Efficiently managing finances, whether personal or business-related, is paramount in today’s world. Expense tracking software offers a powerful solution, streamlining the process of recording, categorizing, and analyzing financial transactions. From simple budgeting apps to sophisticated enterprise-level solutions, a wide array of options caters to diverse needs and preferences. This guide delves into the multifaceted world of expense tracking software, examining its key features, benefits, and considerations for optimal implementation.

We will explore the various types of software available, including mobile apps, desktop programs, and cloud-based platforms, comparing their functionalities and suitability for different user profiles. We will also discuss critical aspects such as security, integration with other financial tools, and future trends shaping the landscape of expense management.

Defining Expense Tracking Software

Expense tracking software is a category of applications designed to help individuals and businesses monitor and manage their financial outflows. It simplifies the process of recording, categorizing, and analyzing expenses, ultimately providing valuable insights into spending habits and facilitating better financial decision-making. This software ranges from simple mobile apps to sophisticated enterprise-level solutions, each tailored to meet specific needs and complexities.

Expense tracking software typically offers a range of core functionalities. These include the ability to input expenses manually or automatically import transaction data from linked bank accounts and credit cards. The software then categorizes these expenses (e.g., travel, food, rent), often allowing for custom category creation. Many programs also generate reports and visualizations, offering summaries of spending patterns over various time periods. Advanced features might include budgeting tools, invoice management, and integration with accounting software.

User Types and Benefits

Expense tracking software benefits a wide range of users. Individuals utilize these tools to gain control over their personal finances, track spending against budgets, and identify areas for potential savings. Small businesses rely on such software for accurate expense reporting, simplifying tax preparation and improving financial forecasting. Large corporations often use sophisticated expense management systems to streamline reimbursement processes, enforce compliance policies, and gain a comprehensive overview of company-wide spending. The scalability and features offered vary greatly depending on the user’s specific requirements.

Expense Tracking Software Categories

Different types of expense tracking software cater to diverse needs and preferences. The following table compares three common categories:

| Category | Description | Pros | Cons |

|---|---|---|---|

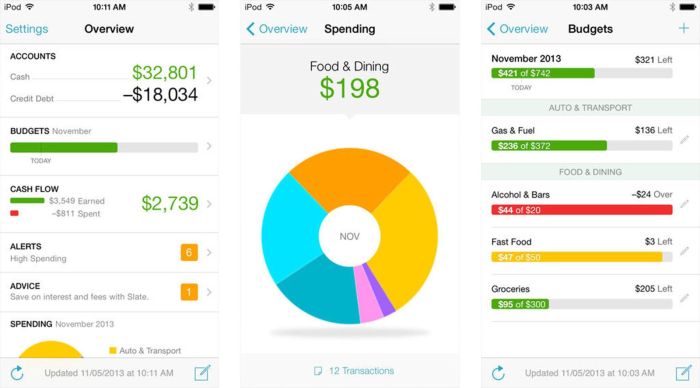

| Mobile Apps | Expense tracking applications designed for smartphones and tablets. Often offer user-friendly interfaces and convenient on-the-go expense entry. Examples include Mint, Personal Capital, and Expensify. | Portability, ease of use, often free or low-cost options. | Limited features compared to desktop or cloud-based solutions, potential data security concerns depending on the app. |

| Desktop Software | Software installed directly onto a computer. May offer more advanced features and greater control over data management compared to mobile apps. Examples include Quicken and Moneydance. | Robust features, offline accessibility, potentially better data security than some mobile apps. | Less portable, requires dedicated computer space, potential compatibility issues. |

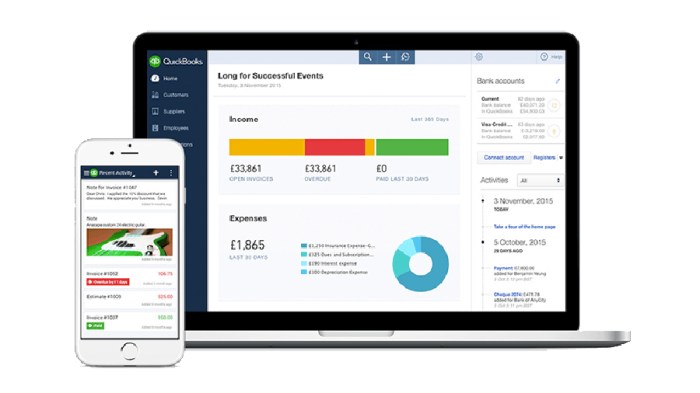

| Cloud-Based Solutions | Software accessed via the internet, typically offering data storage and collaboration features. Examples include Zoho Expense and QuickBooks Online. | Accessibility from multiple devices, data backup and recovery, often collaborative features for teams. | Requires internet connectivity, potential data security and privacy concerns depending on the provider. |

Key Features and Benefits

Effective expense tracking software offers a range of features designed to simplify and streamline the process of monitoring financial outflows, whether for personal or business use. These tools provide a significant advantage over manual methods, offering increased accuracy, efficiency, and valuable insights into spending habits. The benefits extend to both personal financial management and business accounting, impacting budgeting, forecasting, and overall financial health.

Expense tracking software’s core functionality revolves around data input and analysis. Users typically record transactions through various methods, such as manual entry, automated imports from bank accounts and credit cards, or receipt scanning. The software then categorizes and analyzes this data, generating reports and visualizations that highlight spending patterns, identify areas for potential savings, and facilitate informed financial decisions.

Essential Features of Effective Expense Tracking Software

Effective expense tracking software incorporates several key features to maximize its utility. These include robust data import capabilities, customizable categorization options, comprehensive reporting functionalities, and secure data storage. The software should also be user-friendly and intuitive, allowing for easy navigation and data entry. Furthermore, features like budget setting, expense forecasting, and insightful visualizations enhance the overall user experience and provide actionable insights. For business applications, integration with accounting software is crucial for seamless data transfer and streamlined accounting processes.

Benefits of Expense Tracking Software for Personal Finance Management

Utilizing expense tracking software significantly improves personal financial management. By providing a clear picture of spending habits, individuals can identify areas of overspending and make informed decisions to adjust their budgets. The software facilitates goal setting, whether it’s saving for a down payment, paying off debt, or simply improving overall financial stability. Automated features, such as scheduled imports and reminders, minimize the effort required for consistent tracking, ensuring accuracy and reducing the likelihood of missed transactions. Visual representations of spending patterns provide a quick and easy understanding of financial health, empowering individuals to take control of their finances. For example, a user might discover that dining out constitutes a significant portion of their spending, prompting them to adjust their eating habits and allocate those funds elsewhere.

Advantages of Expense Tracking Software for Business Accounting

For businesses, expense tracking software is invaluable for accurate and efficient accounting. It streamlines the process of collecting, categorizing, and reporting expenses, simplifying tax preparation and reducing the risk of errors. The software ensures compliance with accounting standards, providing an auditable trail of financial transactions. Furthermore, real-time expense tracking enables businesses to monitor their financial health proactively, identify potential cost-saving measures, and make informed decisions about resource allocation. Integration with other business software, such as payroll and invoicing systems, further enhances efficiency and reduces manual data entry. For instance, a small business owner can track marketing expenses separately and analyze their ROI, leading to more effective marketing strategies.

Manual vs. Automated Expense Tracking

The choice between manual and automated expense tracking depends on individual needs and preferences. Both methods have their advantages and disadvantages.

Let’s consider the pros and cons of each approach:

- Manual Expense Tracking:

- Pros: Complete control over data entry; potentially lower initial cost (no software subscription).

- Cons: Time-consuming; prone to errors; lacks insightful analysis and reporting features; difficult to maintain long-term consistency.

- Automated Expense Tracking:

- Pros: Saves time and effort; reduces errors; provides comprehensive reporting and analysis; offers insightful visualizations; facilitates better financial decision-making.

- Cons: Requires initial investment in software; may require learning curve; potential for reliance on technology and connectivity.

Choosing the Right Software

Selecting the ideal expense tracking software requires careful consideration of various factors to ensure it aligns with your specific needs and budget. The right software can significantly improve your financial organization and decision-making, while the wrong choice can lead to frustration and inefficiency. This section will guide you through the process of evaluating and choosing the best option for you.

Factors to Consider When Selecting Expense Tracking Software

Several key factors influence the selection of appropriate expense tracking software. These include the scale of your expense tracking needs (personal vs. business), the level of automation desired, integration capabilities with other financial tools, the user interface’s intuitiveness, the software’s security features, and, of course, the cost. A thorough assessment of these elements is crucial for making an informed decision.

A Step-by-Step Guide to Evaluating Expense Tracking Software

- Define your needs: Clearly identify your expense tracking requirements. Are you a freelancer needing simple income and expense tracking, or a large business requiring sophisticated features like multi-user access and detailed reporting?

- Research available options: Explore different software options available in the market. Consider both free and paid options, noting their features and limitations.

- Trial the software: Many software providers offer free trials or demos. Take advantage of these to test the software’s usability and features before committing to a purchase.

- Compare features and pricing: Create a comparison table (as shown below) to systematically analyze different software packages based on their pricing models, key features, and user reviews.

- Read user reviews: Examine user reviews on platforms like Capterra or G2 to understand real-world experiences with the software.

- Consider long-term scalability: Choose software that can adapt to your growing needs as your business or personal finances evolve.

Essential Features Checklist for Expense Tracking Software

Before making a decision, it’s crucial to verify that the software possesses the necessary features to effectively manage your expenses. This checklist highlights key features to look for:

- Import functionality: Ability to import transactions from bank accounts and credit cards.

- Categorization and tagging: Options for categorizing and tagging expenses for detailed analysis.

- Reporting and analytics: Comprehensive reporting features to visualize spending patterns.

- Budgeting tools: Capabilities for setting budgets and tracking progress against those budgets.

- Receipt management: Features for storing and organizing digital receipts.

- Data security and privacy: Robust security measures to protect sensitive financial data.

- User-friendly interface: Intuitive and easy-to-navigate interface.

- Customer support: Reliable customer support channels for assistance.

Comparison of Expense Tracking Software

The following table compares three popular expense tracking software packages. Note that pricing and features can change, so always check the provider’s website for the most up-to-date information. User reviews are summarized based on a range of online sources and reflect a general sentiment, not a definitive measure.

| Software | Pricing | Key Features | User Reviews |

|---|---|---|---|

| Mint | Free (with ads); Premium options available | Budgeting, expense tracking, financial overview, bill payment reminders, credit score monitoring | Generally positive; praised for ease of use and free features; some complaints about limited customization and occasional glitches. |

| Personal Capital | Free (basic); Premium options available | Investment tracking, retirement planning, budgeting, expense tracking, net worth tracking | Positive reviews for its comprehensive financial overview and investment tracking; premium features are well-regarded; some users find the interface overwhelming for simple expense tracking. |

| QuickBooks Self-Employed | Paid subscription | Mileage tracking, income and expense tracking, tax preparation tools, invoicing, profit and loss reports | Generally positive reviews for its features aimed at self-employed individuals; praised for its tax-related tools; some users find the pricing a bit high compared to free options. |

Implementation and Use

Successfully implementing expense tracking software involves a straightforward process, from initial setup to ongoing maintenance. Understanding the software’s features and adapting your workflow are key to maximizing its benefits. This section details the steps involved, from initial configuration to the ongoing management of your financial records.

Setting up and configuring expense tracking software typically begins with creating an account. This often involves providing basic personal or business information. Following account creation, you’ll need to personalize the software to reflect your specific financial needs. This may involve setting up budget categories, linking bank accounts (if supported), and configuring any automated import features. Many software options offer customizable dashboards and reporting features; taking the time to tailor these settings ensures you gain maximum insight from your expense data.

Software Setup and Configuration

The initial setup process usually involves creating a user profile and customizing settings. Users will typically input personal or business details, such as company name and address (for business accounts). Next, they might define budget categories, reflecting their spending habits (e.g., groceries, rent, transportation, entertainment). Some software integrates with bank accounts, allowing for automatic import of transactions. This automation feature significantly reduces manual data entry. Finally, users can customize their dashboards to display the key metrics most relevant to their needs, such as monthly spending totals per category or upcoming bills.

Recording Various Expense Types

Accurately recording expenses requires attention to detail. For receipts, you can typically upload photos directly into the software. The software often uses Optical Character Recognition (OCR) to automatically extract key data such as date, merchant, and amount. For bills, the process is similar; you can upload a photo or scan of the bill, allowing the software to extract the relevant information. Subscriptions can be recorded either manually or, in some cases, automatically imported if the software integrates with your online banking or subscription management services. Consistent and timely recording is crucial for maintaining accurate financial records. For example, entering expenses on the same day they occur helps avoid confusion and ensures data accuracy.

Best Practices for Maintaining Organized Expense Records

Maintaining organized expense records is critical for accurate financial analysis and reporting. Effective organization ensures efficient data retrieval and simplifies tax preparation. Inconsistent record-keeping can lead to inaccuracies and difficulties in tracking spending patterns.

- Regular Data Entry: Enter expenses daily or at least weekly to prevent data backlog and ensure accuracy.

- Consistent Categorization: Use a consistent and logical categorization system to facilitate analysis and reporting. Avoid overly broad or vague categories.

- Detailed Descriptions: Include descriptive notes for each expense to clarify the purpose and context of the transaction. For instance, instead of “Restaurant,” use “Dinner with clients at The Italian Place.”

- Regular Backups: Regularly back up your data to prevent loss due to software malfunctions or other unforeseen circumstances.

- Periodic Reviews: Review your expense records regularly (e.g., monthly or quarterly) to identify trends and areas for potential savings.

Optimizing Expense Tracking Software for Maximum Efficiency

Optimizing your expense tracking software involves leveraging its features and adapting your workflow to maximize its benefits. This includes utilizing automation features and regularly reviewing your setup to ensure it remains efficient and effective. A well-optimized system significantly reduces the time and effort required for expense tracking, enabling better financial management.

- Utilize Automation: Leverage features such as automatic bank account imports and recurring transaction reminders to minimize manual data entry.

- Customize Reports: Tailor reports to your specific needs to gain valuable insights into your spending habits. Focus on the metrics that are most important to you.

- Regularly Review and Adjust Categories: Periodically review your expense categories to ensure they remain relevant and accurate. Adjust them as your spending habits evolve.

- Integrate with Other Tools: Explore integrations with other financial management tools to streamline your workflow. For example, integrating with budgeting software can provide a more holistic view of your finances.

- Explore Advanced Features: Familiarize yourself with advanced features such as expense forecasting or custom report generation to enhance your financial analysis capabilities.

Reporting and Analysis

Effective expense tracking software goes beyond simple record-keeping; it provides powerful reporting and analysis tools to offer valuable insights into spending habits. Understanding these reports is crucial for making informed financial decisions and achieving better financial control.

Expense tracking software generates a variety of reports to help users visualize and analyze their spending. These reports provide a clear picture of where money is being spent, allowing for the identification of areas for potential savings and adjustments to financial planning.

Types of Expense Reports

Expense tracking software typically offers several standard report types. These include summary reports showing total expenses by category over a specified period (e.g., monthly, quarterly, yearly). Detailed reports list each individual transaction with associated details such as date, vendor, and payment method. Comparative reports allow for side-by-side comparisons of expenses across different time periods or budget categories, highlighting variations and trends. Customizable reports allow users to tailor the report’s content and format to meet their specific needs. For example, a user might create a report focusing solely on business-related expenses for tax purposes.

Interpreting Expense Reports to Identify Spending Patterns and Trends

Analyzing expense reports involves identifying recurring expenses, unusual spending spikes, and consistent patterns across different categories. For example, a consistent overspending in the “dining out” category might indicate a need to reduce restaurant visits. Similarly, a sudden increase in transportation costs could warrant investigation into potential cost-saving measures like using public transportation or carpooling. By comparing expenses across different periods, users can track progress toward financial goals and identify areas where spending habits have improved or deteriorated. For instance, comparing monthly expenses over a year reveals seasonal variations in spending and helps in proactive budgeting.

Using Expense Reports to Improve Financial Planning

Expense reports are invaluable for improving financial planning. By analyzing spending patterns, users can create more realistic budgets aligned with their actual spending habits. Identifying areas of overspending allows for the development of strategies to reduce expenses, such as negotiating lower bills or finding cheaper alternatives. The reports also facilitate the setting of financial goals, such as saving for a down payment on a house or paying off debt, by providing a clear picture of available funds after necessary expenses are accounted for. For example, if a report reveals consistent underspending in a savings category, a user might adjust their budget to allocate more funds to savings, thereby accelerating progress toward their financial goal.

Creating Visually Appealing Charts and Graphs

Visual representations of expense data significantly enhance understanding and facilitate decision-making. Pie charts effectively illustrate the proportion of expenses allocated to different categories, instantly highlighting the largest spending areas. Bar charts are ideal for comparing expenses across different time periods or categories, showing trends and variations over time. Line graphs are useful for visualizing changes in expenses over an extended period, revealing upward or downward trends. Scatter plots can be used to identify correlations between different expense categories, such as the relationship between entertainment spending and income level. A well-designed dashboard can combine several chart types for a comprehensive overview of expenses. For instance, a dashboard might include a pie chart showing expense categories, a bar chart showing monthly spending, and a line graph showing savings over time. The visual nature of these charts makes it easy to spot outliers, trends, and areas for improvement in spending habits.

Security and Privacy

Protecting your financial data is paramount when using expense tracking software. Reputable software providers prioritize security and privacy, implementing robust measures to safeguard your information. Understanding these measures and potential risks is crucial for making informed choices and maintaining control over your sensitive data.

Data encryption and privacy protection are cornerstones of secure expense tracking. Without these, your sensitive financial information is vulnerable to unauthorized access and potential misuse. The level of security offered directly impacts your financial well-being and peace of mind.

Data Encryption Methods

Expense tracking software utilizes various encryption methods to protect data both in transit and at rest. This typically involves using strong encryption algorithms like AES-256 to scramble your data, making it unreadable without the correct decryption key. This ensures that even if your data is intercepted, it remains confidential. Furthermore, reputable providers regularly update their encryption protocols to stay ahead of evolving security threats.

Privacy Protection Measures

Beyond encryption, strong privacy protection involves implementing measures to control data access and usage. This includes adhering to strict data privacy regulations like GDPR and CCPA, limiting data collection to only what is necessary for the software’s functionality, and providing users with clear control over their data, including the ability to export, delete, or modify their information. Transparency in data handling practices is a key indicator of a privacy-focused software provider.

Potential Security Risks and Mitigation Strategies

While reputable software aims to minimize risks, potential security threats exist. These include phishing attacks targeting user credentials, malware infecting devices accessing the software, and data breaches targeting the software provider’s servers. Mitigation strategies involve using strong, unique passwords, enabling two-factor authentication, regularly updating software and operating systems, being wary of suspicious emails and links, and choosing software providers with a proven track record of security and robust security protocols in place. Regular security audits and penetration testing by the software provider also contribute to a more secure environment.

Choosing Secure and Privacy-Focused Software

Selecting secure and privacy-focused expense tracking software requires careful consideration. Look for software providers who openly communicate their security and privacy practices, undergo regular security audits, comply with relevant data privacy regulations, and offer features such as two-factor authentication and data encryption. Reading user reviews and checking independent security assessments can provide additional insights into the software’s security posture. Consider the provider’s reputation and their commitment to data security as key factors in your decision-making process. Transparency in their security and privacy policies is also essential.

Integration with Other Tools

Effective expense tracking software shouldn’t exist in isolation. Its true power lies in its ability to seamlessly connect with other financial tools, creating a unified and efficient financial management system. This integration streamlines workflows, reduces manual data entry, and provides a more comprehensive view of your financial health.

Seamless integration between various financial management tools offers significant advantages. By eliminating the need for manual data transfer between different platforms, it minimizes the risk of errors and inconsistencies. This automated data flow saves considerable time and effort, allowing users to focus on strategic financial decisions rather than tedious data entry. Moreover, a holistic view of financial data, encompassing income, expenses, budgeting, and accounting, provides a clearer picture of overall financial performance and facilitates more informed decision-making.

Examples of Successful Integrations

Several expense tracking software providers offer robust integration capabilities. For instance, many platforms integrate directly with popular accounting software like Xero or QuickBooks. This allows for automatic transfer of expense data into the accounting system, eliminating the need for manual reconciliation. Similarly, integrations with budgeting apps enable users to automatically track expenses against their budget, providing real-time insights into spending habits and helping to identify potential overspending areas. A successful integration example could involve an employee submitting an expense report through an expense tracking app that automatically uploads the data to the company’s accounting software, where it is automatically categorized and reconciled. This eliminates manual data entry and ensures accuracy.

Potential Integrations and Their Advantages

The potential for integration extends beyond accounting and budgeting software. A well-designed system can connect with various other financial tools, greatly enhancing its functionality and usefulness.

- Accounting Software (e.g., Xero, QuickBooks): Automatic transfer of expense data for streamlined accounting processes and reduced manual data entry. This ensures consistency and accuracy in financial reporting.

- Budgeting Apps (e.g., Mint, YNAB): Real-time expense tracking against budget allocations, providing insights into spending patterns and facilitating proactive financial management. This allows for immediate identification of overspending or areas where adjustments are needed.

- Banking Platforms: Automatic import of bank transactions, simplifying the expense tracking process and minimizing manual data entry. This reduces the likelihood of errors and omissions in recording expenses.

- Project Management Software (e.g., Asana, Trello): Linking expenses to specific projects for improved cost tracking and project profitability analysis. This offers valuable insights into the financial performance of individual projects.

- CRM Software (e.g., Salesforce, HubSpot): Connecting expenses to client interactions for better understanding of client profitability and resource allocation. This provides a comprehensive view of client relationships and associated costs.

Future Trends in Expense Tracking Software

The expense tracking software market is in constant evolution, driven by technological advancements and changing user needs. We are moving beyond simple record-keeping towards intelligent, proactive solutions that offer deeper insights and automate more of the process. This shift is fueled by the increasing adoption of cloud computing, mobile accessibility, and the rise of artificial intelligence.

The potential impact of technological advancements is substantial, promising more efficient and insightful expense management. This section will explore the key trends shaping the future of expense tracking, focusing on the role of AI and providing predictions for the software’s development.

Increased Automation and AI-Powered Insights

Artificial intelligence and machine learning are revolutionizing expense tracking. AI algorithms can automate tasks such as receipt scanning and categorization, significantly reducing manual effort. Furthermore, AI can analyze spending patterns to identify anomalies and potential areas for cost savings, providing users with actionable insights they might otherwise miss. For example, an AI-powered system might flag unusually high spending in a specific category or identify recurring expenses that could be negotiated or reduced. Machine learning models can also improve the accuracy of expense categorization over time, learning from user corrections and feedback to continuously refine their performance. This leads to more reliable data and more accurate financial reporting.

Enhanced Mobile Accessibility and Integration

Expense tracking software is increasingly optimized for mobile devices. This trend reflects the growing preference for on-the-go access and the need to record expenses immediately after they occur. Modern apps provide seamless integration with other mobile tools, such as banking apps and payment platforms, enabling real-time expense tracking and reducing the likelihood of errors or omissions. For example, a user could snap a photo of a receipt with their phone, and the app would automatically extract the relevant information and categorize the expense. Further integration with calendar apps could also automatically associate expenses with specific business trips or projects.

Improved Data Security and Privacy

As more sensitive financial data is stored and processed digitally, robust security measures are paramount. Future expense tracking software will incorporate advanced encryption techniques and comply with stringent data privacy regulations. Multi-factor authentication, data loss prevention strategies, and regular security audits will be standard features, ensuring the protection of user data and compliance with regulations like GDPR and CCPA. This increased focus on security will build trust and encourage wider adoption of these systems.

Predictive Analytics and Budget Management

The integration of predictive analytics will move expense tracking beyond simple reporting. By analyzing historical spending data and external factors like economic trends, the software can provide users with predictive insights into future expenses. This capability allows for more effective budget planning and proactive financial management. For instance, the software could predict potential increases in travel costs based on seasonal fluctuations and suggest adjustments to the budget accordingly. This proactive approach empowers users to make informed financial decisions and avoid potential budget overruns.

Blockchain Technology Integration

While still nascent, the potential of blockchain technology in expense tracking is noteworthy. Blockchain’s inherent security and transparency could enhance the integrity and auditability of expense records. This could be particularly beneficial for businesses with complex expense structures or those requiring strict regulatory compliance. For example, a blockchain-based system could provide an immutable record of expenses, making it difficult to alter or manipulate the data. This could increase trust and transparency within organizations and facilitate more efficient audits.

Wrap-Up

In conclusion, effective expense tracking is crucial for both personal financial health and successful business operations. The right expense tracking software can significantly simplify financial management, providing valuable insights into spending habits and enabling informed decision-making. By carefully considering factors like features, security, and integration capabilities, users can select a solution that optimally meets their needs and contributes to improved financial outcomes. The future of expense tracking is bright, with ongoing technological advancements promising even more streamlined and intelligent solutions.

FAQs

What is the best expense tracking software for small businesses?

The “best” software depends on specific needs. Consider factors like budget, number of users, and required features before choosing. Popular options include Xero, QuickBooks, and FreshBooks, but research is recommended to find the optimal fit.

Is my data safe with expense tracking software?

Reputable software providers employ robust security measures, including data encryption and secure servers. However, always review a provider’s privacy policy and security practices before using their software. Look for features like two-factor authentication for added protection.

Can I integrate expense tracking software with my bank account?

Many expense tracking software options offer bank account integration, automating the import of transactions. This feature simplifies the process of recording expenses and reduces manual data entry. Check the software’s capabilities to ensure compatibility with your financial institution.

How much does expense tracking software typically cost?

Pricing varies widely depending on features and the scale of the software (personal vs. business). Some offer free plans with limited features, while others charge monthly or annual subscriptions, with pricing tiers often based on the number of users or transactions.