Navigating the complexities of the global economy requires a keen understanding of current trends and future projections. This Economic Trends Forecast provides a comprehensive analysis of key economic indicators, examining the interplay of global events, technological advancements, and policy decisions. We delve into the inflationary pressures impacting various sectors, the dynamics of the energy market, and the significant influence of geopolitical risks on economic stability.

From analyzing the performance of major economies like the US, EU, and China, to exploring the impact of emerging technologies and sustainable development goals, this forecast offers a multifaceted view of the economic landscape. We will examine both the challenges and opportunities presented by these trends, offering insights into potential risks and mitigation strategies for businesses and policymakers alike.

Global Economic Outlook

The global economy currently presents a complex and somewhat uncertain picture. While significant recovery has been observed since the acute phases of the COVID-19 pandemic, persistent inflation, geopolitical instability, and tightening monetary policies continue to pose considerable challenges to sustained growth. The trajectory of the global economy in the coming years will depend significantly on how effectively these challenges are addressed.

Current Global Economic Situation

Global economic growth has slowed considerably in 2023 compared to the post-pandemic rebound. High inflation rates in many countries have forced central banks to implement aggressive interest rate hikes, impacting consumer spending and investment. Supply chain disruptions, although easing, continue to exert upward pressure on prices. The war in Ukraine has significantly disrupted energy markets and exacerbated global food insecurity, adding to inflationary pressures and hindering economic activity in many regions. Furthermore, the increasing frequency and intensity of extreme weather events linked to climate change are posing additional economic risks.

Comparison of Major Economies (US, EU, China)

The US economy, while demonstrating resilience, has experienced a slowdown in growth due to the Federal Reserve’s aggressive monetary tightening. Inflation remains a significant concern, although there are signs it may be peaking. The Eurozone has faced a more challenging economic environment, grappling with high energy prices driven by the war in Ukraine and persistent supply chain bottlenecks. China’s economy, after a period of relatively slow growth, is showing signs of recovery, but faces headwinds from a weakening property market and lingering effects of its zero-COVID policy. The differing responses of these major economies to global challenges highlight the diverse nature of the current economic landscape.

Factors Influencing Global Economic Growth (Next 12-24 Months)

Several key factors will shape global economic growth over the next two years. The effectiveness of central bank policies in curbing inflation without triggering a significant recession will be crucial. The resolution of the war in Ukraine and the subsequent stabilization of energy markets will play a vital role. The pace of China’s economic recovery will also have a significant global impact, given its size and importance in global trade. Finally, the ongoing risks associated with climate change, including extreme weather events and the transition to a low-carbon economy, will continue to pose challenges. These interconnected factors highlight the complexity of forecasting future economic growth.

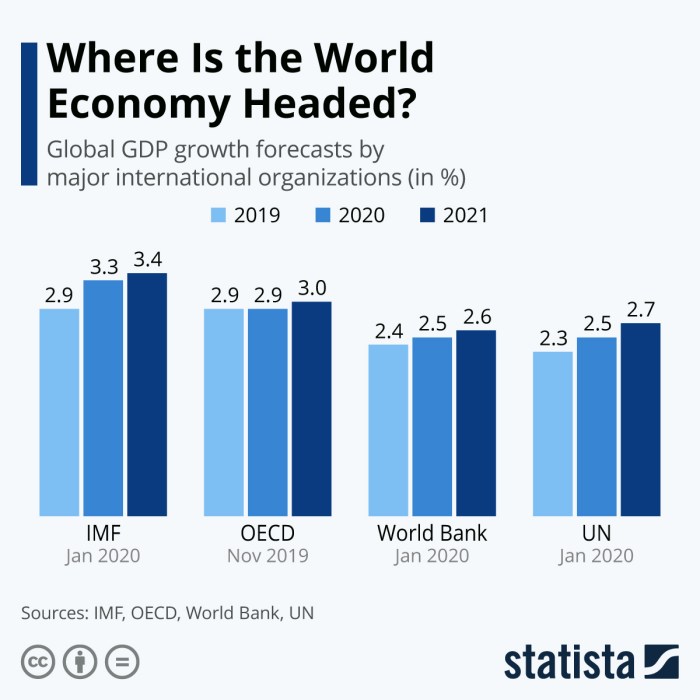

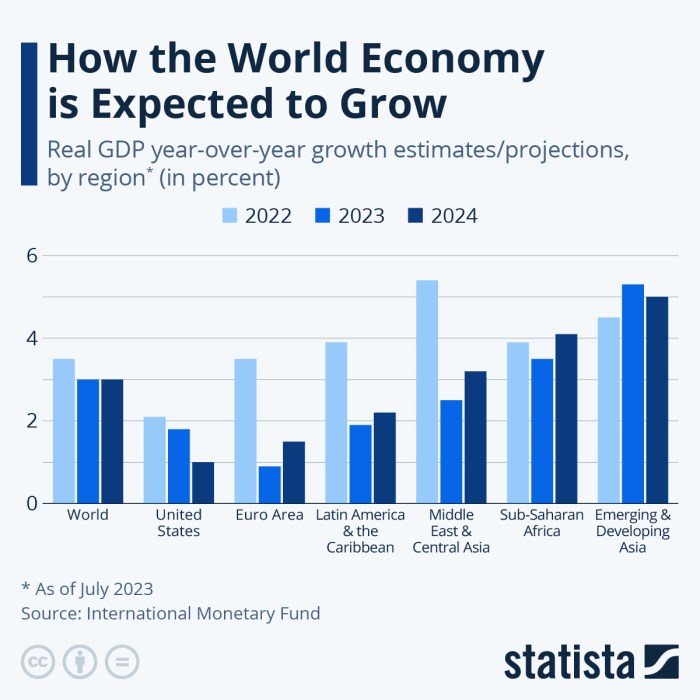

Projected GDP Growth Rates

The following table presents projected GDP growth rates for key regions, acknowledging that these are subject to considerable uncertainty given the current volatile global environment. These projections are based on a consensus of leading economic forecasts, but it’s crucial to remember that unforeseen events could significantly alter these estimates. For example, a sudden escalation of geopolitical tensions or a more severe-than-anticipated global recession could dramatically impact these projections.

| Region | Projected GDP Growth (2024) | Growth Drivers | Potential Risks |

|---|---|---|---|

| United States | 1.5% | Robust consumer spending, continued labor market strength | High inflation, potential recession |

| Eurozone | 1.0% | Easing energy prices, strong domestic demand in some countries | High energy prices, geopolitical uncertainty |

| China | 5.0% | Government stimulus measures, recovering consumer confidence | Real estate market weakness, geopolitical tensions |

| Emerging Markets | 4.0% | Strong domestic demand in some regions, commodity price increases | High debt levels, global economic slowdown |

Inflationary Pressures and Monetary Policy

The global economy is currently grappling with a complex inflationary environment, driven by a confluence of factors including supply chain disruptions, robust demand, and geopolitical instability. This has led to significant increases in the prices of goods and services, impacting various sectors and posing challenges for central banks worldwide. Understanding the nature of these inflationary pressures and the policy responses implemented is crucial for navigating the current economic landscape.

Inflation’s Impact on Various Sectors

The current inflationary surge has differentially impacted various economic sectors. Energy and food prices have experienced particularly sharp increases, disproportionately affecting lower-income households. The manufacturing sector faces rising input costs, leading to reduced profit margins and potential job losses in some cases. The services sector, while experiencing some price increases, has generally shown more resilience due to strong consumer demand in many regions. Housing markets, in many developed economies, have seen price appreciation fueled by low interest rates in the past, but now face headwinds from rising mortgage rates. This uneven impact underscores the need for nuanced policy responses tailored to specific sectors and economic vulnerabilities.

Central Bank Responses to Inflation

Central banks globally have adopted a range of monetary policy tools to combat inflation. The most prominent response has been a series of interest rate hikes. The Federal Reserve in the United States, the European Central Bank, and the Bank of England, among others, have aggressively raised interest rates to cool down overheated economies and curb demand-pull inflation. These increases aim to make borrowing more expensive, reducing investment and consumer spending. Additionally, some central banks have employed quantitative tightening (QT), reducing their balance sheets by selling off government bonds and other assets acquired during previous quantitative easing programs. This aims to reduce the money supply and further curb inflationary pressures. The effectiveness of these measures varies depending on the specific economic context and the degree of inflation persistence.

Effectiveness of Monetary Policy Tools

The effectiveness of different monetary policy tools is a subject of ongoing debate among economists. Interest rate hikes, while effective in curbing demand, can also lead to economic slowdowns or even recessions if implemented too aggressively. Quantitative tightening can further exacerbate these risks by reducing liquidity in the financial system. The lag between policy implementation and its impact on inflation adds to the complexity of managing the economy. For instance, the impact of interest rate hikes on inflation may not be fully realized for several months or even a year. Therefore, central banks must carefully calibrate their policy responses to avoid unintended consequences.

Examples of Inflation Management

Some countries have demonstrated more success in managing inflation than others. For example, Switzerland, known for its independent central bank and robust fiscal policies, has generally maintained lower inflation rates compared to many other developed economies. Their success can be partially attributed to a combination of prudent monetary policy and structural factors such as a strong export sector. Conversely, countries like Argentina and Venezuela have struggled with persistent high inflation, often due to a combination of factors including weak institutional frameworks, political instability, and unsustainable fiscal policies. These contrasting examples highlight the complex interplay of factors that influence a country’s ability to manage inflation effectively.

Energy Market Dynamics and Their Economic Impact

The global energy market is currently experiencing a period of significant transformation, driven by geopolitical instability, the ongoing energy transition, and fluctuating demand. Understanding the dynamics of this market is crucial for predicting future economic trends, as energy prices directly impact inflation, industrial production, and consumer spending. This section will examine the current state of the energy market, key influencing factors, and the resulting economic consequences.

The global energy market is a complex interplay of oil, natural gas, and renewable energy sources. Oil prices remain volatile, influenced by OPEC+ production decisions, geopolitical events (such as the ongoing conflict in Ukraine), and global demand. Natural gas prices have experienced significant spikes in recent years, particularly in Europe, due to reduced Russian supplies and increased competition for limited resources. Meanwhile, the renewable energy sector, encompassing solar, wind, and hydro power, is experiencing rapid growth, driven by technological advancements, government policies, and increasing environmental concerns. However, the intermittency of renewable energy sources presents challenges for grid stability and reliable energy supply.

Factors Influencing Energy Prices and Their Economic Ripple Effects

Several key factors are driving energy price volatility and influencing the global economy. These include geopolitical instability, impacting supply chains and production; fluctuating demand, particularly influenced by economic growth and seasonal variations; and the pace of the energy transition, as the shift towards renewables requires significant investment and infrastructure development. The ripple effects are widespread, impacting inflation (through increased production costs), consumer spending (through higher energy bills), and investment decisions across various sectors. High energy prices can stifle economic growth, particularly in energy-intensive industries, while low prices can lead to overconsumption and environmental concerns.

Economic Consequences of Energy Price Volatility

The volatility in energy prices has several significant economic consequences.

- Inflationary Pressures: Increased energy costs are passed down the supply chain, leading to higher prices for goods and services.

- Reduced Economic Growth: High energy prices increase production costs, reducing competitiveness and potentially leading to job losses in energy-intensive industries.

- Increased Energy Poverty: Higher energy bills disproportionately affect low-income households, exacerbating inequality.

- Geopolitical Risks: Dependence on volatile energy sources can create geopolitical vulnerabilities and increase the risk of conflict.

- Investment Uncertainty: Fluctuating energy prices make it difficult for businesses to plan long-term investments.

Fossil Fuels versus Renewable Energy: Economic Implications

The economic implications of relying on fossil fuels versus transitioning to renewable energy are starkly different. Continued reliance on fossil fuels maintains existing energy infrastructure but carries significant environmental costs, including climate change and air pollution. This also creates vulnerability to price shocks and geopolitical instability associated with fossil fuel markets. For example, the sharp increase in natural gas prices in Europe following the reduction of Russian gas supplies highlighted the economic vulnerability of relying on a single major supplier. Conversely, a transition to renewable energy sources requires substantial upfront investment in new infrastructure and technologies. However, it offers long-term economic benefits such as reduced reliance on volatile global markets, improved energy security, and the creation of new jobs in the renewable energy sector. Furthermore, the long-term economic costs of climate change mitigation are significantly less than the costs of inaction. For instance, the economic damage from extreme weather events linked to climate change is projected to be substantial, necessitating a shift towards more sustainable energy practices.

Technological Advancements and Economic Transformation

The rapid pace of technological advancement is reshaping global economies, creating both unprecedented opportunities and significant challenges. Emerging technologies, particularly artificial intelligence (AI) and automation, are profoundly impacting various sectors, leading to shifts in employment patterns and the emergence of entirely new industries. Understanding these transformations is crucial for navigating the economic landscape of the future.

The integration of AI and automation is transforming industries at an accelerating rate. From manufacturing and logistics to healthcare and finance, these technologies are increasing efficiency, improving productivity, and driving innovation. However, this transformation also presents considerable challenges, primarily concerning the potential displacement of human workers and the need for workforce adaptation and reskilling.

Impact of Emerging Technologies on Various Industries

The impact of AI and automation varies across industries. In manufacturing, robots and automated systems are enhancing production lines, leading to higher output and lower costs. The logistics sector benefits from autonomous vehicles and optimized delivery routes, improving efficiency and reducing delivery times. In healthcare, AI-powered diagnostic tools and personalized medicine are revolutionizing patient care. The financial sector utilizes AI for fraud detection, risk assessment, and algorithmic trading. Even creative industries are being impacted, with AI tools assisting in tasks like content creation and design. This widespread adoption signifies a fundamental shift in how businesses operate and compete.

Job Displacement and Creation

Technological advancements inevitably lead to job displacement in certain sectors. Repetitive, manual tasks are particularly vulnerable to automation. For example, factory workers performing assembly line tasks or data entry clerks are at higher risk of job displacement. However, technological progress also creates new jobs. The development, implementation, and maintenance of these technologies require skilled professionals in areas such as AI engineering, data science, and cybersecurity. Furthermore, new industries and business models emerge, generating employment opportunities in fields previously unimagined. The net effect on employment is complex and depends on various factors, including the pace of technological adoption, government policies, and workforce adaptability. Successful navigation of this transition requires proactive investment in education and training programs focused on developing the skills needed for the future workforce.

Economic Opportunities Presented by New Technologies

The adoption of new technologies presents significant economic opportunities. Increased productivity and efficiency lead to economic growth and higher standards of living. The development and deployment of AI and automation create new markets and industries, generating investment and stimulating innovation. For example, the growth of the AI industry itself is creating numerous high-paying jobs and attracting significant investment. Moreover, the ability to personalize products and services based on individual needs opens up new avenues for businesses to cater to specific customer preferences, fostering competition and driving innovation. The potential for technological advancements to solve global challenges, such as climate change and disease, represents a further economic opportunity, creating new markets for sustainable solutions and healthcare technologies.

Projected Impact of Technological Advancements on the Global Economy

| Year | Technology | Projected Impact | Example/Real-life Case |

|---|---|---|---|

| 2025 | AI-powered customer service | Significant increase in customer service efficiency across various industries; potential for job displacement in entry-level roles. | Companies like Amazon already extensively use AI chatbots for customer support. |

| 2030 | Autonomous vehicles | Disruption of the transportation sector; potential job losses in trucking and taxi industries; creation of new jobs in autonomous vehicle development and maintenance. | Waymo and Tesla are leading the development and deployment of self-driving cars. |

| 2035 | Advanced robotics in manufacturing | Increased automation in manufacturing leading to higher productivity and lower costs; potential for significant job displacement in certain manufacturing roles. | Foxconn, a major electronics manufacturer, is increasingly using robots in its factories. |

| 2040 | Personalized medicine through AI | Revolution in healthcare; improved diagnosis and treatment; increased demand for healthcare professionals specializing in data analysis and AI applications. | Companies like IBM Watson Health are already developing AI-powered tools for disease diagnosis and treatment. |

Geopolitical Risks and Their Economic Consequences

Geopolitical risks represent a significant and ever-present threat to global economic stability. These risks, stemming from international relations and political dynamics, can trigger unpredictable economic shocks, disrupting established trade patterns, investment flows, and overall economic growth. Understanding these risks and their potential impacts is crucial for effective economic forecasting and strategic planning.

Geopolitical risks manifest in various forms, each carrying unique economic consequences. These risks range from large-scale conflicts and trade wars to political instability within key nations and the rise of protectionist policies. The interconnectedness of the global economy means that even seemingly localized events can have far-reaching economic ramifications.

Key Geopolitical Risks and Their Potential Impacts

The global economy faces numerous geopolitical threats. Trade wars, for instance, involve the imposition of tariffs and trade restrictions, leading to higher prices for consumers, reduced trade volumes, and disruptions to global supply chains. Political instability, whether caused by internal conflict, regime change, or external aggression, can severely impact economic activity through reduced investment, capital flight, and damage to infrastructure. The rise of nationalism and protectionism also poses a risk, as countries prioritize domestic interests over international cooperation, leading to trade barriers and reduced economic integration. Finally, the spread of cyber warfare and data breaches can destabilize financial markets and undermine confidence in international institutions. These events can have ripple effects throughout the global economy, influencing everything from commodity prices to stock markets.

Examples of Past Geopolitical Events and Their Economic Consequences

History provides numerous examples of how geopolitical events have significantly impacted the global economy. The 1973 oil crisis, triggered by the Yom Kippur War, led to a sharp increase in oil prices, causing a global recession. The collapse of the Soviet Union in 1991 resulted in significant economic disruption in Eastern Europe and the former Soviet republics. The 2008 global financial crisis, while having multiple causes, was exacerbated by geopolitical uncertainties surrounding the Iraq War and the instability in the Middle East. More recently, the ongoing war in Ukraine has led to soaring energy prices, food shortages, and widespread economic disruption across Europe and beyond. These examples highlight the significant and often unpredictable economic consequences of geopolitical instability.

Geopolitical Risks and Their Effects on Supply Chains and Investment Decisions

Geopolitical events can severely disrupt global supply chains. Trade wars, sanctions, and political instability can lead to delays, increased costs, and even complete disruptions in the flow of goods and services. Businesses are forced to re-evaluate their sourcing strategies, potentially leading to higher production costs and reduced competitiveness. Similarly, geopolitical risks influence investment decisions. Investors are hesitant to commit capital to countries perceived as politically unstable or subject to significant geopolitical risks. This can lead to a decline in foreign direct investment, hindering economic growth and development. The uncertainty created by geopolitical risks makes long-term planning difficult and increases the risk premium associated with investments in affected regions.

Scenario Analysis of Geopolitical Events and Their Economic Impacts

| Scenario | Potential Impacts | Mitigation Strategies |

|---|---|---|

| Major escalation of the conflict in Ukraine | Further increases in energy and food prices, global recession, increased inflation, disruptions to global supply chains, significant refugee flows. | Diversification of energy sources, increased investment in food security, strengthening of international cooperation to address humanitarian crisis, support for Ukrainian economy. |

| Major trade war between the US and China | Higher consumer prices, reduced global trade, disruptions to supply chains, reduced economic growth in both countries and globally. | De-escalation of trade tensions through diplomatic negotiations, diversification of supply chains, promotion of regional trade agreements. |

| Widespread political instability in a major emerging market | Capital flight, currency devaluation, reduced foreign direct investment, economic contraction, potential debt crisis. | Strengthening of domestic institutions, promoting economic diversification, providing financial assistance through international organizations, fostering political dialogue and stability. |

Impact on Specific Sectors

The following analysis examines the projected economic trends across several key sectors, offering insights into their anticipated performance and the factors influencing their trajectory in the coming years. These projections consider the broader global economic outlook discussed previously, including inflationary pressures, monetary policy shifts, and geopolitical risks.

Technology Sector Performance

The technology sector is expected to experience a period of moderate growth, albeit slower than in previous years. Increased interest rates and reduced venture capital funding are likely to curb the rapid expansion seen in recent times. However, long-term trends such as the continued adoption of cloud computing, artificial intelligence, and the expansion of the Internet of Things (IoT) will continue to drive innovation and create new opportunities. Companies focused on cybersecurity and data analytics are anticipated to perform particularly well, driven by increasing demand for data protection and efficient data management solutions. For example, the growth of remote work and the increasing reliance on digital infrastructure will continue to fuel demand for robust cybersecurity measures, creating opportunities for companies specializing in this area. Conversely, sectors heavily reliant on consumer discretionary spending, such as gaming and certain segments of e-commerce, may face challenges.

Agricultural Sector Outlook

The agricultural sector faces a complex interplay of challenges and opportunities. Climate change, with its increased frequency of extreme weather events, poses a significant risk to crop yields and livestock production globally. Simultaneously, rising input costs, including fertilizers and energy, are putting pressure on profit margins. However, growing global population and increasing demand for food, particularly in developing economies, should support overall sector growth. Technological advancements in precision agriculture, such as the use of drones and data analytics for optimizing crop management, could mitigate some of the negative impacts of climate change and rising input costs. Furthermore, government policies aimed at supporting sustainable agriculture and food security will play a critical role in shaping the sector’s trajectory. For instance, the EU’s Common Agricultural Policy, while facing ongoing reform, continues to provide significant support to European farmers.

Financial Services Industry Transformation

The financial services industry is poised for significant transformation driven by technological advancements, regulatory changes, and evolving consumer preferences. The rise of fintech companies and the increasing adoption of digital banking are reshaping the competitive landscape. Regulatory scrutiny, particularly concerning data privacy and cybersecurity, will intensify. We expect to see a continued push towards open banking initiatives, which aim to enhance customer choice and competition by facilitating data sharing between financial institutions. This will likely lead to greater innovation in areas such as personalized financial advice and tailored financial products. The increasing focus on Environmental, Social, and Governance (ESG) factors will also drive changes in investment strategies and lending practices. For example, the introduction of stricter regulations on carbon emissions within the financial sector could lead to significant changes in investment portfolios, favouring companies with strong ESG profiles.

Projected Growth or Decline in Other Key Sectors

The following bullet points summarize the projected growth or decline in other key economic sectors:

- Manufacturing: Moderate growth, driven by reshoring and automation, but facing challenges related to supply chain disruptions and rising energy costs. Examples include the ongoing efforts of some multinational companies to diversify their manufacturing base and bring production closer to home markets.

- Healthcare: Steady growth, driven by an aging population and advancements in medical technology. However, challenges related to rising healthcare costs and workforce shortages remain.

- Tourism: Significant recovery expected, though uneven across regions, dependent on factors like travel restrictions and economic conditions in source markets. The rebound in international travel following the COVID-19 pandemic offers a relevant example.

Sustainable Development Goals and Economic Growth

The pursuit of sustainable development goals (SDGs) is increasingly recognized as intrinsically linked to robust and inclusive economic growth. While initially perceived as potentially conflicting – environmental protection versus economic expansion – a growing body of evidence demonstrates a synergistic relationship: achieving the SDGs can unlock significant economic opportunities, while neglecting them poses substantial economic risks. This section explores this dynamic interplay, highlighting the economic benefits of sustainable practices and the potential costs of inaction.

Sustainable development goals and economic growth are not mutually exclusive but rather mutually reinforcing. Investments in sustainable infrastructure, renewable energy, and resource-efficient technologies create jobs, stimulate innovation, and enhance productivity, ultimately boosting economic growth. Furthermore, a focus on social equity and inclusion, as promoted by several SDGs, fosters a more stable and productive workforce, contributing to a healthier and more prosperous economy.

Economic Opportunities from Sustainable Investments

Investing in sustainable practices presents a wealth of economic opportunities across various sectors. The renewable energy sector, for example, is experiencing explosive growth, creating jobs in manufacturing, installation, and maintenance. Similarly, the green building industry is booming, driven by increasing demand for energy-efficient and environmentally friendly construction materials and techniques. The circular economy model, focusing on reducing waste and maximizing resource utilization, also offers significant economic potential by creating new markets for recycled materials and innovative recycling technologies. For instance, the shift towards electric vehicles is not only reducing carbon emissions but also fostering growth in battery technology, charging infrastructure, and related industries. These examples demonstrate that transitioning to a sustainable economy is not just environmentally beneficial but also economically advantageous.

Economic Risks of Failing to Address Climate Change and Environmental Degradation

Conversely, failing to address climate change and environmental degradation poses significant economic risks. The increasing frequency and intensity of extreme weather events, such as floods, droughts, and wildfires, lead to substantial economic losses through damage to infrastructure, disruption of supply chains, and displacement of populations. The agricultural sector is particularly vulnerable, with changing climate patterns affecting crop yields and livestock production. Furthermore, resource depletion and environmental pollution can have long-term consequences for economic productivity and human health, placing a strain on healthcare systems and reducing workforce participation. For example, the rising cost of extreme weather damage in coastal cities globally, as seen in events like Hurricane Katrina or the frequent flooding in Bangladesh, illustrates the financial burden of climate inaction. The economic consequences of failing to mitigate climate change and protect our environment are far-reaching and potentially devastating.

Visual Representation of the Interconnectedness of Economic Growth and Environmental Sustainability

Imagine a Venn diagram. One circle represents “Economic Growth,” encompassing elements like GDP growth, employment rates, and technological innovation. The other circle represents “Environmental Sustainability,” including indicators such as carbon emissions, biodiversity, and resource depletion. The area where the two circles overlap represents the “Sustainable Development Zone.” This overlapping area is significantly larger than the areas unique to either circle, visually emphasizing the significant synergy between economic growth and environmental sustainability. Within the “Economic Growth” circle, elements such as green technologies and sustainable infrastructure are highlighted, showing their contribution to both economic growth and environmental sustainability. Similarly, within the “Environmental Sustainability” circle, elements such as reduced pollution and resource conservation are shown to contribute to long-term economic stability and resilience. The size of the “Sustainable Development Zone” is emphasized to visually represent the substantial economic opportunities and reduced risks associated with pursuing sustainable development goals. This visual representation clearly demonstrates that pursuing sustainable development is not a trade-off between economic growth and environmental protection, but rather a pathway to achieving both simultaneously and more effectively.

Last Word

In conclusion, this Economic Trends Forecast paints a dynamic picture of the global economy, highlighting both the challenges and opportunities that lie ahead. While inflationary pressures and geopolitical uncertainties remain significant concerns, the potential for growth driven by technological innovation and sustainable practices offers a path towards a more resilient and prosperous future. Understanding these interconnected forces is crucial for informed decision-making in the years to come. A proactive approach, incorporating risk mitigation strategies and embracing sustainable development, will be key to navigating the complexities of the evolving global economic landscape.

Clarifying Questions

What are the key assumptions underlying this forecast?

The forecast relies on several key assumptions, including continued globalization (though potentially with adjustments), stable political systems in major economies, and the continued development and adoption of key technologies. These assumptions are acknowledged as subject to change and are explicitly stated where relevant within the detailed analysis.

How does this forecast account for unforeseen events (e.g., black swan events)?

While this forecast provides a robust analysis based on current data and trends, it acknowledges the inherent uncertainty in economic forecasting. The analysis includes sections dedicated to geopolitical risks and potential disruptions, offering scenario analyses to explore the potential impact of unforeseen events. However, the unpredictable nature of black swan events limits the ability to provide precise predictions for such occurrences.

Where can I find the detailed data and methodology used in this forecast?

The detailed data sources and methodologies used are available upon request. Contact [Insert Contact Information Here] for access to this supporting documentation.