Sustainable investing, a rapidly growing field, moves beyond traditional financial metrics to incorporate environmental, social, and governance (ESG) factors into investment decisions. This approach recognizes the interconnectedness of financial performance and the long-term health of the planet and society. It explores how investors can generate positive returns while contributing to a more sustainable future, examining various strategies and considering both opportunities and risks.

This guide delves into the core principles of sustainable investing, exploring diverse approaches such as ESG integration, impact investing, and sustainable bonds. We’ll analyze how to identify sustainable investment opportunities across various asset classes, assess related risks, and measure the performance of these strategies. Furthermore, we will examine the influence of regulations and policies on the growth of sustainable finance and consider future trends in this transformative area of investment.

Defining Sustainable Investing

Sustainable investing represents a significant shift in how we approach financial markets, moving beyond traditional profit maximization to incorporate environmental, social, and governance (ESG) factors into investment decisions. It’s a philosophy that recognizes the interconnectedness of financial returns and the well-being of people and the planet. This approach aims to generate long-term value while contributing to a more sustainable future.

Sustainable investing encompasses a range of strategies, all sharing the common goal of integrating ESG considerations into investment processes. The core principle is to consider the potential impact of investments on a wide range of stakeholders, including communities, employees, and the environment, not just shareholders. This broader perspective seeks to identify companies that are not only financially sound but also demonstrate responsible and sustainable practices.

Sustainable Investing Approaches

Several distinct approaches fall under the umbrella of sustainable investing. Each approach emphasizes different aspects of sustainability and employs various strategies to achieve its goals.

- ESG Integration: This widely used approach systematically incorporates ESG factors into traditional financial analysis. Analysts assess a company’s performance across environmental, social, and governance metrics to determine its overall sustainability profile and its potential financial implications. A company with strong ESG performance might be viewed as less risky and potentially more profitable in the long term.

- Impact Investing: This approach focuses on investments that directly generate measurable positive social and environmental impact alongside financial returns. Investors actively seek out opportunities to address specific sustainability challenges, such as climate change, poverty, or access to clean water. Examples include investments in renewable energy projects or companies developing sustainable agriculture practices.

- Sustainable Thematic Investing: This strategy targets specific sectors or themes aligned with sustainability goals. Investors might focus on companies involved in renewable energy, clean technology, sustainable agriculture, or other sectors contributing to a more sustainable economy. This approach allows for concentrated exposure to specific sustainability trends.

Traditional Investing versus Sustainable Investing

Traditional investing primarily focuses on maximizing financial returns with limited consideration for ESG factors. The primary goal is to achieve the highest possible return on investment, often with a short-term perspective. Risk is typically assessed through financial metrics alone. In contrast, sustainable investing integrates ESG factors into the investment process, aiming to balance financial returns with positive social and environmental impact. Risk assessment incorporates not only financial but also environmental, social, and governance risks. A longer-term perspective is often adopted, recognizing that sustainable practices can contribute to long-term value creation.

Environmental, Social, and Governance (ESG) Factors

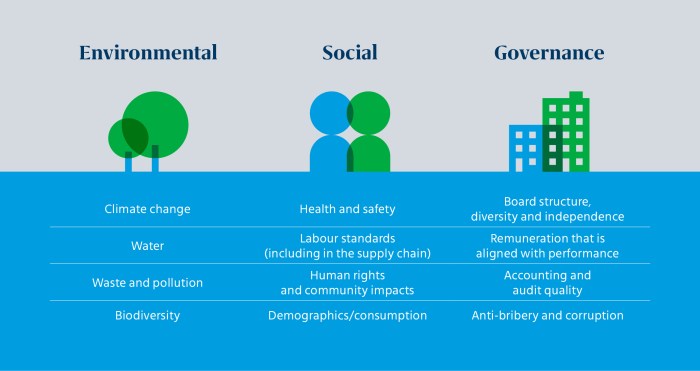

ESG factors represent the key criteria used to assess a company’s sustainability performance. They encompass a wide range of issues, each carrying significant implications for long-term value creation.

- Environmental Factors: These include a company’s carbon footprint, water usage, waste management practices, pollution levels, and its commitment to environmental protection. Examples of relevant metrics include greenhouse gas emissions, energy efficiency, and waste reduction initiatives.

- Social Factors: These relate to a company’s relationships with its employees, customers, suppliers, and the wider community. Key considerations include labor practices, human rights, product safety, data privacy, and community engagement. Metrics could include employee satisfaction scores, diversity and inclusion data, and community investment programs.

- Governance Factors: These assess the quality of a company’s management, its corporate structure, and its commitment to ethical business practices. Important aspects include board diversity, executive compensation, transparency, and anti-corruption measures. Examples of metrics include board composition, executive pay ratios, and the frequency of ESG reporting.

Identifying Sustainable Investment Opportunities

Sustainable investing seeks to generate positive financial returns while contributing to a more sustainable future. Identifying suitable investment opportunities requires a thorough understanding of both financial performance and environmental, social, and governance (ESG) factors. This involves analyzing various sectors, companies, and investment products to build a portfolio aligned with sustainable development goals.

Identifying suitable investments requires a multi-faceted approach. We need to consider the alignment of industries with global sustainability goals, evaluate the sustainability performance of individual companies, and understand the structure and performance of sustainable investment products. A well-constructed portfolio will then leverage this information to achieve both financial and environmental objectives.

Sectors and Industries Aligned with Sustainable Development Goals

The United Nations Sustainable Development Goals (SDGs) provide a framework for identifying sectors and industries contributing to a more sustainable future. Many sectors are inherently aligned with these goals, offering opportunities for impact investing. For example, renewable energy (SDG 7: Affordable and Clean Energy), sustainable agriculture (SDG 2: Zero Hunger), and green building (SDG 11: Sustainable Cities and Communities) represent significant investment areas. Companies operating within these sectors, demonstrating a commitment to sustainability practices, present compelling investment opportunities. Furthermore, sectors focused on resource efficiency, waste reduction, and circular economy principles are increasingly attractive to sustainable investors.

Companies Demonstrating Strong Sustainability Performance

Numerous companies actively integrate ESG factors into their business strategies and operations. Evaluating a company’s sustainability performance involves analyzing various data points, including carbon emissions, waste management practices, supply chain transparency, and employee relations. Independent ESG rating agencies, such as MSCI and Sustainalytics, provide valuable assessments of company performance. For instance, companies with high ESG ratings often demonstrate robust long-term value creation, attracting investors seeking both financial returns and positive social impact. Examples of companies frequently cited for strong sustainability performance vary by industry and region but typically include leaders in renewable energy, sustainable agriculture, and green technology. These companies often publish detailed sustainability reports outlining their ESG initiatives and progress.

Examples of Sustainable Investment Products

Several investment products cater specifically to sustainable investors. Sustainable mutual funds and exchange-traded funds (ETFs) offer diversified exposure to companies with strong ESG profiles. These funds employ various screening methodologies, such as negative screening (excluding companies involved in controversial activities) and positive screening (selecting companies demonstrating strong sustainability performance). Impact investing funds directly invest in companies or projects aiming to generate measurable social and environmental impact alongside financial returns. Green bonds, debt securities used to finance green projects, provide another avenue for sustainable investing. The choice of product depends on individual investor preferences and risk tolerance. For example, a globally diversified ETF focusing on renewable energy companies might offer a relatively lower-risk approach, while an impact investing fund focused on microfinance in developing countries might entail higher risk but also potentially higher social impact.

Hypothetical Sustainable Investment Portfolio

A hypothetical sustainable investment portfolio might allocate assets across various sectors and product types. A sample allocation could be: 30% in a globally diversified ESG ETF, 25% in a renewable energy focused mutual fund, 20% in a green bond ETF, 15% in an impact investing fund focused on sustainable agriculture, and 10% in a company directly involved in developing sustainable technologies. This allocation aims for diversification across asset classes and sectors while maintaining a strong focus on sustainability. The specific asset allocation would depend on the investor’s risk tolerance, investment horizon, and specific sustainability goals. It’s crucial to remember that this is a hypothetical example, and individual portfolios should be tailored to specific circumstances and risk profiles, always considering professional financial advice.

Assessing Sustainability Risks and Opportunities

Understanding the interplay between sustainability and financial performance is crucial for effective investment strategies. Sustainable investing isn’t merely about doing good; it’s about mitigating risks and identifying opportunities that can lead to superior long-term returns. This section delves into the financial implications of both unsustainable practices and sustainable solutions.

Financial Risks Associated with Unsustainable Practices

Unsustainable business practices expose companies to a range of financial risks. These risks can manifest in various ways, impacting profitability, valuation, and even long-term viability. For example, companies reliant on depleting natural resources face the risk of resource scarcity and price volatility. Similarly, businesses with high carbon footprints are vulnerable to increasing carbon taxes, stricter regulations, and shifting consumer preferences towards environmentally friendly alternatives. Reputational damage from environmental scandals or unethical labor practices can also severely impact a company’s brand value and market share, leading to significant financial losses. Furthermore, the physical risks associated with climate change, such as extreme weather events and sea-level rise, can directly damage assets and disrupt operations, causing substantial financial losses. Ignoring these risks can lead to significant undervaluation of a company’s true cost of operations and future liabilities.

Opportunities Presented by Investing in Sustainable Solutions

The transition to a more sustainable economy presents significant investment opportunities. The renewable energy sector, for instance, is experiencing rapid growth driven by technological advancements, supportive government policies, and increasing consumer demand for clean energy. Investing in companies developing and deploying renewable energy technologies, such as solar panels, wind turbines, and energy storage solutions, offers the potential for high returns as the sector continues to expand. Similarly, the green building sector, focusing on energy-efficient and environmentally friendly construction materials and practices, presents attractive investment prospects. Companies involved in developing sustainable agriculture practices, water management solutions, and circular economy initiatives also offer significant potential for growth and positive impact. These investments not only generate financial returns but also contribute to a more sustainable future.

Long-Term Financial Performance Comparison

While historical data is still accumulating, a growing body of research suggests that companies with strong environmental, social, and governance (ESG) profiles often outperform their less sustainable counterparts over the long term. Studies have shown a positive correlation between ESG performance and financial performance metrics such as profitability, return on equity, and stock market valuation. This is likely due to several factors, including reduced operational risks, enhanced reputation, improved employee morale, and increased access to capital. For example, companies proactively managing their carbon footprint may be better positioned to navigate future climate regulations and avoid costly penalties. Conversely, companies with poor ESG performance may face increased scrutiny, boycotts, and litigation, leading to financial losses. However, it is crucial to remember that correlation does not equal causation, and further research is needed to establish definitive causal links.

Incorporating Sustainability Risk Assessment into Investment Decisions

Integrating sustainability risk assessment into investment decisions requires a multi-faceted approach. This involves conducting thorough due diligence on companies, analyzing their ESG performance, and assessing their exposure to various sustainability-related risks. Investors can utilize various tools and resources, including ESG rating agencies, sustainability reports, and independent research, to gather relevant data. This information can then be used to evaluate the financial implications of a company’s sustainability profile, including potential risks and opportunities. Furthermore, engaging with companies to understand their sustainability strategies and practices can provide valuable insights. By systematically incorporating sustainability considerations into the investment process, investors can make more informed decisions and potentially enhance their portfolio’s long-term performance while contributing to a more sustainable future.

Measuring and Reporting Sustainable Investment Performance

Accurately measuring and reporting the performance of sustainable investments is crucial for demonstrating impact, attracting investors, and driving further progress towards sustainability goals. This involves selecting appropriate Key Performance Indicators (KPIs), utilizing established reporting frameworks, and implementing best practices for data transparency and accuracy. Effective communication of sustainable investment performance builds trust and ensures accountability.

Key Performance Indicators (KPIs) for Sustainable Investment Impact

Tracking the impact of sustainable investments requires a multifaceted approach, employing KPIs that capture both financial returns and environmental, social, and governance (ESG) performance. These metrics provide a comprehensive view of investment success, going beyond traditional financial measures. Different KPIs will be relevant depending on the specific investment strategy and target goals.

Examples of Reporting Frameworks for Sustainable Investment Performance

Several widely recognized frameworks guide the reporting of sustainable investment performance, ensuring consistency and comparability across different investments. These frameworks provide a structured approach to data collection, analysis, and disclosure. Adherence to these standards enhances transparency and facilitates informed decision-making by investors.

- Global Reporting Initiative (GRI): A widely used framework offering comprehensive guidelines for sustainability reporting, encompassing economic, environmental, and social performance.

- Sustainability Accounting Standards Board (SASB): Focuses on material ESG issues relevant to specific industries, providing industry-specific standards for disclosure.

- Task Force on Climate-related Financial Disclosures (TCFD): Provides recommendations for disclosing climate-related risks and opportunities, focusing on governance, strategy, risk management, and metrics and targets.

Best Practices for Transparent and Accurate Reporting of ESG Data

Transparency and accuracy are paramount in reporting ESG data. Robust data collection methods, rigorous verification processes, and clear communication are essential to build investor confidence and ensure accountability. Best practices also include incorporating materiality assessments to prioritize the most relevant ESG factors.

- Data Quality Assurance: Implementing robust data collection and verification processes to ensure accuracy and reliability.

- Materiality Assessment: Identifying and prioritizing the most significant ESG factors for each investment.

- Third-Party Verification: Utilizing independent verification to enhance credibility and transparency.

- Consistent Methodology: Applying consistent methodologies across different investments to facilitate comparisons.

- Clear and Concise Reporting: Presenting ESG data in a clear, concise, and accessible manner.

Comparative Performance Metrics of Sustainable Investment Strategies

The following table compares the performance metrics of three different sustainable investment strategies over a five-year period (hypothetical data for illustrative purposes). Note that past performance is not indicative of future results.

| Strategy | Average Annual Return | ESG Rating (out of 100) | Carbon Footprint Reduction (%) |

|---|---|---|---|

| Renewable Energy Portfolio | 12% | 92 | 45% |

| Socially Responsible Equity Fund | 8% | 85 | 20% |

| Green Bond Portfolio | 6% | 78 | 15% |

Sustainable Investing Strategies across Asset Classes

Sustainable investing principles are increasingly applied across various asset classes, each presenting unique opportunities and challenges. Understanding how these principles translate into practical strategies for different investment vehicles is crucial for effective portfolio construction and achieving both financial and environmental, social, and governance (ESG) goals. This section will explore the application of sustainable investing across equities, fixed income, and alternative investments.

Sustainable Investing in Equities

Sustainable investing in equities focuses on identifying and investing in companies demonstrating strong ESG performance. This involves analyzing a company’s environmental impact, social responsibility initiatives, and corporate governance practices. Investors might use ESG ratings, corporate sustainability reports, and engagement with company management to assess a company’s sustainability profile. Strategies range from exclusionary screening (avoiding companies involved in controversial activities) to positive screening (favoring companies with strong ESG performance) and active ownership (engaging with companies to improve their ESG practices). For example, an investor might choose to invest in a technology company with a strong record of renewable energy usage and diversity initiatives over a similar company with a poor environmental record.

Sustainable Investing in Fixed Income

Applying sustainable investing principles to fixed income involves assessing the ESG risks and opportunities associated with bond issuers. This might include analyzing a company’s debt sustainability in relation to its environmental commitments or evaluating the social impact of a municipal bond financing a green infrastructure project. Green bonds, specifically designed to finance climate-friendly projects, represent a prominent segment of the sustainable fixed income market. Investors can assess the “greenness” of these bonds by examining the use of proceeds and alignment with established green bond principles. For example, a green bond issued by a municipality to finance renewable energy infrastructure would be considered a sustainable investment, while a bond issued by a company with a high carbon footprint might be avoided.

Sustainable Investing in Alternative Investments

Alternative investments, such as real estate and private equity, offer unique opportunities for sustainable investing. In real estate, this might involve investing in energy-efficient buildings, properties promoting sustainable transportation, or developments fostering community resilience. Due diligence in this area often involves assessing a building’s energy consumption, its location relative to public transportation, and the overall sustainability of its design and construction. In private equity, sustainable investing can involve actively guiding portfolio companies towards improved ESG practices, promoting resource efficiency, and reducing their environmental impact. For example, a private equity firm might invest in a company focused on developing sustainable agricultural practices or a renewable energy technology.

Comparison of Sustainable Investing Strategies Across Asset Classes

While the core principles of sustainable investing remain consistent across asset classes, the specific strategies and challenges vary significantly. Equities offer a wide range of companies with varying ESG profiles, allowing for diversified portfolios tailored to specific sustainability goals. Fixed income provides opportunities for targeted investments in green projects or issuers with strong ESG performance, but the availability of truly sustainable options may be limited in some sectors. Alternative investments, especially real estate and private equity, offer opportunities for significant positive impact but also require more in-depth due diligence and longer-term investment horizons. The liquidity of sustainable investments also differs across asset classes, with equities generally being more liquid than private equity or certain types of real estate.

The Role of Regulation and Policy in Sustainable Investing

Government regulations and international agreements are increasingly shaping the landscape of sustainable investing, driving both the growth and the standardization of environmentally and socially conscious investment practices. This influence extends from mandatory disclosures to the creation of tax incentives, fundamentally altering how investors approach risk and return.

The impact of government regulations on sustainable investing practices is multifaceted. Regulations can directly mandate certain behaviors, such as requiring companies to disclose their environmental, social, and governance (ESG) performance. This transparency allows investors to make more informed decisions, fostering a market where sustainable practices are rewarded and unsustainable ones are penalized. Furthermore, governments can indirectly influence sustainable investing through policies that incentivize green technologies or penalize environmentally damaging activities. For example, carbon taxes or subsidies for renewable energy projects can shift the investment landscape towards more sustainable options.

Government Regulations and Sustainable Investing

Government regulations play a crucial role in promoting sustainable investing by setting standards for disclosure, creating incentives for sustainable practices, and penalizing unsustainable behaviors. The implementation of mandatory ESG reporting requirements, for instance, enhances transparency and allows investors to better assess the sustainability profiles of companies. Similarly, tax incentives for green investments can stimulate capital flows towards environmentally friendly projects, contributing to the growth of the sustainable finance sector. Conversely, regulations that impose penalties on companies with poor ESG performance can discourage unsustainable practices and encourage responsible business conduct. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) is a prime example of a comprehensive regulatory framework designed to promote transparency and standardization in sustainable finance.

International Agreements and Sustainable Finance

International agreements play a significant role in coordinating global efforts to promote sustainable finance. These agreements often establish common goals and standards, fostering collaboration among countries and encouraging the development of global sustainable finance initiatives. The Paris Agreement, for example, aims to limit global warming and has spurred significant investment in renewable energy and other climate-friendly technologies. Such international collaborations help to create a more unified and effective approach to tackling global sustainability challenges. Furthermore, international organizations such as the United Nations Environment Programme Finance Initiative (UNEP FI) play a key role in developing principles and guidelines for sustainable finance, providing a framework for both public and private sector actors.

Industry Initiatives and Standards in Sustainable Investing

Industry initiatives and standards are instrumental in shaping sustainable investing practices. These initiatives often establish voluntary guidelines and frameworks for ESG reporting and investment strategies, promoting consistency and comparability across different markets and asset classes. Examples include the Global Reporting Initiative (GRI) standards for sustainability reporting and the Principles for Responsible Investment (PRI), which provide a framework for incorporating ESG factors into investment decisions. These initiatives play a crucial role in promoting best practices and driving the adoption of sustainable investment principles throughout the industry. The development and adoption of common standards improve data quality and transparency, enabling more robust comparisons and ultimately promoting greater investor confidence.

Key Regulatory Developments Impacting Sustainable Investing

The regulatory landscape surrounding sustainable investing is constantly evolving. Below is a list of key regulatory developments that have significantly impacted the field:

- The EU Taxonomy Regulation: This regulation establishes a classification system for environmentally sustainable economic activities, providing a common definition of what constitutes a green investment.

- The EU Sustainable Finance Disclosure Regulation (SFDR): This regulation mandates disclosures related to ESG factors for financial market participants, enhancing transparency and enabling investors to make more informed decisions.

- The US SEC’s proposed climate-related disclosure rule: This proposed rule would require publicly traded companies to disclose their climate-related risks and greenhouse gas emissions.

- The Task Force on Climate-related Financial Disclosures (TCFD) recommendations: While not legally binding, the TCFD recommendations have significantly influenced corporate reporting practices on climate-related risks and opportunities.

Future Trends in Sustainable Investing

The sustainable investing market is poised for explosive growth, driven by increasing awareness of environmental, social, and governance (ESG) factors, stricter regulatory frameworks, and the escalating demand from both individual and institutional investors. This section will explore the key trends shaping the future of this dynamic field, highlighting the opportunities and challenges that lie ahead.

Predictions for the future growth of sustainable investing are overwhelmingly positive. Consultancy firm PwC, for example, projects significant increases in sustainable investment flows over the coming years, driven by factors like the growing recognition of climate change risks and the increasing availability of ESG data. While precise figures vary depending on the methodology and assumptions used, the overall consensus points towards a substantial expansion of the market. This growth will not be uniform across all asset classes or geographies, however, with some sectors and regions experiencing more rapid expansion than others.

Emerging Trends in Sustainable Finance and Technology

Technological advancements are revolutionizing sustainable finance, creating new opportunities for data analysis, impact measurement, and investment strategies. Blockchain technology, for instance, offers enhanced transparency and traceability in supply chains, enabling investors to verify the sustainability claims of companies more effectively. Artificial intelligence (AI) and machine learning (ML) are being used to analyze vast datasets of ESG information, identifying promising investment opportunities and assessing sustainability risks with greater precision. Furthermore, the rise of fintech companies specializing in sustainable finance is fostering innovation and accessibility in this space. For example, several platforms now allow investors to easily screen investments based on their ESG performance and contribute to specific environmental or social projects.

Challenges and Opportunities in Sustainable Investing

Despite the optimistic outlook, significant challenges remain. One major hurdle is the lack of standardization in ESG data and reporting. Inconsistencies in methodologies and metrics make it difficult to compare the sustainability performance of different companies and investments accurately. This lack of comparability can hinder informed decision-making and potentially lead to “greenwashing,” where companies exaggerate their sustainability efforts to attract investors. Another challenge is the integration of ESG factors into traditional financial models and investment strategies. Many investors still struggle to incorporate ESG considerations into their decision-making processes, hindering the widespread adoption of sustainable investing practices. However, these challenges also represent opportunities. The development of robust and standardized ESG reporting frameworks, along with the integration of ESG data into mainstream financial analysis, will be crucial for the future growth of sustainable investing. This presents opportunities for companies developing ESG data analytics tools and for investors who can effectively navigate the complexities of ESG investing.

Technological Advancements Impacting Sustainable Investing Strategies

The increasing availability of data and the development of sophisticated analytical tools are significantly impacting sustainable investing strategies. AI-powered platforms can analyze vast amounts of ESG data to identify undervalued companies with strong sustainability profiles. Satellite imagery, for example, can be used to monitor deforestation and assess the environmental impact of agricultural practices, providing valuable insights for investors in related sectors. Furthermore, blockchain technology can enhance the transparency and traceability of supply chains, reducing the risk of fraud and enabling investors to verify the sustainability claims of companies more easily. These technological advancements are not only improving the efficiency and effectiveness of sustainable investing but also expanding the range of investment opportunities available. For example, the ability to track carbon emissions more accurately allows investors to focus on companies that are effectively reducing their carbon footprint, potentially leading to superior financial performance in the long term.

Summary

In conclusion, sustainable investing offers a compelling pathway to align financial goals with broader societal and environmental objectives. By carefully considering ESG factors, investors can mitigate risks associated with unsustainable practices and capitalize on emerging opportunities in the burgeoning green economy. While challenges remain, the increasing awareness of the importance of sustainability, coupled with technological advancements, points towards a future where sustainable investing becomes the norm, not the exception. This comprehensive approach promises not only financial returns, but also a tangible contribution to a more sustainable and equitable world.

Popular Questions

What is the difference between ESG and Impact Investing?

ESG investing integrates environmental, social, and governance factors into investment analysis to manage risk and potentially enhance returns. Impact investing, on the other hand, aims to generate measurable social and environmental impact alongside financial returns.

Are sustainable investments less profitable than traditional investments?

Studies have shown mixed results. While some studies suggest comparable or even superior long-term returns for sustainable investments, others indicate no significant difference. The performance depends on various factors, including the specific strategy employed and the market conditions.

How can I screen for sustainable investments?

Many online platforms and financial advisors offer tools and resources to screen investments based on ESG criteria. You can also consult sustainability ratings from reputable organizations.

What are some examples of sustainable investment products?

Examples include ESG mutual funds, sustainable ETFs, green bonds, and impact investments in renewable energy or sustainable agriculture.