Understanding market dynamics is crucial for business success. Market Insights Analysis provides a structured approach to deciphering consumer behavior, competitive landscapes, and emerging trends. This analysis goes beyond simple data collection; it involves interpreting complex information to generate actionable strategies for growth and sustained competitive advantage. This exploration delves into the methodologies, data sources, and analytical techniques vital for effective market understanding.

From defining the scope of market research and identifying reliable data sources to conducting competitive analyses and forecasting future trends, this analysis equips businesses with the tools to make informed decisions. We’ll examine various market research methodologies, including qualitative and quantitative approaches, highlighting their strengths and weaknesses in different contexts. The goal is to translate raw data into compelling narratives that drive strategic decision-making.

Defining the Scope of Market Research

Understanding the market is crucial for any business aiming for sustainable growth. This involves more than just knowing your competitors; it requires a deep dive into consumer behavior, market trends, and competitive landscapes to inform strategic decision-making. This section will define market insights and explore the methodologies used to obtain them.

Market insights are actionable pieces of information derived from market research that provide a clear understanding of consumer needs, preferences, and behaviors. They illuminate opportunities and challenges, guiding businesses towards informed decisions regarding product development, marketing strategies, and overall business operations. In today’s dynamic business environment, access to reliable and timely market insights is no longer a luxury but a necessity for competitive advantage.

Market Research Methodologies

Several methodologies are employed to gather the data necessary for generating valuable market insights. The choice of methodology depends heavily on the research objectives, budget, and timeframe. These methods can be broadly categorized as qualitative or quantitative, often used in conjunction for a comprehensive understanding.

Qualitative and Quantitative Market Research

Qualitative research focuses on understanding the “why” behind consumer behavior. It delves into in-depth opinions, motivations, and attitudes. Methods include focus groups, in-depth interviews, and ethnographic studies. Qualitative research excels at uncovering nuanced information and generating hypotheses, but its findings are often subjective and not easily generalizable to a larger population. For example, a focus group with a specific demographic could reveal valuable insights into their preferences for a new product feature, but the results may not accurately reflect the preferences of the broader market.

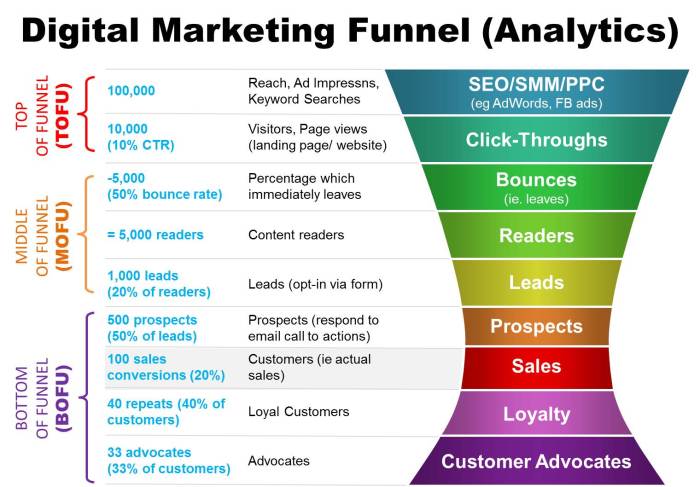

Quantitative research, conversely, focuses on measuring and quantifying market phenomena. It uses statistical methods to analyze large datasets and draw generalizable conclusions. Common methods include surveys, experiments, and data analysis from existing sources. Quantitative research provides statistically significant results, facilitating objective comparisons and predictions. However, it may miss the subtle nuances revealed by qualitative methods. For instance, a large-scale survey could accurately measure market share for a product, but it may not explain *why* that market share is high or low.

Key Performance Indicator (KPI) Framework

A well-defined framework is essential for identifying relevant KPIs for a specific market analysis. The framework should align with the overall business objectives and the specific research questions. A typical framework could include:

- Defining Objectives: Clearly state the goals of the market analysis. What questions need to be answered? What decisions need to be informed?

- Identifying Key Metrics: Based on the objectives, select relevant metrics that can be measured and tracked. Examples include market size, market share, customer acquisition cost, customer lifetime value, brand awareness, and customer satisfaction.

- Data Collection and Analysis: Determine the data sources and methodologies to collect the necessary data. Analyze the data to identify trends and patterns.

- Reporting and Interpretation: Present the findings in a clear and concise manner, highlighting key insights and recommendations.

For example, a company launching a new mobile game might define its objectives as maximizing downloads and in-app purchases. Relevant KPIs would then include daily/monthly active users, average revenue per user (ARPU), conversion rates, and customer churn. By tracking these KPIs, the company can monitor the success of its marketing campaigns and make data-driven adjustments to its strategy.

Data Collection and Sources

Gathering reliable and relevant data is paramount to conducting a successful market analysis. The quality of your insights is directly tied to the quality of your data. This section will explore several key data sources, their strengths and weaknesses, and best practices for data handling.

Reliable Data Sources for Market Research

Choosing appropriate data sources is crucial. Different sources offer varying levels of detail, accuracy, and cost. The optimal choice depends on the specific research objectives and available resources.

- Government Agencies and Statistical Offices: Organizations like the U.S. Census Bureau or Eurostat provide extensive demographic, economic, and social data. Advantages include high reliability and often free access. Disadvantages can include infrequent updates and potentially limited granularity for niche markets.

- Industry Associations and Trade Publications: These organizations often compile market-specific data, trends, and analyses. Advantages include specialized insights and often detailed reports. Disadvantages can be limited scope, potential bias towards members, and subscription costs.

- Market Research Firms: Companies like Nielsen, Statista, and Mintel offer comprehensive market reports, often employing advanced analytical techniques. Advantages include high-quality data, expert analysis, and readily available insights. Disadvantages are significant costs, potential lack of customization, and reliance on a third party.

- Academic Databases and Journals: Resources like JSTOR and ScienceDirect contain research papers and studies relevant to various market segments. Advantages include access to peer-reviewed research and in-depth analysis. Disadvantages include a potentially steep learning curve to find relevant data, and access may require subscriptions.

- Company Internal Data: Sales figures, customer demographics, and website analytics offer valuable first-hand insights into a company’s own performance and market position. Advantages include direct relevance to the business and readily available data. Disadvantages include potential biases and limitations in scope, reflecting only the company’s specific market segment.

Data Cleaning and Preparation

Raw data rarely comes in a format suitable for direct analysis. Thorough cleaning and preparation are essential for accurate insights. This involves several key steps:

Data cleaning encompasses identifying and correcting errors, inconsistencies, and missing values. Missing data can be handled through imputation techniques (e.g., using mean, median, or more sophisticated methods) or by excluding affected data points if the missingness is not random. Outliers, data points significantly deviating from the norm, should be carefully examined. They may indicate errors or represent truly unique market segments, requiring individual assessment before removal or adjustment.

Data Visualization Techniques

Effective data visualization is crucial for communicating complex market insights clearly and concisely. Several techniques can be employed:

Charts and graphs, such as bar charts, line graphs, and pie charts, are useful for showing trends, comparisons, and proportions. Heatmaps can illustrate correlations between variables. Interactive dashboards allow for exploration of data across multiple dimensions. Choosing the right visualization depends on the data type and the message to be conveyed.

Example of Data Visualization

Below is a sample table visualizing market share data for different brands of smartphones:

| Brand | Market Share (%) | Growth Rate (%) | Customer Satisfaction (Score) |

|---|---|---|---|

| Brand A | 35 | 5 | 8.5 |

| Brand B | 28 | 2 | 7.8 |

| Brand C | 20 | 10 | 8.2 |

| Brand D | 17 | -3 | 7.2 |

Market Research Report Structure

A well-structured report ensures clarity and efficient communication of findings. A typical structure includes:

- Executive Summary: A concise overview of the key findings and recommendations.

- Methodology: A detailed description of the research approach, data sources, and analytical techniques used.

- Findings: A presentation of the key data and insights, supported by visualizations.

- Recommendations: Actionable suggestions based on the research findings.

Competitive Landscape Analysis

Understanding the competitive landscape is crucial for strategic decision-making. This analysis examines the positions of three leading competitors in the fast-casual pizza market: Domino’s, Pizza Hut, and Papa John’s. We will compare their market strategies, identify strengths and weaknesses, and explore potential threats and opportunities within this dynamic sector.

Competitor Market Positions

This section compares and contrasts the market positions of Domino’s, Pizza Hut, and Papa John’s, highlighting their key strengths and weaknesses.

| Competitor | Strengths | Weaknesses |

|---|---|---|

| Domino’s |

|

|

| Pizza Hut |

|

|

| Papa John’s |

|

|

Competitive Strategies

Each competitor employs distinct competitive strategies. Domino’s leverages technology for efficient delivery and online ordering, focusing on speed and convenience. Pizza Hut emphasizes a broader menu and dine-in experience, catering to a wider range of customer preferences. Papa John’s highlights superior ingredients and quality, aiming for a premium market segment. Pricing strategies vary, with Domino’s often offering value-oriented deals, while Papa John’s positions itself at a slightly higher price point. Marketing efforts are tailored to each brand’s unique positioning, utilizing digital channels, television advertising, and loyalty programs.

Competitive Threats and Opportunities

The fast-casual pizza market faces several threats, including increasing competition from smaller, local pizzerias and the rise of other quick-service restaurant options. Changing consumer preferences, particularly towards healthier food choices, also pose a challenge. However, opportunities exist in expanding delivery services to underserved areas, introducing innovative menu items, and leveraging data analytics to personalize customer experiences. The growing popularity of online ordering and delivery presents significant opportunities for all competitors, as does the expansion into new international markets. For example, the increasing demand for vegan and vegetarian options presents a significant opportunity for all three brands to capture a growing market segment. Domino’s successful introduction of plant-based pizzas showcases the potential for success in this area.

Market Segmentation and Targeting

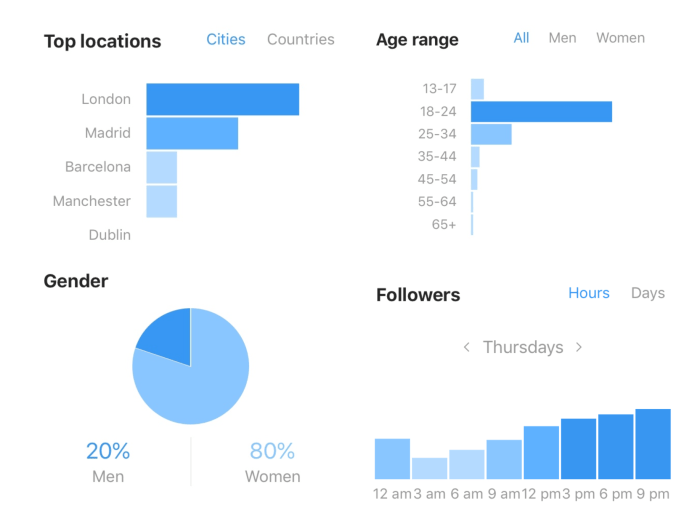

This section delves into the crucial process of segmenting the coffee market and identifying key target audiences for a hypothetical premium coffee brand, “Artisan Roast.” Effective segmentation allows for focused marketing efforts, maximizing resource allocation and achieving higher conversion rates. We will analyze three distinct segments, detailing their characteristics and outlining a targeted marketing strategy for one.

Market Segment Identification and Description

We’ve identified three distinct market segments within the premium coffee market: the “Coffee Connoisseur,” the “Health-Conscious Coffee Lover,” and the “Convenience-Seeking Premium Buyer.” These segments differ significantly in their demographics, psychographics, and purchasing behaviors, requiring tailored marketing approaches.

Coffee Connoisseur Segment Characteristics

This segment comprises individuals aged 35-55, with higher-than-average disposable incomes. They are passionate about coffee, possessing extensive knowledge of brewing methods, bean origins, and flavor profiles. Psychographically, they value authenticity, quality, and unique experiences. Their buying behavior is characterized by a willingness to pay a premium for high-quality, ethically sourced coffee, often purchasing whole beans and specialized brewing equipment.

Health-Conscious Coffee Lover Segment Characteristics

This segment consists primarily of millennials and Gen Z, with a strong focus on health and wellness. They are interested in organic, fair-trade, and low-acid coffee options. Psychographically, they value sustainability, ethical sourcing, and health benefits. Their purchasing behavior is driven by health concerns and a desire for transparency in sourcing and production. They are more likely to purchase single-serve options or ready-to-drink coffee.

Convenience-Seeking Premium Buyer Segment Characteristics

This segment spans a wider age range, but is characterized by a busy lifestyle and a preference for convenience. They are willing to pay a premium for high-quality coffee but prioritize ease of preparation and consumption. Psychographically, they value efficiency and time-saving solutions. Their buying behavior favors pre-ground coffee, single-serve pods, or ready-to-drink options.

Customer Persona Development

To further illustrate these segments, we’ve developed customer personas:

Coffee Connoisseur Persona: “The Artisan”

Name: Amelia Hernandez

Age: 42

Occupation: Architect

Income: High

Lifestyle: Enjoys sophisticated experiences, values quality and craftsmanship. Actively seeks out unique and high-quality products.

Needs: Exceptional coffee quality, ethically sourced beans, unique flavor profiles.

Motivations: Appreciation for the art of coffee making, desire for a superior sensory experience.

Pain Points: Difficulty finding consistently high-quality beans, limited access to rare or unique coffee varieties.

Health-Conscious Coffee Lover Persona: “The Wellness Warrior”

Name: Kai Chen

Age: 28

Occupation: Software Engineer

Income: Middle-class

Lifestyle: Health-conscious, values sustainability and ethical practices. Actively seeks out healthy alternatives.

Needs: Organic, fair-trade, low-acid coffee options, transparent sourcing information.

Motivations: Desire for a healthy and ethically sourced beverage, alignment with personal values.

Pain Points: Finding organic and fair-trade options that also taste good, concerns about the environmental impact of coffee production.

Convenience-Seeking Premium Buyer Persona: “The Busy Professional”

Name: David Miller

Age: 39

Occupation: Lawyer

Income: High

Lifestyle: Busy professional with limited time, appreciates convenience and efficiency. Willing to pay a premium for quality and convenience.

Needs: High-quality coffee that is quick and easy to prepare, convenient packaging.

Motivations: Desire for a high-quality coffee experience without sacrificing time or convenience.

Pain Points: Lack of time for elaborate coffee preparation, difficulty finding convenient high-quality options.

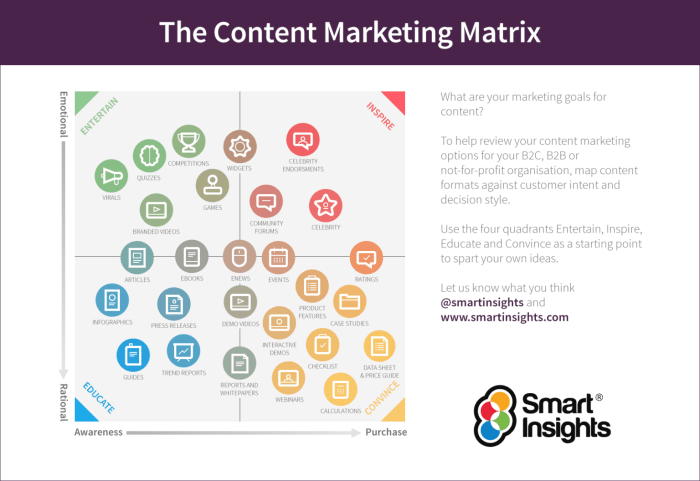

Targeted Marketing Strategy for the “Coffee Connoisseur” Segment

Our marketing strategy for the “Coffee Connoisseur” segment will focus on highlighting the unique and exceptional quality of Artisan Roast coffee. We will utilize high-quality photography and videography showcasing the bean origins, roasting process, and brewing methods. Key messaging will emphasize the artisanal craftsmanship, unique flavor profiles, and ethical sourcing practices. Channels will include targeted online advertising on coffee-related websites and blogs, partnerships with specialty coffee shops and cafes, and participation in coffee-tasting events and festivals. We will also develop exclusive content, such as brewing guides and tasting notes, to further engage this segment.

Trend Analysis and Forecasting

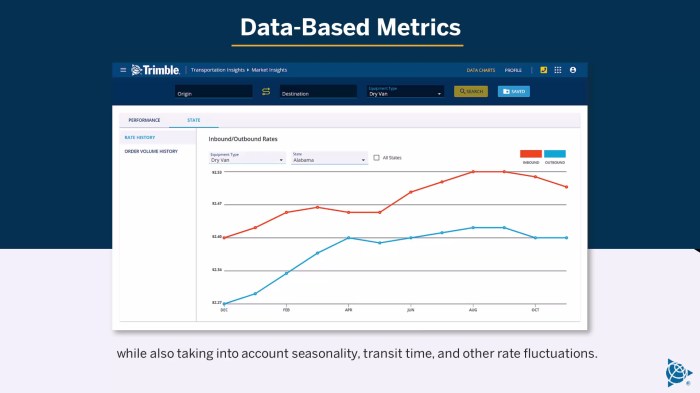

Analyzing market trends and forecasting future performance is crucial for businesses to remain competitive and adapt to evolving consumer needs and technological advancements. Accurate forecasting allows for proactive strategic planning, resource allocation, and investment decisions. This section will examine three significant trends impacting the renewable energy sector and their implications for businesses within this industry.

Significant Market Trends in the Renewable Energy Sector

The renewable energy sector is experiencing rapid growth driven by several key trends. These trends present both opportunities and challenges for businesses operating in this dynamic market. Understanding and adapting to these shifts is essential for long-term success.

The Increasing Adoption of Solar and Wind Power

The cost of solar and wind energy has dramatically decreased in recent years, making it increasingly competitive with fossil fuels. Government policies promoting renewable energy, such as tax incentives and subsidies, further accelerate adoption. This is evidenced by the exponential growth in installed solar and wind capacity globally, as reported by the International Renewable Energy Agency (IRENA). For example, China’s massive investment in renewable energy infrastructure has significantly increased its global share of renewable energy production. This trend presents opportunities for businesses involved in manufacturing, installation, and maintenance of solar and wind power systems, as well as energy storage solutions. However, it also increases competition within the sector, requiring businesses to innovate and offer competitive pricing and services.

Technological Advancements in Energy Storage

The intermittency of renewable energy sources like solar and wind remains a challenge. However, advancements in battery technology and other energy storage solutions are mitigating this issue. Improved battery efficiency, longer lifespans, and reduced costs are making energy storage increasingly viable and cost-effective. Companies like Tesla are leading the charge in developing and deploying advanced battery technologies for grid-scale energy storage and electric vehicles. This trend presents opportunities for businesses involved in developing, manufacturing, and integrating energy storage systems into renewable energy projects. Businesses need to invest in research and development to stay ahead of the curve and offer cutting-edge solutions.

Growing Consumer Demand for Sustainable Energy

Consumers are increasingly aware of the environmental impact of their energy consumption and are actively seeking sustainable alternatives. This growing demand is driving the adoption of renewable energy sources in both residential and commercial sectors. Surveys consistently show a rising preference for renewable energy among consumers, who are willing to pay a premium for green energy options. This trend presents significant opportunities for businesses to market and sell renewable energy products and services to environmentally conscious consumers. Businesses can leverage this trend by emphasizing the sustainability aspects of their products and services, promoting their environmental benefits, and engaging in transparent and ethical business practices.

Market Trend Forecast

The following table provides a forecast for the growth of the renewable energy sector, specifically focusing on solar and wind power capacity additions (in Gigawatts) over the next five years. These figures are illustrative and based on current growth trends and expert predictions, and should not be considered definitive.

| Year | Solar (GW) | Wind (GW) | Total (GW) |

|---|---|---|---|

| 2024 | 200 | 150 | 350 |

| 2025 | 250 | 180 | 430 |

| 2026 | 300 | 220 | 520 |

| 2027 | 350 | 260 | 610 |

| 2028 | 400 | 300 | 700 |

Interpreting and Communicating Findings

Interpreting market research data involves moving beyond raw numbers to uncover meaningful patterns and actionable insights. This process requires a critical eye, a solid understanding of statistical methods, and the ability to connect findings back to the overall business objectives. Effective communication then ensures these insights drive informed decision-making across the organization.

Deriving Actionable Insights from Key Findings

Interpreting key findings requires a multi-faceted approach. First, analyze the data to identify statistically significant trends. For example, if a survey reveals a strong correlation between a specific demographic group and a preference for a particular product feature, this suggests a potential market segment for targeted marketing campaigns. Second, compare the findings against your initial hypotheses and research objectives. Did the results confirm your assumptions, or did they reveal unexpected opportunities or challenges? Finally, consider the limitations of the data. Were there any sampling biases or methodological limitations that could influence the interpretation of the results? Understanding these limitations is crucial for avoiding inaccurate conclusions. For instance, if your sample size was small, the results might not be generalizable to the entire population.

Effective Communication Strategies for Different Stakeholders

Tailoring communication to different audiences is crucial for maximizing impact. Executives need concise, high-level summaries that focus on key strategic implications. A presentation for executives might highlight overall market size, growth potential, and competitive landscape, using charts and graphs to illustrate key trends. Marketing teams, on the other hand, require more detailed information on consumer preferences, segmentation, and potential marketing channels. A detailed report with specific data points on consumer demographics and psychographics would be appropriate here. Sales teams need information directly applicable to their daily activities, such as key selling points, target customer profiles, and competitive advantages. Sales training materials focusing on addressing common customer objections and highlighting unique product features would be beneficial.

Creating Compelling Narratives Around Market Insights

Transforming data into a compelling narrative is essential for influencing decision-making. Instead of simply presenting data points, construct a story that engages the audience and highlights the significance of the findings. For instance, instead of stating “Market share increased by 15%,” you could say, “Our innovative marketing campaign resulted in a 15% increase in market share, exceeding our initial target by 5% and solidifying our position as a market leader.” Use strong verbs, clear language, and avoid jargon. Focus on the “so what?”—what are the implications of these findings, and what actions should be taken as a result?

Presentation Summarizing Key Market Insights

A presentation summarizing key market insights should be visually engaging and easy to understand. The title slide should clearly state the topic and date. A slide showing the overall market size and growth projections could use a bar chart illustrating market size over time, with projections extending into the future. A pie chart would effectively represent market share amongst competitors. To illustrate market segmentation, a clustered bar chart could compare key demographic segments across various product features. A geographical map highlighting regional variations in sales or consumer preferences could be used. Finally, a concluding slide should summarize key recommendations and next steps, supported by visually compelling data summaries. All charts and graphs should be clearly labeled with titles, axis labels, and legends. Consistent color schemes and font styles should be used throughout the presentation to ensure visual appeal and readability. Consider using animation to emphasize key points and keep the audience engaged. For example, a gradual reveal of data points on a bar chart can highlight trends and comparisons effectively.

Wrap-Up

Ultimately, effective Market Insights Analysis is about more than just numbers; it’s about translating data into a clear understanding of the market, your customers, and your competitors. By combining robust methodologies with insightful interpretation, businesses can identify opportunities, mitigate risks, and develop targeted strategies for sustainable growth. The ability to effectively communicate these insights to various stakeholders—from executives to marketing teams—is equally crucial for successful implementation and achieving desired business outcomes. The frameworks and techniques explored here provide a solid foundation for navigating the complexities of the modern marketplace.

FAQ Summary

What is the difference between primary and secondary market research?

Primary research involves collecting original data (e.g., surveys, interviews), while secondary research utilizes existing data (e.g., industry reports, government statistics).

How can I ensure the accuracy of my market insights?

Employ rigorous data validation techniques, use multiple data sources, and consider potential biases in your data collection and analysis methods.

What are some common pitfalls to avoid in market analysis?

Common pitfalls include relying solely on one data source, neglecting qualitative data, failing to account for biases, and misinterpreting correlations as causation.

How often should market insights analysis be conducted?

Frequency depends on industry dynamics and business goals. Fast-moving industries may require more frequent analysis than stable ones.