Unlocking the power of data visualization, financial dashboards offer a transformative approach to financial management. They condense complex financial information into easily digestible visuals, empowering businesses of all sizes to make informed, data-driven decisions. From tracking key performance indicators (KPIs) to identifying emerging trends, these dynamic tools provide a clear, concise overview of financial health, facilitating proactive strategies and improved operational efficiency.

This guide delves into the diverse world of financial dashboards, exploring various types, design best practices, and the software solutions available to build them. We’ll examine how different visualizations can effectively communicate complex financial data, and how interactive elements enhance analysis and decision-making speed. We will also consider the challenges of implementation and how to overcome them, providing real-world examples to illustrate the benefits of effective dashboard design.

Types of Financial Dashboards

Financial dashboards are crucial tools for visualizing key financial data, enabling informed decision-making across various organizational levels. The type of dashboard implemented depends heavily on the specific needs of the business, its size, and the users’ roles. Different dashboards emphasize different aspects of financial performance, offering tailored insights for specific audiences.

Categorization of Financial Dashboards by Business Size and User

The following table illustrates different types of financial dashboards categorized by business size and the intended audience, highlighting key metrics and providing illustrative examples.

| Dashboard Type | Target Audience | Key Metrics | Illustrative Example |

|---|---|---|---|

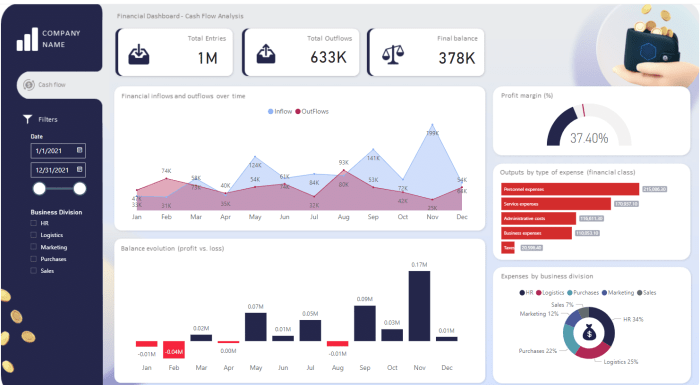

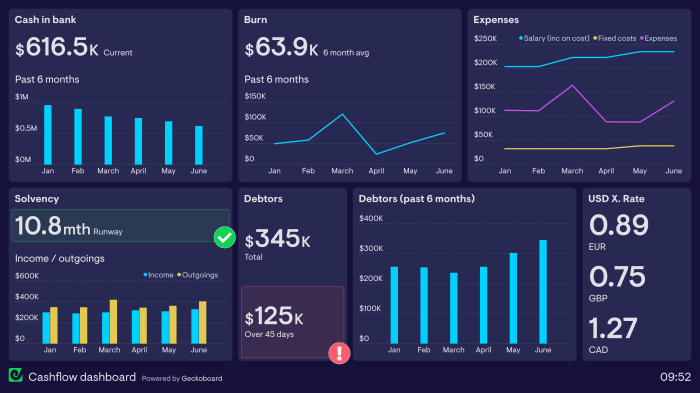

| Simple Cash Flow Dashboard | Small Business Owner | Cash on hand, accounts receivable, accounts payable, upcoming expenses, net cash flow | A single-page dashboard showing a bar chart of monthly cash flow for the past year, a table summarizing current account balances, and a list of upcoming significant expenses. This provides a quick overview of the company’s liquidity. |

| Profitability and Sales Dashboard | Medium Business Management Team | Gross profit margin, net profit margin, sales revenue by product line, customer acquisition cost, return on investment (ROI) | A dashboard displaying interactive charts showing sales trends over time, segmented by product category. It also features key profitability ratios and allows for drill-down analysis to identify profitable and underperforming areas. |

| Comprehensive Financial Performance Dashboard | Large Enterprise Executive Team | Revenue, cost of goods sold (COGS), operating expenses, net income, earnings per share (EPS), key performance indicators (KPIs) across various departments, debt-to-equity ratio | A highly customizable dashboard with interactive maps showing regional performance, interactive charts comparing year-over-year performance against budgets and forecasts, and detailed tables with financial ratios and KPIs. This dashboard provides a holistic view of the company’s financial health. |

| Operational Efficiency Dashboard | Operational Teams (all sizes) | Inventory turnover, days sales outstanding (DSO), accounts payable turnover, production efficiency, process cycle times | This dashboard focuses on operational metrics, displaying charts showing inventory levels, order fulfillment times, and other efficiency indicators. It helps identify bottlenecks and areas for improvement in operational processes. For a small business, this might track order fulfillment times; for a large business, this might track warehouse efficiency across multiple locations. |

Key Features and Functionalities of Financial Dashboards

Effective financial dashboards share several common features. These include real-time data updates, customizable views allowing users to tailor the displayed information to their needs, interactive elements enabling drill-down analysis, data visualization through charts and graphs for easy interpretation, and integration with other business systems for a holistic view of the business. Data security and access control are also critical features, ensuring that sensitive financial information is protected.

Design Elements for Executive vs. Operational Dashboards

Dashboards designed for executive management prioritize high-level summaries and key performance indicators (KPIs). They typically use concise visualizations like charts and graphs that highlight overall performance trends. Color-coding is frequently used to quickly indicate positive or negative performance. In contrast, operational dashboards provide more detailed information and granular data, often including tables and more complex visualizations to support in-depth analysis and troubleshooting. Executive dashboards emphasize strategic decision-making, while operational dashboards focus on operational efficiency and problem-solving. For example, an executive dashboard might show overall revenue growth, while an operational dashboard might break down revenue by product line and sales region, revealing potential issues in specific areas.

Key Performance Indicators (KPIs) in Financial Dashboards

Financial dashboards rely heavily on Key Performance Indicators (KPIs) to provide a concise and insightful overview of a company’s financial health. These metrics offer a snapshot of critical aspects of the business, enabling quick identification of trends, areas needing attention, and overall performance against targets. Effectively chosen and displayed KPIs are crucial for informed decision-making at all levels of an organization.

Selecting and presenting the right KPIs is key to creating a useful and effective financial dashboard. The choice of KPIs should directly reflect the organization’s strategic goals and the specific questions the dashboard is designed to answer. Overloading the dashboard with irrelevant KPIs can lead to confusion and hinder effective analysis.

Common Financial KPIs and Their Significance

The selection of KPIs should align with the overall business objectives. A well-designed dashboard will include a balanced mix of metrics representing various aspects of financial performance. Here are some examples:

- Revenue Growth: This KPI tracks the change in revenue over a specific period (e.g., year-over-year, month-over-month). A positive trend indicates growth and business success, while a negative trend may signal underlying problems requiring investigation. It can be calculated as [(Current Revenue – Previous Revenue) / Previous Revenue] * 100%.

- Profit Margin: This shows the profitability of sales, expressed as a percentage. A higher profit margin indicates greater efficiency and better control over costs. It is calculated as (Net Profit / Revenue) * 100%. A consistent decline in profit margin might suggest the need for cost-cutting measures or a pricing strategy review.

- Return on Investment (ROI): ROI measures the profitability of an investment relative to its cost. It’s crucial for evaluating the effectiveness of various initiatives and capital expenditures. It’s calculated as (Net Profit / Cost of Investment) * 100%. A high ROI indicates a successful investment, while a low ROI may suggest a need for reevaluation.

- Customer Acquisition Cost (CAC): This KPI tracks the cost of acquiring a new customer. A lower CAC indicates greater efficiency in marketing and sales efforts. Understanding CAC is vital for optimizing marketing spend and ensuring sustainable growth. It is typically calculated by dividing total marketing and sales costs by the number of new customers acquired.

- Customer Lifetime Value (CLTV): This represents the total revenue expected from a customer throughout their relationship with the company. A high CLTV indicates strong customer loyalty and retention. Comparing CLTV to CAC helps assess the long-term profitability of customer acquisition strategies.

KPI Selection Based on Business Goals

The most effective dashboards are tailored to specific business objectives. For example, a company focused on rapid expansion might prioritize revenue growth and market share KPIs. Conversely, a company aiming to improve profitability might focus on profit margins, operational efficiency, and cost reduction metrics. Consider these steps when selecting KPIs:

- Define Clear Objectives: Start by outlining the specific goals the dashboard is intended to support. Are you aiming to increase revenue, improve profitability, optimize operations, or enhance customer satisfaction?

- Identify Key Drivers: Determine the factors that directly influence the achievement of your objectives. These factors will form the basis for your KPI selection.

- Select Relevant Metrics: Choose KPIs that accurately measure the key drivers identified in the previous step. Ensure the metrics are relevant, measurable, achievable, and time-bound (SMART).

- Prioritize and Limit: Focus on a manageable number of KPIs to avoid overwhelming the dashboard. Prioritize the most critical metrics that provide the most valuable insights.

Sample Dashboard Layout

Imagine a dashboard divided into four quadrants. The top-left quadrant displays key revenue metrics, including revenue growth (displayed as a line chart showing year-over-year trends), and average revenue per user (ARPU, shown as a bar chart comparing different customer segments). The top-right quadrant showcases profitability, presenting profit margin (as a gauge chart indicating performance against target) and ROI (displayed as a table comparing different investments). The bottom-left quadrant focuses on customer metrics, including CLTV (as a bar chart comparing different customer segments) and customer churn rate (as a line chart showing trends over time). Finally, the bottom-right quadrant shows operational efficiency metrics, such as operational expenses (as a pie chart showing the breakdown of expenses) and inventory turnover (as a line chart showing trends over time). Each quadrant is clearly labeled, and the visualizations are chosen to best represent the data and allow for easy interpretation. Color-coding and clear annotations further enhance readability.

Data Visualization Techniques

Effective data visualization is crucial for transforming complex financial data into easily understandable insights within a dashboard. The right visualization method can significantly impact a user’s ability to quickly grasp key trends and make informed decisions. Choosing appropriate charts and graphs is essential for clear communication and effective analysis.

Various data visualization techniques offer unique advantages and disadvantages depending on the type of financial data being presented and the insights desired. Careful consideration of these factors ensures that the dashboard effectively communicates the relevant information. The selection should prioritize clarity, accuracy, and ease of interpretation for the intended audience.

Examples of Data Visualization Techniques in Financial Dashboards

The following table Artikels several common data visualization techniques, their suitability for different financial data types, their advantages, and example use cases.

| Visualization Type | Suitable Data | Advantages | Example Use Case |

|---|---|---|---|

| Bar Chart | Comparisons of discrete categories (e.g., revenue by product line, expenses by department) | Easy to compare values across categories; visually appealing and easily understood. | Comparing monthly sales figures across different regions. |

| Line Chart | Trends over time (e.g., revenue growth, stock prices) | Clearly shows trends and patterns over time; useful for identifying growth or decline. | Illustrating the change in a company’s net profit over a five-year period. |

| Pie Chart | Proportions of a whole (e.g., revenue breakdown by product, expense allocation) | Effectively displays the relative contribution of different components to a total. | Showing the percentage of total revenue generated by each product category. |

| Gauge Chart | Single key metric against a target (e.g., sales target achievement, budget adherence) | Provides a quick visual representation of progress towards a goal; easily understood at a glance. | Displaying the percentage of a sales target achieved for the current quarter. |

| Heatmap | Showing correlations or relationships between two variables (e.g., sales performance across different regions and time periods) | Highlights patterns and correlations in large datasets; visually represents intensity of data. | Illustrating sales performance across different product lines and regions, showing high and low performing areas. |

Advantages and Disadvantages of Visualization Methods

The choice of visualization method significantly impacts the effectiveness of a financial dashboard. While some methods excel at showing trends, others are better suited for comparisons or highlighting specific metrics. Understanding these strengths and weaknesses is key to creating a clear and insightful dashboard.

For instance, while bar charts are excellent for comparing discrete categories, they are less effective for showing trends over time. Conversely, line charts are ideal for visualizing trends but may not be as effective for comparing distinct categories. Pie charts are excellent for showing proportions but can become cluttered with too many segments. Gauges are great for highlighting key metrics but may not provide detailed information.

Effective Use of Color and Labeling

Color and labeling are crucial for enhancing the readability and understanding of financial data visualizations. Strategic use of color can highlight key trends, draw attention to important data points, and improve the overall aesthetic appeal of the dashboard. Clear and concise labels are essential for ensuring that the data is easily interpreted.

Imagine a line chart depicting revenue over time. Using a vibrant green to represent periods of growth and a subdued red for periods of decline would instantly make the trends clear. Furthermore, adding clear labels to the axes (e.g., “Revenue in Millions” and “Year”) and data points would further improve readability. Similarly, in a heatmap, using a color scale that clearly represents intensity (e.g., dark red for high values and light green for low values) is vital for understanding the correlations presented. Avoid using too many colors or colors that are difficult to distinguish. Consistent use of color schemes across the entire dashboard is also essential for maintaining visual harmony and ease of understanding.

Dashboard Design Best Practices

Creating effective financial dashboards requires careful consideration of design principles to ensure data is presented clearly, intuitively, and efficiently. A well-designed dashboard facilitates quick understanding and informed decision-making, while a poorly designed one can lead to confusion and misinterpretations. The focus should always be on the user experience and the effective communication of key financial insights.

Effective dashboard design is not merely about aesthetics; it’s about usability and the clear communication of complex financial data. This involves a combination of thoughtful planning, data visualization techniques, and an understanding of user needs. The following best practices will guide you in building dashboards that are both visually appealing and highly functional.

Data Selection and Preparation

Before even considering the visual aspects, the foundation of any effective dashboard lies in the careful selection and preparation of the data. This involves identifying the key performance indicators (KPIs) relevant to the intended audience and their specific needs. Data should be accurate, reliable, and up-to-date. Cleaning and transforming the data is crucial to ensure consistency and accuracy. Consider using data validation techniques to identify and correct errors. Once the data is prepared, it should be organized in a way that makes it easy to access and integrate into the dashboard.

User Interface Design Principles

A user-friendly interface is paramount. The following points highlight key considerations:

- Clear and Concise Labeling: All data points, charts, and graphs should be clearly labeled with concise and unambiguous descriptions. Avoid jargon and technical terms unless the intended audience is highly familiar with them.

- Intuitive Navigation: The dashboard should be easy to navigate, with clear visual cues and interactive elements. Users should be able to quickly find the information they need without difficulty.

- Consistent Design Elements: Maintain consistency in fonts, colors, and overall visual style throughout the dashboard. This enhances readability and creates a professional look.

- Appropriate Chart Types: Select chart types that best represent the data and are easily understood by the target audience. For example, use bar charts for comparisons, line charts for trends, and pie charts for proportions. Avoid using too many different chart types in a single dashboard to maintain visual consistency.

- Data Hierarchy and Grouping: Organize data logically, grouping related information together and using visual cues to guide the user’s eye. This helps to create a clear visual hierarchy and makes it easier to understand the relationships between different data points.

Step-by-Step Design Process

The design process should be methodical and iterative. A step-by-step approach ensures a comprehensive and effective outcome:

- Define Objectives and Audience: Clearly define the purpose of the dashboard and identify the key stakeholders who will be using it. Understanding their needs and information requirements is crucial.

- Data Selection and Preparation: As mentioned earlier, this involves identifying the relevant KPIs, cleaning the data, and ensuring its accuracy and reliability.

- Visual Design and Layout: Choose appropriate charts and graphs, and create a visually appealing and easy-to-navigate layout. Consider using color effectively to highlight key information and create visual interest.

- Interactive Elements: Incorporate interactive elements such as filters, drill-downs, and tooltips to allow users to explore the data in more detail.

- Testing and Iteration: Test the dashboard with users to gather feedback and make necessary adjustments. Iteration is key to refining the design and ensuring it meets the needs of the intended audience.

- Deployment and Monitoring: Deploy the dashboard and continuously monitor its performance to identify areas for improvement. Regular updates and maintenance are essential to ensure the dashboard remains relevant and effective.

Real-World Examples and Case Studies

Financial dashboards, when implemented effectively, can significantly improve a company’s financial performance and decision-making processes. Their success hinges on careful planning, selection of appropriate KPIs, and a user-friendly design. Examining real-world examples provides valuable insights into best practices and potential challenges.

Successful implementations demonstrate the transformative power of data visualization in financial management. Analyzing these cases highlights the benefits achieved and the strategies employed to overcome implementation hurdles.

Examples of Successful Financial Dashboard Implementations

Several organizations across diverse industries have successfully leveraged financial dashboards to enhance their financial management. These examples showcase the versatility and effectiveness of dashboards in various contexts.

- Industry: Retail. Dashboard Purpose: Real-time sales tracking and inventory management. Key Features: Interactive sales charts showing daily/weekly/monthly trends, inventory levels with low-stock alerts, and a comparison of sales performance against targets. Positive Outcomes: Improved inventory control, reduced stockouts, increased sales, and better forecasting accuracy leading to a 15% increase in profitability within six months.

- Industry: Manufacturing. Dashboard Purpose: Monitoring production costs and efficiency. Key Features: Visual representation of production costs per unit, machine downtime tracking, and a comparison of actual versus planned production output. Positive Outcomes: Identification of production bottlenecks, optimized resource allocation, and a 10% reduction in production costs within a year.

- Industry: Finance. Dashboard Purpose: Portfolio performance tracking and risk management. Key Features: Real-time portfolio valuations, risk assessments, and key financial ratios. Positive Outcomes: Improved investment decisions, enhanced risk mitigation, and better client reporting, leading to a 5% increase in client retention.

Challenges Faced During Financial Dashboard Implementation

Implementing a financial dashboard is not without its challenges. Careful planning and resource allocation are crucial to mitigate potential roadblocks.

One common challenge is data integration. Consolidating data from disparate sources can be complex and time-consuming, requiring significant technical expertise. This challenge can be overcome by utilizing ETL (Extract, Transform, Load) processes and investing in robust data integration tools. Another challenge is ensuring data accuracy and reliability. Inaccurate data can lead to flawed insights and poor decision-making. Implementing data validation checks and rigorous data quality control measures is crucial to address this.

Finally, user adoption can be a significant hurdle. If users find the dashboard difficult to use or understand, they are less likely to utilize it effectively. This challenge can be addressed by involving users in the design process, providing comprehensive training, and ensuring the dashboard is intuitive and easy to navigate. Clear communication and user feedback loops are vital to facilitate successful adoption.

Hypothetical Case Study: Improved Decision-Making with a Financial Dashboard

Imagine a small manufacturing company struggling with inconsistent profitability. Their financial data is scattered across various spreadsheets and systems, making it difficult to gain a comprehensive overview of their financial health. Implementing a custom financial dashboard provided a centralized view of key performance indicators, including production costs, sales revenue, and inventory levels. The dashboard allowed management to quickly identify bottlenecks in production, optimize resource allocation, and improve inventory management. As a result, the company saw a 12% increase in profitability within the first year, directly attributable to the improved decision-making enabled by the dashboard’s data-driven insights. The dashboard also facilitated proactive identification of potential risks and allowed for timely corrective actions, leading to improved overall financial stability.

Interactive Elements and Reporting

Interactive financial dashboards significantly enhance the user experience and decision-making process by moving beyond static displays of data. The ability to manipulate data directly within the dashboard allows for deeper insights and a more dynamic understanding of financial performance. This interactivity, coupled with seamless reporting integration, streamlines data analysis and reporting cycles.

Interactive elements allow users to explore data in a far more granular way than static reports. This empowers users to uncover hidden trends and patterns that might otherwise be missed. Integrating these dashboards with automated reporting tools ensures timely and accurate information dissemination, promoting efficient communication and informed decision-making across the organization.

Drill-Down Capabilities and Filtering

Drill-down capabilities allow users to progressively explore data at increasingly granular levels. For example, a user might start by viewing overall revenue, then drill down to see revenue by region, then by product line, and finally by individual sales representative. Filtering enables users to isolate specific data subsets based on various criteria, such as date ranges, product categories, or customer segments. These features enable focused analysis, helping users identify specific areas of strength or weakness within the broader financial picture. This targeted approach minimizes time spent sifting through irrelevant data, focusing attention on key areas needing immediate action. Consider a scenario where a company is experiencing a decline in overall sales. By using drill-down and filtering capabilities, the finance team can quickly pinpoint the specific product lines or geographical regions contributing to this decline, allowing for a swift and targeted response.

Dashboard Integration with Reporting Tools

Integrating financial dashboards with reporting tools automates data updates and distribution, eliminating manual data entry and reducing the risk of human error. This integration can be achieved through various methods, including direct database connections, APIs, or ETL (Extract, Transform, Load) processes. Automated updates ensure that dashboards always reflect the most current data, providing users with a real-time view of financial performance. Automated distribution allows for scheduled reports to be delivered to stakeholders, saving time and ensuring timely access to critical information. For instance, a company could automatically generate and distribute a weekly financial performance report to senior management, highlighting key KPIs and any significant variances from budget. This ensures that critical information reaches the right people at the right time, fostering proactive decision-making.

Enhanced Data Analysis and Decision-Making Speed

Interactive features significantly accelerate data analysis and improve decision-making speed. The ability to quickly filter data, drill down into specific areas of interest, and visualize information in various ways allows users to identify trends and patterns more efficiently. This speed and efficiency are crucial in today’s fast-paced business environment, where timely decisions can significantly impact profitability and competitiveness. For example, a company facing unexpected supply chain disruptions can leverage interactive dashboards to quickly analyze the impact on various product lines and make informed decisions regarding resource allocation and pricing strategies. The ability to quickly visualize the financial impact of different scenarios empowers faster, more informed responses to unexpected challenges.

Software and Tools for Building Dashboards

Building effective financial dashboards requires the right tools. The market offers a wide array of software and platforms, each with its own strengths and weaknesses. Choosing the appropriate tool depends heavily on factors like budget, technical expertise within the team, and the specific needs of the business. This section explores various options and factors to consider during selection.

Several software solutions cater to the creation of financial dashboards, each offering a unique set of features and functionalities. The choice often depends on the size of the organization, the complexity of the data, and the level of technical expertise available. Below is a comparison of some popular options.

Dashboarding Software Comparison

| Software/Tool | Key Features | Pricing Model | Target User |

|---|---|---|---|

| Tableau | Drag-and-drop interface, interactive visualizations, robust data connectivity, advanced analytics capabilities. | Subscription-based, tiered pricing. | Businesses of all sizes, data analysts, and business intelligence professionals. |

| Power BI | User-friendly interface, strong integration with Microsoft products, excellent data visualization capabilities, collaborative features. | Subscription-based, tiered pricing, free version available with limitations. | Businesses using Microsoft products, data analysts, and individuals. |

| Qlik Sense | Associative data exploration, self-service analytics, strong data visualization capabilities, mobile accessibility. | Subscription-based, tiered pricing. | Businesses seeking self-service analytics, data analysts, and business users. |

| Google Data Studio (Looker Studio) | Free and easy-to-use, integrates with various Google services, customizable dashboards, collaborative features. | Freemium model, with paid options for advanced features. | Small to medium-sized businesses, individuals, and those within the Google ecosystem. |

Factors to Consider When Selecting a Dashboarding Tool

Selecting the right dashboarding tool requires careful consideration of several key factors. The optimal solution will depend on the specific needs and context of the organization. These factors should guide the decision-making process.

The factors influencing the selection of a dashboarding tool are diverse and interconnected. They range from technical capabilities to budget constraints and user experience considerations. A comprehensive evaluation is essential to ensure the chosen tool effectively meets the organization’s requirements.

For example, a small business with limited IT resources might prioritize ease of use and a low cost of ownership, while a large enterprise with complex data needs might require a more robust and scalable solution with advanced analytics capabilities. The specific KPIs to be tracked and the level of customization needed also play a significant role in the selection process. Furthermore, data integration capabilities with existing systems are critical to avoid data silos and ensure a holistic view of the financial performance.

Final Conclusion

Ultimately, effective financial dashboards are more than just pretty pictures; they are strategic tools that translate raw data into actionable insights. By carefully selecting KPIs, employing effective visualization techniques, and utilizing appropriate software, businesses can leverage the power of financial dashboards to optimize performance, enhance profitability, and achieve their financial goals. The journey from data chaos to informed decision-making begins with understanding and implementing the principles Artikeld in this guide.

Questions Often Asked

What is the difference between a dashboard for executives and one for operational teams?

Executive dashboards typically focus on high-level summaries and key strategic indicators, while operational dashboards provide more granular detail and operational metrics.

How often should a financial dashboard be updated?

Update frequency depends on the specific KPIs and business needs. Some dashboards might update in real-time, while others might be updated daily, weekly, or monthly.

What are some common mistakes to avoid when designing a financial dashboard?

Common mistakes include using too many KPIs, poor data visualization choices, cluttered layouts, and a lack of clear labeling.

How can I ensure my dashboard is secure?

Implement robust security measures, including access controls, data encryption, and regular security audits, depending on the chosen software and data sensitivity.