | Comprehensive portfolio tracking, retirement planning tools, fee analysis. | Free (basic features), paid (premium features). |

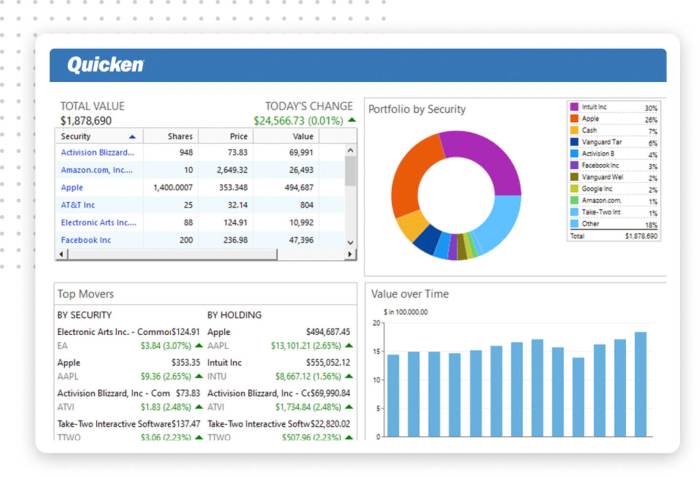

| Quicken | Dedicated Software | Detailed financial management, budgeting, investment tracking. | One-time purchase or subscription. |

| Robinhood | Mobile Application | Simplified trading, portfolio tracking, fractional shares. | Free (basic brokerage services). |

| Acorns | Mobile Application | Automated investing, micro-investing, portfolio diversification. | Subscription-based fees. |

Advantages and Disadvantages of Each Category

Spreadsheet-based solutions offer maximum customization and control but require significant technical skills and manual data entry. Dedicated software provides comprehensive features and automation but may be expensive and less flexible. Mobile applications offer convenience and accessibility but may lack the depth of features found in dedicated software.

| Category | Advantages | Disadvantages |

|---|---|---|

| Spreadsheet-based | Highly customizable, complete control, offline access, cost-effective (if you already have the software). | Requires technical skills, manual data entry, prone to errors, limited automation. |

| Dedicated Software | Comprehensive features, automation, advanced analysis tools, often includes financial planning features. | Can be expensive, less flexible than spreadsheets, may require a steep learning curve. |

| Mobile Applications | Convenient and accessible, user-friendly interface, often integrates with brokerage accounts. | Limited features compared to dedicated software, may lack customization options, potential security concerns. |

Comparison of Popular Investment Tracking Tools

The following table compares five popular investment tracking tools, highlighting their features and target user profiles.

| Tool Name | Key Features | Target User Profile |

|---|---|---|

| Personal Capital | Comprehensive portfolio tracking, retirement planning, fee analysis, net worth tracking. | High-net-worth individuals, investors seeking detailed financial planning. |

| Quicken | Detailed financial management, budgeting, investment tracking, bill payment. | Individuals seeking comprehensive financial management tools. |

| Yahoo Finance | Portfolio tracking, stock quotes, financial news, charting tools. | Casual investors, those seeking basic portfolio tracking and market information. |

| Robinhood | Simplified trading, portfolio tracking, fractional shares, educational resources. | Beginner investors, those seeking a user-friendly trading platform. |

| Morningstar | Portfolio tracking, research tools, investment analysis, mutual fund ratings. | Investors who prioritize research and analysis before making investment decisions. |

Key Features of Investment Tracking Tools

Effective investment management relies heavily on the use of robust tracking tools. These tools provide the necessary functionalities to monitor, analyze, and optimize investment portfolios, ultimately leading to better financial outcomes. A well-designed tool empowers investors with the insights needed to make informed decisions and adjust their strategies as market conditions change.

Investing involves a degree of complexity, and keeping track of multiple assets across various accounts can quickly become overwhelming without the right tools. Investment tracking tools simplify this process by centralizing information and automating many of the tasks involved in managing a portfolio. This allows investors to focus on strategic decision-making rather than getting bogged down in administrative details.

Portfolio Valuation

A core function of any investment tracking tool is the accurate and up-to-date valuation of your portfolio. This involves aggregating the current market value of all your holdings, including stocks, bonds, mutual funds, and other assets. The tool should automatically fetch real-time pricing data from reliable sources, ensuring your portfolio valuation reflects the current market conditions. This feature is crucial for understanding your overall net worth and tracking your investment progress. A clear and concise display of your portfolio’s total value, along with individual asset valuations, is essential.

Transaction Recording

Accurate record-keeping is fundamental to effective investment management. A robust investment tracking tool should seamlessly integrate transaction recording capabilities. This includes the ability to input details of all buy and sell orders, dividends received, and other relevant transactions. The tool should automatically calculate capital gains and losses, simplifying tax preparation and providing a clear audit trail of all investment activity. The ability to categorize transactions (e.g., by asset class or investment goal) further enhances the analytical capabilities of the tool.

Performance Analysis

Beyond simple valuation, a strong investment tracking tool should provide comprehensive performance analysis. This includes calculating key metrics such as total return, annualized return, Sharpe ratio, and standard deviation to assess both the profitability and risk associated with your investment strategy. Visualizations, such as charts and graphs, are invaluable for quickly understanding performance trends over time. These analyses facilitate a critical review of investment decisions and help in identifying areas for potential improvement. For example, comparing the performance of different asset classes within a portfolio allows for a more informed rebalancing strategy.

Reporting Capabilities

The ability to generate customized reports is a crucial feature for investors who need to track their progress over time or present their investment performance to others. A good investment tracking tool will offer various report formats, including summaries of portfolio performance, transaction histories, and tax reports. These reports can be exported in various formats (e.g., PDF, CSV) for easy sharing or archiving. The ability to customize report parameters (e.g., date range, asset class) further enhances their usefulness.

Advanced Features of Premium Investment Tracking Tools

Premium tools often include advanced features designed to enhance efficiency and decision-making. These features can significantly improve the investment management process.

- Tax Optimization Tools: These tools help investors strategically manage their investments to minimize their tax liabilities. They might include features such as tax-loss harvesting recommendations.

- Automated Rebalancing: This feature automatically adjusts the allocation of assets in your portfolio to maintain your desired asset allocation strategy. This ensures that your portfolio remains aligned with your risk tolerance and investment goals over time.

- Portfolio Allocation Suggestions: Based on your risk profile, investment goals, and market conditions, some premium tools offer suggestions for optimizing your portfolio allocation. These suggestions can help you diversify your holdings effectively and potentially improve your returns.

Data Management and Security in Investment Tracking Tools

Protecting your financial data is paramount when using investment tracking tools. These tools often hold sensitive information, including account numbers, balances, and transaction history, making them prime targets for cybercriminals. Understanding the data management and security practices of any tool you choose is crucial to mitigating potential risks and safeguarding your investments.

The importance of robust data security and privacy features cannot be overstated. Breaches can lead to identity theft, financial loss, and significant reputational damage. Reputable investment tracking tools employ a multi-layered approach to security, encompassing data encryption, access control mechanisms, and regular security audits. Failing to adequately protect user data can result in severe legal and financial consequences for the tool provider, further underscoring the necessity of prioritizing security.

Data Encryption and Access Control Mechanisms

Many reputable investment tracking tools utilize robust encryption methods, such as AES-256 encryption, to protect data both in transit and at rest. This means that your data is scrambled and unreadable unless you possess the correct decryption key. Furthermore, strong access control mechanisms, including multi-factor authentication (MFA), password managers, and biometric authentication, are commonly implemented to limit access to authorized users only. For example, a tool might require a password and a one-time code sent to your phone or email before granting access, adding an extra layer of protection. Sophisticated tools may also incorporate role-based access control (RBAC), allowing administrators to define specific permissions for different users, enhancing granular control over data access.

Factors to Consider When Assessing Security Features

Before selecting an investment tracking tool, it’s essential to carefully evaluate its security features. Consider the following factors:

- Encryption methods used: Look for tools that utilize industry-standard encryption, such as AES-256, for both data in transit and at rest.

- Authentication methods: Multi-factor authentication (MFA) should be a mandatory feature. The more authentication factors (password, one-time code, biometric scan), the better.

- Data storage location: Inquire about where your data is stored and whether it complies with relevant data privacy regulations (e.g., GDPR, CCPA).

- Security certifications and audits: Check if the tool has undergone independent security audits and holds relevant security certifications (e.g., ISO 27001).

- Data backup and recovery procedures: Understand how the tool protects against data loss and ensures data recovery in case of a system failure or cyberattack.

- Privacy policy and terms of service: Carefully review the tool’s privacy policy and terms of service to understand how your data is handled and protected.

- Incident response plan: A well-defined incident response plan demonstrates the tool’s preparedness to handle security breaches and minimize their impact.

Integration with Other Financial Platforms

Seamless integration with other financial platforms significantly enhances the utility of investment tracking tools, transforming them from simple record-keepers into powerful, centralized hubs for managing your entire financial life. This integration streamlines data entry, reduces errors, and provides a more comprehensive view of your financial health.

The benefits of connecting your investment tracking tool with brokerage accounts, banking apps, and tax software are substantial. Automated data synchronization eliminates the manual input of transaction details, saving considerable time and effort. Furthermore, a consolidated view of all your assets and liabilities facilitates better financial planning and decision-making, enabling a more holistic understanding of your overall financial situation. This integrated approach also minimizes the risk of discrepancies between different financial records, leading to greater accuracy and peace of mind.

API and Data Import/Export Functionalities

Many modern investment tracking tools utilize Application Programming Interfaces (APIs) to connect with other financial platforms. APIs allow for the automated exchange of data between different systems, typically in a standardized format like JSON or XML. For instance, an investment tracking tool might use the API of a brokerage firm to automatically download transaction history, account balances, and holdings. Similarly, data import/export functionalities, often in CSV or spreadsheet formats, provide alternative methods for transferring data between platforms. These functionalities may be less automated than API integrations but offer flexibility for users with platforms lacking direct API support. For example, a user could download a transaction report from their bank as a CSV file and then import this data into their investment tracking tool.

Streamlining Investment Management

The integration of investment tracking tools with other financial platforms significantly streamlines the investment management process. For example, linking to a brokerage account allows for real-time monitoring of portfolio performance, facilitating timely adjustments to investment strategies. Connecting with banking apps provides a complete picture of cash flow, enabling better allocation of funds for investments. Integration with tax software simplifies tax preparation by automatically populating relevant investment-related information, such as capital gains and losses, reducing the potential for errors and making tax filing significantly less cumbersome. A hypothetical example: imagine a scenario where an investor uses a tool that integrates with their brokerage, bank, and tax software. At tax time, the software automatically pulls all necessary investment data, calculating capital gains and losses, and populating the relevant tax forms, saving hours of manual data entry and reconciliation.

User Experience and Interface Design

A user-friendly interface is paramount for any investment tracking tool. Its success hinges on the ability to present complex financial data in a clear, accessible, and engaging manner. Without intuitive design, even the most powerful features can be rendered useless, leading to user frustration and ultimately, abandonment of the tool.

Effective UI/UX design in investment tracking tools translates directly to increased user engagement and satisfaction. A well-designed interface simplifies portfolio management, allowing users to quickly grasp their financial standing and make informed decisions. Conversely, a poorly designed interface can lead to data misinterpretations, missed opportunities, and ultimately, poor investment outcomes.

Intuitive Navigation and Data Visualization

Intuitive navigation is crucial for efficient interaction with the tool. Users should be able to easily locate specific information, perform necessary actions, and understand the overall flow of the application without needing extensive training. Clear and concise labeling of menus, buttons, and features is essential. Data visualization should employ charts, graphs, and other visual aids to present complex financial data in an easily digestible format. For example, a line graph showing portfolio performance over time is far more intuitive than a simple table of numbers. Color-coding, highlighting key data points, and using interactive elements further enhance the understanding and engagement with the data.

Personalized Settings and Customization Options

The ability to personalize the user experience significantly impacts user satisfaction. Users should be able to customize their dashboards, choosing which metrics to display prominently, selecting preferred chart types, and setting alerts for specific events. For instance, a user heavily invested in a particular sector might want to see real-time updates on that sector’s performance, while another might prefer a broader overview of their entire portfolio. Options for customizing the display of data (e.g., currency, date format) further enhance personalization and cater to individual preferences. Accessibility features, such as adjustable font sizes and color contrast options, should also be included to cater to users with visual impairments.

Ideal User Experience for an Investment Tracking Tool

An ideal user experience would seamlessly blend ease of use with powerful functionality. The tool should be immediately intuitive, requiring minimal effort to understand and navigate. Data should be presented clearly and concisely, allowing users to quickly assess their portfolio’s performance. Customizable dashboards and personalized settings would allow users to tailor the tool to their specific needs and preferences. The tool should also integrate seamlessly with other financial platforms, providing a unified view of a user’s complete financial picture. Robust security features would protect sensitive data, and excellent customer support would be readily available to address any issues. For example, imagine a user effortlessly monitoring their portfolio’s performance on their mobile device, receiving real-time alerts about significant market changes, and easily adjusting their investment strategy based on personalized charts and insights – this represents an ideal user experience.

Cost and Value Proposition of Investment Tracking Tools

Choosing the right investment tracking tool depends not only on its features but also on its cost and the overall value it provides. Different tools cater to varying needs and budgets, employing diverse pricing strategies to reach their target audiences. Understanding these pricing models and how they relate to the value proposition is crucial for making an informed decision.

Pricing models for investment tracking tools vary considerably. Some tools operate on a subscription-based model, offering different tiers with varying features and levels of support. Others adopt a freemium model, providing basic functionality for free while charging for premium features or increased data storage capacity. A less common approach is a one-time purchase, where users pay a fixed fee for lifetime access to the software, although updates and support may be limited. The choice of pricing model significantly impacts the overall cost and accessibility of the tool.

Pricing Models of Investment Tracking Tools

Investment tracking tools utilize various pricing strategies to cater to different user needs and budgets. Subscription-based models often offer monthly or annual plans, with higher-tier subscriptions unlocking more advanced features, such as portfolio optimization tools, tax reporting capabilities, and enhanced customer support. Freemium models typically offer a basic version with limited features for free, while premium features, like unlimited portfolio tracking or real-time data feeds, are available through a paid subscription. One-time purchase models provide users with lifetime access to the software for a single upfront payment, although future updates or support might not be guaranteed. The selection of the appropriate pricing model hinges on individual needs and budget constraints. For instance, a casual investor might find a freemium model sufficient, while a professional investor might prefer a comprehensive subscription-based service.

Factors Influencing Value Proposition

The value proposition of an investment tracking tool varies greatly depending on the user segment. For individual investors, ease of use, intuitive interface, and accurate data reporting are paramount. They may prioritize tools that offer clear visualizations of their portfolio performance and simplify tax reporting. Financial advisors, on the other hand, require more sophisticated features such as client portfolio management, performance reporting, and integration with other financial planning software. They may be willing to pay a premium for robust features that streamline their workflow and enhance their client service capabilities. Businesses or institutional investors would likely prioritize features such as advanced analytics, security, and scalability to handle large volumes of data.

Return on Investment (ROI) from Investment Tracking Tools

The ROI from utilizing investment tracking tools can be substantial, though it’s not always directly quantifiable in monetary terms. Improved investment decision-making, resulting from clearer insights into portfolio performance and risk, is a significant benefit. For example, identifying underperforming assets early on allows for timely adjustments, potentially mitigating losses. Furthermore, efficient tax reporting and portfolio optimization features can lead to tax savings and improved returns. For financial advisors, the time saved by using efficient client portfolio management tools translates to increased productivity and the ability to serve more clients. While a precise monetary ROI calculation may be challenging, the qualitative benefits in terms of improved decision-making, enhanced efficiency, and reduced risk contribute significantly to the overall value. For example, a financial advisor who saves 10 hours per week through automated reporting could dedicate that time to acquiring new clients or providing more personalized advice, ultimately increasing revenue and profitability.

Final Summary

Ultimately, the choice of an investment tracking tool hinges on individual needs and preferences. From simple spreadsheet solutions to advanced software packages, the market offers a diverse range of options. By carefully considering features, security, integration capabilities, and user experience, investors can empower themselves with the tools necessary to effectively manage and grow their portfolios. The right tool can significantly enhance your investment journey, leading to more informed decisions and improved financial outcomes.

Common Queries

What is the difference between free and paid investment tracking tools?

Free tools often offer basic features like portfolio tracking and transaction recording, but may lack advanced functionalities such as tax optimization or automated rebalancing. Paid tools usually provide a broader range of features and superior support.

How can I ensure the security of my investment data?

Choose tools with robust security features like encryption, two-factor authentication, and secure data storage practices. Regularly review the tool’s security policies and update your passwords.

Are investment tracking tools suitable for beginners?

Yes, many tools offer user-friendly interfaces and tutorials to guide beginners. Start with a simple tool and gradually explore more advanced features as your comfort level increases.

Can I import data from multiple brokerage accounts?

Many tools support data import from various brokerage accounts through APIs or manual uploads. Check the tool’s specifications for compatibility with your specific accounts.