Understanding Indonesia’s tax system, or “Pajak,” offers a fascinating glimpse into the nation’s economic engine. From its historical roots to its current complexities, the Indonesian tax landscape shapes public spending, influences economic growth, and presents both opportunities and challenges for businesses and individuals alike. This exploration delves into the various types of taxes, compliance procedures, available incentives, and the ongoing efforts to combat tax evasion.

We will examine the intricacies of Indonesian tax law, comparing it to regional counterparts and highlighting its impact on various sectors. The discussion will cover the crucial role of tax revenue in funding public services, the implications of tax policies on economic development, and the ongoing evolution of the Indonesian tax system itself. This analysis aims to provide a comprehensive overview, clarifying key aspects for a better understanding of this vital component of the Indonesian economy.

Understanding “Pajak” (Tax) in Indonesia

Indonesia’s tax system, known as “Pajak,” plays a vital role in funding the nation’s development and public services. Its evolution reflects Indonesia’s economic and political journey, from a colonial past to its current status as a developing nation. Understanding this system is crucial for both individuals and businesses operating within the country.

A Brief History of the Indonesian Tax System

The Indonesian tax system has undergone significant changes throughout its history. During the colonial era under Dutch rule, the system was primarily focused on extracting resources and wealth. Post-independence, the system was gradually reformed to better suit the needs of a newly independent nation, aiming for greater equity and efficiency. The system continues to evolve, adapting to economic changes and global best practices. Significant reforms have been undertaken in recent decades to simplify tax administration, broaden the tax base, and improve tax compliance. This includes efforts to modernize tax collection methods and introduce electronic filing systems.

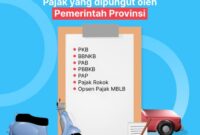

Types of Taxes in Indonesia

Indonesia levies a variety of taxes to generate revenue. These taxes can be broadly categorized into direct and indirect taxes. Direct taxes are levied directly on individuals or entities, while indirect taxes are levied on goods and services.

Income Tax (Pajak Penghasilan or PPh)

Income tax in Indonesia is a progressive tax, meaning higher earners pay a larger percentage of their income in taxes. It applies to various income sources, including salaries, business profits, and investment returns. Tax rates vary depending on the level of income and the type of income received. There are specific regulations and allowances for deductions to reduce the tax burden.

Value Added Tax (Pajak Pertambahan Nilai or PPN)

Value Added Tax (VAT) is an indirect tax levied on the supply of goods and services. It is a multi-stage tax, meaning that tax is added at each stage of the production and distribution process. The standard VAT rate in Indonesia is currently 11%, although some goods and services are exempt or subject to a lower rate.

Property Tax (Pajak Bumi dan Bangunan or PBB)

Property tax is levied on the ownership of land and buildings. The tax rate varies depending on the location and value of the property. This tax is a significant source of revenue for local governments.

Other Taxes

Other taxes levied in Indonesia include import duties, excise duties (on specific goods like tobacco and alcohol), and various regional taxes. The specific regulations and rates for these taxes can be complex and vary depending on the type of good or service and the location.

Comparison of Indonesian Tax Rates with Other Southeast Asian Countries

Comparing tax rates across Southeast Asian countries requires careful consideration of various factors, including the types of taxes levied, tax brackets, and exemptions. Direct comparison is challenging due to differences in tax systems and reporting methodologies. However, generally speaking, Indonesia’s tax rates on corporate income and personal income are comparable to those in other Southeast Asian nations, although specific rates can vary significantly depending on the income level and the type of tax. A detailed comparative analysis would require a dedicated study incorporating data from various reliable sources such as the IMF, World Bank, and national statistical agencies.

Summary of Key Indonesian Tax Features

| Tax Type | Description | Rate | Key Features |

|---|---|---|---|

| Pajak Penghasilan (PPh) – Income Tax | Tax on income from various sources | Progressive rates, varying by income level | Various deductions and allowances available |

| Pajak Pertambahan Nilai (PPN) – Value Added Tax | Tax on the supply of goods and services | 11% (standard rate) | Multi-stage tax, exemptions for certain goods and services |

| Pajak Bumi dan Bangunan (PBB) – Property Tax | Tax on land and building ownership | Varies by location and property value | Significant revenue source for local governments |

Tax Compliance in Indonesia

Navigating the Indonesian tax system requires understanding the registration process, filing methods, and common compliance issues. This section provides a practical overview to assist both businesses and individuals in meeting their tax obligations.

Tax Registration in Indonesia

Registering for tax purposes in Indonesia is a crucial first step for all taxpayers, whether individuals or businesses. The process involves applying for a Taxpayer Identification Number (NPWP), which is essential for all tax-related transactions. This is typically done through the official website of the Directorate General of Taxes (DGT) or by visiting a local tax office. The application requires providing personal or business information, including identification documents, proof of address, and business registration details (for businesses). After successful registration, taxpayers receive their NPWP, which serves as their unique identifier for all tax-related activities. Failure to register can lead to penalties and difficulties in conducting business.

Filing Tax Returns in Indonesia

Filing tax returns in Indonesia can be done through various methods, offering convenience and accessibility to taxpayers. The most common methods include online filing through the DGT’s e-Filing system, which allows taxpayers to submit their returns electronically from anywhere with an internet connection. Alternatively, taxpayers can file manually by submitting physical copies of their tax returns to a designated tax office. The DGT provides detailed instructions and guidance on the required forms and procedures for both online and manual filing. Choosing the appropriate method depends on individual preferences and technical capabilities. Accurate and timely filing is crucial to avoid penalties.

Common Tax Compliance Issues

Businesses and individuals in Indonesia often face various tax compliance challenges. One common issue is inaccurate record-keeping, leading to incorrect tax calculations and potential penalties. Another frequent problem is a lack of understanding of the complex tax regulations, resulting in unintentional non-compliance. Furthermore, difficulties in navigating the online tax systems and obtaining timely assistance from tax authorities can also contribute to compliance issues. Businesses might face additional complexities related to Value Added Tax (VAT) calculations and withholding taxes. Understanding these potential issues and seeking professional advice when necessary is crucial for maintaining tax compliance.

Annual Income Tax Return Filing Flowchart

The following flowchart illustrates the steps involved in filing an annual income tax return in Indonesia:

[Imagine a flowchart here. The flowchart would begin with “Start,” then proceed through steps such as: 1. Gather necessary documents (income statements, receipts, etc.). 2. Calculate taxable income. 3. Fill out the relevant tax return form (either online or manually). 4. Submit the tax return (online or in person). 5. Receive confirmation of submission. 6. Pay taxes (if applicable). 7. End.] The flowchart would visually represent the sequential nature of these steps, using boxes and arrows to connect them. Each step would be clearly labeled for easy understanding. For example, a diamond shape could represent a decision point, such as “Tax due?” leading to different paths depending on the answer.

Tax Incentives and Benefits

Indonesia offers a range of tax incentives to attract foreign and domestic investment, stimulate economic growth in specific sectors, and promote national development goals. These incentives are designed to reduce the tax burden on eligible businesses, making Indonesia a more attractive location for investment and encouraging expansion within targeted industries. Understanding these incentives is crucial for businesses operating or planning to operate within the Indonesian market.

Eligibility for tax incentives is determined by various factors, including the type of business, location of investment, and compliance with specific regulations. Generally, incentives are granted based on pre-approved investment plans and adherence to performance targets. The Indonesian government regularly reviews and updates these incentives to adapt to evolving economic conditions and national priorities.

Types of Tax Incentives

Several types of tax incentives are available, including tax holidays, tax allowances, and accelerated depreciation. Tax holidays offer a complete exemption from corporate income tax for a specific period. Tax allowances reduce the taxable income, while accelerated depreciation allows businesses to deduct a larger portion of an asset’s value in the early years of its life. These incentives can significantly impact a company’s profitability and cash flow, fostering investment and expansion.

Eligibility Criteria for Tax Benefits

Eligibility criteria vary depending on the specific incentive and the industry sector. Generally, businesses must meet certain investment thresholds, create a minimum number of jobs, operate in designated regions, or invest in specific technologies. Compliance with environmental regulations and adherence to good corporate governance practices are also often considered. Detailed criteria are Artikeld in relevant government regulations and are subject to change. A thorough understanding of these criteria is essential for businesses seeking to benefit from these incentives.

Examples of Tax Incentives Stimulating Economic Growth

Tax incentives can directly stimulate economic growth by encouraging investment in specific sectors. For example, tax holidays granted to manufacturing companies in designated economic zones have led to the creation of new jobs and increased production capacity. Similarly, tax allowances for research and development activities have spurred innovation and technological advancement. These incentives, by reducing the financial burden on businesses, encourage expansion, leading to higher GDP growth and improved living standards.

Tax Incentives by Industry Sector

The Indonesian government targets specific sectors for growth through tailored tax incentives. The specific incentives offered vary depending on the government’s strategic priorities at any given time.

- Manufacturing: Tax holidays, accelerated depreciation, and import duty exemptions are commonly offered to attract investment in manufacturing, particularly in export-oriented industries.

- Tourism: Tax allowances and reduced import duties on tourism-related equipment are often provided to boost the tourism sector.

- Renewable Energy: Significant tax incentives are available for investments in renewable energy projects, including tax holidays and accelerated depreciation, to support the country’s transition to cleaner energy sources.

- Technology: Tax incentives are offered to encourage investment in technology and innovation, particularly in areas like digital technology and e-commerce.

- Agriculture: Incentives may include tax allowances and subsidies to support agricultural development and improve food security.

The Role of Tax in Indonesian Economic Development

Tax revenue plays a crucial role in funding Indonesia’s public spending and driving its economic development. The Indonesian government utilizes tax revenue to finance essential services and infrastructure projects, ultimately impacting various sectors and contributing to overall economic growth. Understanding this relationship is key to assessing the effectiveness of tax policies and their influence on the nation’s economic trajectory.

Tax revenue contributes significantly to public spending in Indonesia, enabling the government to invest in vital areas.

Tax Revenue’s Contribution to Public Spending

A substantial portion of Indonesia’s national budget is derived from tax revenue. This funding supports various government programs and projects, including healthcare, education, infrastructure development (roads, bridges, ports, airports), and social welfare initiatives. For instance, tax revenue finances the national healthcare insurance program (JKN), providing access to healthcare services for millions of Indonesians. Similarly, funding for public education, from primary schools to universities, relies heavily on tax revenue. Investment in infrastructure projects, crucial for economic growth and connectivity, also directly benefits from tax collections. The construction of toll roads, for example, is largely funded through government budgets supported by tax revenue. Without this consistent stream of tax revenue, the government’s capacity to deliver these essential services would be severely hampered.

Impact of Tax Policies on Different Sectors

Tax policies implemented by the Indonesian government have a direct impact on various economic sectors. For example, tax incentives offered to specific industries, such as manufacturing or renewable energy, can stimulate investment and job creation within those sectors. Conversely, increased taxes on certain goods or services can influence consumer behavior and potentially affect the profitability of related businesses. Tax policies related to import and export duties also influence international trade and the competitiveness of Indonesian businesses in the global market. For instance, reducing import duties on raw materials can lower production costs for domestic manufacturers, making them more competitive internationally.

Effectiveness of Different Tax Policies in Achieving Economic Objectives

The effectiveness of tax policies in achieving economic objectives varies depending on factors such as the design of the policy, its implementation, and the overall economic climate. For example, a progressive tax system, where higher earners pay a larger percentage of their income in taxes, aims to reduce income inequality and generate revenue for social programs. However, the effectiveness of such a system depends on factors such as tax evasion and the ability of the government to efficiently collect taxes. Similarly, policies aimed at stimulating investment through tax incentives may be effective in attracting foreign investment but may also lead to a loss of revenue in the short term. Careful evaluation and adjustments are needed to ensure that tax policies effectively contribute to achieving broader economic goals, such as sustainable growth, equitable distribution of wealth, and macroeconomic stability.

Relationship Between Tax Revenue and Government Spending

The relationship between tax revenue and government spending is intrinsically linked. A line graph illustrating this relationship would show a positive correlation, with increases in tax revenue generally corresponding to increases in government spending.

The graph would have “Tax Revenue (in Trillions of Rupiah)” on the Y-axis and “Year” on the X-axis. Data points would represent the actual tax revenue collected and government spending for each year, potentially spanning a decade or more. The line connecting the data points would visually demonstrate the correlation between tax revenue and government expenditure. For example, a point at (2020, 1500) would represent 1500 trillion Rupiah in tax revenue collected in 2020, with a corresponding point reflecting government spending in the same year. The slope of the line would indicate the extent to which government spending increases with increases in tax revenue. A steeper slope would suggest a higher proportion of tax revenue being directly allocated to government spending. The graph would also potentially include error bars or confidence intervals to represent the uncertainty associated with the data. Fluctuations in the line could be explained by changes in government priorities, economic conditions, or the effectiveness of tax collection.

Tax Evasion and Avoidance in Indonesia

/photo/gridoto/2018/03/06/2971014650.jpg?w=700)

Tax evasion and avoidance represent significant challenges to Indonesia’s economic development and fiscal stability. Understanding the methods employed, their legal ramifications, and effective countermeasures is crucial for strengthening tax compliance and fostering a fairer tax system. This section will examine these issues in detail.

Common Methods of Tax Evasion and Avoidance in Indonesia

Several methods are commonly used to circumvent Indonesia’s tax laws. These range from underreporting income and manipulating invoices to utilizing complex financial structures to minimize tax liabilities. Underreporting income, a prevalent method, often involves concealing business transactions or personal earnings. Manipulating invoices, including creating false invoices or understating the value of goods and services, is another common tactic. The use of shell companies or offshore accounts also allows individuals and businesses to hide assets and income from tax authorities. Furthermore, taking advantage of loopholes in the tax code, or engaging in aggressive tax planning, represents a more sophisticated form of avoidance. These activities erode the tax base and hinder Indonesia’s ability to fund essential public services.

Legal Consequences of Tax Evasion in Indonesia

Tax evasion carries severe legal consequences in Indonesia. These penalties can include substantial fines, imprisonment, and the seizure of assets. The severity of the punishment depends on the scale of the evasion and the intent behind it. For example, individuals or businesses found guilty of intentionally underreporting income could face significant financial penalties and even jail time. The Indonesian Directorate General of Taxes (DGT) actively pursues tax evaders, employing both audits and investigations to uncover illegal activities. The reputational damage associated with tax evasion can also be significant, potentially impacting business relationships and access to credit. The legal framework surrounding tax evasion is designed to deter such behavior and ensure a level playing field for all taxpayers.

Strategies for Combating Tax Evasion and Improving Tax Compliance

Combating tax evasion requires a multi-pronged approach. Strengthening enforcement mechanisms, such as increasing the number of tax audits and improving data analysis capabilities, is crucial. Improving taxpayer education and awareness regarding tax obligations can also significantly enhance compliance. Simplifying the tax system and making it more transparent can reduce opportunities for evasion. Implementing robust anti-money laundering (AML) regulations and enhancing international cooperation to track illicit financial flows are also vital steps. Furthermore, leveraging technology, such as data analytics and artificial intelligence, can help identify patterns of tax evasion and improve the efficiency of tax audits. These strategies aim to create a more equitable and efficient tax system that fosters greater compliance.

Comparison of Tax Evasion and Tax Avoidance

| Feature | Tax Evasion | Tax Avoidance |

|---|---|---|

| Legality | Illegal; a deliberate act to avoid paying taxes owed. | Legal; utilizing legal loopholes and strategies to minimize tax liability. |

| Methods | Underreporting income, manipulating invoices, using shell companies, concealing assets. | Strategic tax planning, using deductions and allowances, investing in tax-advantaged instruments. |

| Consequences | Significant fines, imprisonment, asset seizure, reputational damage. | No legal penalties; however, may be subject to scrutiny if deemed aggressive. |

| Ethical Implications | Unethical; violates tax laws and undermines the fairness of the tax system. | Ethically gray; while legal, aggressive avoidance may be viewed as morally questionable. |

The Future of the Indonesian Tax System

Indonesia’s tax system stands at a crucial juncture. While significant progress has been made in broadening the tax base and improving collection efficiency, persistent challenges remain. Addressing these challenges effectively will be vital for ensuring sustainable economic growth and equitable distribution of resources. The future of the Indonesian tax system hinges on proactive reforms that enhance transparency, simplify procedures, and bolster taxpayer compliance.

Potential Reforms to the Indonesian Tax System involve a multifaceted approach. The current system, while functional, could benefit from streamlining processes to reduce the administrative burden on both taxpayers and the tax authority. This includes exploring digitalization initiatives to improve efficiency and transparency. Furthermore, a review of existing tax rates and exemptions is necessary to ensure fairness and optimize revenue generation. This might involve targeted adjustments to address loopholes and ensure that the tax burden is distributed equitably across various income brackets and sectors. Finally, strengthening international tax cooperation is essential to combat tax evasion and avoidance, particularly in cross-border transactions.

Challenges Facing the Directorate General of Taxation (DJP)

The DJP faces numerous challenges in its efforts to modernize and optimize the Indonesian tax system. A significant hurdle is the large informal sector, which contributes a substantial portion of the national economy but remains largely untaxed. This necessitates innovative strategies to bring these businesses into the formal economy. Furthermore, limited resources and capacity within the DJP itself pose a constraint on effective tax administration and enforcement. Technological advancements are needed to enhance data analysis, improve risk assessment, and streamline tax audits. Public perception and trust in the tax authority also play a critical role. Building greater public confidence requires increased transparency, accountability, and effective communication regarding tax policies and their impact.

Recommendations for Improving Tax Administration and Collection

Improving tax administration and collection requires a comprehensive strategy encompassing technological upgrades, enhanced human capital development, and strengthened public engagement. Investing in robust digital infrastructure is paramount, allowing for real-time data processing, automated tax filings, and efficient communication between taxpayers and the DJP. This includes expanding digital literacy programs to assist taxpayers in navigating the digital system. Furthermore, the DJP needs to invest in training and development programs to equip its personnel with the necessary skills and expertise in tax administration, data analytics, and fraud detection. Finally, enhancing public awareness and promoting tax compliance through targeted communication campaigns is crucial. This includes emphasizing the benefits of paying taxes and highlighting the role of taxes in funding public services.

Hypothetical Scenario: Impact of a Value-Added Tax (VAT) Reform

Let’s consider a hypothetical scenario involving a reform of Indonesia’s VAT system. Currently, the standard VAT rate is 11%. Imagine a reform that gradually increases the rate to 12% over a two-year period, while simultaneously broadening the tax base by reducing the number of exemptions. This would generate additional revenue for the government. However, it could also lead to a temporary increase in consumer prices, potentially impacting lower-income households. To mitigate this, the government could introduce compensatory measures, such as targeted subsidies or tax relief for vulnerable groups. This reform, if implemented effectively, could lead to increased government revenue, which could be used to fund infrastructure development, education, and healthcare. The success of such a reform would depend heavily on careful planning, transparent communication, and effective implementation to minimize negative impacts on the economy and the population. A similar reform was attempted in several developed countries, and the results have varied depending on the accompanying policies. For instance, Canada’s implementation of a GST (Goods and Services Tax) showed increased revenue generation but also faced initial public resistance.

Last Recap

:strip_icc():format(jpeg)/kly-media-production/medias/973400/original/017583100_1441092355-20150901-Peresmian-Gerai-Pajak-Jakarta-Ahok4.jpg?w=700)

Navigating the Indonesian tax system, while complex, is crucial for both economic prosperity and responsible citizenship. From understanding the diverse tax types and compliance procedures to leveraging available incentives and contributing to a fair tax system, this exploration of Pajak highlights the multifaceted nature of taxation in Indonesia. The ongoing efforts to improve tax administration and combat evasion are essential for sustainable economic growth, ensuring that tax revenue effectively supports national development and public welfare. A deeper understanding of Pajak empowers individuals and businesses to participate responsibly and contribute to Indonesia’s continued progress.

Essential FAQs

What are the penalties for late tax filing in Indonesia?

Penalties vary depending on the type of tax and the length of the delay. They typically involve late payment interest and potentially additional fines.

Can foreign companies operating in Indonesia claim tax deductions?

Yes, foreign companies can claim certain tax deductions, but eligibility depends on specific circumstances and compliance with Indonesian tax regulations. Professional tax advice is recommended.

Where can I find more detailed information about specific tax regulations?

The official website of the Indonesian Directorate General of Taxes (DJP) provides comprehensive information on tax laws, regulations, and procedures.