Navigating the complexities of tax season can be daunting, but the right tools can significantly ease the burden. Tax planning software has evolved from simple calculators to sophisticated platforms offering comprehensive solutions for individuals and businesses alike. This evolution has been driven by increasingly complex tax codes and a growing need for efficient, accurate tax preparation.

From basic tax return filing to advanced strategic planning, these software solutions offer a range of features designed to optimize your tax outcome. This exploration delves into the core functionalities, user experience, security considerations, and future trends shaping this vital sector of financial technology.

Introduction to Tax Planning Software

Tax planning software has revolutionized the way individuals and businesses manage their tax obligations. These sophisticated tools offer a range of functionalities designed to simplify complex tax calculations, identify potential savings, and ultimately minimize tax liabilities. By automating tedious processes and providing insightful analyses, tax planning software empowers users to make informed financial decisions and improve their overall tax efficiency.

Tax planning software helps users accurately complete tax returns, predict future tax liabilities, and strategize for tax minimization within legal parameters. Benefits extend beyond simple tax preparation, encompassing proactive planning for retirement, investment optimization, and estate planning. The software’s ability to analyze various scenarios allows for informed decision-making, leading to greater financial security and peace of mind.

A Brief History of Tax Planning Software Development

Early tax software focused primarily on basic tax return preparation. These initial programs were largely text-based and offered limited analytical capabilities. As computing power increased and software development techniques advanced, tax software evolved to incorporate more complex calculations, data integration, and user-friendly interfaces. The introduction of graphical user interfaces (GUIs) significantly improved user experience, making tax software accessible to a wider audience. Today’s tax planning software incorporates advanced algorithms, machine learning, and cloud-based technologies, enabling sophisticated analysis and predictive modeling. This evolution reflects a shift from simply preparing tax returns to proactive tax planning and strategic financial management. For example, early programs might only calculate simple deductions, while modern software can simulate the tax implications of various investment strategies or estate planning scenarios.

Types of Tax Planning Software

Several categories of tax planning software cater to diverse needs and user expertise levels. The range spans from basic, user-friendly applications designed for individual taxpayers to highly specialized, enterprise-level solutions used by large corporations and accounting firms.

Some common types include:

- Individual Tax Software: These programs are designed for individuals to prepare and file their personal income tax returns. They typically offer guided interviews, error checking, and electronic filing capabilities. Examples include TurboTax and H&R Block.

- Small Business Tax Software: These programs cater to the specific needs of small businesses, incorporating features for managing payroll taxes, sales taxes, and other business-related tax obligations. Examples include QuickBooks Self-Employed and Xero.

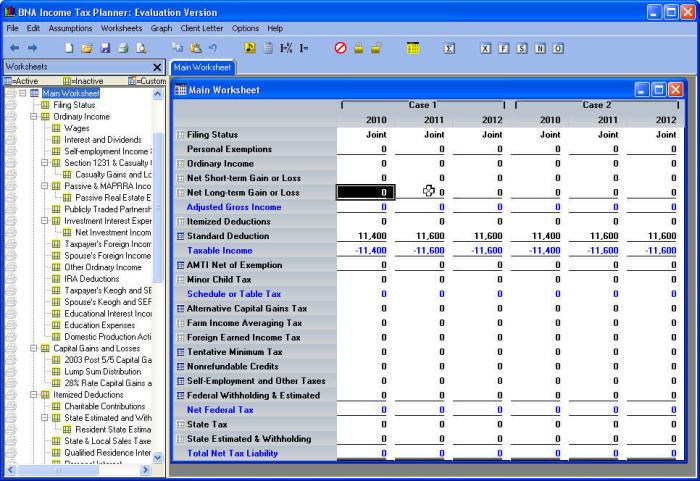

- Tax Planning and Projection Software: These advanced tools go beyond simple tax return preparation. They allow users to model different tax scenarios, predict future tax liabilities, and optimize tax strategies. These often incorporate features for retirement planning and estate planning. Examples might include specialized software used by financial advisors or larger tax firms, often not available to the general public.

- Enterprise Tax Software: Large corporations and multinational organizations often utilize sophisticated enterprise-level tax software solutions that integrate with their existing financial systems. These programs offer comprehensive tax compliance, planning, and reporting capabilities. These are highly customized and integrated systems, often requiring significant investment and specialized expertise.

Key Features of Tax Planning Software

Tax planning software offers a range of functionalities designed to simplify and streamline the tax preparation process, providing users with tools to minimize tax liabilities and maximize returns. The specific features offered vary depending on the software provider and the target user base (individuals versus businesses), but several core functionalities are common across most platforms.

Tax planning software aims to reduce the complexity of tax calculations and compliance, offering benefits from simple tax return preparation to sophisticated tax optimization strategies. The choice of software depends heavily on individual needs and complexity of financial situations.

Core Functionalities of Tax Planning Software

Most tax planning software packages include fundamental features such as data import capabilities (from bank statements, investment accounts, etc.), guided tax form completion, error checking, and electronic filing options. Beyond these basics, more advanced software may incorporate features like tax projection tools, optimization algorithms, and personalized financial planning modules. These advanced features are particularly useful for individuals with complex financial situations or businesses with intricate tax structures.

Comparison of Features Across Different Software Options

Different software options cater to various needs and budgets. For example, some software packages focus primarily on individual tax returns and offer a simplified interface, while others are designed for businesses and include features for managing payroll taxes, depreciation, and other business-specific tax obligations. Pricing models also vary significantly, ranging from free (often with limited features) to subscription-based services with varying levels of access and support. The choice often depends on a user’s comfort level with technology and their specific tax requirements. Consider comparing features like the number of supported tax forms, the availability of customer support, and the overall ease of use when selecting software.

Essential Features for Different User Types

The essential features of tax planning software differ significantly based on user type. For individuals, essential features include straightforward data entry, accurate calculation of federal and state taxes, and easy electronic filing capabilities. Individuals with investment income or rental properties might benefit from software that handles these complexities effectively. For businesses, essential features include the ability to manage payroll taxes, track business expenses, and generate reports for tax purposes. Larger businesses may require more sophisticated features like integration with accounting software and support for multiple tax jurisdictions. Small businesses may find simpler, more affordable options sufficient.

User Experience and Interface Design

A user-friendly interface is paramount for tax planning software. Complex tax regulations already present a significant challenge for users; cumbersome software only exacerbates the issue. Intuitive design fosters user confidence, reduces errors, and ultimately leads to greater user satisfaction and adoption.

The success of tax planning software hinges on its ability to present complex information in a clear, accessible, and efficient manner. Poor design can lead to frustration, errors in data entry, and ultimately, inaccurate tax calculations. Conversely, a well-designed interface can significantly streamline the tax planning process, making it more manageable and less daunting for users of all technical skill levels.

Intuitive Navigation and Information Architecture

Effective information architecture is crucial for guiding users through the software. A logical flow, clear labeling, and consistent placement of elements are essential. Users should be able to easily find the information and tools they need without unnecessary searching or clicking. For instance, a well-structured menu system with clear categories (e.g., Income, Deductions, Credits) allows users to quickly navigate to the relevant sections. Furthermore, a comprehensive search function allows users to find specific information quickly, improving overall efficiency. Internal links should be strategically placed to guide users to related information and resources, improving navigation and understanding.

Common Design Elements and Their Impact on Usability

Several design elements significantly impact usability. Clear visual hierarchy (using size, color, and font weight to emphasize important information), consistent use of visual language (e.g., icons, buttons), and sufficient white space (to avoid visual clutter) are all critical. The use of progress indicators (e.g., progress bars) helps users track their progress and understand the steps involved in the tax planning process. Error messages should be clear, concise, and helpful, guiding users towards correction. Accessibility features, such as keyboard navigation and screen reader compatibility, are crucial for inclusivity. The use of interactive tutorials and help sections within the software can further enhance user understanding and confidence.

Mock-up of an Intuitive Interface

The following table provides a simplified example of an intuitive interface for tax planning software, employing a responsive four-column layout.

| Feature | Description | Action | Status |

|---|---|---|---|

| Income Entry | Enter all income sources (W-2s, 1099s, etc.) | Click to expand form | Incomplete |

| Deduction Entry | Input eligible deductions (mortgage interest, charitable contributions, etc.) | Click to expand form | Complete |

| Tax Credit Input | Add applicable tax credits (child tax credit, education credits, etc.) | Click to expand form | Incomplete |

| Tax Calculation | Software automatically calculates tax liability based on entered data | Click to view results | Pending |

| Tax Planning Strategies | Provides personalized tax planning recommendations | Click to view recommendations | Pending |

| Report Generation | Generate comprehensive tax reports for review and filing | Click to generate reports | Pending |

| Data Import/Export | Import data from other sources or export data for external use | Click to import/export | Available |

| Help & Support | Access tutorials, FAQs, and contact support | Click to access help | Available |

Data Security and Privacy in Tax Software

Protecting your financial information is paramount, and our tax planning software prioritizes data security and user privacy through a multi-layered approach. We understand the sensitive nature of tax data and have implemented robust measures to safeguard your information from unauthorized access, use, disclosure, alteration, or destruction.

Data encryption and secure storage are fundamental to our security strategy. All data transmitted to and from our servers is encrypted using industry-standard protocols, ensuring that your information remains confidential even if intercepted. Furthermore, your data is stored on secure servers with restricted access, employing physical and digital security measures to prevent unauthorized access. Regular security audits and penetration testing help us identify and address potential vulnerabilities proactively.

Data Encryption and Secure Storage Methods

Our software utilizes advanced encryption techniques, including AES-256 bit encryption for data at rest and TLS 1.3 for data in transit. This means that your data is encrypted both while it’s stored on our servers and while it’s being transferred between your computer and our servers. Access to the servers themselves is restricted through multi-factor authentication and rigorous access control lists, limiting access only to authorized personnel. Regular backups of your data are stored in geographically separate, secure locations, providing redundancy and protection against data loss due to unforeseen circumstances, such as natural disasters or equipment failures.

User Best Practices for Data Privacy

Maintaining the privacy of your data requires a collaborative effort. While we employ robust security measures, responsible user practices are crucial.

The following best practices are recommended:

- Choose a strong, unique password for your account, incorporating a mix of uppercase and lowercase letters, numbers, and symbols.

- Enable two-factor authentication (2FA) whenever available. This adds an extra layer of security by requiring a second verification method, such as a code sent to your phone or email, in addition to your password.

- Keep your software updated with the latest security patches. These updates often include fixes for vulnerabilities that could be exploited by malicious actors.

- Be cautious of phishing emails or suspicious links. Never click on links or open attachments from unknown senders, as these could contain malware designed to steal your information.

- Log out of your account when you’re finished using the software, especially if you’re using a shared computer.

- Regularly review your account activity to detect any unauthorized access attempts.

Cost and Pricing Models of Tax Planning Software

Choosing the right tax planning software often involves careful consideration of its cost. Different software providers employ various pricing models, each with its own advantages and disadvantages. Understanding these models is crucial for selecting a solution that aligns with your budget and needs. This section will explore the common pricing structures and provide examples to aid in your decision-making process.

Tax planning software typically follows either a subscription-based model or a one-time purchase model. Subscription models offer ongoing access to updates, features, and support, while one-time purchases provide a permanent license but may lack ongoing support or updates. The choice between these models depends largely on the frequency of use, the need for continuous updates, and the overall budget.

Subscription Pricing Models

Subscription models are prevalent in the tax software market. These models typically involve recurring monthly or annual payments for access to the software’s features. This ensures users always have access to the latest updates, bug fixes, and new features as they are released. The cost varies depending on the software’s capabilities, the number of users, and the level of support included. For example, TaxAct offers various subscription tiers, ranging from basic plans suitable for simple returns to more comprehensive plans designed for self-employed individuals or businesses with complex tax situations. Similarly, H&R Block’s online tax software uses a subscription model with tiered pricing based on the complexity of the tax return.

One-Time Purchase Pricing Models

While less common for sophisticated tax planning software, some simpler programs might offer a one-time purchase option. This means a single payment grants permanent access to the software. However, it’s important to note that updates and support may not be included, and the software might become outdated over time. This model is generally suitable for users who only need the software for a single tax season or those with simpler tax situations and limited need for ongoing support. Examples of this model are less prevalent among major players but may be found in niche software offerings targeting very specific user needs.

Pricing Plans Comparison

The following table compares pricing plans from hypothetical providers, illustrating the variations in features and costs across different models. Note that these are illustrative examples and actual pricing may vary.

| Software Provider | Plan Name | Price (Annual) | Included Features |

|---|---|---|---|

| TaxPro | Basic | $49 | Basic tax filing, limited support |

| TaxPro | Premium | $99 | Advanced tax planning tools, unlimited support, audit support |

| TaxEase | Standard | $79 | Standard tax filing, access to tax guides |

| TaxEase | Business | $149 | Business tax filing, advanced reporting, dedicated support |

Integration with Other Financial Tools

Seamless integration with other financial tools is a critical feature of modern tax planning software, significantly enhancing its utility and streamlining the overall financial management process. By connecting your tax software to other applications, you can automate data transfer, reduce manual entry, and gain a more holistic view of your financial situation. This ultimately leads to improved accuracy, efficiency, and informed decision-making.

The benefits of integration extend beyond simple convenience. Connecting your tax software with accounting and financial management platforms creates a powerful synergy, minimizing the risk of errors associated with manual data entry and reconciliation. This streamlined workflow allows for more time to be dedicated to strategic tax planning and less time spent on tedious administrative tasks. Moreover, access to a consolidated financial picture facilitates better-informed decisions regarding investment strategies, expense management, and overall financial health.

Examples of Successful Integrations

Several successful integrations demonstrate the practical advantages of connecting tax planning software with other financial tools. For example, integrating with popular accounting software like Xero or QuickBooks allows for automatic import of financial transactions, eliminating the need for manual data entry into the tax software. This automated process significantly reduces the risk of human error and saves considerable time. Another example is the integration with financial management software that tracks investments, retirement accounts, and other assets. This integration provides a comprehensive view of an individual’s or business’s financial health, allowing for more effective tax planning strategies that consider all aspects of their financial situation. A successful integration might also involve payroll software, automatically transferring payroll data for accurate tax calculations and reporting. These examples highlight how diverse integrations can contribute to a more efficient and effective tax planning process.

Tax Planning Software and Different Tax Systems

Tax planning software must navigate the complexities of diverse global tax systems to provide accurate and reliable results. The ability to adapt to varying tax regulations, reporting requirements, and calculation methods is crucial for the software’s success and user satisfaction. This necessitates sophisticated design and ongoing updates to remain compliant with evolving tax laws across different jurisdictions.

The development of tax planning software capable of handling multiple tax systems presents significant challenges. These challenges stem from the inherent differences in tax structures, the sheer volume of regulations, and the frequent changes to tax laws in various countries. Maintaining accuracy requires meticulous attention to detail and continuous updates, incorporating legal and regulatory changes across all supported jurisdictions. Furthermore, ensuring the software’s usability across different languages and cultural contexts adds another layer of complexity.

Software Adaptation to Different Tax Jurisdictions

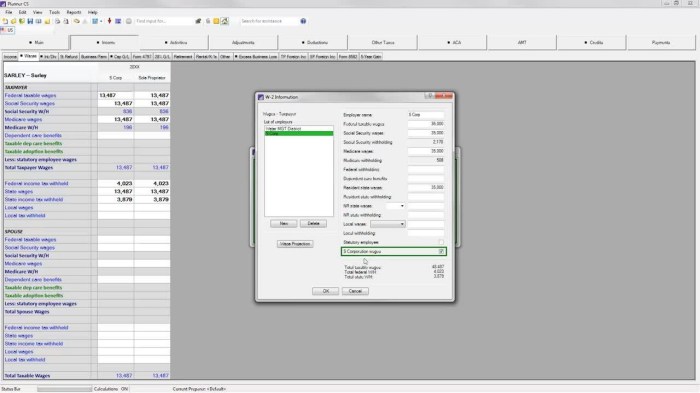

This section details how tax planning software adapts to various tax systems. The software achieves this adaptability through a modular design, allowing for the addition or modification of specific tax modules tailored to individual countries or regions. These modules contain the specific tax rates, rules, and forms relevant to that jurisdiction. For instance, a module for the United States would include forms like 1040, 1099, and W-2, along with the relevant tax brackets and deductions, while a Canadian module would incorporate forms like T1 and T4, reflecting Canadian tax law. The user selects their relevant jurisdiction at the start, and the software automatically loads the appropriate module. This allows for accurate calculations and form generation, tailored to the user’s specific tax environment. The software also needs to adapt to different accounting standards (like GAAP or IFRS) that may influence the data input and reporting.

Challenges in Developing Software for Diverse Tax Regulations

Developing software that accurately reflects the intricacies of multiple tax systems presents several significant hurdles. First, the sheer volume of regulations and their frequent updates require continuous maintenance and updates to the software. Secondly, ensuring consistent accuracy across all modules requires rigorous testing and validation. Thirdly, the software must be designed to handle variations in data formats and reporting requirements across different jurisdictions. Finally, translating the software interface and documentation into multiple languages adds another layer of complexity to the development process. For example, the interpretation of certain tax deductions or credits can vary subtly between countries, requiring precise coding to capture these nuances. A failure to account for these subtleties can lead to inaccurate tax calculations and potentially serious consequences for the user.

Handling Various Tax Forms and Regulations

The software’s capability to handle various tax forms and regulations is central to its functionality. The following bullet points illustrate this capability:

- Support for multiple tax forms: The software supports a wide range of tax forms from different countries, automatically selecting the appropriate forms based on the user’s specified jurisdiction and tax situation. Examples include Form 1040 (US), T1 (Canada), and various VAT/GST returns.

- Automatic tax calculation: The software automatically calculates taxes based on the user’s input data and the relevant tax laws of the selected jurisdiction, minimizing the risk of manual errors.

- Compliance with evolving tax laws: Regular updates ensure the software remains compliant with the latest tax laws and regulations in all supported jurisdictions. This includes adapting to changes in tax rates, deductions, and reporting requirements.

- Integration of tax treaties: Where applicable, the software incorporates provisions from relevant tax treaties to optimize tax planning strategies. This requires a complex system of rules to handle different treaty provisions and their implications.

- Support for different accounting standards: The software adapts to various accounting standards, allowing users to input data and generate reports in accordance with the relevant standards (e.g., GAAP, IFRS).

Future Trends in Tax Planning Software

The landscape of tax planning software is constantly evolving, driven by advancements in technology and the increasing complexity of tax regulations. We are moving beyond simple tax preparation tools towards sophisticated platforms that leverage artificial intelligence, machine learning, and enhanced data security to provide more accurate, efficient, and user-friendly tax planning experiences.

The integration of emerging technologies is fundamentally reshaping the capabilities and functionality of tax planning software. This evolution promises to streamline processes, reduce errors, and offer more proactive and personalized tax advice.

Artificial Intelligence and Machine Learning in Tax Software

AI and machine learning are poised to revolutionize tax planning. These technologies can automate complex tasks such as data entry, form completion, and error detection, significantly reducing the time and effort required for tax preparation. Furthermore, machine learning algorithms can analyze vast datasets of tax information to identify potential deductions, credits, and optimization strategies that might be overlooked by human tax professionals. For example, an AI-powered system could analyze a user’s income, expenses, and investment portfolio to automatically identify eligible deductions for charitable contributions or home office expenses, presenting the user with personalized recommendations for tax optimization. This proactive approach moves beyond simple compliance to strategic tax planning.

Enhanced Data Security and Privacy Features

With the increasing volume of sensitive financial data handled by tax software, robust security and privacy measures are paramount. Future developments will likely focus on advanced encryption techniques, blockchain integration for secure data storage and transfer, and improved user authentication protocols. For example, multi-factor authentication and biometric verification could be implemented to further enhance security, protecting user data from unauthorized access and cyber threats. The incorporation of privacy-enhancing technologies, such as differential privacy, could also allow for the analysis of aggregated data while preserving the confidentiality of individual user information.

Improved User Interface and User Experience

Future tax software will likely prioritize intuitive and user-friendly interfaces. This includes features like personalized dashboards, interactive tutorials, and integrated help systems to guide users through the tax planning process. Natural language processing (NLP) could enable users to interact with the software through voice commands or conversational interfaces, making the experience more accessible and efficient. Imagine a scenario where a user could simply ask the software, “What deductions am I eligible for?” and receive a clear and concise answer, along with supporting documentation.

Predictive Analytics and Tax Forecasting

The incorporation of predictive analytics will enable tax software to provide users with more proactive and personalized tax advice. By analyzing historical data and current trends, the software can forecast future tax liabilities and provide recommendations for optimizing tax strategies. For example, the software could predict the impact of changes in tax laws or investment decisions on a user’s tax burden, allowing them to make informed choices and plan accordingly. This proactive approach transforms tax planning from a reactive to a preventative measure.

Integration with Other Financial Tools

Seamless integration with other financial tools, such as banking platforms, investment accounts, and accounting software, will further enhance the efficiency and accuracy of tax planning. This integration will automate the flow of financial data into the tax software, eliminating the need for manual data entry and reducing the risk of errors. For example, a user’s bank account transactions could be automatically categorized and imported into the tax software, simplifying the process of tracking expenses and income. This integration will create a more holistic view of a user’s financial situation, facilitating more informed tax planning decisions.

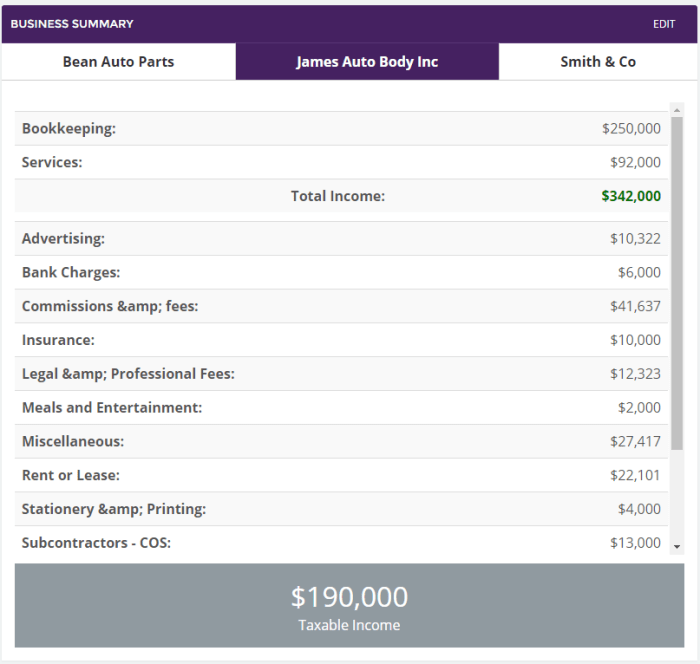

Illustrative Example: Software for Small Businesses

Small business owners often face complex tax obligations, making efficient tax planning crucial for success. Specialized tax software designed for small businesses simplifies this process by providing tools to manage various tax aspects, from tracking income and expenses to generating tax reports. This example demonstrates how such software can streamline the tax management process for a small business owner.

Let’s consider “Cozy Coffee,” a small café owned by Sarah. Cozy Coffee uses a simplified tax software solution designed for small businesses. The software helps Sarah manage her income, expenses, and tax obligations throughout the year, ultimately simplifying tax preparation come filing time.

Tax Scenario: Cozy Coffee’s First Year

Sarah started Cozy Coffee in January. Throughout the year, she meticulously recorded all her income and expenses using the software. This included sales from coffee, pastries, and merchandise, along with expenses such as rent, utilities, supplies, employee wages, and marketing costs. The software automatically categorizes these transactions, making it easy for Sarah to track her profitability and identify areas for potential tax deductions. By the end of December, Sarah is ready to prepare her tax return.

Software Features in Action

The software’s key features significantly simplify Sarah’s tax preparation. The dashboard provides a clear overview of her financial performance and tax liabilities. Imagine a dashboard with the following key elements:

Visual Representation of Dashboard: The dashboard displays a circular graph showing the percentage breakdown of Cozy Coffee’s income sources (e.g., 60% coffee sales, 25% pastries, 15% merchandise). A bar graph visually represents the major expense categories (rent, utilities, supplies, etc.) over the year. Key figures are prominently displayed, including total income, total expenses, net profit, estimated tax liability, and remaining tax payments due. A progress bar indicates the percentage of tax preparation completed. Additionally, a calendar displays upcoming tax deadlines and reminders.

Tax Report Generation

Once Sarah has reviewed all the data and made any necessary adjustments, the software generates the necessary tax forms and reports automatically. This eliminates the need for manual data entry and reduces the risk of errors. The software also provides explanations of the various tax forms and calculations, assisting Sarah in understanding her tax obligations.

Tax Deduction Identification

The software highlights potential tax deductions based on Sarah’s recorded expenses. For example, it identifies eligible deductions for business expenses like office supplies, marketing costs, and employee wages. It also provides information on available tax credits and incentives for small businesses, maximizing Sarah’s potential tax savings.

Integration with Accounting Software

The software seamlessly integrates with Cozy Coffee’s accounting software, automatically importing financial data. This eliminates the need for manual data entry and ensures data consistency, further reducing the risk of errors and saving Sarah valuable time.

Last Word

Ultimately, the selection of tax planning software depends on individual or business needs and budget. Understanding the key features, security protocols, and integration capabilities is crucial for making an informed decision. By leveraging the power of technology, taxpayers can confidently navigate the tax landscape, minimize their tax liabilities, and achieve greater financial control. The future of tax planning software promises even greater efficiency, accuracy, and user-friendly interfaces, further empowering individuals and businesses in managing their financial obligations.

General Inquiries

What types of tax returns can tax planning software handle?

Most software handles various forms, including 1040, 1040-ES, 1065, 1120, and others, depending on the specific software and its features. Always verify compatibility with your specific needs.

Is my data safe with tax planning software?

Reputable software providers employ robust security measures like encryption and secure data storage to protect user information. However, it’s vital to choose established providers with a proven track record of data security.

Can I integrate tax planning software with my existing accounting software?

Many tax planning software solutions offer seamless integration with popular accounting platforms, allowing for streamlined data transfer and improved efficiency. Check for compatibility before purchasing.

What if I make a mistake using the software?

While the software aims to minimize errors, human oversight remains crucial. Review all calculations and consult a tax professional if you have any doubts or uncertainties.